Why traceloans.com mortgage loans Are Changing Home Financing

Traceloans.com mortgage loans represent a modern, tech-driven approach to home financing, blending digital convenience with personalized support. As a digital mortgage marketplace, Traceloans.com connects borrowers with a network of lenders through a single, streamlined online platform. As local mortgage advisors serving {{companyLocations}}, we tailor guidance to neighborhood market conditions, local underwriting norms, and closing customs unique to our area.

Quick Answer: What You Need to Know About Traceloans.com Mortgage Loans

- Platform Type: Digital mortgage marketplace connecting borrowers with lenders

- Loan Types: Conventional, FHA, VA, USDA, and Jumbo loans

- Key Benefits: Competitive rates, transparent fees, hybrid customer service

- Processing Time: Average 21 days vs. 30+ days for traditional banks

- Security: 256-bit SSL encryption and multi-factor authentication

- Best For: Tech-savvy buyers, busy professionals, first-time homebuyers

- Service Areas: {{companyLocations}}

The mortgage landscape has evolved beyond lengthy bank visits and paper-heavy processes. Today’s homebuyers demand efficiency without sacrificing service quality. Traceloans.com addresses this need with a “hybrid approach” that combines technology with dedicated mortgage advisors, giving you digital speed and human guidance. In competitive neighborhoods across {{companyLocations}}, a faster close and locally attuned advice with traceloans.com mortgage loans can strengthen your offer and reduce uncertainty at the closing table.

For food lovers and travel enthusiasts, securing the right mortgage is about more than buying a house. It’s about creating financial freedom to pursue your passions, whether that’s exploring new restaurants, planning culinary trips, or designing a beautiful kitchen. The platform’s focus on competitive rates can help free up your budget for the experiences that matter most.

Quick * traceloans.com mortgage loans* definitions:

What is Traceloans.com and How Does It Work?

Imagine wanting a home with a kitchen perfect for recreating recipes from your travels, but dreading the mortgage process. That’s where traceloans.com mortgage loans come in, simplifying a traditionally complex task.

Think of Traceloans.com as a personal matchmaker for mortgages. Instead of going from bank to bank, this digital mortgage marketplace brings multiple lenders to you. It’s a tech-driven platform that connects you with various lending options from the comfort of your home, allowing you to focus on your financial goals and lifestyle aspirations.

The Digital Application Process

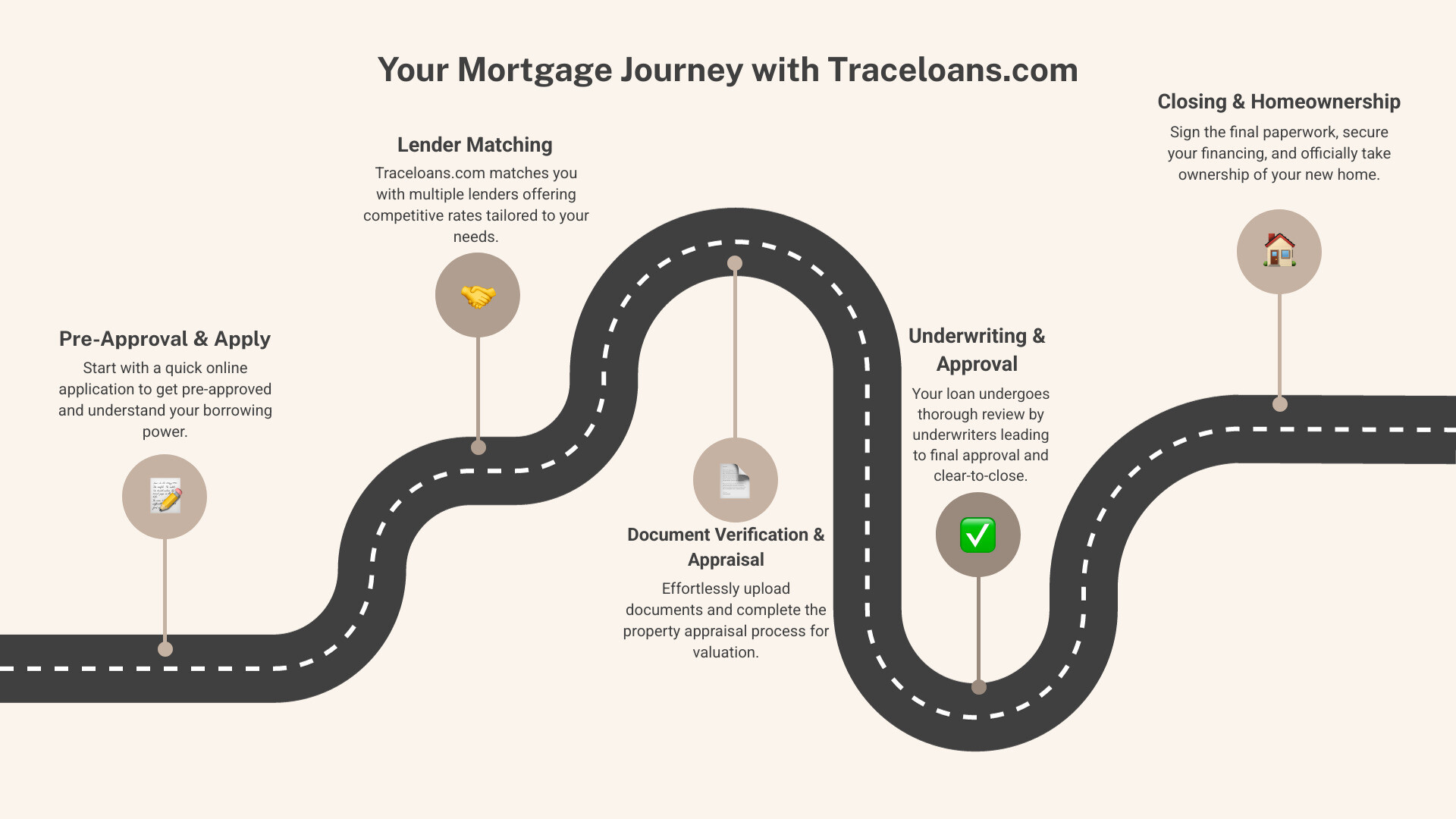

The Traceloans.com mortgage loans application process is refreshingly modern. It starts with an initial inquiry where you provide basic information. The platform’s algorithms then perform lender matching, connecting you with lenders suited to your profile.

The entire process is managed through a secure online portal. You can upload documents and use real-time status tracking to monitor your application’s progress. This efficiency often leads to quick pre-approval, sometimes within hours, which is a significant advantage in the competitive housing markets across {{companyLocations}}.

Key Features and Benefits

What makes Traceloans.com mortgage loans stand out is the thoughtful user experience. The platform fosters competition among lenders, which can lead to competitive rates for you. Transparency is also a key principle, with a promise of no hidden fees and access to educational resources to help you understand each step.

Crucially, they offer hybrid customer service. You get the efficiency of a digital platform backed by dedicated mortgage advisors who can offer expert guidance. This combination of technology and human support creates a streamlined process that saves time, money, and stress. This approach is ideal for busy professionals, tech-savvy buyers, and anyone who values efficiency. For those exploring broader financing options, you might also find value in our guide about business loans.

A Culinary Guide to Traceloans.com Mortgage Loan Options

Choosing a mortgage is like browsing a well-curated menu; the right choice depends on your unique appetite. Traceloans.com mortgage loans offers a diverse portfolio to satisfy different financial situations, from first-time homebuyers to seasoned investors.

Just as The Dining Destination helps food lovers find the perfect culinary experience, Traceloans.com serves up mortgage solutions that fit various needs. First-time buyers might prefer something approachable, while investors may seek more sophisticated options. For more insights into business financing options that complement your investment goals, check out our Fintechzoom.com Business Guide.

Conventional & Jumbo Loans

Conventional loans are the classic, popular dishes on the mortgage menu. These traceloans.com mortgage loans are a reliable choice for many borrowers.

- Fixed-rate mortgages offer a consistent interest rate and monthly payment for the life of the loan (typically 15 or 30 years), making budgeting simple.

- Adjustable-rate mortgages (ARMs) start with a lower fixed rate for an initial period before adjusting based on market conditions.

Conforming loans must fall within the limits set annually by the Federal Housing Finance Agency (FHFA). They are accessible to borrowers with credit scores often starting around 620, with down payments as low as 3% for qualified first-time buyers.

For properties exceeding these limits, jumbo loans provide financing for large purchases. These loans have stricter qualification requirements but make it possible to purchase higher-priced homes.

Government-Backed Loans

These government-backed traceloans.com mortgage loans offer flexibility and support, making homeownership more accessible.

- FHA loans, insured by the Federal Housing Administration, are great for first-time homebuyers, allowing down payments as low as 3.5% and more flexible credit requirements.

- VA loans are a benefit for eligible veterans, active-duty service members, and surviving spouses. They often require no down payment and no private mortgage insurance.

- USDA loans, guaranteed by the U.S. Department of Agriculture, are for properties in eligible rural and suburban areas. They often require no down payment, opening homeownership opportunities in qualifying regions, including many of the communities surrounding {{companyLocations}}.

These options ensure more people can achieve their homeownership dreams. For official details, visit Government-backed home loans and mortgage assistance. Securing the right mortgage helps build a foundation for the lifestyle you want, including those culinary trips you’ve been dreaming about.

The Financial Recipe: Understanding Rates, Fees, and Savings

Shopping for traceloans.com mortgage loans is like planning a budget for a great meal; you want the best quality at a fair price with no surprises. Understanding the components of your mortgage cost is key.

Traceloans.com is built on transparency. Your total cost is determined by several factors. Interest rates are the percentage you pay to borrow money. However, the APR (Annual Percentage Rate) gives a fuller picture, as it includes the interest rate plus other costs like origination fees, providing the true annual cost of the loan.

Closing costs, typically 2-5% of the loan amount, cover services like the appraisal, credit report, and title insurance. Here in {{companyLocations}}, these costs can vary based on local taxes and fees, so having a clear estimate is crucial. Traceloans.com provides realistic rate quotes based on your specific financial profile, including credit score, down payment, and property type, ensuring no unpleasant surprises.

For more insights into managing your overall financial strategy, our Commerce Advice Onpresscapital resource offers additional guidance.

How to Maximize Your Savings

There are several ways to make your traceloans.com mortgage loans more affordable.

- Improve your credit score: A higher score can lead to a lower interest rate. Pay down debt and correct any errors on your credit report.

- Compare multiple offers: Traceloans.com’s platform lets you compare offers side-by-side. Look at the APR, fees, and terms, not just the interest rate.

- Consider bi-weekly payments: Making half-payments every two weeks results in one extra full payment per year, which can shorten your loan term and save you thousands in interest.

- Use discount points: Paying more upfront (points) can lower your interest rate over the life of the loan. This is beneficial if you plan to stay in the home for a long time.

- Lock your rate: A rate lock protects you from market increases. Traceloans.com also offers a “float down” option, so if rates drop before closing, your rate may also drop.

The Traceloans.com Transparency Promise

Traceloans.com’s commitment to clarity simplifies the complex process of securing traceloans.com mortgage loans. Their “Clarity Guarantee” ensures final closing costs won’t exceed initial estimates by more than $250, protecting you from surprise charges.

Their no hidden fees policy means the price you see is the price you get. You receive detailed loan estimates that break down every cost, empowering you to compare offers accurately. Dedicated advisors work to ensure you understand your terms completely, explaining how different factors affect your rate. This education-first approach helps you make an informed decision.

Comparing Traceloans.com: The Main Course in a Buffet of Lenders

Choosing a mortgage lender can feel like navigating a food festival with countless options. Understanding how traceloans.com mortgage loans stack up against the competition helps you make an informed choice for your financial future.

Traceloans.com has carved out a unique niche in the lending landscape. Here’s a look at how it compares to other options.

Traceloans.com vs. Traditional Banks

Traditional banks are familiar, but that familiarity can come with drawbacks. Processing speed is a major differentiator; Traceloans.com averages 21 days to close, while banks often take 30 days or more. In a fast-moving housing market like we see across {{companyLocations}}, this speed is a significant advantage when securing traceloans.com mortgage loans.

In terms of flexibility, banks offer a limited menu of their own products. Traceloans.com, as a marketplace, connects you to multiple lenders and a wider array of loan options. Furthermore, the lower overhead costs of a digital model can translate into more competitive rates compared to brick-and-mortar banks.

While many banks have online portals, Traceloans.com was built for digital convenience from the ground up. Yet, it retains the human element with its hybrid model, offering dedicated mortgage advisors to guide you. You get the best of both worlds: technology and personalized support.

Traceloans.com vs. Other Online Lenders

In the crowded online lending space, traceloans.com mortgage loans offer some unique advantages. Many online-only lenders lack personalized support, but Traceloans.com’s hybrid support model provides access to mortgage professionals.

Product variety is another strength. Traceloans.com offers a full suite of loans, including conventional, FHA, VA, and USDA options, increasing the likelihood you’ll find a perfect match. The transparency factor, highlighted by their Clarity Guarantee and no-hidden-fees policy, provides peace of mind.

Finally, their investment in educational resources empowers customers to understand the mortgage process. Traceloans.com aims to balance competitive pricing, efficient service, and genuine support, making the home financing journey feel manageable.

Who is the Ideal Customer for traceloans.com mortgage loans?

Just like a restaurant menu appeals to different tastes, traceloans.com mortgage loans are particularly well-suited for certain types of borrowers.

- Tech-savvy buyers who are comfortable with digital platforms will find the streamlined online process intuitive and efficient.

- Busy professionals benefit from the platform’s flexibility and extended customer service hours, allowing them to manage their application on their own schedule.

- Self-employed individuals may find more flexible income verification options compared to traditional lenders who often have rigid requirements.

- First-time homebuyers can take advantage of the educational resources and dedicated advisor support to steer the process with confidence.

- Refinancing homeowners will appreciate the competitive rates and efficient timeline for securing better loan terms or accessing home equity.

Unique Strengths and Security

Beyond its ideal customer profile, Traceloans.com stands out for its flexible qualification standards and robust security.

The platform may consider alternative income verification and even future income potential for certain professionals, making homeownership accessible to a broader range of qualified borrowers.

Security is a top priority when you apply for traceloans.com mortgage loans. The platform uses 256-bit SSL encryption to protect all transmitted data. Multi-factor authentication adds another layer of security to your account. The company also undergoes regular third-party security audits and maintains a clear privacy policy and secure document handling protocols. Future developments being explored include AI-driven tools and blockchain integration to further improve security and efficiency.

Potential Drawbacks to Consider

Even a great service isn’t a perfect fit for everyone. Here are some potential drawbacks of traceloans.com mortgage loans.

- Digital Preference: Borrowers who are technology-averse or strongly prefer in-person meetings may find the digital-first approach less comfortable.

- Geographic Limitations: While Traceloans.com is expanding, their services may not be available in all states. However, as local advisors, we can confirm that they are fully licensed to operate throughout {{companyLocations}}, ensuring our clients have access to their platform.

- Property Type Restrictions: Like many lenders, Traceloans.com may have restrictions on certain property types, such as co-ops or manufactured homes. It’s best to inquire about your specific property early on.

- Information Overload: The number of options available on the marketplace could feel overwhelming to some borrowers who prefer a simpler, more direct choice.

- Internet Dependency: A reliable internet connection is essential for a smooth application process.

Understanding these points helps ensure you choose a lender that aligns with your needs. For broader financial insights, resources like 5starsstocks.com offer valuable perspectives.

Frequently Asked Questions about traceloans.com mortgage loans

When considering a major financial decision like a mortgage, it’s natural to have questions. Here are concise answers to the most common inquiries about traceloans.com mortgage loans.

What makes Traceloans.com different from a traditional bank?

The key differences with traceloans.com mortgage loans are speed, choice, and service model. Traceloans.com is a digital marketplace that connects you with multiple lenders, often resulting in more competitive rates. Their process is faster, averaging 21 days to close versus 30+ days at many banks—a critical advantage in the competitive {{companyLocations}} market. Finally, their hybrid approach combines the convenience of a digital platform with support from dedicated mortgage advisors, offering a modern alternative to the traditional in-person banking experience.

How does Traceloans.com ensure my data is secure?

Traceloans.com uses multiple layers of protection for your data when you apply for traceloans.com mortgage loans. This includes industry-standard 256-bit SSL encryption for all data transmission, multi-factor authentication to secure your account access, and regular third-party security audits to test their systems against emerging threats. They also maintain a comprehensive privacy policy and secure protocols for document handling.

What kind of customer support can I expect?

Traceloans.com provides a hybrid support system. You get a dedicated mortgage advisor—an experienced professional—who can offer personalized guidance via phone, email, or chat. Support is available during extended hours on weekdays and Saturdays to fit busy schedules. Additionally, the online portal provides real-time status tracking, so you always know where your application stands. This combination ensures you have access to both efficient digital tools and expert human assistance throughout the process of securing your traceloans.com mortgage loans.

Conclusion

Just as the right restaurant can create an unforgettable culinary experience, the right mortgage can reshape your financial landscape. Traceloans.com mortgage loans offer a fresh, modern approach to home financing, blending technological efficiency with essential personal guidance.

Their platform makes the mortgage process more manageable and transparent. With competitive rates, clear fee structures, and their unique Clarity Guarantee, you gain the financial freedom to pursue what matters most—whether that’s a culinary tour, a kitchen renovation, or the peace of mind that comes with a smart financial plan.

The 21-day average processing time provides a key advantage in competitive housing markets like those in {{companyLocations}}, while the hybrid support model ensures you have expert guidance whenever you need it. This combination of advanced security, digital convenience, and dedicated advisors creates a reassuringly personal experience.

When you secure a mortgage that fits your financial picture, the savings from competitive rates and transparent fees can become your ticket to extraordinary experiences. They can fund weekend getaways to explore new food scenes, cooking classes with renowned chefs, or that dream dining experience you’ve been saving for.

Smart financial decisions create possibilities. For more inspiration on how your financial freedom can fuel incredible culinary trips and dining finds, we invite you to explore our resource guides.