Why Managing Multiple Debts Can Feel Overwhelming

As NYC-based food and travel editors at The Dining Destination, we hear from readers who want to explore tasting menus in Manhattan, ramen spots in Queens, and waterfront eateries in Brooklyn—but feel stuck juggling bills. In a city where every minute and dollar counts, managing multiple debts can derail the culinary trips you came for. That’s where traceloans.com debt consolidation can support your broader lifestyle goals: by potentially lowering interest and simplifying payments, you can redirect mental energy and, over time, more of your budget toward the dining experiences that make New York City special.

Quick Overview of Traceloans.com Debt Consolidation:

- What it is: A platform connecting borrowers with lenders for debt consolidation loans.

- How it works: Combines credit cards, personal loans, and medical bills into one payment.

- Key benefit: Potential for lower interest rates and simplified monthly payments.

- Credit requirements: Options available for various credit scores, including bad credit.

- Funding time: Typically 1-3 business days after approval.

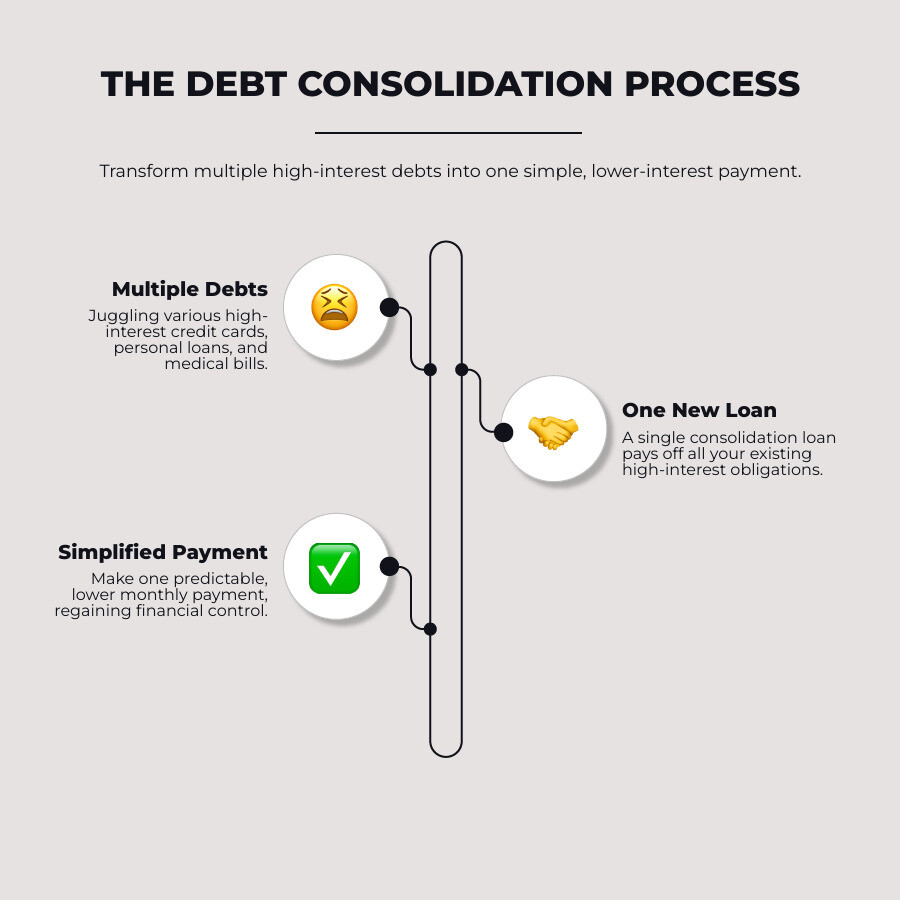

Instead of making several payments each month, you take out one new loan to pay off all your existing debts. Then you make just one monthly payment on the new loan. Traceloans.com acts as a bridge to multiple lending partners, increasing your chances of finding suitable terms. For New Yorkers balancing rent, transit, and a love of the city’s food scene, the goal is to regain control and work toward becoming debt-free—so you can plan that next Chinatown crawl or Brooklyn market day without the background stress.

As local experts, we aim to connect practical money moves like traceloans.com debt consolidation with the reason you’re here—making the most of NYC’s dining culture, one smart decision at a time.

What is Debt Consolidation and How Can It Help?

Picture your kitchen table covered in bills—credit card statements, medical bills, personal loan paperwork. It feels like financial whack-a-mole. Debt consolidation is your way out of this chaos. You take out a single new loan, usually an unsecured personal loan, to pay off all your existing debts. Instead of juggling multiple payments, you’re left with just one monthly payment to one lender.

The real magic is in the interest rates. Credit card debt often carries rates of 20% or higher. A traceloans.com debt consolidation loan frequently comes with a significantly lower fixed interest rate. This means you save money and can see a clear end to your debt. With a consolidation loan, you get a fixed repayment schedule, so you know exactly how much to pay and when you’ll make that final payment.

For New Yorkers, that clarity matters. It helps you plan around rent cycles, transit costs, and yes—setting aside a small, intentional dining budget to enjoy the city without sabotaging your progress. This approach works well for unsecured debts like credit card balances, personal loans, and medical bills. Federal student loans have their own specific consolidation programs. If you’re curious about other strategies, you can explore alternatives to debt consolidation. Understanding your financial health is key, so getting more info about your credit score is also a smart move.

The Pros and Cons of Consolidating Your Debt

Like any financial tool, debt consolidation has its bright sides and potential pitfalls. Think of it like choosing a restaurant in NYC: even the best spot isn’t right for every occasion.

The bright side: You get simplified payments—one payment, one due date. A lower, fixed interest rate means more of your payment reduces the actual debt. You’ll also have a fixed payment schedule with a clear finish line. Plus, paying off credit cards can improve your credit utilization ratio, which is great for your credit score. For our NYC readers, this structure makes it easier to plan intentional food experiences—like a monthly Queens Night Market visit—without losing traction.

The reality check: Debt consolidation restructures debt; it doesn’t erase it. If you don’t address the spending habits that led to debt, you could end up with a consolidation loan and new credit card debt. A lower monthly payment might mean a longer repayment period, potentially costing more in total interest over time. Traceloans.com debt consolidation requires serious spending discipline and be aware of potential origination fees.

Who is a Good Candidate for Debt Consolidation?

Debt consolidation is especially helpful if you’re struggling with multiple payments on high-interest credit cards. A stable income is crucial, as lenders will look at your debt-to-income ratio to ensure you can handle the new payment. The best candidates have a genuine desire for a structured plan and a real commitment to financial health. Even if your credit isn’t perfect, traceloans.com debt consolidation offers options that can provide a clear path forward. For diners and travelers in NYC, that path often means confidently budgeting for the occasional reservation or food tour while steadily paying down what you owe.

Why Choose Traceloans.com for Debt Consolidation?

When you’re already stressed about finances, finding the right platform can be tough. Traceloans.com stands out with a refreshingly straightforward approach that our New York audience appreciates—clear steps, quick comparisons, and less time lost to paperwork when you’d rather be finding a new neighborhood spot.

What makes traceloans.com debt consolidation different is its user-centric platform. The real game-changer is their access to multiple lenders. Instead of you applying to dozens of banks, Traceloans.com connects you with its network, increasing your chances of finding a loan that works for your situation.

Crucially, they use a soft credit pull for pre-qualification, so checking your options won’t hurt your credit score. You’ll also get transparent terms upfront—interest rates, monthly payments, and total costs—with no surprises. Once approved, their quick funding process means funds typically arrive within 1-3 business days, so you can tackle high-interest debts right away. For more details, visit Traceloans.com directly. For NYC readers planning around Restaurant Week or a Brooklyn pizza crawl, that speed can help you lock in a simpler budget before those plans hit the calendar.

How Traceloans.com Helps Borrowers with Bad Credit

Having bad credit can feel like being stuck in financial quicksand. Traceloans.com understands this. While perfect credit gets the best rates, bad credit doesn’t automatically disqualify you from getting help through their network.

Their lender partners often look beyond the three-digit score, considering your current income and job stability. It’s about your ability to repay now, not just past mistakes. This approach creates a real path to rebuilding credit, as on-time payments are reported to credit bureaus. While you’ll likely face higher interest rates, a consolidation loan can still be a lifeline compared to high-cost credit cards or payday loans.

Types of Debt You Can Consolidate with Traceloans.com

Traceloans.com debt consolidation focuses on unsecured debts—those not backed by collateral. This includes:

- Credit card balances: The most common type, often with cripplingly high interest rates.

- High-interest personal loans: Consolidating these simplifies your financial life.

- Medical bills: These can pile up from multiple providers, creating a paperwork nightmare.

- Store cards: These often carry some of the highest interest rates around.

- Payday loans: For some borrowers, this can be a way out of the expensive payday loan trap.

While private student loans might be eligible, federal student loans have their own specific programs. For those managing business finances, we also offer guidance on business loan options. For NYC locals, consolidating the right mix of debts can make month-to-month planning smoother, so you can say yes to more neighborhood eats without losing sight of your payoff plan.

The Step-by-Step Application Process

Taking control with traceloans.com debt consolidation is a clear, manageable process. Think of it like planning a perfect dining experience in NYC—you want to know what to expect and budget accordingly.

- Step 1: Assess your debts. Gather all your statements to know the total amount owed, interest rates, and monthly payments for each debt. An honest look at your income and expenses helps determine what you can afford. NYC tip: plan around fixed costs like rent and transit, then set a small, realistic dining allowance you can enjoy without breaking stride.

- Step 2: Fill out the pre-qualification form. On the Traceloans.com website, complete their simple form. This step uses a soft credit pull, so it won’t affect your credit score.

- Step 3: Compare lender offers. You’ll receive pre-qualified offers from multiple lenders. Compare the interest rate, loan term, monthly payment, and any origination fees to find the best fit.

- Step 4: Finalize the loan and pay off debts. Once you choose an offer, complete the formal application. After approval, funds typically arrive in 1-3 business days. Some lenders will even pay your creditors directly.

Applying for traceloans.com debt consolidation

Being prepared makes the process smoother. Gather your recent pay stubs, bank statements, and a valid ID ahead of time. Provide accurate information to avoid delays. Always review loan agreements carefully, paying close attention to the APR, which includes all fees and gives you the true cost of borrowing. Once finalized, loan disbursement happens quickly, either to you or directly to your creditors.

Managing Your Finances After Consolidation

Traceloans.com debt consolidation gives you a fresh start. Now it’s time to make the most of it.

- Create a budget: With one predictable payment, budgeting becomes much easier. In NYC, try earmarking a fixed monthly amount for food exploration—think one special meal or market visit—so your plan stays sustainable.

- Avoid new debt: This is the most important habit. Protect the freedom you’ve gained.

- Stick to the repayment plan: Set up automatic payments to build a positive payment history and strengthen your credit score.

- Build an emergency fund: Save 3-6 months of expenses to handle unexpected costs without resorting to credit.

- Monitor your credit: Watch your hard work pay off as your score improves. After mastering debt, building wealth is the next step. You might find value in exploring more info about investing tips.

Potential Risks and Smart Alternatives

While traceloans.com debt consolidation can be a lifeline, it’s important to approach it with your eyes open. The biggest mistake is treating it as a magic wand. Consolidation reorganizes your finances, but you still need to change your spending habits.

Ignoring spending habits is the number one trap. If you pay off your credit cards only to charge them up again—say, celebrating with a costly multi-course dinner—you’ll be in a worse position with both a consolidation loan and new debt. Another pitfall is not reading the fine print. Understand the APR, origination fees, and late payment penalties. Also, be wary of choosing a loan with a longer term just for a lower monthly payment, as it could cost you more in total interest. In NYC, a small, intentional dining budget can scratch the foodie itch without restarting the debt cycle.

Here’s how debt consolidation compares to other strategies:

| Feature | Debt Consolidation Loan | Debt Management Plan | Debt Settlement |

|---|---|---|---|

| How it Works | New loan pays off old debts; single payment to one lender | Credit counseling agency negotiates with creditors; you pay agency monthly | Company negotiates to pay less than full amount owed |

| Credit Impact | Initial small dip, then improvement with payments | Generally positive with consistent payments | Major negative impact for several years |

| Interest Rates | Potentially lower than current debts | Reduced through negotiation | Often no interest, but high fees apply |

| Best For | Stable income, good discipline, wants simplicity | Needs guidance, willing to close credit accounts | Severe hardship, can’t make minimum payments |

How traceloans.com debt consolidation Impacts Your Credit Score

Your credit score’s reaction to traceloans.com debt consolidation is usually positive long-term. Initially, the lender’s hard inquiry causes a small, temporary dip. The real benefit comes from lowered credit utilization. Paying off maxed-out credit cards can significantly boost your score, as this factor accounts for 30% of it. Building a positive payment history with your new loan is also crucial, making up 35% of your score. Most people see their scores improve within 3-6 months. For more details, read Will Consolidating Debt Damage my Credit?. With a stronger score, planning ahead for NYC Restaurant Week or a borough-by-borough food tour becomes easier to budget with confidence.

Alternatives to Debt Consolidation

While consolidation works for many, it’s not the only option.

- A Debt Management Plan (DMP) through a non-profit credit counseling agency can lower interest rates without a new loan.

- The Debt Snowball or Avalanche methods are DIY approaches that require discipline but no new credit.

- Balance transfer credit cards offer 0% introductory APRs for those with good credit, but watch for fees and the promotion’s end date.

- Home Equity Loans or Lines of Credit (HELOC) offer low rates but put your home at risk if you can’t make payments.

Choosing the right approach depends on your situation. For more on these options, see Debt Consolidation Loans: How to Reduce Your Personal Debt.

Frequently Asked Questions about Traceloans.com Debt Consolidation

When it comes to debt, we know you have questions. As your financial guides here in New York City, we’ve heard them all. Let’s address the most common questions about traceloans.com debt consolidation.

Can I get a debt consolidation loan from Traceloans.com with a poor credit history?

Yes, and that’s a key benefit of their approach. While excellent credit secures the best rates, Traceloans.com understands that life happens. Their lending partners often look beyond just your credit score, considering your current income stability and your debt-to-income ratio. They focus on your ability to make payments now. The interest rates might be higher, but it’s often a much better deal than juggling high-interest credit cards. Plus, successfully managing your consolidated loan provides a genuine opportunity to rebuild your credit with on-time payments. For NYC readers, that progress can translate into a predictable budget that leaves room for the occasional special meal without losing momentum.

How quickly can I receive funds after being approved?

Speed matters when you’re stressed about debt. Once approved, you can typically expect funds within 1-3 business days. The exact timing depends on the lender and your bank. Conveniently, some lenders in the Traceloans.com network will pay your creditors directly, taking that task off your plate and reducing stress.

What is the difference between debt consolidation and debt settlement?

This is a critical distinction. They are very different approaches with different consequences.

Debt consolidation, which is what traceloans.com debt consolidation offers, is about reorganizing your finances. You take out a new loan to pay off existing debts, restructuring everything into one manageable payment. You still owe the same amount, but hopefully with better terms. With consistent payments, your credit score typically improves over time.

Debt settlement is when a company negotiates with your creditors to accept less than what you owe. While paying less sounds good, it can have serious, long-term negative consequences for your credit score, as it’s reported that you didn’t pay the full amount. It’s typically a last resort for those in severe financial hardship.

Conclusion

Taking the step toward traceloans.com debt consolidation can feel like finding a hidden gem of a restaurant in NYC—exciting but a little nerve-wracking. We get it. Financial decisions are deeply personal.

The benefits are compelling: simplified monthly payments, potentially lower interest rates, and a fixed repayment schedule that gives you a clear finish line on your journey to financial freedom. Traceloans.com debt consolidation stands out with its user-friendly approach and access to multiple lenders, offering options even if your credit history isn’t perfect.

Consolidation is the beginning, not the destination. Its success depends on your commitment to changing the spending habits that led to debt in the first place. As your trusted guides at The Dining Destination here in New York City, we’ve seen how the right financial tools can open up new possibilities—like planning that borough-hop for dumplings, pizza, and pastries—freeing up resources for the culinary trips and experiences that matter to you.

Whether you’re dealing with credit card balances, high-interest loans, or medical bills, this offers a path forward. It requires discipline, but it can be the fresh start you need to regain control of your financial story and savor more of NYC’s dining culture, responsibly.

Ready to take the first step? We’re here to support your journey. Begin your journey to financial control with our resource guides and find how taking charge of your finances can open up a world of new possibilities.