Why Traceloans.com Personal Loans Are Changing How People Borrow Money

Traceloans.com personal loans have emerged as a popular solution for people seeking fast, flexible financing in today’s digital world. Whether you’re planning that dream culinary adventure across Europe, renovating your kitchen to create the perfect entertaining space, or consolidating high-interest credit card debt, personal loans can provide the financial flexibility you need.

Here’s what you need to know about Traceloans.com personal loans:

- Loan marketplace – Connects you with multiple lenders, not a direct lender itself

- Loan amounts – Typically $500 to $50,000 depending on the lender

- Fast approval – Most loans approved within 24 hours

- All credit scores – Options available even with less-than-perfect credit

- No platform fees – Free to use the Traceloans.com service

- Flexible terms – Repayment periods up to 84 months

- Transparent process – No hidden charges or surprise fees

The personal loan market has seen dramatic changes recently. Digital lending platforms have captured nearly 38% of the personal loan market since 2023, making it easier than ever to compare options and find competitive rates. However, with average personal loan interest rates ranging from 6-36% and a 23% increase in rates for borrowers with credit scores below 680, understanding your options is more important than ever.

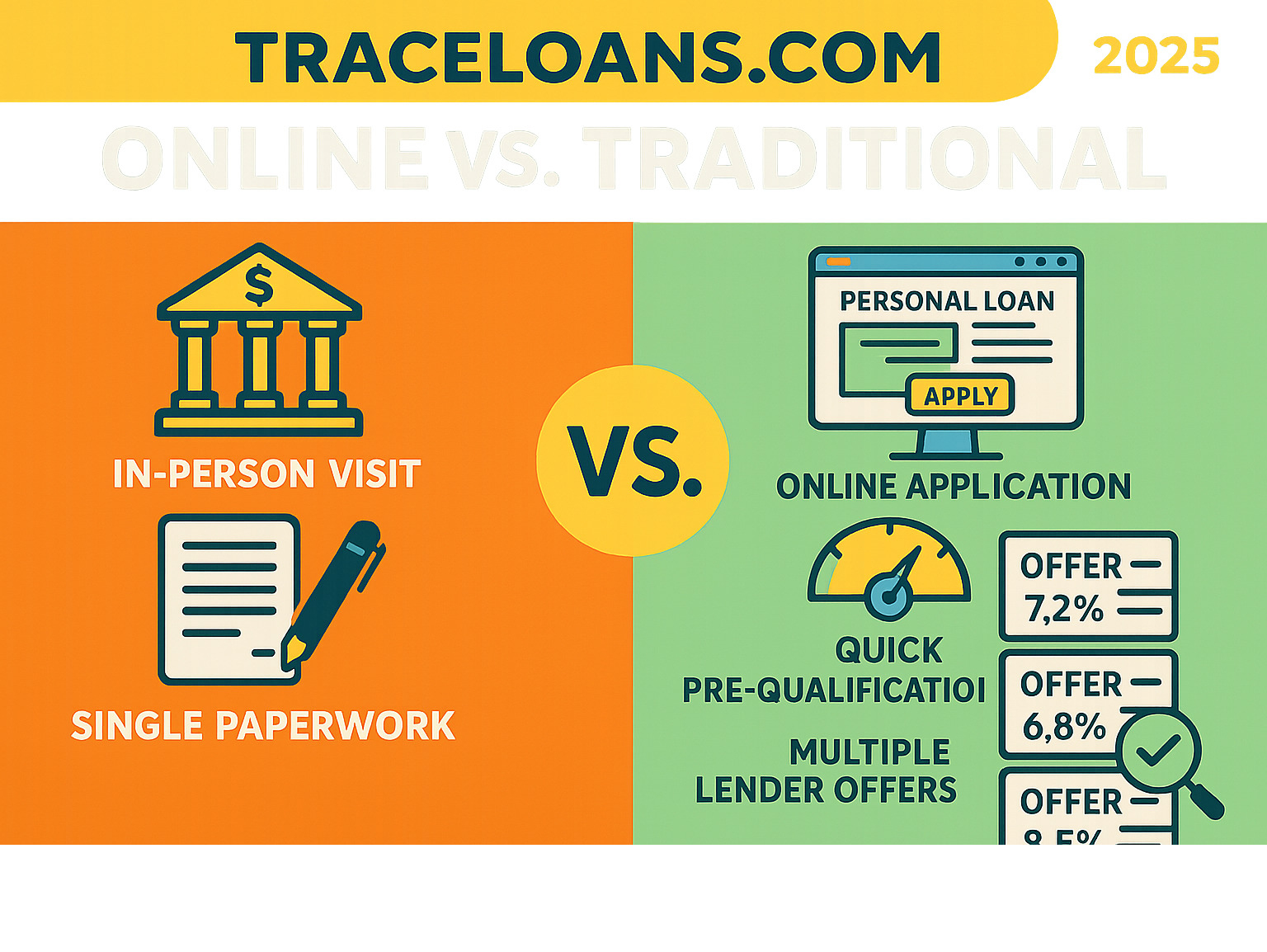

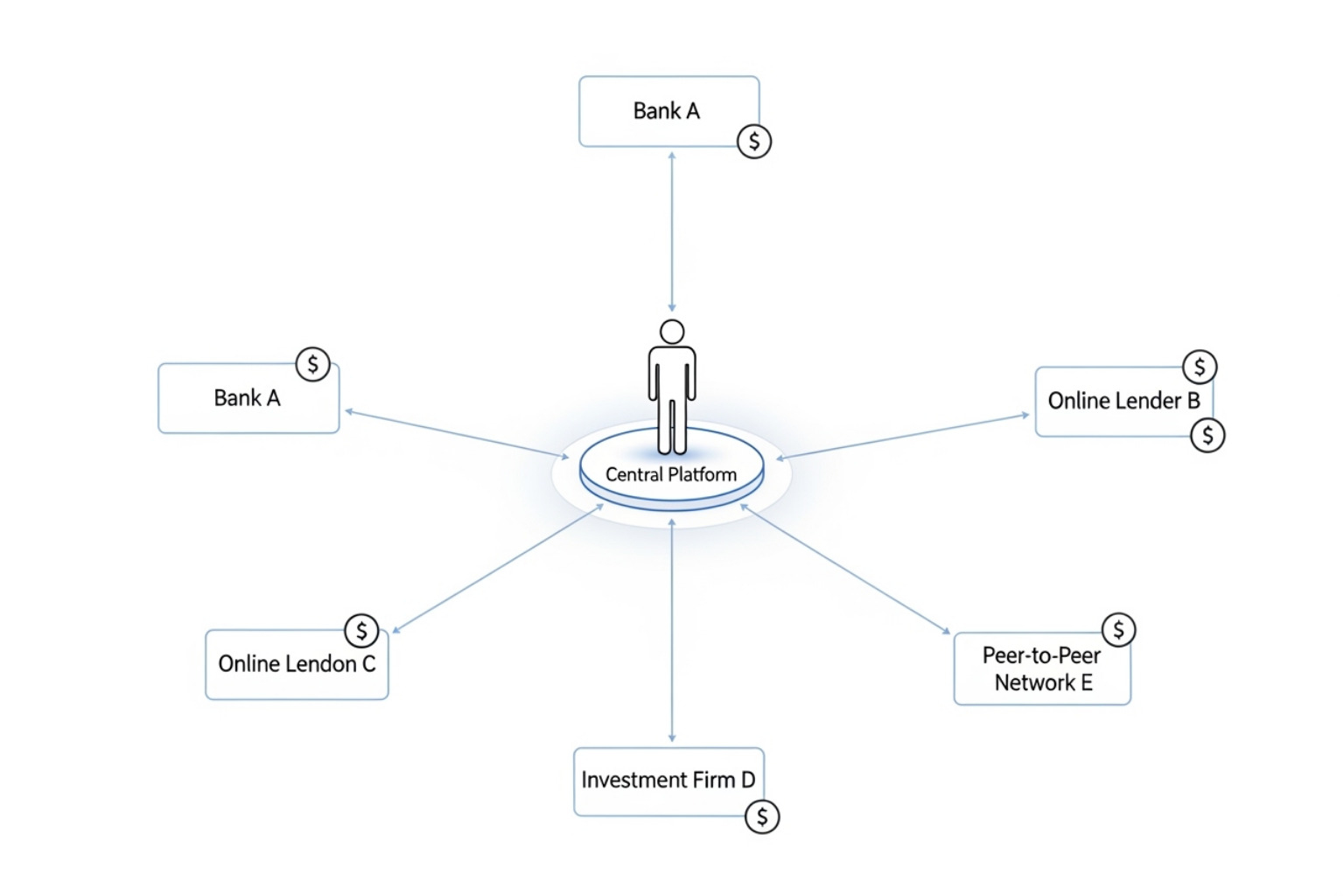

Traceloans.com positions itself as a loan aggregator that simplifies this complex landscape. Instead of visiting multiple bank websites or filling out countless applications, you can submit one form and receive offers from various lenders in their network.

Traceloans.com personal loans terms to know:

What is Traceloans.com and How Does It Work?

Think of planning the perfect dinner party – you wouldn’t want to visit every grocery store in town individually to find the best ingredients. That’s exactly the problem Traceloans.com personal loans solve in the lending world. Instead of hopping from bank to bank with separate applications, this platform brings all your options to one convenient place.

Traceloans.com operates as a loan marketplace, which means they’re not actually lending you money themselves. Instead, they act as the helpful connector between you and a network of trusted lenders. It’s like having a knowledgeable friend who knows all the best lending options and can introduce you to the right ones for your specific situation.

The beauty of this streamlined process lies in its simplicity. You fill out one application, and Traceloans.com presents you with multiple offers from different lenders in their network. No more repetitive paperwork, no more wondering if you missed a better deal somewhere else. The platform does the heavy lifting while you focus on comparing your options.

For more details about their services, you can explore Traceloans.com to see how their marketplace approach might work for your financial needs.

The Application Process: A Step-by-Step Guide

Getting started with Traceloans.com personal loans feels refreshingly straightforward. The entire process happens online, so you can apply from anywhere – whether you’re at home planning your next culinary adventure or taking a quick break at work.

First, you’ll complete their online form with basic information about yourself, your income, and how much you’d like to borrow. The platform then runs a soft credit check to understand your financial profile. Here’s the great news: this soft inquiry won’t ding your credit score at all, so you can explore your options without worry.

Once that’s done, the magic happens. Traceloans.com matches you with lenders from their network and presents you with loan offers to compare. You’ll see different interest rates, terms, and fees side by side, making it easy to spot the best deal for your situation.

When you’ve chosen your preferred offer, you’ll need to submit some documents to your selected lender. This typically includes proof of income, bank statements, and identification. The platform provides a secure way to upload these documents, keeping your personal information protected.

The fast approval process means most borrowers hear back within 24 hours. If approved, funding can happen within 24 hours or sometimes even the same day, depending on when your application is processed and your bank’s policies.

Understanding the Costs: Interest Rates and Fees

Let’s talk numbers – because nobody likes financial surprises. Traceloans.com personal loans come with typical APRs that generally range from 6% to 36%, though your specific rate depends on factors like your credit score and the lender you choose.

You might encounter origination fees, which are one-time charges for processing your loan. These typically range from 1% to 5% of your loan amount, but here’s what sets Traceloans.com apart: complete transparency. Every fee is clearly disclosed upfront, so there are no hidden charges waiting to surprise you later.

Most loans offered through the platform come with fixed rates, which means your monthly payment stays the same throughout your loan term. This predictability makes budgeting much easier – just like knowing exactly how much you’ll spend on groceries each month.

For detailed information about personal loan regulations and consumer protections, the Consumer Financial Protection Bureau provides excellent resources to help you understand your rights as a borrower.

Exploring Your Options with Traceloans.com Personal Loans

Picture this: you’re standing in your cramped kitchen, dreaming of hosting dinner parties with friends, but there’s barely room to flip a pancake. Or maybe you’re staring at a stack of credit card bills, each with its own interest rate and due date, feeling overwhelmed. These are exactly the moments when Traceloans.com personal loans shine brightest.

The real beauty of personal loans lies in their incredible loan versatility. Unlike a mortgage that’s tied to your house or a car loan that’s stuck to your vehicle, personal loans offer true financial flexibility. They’re like that perfect little black dress in your financial wardrobe – suitable for almost any occasion and always ready to help you look your best.

What makes Traceloans.com personal loans particularly appealing is how they open doors to achieving goals that might otherwise feel out of reach. Whether you’re planning a major life change or handling an unexpected curveball, having access to flexible funding can transform stress into opportunity.

Common Uses for Traceloans.com Personal Loans

Let’s talk about the real-world situations where Traceloans.com personal loans can make a genuine difference in your life. From our experience helping people steer financial decisions, these are the scenarios where personal loans truly shine.

Debt consolidation tops the list for good reason. If you’re juggling multiple credit card payments with different interest rates and due dates, it’s like trying to cook a five-course meal on three different stoves. A personal loan can simplify this chaos by rolling everything into one manageable monthly payment, often at a lower interest rate. For anyone feeling overwhelmed by multiple debts, check out this comprehensive TraceLoans.com Debt Consolidation – A Complete Guide for detailed strategies.

Home improvement projects are another sweet spot. Whether you’re dreaming of that kitchen renovation to create the perfect entertaining space or need to tackle urgent repairs, personal loans provide the upfront capital without touching your emergency savings. It’s particularly helpful for those major purchases that can’t wait for you to save up slowly.

Life has a way of throwing unexpected expenses our way, and medical emergencies can be especially stressful. Having access to quick funding through a personal loan means you can focus on what matters most – your health and recovery – without the added worry of how to pay for treatment.

The flexibility extends to more positive situations too. Maybe you’re considering going back to school or taking that specialized course that could advance your career. Personal loans can bridge the gap for educational expenses, turning professional dreams into achievable goals.

Flexible Repayment and Loan Terms

Here’s where Traceloans.com personal loans really show their strength – in offering terms that actually work with your life, not against it. The platform connects you with lenders who understand that one size definitely doesn’t fit all when it comes to borrowing money.

Loan amounts typically range from $500 to $50,000, which means whether you need a small boost for a minor expense or substantial funding for a major project, there’s likely an option that fits. This wide range gives you the freedom to borrow exactly what you need without being forced into a loan that’s too large or too small.

Repayment periods offer impressive flexibility, with terms extending up to 84 months. This longer timeframe can significantly reduce your monthly payment, making it easier to fit loan payments into your existing budget. Think of it as choosing between a sprint and a marathon – sometimes the longer, steadier approach is exactly what your finances need.

The fixed monthly payments feature is a game-changer for budgeting. When your payment amount stays the same each month, you can plan ahead with confidence. No surprises, no fluctuating amounts – just predictable payments that fit neatly into your financial routine.

Perhaps most importantly, there are typically no prepayment penalties with these loans. This means if you come into some extra money – maybe a bonus at work or a tax refund – you can pay off your loan early without being punished with additional fees. It’s refreshing to work with lenders who actually want you to succeed financially.

Who Can Qualify? Eligibility and Credit Considerations

Here at The Dining Destination, we’ve always believed that great experiences shouldn’t be limited by your background – whether that’s trying authentic ramen in Tokyo or securing the financing you need for life’s important moments. Traceloans.com personal loans accept this same philosophy, working hard to make borrowing accessible to people from all walks of life, regardless of where they’re starting from credit-wise.

The beautiful thing about using a loan marketplace like Traceloans.com is that it opens doors that might otherwise stay closed. Instead of getting a single “yes” or “no” from one bank, you’re essentially knocking on multiple doors at once. This approach to financial inclusion means that even if your credit history has a few bumps in the road, there’s likely a lender in their network who’s willing to work with you.

Think of it this way: if you were planning a food tour of New York City, you wouldn’t want to limit yourself to just one type of cuisine. Similarly, Traceloans.com doesn’t limit you to just one lender’s criteria – they cast a wide net to find the best match for your unique situation.

Navigating General Eligibility Requirements

While each lender in the Traceloans.com network has its own personality (much like how every restaurant has its own flavor), there are some basic requirements that most will expect. These aren’t meant to exclude people, but rather to ensure everyone can handle their loan responsibly.

First, you’ll need to be a U.S. citizen or permanent resident. This is pretty standard across the lending industry and helps lenders verify your identity and legal status. You’ll also need to be at least 18 years old – though if you’re in Alabama or Nebraska, you’ll need to wait until 19 to qualify for most loans.

Proof of income is another biggie, and this makes perfect sense when you think about it. Just like a restaurant needs to know they can afford their ingredients before planning a menu, lenders need confidence that you can handle the monthly payments. This doesn’t mean you need a traditional 9-to-5 job – freelancers, gig workers, and self-employed folks can often qualify too, though you might need to provide additional documentation like tax returns or bank statements.

You’ll also need an active bank account. This is where your loan funds will land and where your monthly payments will typically come from. It’s also a way for lenders to verify your financial stability and see how you manage money day-to-day.

Finally, each lender has its own specific criteria that might include things like minimum income requirements or debt-to-income ratios. This is exactly why Traceloans.com’s matching service is so valuable – instead of you having to research and understand dozens of different lender requirements, their system does the heavy lifting and connects you with lenders who are most likely to say yes.

Solutions for Bad or Limited Credit

Here’s where Traceloans.com personal loans really shine, and it’s something we’re particularly excited about. We know that life doesn’t always go according to plan – maybe you had a medical emergency that led to some missed payments, or perhaps you’re just starting out and haven’t had the chance to build much credit history yet.

The traditional banking system can sometimes feel like an exclusive restaurant that only serves people who are already well-fed. But Traceloans.com operates more like a welcoming neighborhood spot that finds a way to accommodate everyone. All credit scores are considered, which means even if your credit isn’t perfect, you still have options.

Now, let’s be honest – if your credit score is on the lower side, you’ll probably face higher interest rates. That’s just the reality of lending. But having access to credit when you need it, even at a higher rate, can be incredibly valuable. Maybe you need to consolidate high-interest credit card debt, handle an emergency repair, or invest in something that will improve your financial situation long-term.

What’s really exciting is that Traceloans.com personal loans can actually help you rebuild your credit over time. Many of the lenders in their network report your payment history to the major credit bureaus. This means that every on-time payment you make is like a positive review for your financial reputation. Over time, these consistent payments can help boost your credit score, opening up even better borrowing opportunities in the future.

Think of it as a stepping stone rather than a destination. You might start with a higher interest rate, but as you prove your reliability and your credit score improves, you’ll qualify for better terms down the road. It’s a practical way to turn a challenging situation into an opportunity for financial growth.

For more detailed guidance on understanding and improving your credit score, check out Gomyfinance.com Credit Score, which offers comprehensive insights into credit management.

Frequently Asked Questions about Traceloans.com

When we’re exploring financial options, especially something as important as a personal loan, it’s natural to have questions. Over the years at The Dining Destination, we’ve found that the best decisions come from having all the information we need upfront. Here are the most common questions we encounter about Traceloans.com personal loans, answered in the straightforward way we’d explain them to a friend over dinner.

Does checking for offers on Traceloans.com affect my credit score?

Here’s some great news that’ll put your mind at ease: checking for offers on Traceloans.com will not affect your credit score. When you submit your information to explore loan options, they perform what’s called a “soft inquiry” or “soft credit check.” Think of it like window shopping for loans – you can look around all you want without any consequences.

This soft inquiry allows Traceloans.com to assess your creditworthiness and match you with potential lenders, but it leaves no mark on your credit report. It’s completely invisible to other lenders and won’t impact your credit score in any way.

The only time a “hard inquiry” occurs – which can temporarily lower your credit score by a few points – is when you actually accept a specific loan offer and move forward with the full application for funding. This pre-qualification approach gives you the freedom to explore your options without any risk to your credit standing.

How does Traceloans.com protect my personal information?

We completely understand why data security would be a top concern – you’re sharing some pretty sensitive financial information, after all. Traceloans.com takes this responsibility seriously and has implemented robust security measures to protect your personal data.

Their platform uses advanced encryption technologies to safeguard your information during both transmission and storage. When you upload documents through their secure document portal, your sensitive details are protected by the same type of encryption that banks use for online transactions.

Many modern lending platforms, including those in Traceloans.com’s network, are now leveraging cutting-edge security features like blockchain technology and sophisticated algorithms to prevent fraud and improve protection. These privacy measures ensure your information stays exactly where it should – safe and secure.

For additional peace of mind, we always recommend following best practices for online security. The Federal Trade Commission provides excellent guidelines on protecting your personal information online.

Is Traceloans.com a direct lender?

This is probably the most important distinction to understand: no, Traceloans.com is not a direct lender. They operate as a loan marketplace or aggregator, which actually works in your favor.

Instead of being a single lender with one set of terms, Traceloans.com connects you with an entire network of lending partners. It’s like having a personal shopper for loans – they take your information and shop it around to multiple lenders to find you the best possible options.

This marketplace model means you get to compare offers from various lenders side by side, all from submitting just one application. Rather than spending hours filling out separate applications at different banks or lending institutions, you can see multiple offers and choose the one that works best for your situation. It’s this comparing options approach that makes Traceloans.com personal loans such a valuable tool for borrowers looking for the right fit.

Conclusion: Is a Traceloans.com Loan Right for You?

After diving deep into Traceloans.com personal loans, we’ve finded a platform that truly understands what modern borrowers need. Just like how we at The Dining Destination believe in making complex culinary experiences accessible to everyone, Traceloans.com has simplified the often overwhelming world of personal lending.

The convenience of their digital-first approach really stands out. Being able to complete an entire loan application from our couch while enjoying a home-cooked meal is pretty remarkable. The speed is equally impressive – getting pre-qualified offers without impacting our credit score, then potentially receiving funds within 24 hours when approved. For those of us juggling busy New York City lifestyles, this efficiency can be a real lifesaver when unexpected expenses pop up or when we’re ready to invest in that dream kitchen renovation.

What we particularly appreciate is the platform’s commitment to transparency. There are no surprise fees hiding in the fine print, and all costs are clearly disclosed upfront. The accessibility for various credit scores means more people can find financing solutions, even if their credit history isn’t perfect. It’s refreshing to see a platform that believes financial tools should be available to everyone, not just those with pristine credit.

The flexibility in repayment terms is another major plus. With options extending up to 84 months and typically no prepayment penalties, we can structure payments that actually fit our budget. For anyone looking to rebuild their credit, the opportunity to improve their score through consistent, on-time payments reported to credit bureaus adds real long-term value.

Of course, Traceloans.com is a marketplace, not a direct lender. This means the final loan terms and approval decisions come from their network of lending partners. While this gives us more options to compare, those with lower credit scores might still face higher interest rates. Additionally, once we choose a lender, our ongoing customer service will primarily be through that specific lender rather than Traceloans.com directly.

Looking toward the future, Traceloans.com’s investment in advanced technology and AI-driven underwriting suggests even faster, more personalized loan experiences ahead. Their innovative approach positions them well in the rapidly evolving digital lending landscape.

If you’re seeking a user-friendly platform that simplifies loan shopping, connects you with multiple lenders, and offers transparent terms, Traceloans.com personal loans deserve serious consideration. The key is taking time to compare offers carefully and choosing terms that support your financial goals rather than strain your budget.

Making informed financial decisions is just as important as making informed dining choices. Both require research, comparison, and understanding what works best for your unique situation. For more insights into navigating life’s financial and culinary adventures, we invite you to explore our complete resource guides.