Why Understanding Traceloans.com Bad Credit Options Matters

Traceloans.com bad credit solutions can help you access financing even when traditional lenders turn you away. This loan connection platform specializes in matching borrowers with lenders who work with less-than-perfect credit scores.

Quick Answer for Bad Credit Seekers:

- What it is: Traceloans.com connects you with lenders offering bad credit loans

- Credit requirements: No minimum credit score required

- Loan types: Personal loans, debt consolidation, emergency funding

- Approval odds: Higher than traditional banks for bad credit borrowers

- Funding speed: Often within 24-48 hours after approval

- APR range: Typically 5.99% to 35.99% depending on your profile

If you’ve been declined by banks or have a credit score below 620, you’re not alone. Research shows that many lenders consider anyone with a FICO score below 580 to have poor credit, making traditional financing nearly impossible.

Traceloans.com positions itself as a solution by connecting borrowers with a network of lenders who specifically work with challenging credit situations. The platform offers access to personal loans, debt consolidation options, and emergency funding without requiring a minimum credit score.

However, it’s important to understand that higher risk often means higher costs. While Traceloans.com can help you find lenders willing to work with bad credit, you’ll likely face higher interest rates and fees compared to borrowers with excellent credit.

This guide will walk you through everything you need to know about using Traceloans.com for bad credit loans, including eligibility requirements, application processes, and what to expect in terms of rates and terms.

Handy traceloans.com bad credit terms:

What is Traceloans.com and How Does It Work?

When you’re facing financial challenges, finding the right lender can feel as overwhelming as searching for the perfect restaurant in an unfamiliar city. That’s where Traceloans.com steps in to simplify your journey.

Traceloans.com operates as a loan connection service, not a direct lender. Think of it as your personal financial concierge – they don’t actually provide the loans themselves, but they know exactly who might be willing to help you. This borrower-lender network approach means you get access to multiple lending partners through one convenient platform.

The beauty of this system lies in its loan variety. Whether you need emergency funds for an unexpected expense or want to consolidate debt, Traceloans.com connects you with lenders who specialize in different types of financing. This is particularly valuable when you’re dealing with traceloans.com bad credit situations, as traditional banks often have strict requirements that many borrowers can’t meet.

For more detailed information about how this platform works, you can explore our comprehensive guide: More info about Traceloans.com.

Services Offered for Various Financial Needs

Traceloans.com understands that financial needs are as diverse as people’s tastes in food. While we’re focusing on bad credit options here, the platform offers connections to lenders across multiple categories.

Personal loans form the backbone of their service, perfect for covering everything from medical bills to home repairs. These flexible loans don’t restrict how you use the funds, giving you the freedom to address your specific needs.

For entrepreneurs looking to start or expand their business, business loan connections are available through specialized lenders. Our detailed guide on traceloans.com business loans covers this topic extensively.

Mortgage loan connections help people steer the complex world of home financing. Whether you’re a first-time buyer or looking to refinance, you can learn more in our traceloans.com mortgage loans resource.

Auto loans connect you with lenders who understand that reliable transportation is essential for work and daily life. Student loans help bridge the gap between educational dreams and financial reality.

Debt consolidation deserves special attention for bad credit borrowers. This service connects you with lenders who can help combine multiple high-interest debts into a single, potentially more manageable payment. Our traceloans.com debt consolidation guide explains how this can improve your financial situation.

The Role of Traceloans.com in the Loan Process

The loan aggregator model that Traceloans.com uses is genuinely helpful for borrowers. Instead of visiting multiple lender websites and filling out countless applications, you complete one single application on their platform.

This single application convenience saves hours of repetitive data entry. Your information gets shared with multiple lenders in their network, and you can receive multiple lender offers to compare. It’s like having a personal assistant who shops around for the best deals on your behalf.

Data security is a crucial concern, especially when sharing sensitive financial information. Traceloans.com uses industry-standard encryption to protect your data during transmission. They also emphasize user privacy, though it’s important to understand that your information will be shared with potential lenders in their network – that’s how the matching process works.

This approach is particularly valuable for traceloans.com bad credit borrowers, who often face rejection from traditional lenders. By connecting you with lenders who specifically work with challenging credit situations, Traceloans.com increases your chances of finding financing when you need it most.

Navigating Traceloans.com Bad Credit Loan Options

Having bad credit can feel like being locked out of the financial world. You know that sinking feeling when another lender says “no,” leaving you wondering where to turn next. The good news? Traceloans.com bad credit options are specifically designed for people in exactly this situation.

Think of Traceloans.com as your financial wingman. They’ve created a specialized bad credit category that connects you directly with lenders who actually want to work with borrowers who have credit challenges. Instead of wasting time applying to lenders who’ll automatically reject you, you’re matched with ones who understand that life happens and credit scores don’t tell your whole story.

Here’s the reality check, though: these loans come with trade-offs. Lenders who work with bad credit borrowers charge higher rates because they’re taking on more risk. It’s like paying a premium for a last-minute dinner reservation at that hot new restaurant – you’ll get a table, but it’ll cost you more.

The key is understanding exactly what you’re getting into. When you know the loan products inside and out, you can make smart decisions that actually help your financial future instead of making things worse.

Understanding Your Eligibility for a traceloans.com bad credit Loan

So what does it actually take to qualify for a traceloans.com bad credit loan? The beauty of this platform is that they don’t set a minimum credit score requirement. That’s right – no magic number you need to hit.

However, each lender in their network has their own criteria. Most will want to see that you’re at least 18 years old and a U.S. citizen or permanent resident. Pretty straightforward stuff.

The big one is stable income. Lenders need to know you can pay them back, but this doesn’t mean you need a traditional 9-to-5 job. Here in New York, with our gig economy and diverse work opportunities, lenders often accept various income sources – from freelance work to benefits to self-employment earnings.

You’ll also need an active bank account where they can deposit your funds and set up automatic payments. And here’s something crucial that many people overlook: your debt-to-income ratio. This measures how much of your monthly income already goes toward debt payments.

Even with bad credit, showing steady income and manageable existing debt can dramatically improve your approval odds. For deeper insights on this topic, Experian has an excellent guide on How to Get a Loan With Bad Credit that’s worth checking out.

Types of Bad Credit Loans Available

When you explore traceloans.com bad credit options, you’ll encounter several loan types designed for people with credit challenges.

Personal installment loans are the most popular choice. You get your money upfront as a lump sum, then pay it back over a set period – usually 12 to 60 months – with fixed monthly payments. This predictability makes budgeting much easier since you know exactly what to expect each month.

Some lenders offer payday loan alternatives, which are short-term, smaller loans typically offered through credit unions. These are much safer than traditional payday loans, with APRs usually capped around 28% and more reasonable repayment terms.

You’ll also see both secured and unsecured options. Unsecured loans don’t require collateral, which means you don’t risk losing your car or other assets if you can’t pay. Most loans you’ll find through Traceloans.com are unsecured, though they come with higher interest rates since lenders can’t seize anything if you default.

Secured loans require you to put up something valuable as collateral – like your car or savings account. Because lenders have that safety net, they might offer better rates even with bad credit.

People use these loans for all sorts of needs: emergency medical bills, urgent car repairs, home maintenance, unexpected utility bills, or debt consolidation. That last one is particularly popular – combining multiple high-interest debts into one manageable payment. If that sounds appealing, our traceloans.com debt consolidation guide dives deeper into this strategy.

Typical Rates, Fees, and Repayment Terms

Now for the part that might make you wince a bit – the costs. Because you’re considered higher risk, traceloans.com bad credit loans come with higher price tags than loans for people with excellent credit.

APRs for bad credit loans can range widely, but expect to see rates significantly higher than the platform’s general range. While some borrowers might see rates in the 20-30% range, others might face APRs of 50% or even higher, especially for very short-term loans.

Let’s put this in perspective: a $10,000 loan over three years with a 29% APR and 5% origination fee could mean monthly payments around $419 and over $5,000 in total interest. Compare that to someone with good credit who might get a 10% APR and pay much less overall.

Origination fees are another cost to watch for. These typically range from 1% to 5% of your loan amount and get deducted before you receive your money. So if you’re approved for $5,000 with a 5% origination fee, you’d actually receive $4,750.

Late payment penalties can be steep and will further damage your credit, so staying on top of payments is crucial. Most loans come with fixed monthly payments over periods ranging from a few months to several years. Longer terms mean lower monthly payments but more interest paid overall.

Traceloans.com doesn’t charge hidden fees for their connection service, but the lenders they connect you with will have their own specific terms. Always read the fine print and don’t hesitate to ask questions. The Consumer Financial Protection Bureau (CFPB) is an excellent resource for understanding loan terms and protecting yourself as a borrower.

The Step-by-Step Application Process

Getting a traceloans.com bad credit loan doesn’t have to feel like navigating the subway system during your first week in New York. While it might seem daunting at first, the process is actually quite straightforward when you know what to expect.

Think of it like planning the perfect dinner party – a little preparation upfront makes everything run smoothly later. The same principle applies here. When you have your documents ready and understand each step, you’ll breeze through the application process with confidence.

Preparing Your Information

Before you start clicking away on your laptop, take a moment to gather everything you’ll need. This prep work is like mise en place in cooking – having everything ready before you start makes the whole process much smoother.

Your ID proof is the foundation of any loan application. A current driver’s license or passport will do the trick perfectly. Next, you’ll need solid income verification to show lenders you can handle the monthly payments. Recent pay stubs work great for traditional employees, while tax returns are your best friend if you’re self-employed or have a side hustle.

Don’t forget your bank statements – lenders want to see that active checking account where they’ll deposit your funds. You’ll also need your Social Security Number handy for identity verification and credit checks.

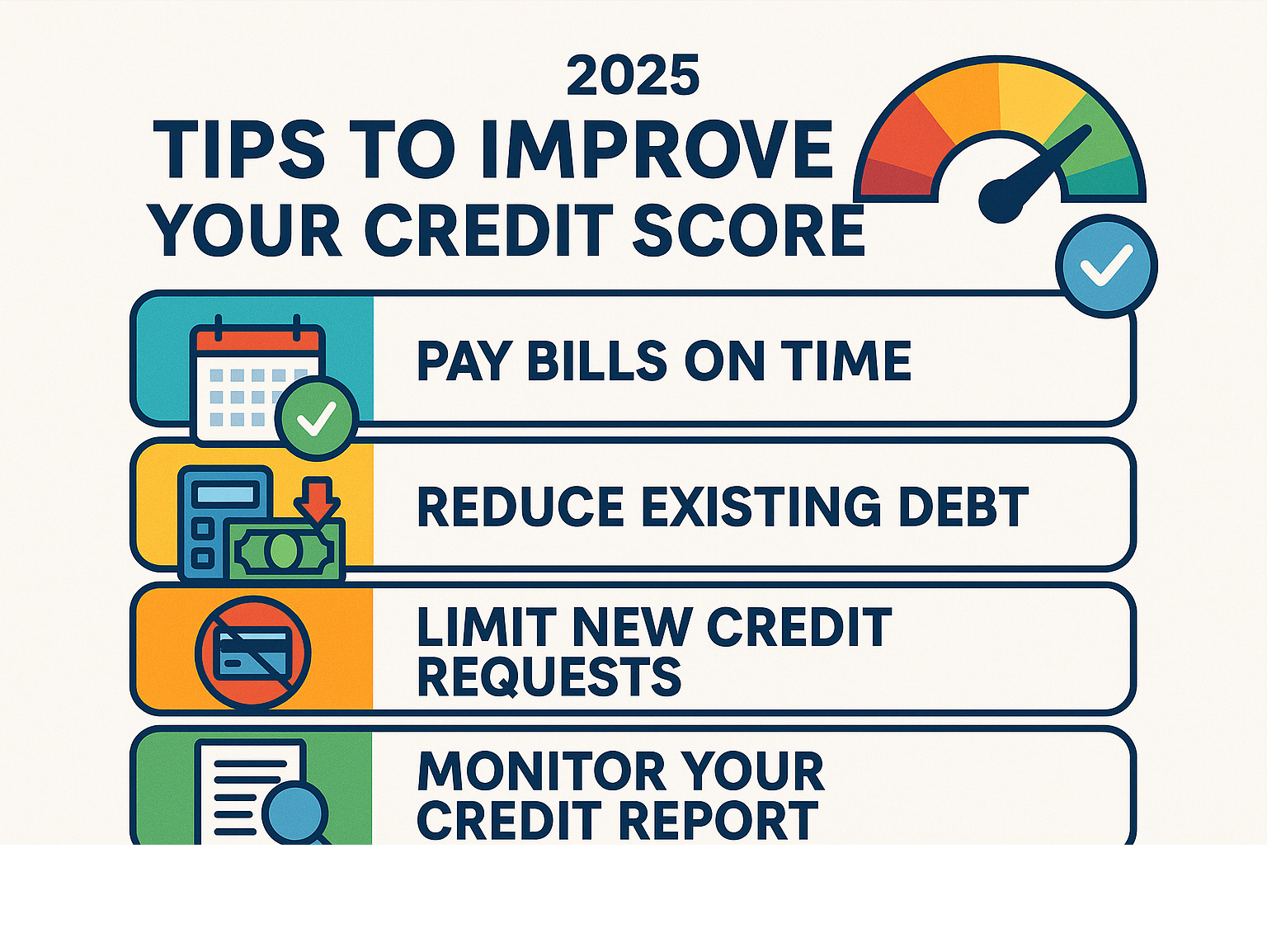

Here’s a pro tip that many people overlook: check your credit reports before you apply. Even with bad credit, knowing exactly what’s on your report helps you understand what lenders will see. You might even spot errors that are dragging your score down unnecessarily. You can get free copies of your credit reports once a year from all three major bureaus.

Submitting Your Application on Traceloans.com

Once you’ve got your paperwork sorted, the actual application process is refreshingly simple. The online form completion asks for basic information – your name, contact details, income, how much you want to borrow, and what you need the money for. Nothing too complicated here.

The beauty of Traceloans.com’s system is in its lender matching process. Instead of you having to research and contact multiple lenders individually, their platform does the heavy lifting. It takes your information and connects you with lenders in their network who are most likely to say yes to your application.

Document submission happens through a secure portal where you can upload photos or scans of your paperwork. Most people can handle this right from their phone these days, which makes things incredibly convenient.

The importance of accuracy cannot be overstated here. Double-check every single detail before hitting submit. A simple typo in your income or a wrong digit in your Social Security Number can cause delays or even rejection. Take an extra minute to review everything – your future self will thank you.

From Approval to Funding

This is where things get exciting. After you submit your application, the waiting game begins – but thankfully, it’s usually a short one.

Receiving offers typically happens within 24 hours. These offers come directly from the lenders who are interested in working with you, each with their own proposed terms, interest rates, and fees. It’s like getting multiple restaurant recommendations – you get to pick the one that looks most appealing.

The comparing loan terms step is crucial, especially for traceloans.com bad credit borrowers. Don’t just grab the first offer that lands in your inbox. Look at the APR (that’s the real cost of your loan), the monthly payment amount, how much you’ll pay in total, and any extra fees. Sometimes a slightly higher monthly payment can save you hundreds or even thousands in total interest.

Once you’ve made your choice, accepting an offer is as simple as clicking “yes” and moving forward with that specific lender. Most modern lenders use e-signing documents, so you can finalize everything digitally without printing a single page or making a trip anywhere.

The fund transfer timeline is often the most pleasant surprise for borrowers. Many lenders can get money into your account within one business day after you sign the agreement. That emergency car repair or unexpected medical bill doesn’t have to wait around while you stress about financing.

Pros, Cons, and Legitimacy of Using Traceloans.com

Let me be honest with you – when you’re dealing with bad credit, finding reliable financial help can feel like searching for an authentic dim sum spot in a tourist trap neighborhood. You want to believe it’s out there, but you’re naturally skeptical. That’s exactly how many people feel about traceloans.com bad credit options, and frankly, that healthy skepticism is smart.

After diving deep into how this platform works, I want to give you the full picture – the good, the not-so-good, and the reality of what you’re getting into. Think of this as your financial reality check, served with a side of practical wisdom.

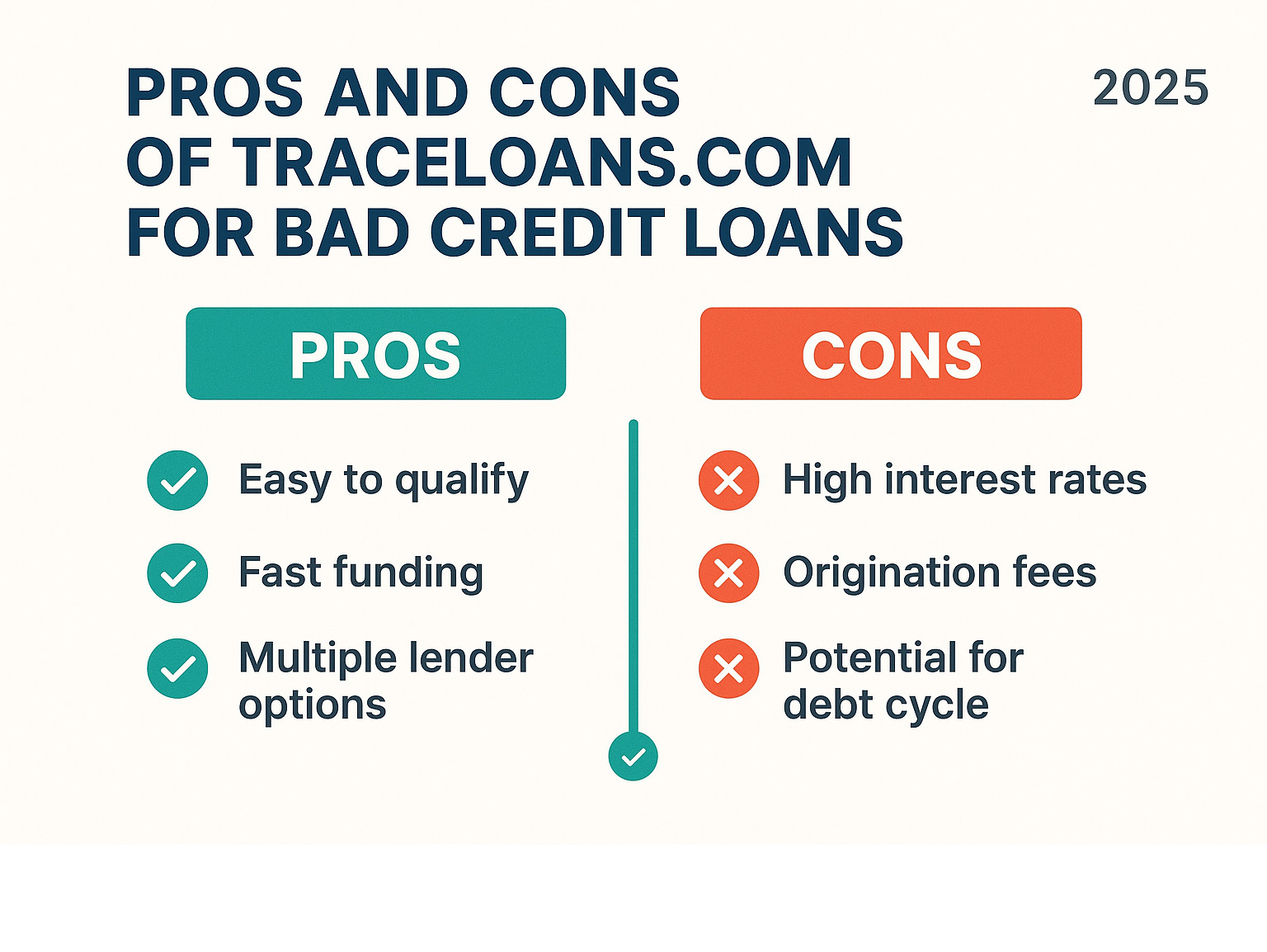

Key Benefits for Bad Credit Borrowers

Here’s where Traceloans.com really shines for folks who’ve been turned away by traditional banks. The accessibility factor alone is huge – imagine having doors opened that were previously slammed shut. Instead of facing another “thanks, but no thanks” from your local bank, you’re connected with lenders who actually want to work with people in your situation.

The speed and convenience aspect genuinely impressed me. You can literally apply while enjoying your morning coffee, and by the time you’re thinking about lunch, you might already have loan offers in your inbox. We’re talking about potentially receiving multiple offers within 24 hours – that’s pretty remarkable in the lending world.

What really sets this apart is getting multiple offers from one application. Rather than spending your weekend filling out form after form on different websites (and potentially hurting your credit with multiple inquiries), you submit once and let the lenders compete for your business. It’s like having several restaurants bid to cater your event instead of you calling each one individually.

Your approval odds are genuinely higher here. The platform specifically connects you with lenders who are more flexible about credit requirements. It’s not magic, but it’s strategic matching that works in your favor.

Potential Risks and Drawbacks to Consider

Now for the reality check – and this is important. The biggest drawback is those high APRs. When I say high, I mean potentially eye-watering. While the convenience is appealing, you’ll pay for that accessibility through higher interest rates and fees. It’s the trade-off for being considered a higher-risk borrower.

Traceloans.com is not a direct lender – they’re the matchmaker, not the bride or groom. This means they don’t control the final loan terms, interest rates, or approval decisions. They facilitate the introduction, but the actual relationship is between you and the lender they connect you with.

There’s also the reality of data sharing with partners. To match you with suitable lenders, your application information gets shared across their network. While they emphasize security and privacy, your data does travel to multiple financial institutions.

Here’s where I need to wave a caution flag: predatory lending risks exist in this space. While Traceloans.com aims to work with reputable lenders, the bad credit loan market can attract some less-than-stellar players. Always thoroughly research any lender you’re matched with. If something feels off or too good to be true, trust that instinct. The Federal Trade Commission (FTC) has excellent resources to help you review lending regulations and protect yourself.

Is Traceloans.com a Legitimate Service?

Let’s address the elephant in the room – is this legitimate or just another online scam? Based on my research, Traceloans.com operates as a legitimate loan connection service. They’re not pretending to be something they’re not, which is refreshing in this industry.

The key word here is “connection service.” They’re essentially a sophisticated referral system that connects borrowers with lenders. Think of them like a real estate agent who helps match buyers with sellers – they facilitate the introduction but don’t control the final deal terms.

What makes them legitimate is their transparency about what they do and don’t do. They don’t promise “guaranteed approval” (which should always be a red flag), and they’re upfront about being a connection service rather than a direct lender.

The confusion about legitimacy often comes from people not understanding this loan aggregator model. Some folks expect Traceloans.com to control every aspect of the loan process, but that’s not how they operate. They handle the initial matching; you handle the final vetting and decision-making.

The bottom line? Traceloans.com appears to be a legitimate tool for finding traceloans.com bad credit loan options. However, the importance of vetting the final lender cannot be overstated. Just because Traceloans.com connected you doesn’t mean you should skip your due diligence on the actual lender offering you money.

Frequently Asked Questions about traceloans.com bad credit

When you’re exploring traceloans.com bad credit options, it’s natural to have questions. After all, navigating the loan landscape with less-than-perfect credit can feel like trying to find the perfect hole-in-the-wall restaurant in New York City – you want to make sure you’re making the right choice before you commit.

Let me address the most common concerns we hear from borrowers who are considering this platform for their financial needs.

How quickly can I get funds with a bad credit loan from Traceloans.com?

The beauty of the digital age is speed, and that extends to loan funding too. Once a lender in the Traceloans.com network approves your application, funds are often available within one business day. That means if you’re approved on a Tuesday, you could potentially have the money in your account by Wednesday.

However, Traceloans.com connects you with different lenders, and each has their own processes and timelines. Some might be lightning-fast with same-day funding, while others might take two to three business days. The exact timing really depends on which specific lender you choose and how quickly they can process your paperwork.

Your bank can also play a role in the timeline. Some banks process incoming transfers faster than others, so it’s worth checking with your financial institution about their policies for receiving loan funds.

Will applying through Traceloans.com affect my credit score?

This is probably the question that keeps most people up at night, and I completely understand why. When your credit is already struggling, the last thing you want is to make it worse by shopping for loans.

Here’s the good news: the initial request on Traceloans.com typically uses a soft inquiry, which won’t impact your credit score at all. Think of it as a gentle peek rather than a deep dive into your credit history. This soft pull allows them to match you with potential lenders without any damage to your credit profile.

However, here’s where you need to pay attention. If you decide to move forward with a specific lender’s offer, that lender will likely perform a hard inquiry to make their final approval decision. This hard pull can temporarily lower your credit score by a few points, typically for a few months.

The silver lining? If you’re shopping for loans within a focused timeframe (usually 14-45 days, depending on the credit scoring model), multiple hard inquiries for the same type of loan are often treated as a single inquiry. This is designed to encourage smart shopping without penalizing your credit score.

Are there any guaranteed approval loans for bad credit on Traceloans.com?

I wish I could tell you there’s a magic button that guarantees approval, but that would be misleading you – and frankly, any service that promises “guaranteed approval” should raise immediate red flags.

There is no such thing as a guaranteed approval loan, period. Even through Traceloans.com, which specializes in connecting borrowers with lenders who are more flexible about credit requirements, final approval is always at the individual lender’s discretion.

What Traceloans.com does offer is a higher likelihood of approval compared to walking into a traditional bank. They’ve built relationships with lenders who specifically work with borrowers who have credit challenges. These lenders understand that a low credit score doesn’t necessarily tell the whole story of your financial responsibility.

Your approval will still depend on factors like your income stability, debt-to-income ratio, employment history, and overall financial profile. The difference is that the lenders in their network are more willing to look beyond just your credit score and consider the bigger picture of your financial situation.

Legitimate lenders want to ensure you can repay the loan – it’s in everyone’s best interest. Be wary of any service that promises approval without considering your ability to repay, as this could be a sign of predatory lending practices.

Conclusion

So, what’s the final dish on traceloans.com bad credit options? Our research indicates that Traceloans.com can be a valuable tool for individuals seeking financing when traditional avenues are closed due to a less-than-perfect credit score. It acts as an efficient bridge, connecting you with a network of lenders who specialize in working with challenging credit histories. This can be a lifeline for unexpected expenses or consolidating high-interest debt, helping you breathe a little easier.

However, like any powerful tool, it must be used wisely. The key takeaways are to understand that while access to funds might be easier, the cost will likely be higher in terms of interest rates and fees. Always compare offers carefully, read all the fine print, and ensure you can comfortably manage the repayment terms. Responsible borrowing is paramount to rebuilding your financial future.

At The Dining Destination, just as we guide you to the most exquisite culinary experiences around the globe, we also aim to equip you with the knowledge to manage your finances effectively. After all, a healthy financial life allows for more delicious adventures! Whether you’re planning your next food tour in busy New York City or dreaming of a quiet retreat, financial stability is a crucial ingredient.

We hope this comprehensive guide has demystified the process of seeking loans with bad credit through Traceloans.com. For even more insights and to continue your journey towards financial literacy and beyond, we invite you to Explore our comprehensive resource guides for more financial insights.