Why Traceloans.com Auto Loans Are Changing Car Financing

Traceloans.com auto loans connect you with multiple lenders through a single platform, making car financing faster and easier than traditional bank visits. Here’s what you need to know:

Key Features:

- Loan Marketplace: Compare offers from multiple lenders at once

- Soft Credit Check: Won’t impact your credit score during comparison

- Fast Process: Most loans approved within 24 hours

- All Credit Scores: Options available even with bad credit

- No Platform Fees: Free to use for borrowers

Available Loan Types:

- New car loans

- Used car loans

- Auto refinancing

- Private party purchases

Getting a car loan used to mean visiting multiple banks, filling out countless forms, and waiting days for answers. Today’s car buyers need a smarter approach.

Based on our research, Traceloans.com acts as a loan aggregator rather than a direct lender. This means they connect you with various lenders who compete for your business, potentially getting you better rates and terms.

The platform uses a loan matching algorithm based on your credit profile and needs. You fill out one application, and multiple lenders review it. This saves time and increases your chances of approval.

Most users receive loan offers within minutes and can complete the entire process in less than a day. The platform emphasizes transparency with no hidden charges from their end, though individual lenders may have their own fees.

This guide walks you through each step of applying for an auto loan through Traceloans.com, from gathering documents to getting your funds.

Quick look at traceloans.com auto loans:

What is Traceloans.com and How Does It Simplify Car Financing?

Picture this: you’re craving the perfect meal, but instead of visiting every restaurant in the city, you have a food guide that brings all the best options to you in one place. That’s exactly how Traceloans.com auto loans work for car financing. This clever platform acts as a loan marketplace, connecting you with multiple lenders instead of forcing you to hunt them down one by one.

Think of Traceloans.com as your personal loan concierge. It’s not a bank itself, but rather a comparison platform that does the heavy lifting for you. When you need an auto loan, their smart loan matching algorithm takes your information and shops it around to various lenders in their network. It’s like having a friend in the finance world who knows exactly which lenders might say “yes” to your specific situation.

The real magic happens with their soft credit pull feature. When you first explore your options, Traceloans.com performs a gentle credit check that won’t ding your credit score. This means you can shop around freely without worrying about hurting your credit – something that’s impossible when you apply directly to traditional lenders.

The user-friendly interface makes the whole process feel less intimidating. Instead of drowning in financial jargon and complicated forms, you’ll find a straightforward platform designed for real people who just want to buy a car without the headache.

Key Features and Benefits of Using Traceloans.com

What makes Traceloans.com stand out in the crowded world of auto financing? Let’s break down the features that actually matter to you as a borrower.

The fast application process is genuinely impressive. Most people receive loan offers within minutes of submitting their information. That’s faster than getting your coffee order at a busy café! The quick approval times mean you could go from needing a loan to having approval in hand within 24 hours, depending on how quickly you can gather your documents.

Transparent fees are another major win. Unlike some financial services that surprise you with hidden costs, Traceloans.com operates with no hidden charges for borrowers. The platform itself is completely free to use – they make their money from the lenders, not from you. While individual lenders may have their own fees (like origination fees), you’ll know about these upfront.

Perhaps the biggest advantage is your increased approval chances. When you apply through Traceloans.com, you’re not putting all your eggs in one basket. If one lender passes on your application, several others might compete for your business. This multi-lender approach has helped many people secure financing when traditional single-lender applications failed them.

For those juggling multiple financial obligations, you might find it helpful to explore More info about Traceloans.com Debt Consolidation to see how the platform can help streamline your overall financial picture.

Types of Auto Financing Options Available

Traceloans.com auto loans aren’t a one-size-fits-all solution – they offer financing options for virtually any vehicle situation you can imagine.

New car loans typically come with the most competitive rates since the vehicle serves as solid collateral. Whether you’re eyeing a fuel-efficient hybrid or a family-friendly SUV, new car financing through the platform can help you secure favorable terms.

Used car loans open up even more possibilities. The used car market offers incredible value, and Traceloans.com connects you with lenders who understand that a pre-owned vehicle can be just as reliable as a new one. While rates might be slightly higher than new car loans, they’re often still very competitive.

Already have an auto loan but wish you’d gotten better terms? Auto refinancing through the platform could save you hundreds or even thousands over the life of your loan. Many borrowers use refinancing to lower their monthly payments or pay off their loan faster.

Private party loans solve a common financing headache. When you find the perfect car from a private seller, traditional dealership financing isn’t available. Traceloans.com connects you with lenders who specialize in private party purchases, giving you the flexibility to buy from anyone.

The platform handles financing for various vehicle types including cars, trucks, and SUVs of all sizes. Whether you need a compact car for city driving, a pickup truck for work, or a spacious SUV for family adventures, the lending network has options to match your needs.

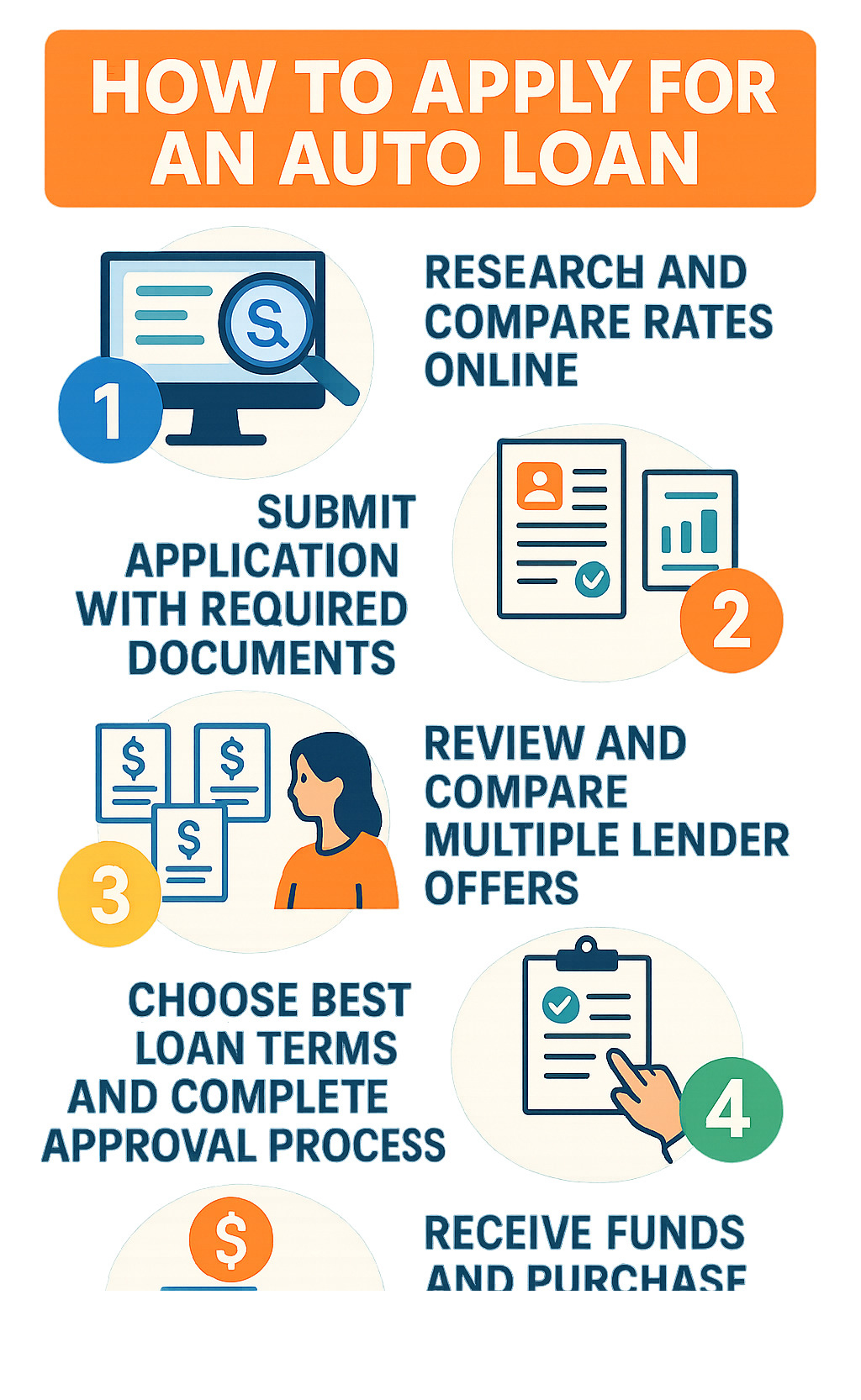

The Step-by-Step Traceloans.com Auto Loan Application Process

Getting your traceloans.com auto loans approved feels a lot like ordering from your favorite local deli – you know exactly what you want, the process is familiar, and before you know it, you’re walking away satisfied. We’ve walked through this process ourselves and want to share exactly what happens from start to finish.

Your journey starts with a simple online form on the Traceloans.com website. Don’t worry – this isn’t one of those endless applications that make you want to give up halfway through. The form guides you step by step, asking for your personal information like your name, address, and contact details first. Accuracy matters here because any mistakes could slow things down later.

Next comes the financial details section. You’ll share information about your income, where you work, and give them a sense of your credit situation. The great news? You don’t need perfect credit to get started, and this initial step won’t hurt your credit score at all.

The document submission part is where having your paperwork ready really pays off. You’ll upload the documents we’ll discuss in detail below, but having them prepared beforehand can turn a potentially frustrating step into a quick upload session.

Here’s where things get exciting – comparing offers. Once Traceloans.com’s system works its magic, you’ll see multiple loan offers laid out clearly. You can compare interest rates, monthly payments, and loan terms side by side. It’s like having several lenders compete for your business, which often means better deals for you.

The final step is finalizing the loan with your chosen lender. You’ll review the terms, sign electronically, and then wait for the funds to hit your account. Most people are surprised by how straightforward this entire process feels, especially compared to traditional bank visits.

Gathering Your Documents: What You’ll Need to Apply

Think of document preparation like mise en place in a restaurant kitchen – having everything organized and ready makes the whole process flow smoothly. We always tell people to gather their documents before starting the application, and you’ll thank yourself later for this preparation.

Your proof of identity comes first, and a current driver’s license usually covers this requirement perfectly. Since you’re applying for an auto loan, you’ll need this anyway, so it’s convenient that it serves double duty.

For proof of income, recent pay stubs work great if you’re employed. If you’re self-employed or have irregular income, tax returns become your best friend here. The key is showing lenders that money comes in regularly and reliably.

Bank statements from the last few months give lenders a window into your financial habits. They’re looking for consistent income deposits and responsible spending patterns. Don’t worry if you’re not perfect – lenders understand that life happens.

Vehicle information depends on where you are in your car shopping journey. If you’ve already found your dream car, have the VIN, make, model, and year ready. If you’re still shopping, you can often update this information later in the process.

Having digital copies of these documents saved on your computer or phone makes uploading them quick and painless. Clear photos work just fine if you don’t have a scanner – just make sure all the text is readable.

From Submission to Approval: What to Expect

Once you hit submit on your traceloans.com auto loans application, the behind-the-scenes magic begins. We’ve seen this process work for countless people, and the speed still impresses us.

The application review happens first, but it’s mostly automated. Traceloans.com’s system checks that you’ve provided all the necessary information and that everything looks complete. This usually takes just minutes.

Lender matching is where Traceloans.com really shows its value. Their algorithm looks at your profile and matches you with lenders who are most likely to say yes. Instead of you having to guess which lenders might work with your situation, the system does the heavy lifting.

The approval timeline is where things get exciting. Most people see initial offers within minutes of submitting their application. That’s not a typo – we’re talking about the time it takes to grab a coffee, not days of waiting by the phone.

Once you choose an offer and move forward with a specific lender, final approval typically happens within 24 hours. The actual fund disbursement can be just as quick, with many lenders offering 24-hour funding potential. This means you could literally apply today and have the money in your account tomorrow, ready to buy your car.

The whole experience feels refreshingly modern compared to traditional lending, where you might wait days or weeks for answers. It’s designed for people who want to move forward with their lives, not sit around wondering if they’ll get approved.

Understanding Eligibility for traceloans.com auto loans

Let’s be honest – figuring out whether you qualify for traceloans.com auto loans can feel a bit like trying to decode a restaurant menu in a foreign language. But here’s the good news: it’s actually more straightforward than you might think, and we’re here to walk you through it step by step.

When lenders look at your application, they’re essentially asking themselves one key question: “Will this person be able to pay us back?” To answer that, they examine several important factors that paint a picture of your financial health.

Your credit score often takes the spotlight in this evaluation. Think of it as your financial report card – it tells lenders how well you’ve managed credit in the past. While Traceloans.com welcomes borrowers with all types of credit scores, having a higher score typically opens doors to better interest rates and more favorable terms.

Your credit score is built on five main ingredients: your payment history (which makes up a whopping 35% of your score), how much you owe, how long you’ve had credit, any new credit accounts, and the mix of credit types you have. The takeaway? Making payments on time is absolutely crucial for maintaining a healthy score.

But your credit score isn’t the only thing lenders care about. They also want to understand your current financial situation through your debt-to-income ratio. This simple calculation compares all your monthly debt payments to your gross monthly income. A lower ratio means you have more breathing room in your budget for a new car payment, which makes lenders feel more confident about approving your loan.

Your employment status also plays a starring role. Lenders love to see stable, consistent income because it suggests you’ll be able to make those monthly payments reliably. They’ll typically ask for proof of employment and income to verify this stability.

Finally, the loan amount you’re requesting matters too. Lenders want to make sure the amount makes sense given your income and overall financial picture. Asking for a reasonable amount that aligns with your budget shows you’re thinking responsibly about this major purchase.

Understanding these factors can help you prepare for your application and potentially improve your chances of getting approved with great terms. If you’re exploring other financial options beyond auto loans, you might find it helpful to check out More info about Traceloans.com Mortgage Loans on our site.

Navigating traceloans.com auto loans with a Lower Credit Score

We get it – not everyone has a perfect credit history. Life has a way of throwing curveballs, and sometimes our credit scores take a hit along the way. Maybe you went through a tough period, faced unexpected medical bills, or dealt with job loss. Whatever the reason, you’re not alone, and more importantly, you’re not out of options.

This is where traceloans.com auto loans really shine. The platform was designed with real people in mind – people who might have stumbled financially but are ready to get back on track. Instead of slamming doors shut, Traceloans.com opens them by connecting you with lenders who take a more holistic view of your financial situation.

The beauty of this approach is that these lenders don’t just look at a three-digit number and make a snap judgment. They consider your current income, employment stability, and overall ability to make payments. It’s what we like to call a “commonsense approach to lending” – looking at the whole person, not just their past mistakes.

If you’re working with a lower credit score, here are some strategies that can help strengthen your application. First, there are lenders who specialize in bad credit auto loans. These aren’t predatory lenders trying to take advantage – they’re legitimate financial institutions that understand that people’s circumstances change and deserve second chances.

Taking out and successfully managing an auto loan can actually become a powerful tool for rebuilding your credit. Every on-time payment you make gets reported to the credit bureaus, slowly but surely improving your credit history. It’s like adding positive reviews to your financial reputation, one payment at a time.

If your credit score is particularly challenging, consider bringing a co-signer into the equation. This could be a family member or close friend with good credit who’s willing to guarantee the loan. Their good credit can help you qualify for better terms, and it gives the lender extra peace of mind. Just remember, this is a big responsibility for your co-signer, so make sure you’re committed to making those payments faithfully.

The bottom line? Traceloans.com’s commitment to serving borrowers with all credit scores means you can focus on finding the right car for your needs while taking positive steps toward a stronger financial future.

Interest Rates, Terms, and Fees Explained for traceloans.com auto loans

Let’s talk money – specifically, the costs and terms you’ll encounter with traceloans.com auto loans. We know financial jargon can feel overwhelming, but understanding these basics will help you make smart decisions and avoid any surprises down the road.

First up: interest rates versus APR. Think of the interest rate as the base price you pay to borrow money – it’s straightforward and expressed as a percentage. But the APR (Annual Percentage Rate) tells the complete story. It includes the interest rate plus any additional fees rolled into one annual percentage. When you’re comparing loan offers, always look at the APR because it gives you the true cost of each loan. It’s like comparing the total price of a meal including tax and tip, not just the menu price.

Loan terms refer to how long you have to pay back the loan, usually ranging from 36 to 72 months or even longer. Here’s where it gets interesting: shorter terms mean higher monthly payments but less total interest paid over time. Longer terms mean smaller monthly payments but more interest overall. It’s all about finding the sweet spot that fits your monthly budget while minimizing long-term costs.

Now, let’s talk about potential fees. Some lenders charge origination fees – basically a one-time processing fee that’s usually a percentage of your loan amount. While Traceloans.com itself doesn’t charge you anything (they’re completely free for borrowers), individual lenders in their network might have these fees. That’s why it’s important to review each offer carefully.

Here’s some good news: many lenders don’t charge prepayment penalties. This means if you come into some extra money and want to pay off your loan early to save on interest, you can do so without getting hit with additional fees. It’s always worth checking this detail in your loan agreement.

The best part about using Traceloans.com? No platform fees whatsoever. They make their money from the lenders, not from you, which keeps the process transparent and straightforward. No hidden charges, no surprise fees – just honest connections to legitimate lenders.

Before signing any agreement, take time to read through all the terms carefully. Understanding these details puts you in the driver’s seat (pun intended!) when choosing the loan that works best for your situation. For more comprehensive information about lending regulations and your rights as a borrower, the Consumer Financial Protection Bureau is an excellent resource to explore.

Maximizing Your Savings and Support Resources

Finding the right traceloans.com auto loans isn’t just about getting approved; it’s about securing the best possible deal and maximizing your savings. And with The Dining Destination, we believe in empowering you with all the tools and knowledge to do just that.

- Comparing Multiple Offers: This is where Traceloans.com truly shines. By presenting you with offers from various lenders, it puts the power of comparison firmly in your hands. Don’t just pick the first offer! Take the time to compare APRs, loan terms, and any associated fees. This side-by-side analysis allows you to identify the most competitive rates and favorable terms custom to your financial situation. Our research shows that comparing loan offers is a best practice for getting the best deal.

- Negotiating Power: Having multiple pre-qualified offers from Traceloans.com gives you significant negotiating power, especially if you’re buying from a dealership. Knowing you have approved financing in hand means you can focus on negotiating the vehicle price, rather than being at the mercy of the dealership’s financing department. This can lead to substantial savings on the overall cost of your car.

- Educational Resources: Traceloans.com aims to be more than just a loan marketplace; it’s also a resource hub. They provide valuable information and guides on various loan types, credit scores, and financial strategies. This educational content empowers you to make informed decisions and better understand the nuances of auto financing. We, too, are committed to providing comprehensive guides to help you steer your financial journey, much like how we guide you through the best culinary destinations.

- Customer Support: While Traceloans.com acts as an intermediary, they often provide customer support to help you steer their platform and understand the process. Should you have questions about using their service or interpreting the offers presented, their support resources are there to assist.

- Financial Calculators: To help you plan your budget, many platforms (and often the lenders themselves) offer financial calculators. These tools allow you to estimate monthly payments based on different loan amounts, interest rates, and terms, helping you visualize how a loan fits into your financial picture.

For those venturing into other financial fields, we also offer comprehensive insights into More info about Traceloans.com Business Loans. And remember, as a borrower, you have rights! We always encourage you to Learn about your rights as a borrower from the FTC to ensure you’re protected throughout the loan process. Empowering yourself with knowledge is the best way to secure your financial future.

Frequently Asked Questions about Traceloans.com Auto Loans

Living in New York City, we know how important it is to get straight answers to your financial questions. That’s why we’ve compiled the most common questions our readers ask about traceloans.com auto loans. Think of this as your quick reference guide – like having a knowledgeable friend explain the ins and outs over coffee.

Does using Traceloans.com affect my credit score?

This question keeps so many of our readers up at night, and we totally get it! Your credit score is precious, especially in a city where everything from apartment rentals to job applications might check it. Here’s the good news: using Traceloans.com for your initial loan search won’t hurt your credit score at all.

When you first explore your options on Traceloans.com, they perform what’s called a soft credit pull. Think of it as window shopping for loans – you can browse and compare without any commitment or consequences. This soft inquiry lets them peek at your credit profile to match you with suitable lenders, but it’s completely invisible to other creditors and has zero impact on your score.

The only time your credit score gets affected is when you decide to move forward with a specific lender. At that point, the chosen lender will perform a hard inquiry as part of their formal application process. But here’s the beauty of it – you’re in complete control of when that happens, and you’ll know exactly which lender you’re committing to before they pull your credit.

How quickly can I receive funds for my auto loan?

Speed matters when you’ve found the perfect car, and traceloans.com auto loans deliver on this front impressively. We’ve seen how the platform’s efficiency can turn what used to be a weeks-long process into something that happens in mere hours.

Most users receive their initial loan offers within minutes of completing their application. It’s almost like magic – you submit your information, grab a quick snack, and boom, multiple lenders are competing for your business. Once you’ve chosen your preferred offer and completed the lender’s documentation requirements, approval typically happens within 24 hours.

The real excitement comes with funding. Many lenders in Traceloans.com’s network can transfer funds directly to your bank account within 24 hours of final approval. This means you could literally apply for a loan on a Tuesday morning and have the money in your account by Wednesday afternoon, ready to seal the deal on your dream car.

The exact timing depends on your specific lender and your bank’s processing schedule, but the goal is always speed without sacrificing thoroughness. Just make sure you provide accurate banking information to avoid any unnecessary delays.

Are there any hidden fees for using the Traceloans.com platform?

Transparency is refreshing in today’s financial world, and Traceloans.com delivers it in spades. The platform itself is completely free for borrowers – no membership fees, no service charges, no surprise bills showing up in your inbox later.

Traceloans.com makes its money through partnerships with lenders, not by charging you. This business model means they’re incentivized to find you the best possible deals, since happy customers lead to successful partnerships. It’s a win-win situation that keeps their service accessible to everyone.

Now, while the platform charges you nothing, individual lenders might have their own fees. These could include things like origination fees or processing charges, but any such costs will be clearly spelled out in the loan offers you receive. No surprises, no fine print tricks – everything is laid out transparently before you make any commitments.

Before finalizing any loan agreement, you’ll have the chance to review all terms, conditions, and fees. We always encourage our readers to read these details carefully, just like you’d check a restaurant menu for prices before ordering. Knowledge is power, especially when it comes to your financial future.

Conclusion

Finding the right car loan doesn’t have to feel like searching for a parking spot in Manhattan during rush hour. As we’ve explored throughout this guide, traceloans.com auto loans transform what used to be a stressful, time-consuming process into something surprisingly straightforward and efficient.

Think about it – in just one afternoon, you could go from browsing cars online to having approved financing in your account. That’s the power of having multiple lenders compete for your business through a single platform.

The simplicity of the process really stands out. Instead of spending your weekends visiting different banks and credit unions across the city, you fill out one application and let technology do the heavy lifting. The platform’s loan matching algorithm works behind the scenes, connecting you with lenders who actually want to work with your credit profile.

Speed is another game-changer, especially for those of us living in New York’s environment. When you find the perfect car, you don’t want to lose it because your financing takes weeks to process. With potential 24-hour funding, you can move from approved to car keys in hand faster than you might expect.

But what we appreciate most is the accessibility Traceloans.com provides. Whether you’re a recent college graduate with limited credit history or someone rebuilding after financial difficulties, the platform connects you with lenders who look beyond just a credit score number. This inclusive approach means more people can get behind the wheel of reliable transportation.

At The Dining Destination, we believe in empowering our community with clear, actionable information. Just as we guide you to the best culinary experiences around the globe, understanding your financing options helps you make confident decisions that fit your lifestyle and budget.

The car-buying journey should be exciting, not exhausting. Traceloans.com auto loans put you in the driver’s seat of your financing decisions, offering transparency, choice, and speed when you need it most.

Ready to explore your options? You can find More info about Traceloans.com on our site. And for insights on everything from travel financing to business growth, Explore our comprehensive resource guides – we’re here to help you steer all of life’s important decisions, one informed choice at a time.