Why Tariff News Matters for New York Food Enthusiasts

For those of us who love the diverse culinary scene in New York, tariff news directly impacts the cost and availability of our favorite imported foods and wines. A recent federal appeals court ruling that struck down several of President Trump’s tariffs has created significant uncertainty in global trade.

Key Tariff News Updates:

- Court Ruling: A federal appeals court ruled 7-4 that Trump’s reciprocal tariffs exceeded presidential authority.

- Affected Countries: India (25% tariff), Switzerland (39% tariff), Vietnam (20% tariff), and others.

- Timeline: Tariffs remain until mid-October pending a Supreme Court appeal.

- Food Impact: Beverages and food face additional costs (e.g., 26.7% total tariff in Taiwan).

- Next Steps: The Supreme Court will determine if $159 billion in collected tariffs stand.

For food lovers in New York, this landmark ruling affects the cost of imported ingredients, wines, and specialty foods. The court found that the president “unlawfully leaned on emergency powers” to impose these import taxes, stating they “exceed any authority granted to the President.” The uncertainty is creating ripple effects across global supply chains that ultimately reach your dinner table.

Explore more about tariff news:

Landmark Court Ruling Challenges Presidential Tariffs

The US Court of Appeals for the Federal Circuit recently struck down President Trump’s reciprocal tariffs in a 7-4 ruling, stating they exceeded legal authority. The judges found the use of emergency powers to impose these import taxes unlawful, calling the tariffs “invalid as contrary to law.” This matters for global cuisine lovers, especially here in New York, as these tariffs have increased the cost of imported ingredients and wines.

President Trump quickly responded on Truth Social, calling the court “highly partisan” and warning the decision would “literally destroy the United States of America,” signaling a prolonged fight. The court set a mid-October deadline for an appeal to the Supreme Court, leaving the tariffs in place for now and keeping imported food prices high—a major concern for New York’s restaurant industry and diners.

The Specifics of the Court’s Decision

The court’s decision hinged on whether the president had the authority to impose tariffs under the International Emergency Economic Powers Act. The invalid levies, or “reciprocal tariffs,” were deemed beyond the president’s power under emergency law. The court also rejected a Nixon-era precedent cited by the administration.

The timeline for enforcement ends in mid-October, after which the tariffs become unenforceable without Supreme Court intervention. This creates a waiting game for food and beverage importers. The legal process now depends on the Supreme Court, which may hear the case due to the split decision in the appeals court.

Immediate Impact of the Latest Tariff News

Business uncertainty is high, especially in the food industry. Planning a restaurant’s wine list, for example, is difficult when the cost of a Swiss wine could change by 39%. Financial market reactions have been swift as investors assess the impact on companies reliant on imports, and the US economy faces potential disruption.

This uncertainty can dampen economic activity, as businesses may delay investments. For importers, this tariff news raises questions about payments and potential refunds. With $159 billion collected, the US Treasury has warned of “financial ruin” if refunds are required.

US Court of Appeals rejected Trump’s argument that trade deficits justified using emergency powers, setting up a major trade case for the Supreme Court.

Understanding the Legal Landscape of US Trade Policy

The legal framework behind trade policy is complex, as highlighted by recent tariff news. The U.S. Constitution gives Congress the power to set tariffs, a key aspect of the separation of powers. However, the evolution of presidential power has seen Congress delegate some trade authority to the executive branch, particularly for national security. Crucially, this ruling does not affect the steel and aluminum tariffs, which were imposed under a different law, Section 232 authority, based on national security threats.

What is the International Emergency Economic Powers Act (IEEPA)?

This legal battle centers on the International Emergency Economic Powers Act (IEEPA), a 1977 law designed to let presidents respond to serious overseas threats. IEEPA allows economic action against an “unusual and extraordinary threat” from abroad, requiring a national emergency declaration. President Trump used IEEPA differently, declaring trade deficits a national emergency to justify his reciprocal tariffs.

The appeals court rejected this, offering a narrower court’s interpretation of IEEPA that does not grant unlimited power to impose tariffs. This ruling could significantly limit the future use of emergency powers for trade policy, pushing presidents to seek congressional approval. For food enthusiasts in New York, this legal framework directly impacts the cost of imported goods, explaining why tariff announcements and policies can suddenly affect our dining experiences.

The Global Ripple Effect: How the Ruling Impacts International Trade

From our vantage point in New York, a global hub of commerce and cuisine, the recent court ruling on tariff news has sent visible shockwaves through international trade. It creates uncertainty for countries doing business with the U.S., with major economies like the UK, Japan, and South Korea now questioning their trade deals. Conversely, Southeast Asia experienced relief, as announced tariffs of around 19% were significantly lower than what had been threatened.

Country-Specific Impacts from Recent Tariff News

The impact of this tariff news varies by country:

- India faces a 25% reciprocal tariff that could be removed, offering significant savings for importers of goods like spices and specialty foods.

- Switzerland was hit with a 39% tariff, severely impacting its $61.5 billion in gold exports to the US. The disruption has been so significant that some Swiss refineries have halted deliveries.

- Vietnam, despite a massive trade surplus with the US, received a 20% tariff, which was much lower than the threatened 46%.

- In Taiwan, the tariff calculation is complex: Taiwan’s tariff calculation revealed as most favored nation rate plus 20%. For food and beverages, this results in a 26.7% total tariff.

The Impact on Food and Beverage Costs

This tariff news directly affects food lovers by influencing the price and availability of imported products. Even domestic producers, like the Michigan cherry industry, feel the impact through higher costs for imported farming supplies. For imported foods, the math is simple. A 25% tariff on a $20 bottle of wine adds $5 to the cost before it even reaches a New York restaurant or shop, and that’s before other markups. Beyond higher prices, tariffs can reduce the variety of imported products available, limiting choices for adventurous diners and restaurants.

Economic Consequences and What Comes Next

The financial stakes of this tariff news are immense. With tariff revenue reaching $159 billion by July, the key question is what happens to this money if the tariffs are ruled illegal. The Justice Department has warned of potential “financial ruin” if the tariffs are revoked, underscoring the Treasury’s reliance on this income. This uncertainty makes it difficult for New York restaurant owners and food importers to plan.

| Outcome | Impact on Tariffs | Impact on US Treasury | Impact on Businesses | Impact on Trade Deals |

|---|---|---|---|---|

| Supreme Court Upholds | Tariffs remain permanently in place | Continued revenue stream of $159+ billion annually | Ongoing higher costs for importers; stable but liftd pricing | Existing bilateral deals remain intact |

| Supreme Court Overturns | Tariffs removed; potential refunds required | Massive revenue loss plus possible $159 billion in refunds | Import costs drop; potential refund windfalls for some companies | Trade agreements may need renegotiation |

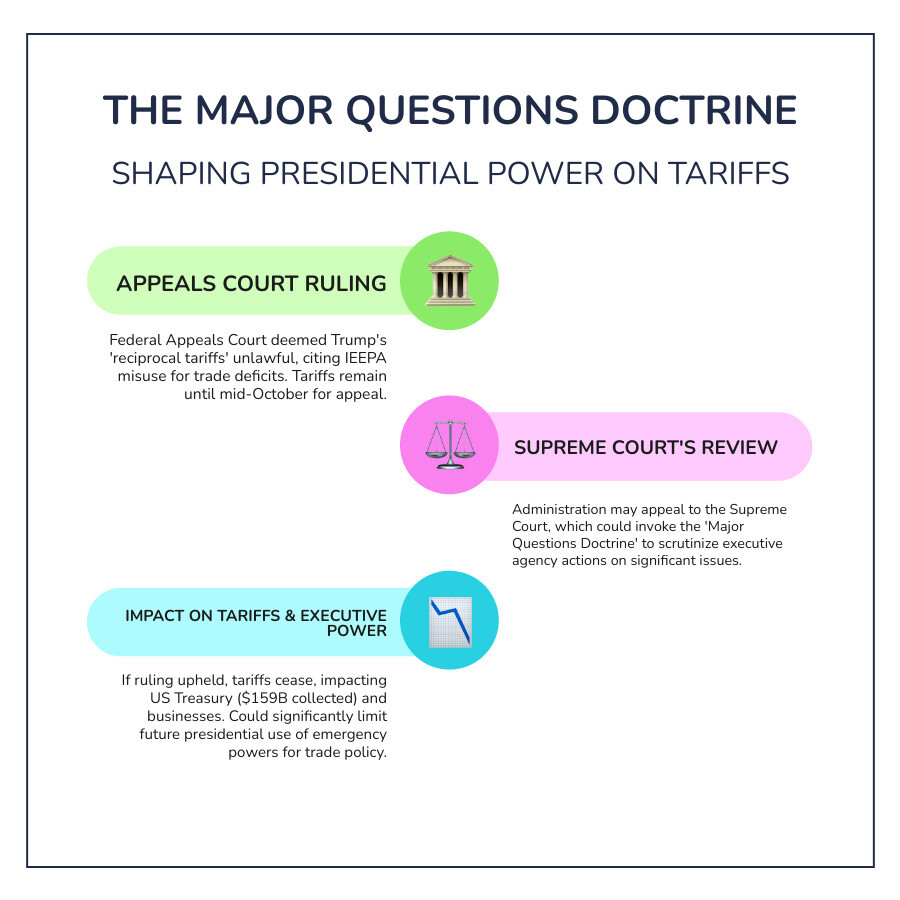

The potential for tariff refunds is complex. If the ruling is upheld, businesses could seek refunds on the $159 billion collected, an administrative challenge of massive proportions. For food businesses, the uncertainty makes it hard to set menu prices. The Supreme Court might apply the major questions doctrine, which could limit how broadly executive emergency powers are interpreted in such economically significant cases.

The Supreme Court’s decision is the $159 billion question. Here in New York, it will not only affect trade policy but also reshape the future of presidential emergency powers and the import landscape for our food and beverage industry.

Landmark Court Ruling Challenges Presidential Tariffs

A recent 7-4 ruling by the US Court of Appeals for the Federal Circuit struck down several of President Trump’s reciprocal tariffs, finding he unlawfully used emergency powers to impose them. The court rejected the argument that the tariffs were permitted under emergency economic powers, calling the levies “invalid as contrary to law.” The US Court of Appeals rejected Trump’s argument, finding the administration’s legal framework did not grant such authority.

President Trump rejected the judgment on Truth Social, calling the court “highly partisan” and the decision a “disaster for the country,” signaling his intent to fight the ruling. The next step is an appeal to the Supreme Court, and the tariffs will remain in place until mid-October to allow time for this appeal. Here in New York City, a hub for global trade, this tariff news is critical. Our food scene depends on imported goods, so any policy change directly impacts the price and availability of ingredients.

The Specifics of the Court’s Decision

The court’s decision centered on its interpretation of the International Emergency Economic Powers Act (IEEPA). It found the “reciprocal tariffs,” imposed by citing trade deficits as a national emergency, were “invalid as contrary to law.” This ruling affects Trump’s “reciprocal tariffs” on most U.S. trading partners. The court also rejected a Nixon-era precedent, ruling the tariffs “exceed any authority granted to the President” under the emergency powers law. The tariffs remain until mid-October, after which they become unenforceable unless the Supreme Court intervenes. The 7-4 split decision makes it more likely the Court will weigh in.

Immediate Impact of the Latest Tariff News

The ruling creates significant business uncertainty and financial market reactions as companies anticipate the outcome. This uncertainty can dampen economic activity, making it difficult for businesses to plan investments or set prices. Importers are in limbo over payments and potential refunds. With tariff revenue at $159 billion by July, the Justice Department warned of “financial ruin” if refunds are required. In New York City, these ripples are felt keenly due to our deep connections to global trade.

Understanding the Legal Landscape of US Trade Policy

To understand this recent tariff news, one must know the legal landscape of U.S. trade policy. The Constitution gives Congress the power to set tariffs, a key aspect of the separation of powers. However, presidential power has evolved through delegated authority, especially for national security. For instance, steel and aluminum tariffs imposed under Section 232 are unaffected by this ruling. Separately, the tariffs on steel, aluminium and copper, which were brought in under a different presidential authority, will remain intact and unaffected by the court’s ruling. The court’s decision applies specifically to reciprocal tariffs imposed under IEEPA.

What is the International Emergency Economic Powers Act (IEEPA)?

The legal challenge centers on the International Emergency Economic Powers Act (IEEPA) of 1977. The 1977 law states a president can use economic levers to deal with an “unusual and extraordinary threat” from outside the U.S. President Trump invoked IEEPA by declaring trade deficits a “national emergency.” The appeals court, however, ruled that IEEPA does not grant the power to impose tariffs in this manner.

If upheld, this ruling would limit future presidents’ ability to use IEEPA for tariffs, pushing that power back toward Congress. For New York’s import-heavy economy, this shift could bring more predictability to the tariff news that affects so many local businesses.

The Global Ripple Effect: How the Ruling Impacts International Trade

This significant tariff news is creating ripples across global trade, potentially disrupting deals with major economies like the UK, Japan, and South Korea. Conversely, Southeast Asian countries felt relief as their announced tariffs were about 19%, far lower than threatened.

Country-Specific Impacts from Recent Tariff News

Here are some specific country impacts from this latest tariff news:

- India: A 25% reciprocal tariff could be removed if the ruling stands, a potential win for importers of Indian goods.

- Switzerland: A 39% tariff has severely impacted gold exports, with some Swiss refineries halting deliveries to the U.S. The issue has prompted calls for clarification. White House to Clarify Tariffs for Gold Bars as Industry Stops Flying Bullion to US.

- Vietnam: Faced a 20% tariff, much lower than the threatened 46%, offering relief despite its large trade surplus with the U.S.

- Taiwan: The tariff is calculated as the most favored nation rate plus 20%, with ongoing talks for more reasonable rates.

The Impact on Food and Beverage Costs

For food lovers, the direct impact of tariff news is on food and beverage costs, as these taxes on imports are usually passed to consumers. Even domestic producers like the Michigan cherry industry are affected by trade policies through higher costs for imported supplies.

The impact on imported food is direct. In Taiwan, for example, the total tariff on food and beverages is 26.7%. This means the price of Italian olive oil or French cheese in a New York City restaurant is directly influenced by these decisions. Tariffs make imported goods more expensive and can also limit the diversity of products available, as some items may become too expensive to import.

Economic Consequences and What Comes Next

The financial stakes of this tariff news are high, with tariff revenue totaling $159 billion by July. The main question is what happens to this revenue if the tariffs are ruled illegal. The Justice Department has warned of potential “financial ruin” if the tariffs are revoked, highlighting the government’s reliance on this income.

Businesses are in legal limbo, wondering about potential refunds, which would be a logistical nightmare. The Supreme Court’s stance is complex, and experts are watching to see if it applies the “major questions doctrine,” which requires clear congressional authority for issues of major economic significance like this one.

| Outcome | Impact on Tariffs | Impact on US Treasury | Impact on Businesses | Impact on Trade Deals |

|---|---|---|---|---|

| Supreme Court Upholds Appeals Court | Reciprocal tariffs removed immediately | Potential $159 billion refund obligation | Possible refunds, supply chain adjustments | Existing deals may need renegotiation |

| Supreme Court Overturns Appeals Court | Tariffs remain in place | Revenue stream continues | Continued higher costs | Current agreements stay intact |

From our perspective in New York’s vibrant food scene, these economic consequences hit close to home. Restaurant owners and specialty food importers are watching this case closely, knowing the outcome could dramatically affect their bottom lines and the prices they charge for authentic international flavors.