Understanding SMCI Stock Price Today

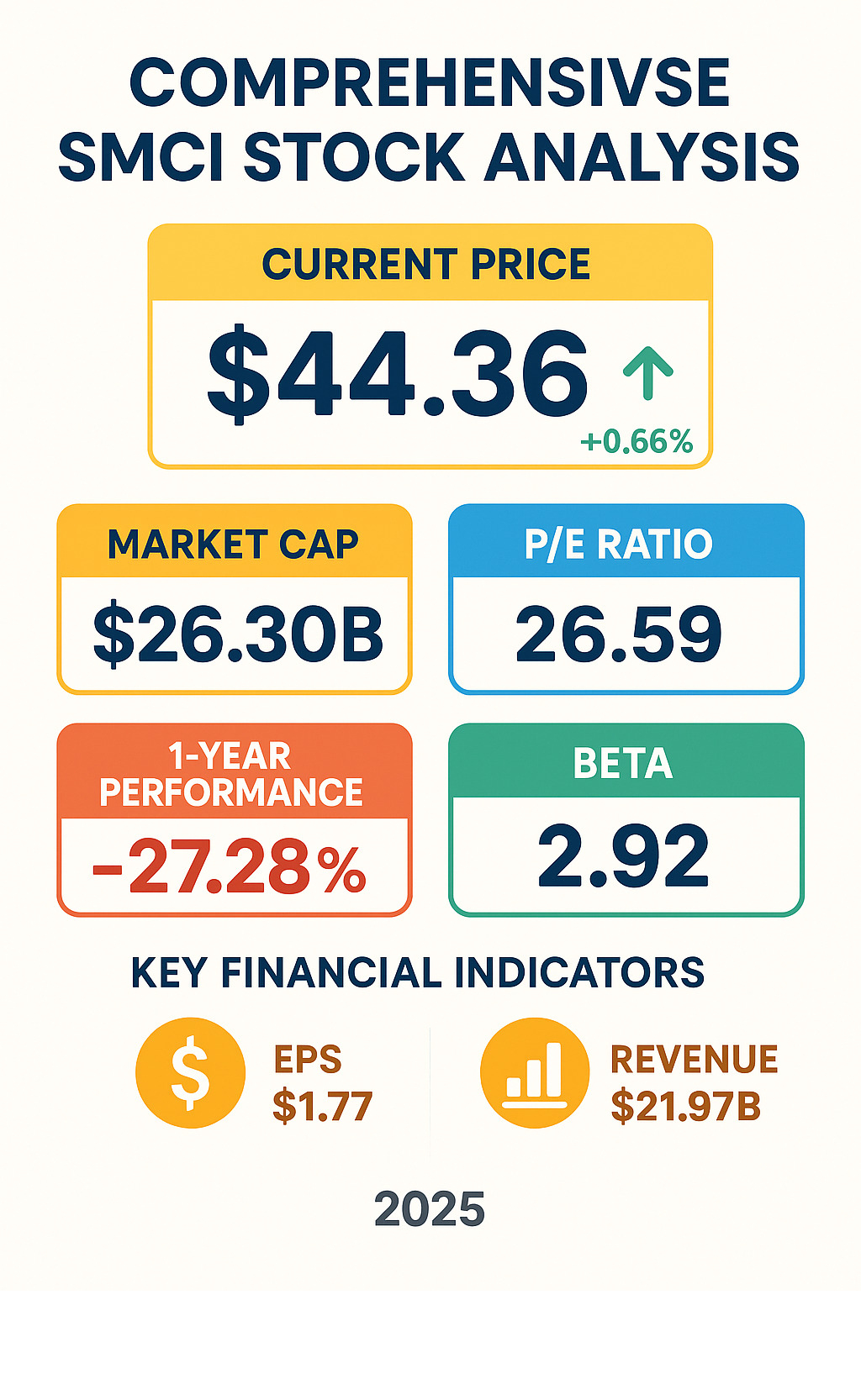

The SMCI stock price has captured significant attention from investors worldwide, with Super Micro Computer’s shares trading at approximately $44.36 as of recent market activity. Here’s what you need to know right now:

Current SMCI Stock Snapshot:

- Current Price: $44.36 USD

- Daily Change: +0.66% (up $0.28)

- 52-Week Range: $17.25 – $122.90

- Market Cap: $26.30 billion

- All-Time High: $122.90 (reached March 8, 2024)

Super Micro Computer has experienced dramatic price swings over the past year, falling 27.28% from its peak but still showing remarkable long-term growth of over 1,373% over five years. The stock’s high volatility – with a beta coefficient of 2.92 – means it moves nearly three times more than the broader market.

The company’s recent performance reflects both the excitement around AI infrastructure and the challenges of meeting ambitious growth targets. SMCI recently cut its fiscal 2026 revenue forecast from $40 billion to $33 billion, contributing to recent price pressure.

“Several short-term signals are positive, despite the stock being in a falling trend,” according to market analysis, suggesting potential buying opportunities for risk-tolerant investors.

Quick smci stock price definitions:

What is Super Micro Computer (SMCI)?

When you’re exploring the smci stock price and wondering what drives this volatile tech stock, it helps to understand the powerhouse behind it. Super Micro Computer, Inc. (SMCI) – commonly known as Supermicro – is like the unsung hero of our digital world, quietly powering everything from your favorite streaming services to cutting-edge AI applications.

Think of Supermicro as the company that builds the invisible backbone of the internet. While you might not see their name on consumer products, their high-performance servers and storage solutions are working behind the scenes in data centers around the globe. What makes them special? Their modular architecture approach – basically, they create building blocks that companies can mix and match to create exactly the computing power they need.

Founders and Company Background

The Supermicro story began in 1993 when Charles Liang, Yih-Shyan Liaw, and Sara Liu, along with Chiu-Chu Liu Liang, had a vision that would reshape enterprise computing. Picture this: the internet was just a baby, most people had never heard of email, and these founders were already thinking about how to build better, faster servers.

Their timing was perfect. As the digital revolution picked up steam, companies desperately needed robust computing infrastructure. The founders didn’t just want to build servers – they wanted to revolutionize how servers were made, focusing on customization and getting products to market faster than anyone else.

From their base in San Jose, CA – right in the heart of Silicon Valley – they set out with a clear company mission: create application-optimized server solutions that could adapt to whatever the future might bring. Looking back at their early history, it’s remarkable how their focus on flexibility and innovation positioned them perfectly for today’s AI boom.

Core Business and Market Position

Today, Supermicro operates as a global technology giant, though you might not realize just how much their work touches your daily life. Every time you ask Siri a question, stream a movie, or use any cloud-based service, there’s a good chance Supermicro hardware is involved somewhere in the process.

Their core business spans everything from the motherboards that form a server’s foundation to the sophisticated server management software that keeps everything running smoothly. The company’s key products and services include Twin Solutions for high-density computing, GPU and Coprocessor Solutions that power AI applications, MicroCloud systems, AMD Solutions, specialized power supplies, SuperServer configurations, comprehensive storage solutions, custom motherboards, flexible chassis designs, Super Workstations, various accessories, SuperRack systems, and advanced server management products.

What’s driving the smci stock price volatility? It’s largely because Supermicro sits at the center of several explosive growth markets. Enterprise data centers are expanding rapidly as companies move to the cloud. Cloud computing continues its relentless growth. Most importantly, Artificial Intelligence (AI) is creating unprecedented demand for specialized computing power. And with 5G and Edge computing bringing processing power closer to users, Supermicro’s modular approach is more valuable than ever.

The company’s global operations span continents, with a significant employee count supporting customers from the United States to Europe, Asia, and beyond. They’ve built a diverse sales network that includes direct sales teams, distributors, value-added resellers, system integrators, and original equipment manufacturers – basically, they’ve made sure their products can reach any company that needs serious computing power.

From their San Jose, CA headquarters, Supermicro has positioned itself as more than just a hardware company – they’re enablers of the digital change that’s reshaping how we work, play, and live.

Deep Dive into the SMCI Stock Price and Financial Health

When you’re looking at investing in Super Micro Computer, understanding the company’s financial health is like checking the ingredients before ordering a meal – you want to know exactly what you’re getting into. The SMCI stock price tells a story that goes far beyond just numbers on a screen.

Super Micro Computer carries a hefty market capitalization of approximately $26.30 billion, which puts it in the big leagues of tech companies. Think of market cap as the total price tag if someone wanted to buy the entire company – it’s a solid indicator of how much the market values SMCI.

The company’s financial metrics paint an interesting picture. With a Price-to-Earnings ratio of 26.59, investors are showing they’re willing to pay a premium for each dollar of earnings, reflecting confidence in the company’s growth potential. The earnings per share for the trailing twelve months sits at $1.77, while revenue reached an impressive $21.97 billion last fiscal year.

Recent quarterly results showed some mixed signals. SMCI reported earnings of $0.41 per share, which came in slightly below analyst expectations of $0.45. Revenue for the quarter was $5.76 billion, also missing the estimated $5.98 billion. However, there’s a silver lining – net income jumped to $195.15 million, representing a solid 79.41% increase from the previous quarter.

The company’s operational efficiency shows through its EBITDA of $1.31 billion with a margin of 5.97%. While these numbers might seem dry, they tell us that SMCI is generating healthy cash flow from its core operations.

Understanding the current smci stock price and volatility

The SMCI stock price currently sits at around $44.36 USD, showing a modest daily gain of 0.66%. But here’s where things get interesting – this stock doesn’t do anything halfway.

SMCI trades with remarkable volatility, sporting a beta coefficient of 2.92. In plain terms, when the market moves up or down by 1%, SMCI typically moves nearly three times as much in the same direction. It’s like riding a roller coaster compared to taking a leisurely stroll through the park.

The stock’s 52-week range tells quite a tale, swinging from a low of $17.25 to a high of $122.90. That all-time high was reached on March 8, 2024, and the journey since then has been anything but smooth. This kind of price action reflects both the excitement around AI infrastructure and the challenges that come with rapid growth in a competitive market.

For investors interested in AI-driven opportunities, understanding this volatility becomes crucial. More info about AI stocks.

Historical smci stock price performance

Super Micro Computer’s historical performance reads like a tale of two stories – spectacular long-term gains paired with recent bumps in the road. The company has delivered what many would call parabolic growth over the years, though recent months have served up a reality check.

Here’s how SMCI has performed across different time horizons:

| Timeframe | SMCI Performance | S&P 500 Comparison |

|---|---|---|

| 1-Day | +0.66% | N/A |

| 1-Month | -14.94% | N/A |

| 6-Months | -25.49% | N/A |

| Year-to-Date | 38.71% | 3.97% |

| 1-Year | -27.28% | 23.46% |

| 5-Years | 1,373.68% | 81.24% |

| All-Time | 4,677.40% | N/A |

The five-year performance of 1,373.68% is nothing short of extraordinary, absolutely crushing the S&P 500’s 81.24% return over the same period. Even with the recent correction showing a 27.28% decline over the past year, the long-term story remains compelling.

This performance pattern is typical of companies riding major technological waves. SMCI has benefited enormously from the AI boom, cloud computing expansion, and the growing need for high-performance computing infrastructure. However, as we’ve seen recently, these same factors can work in reverse when market sentiment shifts or growth expectations need adjustment.

The recent revenue forecast cut from $40 billion to $33 billion for fiscal 2026 has contributed to the stock’s decline from its peak, but many analysts still see the long-term AI infrastructure story as intact.

Analyst Outlook, News, and Forecasts

When we consider the future trajectory of the SMCI stock price, we often turn to insights from financial analysts. Their ratings and price targets provide a collective sentiment about where the stock might be headed, though it’s always wise to remember that these are forecasts, not guarantees.

Analyst ratings for SMCI show a mixed, but leaning positive, sentiment. Approximately 42% of 19 ratings are “Buy,” 42.1% are “Hold,” and 15.8% are “Sell.” This indicates a considerable number of analysts believe in the company’s potential.

Price targets for SMCI have seen some significant adjustments. Barclays raised its price target to $45 from $29, while Raymond James increased its target to $53 from $41. BofA also bumped its target to $37 from $35. However, JPMorgan lowered its target slightly to $45 from $46. This range of adjustments reflects the dynamic nature of the AI server market and the evolving outlook for SMCI. Overall, analysts forecast SMCI’s price to have a maximum estimate of $60.00 USD and a minimum estimate of $15.00 USD.

For a more bullish perspective, we’ve heard sentiments like: ‘Stay Long and Strong,’ Says Top Investor About Super Micro Computer Stock. This kind of confidence often stems from the company’s strong position in the burgeoning AI infrastructure market.

Recent News and Key Events Impacting the Stock

Recent news has played a significant role in the fluctuations of the SMCI stock price. Earnings reports are always a major catalyst, and Supermicro’s recent results drew considerable attention. As we mentioned, the company’s earnings for the last quarter were $0.41 per share on revenue of $5.76 billion, falling short of analyst expectations. This “dismal earnings” report on August 6, 2025, led to the stock crashing 20%, as reported by TipRanks.

A pivotal event impacting the outlook for SMCI was the company’s decision to cut its fiscal 2026 revenue forecast. The projection was lowered from an ambitious $40 billion to $33 billion. This adjustment, along with “four quarters of missed targets and challenges in the AI server market,” has fueled some analyst concerns, with some analysts “slamming Super Micro as AI war bites bottom line.”

Despite these challenges, there’s a strong underlying narrative of growth, particularly driven by the demand for AI infrastructure. Supermicro is a key provider of hardware essential for AI development, often collaborating closely with chip giants like NVIDIA, though specific partnership details aren’t widely publicized in the provided data. The company’s ability to quickly deliver advanced, liquid-cooled server solutions for AI workloads remains a significant advantage.

Legal Actions and Investor Alerts

It’s important to be aware of all factors influencing a stock, and for SMCI, recent legal actions have been a notable development. Super Micro Computer has been the subject of several investor alerts and class-action lawsuits, primarily related to allegations of securities fraud.

Since late 2024, various law firms have issued investor alerts and reminders about deadlines for class-action lawsuits. These alerts often mention “investors with substantial losses” and encourage them to secure counsel. Firms like Bronstein, Gewirtz & Grossman LLC, Faruqi & Faruqi, LLP, Rosen, BFA Law, Hagens Berman, Berger Montague, and Kirby McInerney LLP have all been involved, investigating claims on behalf of investors.

A significant point of concern was a Wall Street Journal report of a DOJ (Department of Justice) probe into Super Micro Computer. This news, coupled with ongoing investor class actions, caused shares to tumble. The lawsuits allege accounting manipulation accusations and focus on potential misstatements or omissions that may have led to investor losses.

For instance, many of these alerts highlighted an important deadline around October 29, 2024, for investors to join these class actions. These developments underscore the importance of thorough due diligence and staying informed about a company’s legal landscape, alongside its financial performance and market position.

More info about investing.

Risks, Opportunities, and Competitors for SMCI

When it comes to investing in any stock, we always believe in looking at the complete picture. The SMCI stock price reflects not just current performance, but also the market’s assessment of both exciting opportunities and genuine risks ahead.

Opportunities in the AI Era

The biggest opportunity for Super Micro Computer sits right at the heart of one of technology’s most transformative trends: artificial intelligence. As AI models grow more sophisticated and businesses across every industry rush to implement AI solutions, the demand for specialized computing infrastructure is absolutely exploding.

Think about it this way – every time you use ChatGPT, stream a recommendation on Netflix, or see a targeted ad, there are powerful servers working behind the scenes. Supermicro’s strength lies in their ability to quickly adapt and deliver exactly what these AI applications need.

Their liquid cooling technology is particularly exciting. As AI workloads generate more heat than traditional computing tasks, efficient cooling becomes critical. This isn’t just about keeping servers running – it’s about sustainability and cost management for massive data centers.

The company’s modular architecture gives them another edge. When new chip technologies emerge (and they do frequently in the AI space), Supermicro can integrate them faster than competitors who use more rigid designs. This agility means they can ride each wave of innovation rather than getting left behind.

Market expansion opportunities are enormous. We’re still in the early stages of AI adoption across industries like healthcare, manufacturing, and financial services. Each new sector that accepts AI creates demand for the high-performance servers that Supermicro specializes in.

Navigating the Risks

Of course, with great opportunity comes significant risk. The SMCI stock price volatility we’ve seen isn’t just random – it reflects real challenges the company faces.

Intense competition tops the risk list. The server market isn’t some quiet niche – it’s a battleground where established technology giants fight for every contract. These competitors often have deeper pockets and longer-standing relationships with enterprise customers.

Supply chain constraints present another ongoing challenge. Like many hardware companies, Supermicro depends on a complex global network of suppliers. When chip shortages hit or shipping gets disrupted, production timelines can stretch and costs can spike unexpectedly.

The stock volatility itself becomes a risk factor. With that beta coefficient of 2.92, SMCI moves almost three times as much as the broader market. This means while gains can be spectacular during good times, losses during downturns can be equally dramatic.

Margin pressures in the AI server market add another layer of complexity. Yes, demand is growing, but so is competition. When multiple companies bid for the same contracts, pricing can get aggressive quickly, squeezing profit margins.

Perhaps most concerning right now is the legal and regulatory scrutiny. The ongoing DOJ probe and multiple class-action lawsuits create uncertainty that extends beyond just potential financial penalties. They can distract management, damage customer relationships, and create ongoing reputational challenges.

Main Competitors

In the competitive landscape of server and storage solutions, Super Micro Computer faces formidable opponents. The two biggest names in their space are Dell Technologies and Hewlett Packard Enterprise (HPE).

Both of these competitors bring significant advantages to the table. They have established relationships with enterprise customers that often span decades. Their global reach and service networks can be particularly appealing to large corporations that need consistent support across multiple locations.

What helps Supermicro stand out is their focus on application-optimized solutions. Rather than trying to be everything to everyone, they specialize in creating servers that are specifically designed for particular workloads – especially AI and high-performance computing tasks.

Their emphasis on rapid innovation and energy efficiency also differentiates them in a market where green computing is becoming increasingly important. Data centers consume enormous amounts of electricity, so solutions that deliver better performance per watt can provide real competitive advantages.

The key for investors is understanding that while competition is fierce, the AI infrastructure market is growing fast enough that multiple companies can succeed simultaneously. The question becomes whether Supermicro can maintain its innovative edge and execution capabilities as the market matures.

Frequently Asked Questions about SMCI Stock

When it comes to SMCI stock price and investment decisions, we get a lot of questions from our readers. Let’s tackle the most common ones with straightforward answers that cut through the financial jargon.

Does Super Micro Computer (SMCI) pay a dividend?

The short answer is no – Super Micro Computer doesn’t currently pay dividends to shareholders. But before you write that off as a negative, let’s talk about why this actually makes sense for a company like Supermicro.

Think of it this way: when you’re a fast-growing tech company in the red-hot AI market, every dollar of profit is like fuel for your growth engine. Instead of handing out dividend checks, Supermicro reinvests those earnings right back into the business. They’re pouring money into research and development, expanding their operations, and positioning themselves to capture more of the exploding AI infrastructure market.

This growth-focused strategy is pretty typical for technology companies, especially ones riding the AI wave. The idea is that by reinvesting profits, they can drive the stock price higher over time – potentially giving investors much better returns than a modest dividend ever could.

Who are Super Micro Computer’s main competitors?

Super Micro Computer doesn’t have the server and storage market to itself – far from it. The company faces some serious competition from well-established tech giants who’ve been in this game for decades.

Dell Technologies stands as one of SMCI’s primary rivals, bringing decades of enterprise experience and a massive global customer base to the table. Hewlett Packard Enterprise (HPE) is another major player, offering comprehensive server and storage solutions that compete directly with Supermicro’s offerings.

Beyond these household names, the competitive landscape includes numerous other server manufacturers and system integrators, all fighting for their slice of the enterprise hardware pie. What helps Supermicro stand out in this crowded field? Their focus on modular, energy-efficient designs and their ability to quickly adapt their solutions for cutting-edge applications like AI and 5G networks.

The company’s application-optimized approach means they’re not just building generic servers – they’re crafting solutions specifically custom for the unique demands of different industries and technologies.

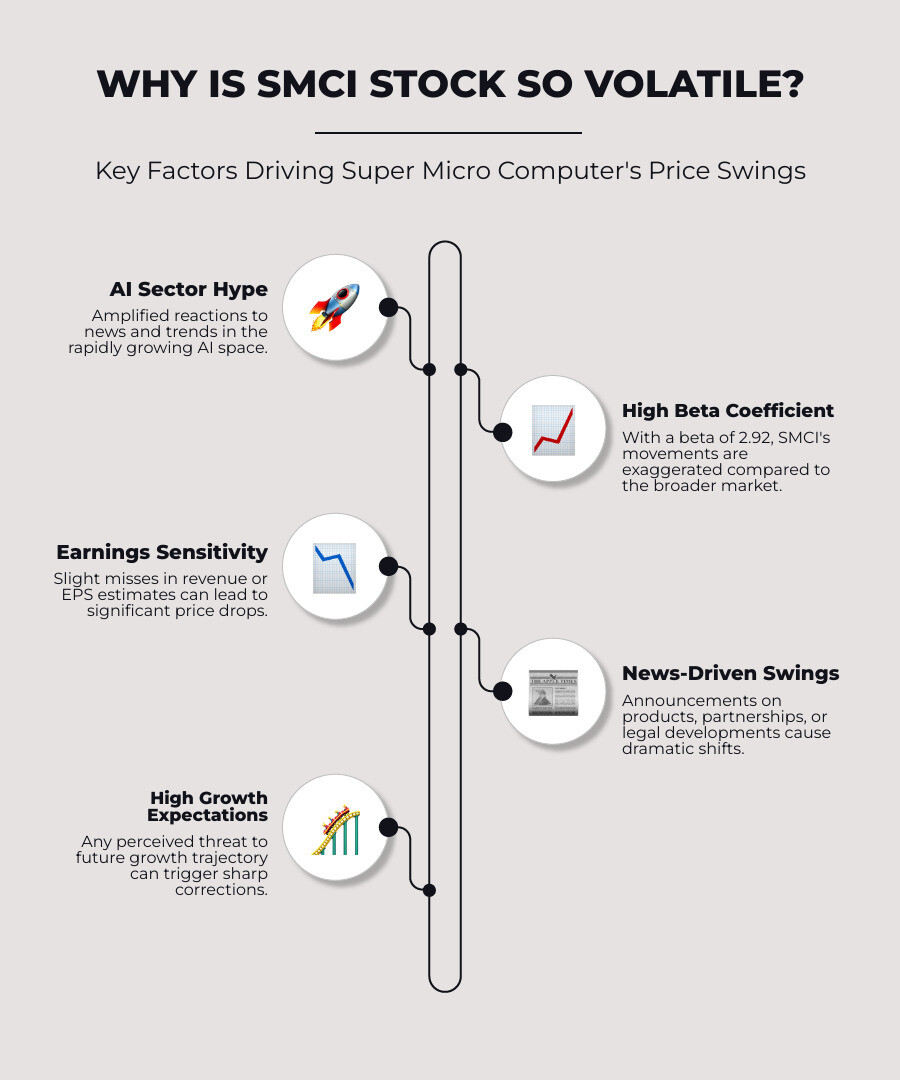

What is causing the high volatility in SMCI’s stock price?

If you’ve been watching the SMCI stock price, you’ve probably noticed it can feel like a roller coaster ride. There are several key factors behind those dramatic ups and downs.

First up is the AI sector hype. Artificial Intelligence is having its moment right now, and as a company that builds the infrastructure powering AI systems, Supermicro gets caught up in every wave of excitement – and every bout of concern – about the AI market’s future.

The stock’s high beta coefficient of 2.92 means it naturally moves with about three times the intensity of the broader market. When the market goes up 1%, SMCI might jump 3%. When it drops 1%, SMCI could fall 3%. It’s like having the volume turned way up on normal market movements.

Earnings sensitivity plays a huge role too. High-growth tech stocks like SMCI live and die by their quarterly results. When the company recently reported earnings of $0.41 per share instead of the expected $0.45, investors reacted swiftly and decisively – sending the stock tumbling.

The stock is also incredibly news-driven. Whether it’s announcements about new products, changes to revenue forecasts (like that recent cut from $40 billion to $33 billion), or legal developments like the DOJ probe, any significant news can trigger major price swings.

Finally, there’s the weight of growth expectations. Investors have priced in tremendous future growth for Supermicro, which means any hint that growth might slow down can cause dramatic corrections. It’s the classic high-risk, high-reward scenario that defines many AI-related stocks right now.

Conclusion

As we wrap up our deep dive into the SMCI stock price, it’s clear that Super Micro Computer represents one of the most intriguing investment stories in today’s AI-driven market. This isn’t just another tech stock – it’s a company positioned at the very foundation of the artificial intelligence revolution that’s reshaping our world.

The numbers tell a remarkable tale. With a current SMCI stock price of $44.36 and an astounding 1,373% growth over five years, Super Micro Computer has delivered the kind of returns that make investors take notice. Yet this success story comes with important caveats that every potential investor needs to understand.

The AI-driven growth potential remains undeniably compelling. As businesses worldwide rush to implement AI solutions, the demand for Supermicro’s high-performance servers and storage systems continues to expand. Their liquid cooling technology and modular architecture give them real competitive advantages in this fast-moving market.

However, we can’t ignore the high-risk, high-reward nature of this investment. The stock’s beta of 2.92 means you’re signing up for a roller coaster ride that moves nearly three times faster than the broader market. Add in the recent legal challenges, revenue forecast cuts, and intense competition, and you have a stock that requires careful consideration and strong risk tolerance.

The importance of thorough research cannot be overstated when it comes to volatile stocks like SMCI. Market sentiment can shift quickly, earnings reports can trigger dramatic price swings, and regulatory developments can create unexpected headwinds. Smart investors know that understanding these dynamics is just as important as recognizing the growth potential.

At The Dining Destination, we believe in serving up well-researched insights that help you make informed decisions. Just as we guide food enthusiasts through complex culinary landscapes, we aim to help you steer the intricate world of growth investing with clarity and confidence.

Whether SMCI fits your investment appetite depends on your risk tolerance, time horizon, and belief in the AI revolution’s staying power. What’s certain is that this stock will continue to be one worth watching as the technology sector evolves.

For more insights into market trends and investment opportunities that can add flavor to your portfolio, explore our comprehensive resource guides for more insights. After all, the best investment strategies, like the best meals, are built on quality ingredients and careful preparation.