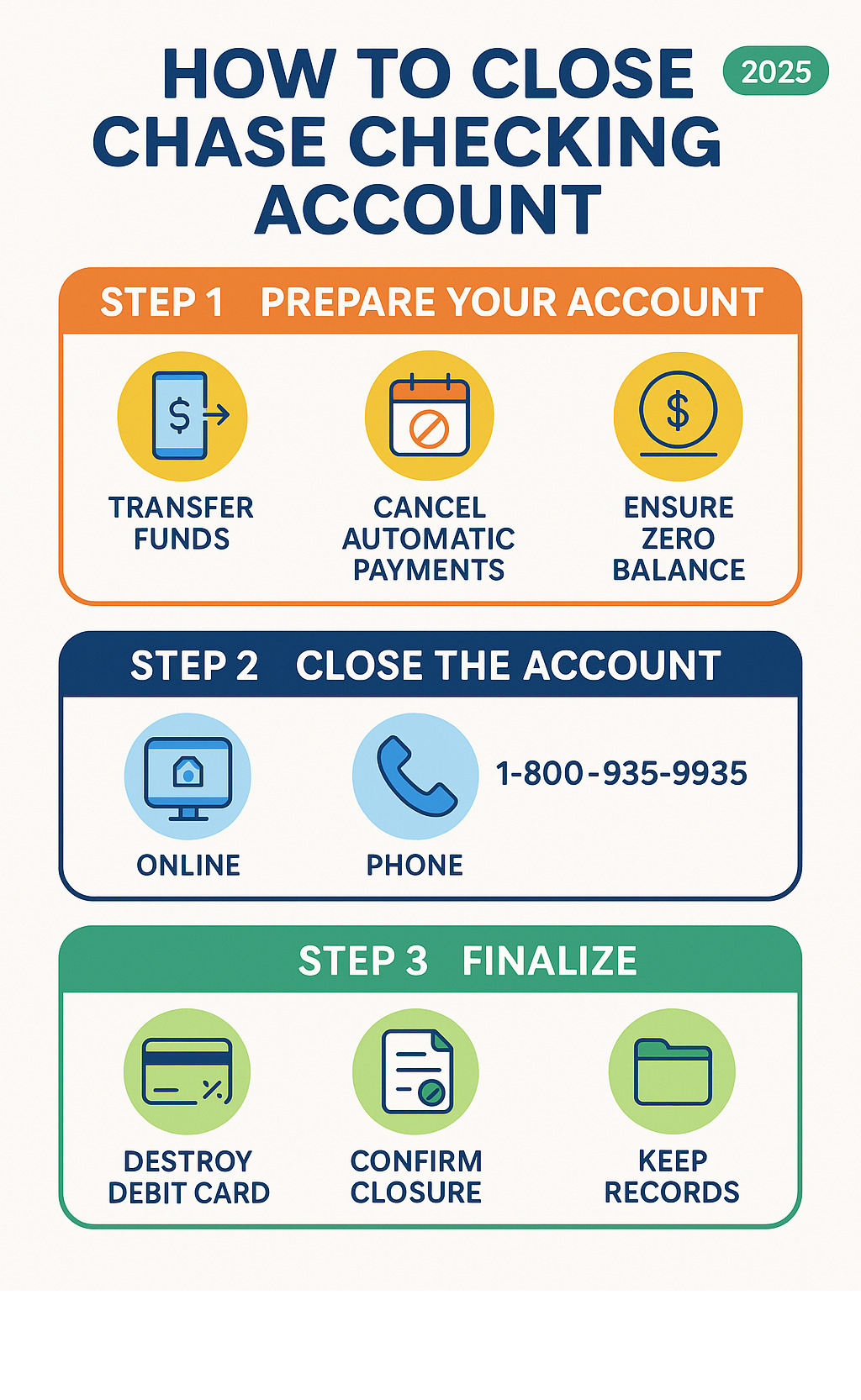

Why Closing Your Chase Checking Account Is Easier Than You Think

How to close Chase checking account is a common concern for many bank customers, but the process is straightforward when you know the right steps. Whether you’re switching to a bank with better rates, consolidating your finances, or simply no longer need the account, Chase offers multiple convenient closure methods.

Quick Answer: 3 Ways to Close Your Chase Checking Account

- Online – Send a secure message through Chase’s online banking platform

- Phone – Call customer service at 1-800-935-9935

- In-Person – Visit any Chase branch with valid ID

- Mail – Send written request to P.O. Box 36520, Louisville, KY 40233-6520

Before you start: Ensure your account has a zero balance and cancel any automatic payments or direct deposits.

The good news? Chase doesn’t charge fees for closing accounts in good standing, and the process typically takes just 1-2 business days once initiated. As millions of Americans switch banks each year, you’re certainly not alone in making this financial move.

The key to a smooth closure lies in proper preparation. You’ll need to handle automatic payments, transfer remaining funds, and choose your preferred closure method. With the right approach, closing your Chase checking account can be as simple as “sending a breakup text to your bank… but way less awkward,” as one financial expert puts it.

Simple how to close chase checking account word guide:

Step 1: Prepare Your Account for a Smooth Closure

Think of preparing to close your Chase checking account like organizing your kitchen before a big move. You wouldn’t pack expired ingredients or leave the stove on, and the same careful attention applies to your banking transition. Taking time to properly prepare prevents headaches later and ensures your financial life stays as smooth as a perfectly blended soup.

Open your replacement account first. This might seem obvious, but you’d be surprised how many people close their account before securing a new banking home. It’s like canceling your restaurant reservation before finding another place to eat – you’ll end up hungry and frustrated. Having your new account ready ensures your money has somewhere safe to land during the transition.

Once your new account is established, transfer all funds to achieve a zero balance. Chase requires your account to be completely empty before closure, so every penny needs to find a new home. You can move money through electronic transfers (up to $25,000 daily for most accounts), ATM withdrawals for smaller amounts, or by visiting a branch for larger sums. Write yourself a check if that feels more comfortable – whatever method works best for your situation.

Settle any negative balances immediately. Chase won’t let you close an account that owes them money, and honestly, that makes perfect sense. Any overdrafts, monthly maintenance fees, or other charges must be cleared first. Think of it as paying your restaurant bill before leaving – it’s just good manners, and it prevents your account from potentially ending up in collections.

Now comes the detective work: identify and redirect all automatic payments and direct deposits. This step requires patience but saves enormous hassle later. Scan through your last year of statements to spot recurring transactions. Your utilities like electricity and internet need new payment instructions, along with subscriptions for streaming services, gym memberships, or that cooking magazine you love. Don’t forget loan payments for your mortgage or car, insurance premiums, and credit card autopay arrangements.

Reroute your direct deposits well in advance – ideally a full week before your next payday. Contact your employer’s payroll department with your new account information. Government benefits, freelance payments, and any other regular income sources also need updating. It’s like changing your address when you move, except your money needs to know where to find you.

Download and save all your account statements before closing. Once Chase shuts down your account, accessing these records becomes much more complicated. You’ll want these documents for tax purposes, expense tracking, or simply for your own peace of mind. It’s your financial paper trail, and keeping it organized now saves scrambling later.

Pay off any outstanding fees that might be lurking in your account. Sometimes small charges appear after you think everything’s settled, so give your account a final once-over to ensure it’s truly ready for closure.

For more comprehensive strategies on managing your financial transitions, explore our resources on Money Management. Just like planning the perfect culinary adventure requires preparation, how to close your Chase checking account successfully depends on taking care of these essential preliminary steps.

Step 2: How to Close Your Chase Checking Account (4 Methods)

Now that your account is prepped and ready, it’s time for the main event: actually closing it. Think of this as choosing your preferred way to say goodbye – some people like a quick phone call, others prefer a face-to-face conversation, and some want everything in writing.

Chase makes how to close chase checking account requests flexible by offering four different methods. No matter which route you choose, you’ll need to have certain information ready for verification. Keep your account number handy, along with a valid government-issued ID (like your driver’s license or passport), and be prepared to provide your Social Security Number if asked. Having these ready will make the process flow much smoother.

Let’s walk through your options, from the most convenient to the most traditional.

How to close your Chase checking account online

If you’re someone who handles everything digitally – from ordering dinner to managing finances – the online method might be your cup of tea. While Chase doesn’t offer a simple “delete account” button (wouldn’t that be nice?), you can definitely get the ball rolling from your couch.

Start by logging into Chase Online Banking using your usual credentials. Once you’re in, steer to the Secure Message Center – think of this as your private, encrypted chat room with Chase.

Click on “New message” and select “Account Inquiry” as your topic, then choose “Close my account” for the subtopic. Now comes the important part: compose a clear, straightforward message stating that you want to close your Chase checking account. Include your full name, the account number you’re closing, and a direct request for closure.

Here’s the thing though – Chase typically responds within 1-2 business days to online closure requests, but they’ll often ask you to schedule a phone call with a representative to finalize everything. This extra step helps them verify your identity thoroughly, which honestly makes sense from a security standpoint.

Closing by Phone

For those who want the quickest method and don’t mind a phone conversation, calling Chase directly is often your best bet. Many people find this approach gets things done fastest, especially if you’re comfortable with phone-based customer service.

Dial Chase’s customer service number: 1-800-935-9935. This number is specifically for checking and savings accounts, so you’ll reach the right department immediately.

When you call, the representative will walk you through identity verification first. They’ll ask security questions to confirm you’re really the account holder – things like your address, recent transactions, or other account details. Once that’s sorted, simply tell them you’d like to close your checking account.

The beauty of this method? If your account meets all the requirements (remember that zero balance we talked about?), the representative can often complete the closure right there on the call. No waiting, no follow-up needed.

Visiting a Chase Branch In-Person

Sometimes there’s no substitute for face-to-face assistance, especially when you’re making important financial decisions. If you prefer speaking with someone in person or have complex questions about your account, visiting a branch gives you that personal touch.

Use the Chase Branch Locator to find your nearest location. Here’s a pro tip: don’t just walk in and hope for the best. Instead, Schedule a meeting ahead of time. This saves you from potentially long waits and ensures a banker will be ready to help you immediately.

When you head to the branch, bring your valid ID and your debit card associated with the account. Having these documents ready shows you’re prepared and helps speed up the process.

The banker will handle everything from verifying your identity to processing the closure. They can also answer any last-minute questions you might have about the process. It’s straightforward and thorough – exactly what you’d expect from an in-person banking experience.

For more insights about how Chase operates and their various services, you might find our information on Chase Bank helpful.

Sending a Written Request by Mail

While it might seem old-school in our digital world, the traditional method of mailing a written request still works perfectly well. This approach appeals to people who want a clear paper trail or simply prefer handling important matters through formal correspondence.

You’ll need to write a formal closure letter that includes all the essential details. Make sure to include your full name exactly as it appears on the account, your complete account number, a clear statement requesting closure, and your signature. Don’t forget to add your contact information – both a phone number and mailing address where Chase can reach you if needed.

Send your letter to: P.O. Box 36520, Louisville, KY 40233-6520.

That this method takes the longest due to mail delivery times and processing. If you choose this route, consider following up with a phone call after a week or two to make sure they received your request and check on the status.

Step 3: Finalize the Closure and Post-Closure Actions

You’ve made it to the home stretch! Just like finishing a perfectly planned dinner party, these final steps ensure everything is wrapped up neatly and you can sit back with complete peace of mind.

After you’ve submitted your how to close Chase checking account request through any of the four methods we discussed, Chase will send you a confirmation of closure within 1-2 business days. This confirmation is your golden ticket – official proof that the deed is done. Keep your eyes peeled for this email or letter, as it’s the document that officially seals the deal.

Now comes one of the most satisfying moments: destroying your debit card. Think of it as the financial equivalent of dramatically tossing your house keys after closing on a new home! Don’t just toss that card in the trash though. Cut it into several pieces, making sure to destroy both the magnetic strip and the chip completely. A paper shredder works wonderfully for this too. The same goes for any unused checks – shred them all to prevent any potential fraud.

What about those last few dollars rattling around in your account? If there are any residual funds over $1 remaining after closure, Chase will mail you a check for that amount. For amounts less than a dollar, Chase typically keeps these funds. Make sure your mailing address is current with Chase so you don’t miss out on your money!

Here’s something many people forget: storing your closure confirmation and final statements is crucial for your financial records. These documents prove your account was properly closed and can be invaluable during tax season or if any questions arise later. Think of them as your financial insurance policy.

Does Closing a Chase Checking Account Affect Your Credit Score?

Here’s some welcome news that’ll make you breathe easier: closing a checking account has no direct impact on your credit score. Your checking account activity isn’t reported to the major credit bureaus (Experian, Equifax, and TransUnion), so simply closing an account in good standing won’t show up on your credit report at all.

But here’s where things get interesting. While the closure itself won’t hurt your credit, there’s a risk of unpaid fees creating problems down the road. If you close your account with a negative balance or leave outstanding fees unpaid, Chase may eventually send that debt to collections. Once a debt hits collections, it will appear on your credit report and can seriously damage your credit score.

This is exactly why we emphasized settling all balances first in Step 1. A negative balance sent to collections can haunt your credit for years, making it much harder to get loans, credit cards, or even rent an apartment.

There’s also something called a ChexSystems report to consider. While not technically a credit bureau, ChexSystems tracks banking behavior. If you have a history of overdrafts or account mismanagement, this can make opening new accounts with other banks more difficult in the future.

For more detailed information straight from the source, check out Chase’s own guide: Learn if closing a bank account hurts your credit.

What to do after you close your Chase checking account

Congratulations! You’ve successfully steerd the how to close Chase checking account process. But just like cleaning up after hosting a dinner party, there are a few final touches that’ll ensure everything is perfectly wrapped up.

First, verify your account is actually closed within a week or two of receiving your confirmation. You can do this by trying to log into your Chase online banking or giving customer service one final call. It’s like double-checking that you actually turned off the stove – a simple step that provides valuable peace of mind.

Keep monitoring for stray transactions on your new bank account statements for the next month or two. Even with your careful preparation, sometimes a forgotten subscription or an old automatic payment might try to pull from your closed Chase account. Catching these early lets you update them quickly with your new banking information.

Don’t forget to securely destroy old debit cards and checks associated with the closed account if you haven’t already. This step is absolutely crucial for preventing fraud. Think of it as the financial equivalent of changing your locks after moving – essential for your security.

Finally, keep those records for tax purposes! Store your closure confirmation, final statements, and any correspondence with Chase in a safe place. These documents serve as your proof of closure and can be incredibly helpful during tax season or if any questions arise years down the road.

Ready to continue building your financial expertise? Explore our other Banking guides for more helpful tips and insights.

Frequently Asked Questions about Closing a Chase Account

We know that figuring out how to close chase checking account can feel overwhelming at first. That’s why we’ve gathered the most common questions people ask when they’re ready to part ways with their Chase account. Think of this as your friendly neighborhood guide to clearing up any lingering doubts!

Are there any fees for closing a Chase checking account?

Here’s some wonderful news for your budget: Chase doesn’t charge a direct fee for closing your checking account. That’s right – saying goodbye to your account won’t cost you a penny in closure fees!

But here’s where it gets important (and why we spent so much time on preparation earlier). While Chase won’t hit you with a “closure fee,” you absolutely must settle any outstanding business first. This means paying off any negative balances and clearing up outstanding fees before Chase will even consider processing your closure request.

Think of it like settling your tab at a restaurant before you leave. You can’t just walk out with an unpaid bill! If your account is overdrawn or has pending charges, you’ll need to deposit enough money to bring that balance to zero or positive. Only then will Chase give you the green light to close your account.

How can I close my account if I’m located overseas?

Maybe you’re living your best life exploring street food markets in Bangkok or savoring wine in Tuscany – distance doesn’t have to be a roadblock! Chase makes it totally possible to close your account from anywhere in the world.

Your best bet is calling Chase customer service directly. You can reach them at 1-800-935-9935 for checking and savings accounts. If you’re calling internationally, you might need to use 1-713-262-3300 instead. Just keep in mind that international calling charges might apply from your phone provider, so check those rates first.

Another smooth option is using Chase’s online Secure Message Center. Just log into your Chase online banking and send a secure message requesting closure. Chase typically responds within 1-2 business days with next steps, which often includes scheduling a phone call to finalize everything.

Some folks have had success with requesting a callback through Chase’s online system. This way, Chase calls you instead of racking up international charges on your phone bill – pretty smart, right?

Just remember to handle all that preparation work we talked about earlier. Transfer your funds out and settle any negative balances before you start the closure process, especially since moving money internationally might involve wire transfer fees.

Can a closed Chase account be reopened?

Unfortunately, this is where we have to deliver some not-so-great news. Once your Chase checking account is officially closed, it cannot be reopened. It’s like trying to walk back into a restaurant after they’ve turned off the lights and locked the doors – it’s just not happening!

If you change your mind down the road and decide you want to bank with Chase again, you’ll need to start completely fresh. This means submitting a brand-new application for another Chase Checking Account. You’ll go through the whole process again – filling out paperwork, providing identification, and meeting all current requirements for new accounts.

That’s exactly why we encourage you to be absolutely certain before you take this step. Make sure you’re truly ready to close that chapter of your banking relationship, because once it’s done, there’s no going back to that same account.

Conclusion

Closing your Chase checking account doesn’t have to be as complicated as deciphering a French menu on your first trip to Paris. With the three-step process we’ve outlined – preparing your account, choosing your closure method, and finalizing everything properly – you now have a clear roadmap to financial freedom.

Think of it this way: you’ve successfully prepared your financial “mise en place,” just like a chef organizing ingredients before cooking. You’ve transferred your funds, updated those sneaky automatic payments, chosen whether to close online, by phone, in-person, or through the mail, and learned how to properly destroy your debit card (because nobody wants their financial information floating around like yesterday’s leftovers).

Managing your money effectively is just as essential as planning the perfect dining experience. Whether you’re switching banks to save for that culinary adventure through Italy, consolidating accounts to simplify your finances, or simply finding better banking terms, taking control of your accounts puts you in the driver’s seat of your financial journey.

The best part? You now know that how to close Chase checking account is completely manageable when you’re armed with the right information. No more mystery, no more stress – just straightforward steps that lead to results.

At The Dining Destination, we understand that smart financial management is the foundation that makes those incredible food experiences possible. After all, budgeting wisely today means you can savor that perfect meal in New York’s hottest new restaurant tomorrow without any financial worries weighing you down.

Ready to take your financial knowledge even further? Explore our complete Resource Guide for more financial tips and find how to make your money work as hard as you do. Here’s to your financial success and many delicious meals ahead!