Understanding Hims Stock: A Comprehensive Investment Overview

Hims stock (NYSE: HIMS) represents shares of Hims & Hers Health, Inc., a telehealth company that has captured significant investor attention with its explosive growth and recent profitability achievements.

Key Facts About HIMS Stock:

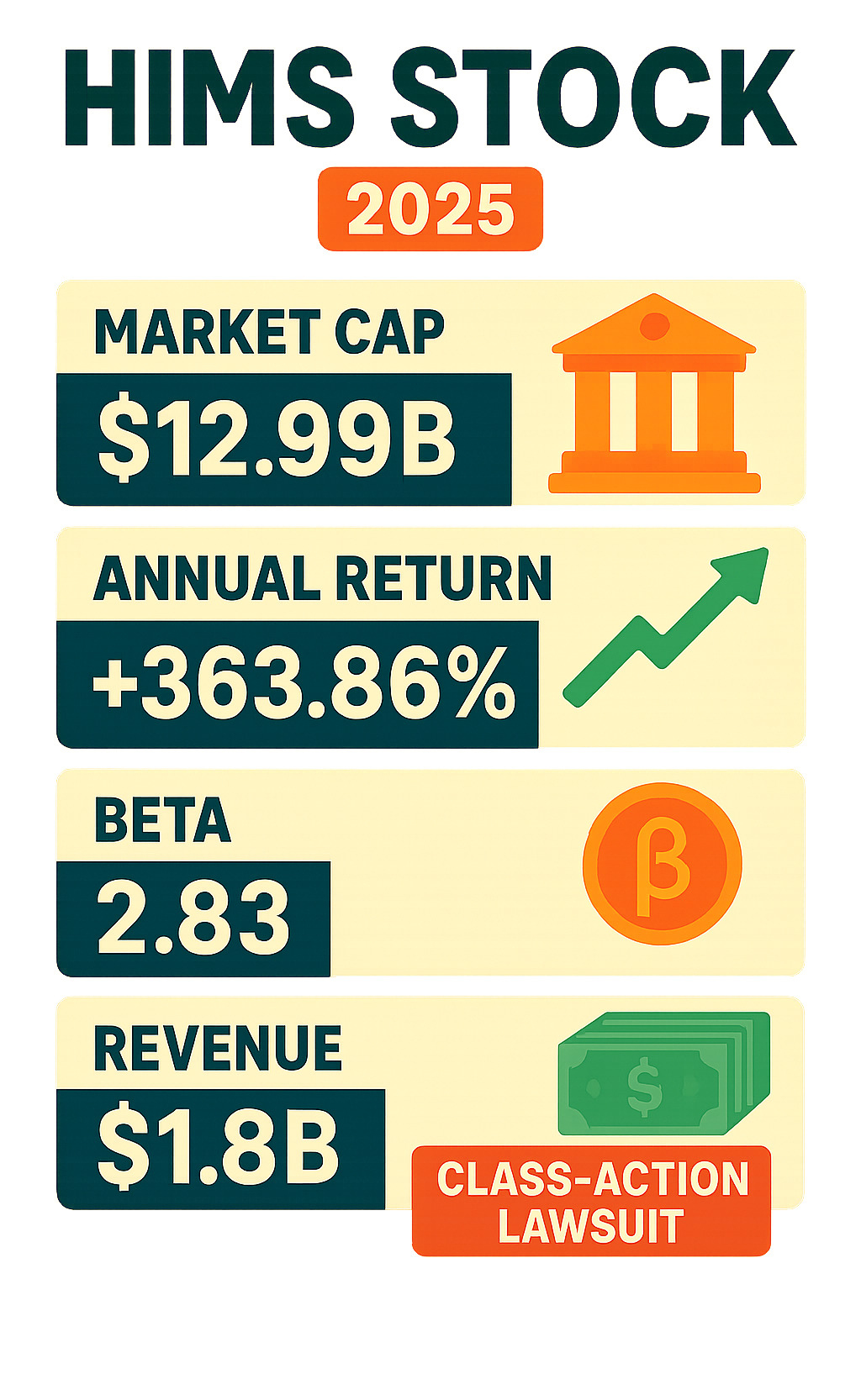

- Current Market Cap: $12.99 billion USD

- Stock Performance: 363.86% increase over the last year

- Trading Status: Profitable as of recent quarters

- Volatility: High (18.80% volatile with beta of 2.83)

- Dividend: No dividend payments to shareholders

- Analyst Outlook: Mixed, with price targets ranging from $28 to $85

Hims & Hers Health, Inc. operates as an American telehealth company established in 2017, connecting over 1 million subscribers to licensed healthcare professionals through its direct-to-consumer platform. The company offers prescription medications, over-the-counter drugs, and personal care products for sexual health, mental health, dermatology, and primary care.

Recent financial performance shows impressive growth: The company generated $1.8 billion in sales over the trailing 12 months and achieved $164 million in earnings over the past four quarters. However, the stock trades at more than 70 times its trailing earnings, indicating a high valuation that reflects investor expectations for continued growth.

The investment story isn’t without controversy. Hims & Hers faces a class-action lawsuit related to its use of compounded drugs and alleged securities fraud, which caused the stock to fall more than 34% in a single trading session in June 2025.

Simple hims stock word guide:

Introduction to Hims & Hers Health, Inc.

When hims stock first hit the market, it represented something pretty in healthcare. Hims & Hers Health, Inc. launched in 2017 as an American telehealth company with a simple but powerful idea: make healthcare less awkward and more accessible.

What started as “Hims” – focusing primarily on men’s health issues that guys often felt too embarrassed to discuss with their doctor – quickly evolved into something much bigger. The company expanded to include “Hers” for women’s health, creating a comprehensive wellness platform that tackles those sensitive health topics we’d all rather handle privately.

The genius of their direct-to-consumer model lies in its simplicity. Instead of scheduling appointments weeks in advance, sitting in waiting rooms, and having potentially uncomfortable conversations face-to-face, customers can connect with licensed healthcare professionals from their couch. It’s healthcare that fits into modern life, not the other way around.

This digital-first approach has clearly struck a chord with consumers. The company now serves over 1 million subscribers who appreciate the convenience of online consultations followed by discreet delivery of their treatments. No pharmacy pickup required – everything arrives right at your door in unmarked packaging.

What Services Does Hims & Hers Offer?

The platform has grown far beyond its original focus, now covering the health concerns that people actually worry about but don’t always feel comfortable discussing. Their comprehensive approach addresses sexual health issues like erectile dysfunction and sexual wellness, mental health support including anxiety and depression treatment, dermatology services for acne and anti-aging concerns, primary care for general health needs, and hair care solutions for hair loss.

What makes this particularly smart from a business perspective is that these are often ongoing concerns rather than one-time treatments. Someone dealing with hair loss or managing anxiety isn’t looking for a quick fix – they need consistent, reliable care. This creates the foundation for their subscription-based revenue model.

The company even brought on Kristen Bell as their first Mental Health Ambassador, which was a brilliant move to help reduce the stigma around seeking mental health support. It’s exactly the kind of mainstream endorsement that helps normalize what they’re doing.

The Hims & Hers Business Model

The beauty of the Hims & Hers system is in its streamlined simplicity. Customers start by completing an online intake form about their symptoms and medical history. A licensed healthcare professional – whether that’s a physician, nurse practitioner, or specialist – reviews everything and creates a personalized treatment plan.

For states that require it, they’ll schedule video or audio consultations. Otherwise, recommendations go straight to the customer’s chat inbox. It’s healthcare communication that actually makes sense in 2024.

The subscription model bundles everything together: the medical consultation, ongoing medication shipments, and direct messaging with providers. One transparent price covers it all, which eliminates the usual healthcare billing confusion that everyone hates.

Perhaps most importantly, no insurance is required. While this might seem like a limitation, it’s actually a huge advantage for many people. No prior authorizations, no fighting with insurance companies, no surprise bills. You know exactly what you’re paying upfront.

The results speak for themselves: 6 million online visits and an average customer rating of 4.7 out of 5 stars. When you’re dealing with sensitive health issues, that level of customer satisfaction says everything about whether the model actually works.

For investors watching hims stock, this business model represents something compelling: predictable recurring revenue from a growing subscriber base, addressing real healthcare needs that traditional medicine often handles poorly. It’s the kind of digital disruption that creates lasting value when executed well.

Analyzing Hims Stock (HIMS) Financial Performance

Let’s be honest – when it comes to hims stock, the numbers tell quite a story. This telehealth company has been turning heads on Wall Street, and for good reason. The financial performance has been nothing short of impressive, though it comes with some important caveats that any smart investor should understand.

Right now, Hims & Hers Health, Inc. sits at a market capitalization of $12.99 billion USD – that’s billion with a “B”! For a company that started just seven years ago, this valuation shows just how much investors believe in the telehealth revolution. But here’s where things get interesting: the stock trades at more than 70 times its trailing earnings. That’s a pretty steep price-to-earnings ratio, which basically means investors are betting big on future growth.

Think of it this way – when you pay 70 times what a company earns today, you’re essentially saying “I believe this company will grow so much that today’s high price will look like a bargain later.” It’s a bold bet, but one that many investors seem willing to make. For the most up-to-date financial data, MarketWatch provides excellent real-time tracking, and we’ve found valuable insights from analysis platforms like 5starsstocks.com.

Key Financial Metrics and Recent Earnings

Here’s where hims stock really starts to shine. Over the past twelve months, this company has generated an impressive $1.8 billion USD in sales. Even more exciting? They’ve managed to turn $164 million USD in earnings over the past four quarters. That translates to a profit margin of more than 9%, which is actually quite healthy for a growth company at this stage.

The recent quarterly performance has been particularly encouraging. In their most recent reported quarter, HIMS delivered earnings of $0.20 USD per share, absolutely crushing the estimated $0.12 USD – that’s a whopping 65.41% surprise to the upside! Similarly, their revenue hit $586.01 million USD, significantly beating the estimated $538.59 million USD with an 8.8% revenue surprise.

What really caught our attention was the dramatic improvement in net income. The company reported $49.48 million USD in net income for their latest quarter, representing a stunning 90.14% increase from the previous quarter’s $26.02 million USD. That’s the kind of growth trajectory that gets investors excited.

The company’s operational efficiency is also improving nicely. Their EBITDA reached $137.93 million USD with a 5.76% EBITDA margin, showing they’re not just growing revenue but doing so profitably. Management is forecasting Q4 2024 revenue between $465 million and $470 million USD, which would represent an incredible 89% to 91% year-over-year increase.

These aren’t just good numbers – they’re exceptional numbers that demonstrate the company has successfully transitioned from a growth-at-all-costs mentality to sustainable, profitable growth.

Historical Performance of hims stock

If you’re looking for a wild ride, hims stock has certainly delivered one. Over the past year alone, shares have skyrocketed by an incredible 363.86%. To put that in perspective, if you had invested $1,000 a year ago, you’d be sitting on nearly $4,640 today – not too shabby!

The stock’s journey has been quite the trip. HIMS reached its all-time high of $72.98 USD on February 19, 2025, a far cry from its all-time low of $2.72 USD on May 12, 2022. That massive range – from under three dollars to over seventy – tells the story of a company that has experienced both the depths of market skepticism and the heights of investor enthusiasm.

But here’s what every potential investor needs to understand: this stock comes with significant volatility of 18.80%. That’s considerably higher than your typical blue-chip stock. Even more telling is the beta coefficient of 2.83, which means HIMS tends to move almost three times as dramatically as the broader market. When the market goes up 1%, HIMS might go up 3%. When the market drops 1%, HIMS could fall 3%.

This volatility is a double-edged sword. Yes, it’s created incredible returns for those who bought and held, but it also means the stock can experience sharp corrections just as quickly as it rises. The 52-week range reflects this dynamic nature, and investors need to be prepared for potentially stomach-churning price swings.

For those with strong stomachs and a belief in the long-term telehealth trend, this volatility has been rewarding. But it’s definitely not for the faint of heart or anyone who checks their portfolio balance obsessively!

Navigating the Controversies and Legal Headwinds

Let’s be honest – no investment story is complete without addressing the bumps in the road. While hims stock has delivered impressive financial results, the company is currently navigating some choppy waters that have investors understandably concerned.

The main issues revolve around compounded medications and some pretty serious legal challenges that emerged in 2025. These controversies have already caused significant stock price volatility, and they’re definitely worth understanding before making any investment decisions.

The Compounded Drugs Controversy

Here’s where things get a bit complicated. Hims & Hers has been offering compounded drugs – essentially customized versions of existing medications that are mixed by licensed pharmacists or physicians for individual patients. Think of it like getting a custom recipe instead of buying something off the shelf.

The problem? These compounded drugs aren’t FDA-approved. While the FDA oversees mass-produced medications with rigorous testing and approval processes, compounded drugs fly under a different regulatory framework. They’re typically used when patients need special dosages or formulations, or during drug shortages when the real deal isn’t available.

This became a major headache when Hims & Hers started offering compounded versions of popular weight-loss medications, particularly semaglutide – the active ingredient in blockbuster drugs like Ozempic and Wegovy. The company even had a brief partnership with Novo Nordisk, the pharmaceutical giant behind these medications.

But here’s where the story takes a dramatic turn. Novo Nordisk quickly pulled the plug on their partnership, citing concerns about deceptive marketing allegations and claiming that Hims & Hers wasn’t following laws that prohibit the mass sale of compounded drugs. Novo Nordisk made it crystal clear: they don’t work with compounding pharmacies and don’t support using compounded products for weight loss.

The safety and effectiveness concerns are real. Without FDA oversight, there’s less certainty about quality control and consistency. This creates both legal implications for the company and genuine health concerns for patients.

For investors, the big worry is a potential regulatory crackdown. If the FDA decides to crack down hard on compounded drug sales, Hims & Hers could face hefty fines, business restrictions, or even be forced to stop selling these medications entirely. Given how lucrative the weight-loss market is, that could seriously impact the company’s growth story.

The Class-Action Lawsuit Against Hims & Hers

As if the regulatory concerns weren’t enough, Hims & Hers is now facing a securities fraud lawsuit that directly stems from the compounded drug controversy. This isn’t just a slap on the wrist – it’s a serious legal challenge that has already hammered the stock price.

The lawsuit, announced by Bleichmar Fonti & Auld LLP, alleges that company executives misled investors about their partnership with Novo Nordisk. Specifically, the misrepresentation claims center on statements that the company could offer both legitimate Wegovy and compounded semaglutide while staying compliant with FDA regulations.

When the truth came out, hims stock took a brutal hit. We’re talking about a stock price decline of more than 34% in just three trading days between June 20 and June 23, 2025. That’s a $22.24 per share drop – the kind of decline that makes investors’ stomachs churn.

The lawsuit covers investors who bought HIMS securities between April 29 and June 23, 2025. If you’re one of those investors, law firms are actively seeking people to join the class action. This creates ongoing uncertainty because nobody knows how much the company might have to pay in settlements or legal fees.

What makes this particularly concerning is the timing. This legal drama unfolded right as Hims & Hers was hitting its stride financially. The contrast between the company’s strong operational performance and these legal headwinds creates a complex investment picture that requires careful consideration.

The outcome of this lawsuit will likely have lasting effects on both the company’s reputation and its stock performance. It’s a reminder that even high-growth companies can face serious challenges that go beyond their core business metrics.

Growth Drivers and Future Outlook

Despite the recent controversies, Hims & Hers has several compelling growth drivers that could propel hims stock forward in the long term. The company’s innovative approach to healthcare and strategic vision position it well within the rapidly evolving digital health landscape.

Expansion into new specialties stands out as one of the primary growth engines. Hims & Hers continues to broaden its service offerings beyond its initial focus on sexual health and hair loss. We’ve watched them venture successfully into mental health and weight management, which are massive and underserved markets. This diversification helps them tap into new revenue streams while attracting a wider consumer base.

The company has also shown a willingness to form strategic partnerships that improve their reach. While the Novo Nordisk partnership ended abruptly, their collaboration with ChristianaCare to expand in-person healthcare access in certain states demonstrates their commitment to integration with traditional healthcare systems. Such alliances can significantly expand their market presence.

Technological advancements remain at the heart of their business model. Continuous improvements to their telehealth platform, mobile app user interface, and backend systems create a seamless patient experience. These innovations improve customer satisfaction while boosting operational efficiency, which directly contributes to stronger profit margins.

Perhaps most importantly, operational efficiency improvements are crucial for sustaining profitability. As they scale, optimizing supply chains, reducing customer acquisition costs, and leveraging their technology infrastructure becomes vital. We anticipate these efforts will lead to continued margin expansion and a more robust financial position. For insights into market trends and the broader fintech landscape, resources like Fintechzoom.com Markets provide valuable analysis.

Analyst Expectations and Forecasts

Analysts generally hold a positive outlook for Hims & Hers’ future performance, though with varying degrees of optimism. This reflects the company’s high growth potential alongside existing risks. The numbers tell an interesting story about hims stock potential.

Earnings growth forecasts are particularly impressive. Some projections indicate a 15.74% per year increase, while another source suggests an expected 177.8% rise in earnings per share next year. This suggests strong belief in the company’s ability to scale its profitability effectively.

Revenue forecasts continue the positive trend. Management expects Q4 2024 revenue between $465 million and $470 million USD, representing an increase of about 89% to 91% year-over-year. This demonstrates continued top-line expansion that investors find encouraging.

The analyst price targets for hims stock reveal quite a wide range, from a minimum estimate of $28.00 USD to a maximum estimate of $85.00 USD. This spread underscores the uncertainty surrounding the stock, but also highlights the significant upside potential that some analysts perceive.

Interestingly, some analyses suggest HIMS is currently trading at 28.5% below Simply Wall St.’s estimate of its fair value. This could imply that despite its high P/E ratio, the stock might still be undervalued based on future growth projections.

Hedge fund interest adds another layer of credibility. In Q3 2024, there were 31 hedge fund holders in HIMS, indicating notable professional investment interest. This often signals confidence from sophisticated investors who have done their homework. For more detailed stock analysis and insights, resources like 5starsstocks.com Stocks can provide valuable perspectives.

The Role of New Treatments in Future Growth

A significant aspect of Hims & Hers’ future growth strategy involves expanding its portfolio of treatments, particularly in high-demand areas. The company’s ability to provide access to innovative medications serves as a critical differentiator in the crowded telehealth space.

While the compounded GLP-1 drug controversy created headwinds, the underlying demand for weight management solutions remains enormous. Hims & Hers’ strategy to offer personalized solutions, whether through compounded or directly sourced medications, directly addresses specific patient needs and preferences. This focus on customization helps build strong customer loyalty and retention.

This approach drives broad consumer attraction by continuously identifying and addressing unmet medical needs with convenient, online solutions. Their agility in adapting to market demands and quickly integrating new treatments into their platform will be crucial for maintaining their competitive edge.

The telehealth model itself, with its convenience and discretion, naturally appeals to a wide demographic, especially for sensitive health issues. As Hims & Hers continues to expand into new therapeutic areas and offer cutting-edge treatments, they’re positioning themselves to capture an even larger share of the growing digital health market.

Investor Outlook: Weighing the Risks and Rewards

When it comes to hims stock, we’re looking at a classic high-risk, high-reward investment scenario. It’s the kind of stock that can make your portfolio shine one day and keep you awake at night the next.

Investor sentiment around HIMS swings like a pendulum – one positive earnings report sends it soaring, while regulatory concerns can trigger sharp selloffs. We’ve noticed some concerning patterns, including shareholder dilution as the company continues issuing new shares to fund growth. Perhaps more telling is the pattern of insider selling by co-founders and executives. While this isn’t always a red flag, it does make us pause and wonder what those closest to the company might be thinking.

The silver lining? Hims & Hers has crossed a crucial threshold by achieving profitability milestones. Moving from burning cash to generating positive net income is no small feat, especially for a growth company. This shift suggests the business model actually works – and that’s huge for long-term growth potential.

The telehealth market is still in its early innings, and Hims & Hers has positioned itself well. But with great potential comes great market volatility, and this stock definitely isn’t for the faint of heart.

Potential Risks for Investors

Let’s be honest about what could go wrong with hims stock. The biggest elephant in the room is those legal challenges we discussed earlier. The class-action lawsuit isn’t just a minor speed bump – it could result in massive financial penalties or force the company to completely overhaul its business practices.

Regulatory changes pose another serious threat. The FDA could crack down on compounded medications tomorrow, and Hims & Hers would have to scramble to adapt. Healthcare regulations change fast, and what’s acceptable today might be prohibited next year.

Then there’s the high valuation issue. Trading at over 70 times earnings means investors are essentially betting on perfection. Any stumble – missed earnings, slower growth, bad news – could send the stock tumbling. We’ve seen growth stocks lose 50% or more of their value when reality doesn’t match sky-high expectations.

The competition is heating up too. Big healthcare companies and tech giants are all eyeing the telehealth space. Hims & Hers pioneered this model, but staying ahead won’t be easy as deeper-pocketed competitors enter the game.

Finally, their dependence on marketing is both a strength and a weakness. They’re masters at acquiring customers through digital advertising, but those costs keep climbing. If customer acquisition becomes too expensive or regulations limit their marketing tactics, growth could stall quickly.

Is hims stock a Buy, Sell, or Hold?

After diving deep into the numbers and controversies, here’s our take on hims stock.

The rewards are genuinely compelling. The company has built something special – a profitable telehealth platform that’s actually growing and making money. Their expansion into mental health and weight management taps into massive markets that traditional healthcare has struggled to serve effectively. Some analysts even argue the stock is undervalued despite its high P/E ratio, suggesting there’s still upside potential.

But those risks we outlined? They’re not theoretical – they’re real and immediate. The legal troubles could drag on for years, regulatory changes could happen overnight, and that high valuation leaves little room for disappointment.

Our honest assessment? Hims stock is a fascinating growth story, but it’s not for everyone. If you’re the type of investor who can handle serious volatility and you believe telehealth will continue revolutionizing healthcare, this might fit your portfolio. The company has proven it can acquire customers, expand into new markets, and yes, actually turn a profit.

However, if you prefer sleeping soundly at night or can’t afford to lose a significant portion of your investment, you might want to wait. The legal and regulatory clouds need to clear before we’d feel comfortable recommending this as anything more than a small, speculative position.

For now, we’d lean toward “hold and watch” for existing investors, and “wait for clarity” for new ones. Sometimes the best investment decision is patience – especially when dealing with a stock that could either soar to new heights or face serious headwinds in the months ahead.

Frequently Asked Questions about Hims Stock

We know that investing in hims stock can raise a lot of questions, especially given the company’s rapid growth and recent controversies. Let’s tackle some of the most common questions we hear from investors who are trying to understand this dynamic telehealth stock.

What is the stock ticker for Hims & Hers Health, Inc.?

If you’re looking to buy shares of Hims & Hers Health, Inc., you’ll want to search for the ticker symbol HIMS on the New York Stock Exchange (NYSE). It’s pretty straightforward – just remember that while the company operates under both the “Hims” and “Hers” brands, the stock trades under the single ticker HIMS.

Has Hims & Hers stock been profitable?

This is one of the most exciting developments for hims stock investors! Yes, the company has recently achieved profitability, which is a huge milestone. After years of prioritizing growth and market expansion over immediate profits (which is pretty typical for tech companies), Hims & Hers started reporting positive net income in recent quarters.

This shift from a growth-at-all-costs model to actual profitability is significant for the company’s financial health. It shows that their business model isn’t just about burning through cash to acquire customers – they can actually make money while doing it. For investors, this transition often marks a turning point where a company becomes more attractive to a broader range of investment strategies.

Does HIMS pay a dividend?

No, Hims & Hers Health, Inc. does not currently pay a dividend to its shareholders. But honestly, this isn’t surprising at all. Like most growth companies, especially those in the tech and healthcare sectors, hims stock focuses on reinvesting every dollar of profit back into the business.

Instead of sending you a quarterly check, the company is using those earnings to fund further expansion into new health categories, improve their technology platform, improve their mobile app experience, and penetrate new markets. For growth-oriented investors, this reinvestment strategy often creates more long-term value than dividend payments would.

If you’re specifically looking for dividend income, hims stock probably isn’t the right fit for your portfolio. But if you’re betting on the company’s ability to continue growing and expanding their market share in the telehealth space, then this reinvestment approach could pay off handsomely over time.

Conclusion

After diving deep into hims stock, we’ve uncovered a company that perfectly embodies both the promise and perils of modern healthcare innovation. Hims & Hers Health, Inc. has carved out an impressive position in the telehealth space, much like how a skilled chef transforms simple ingredients into something extraordinary.

The numbers tell a compelling story of strong growth. We’re talking about a company that generated $1.8 billion in significant revenue over the trailing twelve months and successfully transitioned to recent profitability – no small feat in today’s competitive landscape. This shift from burning cash to actually making money is like watching a restaurant finally hit its stride after years of perfecting its recipes.

But let’s be honest – this isn’t a fairy tale without its dragons. The key risks surrounding hims stock are real and substantial. Those legal controversies we discussed, particularly the messy situation with compounded drugs and the class-action lawsuit, cast a shadow over an otherwise bright story. It’s a bit like finding your favorite restaurant is facing health department scrutiny – the food might still be great, but you’re suddenly more cautious.

The regulatory landscape remains murky, and that uncertainty makes many investors nervous. When Novo Nordisk walked away from their partnership citing “deceptive marketing,” it sent shockwaves through the investment community. The resulting 34% stock drop in a single trading session shows just how quickly sentiment can shift.

For those considering hims stock as an investment, think of it like trying a new fusion restaurant. The potential for an amazing experience is there – the growth trajectory, the expanding market opportunities, the convenience factor that customers clearly love. But you’re also venturing into uncharted territory where the rules are still being written.

The high valuation means you’re paying premium prices for what could be an exceptional meal, but there’s always the risk that the kitchen might not deliver on those sky-high expectations. The ongoing legal challenges add another layer of complexity, like wondering if that trendy new spot will still be open next month.

We believe that understanding these dynamics – both the exciting potential and the genuine risks – is essential for anyone looking to make informed decisions about hims stock. It’s a story that’s still being written, with chapters yet to unfold.

For more insights into market trends and analysis, explore our comprehensive Resource Guide. Just as we help food enthusiasts steer culinary trips, we’re here to help you digest the complexities of the financial markets with the same clarity and warmth you’d expect from The Dining Destination.