Why High-Risk Businesses Need Specialized Payment Processing

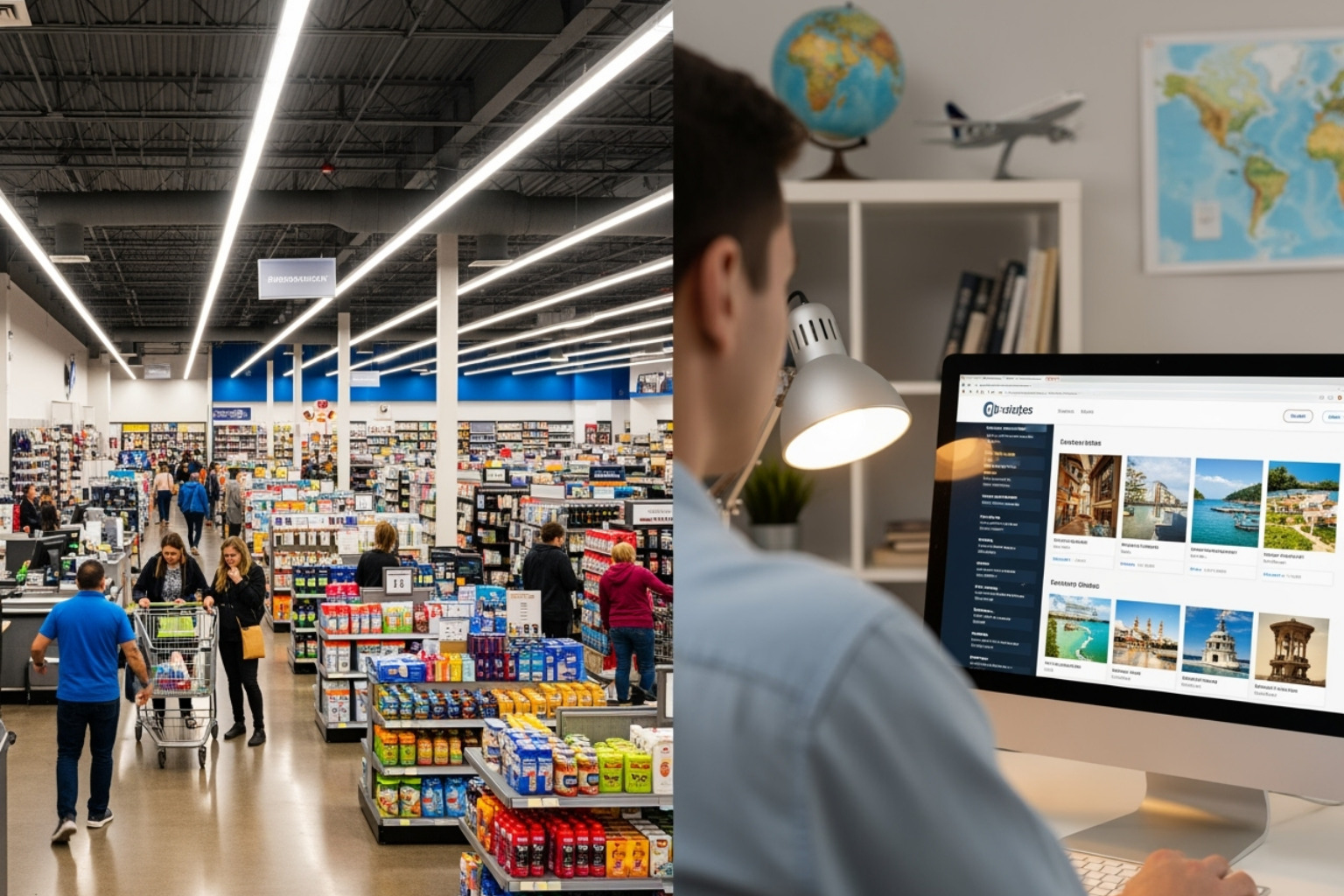

A high risk merchant account at highriskpay.com offers specialized payment processing for businesses that traditional processors often reject. If you’re in travel, food subscriptions, or other challenging industries, you know how frustrating payment barriers can be.

Quick Overview of HighRiskPay.com:

- 99% approval rate for high-risk merchants

- 24-48 hour approval process

- No setup or application fees

- Transaction fees starting at 1.79% + $0.25

- Monthly fees from $9.95

- 95% approval rate for bad credit businesses

- Dedicated account managers with industry expertise

Running a food tour company, restaurant delivery service, or culinary subscription box means dealing with unique payment challenges. Traditional processors like PayPal, Square, and Stripe often reject these businesses due to higher chargeback risks and industry reputation concerns.

The cashless economy has made payment processing essential for survival. Yet many legitimate businesses face constant rejections simply because of their industry type – not their business quality. This creates a frustrating cycle where good businesses can’t grow because they can’t accept payments reliably.

HighRiskPay.com specializes in solving this exact problem. They understand that a chargeback ratio over 1%, monthly processing volumes above $20,000, or operating in travel and hospitality doesn’t make your business illegitimate – it just makes you high-risk by banking standards.

The company has maintained an A+ BBB rating since 2014 and processes payments for thousands of businesses that other providers won’t touch. Their approach focuses on business potential rather than just credit scores or industry bias.

High risk merchant account at highriskpay.com definitions:

What is a High-Risk Merchant Account and Why Might You Need One?

Picture this: you’ve just launched a fantastic food tour company here in New York City, taking hungry travelers through the incredible neighborhoods of Brooklyn or showing them the hidden gems of Greenwich Village. Business is thriving, your customers love the experience, and everything seems perfect. Then suddenly, your payment processor freezes your funds or worse – terminates your account entirely. The reason? Your successful business has been classified as “high-risk.”

A high risk merchant account at highriskpay.com is basically a specialized payment processing service for businesses that traditional banks consider risky. It’s not about your business being shady or unprofitable – it’s just that some industries naturally have higher chances of chargebacks, fraud, or regulatory issues.

Think about it this way: a neighborhood coffee shop selling $5 lattes has pretty predictable transactions. But a travel company selling $500 food tours months in advance? That’s inherently riskier. Customers might cancel, dispute charges, or even commit “friendly fraud” where they claim they didn’t make a purchase they actually did.

Traditional processors like PayPal or Square often reject businesses in these categories entirely. They’re playing it safe, but that leaves legitimate businesses stuck without a way to accept credit cards. In today’s cashless world, that’s basically a death sentence for most companies.

This is where a high risk merchant account at highriskpay.com becomes a lifesaver. These specialized providers understand the risks and have built their systems to handle them. They know that chargeback liability and fraud risk come with the territory, and they’ve developed tools to manage these challenges while keeping your business running smoothly. You can learn more about how these accounts work at High Risk Merchant Accounts.

Key Industries Classified as High-Risk

As someone who explores New York’s amazing food scene regularly, I’ve seen how many of our favorite food-related businesses end up in the high-risk category. The classification isn’t random – it’s based on specific factors like processing over $20,000 monthly, accepting international payments, having average transactions over $500, offering subscriptions, or dealing with higher chargeback rates.

Travel and ticketing businesses are classic examples of high-risk industries. Food tour operators, travel agencies, and event organizers all face the same challenge: they’re selling experiences that happen weeks or months after payment. High ticket prices and long lead times create natural opportunities for disputes. The travel industry loses about $25 billion annually to chargebacks and fraud, which explains why payment processors get nervous.

Subscription services like meal kit deliveries or monthly food boxes also fall into this category. While convenient for customers, recurring billing often leads to disputes when people forget they signed up or can’t figure out how to cancel. Even legitimate businesses see decline rates of 25-30% for recurring payments, with about 33% of declined orders actually being from good customers.

The nutraceuticals and CBD industry faces constant regulatory changes that make processors uncomfortable. Health supplements and CBD products operate in a complex legal landscape that’s always evolving. Fortunately, HighRiskPay.com has a 95% approval rate for CBD merchants, even welcoming businesses with challenging financial histories.

Online dating platforms rely heavily on subscription models and frequently face disputes over service expectations or billing confusion. E-cigarette and vaping businesses deal with age verification requirements and regulatory scrutiny similar to CBD products. High-ticket eCommerce operations selling expensive electronics, furniture, or luxury goods naturally carry bigger fraud risks due to their transaction values.

Other industries that commonly need high-risk processing include adult entertainment, online gaming, credit repair, debt collection, and technical support services. If you’ve ever been rejected by a standard processor, you’re probably in one of these categories.

The Drawbacks of Standard Payment Processors

Using standard payment processors when you’re in a high-risk industry is like trying to squeeze into clothes that don’t fit. It’s uncomfortable, restrictive, and ultimately doesn’t work.

Account freezes and sudden terminations are the nightmare scenario that keeps business owners awake at night. One day everything’s fine, the next day your funds are frozen or your account is completely shut down. This often happens after a spike in chargebacks or when the processor suddenly decides your industry is too risky. The impact on cash flow can destroy a business overnight.

Inflexible underwriting means these processors use rigid, automated systems that can’t understand the nuances of different industries. They see a red flag and immediately reject or terminate without considering the bigger picture. There’s no room for explanation or context.

Lack of industry understanding creates constant friction. Standard processors don’t grasp why travel bookings have long fulfillment times or why subscription services might have higher dispute rates. They apply one-size-fits-all policies that don’t make sense for specialized businesses.

Even if you somehow get approved, you’ll likely face higher decline rates that cost you sales and frustrate customers. When chargebacks do occur, you’ll get minimal support and heavy penalties instead of help resolving the issues.

This is exactly why businesses need specialized solutions like High Risk Payment Processing for Online Businesses. Standard processors simply aren’t equipped to handle the complexities of high-risk industries, leaving legitimate businesses scrambling for alternatives.

Why HighRiskPay.com is a Go-To for High-Risk Businesses

When you’re running a food tour business in Manhattan or launching a meal delivery service in Brooklyn, finding a payment processor that actually gets your industry can feel impossible. Traditional processors see “high-risk” and immediately think “problem.” But HighRiskPay.com? They see opportunity.

What makes HighRiskPay.com different isn’t just their willingness to work with challenging industries. It’s their deep understanding that a high risk merchant account at highriskpay.com isn’t about fixing a problem – it’s about open uping your business potential.

Think about it this way: when PayPal shuts down your account because you’re processing too many international food tour bookings, HighRiskPay.com sees a growing business serving global customers. When other processors worry about your subscription meal service’s chargeback ratio, HighRiskPay.com focuses on helping you manage those disputes effectively.

Their specialized support goes beyond just approving your account. They become genuine partners in your business growth, offering the stability and industry expertise that lets you focus on what you do best – whether that’s crafting amazing culinary experiences or building the next big food delivery platform. You can explore their full range of services at HighRiskPay.com.

Best Approval Rates and Accessibility

Here’s where HighRiskPay.com really shines: they say yes when everyone else says no. Their 99% approval rate for high-risk merchants isn’t just a number – it represents thousands of businesses that found a home after being rejected elsewhere.

But what really impressed us is their approach to businesses with credit challenges. Maybe your restaurant faced tough times during the pandemic, or your startup is still building its financial history. HighRiskPay.com maintains a 95% approval rate for bad credit situations because they understand that past financial struggles don’t define your current business potential.

The best part? No setup or application fees. While other high-risk processors might charge you $500, $1,000, or even $2,000 just to get started, HighRiskPay.com removes that barrier entirely. This startup-friendly approach means you can test their services without a massive upfront investment.

They focus on your business’s future rather than dwelling on past credit scores or industry bias. This philosophy makes them particularly valuable for emerging food businesses, travel startups, and subscription services that need reliable payment processing to grow. Their Bad Credit Merchant Account services demonstrate this commitment to accessibility.

Dedicated and Knowledgeable Support

Getting approved is just the beginning. What happens when you need help managing chargebacks from a canceled food tour? Or when you’re trying to set up international processing for your global meal kit service? This is where HighRiskPay.com’s dedicated account managers become invaluable.

These aren’t generic customer service representatives reading from scripts. They’re industry specialists who understand why food subscription services have seasonal fluctuations, or why travel bookings create longer settlement times. Your account manager becomes your advocate, helping steer the complexities of high-risk payment processing.

The onboarding assistance alone can save you weeks of frustration. Instead of submitting documents blindly and waiting for mysterious rejections, you get clear guidance on exactly what’s needed and why. They help you present your business in the best possible light during underwriting.

But the real value comes with ongoing risk management support. When chargeback rates spike or you want to expand into new markets, your account manager provides strategic guidance custom to your specific industry challenges. This level of personalized support is what makes their High Risk Merchant Services so effective for long-term business growth.

Key Features of a High Risk Merchant Account at Highriskpay.com

Running a food tour business or culinary subscription service in New York City means dealing with payment challenges that most traditional processors simply don’t understand. That’s where a high risk merchant account at highriskpay.com becomes your secret weapon – it’s not just about getting approved, but getting equipped with tools that actually work for your unique business needs.

Think of it this way: if you’re organizing food tours through Brooklyn’s diverse neighborhoods or running a farm-to-table subscription box, you need payment processing that’s as sophisticated as your business model. HighRiskPay.com delivers exactly that with their advanced tools and custom solutions designed specifically for businesses like yours. You can explore their comprehensive approach at High Risk Payment Solutions.

Advanced Fraud Prevention and Chargeback Management

Nobody wants to wake up to frozen funds or a terminated account because of a chargeback spike. We’ve seen too many promising food businesses get blindsided by this exact scenario. HighRiskPay.com takes a completely different approach – they work with you instead of against you.

Their smart fraud detection algorithms are like having a vigilant security guard who never sleeps. These systems spot suspicious patterns immediately, catching potential fraud before it can damage your business. The technology quickly identifies problematic accounts and suspicious affiliates, stopping losses in their tracks.

What really sets them apart is their chargeback prevention program. Instead of panicking when disputes arise, their system gives you early warnings about potential chargebacks. This heads-up allows you to resolve customer issues before they escalate into formal disputes. It’s particularly valuable when you consider that 86% of cardholders skip contacting merchants entirely and file disputes directly with their banks.

The dispute resolution support goes beyond just alerts. HighRiskPay.com’s automated systems win disputes twice as often as industry standards, and here’s the kicker – they only charge you after they win. This partnership approach is crucial for travel and food businesses, which collectively lose about $25 billion annually from chargebacks and fraud. More details on their protective measures can be found at HighRiskPay.com.

Flexible Payment and Billing Options

Your customers want options, and your business model demands flexibility. Whether someone’s booking a multi-course tasting tour three months in advance or subscribing to your monthly artisanal coffee delivery, you need payment systems that adapt to different scenarios.

Recurring billing support is essential for subscription-based food businesses. HighRiskPay.com’s tools keep your monthly revenue flowing smoothly, which is no small feat considering that recurring orders typically face decline rates of 25-30%, even though 33% of those declined transactions are actually legitimate purchases.

The platform handles credit cards, e-checks, and mobile payments seamlessly. This means whether your customer prefers to pay with their phone at a food truck or set up automatic payments for their quarterly wine subscription, you’re covered. Their multi-currency processing capabilities are particularly valuable if you’re attracting international food tourists to your NYC experiences.

This comprehensive payment flexibility ensures smooth checkout experiences, which is especially important for High Risk E-commerce Solutions where customer satisfaction directly impacts chargeback rates.

Seamless and Secure Integration for your high risk merchant account at highriskpay.com

Getting your payment system running shouldn’t require a computer science degree. HighRiskPay.com understands that you want to focus on creating amazing culinary experiences, not wrestling with technical integration headaches.

Their custom payment gateway connects directly to banks and payment networks, creating faster and more reliable transactions. This direct connection reduces the lag time that can frustrate customers during checkout – nobody wants to wait around wondering if their payment went through while booking a popular food tour.

PCI compliance isn’t just a checkbox here; it’s built into every aspect of their system. This robust security protects your customers’ sensitive data and gives them confidence in your business. The fast and reliable transactions that result from this secure, direct connection create smooth experiences for both you and your customers.

Whether you’re integrating with an existing e-commerce platform or need a standalone solution, their systems are designed for compatibility and ease of use. This dedication to secure and efficient processing is what makes their High Risk Payment Gateway services so effective for businesses that can’t afford payment processing hiccups.

Application, Pricing, and Onboarding with HighRiskPay.com

Getting started with a high risk merchant account at highriskpay.com doesn’t have to feel overwhelming. After years of watching New York’s vibrant food scene grow, we’ve seen countless entrepreneurs steer these waters – from ambitious food truck operators to innovative meal kit services. The key is understanding what to expect and coming prepared.

HighRiskPay.com has streamlined their process specifically for businesses that need to move fast. When your culinary venture is ready to accept payments, waiting weeks for approval simply isn’t an option. Their High Risk Merchant Account Application process is designed with this urgency in mind.

How to Apply and What Documents You’ll Need

The application process is refreshingly straightforward, especially compared to traditional banks that might leave you in limbo for weeks. Think of it like preparing for a restaurant inspection – you want everything organized and ready to go.

Your documentation checklist includes your government-issued ID (driver’s license or passport works perfectly), along with your business registration documents like Articles of Incorporation or LLC paperwork. You’ll also need your EIN (Employer Identification Number) and bank statements from the last 3-6 months to show your financial stability.

Don’t forget a voided check or bank letter to verify your business account for payouts. If you’ve processed payments before, having 3-6 months of processing history can actually help speed things along. Most importantly, your operational website needs to be fully functional with clear terms of service, privacy policy, and refund policy prominently displayed.

The team at HighRiskPay.com appreciates when businesses go the extra mile. A solid business plan with revenue projections or detailed information about your customer service processes can make a real difference in how quickly your application moves through review.

Understanding the Fees for a high risk merchant account at highriskpay.com

Let’s talk numbers – because transparency matters when you’re planning your business budget. Many high-risk processors hit you with surprise costs, but HighRiskPay.com takes a different approach that we genuinely appreciate.

The biggest relief? No application or setup fees. While some processors charge up to $2,000 just to get started, HighRiskPay.com eliminates this barrier entirely. For a new Brooklyn bakery or a Manhattan meal delivery service, this can make the difference between launching now or waiting months to save up.

Transaction fees start at just 1.79% + $0.25, which is remarkably competitive for high-risk processing. To put this in perspective, industry standards typically range from 2.95% to 3.95% per transaction. Monthly fees begin at $9.95, keeping your ongoing costs manageable even during slower months.

One aspect to discuss during your application is the rolling reserve policy. Most high-risk processors hold back 5-10% of your daily sales for 90-180 days as protection against chargebacks. While this impacts cash flow initially, it’s standard practice and helps maintain account stability long-term. You can explore the complete fee structure at High Risk Merchant Account Fees.

The Approval Timeline and Getting Started

Here’s where HighRiskPay.com truly shines – speed. In an industry where time literally equals money, their 24-48 hour approval process is game-changing. We’ve seen too many food entrepreneurs miss crucial launch windows because their payment processing got stuck in bureaucratic delays.

Once approved, their technical team doesn’t just hand you login credentials and wish you luck. They provide hands-on integration support, helping you connect seamlessly with your e-commerce platform or existing systems. Whether you’re setting up online ordering for your restaurant or launching a subscription spice box service, they’ll guide you through every technical step.

The cherry on top? Next-day funding means your processed payments hit your bank account quickly, keeping cash flow healthy during those critical early months. This rapid turnaround, combined with ongoing technical assistance, ensures you can focus on what you do best – creating amazing culinary experiences – while they handle the payment complexities.

Their High Risk Credit Card Processing system is built for businesses that can’t afford downtime or delays, making the transition as smooth as a perfectly executed dinner service.

Frequently Asked Questions about HighRiskPay.com

When you’re exploring payment processing options for your food business or travel venture, it’s natural to have questions. We’ve helped many New York City entrepreneurs steer these waters, and these are the questions that come up most often about getting a high risk merchant account at highriskpay.com.

What are the typical costs associated with a high-risk merchant account?

Let’s be honest – cost is usually the first thing on every business owner’s mind. The good news is that while high-risk accounts do cost more than standard processing (that’s just the reality of the industry), HighRiskPay.com works hard to keep their rates competitive.

Most high-risk processors charge transaction fees ranging from 2.95% to 3.95% per transaction, plus around $0.25 per transaction. Monthly fees typically fall between $9.95 and $50.00. These rates reflect the additional risk and specialized services that high-risk processors provide.

However, HighRiskPay.com often beats these industry standards. They offer competitive rates starting at 1.79% plus $0.25 per transaction – which is genuinely lower than what many of their competitors charge. This pricing advantage can make a real difference to your bottom line, especially as your business grows. You can find more details about their fee structure in their explanation at HighRiskPay.com’s competitive rates overview.

Can I get an account with a poor credit history?

This is where HighRiskPay.com really shines, and it’s honestly refreshing to see. Many traditional processors will reject you outright if your credit score falls below 550-600. But HighRiskPay.com takes a completely different approach.

They maintain an impressive 95% approval rate for bad credit merchant accounts. What makes them different is that they look at your current business operations and future potential rather than getting stuck on past credit issues. They understand that a credit score doesn’t tell the whole story of your business’s viability.

Whether you’re launching a new food delivery service in Brooklyn or expanding your catering business after a rough financial patch, they evaluate you based on where you’re going, not just where you’ve been. This forward-thinking approach has helped countless food and travel businesses get the payment processing they need to succeed. HighRiskPay.com explains more about their inclusive approach at their bad credit merchant account information.

How long does the approval process take?

Speed matters when you’re trying to get your business up and running. Nobody wants to wait weeks just to start accepting credit cards from customers.

HighRiskPay.com typically approves applications within 24 to 48 hours. This is remarkably fast for the high-risk processing world, where approvals can often drag on for weeks with other providers.

This quick turnaround means you can start accepting payments almost immediately after approval. For a new restaurant looking to launch online ordering, or a food tour company wanting to capture bookings during peak season, this speed can make all the difference. The faster you can start processing payments, the sooner you can focus on what you do best – creating amazing culinary experiences for your customers. More details about their efficient approval process can be found at HighRiskPay.com’s approval timeline information.

Conclusion

Finding the right payment processor when you’re running a high-risk business can feel overwhelming. We’ve all heard the frustrating stories – a thriving food tour company suddenly having their account frozen, or a promising subscription box service being rejected by every mainstream processor they approach. It’s enough to make any entrepreneur lose sleep.

But here’s what we’ve finded through our exploration: a high risk merchant account at highriskpay.com doesn’t just solve payment problems – it opens doors that traditional processors keep firmly shut.

What really sets HighRiskPay.com apart isn’t just their impressive 99% approval rate or their lightning-fast 24-48 hour approval process. It’s their understanding that being labeled “high-risk” doesn’t make your business any less legitimate or valuable. Whether you’re running food tours through Brooklyn’s best neighborhoods, launching a craft beer subscription service, or building the next big thing in culinary e-commerce, they see your potential rather than just your industry classification.

The financial benefits speak for themselves: no setup fees, competitive rates starting at 1.79% + $0.25, and monthly fees from just $9.95. Even if your credit history isn’t perfect, their 95% approval rate for bad credit accounts means you’re not stuck in payment processing limbo.

Beyond the numbers, though, it’s the human touch that matters. Having a dedicated account manager who actually understands your industry challenges makes all the difference. When a chargeback happens or you need to adjust your payment setup for seasonal demand, you’re not talking to a generic call center – you’re working with someone who gets it.

For businesses in our vibrant New York food and travel scene, reliable payment processing isn’t just convenient – it’s essential for survival. HighRiskPay.com provides that reliability, plus the specialized tools and fraud prevention systems that help high-risk businesses thrive rather than just survive.

The cashless economy isn’t going anywhere, and neither should your business dreams. With the right payment processing partner, those “high-risk” labels become just another challenge to overcome on your path to success.

Ready to explore more ways to grow your food or travel business? Find more expert advice in our resource guides where we share insights from fellow entrepreneurs who’ve steerd these same waters.