Fintechzoom.com gold price: Quick 2025 Start

Why Real-Time Gold Price Data Matters for Modern Investors

Fintechzoom.com gold price tracking has become essential for anyone looking to make informed investment decisions in today’s volatile market. With gold reaching record highs and economic uncertainty driving investor interest, having access to reliable, real-time data can make the difference between profit and loss, especially for those navigating the financial environment of New York City.

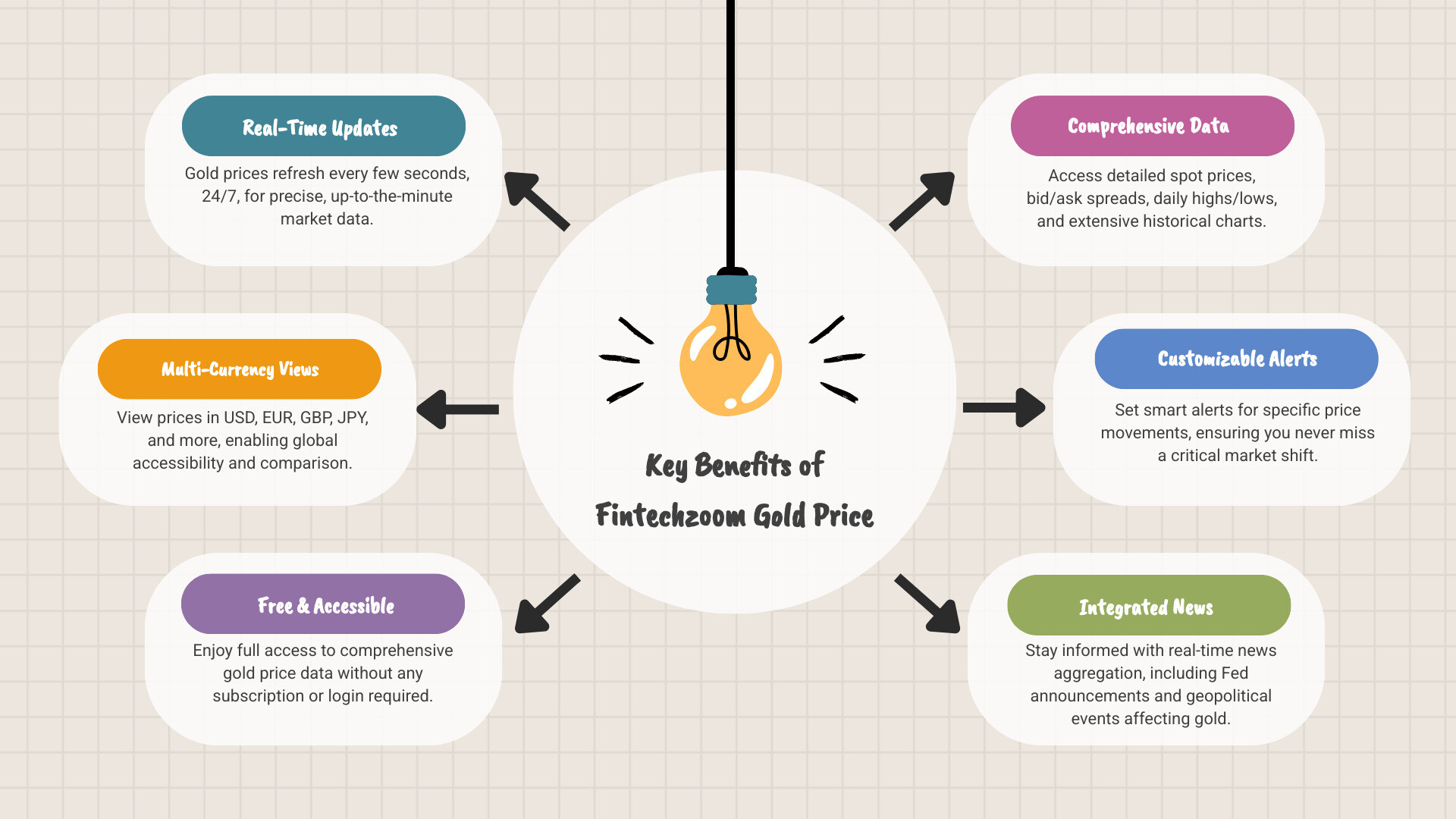

Quick Answer: What You Need to Know About Fintechzoom.com Gold Price:

- Real-time updates: Gold prices refresh every few seconds, 24/7

- Multiple currencies: View prices in USD, EUR, GBP, JPY, and more

- Free access: No subscription or login required

- Comprehensive data: Spot prices, bid/ask spreads, daily highs/lows

- Historical charts: 1 day to 5-year timeframes available

- Smart alerts: Custom notifications for price movements

- News integration: Fed announcements, geopolitical events affecting gold

Gold has surged dramatically in recent years. The average price jumped from $1,800 per ounce in 2022 to $1,950 in 2023, with projections showing continued growth toward $2,200+ in 2025. This makes tracking tools like Fintechzoom’s gold price section more valuable than ever.

The platform stands out because it combines live market data with analytical tools that help both beginners and experienced traders understand what’s driving price movements. Whether you’re a seasoned investor on Wall Street or a savvy saver in Brooklyn looking to hedge against inflation, having access to accurate, up-to-date information is crucial.

Unlike many financial sites that require paid subscriptions, Fintechzoom offers its gold price data completely free. You can monitor prices per ounce, gram, or kilogram, set up custom alerts, and access historical performance data without any barriers.

Handy fintechzoom.com gold price terms:

Understanding the Fintechzoom Gold Price Platform

When you’re exploring fintechzoom.com gold price tracking, you’re not just looking at numbers on a screen. You’re accessing a sophisticated financial technology tool that brings the complex world of gold trading right to your fingertips. Think of it as your personal window into the global precious metals market – one that never closes and never charges you a penny, giving you the same view as a trader in the heart of New York City’s financial district.

What makes this platform special is how it transforms overwhelming market data into something actually useful. Instead of drowning you in financial jargon, it presents everything in a clean, intuitive format that makes sense whether you’re checking prices over your morning coffee or making serious investment decisions.

The real-time updates happen every few seconds, which means you’re always seeing the most current market prices. This isn’t some delayed feed that leaves you guessing – it’s live data that professional traders rely on. You can view prices in multiple currencies like USD, EUR, and GBP, plus choose between different units whether you prefer ounces, grams, or kilograms.

What really sets this apart from other financial sites is the comprehensive coverage without barriers. While many platforms hide their best features behind paywalls, Fintechzoom gives you full access to spot prices, bid-ask spreads, daily highs and lows, and percentage changes – all completely free. For broader market insights, you can explore Fintechzoom.com Markets.

What Makes the Fintechzoom.com Gold Price Tool Unique?

The fintechzoom.com gold price tool stands out because it combines professional-grade features with everyday accessibility. It’s like having a financial advisor who speaks plain English and works around the clock.

The real-time updates are genuinely impressive for a free service. While other sites might update every few minutes, this platform refreshes every few seconds. That matters when gold prices can swing dramatically during major economic announcements or global events.

The multi-currency views make it truly global. Whether you’re planning investments from your office in Midtown New York City or checking prices from abroad, you get instant conversions without the headache of manual calculations. This global perspective is crucial since gold trading never sleeps – it moves across markets as the sun travels around the world.

Perhaps most importantly, the platform includes algorithmic tools that help predict short-term price movements. These aren’t crystal balls, but they’re sophisticated analytical tools that process massive amounts of market data to spot potential breakouts or pullbacks. Combined with sentiment indicators that track global news patterns, you get insights into not just what’s happening with gold prices, but why it’s happening.

The platform also covers other precious metals like silver, platinum, and palladium, making it your one-stop shop for the entire precious metals market. This comprehensive approach saves you from jumping between different sites and ensures all your data comes from the same reliable source.

Core Features for Every Investor

The beauty of fintechzoom.com gold price lies in how it caters to everyone from curious beginners to seasoned traders. The platform doesn’t assume you have a finance degree – it just gives you the tools you need to make informed decisions.

The Live Price Ticker forms the heart of everything. You’ll see the current spot price per ounce, plus essential details like bid-ask spreads and daily highs and lows. The percentage change shows you at a glance whether gold is having a good day or a rough one.

Interactive Historical Charts let you zoom out and see the bigger picture. You can view anything from one day to five years of price history, helping you understand whether today’s price represents a bargain or a peak. These charts aren’t just pretty pictures – they’re interactive tools where you can overlay technical indicators like moving averages and Bollinger Bands.

The Customizable Price Alerts feature is a game-changer for busy people. Set an alert for when gold hits $2,000 per ounce, and you’ll get notified without having to constantly check the site. This is especially valuable since gold markets operate 24/7 across different time zones.

The Integrated News Feed connects the dots between world events and price movements. When you see gold prices jumping, the news feed helps explain whether it’s due to Federal Reserve announcements, inflation data, or geopolitical tensions. Understanding the “why” behind price movements is just as important as knowing the “what.”

For those who enjoy deeper analysis, Technical Indicators like RSI and MACD help assess market momentum and potential trend reversals. These tools give you the same analytical power that professional traders in New York City use, helping you spot overbought or oversold conditions.

All these features work together seamlessly, creating a comprehensive toolkit that grows with your investment knowledge and confidence. For additional investment insights and stock market analysis, you might also find 5StarsStocks.com Stocks helpful for diversifying your research.

How to Use Fintechzoom.com Gold Price Data for Smart Investing

Think of fintechzoom.com gold price data as your secret ingredient for successful investing – just like how a chef needs the freshest ingredients to create an amazing dish, you need fresh, accurate data to make smart investment choices. Whether you’re just starting your investment journey or you’ve been at it for years, this platform gives you the tools to turn raw numbers into real opportunities.

The beauty of using Fintechzoom’s data lies in how it transforms overwhelming market information into clear, actionable insights. Instead of drowning in endless charts and confusing financial jargon, you get a clean, user-friendly interface that actually makes sense. This isn’t just about watching gold prices bounce up and down – it’s about understanding what those movements mean for your financial future.

Smart investing with gold requires more than just knowing the current price. You need to understand trends, timing, and context. That’s where Fintechzoom really shines, offering everything from real-time alerts to historical analysis that helps you see the bigger picture.

Strategies for Beginners and Long-Term Investors

Starting your gold investment journey, especially in a high-stakes environment like New York City, can feel like trying to steer the subway during rush hour without a map. Fortunately, fintechzoom.com gold price data serves as your reliable GPS, guiding you through both simple and complex investment strategies.

Getting Started as a Beginner

If you’re new to gold investing, start by monitoring trends through Fintechzoom’s historical charts. Spend a few weeks just watching how gold prices move – you’ll quickly notice patterns and get comfortable with the platform’s layout. This isn’t about making quick decisions; it’s about building your knowledge foundation.

Setting entry and exit alerts becomes your best friend once you understand the basics. Pick a price point that feels comfortable – maybe you want to buy when gold hits $1,900 per ounce or sell when it reaches $2,100. Set these alerts and let the platform do the watching for you. This removes emotion from your decisions and helps you stick to your plan.

Don’t skip the news section either. Understanding market context means reading why gold prices are moving, not just seeing that they moved. When you see headlines about inflation concerns or geopolitical tensions, you’ll start connecting the dots between world events and gold prices.

Long-Term Investment Approaches

For long-term investors in New York City thinking years ahead rather than months, Fintechzoom offers deeper analytical tools. Assessing long-term performance means diving into those 5-year charts to see how gold has weathered different economic storms. You’ll notice how gold often rises during uncertain times and sometimes falls when stock markets are booming.

Comparing spot prices to ETFs helps you decide whether to buy physical gold or gold funds. The platform shows you real-time spot prices, which you can compare against popular gold ETFs to see which option gives you better value.

The forecasting tools become particularly valuable for long-term planning. While nobody can predict the future perfectly, Fintechzoom’s analysis helps you understand potential scenarios and plan accordingly. For broader investment insights beyond precious metals, you might find our guide on Lessinvest.com Real Estate helpful for diversifying your portfolio.

Forecasting and Predictions with Fintechzoom.com Gold Price Analysis

Predicting gold prices might seem like trying to guess the next big food trend – tricky, but not impossible with the right tools and information. Fintechzoom.com gold price analysis takes much of the guesswork out of forecasting by combining artificial intelligence with real market data.

The platform’s AI-powered analysis works behind the scenes, processing thousands of data points to spot patterns that might indicate short-term breakouts or potential price drops. Think of it as having a really smart friend who never sleeps and is always watching the markets for you.

What makes this particularly useful is how Fintechzoom combines technical analysis with macroeconomic breakdowns. You’re not just seeing that gold might go up – you’re understanding why it might go up. Maybe it’s because inflation is rising, or perhaps there’s political uncertainty affecting global markets.

The sentiment indicators add another layer of insight by measuring how optimistic or pessimistic investors feel about gold. When everyone’s worried about the economy, gold typically becomes more attractive. When confidence is high, people might prefer stocks over gold.

Looking ahead, current price projections for 2024 and 2025 show continued strength in gold markets. Many analysts expect gold to average around $2,050 per ounce in 2024, with some projections reaching $2,200 or higher by 2025. These aren’t just random numbers – they’re based on factors like ongoing inflation concerns, global economic uncertainty, and central bank purchasing patterns.

The platform helps you understand these projections by showing you the underlying data and reasoning. You can see how current trends might continue or what events could change the trajectory. This comprehensive approach aligns with standards set by the global benchmark for gold prices, ensuring you’re working with reliable, internationally recognized data.

Forecasting isn’t about being right 100% of the time – it’s about being prepared for different scenarios and making informed decisions based on the best available information.

Decoding the Market: Factors That Drive Gold Prices

Think of gold prices like the daily specials at a top New York City restaurant – they change based on what’s available, what people want, and what’s happening in the world. The fintechzoom.com gold price reflects this complex dance of global forces, from major economic policies to market sentiment on Wall Street.

What makes Fintechzoom particularly valuable is how it connects the dots for you. Instead of just showing you that gold jumped $50 today, it brings together the news stories, economic data, and market signals that explain why that happened. It’s like having a knowledgeable friend who not only tells you about a great new restaurant but also explains what makes their chef special and why the timing is perfect to visit.

The platform’s integrated news feed is where the magic happens. It pulls together everything from Federal Reserve announcements and inflation reports to geopolitical developments and currency fluctuations. When you see gold’s price moving on Fintechzoom, you can immediately understand the story behind the numbers. This real-time context transforms raw data into actionable intelligence.

Economic Influences on Gold

Gold’s relationship with the economy is fascinating – it often zigs when everything else zags. Understanding these economic drivers through fintechzoom.com gold price data helps you make sense of market movements that might otherwise seem random.

Inflation rates are gold’s best friend. When your dollar buys less groceries than it did last year, gold becomes more attractive as a way to preserve purchasing power. Fintechzoom’s news integration helps you spot inflation trends early, giving you insight into gold’s next potential move.

Interest rate policies from central banks create a tug-of-war for gold. When rates are low, gold looks more appealing because you’re not missing out on much by holding a non-yielding asset. But when rates rise, suddenly those bonds and savings accounts start competing for your attention. Fintechzoom tracks these policy shifts in real-time, helping you understand the immediate impact on gold prices.

The US Dollar Index strength plays a crucial role since gold is priced in dollars globally. A weaker dollar makes gold cheaper for international buyers, boosting demand. You can monitor this relationship through the US Dollar Index strength alongside Fintechzoom’s gold data to spot potential opportunities.

Stock market volatility, often centered around the exchanges in New York City, sends investors running to gold like diners fleeing to their favorite comfort food spot during a stressful week. When markets get choppy, gold’s steady presence becomes incredibly appealing. Fintechzoom’s real-time updates let you watch this “flight to safety” happen as it unfolds.

Central bank purchases add institutional weight to gold’s appeal. When the world’s financial powerhouses buy gold for their reserves, it signals serious confidence in the metal’s long-term value. These large-scale purchases can significantly impact prices, and Fintechzoom’s news aggregation ensures you don’t miss these important developments.

Understanding these economic forces gives you a clearer picture of gold’s role in the broader financial landscape. For deeper insights into global economic trends, exploring information about the global economy can provide valuable context.

Gold’s Historical Role as a Safe-Haven Asset

Gold has been humanity’s financial security blanket for thousands of years, and that reputation isn’t going anywhere anytime soon. The fintechzoom.com gold price historical data tells this story beautifully, showing how gold has weathered every economic storm and emerged stronger.

What makes gold special is its role as a hedge against inflation. While paper money can lose value faster than yesterday’s leftovers, gold tends to hold its purchasing power over time. It’s tangible, finite, and universally recognized – qualities that become incredibly valuable when economic uncertainty hits.

The 2008 financial crisis perfectly illustrated gold’s protective nature. While stock portfolios crumbled and real estate values plummeted, gold provided a steady anchor for investors smart enough to include it in their holdings. Fintechzoom’s historical charts let you see this dramatic contrast in real-time, showing how gold’s performance during crises often shines brightest when everything else looks dim.

More recently, the 2020 pandemic reminded us why gold earned its safe-haven reputation. As markets initially panicked and currencies faced uncertainty, gold once again proved its worth as a store of value. The platform’s extensive historical data allows you to compare these different crisis periods, revealing consistent patterns in gold’s behavior during turbulent times.

Central banks worldwide continue to hold significant gold reserves, essentially giving institutional endorsement to its long-term value. This isn’t just tradition – it’s a practical recognition that gold provides stability in an increasingly digital and volatile financial world.

Whether you’re planning your next culinary trip or building a resilient investment portfolio, gold’s historical context provides valuable perspective. The historical price context available through Fintechzoom helps you understand not just where gold has been, but why it continues to play such a crucial role in global finance. For additional investment insights and market analysis, 5StarsStocks.com offers complementary resources worth exploring.

Frequently Asked Questions about Fintechzoom and Gold Prices

Getting started with fintechzoom.com gold price tracking can feel a bit like trying a new cuisine for the first time – you might have questions about what to expect! We’ve gathered the most common questions from investors who are exploring this powerful platform, and we’re here to give you the straight answers.

These questions come up time and again, whether you’re a seasoned trader or someone just beginning to explore gold as an investment option. Understanding how the platform works will help you make the most of its features and avoid any surprises along the way.

How often is the gold price updated on Fintechzoom?

When it comes to fintechzoom.com gold price updates, you’re getting some of the most current data available anywhere online. The platform refreshes gold prices in real time, typically updating every few seconds throughout the trading day.

This isn’t just during New York City trading hours either – you get 24/7 market coverage that follows gold trading across different time zones and markets worldwide. Whether it’s the market in New York City or others around the globe driving the action, you’ll see those price movements reflected almost instantly.

The accuracy of these updates is impressive for a free platform. While some financial sites might delay their data by 15-20 minutes unless you pay for premium access, Fintechzoom provides this real-time feed without any subscription requirements. This means you can make timely decisions based on current market conditions, not outdated information.

Can I view gold prices in different currencies and units?

Yes, and this is one of the features that makes Fintechzoom truly accessible to a global audience! The platform recognizes that gold investors come from all corners of the world, each with their own preferred way of viewing prices.

You can easily switch between major currencies including USD, EUR, GBP, JPY, and several others. This eliminates the need for manual currency conversions and gives you an immediate sense of gold’s value in your local currency.

The platform also offers flexibility in different units of measurement. Whether you prefer to see prices per ounce (the traditional standard), per gram (popular in many Asian markets), or per kilogram (useful for larger transactions), you can customize your view accordingly.

This global accessibility means whether you’re planning your investment strategy from your home office in New York City or on the go, you’ll see gold prices in a format that makes immediate sense to you.

Is the information on Fintechzoom considered investment advice?

This is perhaps the most important question to address clearly: No, the information and data provided on fintechzoom.com gold price should not be considered professional investment advice.

Think of Fintechzoom as an incredibly sophisticated analytical tool – like having access to a well-stocked kitchen with professional-grade equipment. The tools are there, the ingredients (data) are fresh and high-quality, but you’re still the chef making the final decisions about what to cook.

The platform provides real-time data for analysis, historical charts, news aggregation, and technical indicators, but it’s designed to inform your decision-making process, not replace it. Just as we might research the best restaurants before planning a culinary trip, you should use this data as part of your broader research process.

We always emphasize the importance of consulting financial advisors, whether in New York City or elsewhere, who can provide personalized guidance based on your specific financial situation, risk tolerance, and investment goals. Professional advisors can help you understand how gold fits into your overall portfolio strategy and whether the timing is right for your particular circumstances.

All investments carry risk, and gold is no exception. The platform gives you the tools to make informed decisions, but the final choices – and their outcomes – are yours to make.

Conclusion

What a journey we’ve taken together exploring fintechzoom.com gold price tracking! We’ve finded that this platform is so much more than numbers on a screen – it’s your gateway to understanding one of the world’s most fascinating and enduring investments.

Think about it: we’ve covered everything from real-time price updates that refresh every few seconds to sophisticated analytical tools that help predict market movements. We’ve explored how to set up custom alerts, steer historical charts, and understand the complex web of economic factors that make gold prices dance. Most importantly, we’ve learned how to transform raw data into smart investment decisions.

The beauty of Fintechzoom lies in its accessibility. Here’s a comprehensive financial tool that rivals expensive subscription services, yet it’s completely free. Whether you’re checking prices in USD, EUR, or any other major currency, viewing data per ounce or gram, or diving deep into technical indicators like RSI and MACD – it’s all at your fingertips without any barriers.

At The Dining Destination, we’ve always believed that the best experiences come from being well-informed. Just as we help you find amazing culinary trips, from local eateries to the Michelin-starred restaurants of New York City, understanding financial markets like gold can open doors to new opportunities and security. When you’re financially empowered, you’re free to explore those dream destinations, try that exclusive restaurant, or simply enjoy life’s finer pleasures without worry.

Gold has been humanity’s trusted companion through centuries of economic ups and downs. From the 2008 financial crisis to the uncertainty of 2020, and now as we steer today’s complex economic landscape, gold continues to serve as that reliable friend you can count on. With fintechzoom.com gold price as your guide, you’re equipped with the knowledge and tools to make this relationship work for you.

The platform’s commitment to empowering investors through financial literacy aligns perfectly with our mission of helping people achieve their life goals. Whether you’re saving for a special vacation, planning a weekend of fine dining in New York City, or building long-term wealth for your family’s future, informed decisions are the foundation of success.

So why not take the next step? Visit Fintechzoom today, explore the gold price data, set up your first alert, and start your journey into precious metals investing. The world of gold awaits, and you now have everything you need to steer it confidently. For more insights and guides that can help you live your best life, explore our resource guides for more insights.