Why Understanding the FintechZoom Economy Matters for Modern Travelers

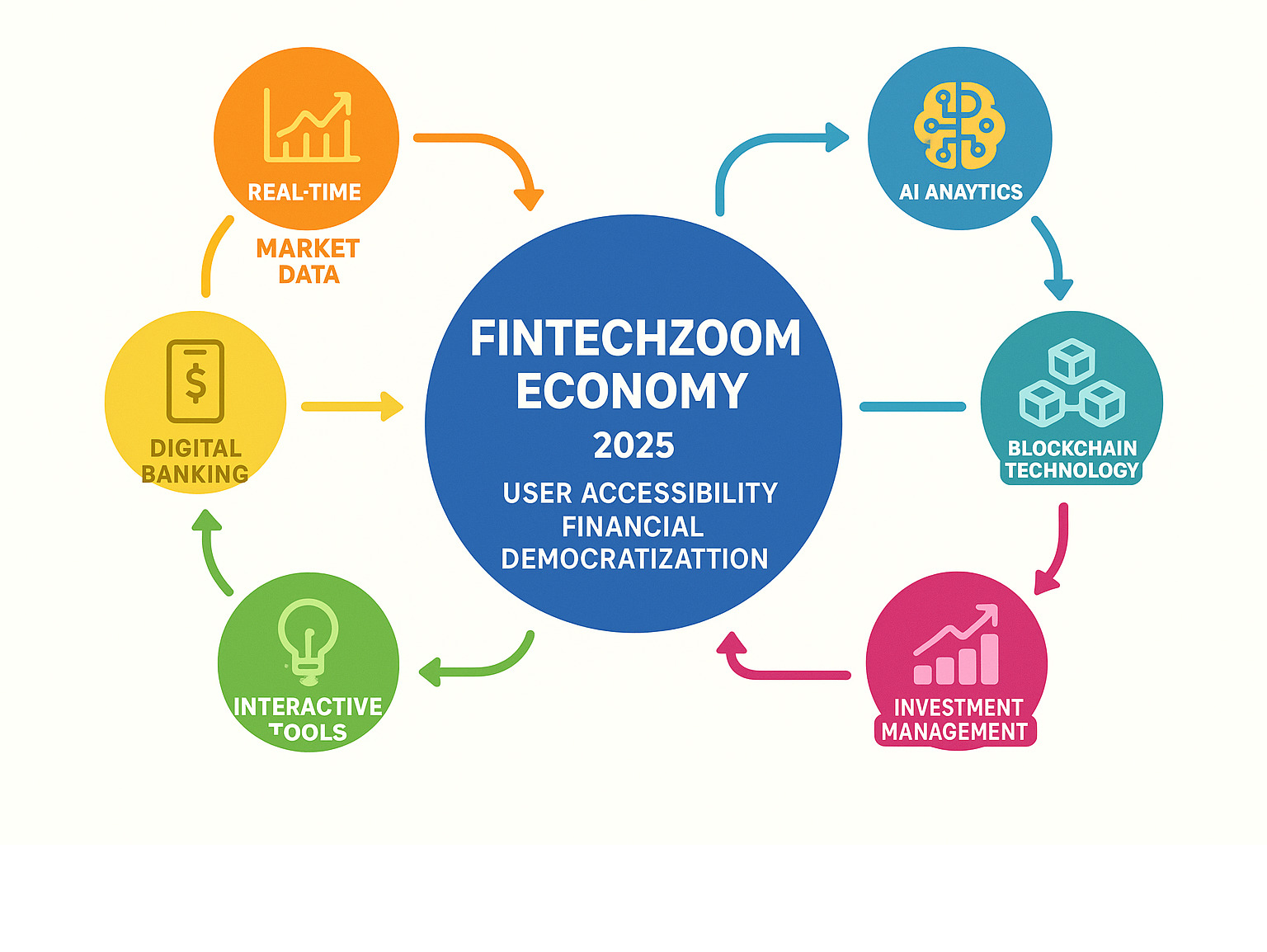

The FintechZoom Economy represents a approach to understanding global financial markets through the lens of accessible, real-time financial technology. Unlike traditional economic reporting, this digital ecosystem combines market data, cryptocurrency insights, and economic analysis in a format that serves both novice investors and seasoned professionals.

Quick Answer: What is the FintechZoom Economy?

- Real-time economic reporting covering Federal Reserve decisions, inflation data, and market movements

- User-friendly financial education that breaks down complex topics like DeFi and blockchain

- Fintech-focused insights showing how AI, digital banking, and automation shape markets

- Global market coverage including stocks, crypto, commodities, and forex

- Interactive tools like charts, alerts, and portfolio tracking for informed decisions

For today’s travelers and food enthusiasts, understanding economic trends has become essential. Currency fluctuations affect your dining budget in Tokyo. Inflation impacts restaurant prices in Paris. Market volatility influences travel costs worldwide.

The platform democratizes financial knowledge by explaining complex concepts in plain language. Instead of dense financial jargon, you get clear explanations of how economic forces impact real-world experiences – from the cost of that Michelin-starred meal to the exchange rates affecting your culinary trips.

As one FintechZoom spokesperson stated: “We strive to explain fintech. Our goal is to empower individuals and businesses with the knowledge they need to steer this rapidly changing landscape.”

This accessibility makes economic insights relevant for anyone planning international dining experiences or managing travel budgets in an increasingly connected global economy.

Find more about FintechZoom Economy:

What is the “FintechZoom Economy”?

When we talk about the “FintechZoom Economy,” we’re delving into a concept that transcends a mere website; it’s a holistic ecosystem for understanding the financial world through the lens of modern financial technology. It’s not a traditional economy in the sense of a nation’s GDP or a specific market sector, but rather a unique approach to economic intelligence. At its core, the FintechZoom Economy refers to Fintechzoom.com’s comprehensive coverage of global economic and financial matters, specifically highlighting how they intersect with the burgeoning fintech landscape.

This platform distinguishes itself by breaking down complex financial concepts into easily digestible formats, curating information from multiple sources to offer a single point of access for comprehensive fintech coverage. It focuses on democratizing financial knowledge, making it accessible to both novice investors and seasoned financial professionals. Imagine trying to plan a culinary tour through Southeast Asia, and needing to understand how local inflation rates or currency fluctuations might affect your budget for street food and fine dining. The FintechZoom Economy provides the insights to help us steer such real-world financial impacts.

It’s about the real-time flow of data, the analysis of market trends, and the interpretation of how technological innovations like AI, big data, and machine learning are impacting financial services and the broader economy. This innovative model simplifies without “dumbing down,” offering a valuable tool for anyone navigating today’s complex financial world. It’s a dynamic space where we can track everything from Federal Reserve rate hikes to cryptocurrency volatility, all explained in plain language.

Why It Matters in 2025

The relevance of the FintechZoom Economy in 2025 cannot be overstated. We are living through an era of unprecedented digital change, where finance and technology are not just intersecting but are rapidly becoming inseparable. As the financial technology landscape becomes increasingly complex, having a trusted source that can simplify and contextualize this information is crucial.

For us, as travelers and food enthusiasts, understanding this evolving landscape is no longer a niche interest but a practical necessity. Imagine planning a trip to New York City to explore its diverse culinary scene. Understanding how global macroeconomic indicators, like interest rate trends or tech layoffs reported by FintechZoom, might influence local tourism or restaurant pricing can help us budget more effectively and make informed decisions.

The FintechZoom Economy empowers us by democratizing financial knowledge. It’s designed to transform passive readers into informed decision-makers, whether we are seasoned financial professionals managing large portfolios or novice investors simply trying to make sense of our personal finances. The platform’s user-centric financial education helps bridge the gap between traditional economic literacy and modern fintech innovations. By providing real-time economic reporting and fintech-specific insights, it equips us to steer market volatility, understand emerging investment opportunities, and even comprehend how technologies like robo-advisors might simplify our personal financial planning for future trips. It helps us stay ahead of the curve, preparing us for the financial shifts that will undoubtedly shape our world in the coming years.

Core Functionalities: Your Toolkit for Market Analysis

Navigating the dynamic world of finance requires robust tools, and the FintechZoom Economy provides exactly that. Its core functionalities revolve around delivering timely and insightful content, breaking down complex financial concepts, and curating information from multiple sources into a user-friendly interface. This isn’t just a news feed; it’s a comprehensive toolkit designed to empower us with the information we need, when we need it. For instance, if we’re planning a food tour through different countries, understanding real-time currency fluctuations is paramount, and FintechZoom’s interface makes this data readily available.

Real-Time Data and Market Coverage

One of the most compelling aspects of the FintechZoom Economy is its commitment to real-time data and broad market coverage. This platform is a powerhouse for up-to-the-minute financial news, insights, and market analyses across a vast spectrum of categories. We can expect to find:

- Stock market updates: Live quotes, price charts, and news updates for major indexes like NASDAQ, Dow Jones, and S&P 500, ensuring we have access to the latest market information. This is invaluable if we have investments that could fund our next culinary trip.

- Cryptocurrency insights: Detailed breakdowns of crypto market movements, regulatory developments, blockchain innovation, and token economics. This helps us understand the volatile yet fascinating world of digital assets.

- Commodities: Real-time data and analysis for commodities like gold and silver. For those of us interested in the broader economic picture, understanding commodity prices can offer insights into global economic health, which indirectly affects everything from airline fuel costs to food prices.

- Global macroeconomic indicators: Coverage of crucial economic data points, including Federal Reserve rate hikes, global inflation data, tech layoffs, and interest rate trends. These are the big picture elements that can influence everything from the cost of our next flight to the price of a local delicacy in New York City.

- Forex: Insights into foreign exchange markets, which are absolutely critical for international travelers. Understanding forex trends helps us maximize our spending power abroad and avoid unpleasant surprises when converting currency for our dining experiences.

Fintechzoom.com is known for its real-time financial news, fintech industry coverage, and accessible economic insights for a global audience. It’s truly a one-stop shop for staying informed.

Advanced Tools for Investors

Beyond just news, the FintechZoom Economy equips us with advanced tools that rival those used by seasoned professionals, yet are presented in an intuitive manner. These tools are designed to help us analyze markets, track investments, and make more informed decisions, whether we’re investing for retirement or saving for that dream culinary journey.

Here are some of the key analytical tools available:

- Advanced charting tools: FintechZoom’s advanced charting tools offer technical indicators like moving averages, Bollinger Bands, and RSI (Relative Strength Index) to help us identify trends and patterns in stock prices. This visual representation makes complex data much easier to interpret.

- Portfolio tracking: We can set up custom watchlists and track our investments, allowing us to monitor performance and make timely adjustments. This is like having a personal financial dashboard, ensuring our travel fund is always on track.

- Customizable alerts: We can set up alerts for specific price movements, news events, or economic indicators relevant to our interests. Imagine getting an alert when the exchange rate for the Euro hits a favorable point for our upcoming European food tour!

- Market sentiment analysis: FintechZoom aggregates news articles, analyst ratings, and social media sentiment related to stocks and other assets. This helps us gauge the overall mood of the market, which can be a powerful indicator for future movements. As the saying goes, “the trend is your friend,” and understanding market sentiment can help us ride those trends.

These features, combined with live market updates and wide market coverage, empower us to simplify complicated financial information quickly and make better decisions, regardless of our experience level.

Democratizing Finance: FintechZoom’s Role in Financial Education

Here’s something refreshing: the FintechZoom Economy isn’t trying to impress you with fancy financial jargon. Instead, it’s doing something much more valuable – making finance actually understandable for real people like us.

For too long, financial education felt like an exclusive club where you needed a finance degree just to understand the basics. But FintechZoom is changing that game entirely. Whether you’re a food enthusiast planning your next culinary trip or someone just trying to make sense of your investment portfolio, this platform meets you where you are.

Think about it this way: if you can plan a multi-city food tour, you can definitely understand financial concepts when they’re explained properly. The FintechZoom Economy proves that accessibility doesn’t mean dumbing things down – it means smart communication.

Making Complex Concepts Simple

Remember the last time someone tried to explain blockchain technology to you? Probably sounded like they were speaking in code, right? FintechZoom takes a completely different approach. They break down intimidating topics like decentralized finance (DeFi), quantitative easing, and AI in finance using language that actually makes sense.

This approach particularly resonates with millennials and Gen Z who prefer learning through digital platforms. Instead of drowning in technical details, you get clear explanations that connect to real-world situations. For instance, understanding how AI works in finance can help you appreciate those budgeting apps that seem to magically know your spending patterns.

The platform’s strength lies in its ability to explain complex financial concepts without losing the important details. When they discuss blockchain, they don’t just throw around buzzwords – they show you how this technology might affect everything from your travel payments to restaurant loyalty programs.

More info about our resource guides

Practical Applications for Everyone

But here’s where FintechZoom really shines – they don’t stop at explanations. They give you practical tools you can actually use in your daily life.

Their budgeting tutorials aren’t generic advice you’ve heard a thousand times. They’re actionable guides that help you track expenses and save for specific goals, like that dream culinary trip to Tokyo you’ve been planning. Their investment guides explain different options in plain English, whether you’re curious about investing in food tech companies or just want to grow your travel fund.

For those of us passionate about food and travel, credit management becomes crucial. FintechZoom’s resources help you understand how to build credit that works for you – whether that means qualifying for travel rewards cards or getting better rates on business loans if you’re in the hospitality industry.

The platform excels at aiding small business decisions too. If you’re running a restaurant in New York City or any food-related business, you’ll find insights into digital lending models and peer-to-peer payment systems that can actually improve your operations.

And let’s talk about something every traveler needs to understand: forex trends. Currency fluctuations can make or break your dining budget abroad. FintechZoom explains these markets in ways that help you make smarter decisions about when to exchange money for your international food trips.

The result? You’re not just consuming financial information – you’re gaining financial literacy that empowers you to make confident decisions about your money, your travels, and your future.

Key Trends Shaping the 2025 FintechZoom Economy

Think of the FintechZoom Economy as a living, breathing ecosystem that never stops evolving. As we head into 2025, exciting technological shifts are reshaping how we interact with money, investments, and financial planning. These aren’t just abstract changes happening in Silicon Valley boardrooms – they’re real innovations that affect everything from how we budget for our next food trip to the way we track our travel savings.

The beauty of these emerging trends lies in their practical impact on our daily lives. Whether you’re planning a culinary tour through Southeast Asia or simply trying to understand why your investment portfolio behaves the way it does, these technological advances are making financial tools more accessible and intuitive than ever before.

The Impact of AI and Automation

Artificial Intelligence isn’t science fiction anymore – it’s the driving force behind the most exciting developments in the FintechZoom Economy. What makes this particularly fascinating is how AI is changing complex financial analysis into something as simple as asking your phone about the weather.

AI-powered insights are revolutionizing how we receive financial information. Instead of drowning in data, we now get smart, personalized recommendations that understand our unique financial goals. Imagine having a financial assistant that knows you’re saving for that dream trip to Tokyo’s best ramen shops and adjusts its advice accordingly.

The rise of robo-advisors has been a game-changer for everyday investors. These automated platforms use sophisticated algorithms to manage investment portfolios, removing the emotional guesswork that often leads to poor financial decisions. They’re like having a professional financial advisor available 24/7, but without the hefty fees that traditionally came with such expertise.

Automated banking systems are making our financial lives smoother behind the scenes. From intelligent chatbots that can answer our questions instantly to AI-driven fraud detection that protects our accounts while we’re exploring new restaurants abroad, automation is quietly revolutionizing banking operations.

Perhaps most exciting is how AI creates a personalized user experience that learns from our habits. These systems can analyze our spending patterns on dining and travel, then offer custom advice on saving strategies. It’s like having a financial coach who actually understands your passion for finding hidden culinary gems.

Predictive analytics powered by machine learning gives us a crystal ball into market trends and economic shifts. While we can’t predict the future with certainty, these tools help us make more informed decisions about everything from currency exchanges for international trips to timing major purchases.

Emerging Sectors and Future Growth

Beyond artificial intelligence, several exciting sectors are reshaping the financial landscape in ways that directly impact food enthusiasts and travelers. These emerging areas represent not just investment opportunities, but fundamental changes in how we access and use financial services.

Digital banking evolution continues to accelerate, with digital-only banks offering features that traditional institutions struggle to match. These neobanks often provide better exchange rates for international transactions, lower fees for overseas purchases, and mobile-first experiences that make managing travel budgets incredibly convenient.

Green finance is becoming increasingly relevant as sustainable investing gains momentum. This sector focuses on supporting environmentally conscious projects and businesses, including sustainable restaurants, eco-friendly travel companies, and innovative food technologies. It’s an area where our values and investment goals can align beautifully.

The microfinance sector growth is particularly exciting because it’s democratizing access to capital. Small food businesses, local restaurants, and culinary entrepreneurs who might have struggled to get traditional bank loans now have new pathways to funding through innovative lending platforms.

Peer-to-peer lending is creating alternative financing options that bypass traditional banks entirely. This model connects individuals who want to lend money directly with those who need it, often resulting in better rates for both parties. It’s especially valuable for small business owners in the hospitality and food service industries.

The platform continues to expand and innovate, incorporating new technologies and features that make financial information more accessible and actionable. As these trends develop, they’re creating a more inclusive and user-friendly financial ecosystem that serves everyone from seasoned investors to those just beginning their financial journey.

FintechZoom vs. Traditional Media: A New Era of Financial News

The FintechZoom Economy represents a fundamental shift in how we consume financial news and analysis. Gone are the days when we had to wait for tomorrow’s newspaper or catch the evening financial report to understand market movements. This digital-first approach has changed the game entirely, especially for those of us who need quick insights to make informed decisions about our travel budgets or investment plans.

| Feature | FintechZoom Economy | Traditional Financial Media |

|---|---|---|

| Speed | Real-time, instant updates, 24/7 | Daily/weekly publications, broadcast schedules |

| Accessibility | Digital-first, mobile-friendly, global reach | Often paywalled, limited digital presence, regional focus |

| Target Audience | Novice to seasoned investors, tech-savvy, younger demographics | Institutional investors, established professionals, broader public |

| Interactivity | Interactive charts, forums, customizable alerts | Mostly passive consumption |

| Content Focus | Fintech-centric, emerging tech, simplified explanations | Broad market coverage, in-depth reports, complex analysis |

Think about it this way: traditional financial media is like a formal dinner service – structured, predictable, and served at set times. The FintechZoom Economy is more like street food – accessible, immediate, and available whenever hunger strikes. Both have their place, but one clearly fits better with our modern, on-the-go lifestyle.

Speed and Accessibility

When market volatility hits or economic news breaks, waiting until the next business day for analysis feels like using a horse and buggy on the interstate. The FintechZoom Economy thrives on real-time reporting that keeps pace with our interconnected world. Whether we’re checking currency exchange rates before booking that culinary tour of Southeast Asia or monitoring inflation data that might affect restaurant prices, the information flows instantly.

The platform’s 24/7 access means we’re never locked out of crucial financial insights. Picture this: you’re planning a food tour through Europe, and the Euro suddenly strengthens against the dollar. With traditional media, you might not learn about this shift until the morning news. With FintechZoom’s approach, you get immediate updates that could save you hundreds on your dining budget.

The mobile-first approach deserves special mention here. While traditional financial newspapers require physical space and scheduled delivery, digital platforms travel in our pockets. We can check market trends from a café in New York City, monitor commodity prices from a hotel in London, or track forex movements while exploring food markets in Bangkok.

Breaking news coverage happens in real-time, not on editorial schedules. When the Federal Reserve announces rate changes or major economic indicators shift, the FintechZoom Economy delivers this information faster than traditional broadcast cycles. This speed advantage becomes crucial when these changes directly impact our travel costs, dining budgets, or investment portfolios.

Interactivity and User Focus

Traditional financial media often feels like sitting in a lecture hall – you listen, take notes, but rarely participate. The FintechZoom Economy transforms this experience into something more like a workshop where we actively engage with the material.

Interactive charts replace static newspaper graphs with dynamic tools we can manipulate ourselves. Instead of staring at a fixed image showing gold price trends, we can adjust timeframes, add technical indicators, and truly understand the data. This hands-on approach makes complex financial concepts feel less intimidating and more accessible.

Community forums create spaces where fellow travelers and food enthusiasts share insights about economic trends affecting their experiences. Someone might share how currency fluctuations impacted their recent culinary trip to Japan, while another discusses how inflation is changing restaurant pricing in major food destinations. This peer-to-peer learning rarely exists in traditional media formats.

The user-centric design philosophy means information gets presented in digestible, practical formats. Rather than dense financial jargon that requires a business degree to decode, the FintechZoom Economy explains concepts like quantitative easing or blockchain technology in plain language. This approach particularly resonates with millennials and Gen Z investors who value direct, no-nonsense communication.

Educational resources go far beyond simple news reporting. The platform actively teaches us through tutorials, guides, and step-by-step explanations. Want to understand how AI impacts personal budgeting? There’s a guide for that. Curious about how DeFi might affect international money transfers for your next food tour? You’ll find clear explanations without the academic complexity.

This interactive, educational approach empowers us to make informed decisions rather than passively consuming information. We become active participants in our financial education, equipped with tools and knowledge that traditional media simply couldn’t provide through their one-way communication model.

Navigating Risks and Rewards

Stepping into the FintechZoom Economy is like exploring a busy international food market – there are incredible opportunities to find, but you need to know how to steer wisely. For those of us passionate about both financial growth and culinary trips, understanding the landscape becomes essential. After all, the same principles that help us choose a trustworthy street vendor in Bangkok apply to selecting reliable financial platforms.

The beauty of this digital financial ecosystem lies in its potential to transform how we manage money, plan trips, and fund our dining dreams. Yet, just as we wouldn’t eat at every roadside stall without checking it out first, we shouldn’t dive into financial decisions without understanding what we’re getting into.

Understanding the Risks

Let’s be honest – the FintechZoom Economy isn’t without its challenges. Think of these risks as the equivalent of checking restaurant reviews before trying that hole-in-the-wall place your friend recommended.

Market volatility represents perhaps the biggest hurdle. Financial markets, especially cryptocurrency, can swing faster than a chef’s knife through vegetables. One day your investment portfolio looks healthy enough to fund that dream culinary tour of Italy, the next day you’re reconsidering your ramen budget. FintechZoom provides excellent data and analysis, but markets don’t always behave rationally.

Data security concerns deserve serious attention in our connected world. When platforms handle our personal and financial information, they become attractive targets for cybercriminals. Fortunately, Fintechzoom.com prioritizes user data protection with stringent security measures and maintains transparency through clear privacy policies and industry best practices.

Cybersecurity threats extend beyond simple data breaches. Phishing scams and malware lurk like food poisoning at a questionable buffet – you might not see them coming until it’s too late. Always verify the legitimacy of third-party services and be cautious with external links, just as you’d double-check that seafood before ordering it.

Algorithmic bias presents a more subtle risk. As AI becomes more prevalent in financial decision-making, there’s potential for discriminatory practices if these systems aren’t properly monitored. It’s like having a restaurant recommendation algorithm that only suggests expensive places – technically functional, but not necessarily fair or helpful.

Most importantly, due diligence remains your responsibility. The innovative nature of fintech means regulations are still catching up. Always conduct thorough research and consult qualified professionals before major financial decisions, treating any single source as part of a broader information diet.

Maximizing the Rewards

Despite these challenges, the rewards of engaging thoughtfully with the FintechZoom Economy can be substantial – especially for food enthusiasts looking to expand both their financial knowledge and their travel horizons.

Informed investment decisions become possible when you have access to real-time data, comprehensive analysis, and expert insights. Instead of guessing whether to invest in that hospitality stock, you can review detailed earnings reports, revenue trends, and financial metrics. It’s like reading ingredient lists and nutritional information – you make better choices when you understand what you’re getting.

Access to emerging opportunities opens doors you might never have known existed. From understanding digital assets to exploring green finance and peer-to-peer lending, the platform helps identify promising sectors. You might find investment opportunities in food tech companies or sustainable travel initiatives that align with your personal interests.

Improved financial literacy through FintechZoom’s commitment to plain-language explanations transforms complex concepts into actionable knowledge. This improved understanding helps you budget more effectively for culinary trips, plan retirement savings, or even evaluate whether that expensive cooking class in Paris fits your financial goals.

Portfolio diversification becomes more achievable with broad market coverage encouraging investment across various sectors and asset classes. Understanding how different economic areas perform helps you spread risk intelligently – perhaps balancing traditional stocks with food industry investments or sustainable tourism ventures.

The key is approaching the FintechZoom Economy like a seasoned traveler approaches a new destination: with enthusiasm tempered by wisdom, curiosity balanced by caution, and always keeping your broader goals in mind.

Frequently Asked Questions about the FintechZoom Economy

We’ve covered a lot about the FintechZoom Economy, but some common questions often arise. Let’s address them directly to provide further clarity and reinforce why this platform is such a valuable resource for anyone interested in understanding modern finance.

Is FintechZoom a reliable source for financial news?

Yes, FintechZoom is widely considered a reliable source for financial news and insights. The platform demonstrates expert-written content that aligns with Google’s EEAT (Expertise, Authoritativeness, Trustworthiness) guidelines, offering timely and well-sourced information on financial topics that matter to everyday investors.

What makes FintechZoom particularly trustworthy is its commitment to accuracy and timeliness. The platform constantly updates its content multiple times a day, especially during market hours or when breaking economic news emerges. This real-time approach ensures we’re getting the most current information available.

The platform’s dedication to well-sourced information is evident in how it presents complex financial data in an accessible format without sacrificing accuracy. However, like any smart investor planning their next culinary trip abroad, we should always remember that cross-verification with multiple sources is wise when making significant financial decisions.

Can beginners use FintechZoom effectively?

Absolutely! One of the most impressive aspects of the FintechZoom Economy is how it’s specifically designed for accessibility. Whether you’re a complete novice trying to understand how currency fluctuations might affect your dining budget in Paris, or you’re just starting to explore investment options, FintechZoom meets you where you are.

The platform excels at breaking down intimidating financial concepts into simple language. Instead of drowning you in jargon, it explains complex topics like DeFi, blockchain, or quantitative easing in terms that actually make sense. This approach is particularly appealing to millennials and Gen Z investors who appreciate straightforward, no-nonsense explanations.

FintechZoom provides extensive educational guides and tutorials that go far beyond just reporting news. You’ll find step-by-step resources covering everything from basic budgeting to advanced investment strategies. The user-friendly interface ensures you can quickly find what you need without feeling overwhelmed.

Perhaps most importantly, the platform fosters community support where beginners can ask questions and learn from others. This creates a welcoming environment that encourages learning rather than intimidation.

How does the FintechZoom Economy differ from the traditional economy?

The FintechZoom Economy represents a fascinating shift from how we traditionally think about economic information and analysis. Rather than focusing solely on physical goods and established financial institutions, it emphasizes the digital layer where finance and technology intersect.

The most striking difference is the real-time data flow. While traditional economic analysis often relies on quarterly reports and monthly indicators that arrive weeks after the fact, the FintechZoom Economy thrives on immediate insights. This means we can understand market movements and economic shifts as they happen, not after they’ve already impacted our travel budgets or investment portfolios.

Another key distinction is democratized access to information. Historically, in-depth financial analysis was reserved for Wall Street professionals or those willing to pay expensive subscription fees. FintechZoom changes this dynamic by making complex financial concepts and market data available to everyone, from students to everyday consumers planning their financial futures.

The platform’s global and interconnected nature reflects our modern world perfectly. Unlike traditional economic frameworks that often focus on national boundaries, the FintechZoom Economy analyzes cross-border digital payments, international crypto trends, and how tech innovations impact global finance. This perspective is incredibly valuable for understanding how global financial trends might affect everything from the cost of international food tourism to sourcing unique ingredients for restaurants.

Finally, there’s an emphasis on innovation and disruption that sets it apart. While traditional economic analysis often moves incrementally, the FintechZoom Economy constantly covers new technologies, business models, and regulatory developments that are actively reshaping how we manage, transfer, and invest money in our increasingly digital world.

Conclusion: Your Gateway to Modern Economic Insights

As we wrap up our exploration of the FintechZoom Economy, it’s clear we’ve uncovered something truly special. This isn’t just another financial website collecting digital dust in your bookmarks folder. It’s your personal gateway to understanding the modern economic landscape, designed specifically for people like us who want to make smarter financial decisions without drowning in confusing jargon.

Think about it: we’ve journeyed through real-time market data, explored AI-powered investment tools, and finded how fintech is democratizing financial knowledge. The FintechZoom Economy serves as our trusted guide through this complex world, breaking down everything from cryptocurrency trends to Federal Reserve decisions into bite-sized, digestible insights.

What makes this platform genuinely valuable is its commitment to making financial literacy accessible to everyone. Whether you’re a seasoned investor planning your retirement portfolio or a food enthusiast budgeting for that dream culinary tour through Europe, FintechZoom provides the tools and knowledge you need. It’s like having a financial advisor who actually speaks your language.

For us at The Dining Destination, understanding these economic insights has become incredibly relevant to our culinary trips. When we’re planning food tours or exploring dining trends, currency fluctuations and economic shifts directly impact our experiences. That amazing ramen shop in Tokyo becomes more affordable when the yen weakens. European wine tours cost more when inflation rises. The FintechZoom Economy helps us steer these realities with confidence.

The platform’s focus on emerging technologies like blockchain, AI analytics, and digital banking ensures we’re always ahead of the curve. These innovations aren’t just changing how we invest – they’re changing how we travel, dine, and experience the world. Understanding these trends empowers us to make better financial decisions that fund our passions.

The future of financial education is clearly moving toward platforms like FintechZoom. By empowering individuals with accessible information and practical tools, it’s creating a more financially literate global community. This matters whether you’re managing a travel budget, investing in food tech companies, or simply trying to understand how economic trends affect your daily life.

We encourage you to dive deeper into what the FintechZoom Economy offers. Explore its real-time data, experiment with its analytical tools, and most importantly, use its educational resources to build your financial confidence. After all, the best culinary trips start with smart financial planning.