Why FintechZoom.com Russell 2000 Tracking Matters for Your Investment Strategy

FintechZoom.com russell 200 provides essential data and analysis for one of America’s most important small-cap stock indices. The Russell 2000 Index tracks 2,000 of the smallest publicly traded companies in the U.S., representing the entrepreneurial backbone of our economy.

Quick Answer for Russell 2000 Investors:

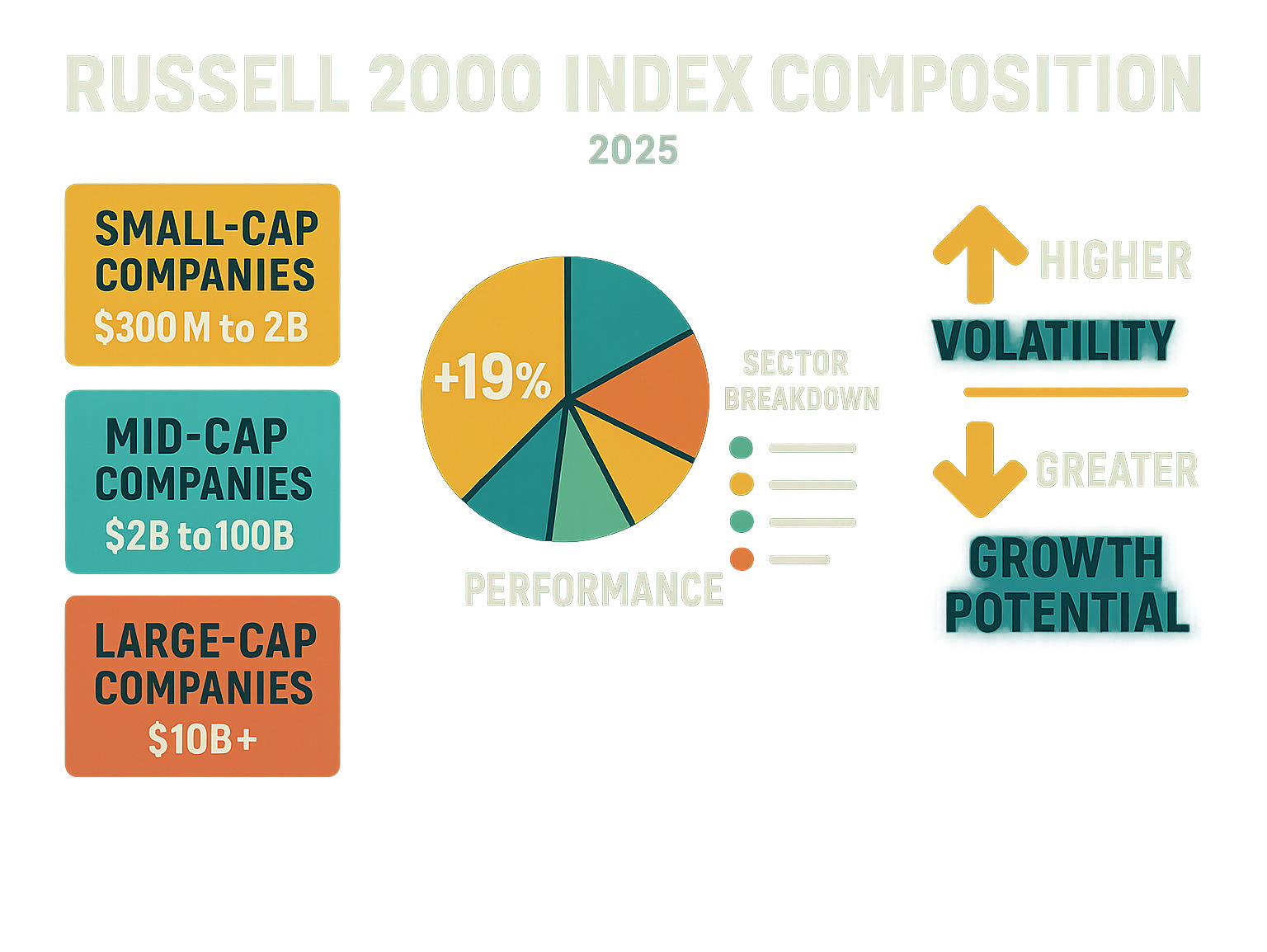

- Index Size: Tracks 2,000 small-cap U.S. companies

- Recent Performance: +19% over past 3 months, +0.5% year-to-date (2025)

- Market Cap Range: Typically $300 million to $2 billion per company

- FintechZoom Value: Real-time data, technical analysis tools, expert insights

- Key Risk: Higher volatility than large-cap indices like S&P 500

- Investment Access: Through ETFs (IWM, VTWO) or individual stocks

The Russell 2000 serves as the heartbeat of U.S. economic health because small companies adapt quickly to economic changes. When consumer confidence rises and people dine out more, travel frequently, and spend on experiences, small-cap companies often benefit first.

Why does this matter? Small-cap stocks historically rally about 60% after bear market lows, making timing crucial. FintechZoom.com offers the real-time tracking and analysis tools needed to spot these opportunities early.

Unlike the S&P 500’s focus on mega-cap tech giants, the Russell 2000 captures America’s emerging businesses – from regional restaurant chains to innovative food tech startups. These companies drive local economies and create the authentic experiences that savvy travelers seek.

Fintechzoom.com russell 200 further reading:

What is the Russell 2000 and Why Does It Matter?

When most people think about the stock market, they picture the big names everyone knows. But there’s a whole world of smaller companies quietly powering America’s economy, and that’s exactly what the Russell 2000 captures.

The Russell 2000 is a stock index that tracks 2,000 small-cap companies – basically, the scrappy underdogs of American business. These companies typically have market values between $300 million and $2 billion. They’re actually the smaller two-thirds of the Russell 3000 Index, which covers the 3,000 largest publicly traded U.S. companies.

Think of it this way: while the giants focus on global markets, these Russell 2000 companies are deeply rooted in American soil. They’re the regional restaurant chains, local manufacturers, and innovative startups that serve communities across the country. When you find that amazing local brewery or that family-owned food company expanding beyond their home state, there’s a good chance they’re part of this index.

Why should you care about these smaller players? Simple – they’re like the canaries in the economic coal mine. The fintechzoom.com russell 200 tracking shows us something fascinating: these companies react to economic changes much faster than their bigger cousins.

When consumers feel confident about spending money on dining out, weekend getaways, or trying new food products, small-cap companies feel it first. They don’t have the luxury of diversified global revenue streams to cushion economic bumps. This makes them incredibly sensitive to what’s happening in American households and communities.

The Russell 2000 serves as an economic barometer precisely because of this sensitivity. During economic recoveries, small-cap stocks often rally before large-cap stocks do. It’s like they’re giving us a sneak peek at where the broader economy is headed. When these companies are thriving, it usually means Americans are feeling good about their finances and ready to spend.

From our perspective at The Dining Destination, this is particularly exciting. A strong Russell 2000 often signals confident consumers who are ready to explore new restaurants, plan food-focused trips, and support innovative culinary businesses. These are the companies creating the next generation of dining experiences and food tourism opportunities.

The domestic focus of these companies makes them a leading indicator for economic recovery. Unlike multinational corporations that might see growth in Asia offset weakness in America, Russell 2000 companies live and breathe the U.S. consumer market.

For more context on how economic indicators affect the broader market landscape, check out more info about the economy. And if you want to dive deeper into the technical details of this index, Understanding the Russell 2000 Index provides comprehensive coverage.

Russell 2000 Performance: Trends, Drivers, and S&P 500 Comparison

The Russell 2000’s performance tells a fascinating story of resilience, volatility, and opportunity. When you understand how this small-cap index moves compared to the mighty S&P 500, you start to see the bigger picture of what’s really happening in the American economy.

Recent Performance has been nothing short of remarkable. The fintechzoom.com russell 200 tracking shows the index surged an impressive +19% over the past 3 months as of July 2025. This kind of rally is exactly what we love to see – it suggests that investors are finally looking beyond the mega-cap tech giants and finding value in smaller, more nimble companies.

Year-to-date for 2025, the Russell 2000 sits at a modest +0.5%, which might seem underwhelming at first glance. But here’s the thing about small-cap stocks: they’re like that perfectly seasoned dish that takes time to develop its full flavor. The recent surge indicates we might be witnessing the beginning of a broader small-cap renaissance.

Looking at the bigger picture, the Russell 2000 has delivered +1.9% over the past year and an impressive +52.1% over five years. These numbers tell us that while the journey might be bumpier than large-cap investing, the destination can be quite rewarding for patient investors.

| Metric | Russell 2000 (IWM ETF) | S&P 500 Index |

|---|---|---|

| Today (Intraday) | -0.7% | Flat |

| 1 Month | +6.0% | +5.2% |

| 3 Months | +19.1% | +19.1% |

| YTD (2025) | +0.5% | +7.0% |

| 1 Year | +1.9% | +13.5% |

| 5 Years | +52.1% | +95.1% |

| Typical Volatility | Higher | Lower |

| Sector Weighting | Financials, Industrials, Healthcare | Technology, Communication Services |

What’s particularly exciting about these numbers is the recent convergence. Notice how both indices gained exactly 19.1% over three months? That’s what we call a broadening market rally – when the investment love spreads beyond just the usual suspects.

Macro Drivers are the secret ingredients shaping this performance. Interest rates act like seasoning for small-cap stocks – too much (high rates) can overpower their growth, while the right amount (lower rates) improves their flavor. Small companies typically rely more heavily on borrowing than their larger counterparts, making them particularly sensitive to rate changes.

Inflation has been another key ingredient in this economic recipe. While high inflation can squeeze the thin margins that many small companies operate on, the recent easing has created a more favorable environment. It’s like reducing the heat under a delicate sauce – suddenly, everything starts to come together beautifully.

The AI dominance theme that captivated markets for so long is finally sharing the spotlight. Instead of all the investment dollars flowing to a handful of tech giants, we’re seeing money spread across a broader range of companies. This shift benefits the Russell 2000 tremendously, as it captures the entrepreneurial spirit of American businesses that might not be building the next AI chatbot but are solving real problems for real people.

Historical Trends show us that small-cap stocks have a particular talent for post-bear market rallies. They typically bounce back about 60% after hitting rock bottom, making them excellent barometers for economic recovery. Their economic cycle sensitivity means they feel the pain first during downturns, but they also tend to celebrate first when good times return.

Think of it this way: when consumer confidence returns and people start dining out more, taking weekend trips, and exploring new experiences, it’s often the smaller, local businesses that benefit first. That regional restaurant chain or boutique hotel group feels the impact of increased spending much faster than a multinational corporation.

For deeper insights into how these market movements affect the broader economic landscape, check out More info about markets.

The beauty of tracking the Russell 2000 lies in understanding that it represents the entrepreneurial heartbeat of America – the companies that create the authentic, local experiences that make travel and dining so memorable.

A Deep Dive into the fintechzoom.com russell 2000 Investment Landscape

Investing in the fintechzoom.com russell 200 is like exploring a busy local food market versus dining at a well-known chain restaurant. The small-cap world offers incredible findies and authentic experiences, but it requires more adventurous taste buds and a willingness to try something new.

The Golden Opportunities

Small-cap investing through the Russell 2000 can be incredibly rewarding for patient investors. Think of these companies as the hidden gems of the investment world – much like finding that amazing hole-in-the-wall restaurant before it becomes the next big food trend.

Discounted valuations often make small-cap stocks attractive bargains. While everyone’s focused on the mega-cap tech giants, many quality small companies trade at reasonable prices simply because fewer people are paying attention. It’s like finding an exceptional local chef before they get their James Beard Award.

The early-cycle growth potential is perhaps the most exciting aspect. When the economy starts recovering, small companies often lead the charge. They’re nimble, adaptable, and can pivot quickly – qualities that serve them well when economic winds shift favorably. A small regional restaurant chain, for example, can expand rapidly into new markets much faster than a massive corporation.

For investors willing to do their homework, undervalued gems await findy. Because these companies receive less analyst coverage and media attention, there’s genuine potential to find tomorrow’s success stories trading at today’s reasonable prices.

The Reality Check: Understanding the Risks

Of course, small-cap investing isn’t all sunshine and rainbows. Higher volatility is the price of admission – these stocks can swing dramatically based on earnings reports, economic news, or even rumors. One day you’re celebrating a 15% gain, the next you might be watching a 12% drop.

Liquidity issues can catch investors off guard. Unlike trading shares of Apple or Microsoft, some small-cap stocks don’t trade as frequently. This means you might not always be able to buy or sell exactly when you want, especially during market stress.

The business instability factor is real too. Smaller companies often operate with thinner margins and smaller cash reserves. When economic storms hit, they feel the impact more acutely than their larger, more established counterparts. Financing costs add another layer of complexity, as these companies typically rely more heavily on borrowed money to fuel growth.

Key Risks for Small-Cap Investors

Let’s be honest about what we’re signing up for with fintechzoom.com russell 200 investing. Economic sensitivity means these companies live and breathe by domestic economic conditions. When Americans tighten their belts and eat out less, travel less, or spend less on experiences, small-cap companies feel it immediately. They’re vulnerable in downturns because they often lack the financial cushions that larger companies enjoy.

The analyst coverage gap creates both opportunity and challenge. While this information inefficiency can lead to finding undervalued companies, it also means you’ll need to do more research yourself. You won’t find as many detailed reports or expert opinions readily available.

Liquidity concerns become especially important during volatile periods. Lower trading volume can lead to wider spreads between what buyers are willing to pay and what sellers want to receive. This can result in unexpected price swings that might catch you off guard.

Identifying Opportunities in the Current Market

Despite these challenges, smart investors can find excellent opportunities in today’s market. Sector-specific plays in areas like biotech and industrials offer compelling growth stories. In our world of food and travel, we’re particularly excited about small companies developing innovative restaurant technologies or sustainable food solutions.

U.S.-centric themes provide another avenue for opportunity. As more companies consider bringing operations back to American soil, domestically focused small-caps could benefit significantly.

For most investors, ETFs and funds offer the smartest entry point. The IWM and VTWO funds provide instant diversification across all 2,000 companies in the index, eliminating the need to pick individual winners and losers. This approach captures the diversification benefits while managing the risks of any single company disappointing.

If you’re interested in researching individual companies within the Russell 2000, platforms like Fintechzoom.com Stocks can help you identify specific investment opportunities that align with your goals and risk tolerance.

The key is approaching small-cap investing with realistic expectations and a long-term perspective. Like finding the best local restaurants, it takes patience, research, and sometimes a willingness to accept that not every choice will be a winner.

How to Master the Russell 2000 with FintechZoom.com

When it comes to tracking the fintechzoom.com russell 200, having the right tools can make all the difference between making informed investment decisions and simply guessing. Think of it like choosing a restaurant in a new city – you could wander around hoping to stumble upon something great, or you could use a reliable platform that gives you real insights into what’s actually worth your time and money.

FintechZoom.com serves as your real-time command center for small-cap investing. Just as we help food travelers find hidden culinary gems before they become mainstream, this platform helps investors spot opportunities in the Russell 2000 before the broader market catches on.

The platform’s true value lies in changing overwhelming market data into actionable insights. Rather than drowning you in numbers, it provides context and clarity. You get tick-by-tick updates on index movements, but more importantly, you understand what’s driving those changes. Whether you’re a newcomer curious about small-cap investing or an experienced trader fine-tuning your strategy, the platform adapts to your needs.

We encourage you to Visit FintechZoom.com to experience these features yourself and see how they can improve your investment approach.

Using FintechZoom.com for Technical Analysis

Technical analysis might sound intimidating, but it’s really just about reading the market’s story through charts and patterns. FintechZoom.com makes this accessible for anyone interested in the fintechzoom.com russell 200.

The platform helps you track key levels that act like important landmarks in the market. Right now, the Russell 2000’s 50-day SMA sits around 2136, which often acts as a support level – think of it as a floor that the index tends to bounce off. The 200-day SMA at approximately 2177 is even more crucial. When the index moves above this level and stays there, it’s often a strong signal that small-caps are entering a healthier phase.

These aren’t just random numbers – they represent the collective behavior of thousands of investors and billions of dollars in trading activity. Understanding them helps you time your entries and exits more effectively.

The charting tools available make technical analysis feel less like rocket science and more like reading a well-organized map. You can customize charts to show anything from minute-by-minute movements to decade-long trends. The platform includes essential indicators like RSI, which tells you if stocks might be overbought or oversold, and MACD, which helps identify momentum shifts. Bollinger Bands show you how volatile the market is getting, while volume analysis confirms whether price movements have real institutional backing.

What we find particularly valuable is how these tools work together to paint a complete picture. High volume accompanying a price breakout above the 200-day moving average, for example, suggests that the fintechzoom.com russell 200 technical outlook is genuinely improving, not just experiencing a temporary blip.

Gaining Strategic Insights on fintechzoom.com russell 200

Beyond the technical charts and indicators, FintechZoom.com excels at providing the strategic context that makes all the difference in investment decisions.

The platform’s expert commentary goes beyond just reporting what happened – it explains why it matters. Market sentiment can shift quickly in the small-cap world, and having access to seasoned analysts’ perspectives helps you understand whether a particular move is part of a larger trend or just market noise.

Sector deep dives are particularly valuable given the Russell 2000’s diversity. The index has significant weightings in Financials, Industrials, and Healthcare, each responding differently to economic conditions. If you’re interested in how dining and hospitality trends might affect small-cap investments, you might focus on Industrial sector companies that provide restaurant technology or Healthcare firms developing nutrition-focused solutions.

The custom alerts feature ensures you never miss important developments. You can set notifications for significant Russell 2000 price movements, volume spikes in specific sectors, or news events that might impact small-cap performance. This is especially useful since small-cap stocks can move quickly on relatively little news.

Comparative analysis tools let you see how the Russell 2000 performs against other major indices like the S&P 500. This benchmarking reveals whether small-caps are participating in broader market rallies or marching to their own drummer. When small-caps start outperforming large-caps, it often signals that economic optimism is spreading beyond just the mega-cap technology companies.

By combining these strategic insights with technical analysis, you develop a more complete understanding of the fintechzoom.com russell 200 landscape. It’s like having a knowledgeable local guide when exploring a new food scene – someone who not only knows where to go but understands why certain places are worth your attention.

Frequently Asked Questions about the Russell 2000

When we talk with fellow food and travel enthusiasts about investing, the fintechzoom.com russell 200 inevitably comes up in conversation. Whether you’re a restaurant owner looking to understand market trends or a culinary traveler interested in investing, these are the questions we hear most often.

Is the Russell 2000 riskier than the S&P 500?

Absolutely, and there’s no sugar-coating it. The Russell 2000 is like that adventurous local restaurant you find off the beaten path – it might serve the most incredible meal of your life, or it might disappoint. The risk is simply higher than dining at a well-established chain.

Yes, the Russell 2000 carries more risk than the S&P 500, and this stems from the nature of small companies themselves. Think about it this way: a small regional restaurant chain faces very different challenges than McDonald’s. The smaller company has higher volatility – meaning bigger ups and downs in stock price. They’re often less financially stable, with fewer resources to weather tough times.

But here’s the exciting part: the potential for higher returns is real. Small companies can grow faster and adapt more quickly than their giant counterparts. They’re also more sensitive to economic shifts, which means they feel the impact of changes in consumer spending patterns almost immediately. When people start dining out more and traveling again, these smaller companies often benefit first.

For us at The Dining Destination, this sensitivity makes perfect sense. When economic confidence returns, people book that culinary tour or try that new farm-to-table restaurant they’ve been eyeing.

How often is the Russell 2000 index rebalanced?

The Russell 2000 gets a major makeover once a year through what’s called annual reconstitution. This typically happens in June, and it’s like watching a restaurant refresh its menu for the new season.

During this process, FTSE Russell takes a fresh look at all U.S. companies, ranks them by size, and decides which 2,000 deserve a spot in the small-cap club. Some companies graduate to bigger indices (like a local restaurant chain going national), while others join for the first time.

This creates predictable volatility and trading opportunities that smart investors watch closely. Companies joining the index often see their stock prices rise as funds rush to buy shares. Those getting kicked out might see the opposite. It’s a fascinating annual ritual that platforms like FintechZoom.com help investors steer.

Can I invest directly in the Russell 2000?

Here’s where things get practical. You cannot invest directly in the Russell 2000 index itself – it’s like trying to buy “the concept of fine dining” rather than a meal at a specific restaurant.

However, you have several delicious options to gain exposure:

ETFs are your best friend here. The iShares Russell 2000 ETF (IWM) and Vanguard Russell 2000 ETF (VTWO) are like curated tasting menus – they give you a sample of all 2,000 companies in one purchase. These offer diversification benefits and professional management, making them perfect for most investors.

Mutual funds provide another route, often with slightly different approaches to small-cap investing. For the truly adventurous, you can research and buy individual stocks within the index, though this requires significant homework – like researching every ingredient in a complex dish before cooking it yourself.

For beginners, we always recommend starting with the ETF approach. It’s like having a knowledgeable sommelier select a wine flight rather than trying to steer an extensive wine cellar on your own.

Conclusion: Your Next Steps in Small-Cap Investing

We’ve taken quite a journey together through small-cap investing, and now it’s time to tie everything together. The fintechzoom.com russell 200 isn’t just another index to track – it’s your window into the beating heart of American entrepreneurship.

Think about it this way: when you’re planning your next culinary trip or seeking out that hidden gem of a restaurant, you’re likely drawn to the innovative, locally-owned establishments that define a city’s food scene. These are the same types of businesses that make up the Russell 2000. They’re the entrepreneurial engine of the domestic economy, where creativity meets opportunity and where tomorrow’s household names are born today.

The Russell 2000’s role as an economic indicator extends far beyond Wall Street. When these 2,000 small companies are thriving, it signals something profound about consumer confidence. People are dining out more, traveling to new destinations, and embracing experiences over material goods. This directly impacts the vibrant food and travel landscape we’re passionate about at The Dining Destination.

We’ve seen how the recent +19% surge over three months demonstrates the explosive potential of small-caps, even amid their characteristic volatility. Yes, the risk versus reward equation is more intense here than with large-cap stocks, but that’s precisely where the opportunity lies. Higher volatility means bigger swings both ways, but for patient investors with a solid strategy, it also means the potential for outsized returns.

This is where FintechZoom.com becomes your essential companion. The platform transforms what could be overwhelming market data into clear, actionable insights. Whether you’re tracking those crucial support levels around the 50-day SMA or setting up custom alerts for sector rotations, having the right tools makes all the difference. It’s like having a seasoned guide when you’re exploring a new city’s food scene – invaluable for navigating unfamiliar territory.

The connection between economic health and consumer confidence is something we witness daily in the food and travel industry. When small businesses across America are flourishing – from innovative food tech startups to regional restaurant chains – it creates a ripple effect. Confident consumers become adventurous diners and eager travelers, driving the very trends we love to explore and share.

Your next steps are clear: start with diversified ETFs like IWM or VTWO to gain broad Russell 2000 exposure, use FintechZoom.com’s tools to stay informed about market movements, and remember that small-cap investing is a marathon, not a sprint. The companies in this index are building the future of American business, one innovation at a time.

For more in-depth analysis and investment strategies that explore how economic trends shape consumer behavior in food and travel, we invite you to dive into our comprehensive Resource Guides. After all, understanding the economy helps us better appreciate the incredible culinary trips waiting to be finded.