Why Fintechzoom.com Nickel Coverage Matters for Modern Investors

Fintechzoom.com nickel has become a popular search term as this industrial metal transforms into a strategic investment asset. Here’s what you need to know:

Key Facts About FintechZoom’s Nickel Coverage:

- Real-time price tracking from global exchanges like the London Metal Exchange (LME)

- Free basic features including daily updates and price charts

- Retail-focused platform that aggregates data rather than providing primary sources

- Best used for sentiment tracking and news monitoring, not institutional trading

- Current nickel price as of April 2025: $15,732 per metric ton (up 5.09% from March)

The surge in interest around nickel isn’t just about price movements. As one industry analyst noted, “If FintechZoom wants to influence serious traders, it must address the difference between tradeable narrative and structural fundamentals.” This highlights a key tension in how retail platforms cover complex commodities.

Nickel’s importance has exploded due to its critical role in electric vehicle batteries and green technology. About 70% of global nickel still goes into stainless steel production, but the EV revolution is reshaping demand patterns entirely.

FintechZoom.com serves as a financial news aggregator that blends sentiment tracking with market analysis. It’s particularly useful for tracking retail trading behavior and news-cycle influence around nickel, but serious traders should understand its limitations compared to institutional data sources.

For investors seeking to understand nickel’s role in the broader economy – from EV batteries to renewable energy infrastructure – FintechZoom offers an accessible entry point. However, the platform’s coverage often oversimplifies complex market dynamics and lacks the transparency needed for high-stakes trading decisions.

Fintechzoom.com nickel basics:

Nickel’s Strategic Importance in the Green Economy

Think of nickel as the quiet hero of your kitchen drawer. That shiny stainless steel fork you use every day? It’s about 8-10% nickel. But while this lustrous, silvery-white metal has been the backbone of stainless steel production for decades – still claiming about 70% of global nickel supply – it’s now stepping into a much bigger spotlight.

The change is remarkable. What was once primarily an industrial workhorse has become a strategic asset in the race toward a cleaner future. The reason? Electric vehicles and the green technology revolution have turned nickel into one of the most sought-after metals on the planet.

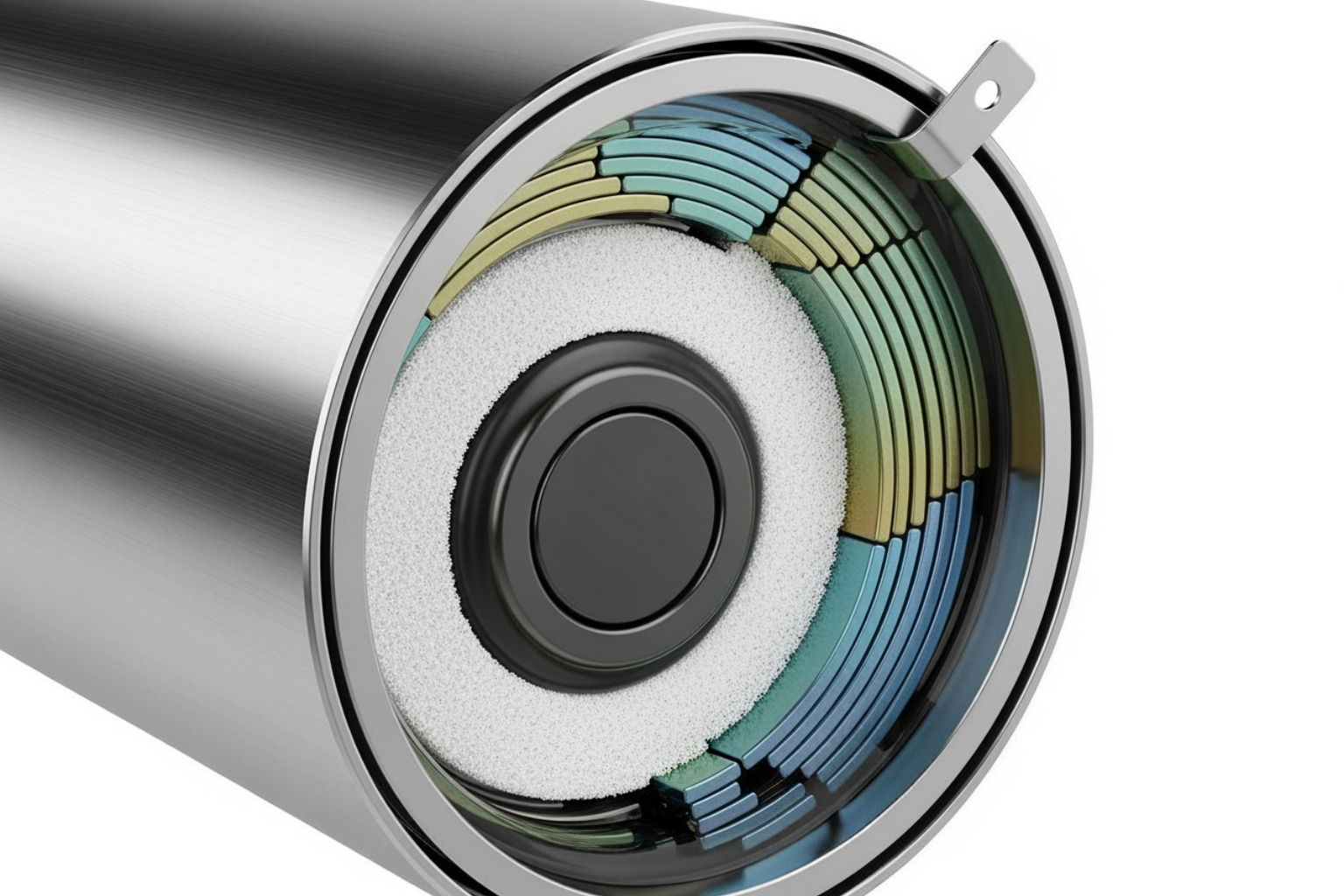

Here’s where things get interesting for Fintechzoom.com nickel tracking. Inside every electric vehicle battery, nickel plays a starring role in the cathode – the part that stores and releases energy. High-nickel chemistries like Nickel-Cobalt-Manganese (NCM) and Nickel-Cobalt-Aluminum (NCA) are the secret sauce behind longer driving ranges and better battery life.

When Tesla or other EV manufacturers talk about improving their vehicles’ range, they’re often talking about increasing the nickel content in their batteries. More nickel means more energy density, which translates to those coveted 300+ mile ranges that make electric vehicles practical for everyday drivers.

But the story doesn’t end with cars. Wind turbines rely on nickel-rich components for their durability against harsh weather conditions. Large-scale energy storage systems that help balance renewable energy grids also depend heavily on nickel-based technologies. Even the charging infrastructure supporting the EV revolution uses nickel in various components.

The numbers tell a compelling story. As of April 2025, nickel traded at $15,732 per metric ton – up 5.09% from March, though still down from the previous year’s highs. This volatility reflects the market’s attempt to balance traditional demand with the explosive growth in green technology applications.

Countries like Indonesia have transformed their economies around this shift, becoming the world’s largest nickel producer and riding the wave of increasing demand. The global supply chains that once focused primarily on stainless steel are now reconfiguring to serve the energy transition.

For investors following Fintechzoom.com nickel coverage, understanding these fundamentals is crucial. The metal sits at the intersection of traditional industry and the green economy, making it both a commodity play and a clean energy investment. The International Nickel Study Group provides in-depth data for those seeking comprehensive market analysis, while more info about market analysis can help contextualize nickel’s role in broader market trends.

This strategic importance means nickel isn’t just another metal to track – it’s become a barometer for how quickly the world is moving toward sustainable energy solutions.

What is FintechZoom and How Does It Cover the Nickel Market?

Picture a digital newsroom where finance meets cutting-edge technology, and you’ll have a good sense of what FintechZoom.com represents. This online platform has established itself as a go-to destination for financial news and analysis, covering everything from blockchain developments and digital banking to stock markets and commodity trading. It’s essentially a financial news aggregator that brings together data, insights, and market commentary under one accessible roof.

When it comes to Fintechzoom.com nickel coverage, the platform takes a comprehensive approach that goes beyond simple price quotes. Think of it as your financial friend who not only tells you what nickel costs today but also explains why it matters and what might happen next.

The platform’s real-time price tracking pulls data from major global exchanges, particularly the London Metal Exchange (LME), giving users a live pulse on nickel’s performance throughout trading hours. This isn’t just a static number on a screen – it’s dynamic data that updates as markets move, which can be incredibly valuable when nickel prices swing due to supply disruptions or sudden demand shifts.

But FintechZoom’s real strength lies in how it presents this information. The historical data charts let you zoom out and see nickel’s journey over days, months, or years. It’s like having a time machine for metal prices, helping you spot patterns that might inform your next investment move.

The platform also excels at investment commentary and sentiment analysis. Rather than leaving you to interpret raw numbers alone, FintechZoom provides context through expert opinions and market narratives. This qualitative layer helps bridge the gap between “nickel went up 3%” and “here’s why that matters for your portfolio.”

One of the most appealing aspects of FintechZoom is its news curation. The platform aggregates relevant articles and updates about nickel from various sources, covering supply chain disruptions, technological breakthroughs in battery chemistry, and geopolitical events that might affect prices. It’s like having a research assistant who filters through the noise to bring you what’s actually important.

Here’s what FintechZoom offers for nickel tracking: Live Price Charts that update in real-time, Daily Updates summarizing key market movements, Curated News from multiple sources, and Basic Technical Indicators like moving averages for preliminary analysis.

The platform’s accessibility deserves special mention. Unlike expensive institutional data terminals that can cost thousands per month, FintechZoom offers free access to its core features. This democratization of financial data means whether you’re a seasoned trader or someone just curious about commodity markets, you can access the same basic information.

How FintechZoom Integrates Nickel with Broader Market Themes

What sets FintechZoom apart is its ability to connect the dots between nickel and the bigger financial picture. Rather than treating this metal as an isolated commodity, the platform weaves it into larger market narratives that help you understand the interconnected nature of modern finance.

The platform frequently draws connections between nickel and fintech themes, exploring how blockchain hardware and digital infrastructure rely on components containing this metal. It’s fascinating to realize that the same nickel powering electric vehicles might also be essential for the servers running cryptocurrency networks.

EV market trends feature prominently in FintechZoom’s nickel analysis, which makes perfect sense given nickel’s starring role in lithium-ion batteries. The platform regularly connects nickel price movements to electric vehicle production targets, battery technology breakthroughs, and consumer adoption rates. When Tesla announces a new battery chemistry or China updates its EV subsidies, FintechZoom helps explain how these developments might ripple through nickel markets.

The platform also links nickel performance to broader indices like the FTSE 100 and STOXX 600, helping you understand how this commodity fits within global economic trends. This contextual approach can be particularly valuable during periods of market volatility, when understanding correlations becomes crucial for risk management.

Perhaps most importantly, FintechZoom excels at capturing and analyzing digital infrastructure trends that impact nickel demand. As our world becomes increasingly connected, the infrastructure supporting this connectivity – from data centers to 5G networks – creates new sources of metal demand that traditional analysis might miss.

For those interested in exploring other precious metals through a similar lens, you can find more info about gold prices using comparable analytical approaches.

A Critical Look at Fintechzoom.com Nickel Data Reliability

When you’re considering any financial platform for investment decisions, understand what you’re really getting. Fintechzoom.com nickel coverage comes with both impressive strengths and notable limitations that every investor should understand before diving in.

The first thing to understand is that FintechZoom operates as a financial news aggregator rather than a primary data source. Think of it like getting your news from a well-curated newsletter versus reading directly from the original reporters. There’s nothing wrong with this approach, but it means you’re getting information that’s been filtered and repackaged.

For casual investors or those just getting started with commodity tracking, this aggregation approach works beautifully. The platform pulls together nickel market information from various sources, presenting it in an easy-to-digest format. However, if you’re making serious trading decisions, you’ll want to know exactly where your data comes from.

One area where FintechZoom truly shines is as a retail sentiment indicator. The platform excels at capturing how everyday investors and the general public are reacting to nickel market events. This sentiment tracking can be incredibly valuable for understanding market psychology and potential speculative pressures.

The platform’s accessibility is another major win. Unlike expensive institutional terminals that can cost thousands per month, FintechZoom offers its basic nickel tracking features completely free. For many investors, this democratization of financial data is a game-changer.

Here’s how FintechZoom stacks up against institutional sources:

| Metric | FintechZoom.com | Institutional Sources |

|---|---|---|

| Data Sourcing | Aggregated, sometimes unclear origins | Direct from exchanges, fully transparent |

| Transparency | Good for headlines, less clear for raw data | Detailed data trails and audited sources |

| Depth of Analysis | Narrative-focused with basic technical tools | Comprehensive fundamental and technical research |

| Target Audience | Retail investors and enthusiasts | Professional traders and institutions |

| Cost | Free basic features, paid premium options | Expensive subscriptions and specialized terminals |

Strengths of FintechZoom’s Nickel Coverage

FintechZoom’s approach to Fintechzoom.com nickel coverage has several standout strengths that make it valuable for its intended audience.

Narrative tracking is where the platform really excels. While institutional sources might give you raw price data, FintechZoom helps you understand the story behind the numbers. When geopolitical tensions affect nickel supply chains or when new EV battery technology creates demand spikes, FintechZoom captures these narratives in real-time.

The platform’s news buzz monitoring capabilities are impressive. During periods of high volatility or major market events, FintechZoom’s coverage tends to spike alongside the action. This gives you a real-time pulse of market excitement, concern, or confusion.

From a practical standpoint, the user-friendly interface makes complex commodity data accessible to everyone. You don’t need a finance degree to understand FintechZoom’s charts and summaries. This ease of use stands in stark contrast to the often intimidating interfaces of professional trading platforms.

The free basic features cannot be understated as a strength. Getting real-time nickel prices, daily market summaries, and basic charts without paying a subscription fee makes FintechZoom an excellent starting point for new commodity investors.

Weaknesses and Potential Risks

While FintechZoom offers valuable services, understanding its limitations is crucial for making informed investment decisions with Fintechzoom.com nickel data.

Oversimplification is perhaps the most significant concern. Commodity markets are incredibly complex, influenced by supply chain logistics, specific contract details, and intricate cost structures. FintechZoom’s narrative-driven approach sometimes glosses over these critical details, potentially leaving investors with an incomplete picture.

The lack of data provenance presents a real challenge for serious investors. When charts and price data don’t clearly show their sources, it becomes impossible to verify accuracy or understand methodology. This transparency gap can be problematic when making significant financial decisions.

Unverified charts compound this issue. Without understanding how data is compiled or what assumptions are built into visualizations, investors risk misinterpreting trends or making decisions based on potentially inaccurate representations.

For anyone considering institutional-level trading, FintechZoom is simply not suitable for professional trading. High-grade institutional trading requires direct exchange data, detailed order book information, and contract-level volume data that FintechZoom typically doesn’t provide.

The platform’s approach can also introduce potential bias through its focus on prevailing market sentiments rather than purely objective analysis. While this sentiment tracking is valuable, it shouldn’t be your only source of market insight.

Understanding these strengths and limitations helps you use FintechZoom effectively as part of a broader analytical toolkit. For more comprehensive stock analysis resources, check out more info about stock analysis.

How to Strategically Use FintechZoom for Investment Analysis

Understanding Fintechzoom.com nickel coverage is one thing, but knowing how to use it strategically? That’s where the real value lies. Think of FintechZoom as your market sentiment thermometer rather than your surgical precision instrument. It’s not going to give you the microscopic details that institutional traders need, but it’s incredibly effective at reading the room.

The beauty of FintechZoom lies in its role as a retail investor tool. It captures the emotional pulse of the market in a way that sterile data feeds simply can’t. When you see nickel headlines exploding across the platform, you’re witnessing retail interest in real-time. This “buzz factor” often precedes or amplifies price movements, making it a valuable early warning system.

Cross-referencing data should be your golden rule. Never treat FintechZoom as your single source of truth. Instead, use it as your starting point, then verify everything with authoritative sources like the London Metal Exchange (LME) or Bloomberg Terminal. It’s like getting directions from a friendly local versus using GPS – both have value, but you want to double-check the route.

One of FintechZoom’s strongest suits is identifying news-driven volatility. The platform tends to light up when geopolitical events or major announcements hit the nickel market. By monitoring the volume and intensity of coverage, you can spot when news cycles are driving prices rather than fundamental supply-demand factors.

Setting price alerts through FintechZoom’s basic features keeps you connected to market movements without constantly checking prices. This is particularly useful for nickel, where sudden supply disruptions or policy changes can create rapid price swings.

The platform also excels at gauging market sentiment through its narrative tracking. When FintechZoom’s coverage shifts from technical analysis to emotional storytelling about nickel shortages or EV revolution impacts, you’re seeing retail sentiment in action. This emotional component often creates momentum that smart investors can either ride or fade, depending on their strategy.

For those interested in diversifying beyond commodities, you might find value in exploring More info about real estate investing.

Understanding Nickel Price Volatility with Fintechzoom.com nickel

Nickel prices move like a roller coaster, and Fintechzoom.com nickel coverage does an excellent job of capturing the drama behind these swings. While the platform might not dive deep into technical market structures, it brilliantly reflects the human stories and geopolitical tensions that send prices soaring or crashing.

Geopolitical pressures dominate nickel volatility, and FintechZoom captures these tensions through its news aggregation. When Indonesia threatens export bans or Russian sanctions impact Norilsk Nickel, the platform’s coverage intensity spikes alongside price volatility. You’ll see headlines multiply and sentiment shift dramatically, giving you a front-row seat to how geopolitics translates into market psychology.

Supply and demand shifts get the narrative treatment on FintechZoom. Rather than dry statistics about production figures, you’ll find stories about the EV revolution driving unprecedented demand or mining disruptions threatening global supply. This storytelling approach helps investors understand not just what’s happening, but why it matters for future price movements.

Policy changes create some of nickel’s most dramatic price swings, and FintechZoom excels at translating complex regulatory shifts into digestible market implications. When China adjusts EV subsidies or the EU implements new battery regulations, the platform helps connect these policy dots to their nickel market impact.

The platform also tracks technological advances that could reshape nickel demand. Whether it’s breakthrough battery chemistries that use more nickel or competing technologies that might reduce demand, FintechZoom presents these developments through an investor lens rather than a purely technical one.

Perhaps most importantly, FintechZoom captures speculative trading sentiment. The platform’s strength in monitoring retail buzz means you can often spot when speculation is driving prices versus fundamental factors. This emotional market intelligence can be incredibly valuable for timing entry and exit points.

The Role of ESG in the Fintechzoom.com nickel Coverage

Environmental, Social, and Governance (ESG) factors are reshaping how investors view nickel, and Fintechzoom.com nickel coverage increasingly reflects this change. The irony isn’t lost on anyone – a metal essential for “clean” electric vehicles often comes from environmentally challenging mining operations.

Sustainable mining practices get significant attention in FintechZoom’s narrative coverage. The platform highlights companies adopting cleaner extraction methods and the growing market premium for “green nickel.” This isn’t just feel-good reporting – it reflects real market forces as EV manufacturers face pressure to clean up their entire supply chains.

The carbon footprint of nickel production is becoming a crucial investment factor, and FintechZoom tracks this trend through company announcements and industry initiatives. When major producers pledge carbon-neutral operations or invest in renewable energy for their facilities, the platform captures both the environmental impact and the potential market advantages.

Ethical sourcing concerns appear regularly in FintechZoom’s coverage, particularly regarding labor practices and community impacts in major producing regions. These social considerations increasingly influence investor decisions and can create significant price premiums for responsibly sourced nickel.

The growing importance of recyclability in the circular economy also gets coverage, as battery recycling technologies could eventually reduce demand for virgin nickel mining. FintechZoom helps investors understand how these technological developments might reshape long-term market dynamics.

While FintechZoom doesn’t provide detailed ESG ratings, its narrative approach helps investors understand how sustainability considerations are becoming market-moving factors. For nickel investors, this ESG lens is becoming as important as traditional supply-demand analysis.

Frequently Asked Questions about Nickel and FintechZoom

We know navigating commodities and financial platforms can feel overwhelming. Think of us as your friendly guide, here to break down the most common questions about Fintechzoom.com nickel coverage in a way that actually makes sense.

Is FintechZoom.com’s nickel data reliable for making trading decisions?

Here’s the honest truth: FintechZoom.com serves as an excellent starting point for tracking news and retail sentiment around nickel, but it shouldn’t be your only source for serious trading decisions.

Think of it like getting restaurant recommendations from a food blogger versus a Michelin inspector. The blogger gives you great insights into what’s trending and what people are talking about, but the inspector provides the detailed, verified analysis you’d want before investing in a restaurant.

FintechZoom excels at capturing retail sentiment and news-driven narratives. It’s fantastic for understanding what stories are moving the market and how everyday investors are reacting to nickel price movements. The platform’s real-time updates and historical trends give you a solid feel for market momentum.

However, for serious trading decisions, its data should always be cross-verified with primary institutional sources due to its lack of transparent data sourcing. Professional traders rely on direct exchange data from sources like the London Metal Exchange (LME) or Bloomberg Terminal because they need granular detail, clear data provenance, and institutional-grade accuracy.

The reality is that FintechZoom operates as a financial news aggregator rather than a primary data provider. While this makes it incredibly accessible and user-friendly, it also means the data might lack the depth and transparency needed for high-stakes trading decisions. Use it as your market pulse-checker, not your trading bible.

Why is nickel so important for Electric Vehicles (EVs)?

Nickel is the unsung hero of the electric vehicle revolution, and understanding its role helps explain why Fintechzoom.com nickel coverage has become so popular among investors.

Nickel is a critical component in the cathodes of lithium-ion batteries, which are essentially the heart of every electric vehicle. But here’s what makes it special: nickel dramatically increases energy density, which translates directly into longer driving ranges for EVs. More nickel in your battery means you can drive further on a single charge – a game-changer for EV adoption.

The automotive industry is rapidly shifting toward high-nickel cathode chemistries like Nickel-Cobalt-Manganese (NCM) and Nickel-Cobalt-Aluminum (NCA) because they offer superior performance. These technologies don’t just extend range; they also improve charging speeds and overall battery longevity.

Think about it this way: if you’re considering buying an EV, you want one that can take you from city to city without constant charging stops. That capability comes largely from nickel’s unique properties. It allows EVs to achieve the performance standards that make them competitive with traditional gasoline vehicles.

This is why the nickel industry is central to EV growth, and why investors are paying such close attention to nickel market dynamics. As EV adoption accelerates globally, nickel demand is expected to surge, making it a strategic commodity for the clean energy transition.

Can I trade nickel directly on FintechZoom.com?

No, FintechZoom.com is a financial news and data aggregation platform, not a brokerage or trading platform. This is an important distinction that often confuses newcomers to commodity investing.

FintechZoom’s role is to provide information to help inform your trading decisions, which must then be executed on dedicated trading platforms. Think of it as your research library rather than your trading desk. You can analyze nickel price trends, read market commentary, and track news developments on FintechZoom, but the actual buying and selling happens elsewhere.

To trade nickel, you’ll need to work with a brokerage account that supports commodity trading. This might involve trading nickel futures contracts on exchanges like the London Metal Exchange, investing in nickel mining stocks, or purchasing ETFs that focus on battery materials and industrial metals.

The process typically works like this: you gather insights and analysis from platforms like FintechZoom, develop your trading strategy based on that research, and then execute your trades through your chosen brokerage platform. FintechZoom serves as your intelligence-gathering tool, helping you understand market sentiment and identify potential opportunities.

This separation actually works in your favor. It allows FintechZoom to focus on what it does best – aggregating news, tracking sentiment, and providing accessible market analysis – while specialized trading platforms handle the complex logistics of commodity transactions.

Conclusion

As we wrap up our exploration of Fintechzoom.com nickel, think of this journey like finding a new restaurant in your neighborhood. You’ve learned about the menu, understood the atmosphere, and now you know exactly when to visit and what to expect.

FintechZoom.com serves up a valuable, accessible feast of information about a commodity that’s becoming as essential to our modern world as a good cup of coffee is to your morning routine. Nickel isn’t just some industrial metal gathering dust in warehouses anymore – it’s the secret ingredient powering the electric vehicles in our driveways and the green technology reshaping our planet.

What makes FintechZoom shine is its role as that friendly neighborhood source who always knows what’s happening. It’s your go-to “narrative scanner” that delivers real-time updates, carefully curated news, and gives you a genuine feel for what everyday investors are thinking. When the nickel market gets spicy with news-driven drama or retail excitement, FintechZoom captures that energy beautifully.

For newcomers to commodity investing, it’s like having a welcoming guide who speaks your language instead of confusing jargon. The platform offers a compelling entry point that won’t break the bank – many features come free, making it accessible to anyone curious about this fascinating market.

But here’s where we need to be honest, like a trusted friend giving you the real scoop. While FintechZoom excels at capturing the buzz and providing that important market pulse, it’s not designed to be your only source for serious investment decisions. Think of it like using a travel blog to plan a trip – fantastic for inspiration and general direction, but you’ll still want to check official sources for the crucial details.

The platform’s limitations around data provenance and institutional-grade analysis mean that smart investors treat it as one valuable ingredient in a larger recipe. Just like you wouldn’t make a complex dish using only one spice, successful investing requires multiple trusted sources working together.

The sweet spot? Use FintechZoom to stay connected with market sentiment and catch those important narrative shifts, while always cross-referencing with authoritative sources like the London Metal Exchange. This approach gives you both the emotional intelligence of the market and the hard facts you need for confident decision-making.

At The Dining Destination, we believe in serving up information that’s both comprehensive and genuinely useful – whether you’re navigating financial markets or exploring the world’s most exciting culinary destinations. Just as we help food enthusiasts find authentic flavors and hidden gems, we’re committed to helping you understand complex topics with clarity and warmth.

Ready to dive deeper into resources that blend insight with practical wisdom? We invite you to explore our resource guides for more comprehensive guides that empower informed decisions across all your interests and investments.