Why the FintechZoom Economy Matters for Today’s Business Owners

The financial world is no longer confined to Wall Street trading floors and dense, jargon-filled reports. We’re in the midst of a digital revolution, and at the heart of it is the Fintechzoom.com economy. This term represents a dynamic ecosystem where financial technology (fintech), real-time data, and accessible analysis converge, empowering everyone from seasoned investors to small business owners. For those in the hospitality and travel sectors, understanding this new landscape isn’t just an advantage—it’s essential for survival and growth.

Quick Answer: What is the FintechZoom.com Economy?

- Real-time Financial Reporting: Get instant updates on market-moving events, from Federal Reserve interest rate decisions to global inflation data, without the traditional media delay.

- Simplified Economic Analysis: Complex topics like quantitative easing, DeFi (Decentralized Finance), and stock market fluctuations are broken down into clear, understandable language. No finance degree required.

- Fintech-Focused Insights: Stay ahead of the curve with dedicated coverage of the latest innovations in digital banking, cryptocurrency, payment processing, and other financial technologies that are reshaping commerce.

- Accessible Education: The content is specifically custom for a modern audience, including entrepreneurs, millennials, and Gen Z, who are eager to build their financial literacy.

- Global Economic Coverage: Understand how international events and technological shifts impact your business, whether you’re running a local café or a global travel service.

For a restaurant owner in a busy city like New York, this means instantly understanding how a shift in commodity prices could affect food costs. For a travel agent, it means anticipating how currency fluctuations might impact travel package pricing. The traditional lag in financial reporting is a thing of the past. The Fintechzoom.com economy delivers the insights you need, when you need them, in a format you can actually use to make informed decisions. As a spokesperson for FintechZoom aptly put it, “We strive to explain fintech. Our goal is to empower individuals and businesses with the knowledge they need to steer this rapidly changing landscape.”

Further Reading:

Why this matters in New York City

New York City is a global hub where local dining rooms and tour operators feel international forces first. The fintechzoom.com economy helps NYC-based entrepreneurs translate big headlines into neighborhood-level action.

- Foot traffic and booking patterns: When economic sentiment improves, Midtown lunch crowds and weekend reservations can surge. Monitoring consumer confidence and employment trends can help you staff accurately and time special menus or prix-fixe offers.

- Cost management: If wholesale food prices begin to climb, a Lower Manhattan bistro might shift toward seasonal, margin-friendly dishes, or introduce a limited-time menu that leans on stable-cost ingredients.

- Payments and tourism: With international visitors returning, adopting frictionless, tourist-friendly digital payment options reduces checkout friction and can lift average check value, especially in high-traffic areas like Times Square, SoHo, and the Theater District.

- Pricing cadence: Tying your price reviews to major data releases (like inflation reports) helps you adjust calmly and consistently rather than making rushed changes after margins are squeezed.

In short, the fintechzoom.com economy puts timely, digestible signals in your hands so you can align menus, packages, and staffing with what’s actually happening in the market—block by block, borough by borough. For The Dining Destination’s New York audience, that’s the difference between reacting late and leading with confidence.

What is the Fintechzoom.com Economy and Why It Matters

The phrase “fintechzoom.com economy” isn’t about a specific country’s GDP or a single market index. Instead, it encapsulates the entire digital media ecosystem centered around FintechZoom.com, a platform dedicated to making financial and economic information accessible, understandable, and actionable. It’s a holistic approach to understanding the global financial landscape, particularly where it intersects with financial technology (fintech). This new economy is built on the principle that financial knowledge shouldn’t be a privilege reserved for Wall Street analysts, but a tool available to everyone, from a student in Brooklyn to a small business owner in Manhattan.

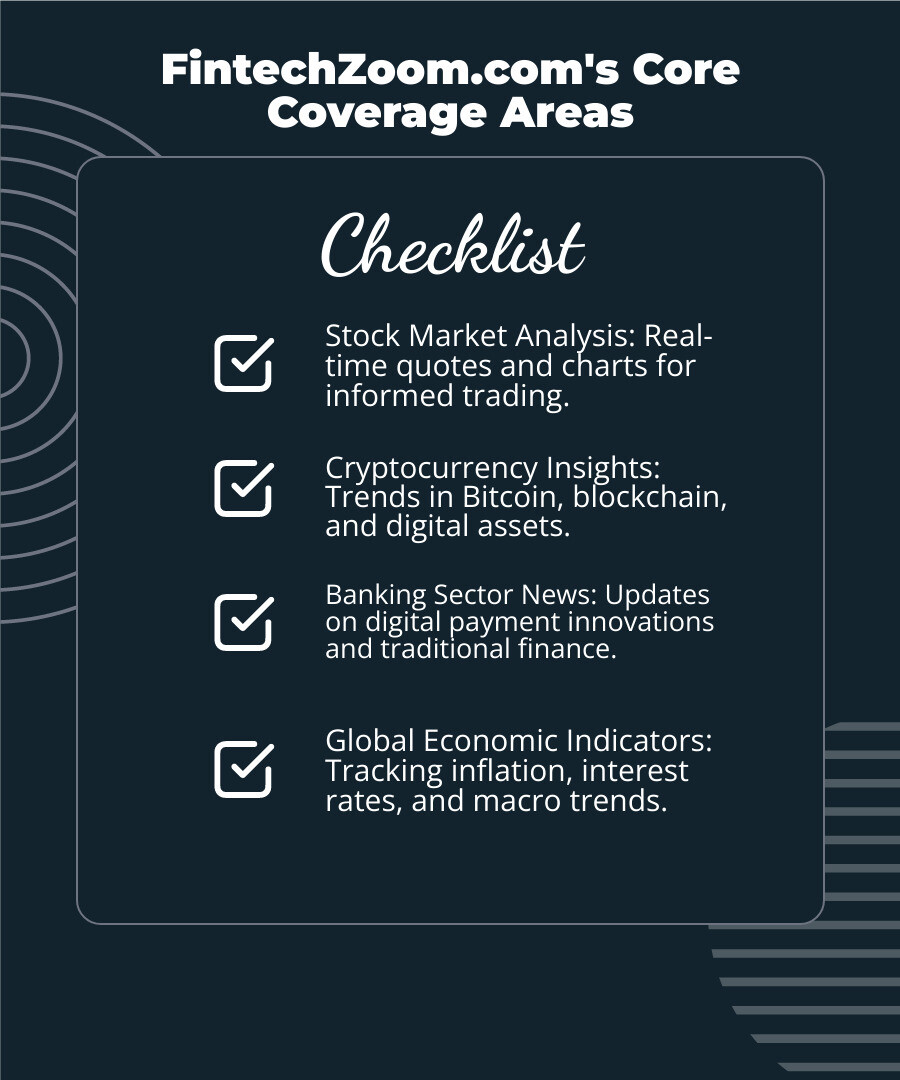

At its core, FintechZoom.com is a digital media outlet focusing on financial news, fintech trends, and economic analysis. It covers a broad spectrum of categories, from stock market updates and cryptocurrency insights to banking sector news, tech innovations in finance, and global macroeconomic indicators. This comprehensive coverage, delivered in real-time and plain language, defines the fintechzoom.com economy. It’s about empowering individuals with the information they need to make smarter financial decisions, whether they’re managing personal investments or navigating the economic challenges of running a business.

This concept stands apart from traditional economic ideas because it emphasizes accessibility and the practical application of financial knowledge. It’s designed to break down complex financial concepts – whether it’s the intricacies of Decentralized Finance (DeFi), the workings of blockchain, or the nuances of quantitative easing – into easily digestible formats. This user-centric approach to financial education makes it particularly appealing to a diverse audience, including Millennials and Gen Z investors, students studying finance, first-time crypto adopters, and tech-savvy entrepreneurs. For us, as guides in the culinary and travel world, this means we can finally grasp the economic forces shaping our businesses without needing a finance degree!

The financial technology (fintech) landscape is rapidly evolving, with new platforms and services emerging daily. The fintechzoom.com economy acknowledges this revolution, acting as a vital bridge that connects users with the financial tools and insights they need. It empowers individuals and businesses by fostering financial literacy and inclusion, regardless of their background or location. This is crucial in today’s world where understanding financial technology is essential for navigating the modern economic landscape. For more information on financial technology, you can explore this detailed overview of financial technology.

How It Differs from Traditional Financial Media

When we talk about the fintechzoom.com economy, we’re describing a distinct approach that sets it apart from traditional financial media outlets. Imagine trying to read a cookbook written for a five-star Michelin chef when all you want to do is whip up a quick, delicious weeknight meal. That’s often what traditional financial news feels like for many of us—dense, full of jargon, and aimed at a very specific, expert audience. FintechZoom.com, however, is like a recipe app that gives you simple, step-by-step instructions, complete with video tutorials and user reviews.

Here’s a quick comparison to highlight these differences:

| Criteria | Fintechzoom.com | Traditional Financial Media |

|---|---|---|

| Language | Simple, clear, and accessible. Avoids jargon. | Often complex, filled with technical terms. |

| Update Speed | Real-time or near-real-time updates. | Daily, weekly, or even monthly reports. |

| Target Audience | Millennials, Gen Z, entrepreneurs, new investors. | Seasoned investors, financial professionals, economists. |

| Focus | Heavily focused on fintech, crypto, and modern finance. | Broader focus on traditional markets, stocks, and bonds. |

| Format | Uses modern formats like infographics, short-form video, and social media integration. | Primarily long-form articles, print editions, and broadcast television. |

This modern approach means that a small business owner in a competitive market like New York City can quickly get up to speed on a new payment technology or understand the implications of a Federal Reserve announcement without having to sift through pages of dense analysis. It’s about delivering actionable intelligence, fast.

Applying Financial Insights to Your Hospitality or Travel Business

Understanding the fintechzoom.com economy isn’t just an academic exercise; it has real-world applications for your New York City business. For those in the hospitality and travel sectors, staying informed can be the difference between thriving and just surviving in a competitive market.

- Tracking Consumer Spending Trends: By analyzing reports on consumer confidence, you can anticipate demand in specific boroughs. For example, if reports indicate a rise in discretionary spending, a SoHo restaurant might launch a premium tasting menu, while a travel agency could promote luxury weekend getaways from the city.

- Understanding Inflation’s Impact: Inflation directly affects the cost of goods, from ingredients sourced for a Brooklyn eatery to fuel for tour buses leaving Manhattan. By monitoring inflation data and expert analysis on platforms like FintechZoom, you can adjust your pricing strategies proactively, rather than reactively, protecting your profit margins without alienating your local clientele.

- Navigating Global Payment Systems: The rise of digital wallets and international payment platforms is changing how customers pay, especially with tourists returning to NYC. Staying informed allows you to adopt the right payment solutions, making transactions smoother for international visitors in Times Square and tech-savvy locals in the East Village.

- Identifying Investment Opportunities: Whether you’re looking to expand your business in Queens or invest in new kitchen equipment in the Bronx, understanding the broader economic climate is crucial. Insights from the fintech world can reveal new funding opportunities relevant to the New York market.

By leveraging the accessible information within the fintechzoom.com economy, you can make smarter, data-driven decisions that strengthen your business’s financial health. For more on how to apply these principles, check out our guide on Fintechzoom.com.

A New York City playbook: Turning insights into action

Use the fintechzoom.com economy as your always-on radar and build a simple operating rhythm around it:

- Set calendar reminders for major economic releases (such as central bank announcements and inflation updates) and schedule a 15-minute review to decide whether to adjust menus, packages, or staffing.

- Pair macro signals with store-level KPIs: track food cost percentage, reservation lead time, average check, and revenue per available seat hour. When input costs rise, consider portion tweaks, seasonal substitutions, or limited-time offers to protect margins without surprising guests.

- For travel planners, watch currency movements and airfare trends alongside demand signals from your inquiries. When volatility increases, offer clear pricing windows and early-booking incentives to lock in value for clients.

- Keep payments flexible. Contactless options and global-friendly digital wallets reduce friction for tourists, especially around Midtown, the Financial District, and museum corridors where impulse purchases are common.

A quick hypothetical example: An NYC café sees commentary that discretionary spending is softening and notices a rise in certain ingredient costs. Instead of across-the-board price hikes, the team introduces a weekday tasting flight that spotlights stable-cost items, nudges traffic to slower periods, and preserves guest satisfaction. That kind of nimble adjustment is exactly what the fintechzoom.com economy makes possible for local operators.