Why FintechZoom.com DAX40 is Your Gateway to German Market Success

At The Dining Destination, we help New York City food travelers and hospitality enthusiasts connect global markets to real-world dining experiences. Understanding how Germany’s economy moves can help you plan culinary trips, spot dining trends, and anticipate the cost of imported German ingredients in NYC. That’s where the Focus Keyphrase fintechzoom.com dax40 becomes useful: it’s your lens for tracking the companies and forces that shape Germany’s hospitality and consumer landscape.

For investors in New York City looking to diversify their portfolios internationally, FintechZoom.com DAX40 is the premier platform for tracking Germany’s top 40 publicly traded companies. This resource provides real-time data, expert analysis, and advanced tools to help you steer one of Europe’s most influential stock indices from anywhere in the world.

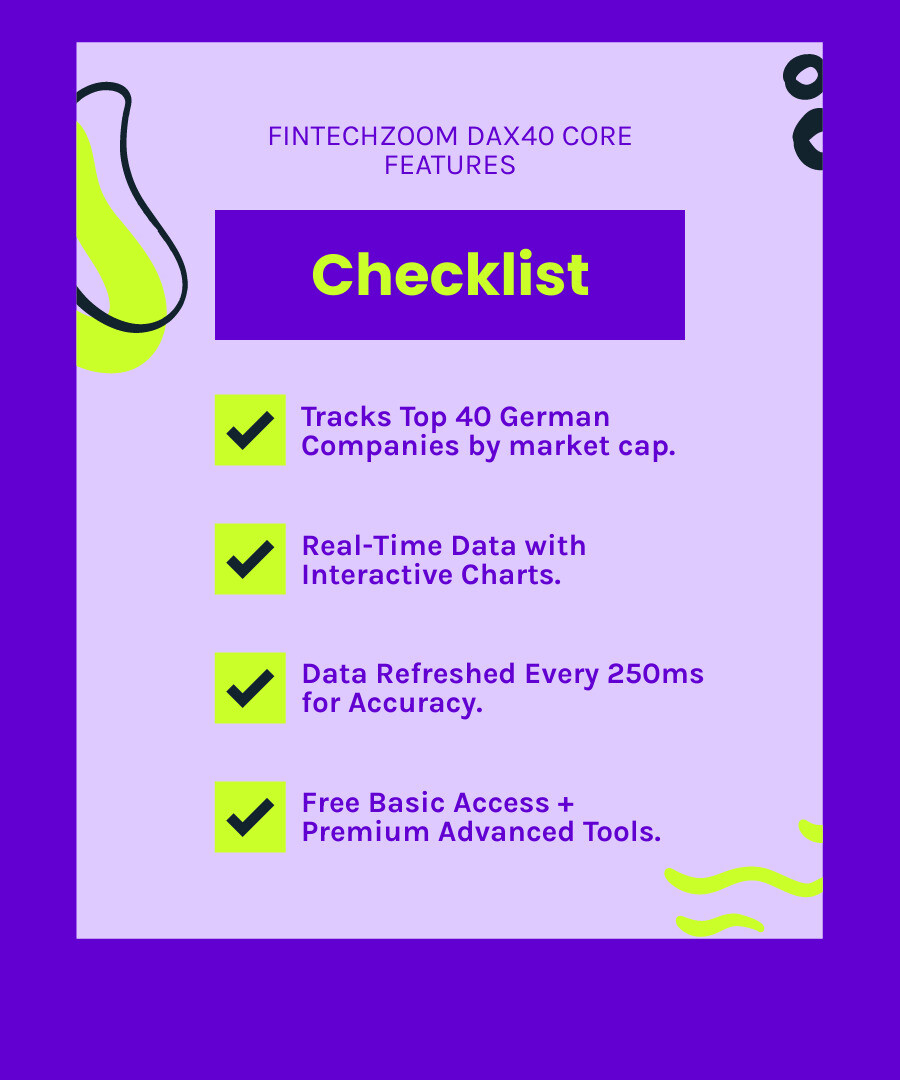

Quick Overview of FintechZoom.com DAX40:

- What it tracks: The 40 largest German companies by market capitalization

- Key features: Real-time data updates, interactive charts, technical indicators

- Free access: Basic charting, live quotes, and news feeds

- Premium tools: Advanced analytics, custom alerts, historical data

- Update frequency: Real-time data refreshed every 250 milliseconds

- Best for: Both beginner and experienced investors seeking German market exposure

The DAX40 serves as Germany’s economic heartbeat, reflecting the performance of major companies like Volkswagen, Siemens, SAP, and Allianz. These blue-chip stocks span diverse sectors including automotive, technology, finance, and chemicals, offering a broad look into Europe’s largest economy. For NYC diners and restaurateurs, shifts in these sectors can influence airfare and travel demand, food packaging and logistics innovations, and the pricing of European food and beverage imports.

FintechZoom.com transforms complex market data into actionable insights through user-friendly interfaces. The platform helps investors and globally minded food travelers understand market trends, set strategic alerts, and make informed decisions about German market developments that can ripple into travel costs and dining trends.

Whether you’re tracking individual company performance or analyzing broader economic trends, FintechZoom.com DAX40 provides the tools and transparency needed for successful investing in Germany’s premier stock index—and practical context for planning culinary journeys between New York City and Germany.

Understanding the DAX40: Germany’s Economic Powerhouse

For a New York City investor and food traveler, understanding the DAX40 is key to tapping into Europe’s largest economy—and to contextualizing how economic shifts may affect travel budgets, hospitality trends, and the cost of German specialties you enjoy in NYC. This powerful index tracks the 40 largest and most actively traded companies on the Frankfurt Stock Exchange, offering a snapshot of Germany’s economic health.

These aren’t just any companies; they’re Germany’s blue-chip stocks—corporate giants that shape global industries. Expanded from 30 to 40 companies in 2021, the index now provides a more complete picture of Germany’s diverse economy. Its sector diversification across automotive, technology, finance, and chemicals makes it an economic barometer for Europe. Because Germany is a major exporter, the DAX40 is also sensitive to global influence and international trade, making it a crucial indicator for globally-minded investors and culinary travelers planning trips or sourcing products.

Why the DAX40 is Crucial for Investors

For investors seeking international exposure, the DAX40 offers several advantages. The high liquidity of its companies means shares can be bought and sold easily. Strict German reporting rules ensure transparency, giving you detailed financial information. Furthermore, the index offers growth potential as many of its companies are global leaders expanding into new markets.

Most importantly for The Dining Destination audience in NYC, the DAX40 reflects Germany’s export-driven economy and strong economic foundation, factors that can influence airfare and hotel pricing, restaurant equipment and packaging innovations, and the availability and cost of imported wines, beers, and pantry staples. For deeper insights into current market trends, explore our comprehensive analysis at market trends.

Key Companies Driving the Index

The DAX40 is composed of international powerhouses. Here are a few examples:

- Volkswagen leads the automotive sector with its push into electric vehicles.

- Siemens represents the technology sector, focusing on industrial automation and digitalization.

- SAP is a software giant that helps businesses manage operations. In 2024, it accounted for a significant portion of the DAX40’s gains.

- Allianz is a global insurance and asset management firm in the financial services sector.

- BASF anchors the chemical industry, focusing on sustainable and innovative materials.

These companies, among others, create a mix of industrial strength and modern innovation. Their performance tells the story of Germany’s adaptation in global markets and can indirectly shape food and travel experiences—from supply-chain reliability to hospitality tech you encounter on the road. For detailed company information, visit Bloomberg’s DAX index page.

FintechZoom.com DAX40 provides the tools to track these influential companies and make informed decisions.

How FintechZoom.com DAX40 Provides Best Market Insights

For an investor in New York City—and for food and travel enthusiasts planning German culinary trips—navigating the German market can feel overwhelming. FintechZoom.com DAX40 acts as your guide, changing complex market information into clear, actionable insights that can inform both investment choices and practical trip planning (like when to book flights or expect shifts in imported ingredient prices).

What sets the platform apart is its ability to deliver real-time market data with a user-friendly interface suitable for all experience levels. It provides comprehensive coverage and expert analysis that explains why market trends are happening, not just what is happening. This approach makes FintechZoom.com DAX40 an invaluable resource for anyone serious about German market investing—and for NYC-based travelers and restaurateurs who want macro context around travel costs and sourcing decisions. For those interested in exploring broader economic trends, you’ll find valuable insights at More info about the economy.

Key Features and Tools for DAX40 Analysis

FintechZoom.com DAX40 is packed with the tools you need for market analysis:

- Advanced charting tools: Customize your view to examine trends across different timeframes.

- Technical indicators: Use RSI, MACD, and moving averages to spot potential turning points.

- Real-time accuracy: Data is refreshed every 250 milliseconds, which is critical in fast-moving markets.

- Historical data archives: Back-test trading strategies using decades of market information.

- Custom alerts: Receive instant notifications for price targets or significant market movements.

- Comparative performance analysis: Benchmark the DAX40 against other global indices to see the bigger picture.

Benefits for Investors Using fintechzoom.com dax40

Using FintechZoom.com DAX40 offers tangible benefits:

- Improved decision-making: Confidently make informed choices with comprehensive data and expert insights.

- Accessibility across devices: Monitor markets from anywhere, a must for a busy New Yorker’s lifestyle. Your watchlists and alerts stay synchronized.

- Educational resources: A user-friendly interface and detailed guides make the complexities of DAX40 investing accessible to everyone.

- Back-testing strategies: Test your investment approaches with historical data before risking capital.

- Real-time accuracy: Work with the most current market conditions, providing a reliable foundation for your analysis.

For The Dining Destination community, these same tools help frame when to plan food trips to Germany, and when NYC restaurants might reevaluate German wine lists or specialty imports based on broader economic momentum.

Strategies and Options for Trading the DAX40

Successful DAX40 trading requires a thoughtful approach, from understanding your investment options to developing a robust strategy. For investors in New York City—and for food travelers curious about how markets relate to travel and dining costs—this means finding the right tools and methods to access the German market and interpret its signals.

FintechZoom.com DAX40 serves as your guide, providing the essential tools and real-time data for each step. For those exploring diverse investment opportunities, our guides on real estate investing offer insights into alternative strategies.

Common Ways to Invest in the DAX40

There are various paths to gain exposure to the DAX40, each with different risks and rewards:

- Exchange-Traded Funds (ETFs): This is the most straightforward approach. A single purchase gives you diversified exposure to all 40 companies with lower costs and high liquidity, making it ideal for new investors.

- Contracts for Difference (CFDs) and Derivatives: These are for experienced traders. They allow you to speculate on price movements with higher leverage, which amplifies both potential gains and losses.

- Mutual Funds: A hands-off approach where professional managers make decisions for you, though typically with higher fees.

- Individual Stocks: This method offers direct engagement by investing in specific companies like Siemens or BASF. It requires more research but offers potentially higher returns.

Developing a Trading Strategy with fintechzoom.com dax40

Crafting a trading strategy requires the right tools and techniques. FintechZoom.com DAX40 provides everything you need.

- Research Companies: Use the platform’s detailed profiles and financial reports to understand each business.

- Choose a Broker: Select a trustworthy broker that provides access to DAX40 trading.

- Combine Analysis: Use fundamental analysis (reviewing financials and economic news) to find strong companies and technical analysis (using charts and indicators like RSI/MACD) to time your entry and exit points.

- Monitor Continuously: Stay informed with real-time data and news feeds. Markets change quickly, and staying informed is key.

- Back-Test Your Strategy: Use historical data on FintechZoom.com DAX40 to test your approach before risking real money.

- Manage Risk: Implement stop-loss orders to limit losses and diversify your portfolio.

Even if you’re primarily a food traveler or NYC restaurateur, this structured approach mirrors how to evaluate timing for culinary trips, budget for menu updates using imported German ingredients, and stay alert to macro shifts that can influence hospitality demand.

Managing Risks and Making Informed Decisions

Investing in the DAX40 offers great potential, but it requires smart risk management, especially for an investor based in New York City looking at overseas markets. The biggest challenge is often managing our own emotions. Fear and greed can lead to poor decisions, making emotional discipline a critical skill. The importance of emotional discipline in trading cannot be overstated.

Beyond psychology, the DAX40 has specific risks to consider:

- Market Concentration Risk: A few large companies, like SAP, can heavily influence the index’s performance. If these giants stumble, the entire index is affected.

- Geopolitical Uncertainty: As Germany’s economy is export-driven, the DAX40 is sensitive to trade tensions and global political shifts.

- Macroeconomic Pressures: Interest rate changes from the European Central Bank, inflation, and other economic trends directly impact DAX40 companies.

This is where FintechZoom.com DAX40 becomes invaluable for risk management. The platform provides the information needed to make smart choices. You can set price alerts for stop-loss levels, monitor volume spikes, and analyze historical volatility to understand potential price swings. Real-time data and company reports help you spot emerging risks.

For The Dining Destination community in NYC, these same risk cues offer practical context: currency moves can affect the cost of a Germany-bound food tour, and input-price swings can influence what shows up on local menus (and at what price). The platform’s educational resources explain risk management techniques like portfolio diversification and using stop-loss orders. By combining the analytical power of FintechZoom.com DAX40 with disciplined risk management, you can steer the German market with greater confidence. The goal isn’t to eliminate risk, but to understand it and ensure you’re compensated for it.

Frequently Asked Questions about the DAX40 and FintechZoom

Exploring fintechzoom.com dax40 can bring up questions. We’ve gathered the most common ones to help clear up any confusion about this powerful financial platform—and how it can be useful context for NYC-based food travelers and hospitality enthusiasts.

Is it free to use FintechZoom.com to track the DAX 40 index?

Yes, FintechZoom.com offers significant free access. Basic charting tools, live quotes, and news feeds are available at no cost, providing real-time insights into the German market. For serious traders, a premium subscription open ups advanced features like comprehensive historical data, sophisticated analytical tools, and custom alerts.

How often is the DAX 40 data updated on FintechZoom?

Timing is everything in the market. FintechZoom.com delivers real-time updates, refreshing DAX40 data approximately every 250 milliseconds. This near-zero latency is crucial during fast-moving market conditions, ensuring you have the most current information for your investment decisions.

Is FintechZoom.com DAX40 suitable for beginner investors?

Absolutely. FintechZoom.com DAX40 is ideal for newcomers, including those investing from cities like New York. The platform features a user-friendly interface that simplifies complex financial data. It also provides extensive educational resources, such as market analysis and step-by-step guides, to help new investors understand the DAX40’s intricacies. The combination of intuitive design and learning materials creates a perfect environment for building investment confidence—and for food and travel readers seeking macro context for planning Germany-focused culinary experiences.

Conclusion

The DAX40 is the pulse of Germany’s economy and a key window into European market dynamics. For an investor in New York City—and for culinary travelers and restaurateurs—it represents a compelling source of context for international diversification, travel budgeting, and understanding how economic trends may influence dining experiences both in Germany and back home in NYC.

FintechZoom.com DAX40 makes this complex financial data accessible and actionable. The platform’s real-time updates, advanced tools, and educational resources empower you to make informed decisions. It democratizes access to professional-grade market analysis, putting powerful tools like custom alerts and historical data at your fingertips.

At The Dining Destination, we believe in empowering people with knowledge, whether it’s about global cuisine or global markets. The principles are similar: do your research, understand the landscape, and learn as you go. Use the insights from the Focus Keyphrase fintechzoom.com dax40 to time food trips to Germany, adjust German wine lists in NYC, or simply deepen your appreciation of the forces shaping the dining world.

FintechZoom.com DAX40 provides the tools for this journey, but your dedication is the key ingredient. Ready to expand your knowledge further? Explore our comprehensive resource guides to help you make more informed decisions in every aspect of your life.