Why Understanding FintechZoom.com Business Matters for Modern Investors

FintechZoom.com business is a leading financial technology news platform providing market analysis, real-time insights, and educational content to global investors. Founded in 2018, the platform combines traditional financial reporting with cutting-edge AI technology.

From our perch in New York City at The Dining Destination, staying on top of tools like fintechzoom.com business isn’t just for Wall Street—it’s increasingly essential for the food and travel community. Restaurant stocks, hospitality REITs, food commodities (coffee, cocoa, grains), airline fares, and foreign exchange all shape culinary travel budgets and dining trends. Knowing how to evaluate a platform that tracks these drivers helps NYC travelers, food entrepreneurs, and hospitality investors make smarter, locally grounded decisions.

Key Facts About FintechZoom.com Business:

- Core Service: Financial news platform focusing on fintech developments and market analysis

- Founded: 2018

- Coverage Areas: Stocks, cryptocurrencies, forex, commodities, and economic reports

- Technology: AI and machine learning for trend identification and predictive insights

- Target Users: Retail traders, institutional investors, fintech professionals, and students

- Pricing: Free basic access, Premium ($19.99/month), Pro ($39.99/month)

The financial world moves at an unprecedented pace. With stocks swinging in minutes and fintech startups disrupting traditional banking, access to reliable, real-time financial intelligence is essential for informed investment decisions—especially when those moves influence NYC’s dining economy and the cost of culinary travel.

FintechZoom stands out by using AI and machine learning to analyze data and identify market trends early. It serves everyone from beginners needing educational resources to professionals requiring advanced analytics.

This is particularly relevant as the platform addresses modern financial complexity, from the rise of neobanks like Revolut and Chime to the 24/7 nature of cryptocurrency markets—and how these affect travel spending, tipping policies, reservations, and payment experiences across New York and beyond.

Quick look at fintechzoom.com business:

What is FintechZoom.com Business? A Deep Dive into its Core Services

At its core, FintechZoom.com business is a financial news platform that translates complex market data into actionable investment wisdom. It serves a diverse audience, from retail traders and institutional investors to fintech professionals, by delivering the market analysis and insights they need. The platform focuses on providing real-time information that users can act on. For those interested in specific stock analysis, our More info about Hims Stock Analysis is an example of the detailed insights such platforms provide.

The Core Offerings of the fintechzoom.com business

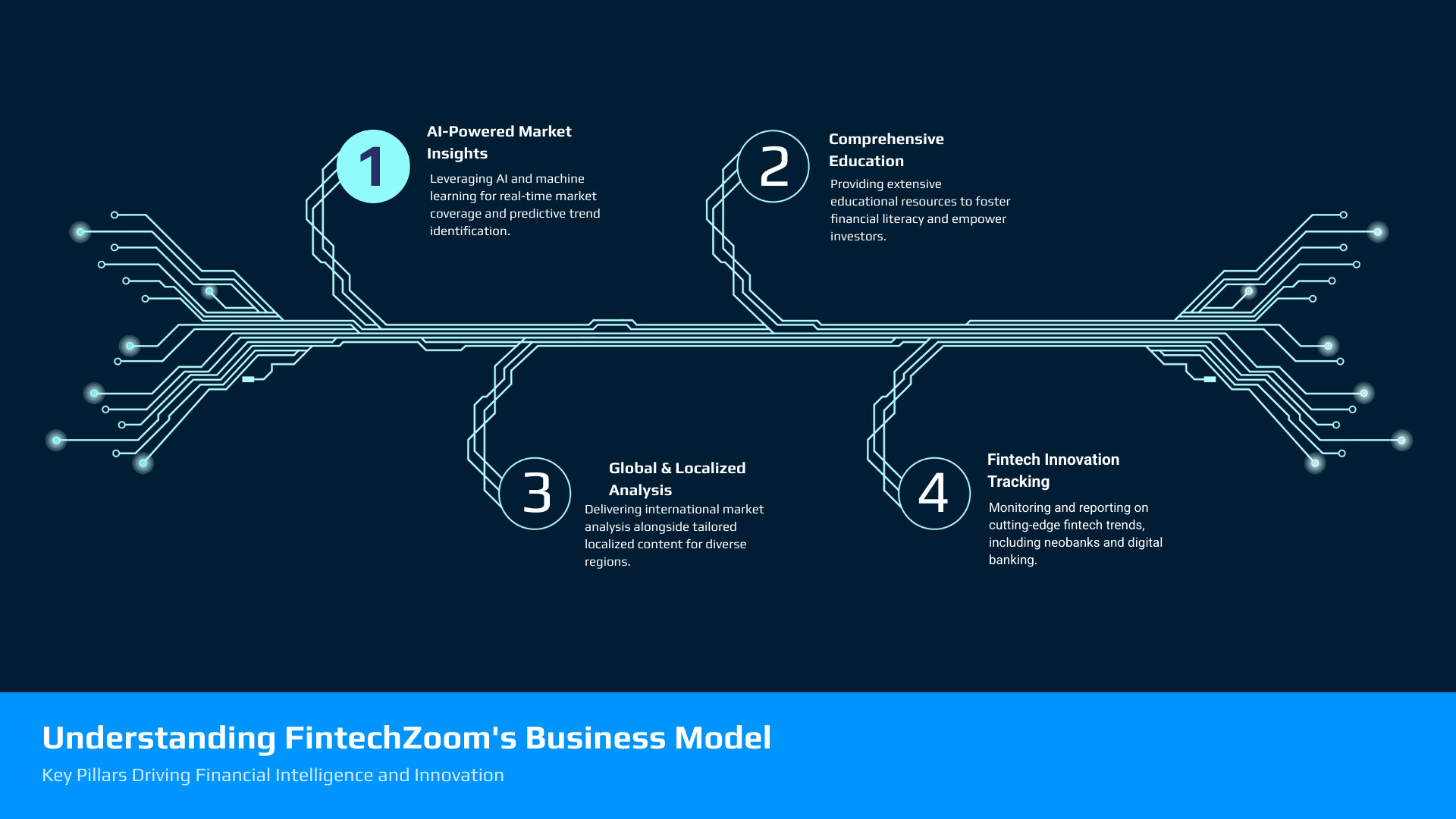

The FintechZoom.com business model delivers comprehensive news coverage across multiple financial sectors, focusing on what matters most to investors.

Stock analysis is a major pillar, with detailed reports on emerging and established companies that explain market movements.

Cryptocurrency coverage offers real-time updates on digital assets, market trends, and regulatory news. The crypto world never sleeps, and neither does their coverage. Our Fintechzoom.com Bitcoin Price Complete Guide offers additional insights into this space.

Forex and commodities analysis provides a complete view of global financial movements, which can significantly impact investment strategies.

Their economic reports offer crucial macroeconomic context, helping investors understand the bigger picture behind market shifts.

Who Benefits from FintechZoom?

The FintechZoom.com business model serves different user groups effectively.

Retail traders benefit from real-time data and clear analysis for quick, informed decisions, which is crucial in volatile markets.

Institutional investors value the comprehensive coverage and data-driven insights for managing large-scale portfolios.

Fintech professionals use the platform to stay current on industry innovations, competitive developments, and regulatory changes.

Students and educators leverage the platform’s accessible resources to understand complex financial topics.

Businesses gain insights into the shift toward digital financial services to inform their own strategic evolution.

For our NYC-based readers at The Dining Destination, this also includes culinary travelers, restaurateurs, and hospitality operators who track restaurant stocks, travel-sensitive FX rates, food-and-beverage commodities, and consumer spending trends that shape dining demand across New York’s neighborhoods.

The Technology Powering FintechZoom: AI, Real-Time Data, and User Experience

Picture this: while you’re sipping your morning coffee, financial markets across the globe are already buzzing with activity. Currency rates shift, stock prices fluctuate, and breaking news can send ripples through entire sectors within minutes. This is where FintechZoom.com business truly shines – by using the power of artificial intelligence and machine learning to make sense of this financial chaos.

Think of it like having a super-smart friend who never sleeps and can read thousands of financial reports in the time it takes you to finish that coffee. The platform doesn’t just collect information – it actually thinks about what it all means. This isn’t just fancy tech talk; it’s the foundation that makes FintechZoom different from your typical financial news site.

We’ve witnessed how AI is Revolutionizing Content Creation With Lip Sync AI and Video Translation Tools, and in the financial world, this technology becomes even more powerful. It’s like upgrading from a bicycle to a sports car when it comes to processing financial data.

Leveraging AI for Smarter Financial News

Here’s where things get really interesting. FintechZoom.com business uses AI in ways that would make science fiction writers jealous. The platform’s artificial intelligence works around the clock, analyzing vast amounts of data that would take human analysts weeks to review. We’re talking about company earnings reports, global economic indicators, social media sentiment, and even weather patterns that might affect commodity prices.

The real magic happens with market trend identification. While most of us are still trying to figure out why a stock went up or down yesterday, FintechZoom’s AI is already spotting patterns that hint at what might happen next week. It’s like having a crystal ball, except this one runs on algorithms instead of mystical powers.

What really sets this apart is the platform’s ability to deliver early news alerts. Imagine getting a heads-up about a potential market shift before it becomes front-page news. The AI doesn’t just report what happened – it offers data-backed predictions by recognizing patterns that human eyes might miss.

This pattern recognition capability means users aren’t drowning in raw data. Instead, they get digestible insights that can actually guide their investment decisions. It’s the difference between being handed a phone book and being given the exact number you need to call.

For The Dining Destination’s NYC audience, this helps connect the dots between macro shifts and everyday dining: from FX moves that change the cost of international food tours, to commodity swings in coffee, cocoa, or wheat that influence menu pricing, to hospitality earnings updates that signal reservation and travel demand across New York.

A Focus on User-Friendly Design

Now, here’s the thing – having the world’s smartest AI is pretty useless if you need a computer science degree to understand what it’s telling you. That’s why FintechZoom.com business puts serious thought into making their platform as user-friendly as possible.

The intuitive interface feels natural from the moment you land on the homepage. No hunting through confusing menus or trying to decode cryptic symbols. The easy navigation means whether you’re a Wall Street veteran or someone who just opened their first investment account, you can find what you need without breaking a sweat.

What we really appreciate is the platform’s commitment to desktop and mobile accessibility. Whether you’re checking market updates during your lunch break on your phone or diving deep into analysis at your home computer, everything works seamlessly. The clear data presentation takes complex financial information and turns it into something you can actually understand and use.

This attention to user experience reminds us of the importance of making technology accessible to everyone. Just like we aim to make our guides easy to follow, platforms like FintechZoom succeed because they remember that behind every screen is a real person trying to make smart financial decisions. Speaking of helpful tools, you might want to check out our Latest Online Tool Guide Zardgadjets for more insights on leveraging digital platforms effectively.

Comprehensive Market Coverage and Educational Empowerment

FintechZoom.com business excels by combining extensive global market coverage with a strong commitment to financial education. The platform understands that financial markets are interconnected and presents information that is both comprehensive and digestible. You can explore their market coverage in our guide on Fintechzoom.com Markets.

Their approach recognizes that global markets are interconnected. They focus on showing these connections rather than treating each market as a separate entity.

For The Dining Destination’s New York readers, those ripples show up in practical ways: airfare and hotel pricing that affect culinary travel, exchange rates that set daily budgets for dining abroad, and commodity trends (coffee, cocoa, seafood, grains) that influence menus from Midtown to Brooklyn.

Global Reach with a Local Touch

FintechZoom.com business makes global finance relevant by providing localized insights. Its international market analysis covers major indices, explaining the drivers behind market movements.

The platform focuses on regional market dynamics, understanding that a policy change in one country affects its markets differently than others. This custom content approach means you receive analysis that considers your specific market environment, offering more than a one-size-fits-all report. For NYC, that can mean connecting travel demand, hospitality earnings, and consumer spending to restaurant openings, reservation trends, and neighborhood dining hotspots.

Building Financial Literacy for All

A core strength of FintechZoom.com business is its dedication to financial literacy. The platform offers educational guides that explain complex concepts in plain English, making financial news accessible to everyone.

Tutorials and interactive webinars help users become more informed investors. There’s something valuable about hearing experts discuss market trends in real-time and being able to ask questions.

The content ranges from beginner guides that build knowledge step-by-step to advanced trading strategies for seasoned professionals. This educational focus aligns with our belief in empowerment through knowledge, similar to the insights in our 5Starsstocks.com Investing Tips. For New Yorkers in food and travel, that might mean understanding how to evaluate restaurant chains as investments, budget for culinary trips when the dollar strengthens or weakens, or follow consumer sentiment that affects dining demand across the city.

Analyzing the Future of Banking: FintechZoom’s Perspective on Neobanks

The banking world is changing rapidly, and FintechZoom.com business is an essential source for understanding these shifts. From our perspective in New York, it’s clear that digital-first banks, or neobanks, are revolutionizing how we manage money. FintechZoom’s coverage explains not just what is happening but why it matters when Navigating the fintech landscape. The platform excels at analyzing open banking and digital wallets; for more on crypto storage, see our Fintechzoom.com Bitcoin Wallet Complete Guide.

For culinary travelers and NYC restaurateurs, these changes are tangible: smoother cross-border payments for dining abroad, transparent FX rates when booking food tours, and faster settlement for restaurants integrating modern POS and reservation systems.

Key Neobanks and Open Banking Examples

FintechZoom.com business highlights key neobanks delivering real value. Standouts for 2024 include Chime for its fee-free model and Varo Bank, a chartered US neobank. Other major players solve traditional banking pain points like long waits and confusing fees.

FintechZoom also tracks major open banking implementations, which create frameworks for secure data sharing and extend consumer data rights beyond banking.

How FintechZoom Evaluates Neobanks

When FintechZoom.com business analyzes neobanks, it uses a comprehensive set of criteria that goes beyond surface-level metrics.

- Customer satisfaction: Assessed through user reviews, complaint data, and retention rates to gauge real-world performance.

- Financial health: Examined by analyzing business models, funding, and paths to profitability.

- Innovation: Focused on whether they are genuinely reimagining financial services, not just creating a prettier app.

- Security measures: Thoroughly evaluated, from encryption standards to fraud prevention systems, to ensure customer assets are protected.

- User-focused design: Judged on how well the service understands and meets customer needs, from account opening to customer support.

- Pricing transparency: Scrutinized to ensure claims of being fee-free are accurate under real-world conditions.

Applied locally, this framework helps NYC diners pick smarter travel cards and digital wallets—and helps restaurant operators assess which payment partners and banking tools can streamline cash flow and reduce fees.

The Future Outlook for the fintechzoom.com business

Looking ahead, FintechZoom.com business is positioned at the intersection of technology and financial opportunity. From our vantage point in New York, it’s clear that staying ahead of the curve is essential. The platform is evolving from a news source into a comprehensive financial intelligence hub.

This commitment to advancement is about providing users with tools that make a real difference. For more on the company, see More about Fintech Zoom, and for insights on AI’s impact, check our 5Starsstocks.com AI Complete Guide.

For New York’s hospitality and dining scene, that means earlier visibility into consumer spending shifts, travel demand patterns, and supply-chain pressures that influence menus, pricing, and reservation flows.

Future of the fintechzoom.com business: Technology and Expansion

The technological roadmap for FintechZoom.com business is ambitious. Key areas include blockchain integration for improved data security and transparency, and continued investment in improved data security against cyber threats. The platform is also expanding its green finance coverage to meet the demand for ESG analysis and is enhancing its fintech startup tracking to identify disruptive innovators early.

For NYC’s food ecosystem, deeper ESG and supply-chain visibility connects directly to sustainable dining—think traceable seafood, lower-waste kitchens, and resilient sourcing.

Anticipated Market Innovations

FintechZoom.com business is preparing to cover several anticipated market innovations. These include the rise of Central Bank Digital Currencies (CBDCs) and their impact on global trade and personal banking. The platform is also developing tools to track the evolution of Decentralized Finance (DeFi).

Looking further ahead, the platform is monitoring the potential impact of quantum computing on financial modeling and cybersecurity. Finally, it is preparing to cover the sophisticated ESG technology integration that will make sustainable investing more precise and accessible.

For travelers and restaurant operators across New York, these shifts could change everything from how guests pay at the table to how suppliers finance inventory—key reasons we evaluate platforms like fintechzoom.com business closely.

Frequently Asked Questions about FintechZoom’s Business

When discussing finances for culinary travel, questions about FintechZoom.com business often arise. Understanding the platform is helpful whether you’re planning a food tour or investing in restaurant stocks. Here are the most common questions.

What makes FintechZoom different from other financial news sites?

FintechZoom.com business stands out by using AI and machine learning to generate predictive insights and identify trends early. Unlike sites that only report past events, FintechZoom offers forward-looking analysis. Its unique combination of real-time news, deep fintech coverage on topics like neobanks, and broad educational resources provides a distinct advantage for making better financial decisions. For NYC readers focused on dining and travel, that means clearer context on hospitality earnings, commodities influencing menus, and FX shifts that affect culinary itineraries.

Is FintechZoom suitable for beginner investors?

Yes, FintechZoom.com business is ideal for beginners. It offers a wealth of educational resources, including tutorials and plain-language guides that break down complex financial topics. The platform is designed to build financial literacy and confidence for new investors without overwhelming them with jargon. It provides a patient, step-by-step approach to understanding finance. New Yorkers planning food trips or exploring restaurant stocks can use these guides to connect market moves with practical budgeting and investing.

What specific markets does FintechZoom cover?

FintechZoom.com business provides extensive coverage across the financial landscape. This includes detailed stock analyses of individual companies and major indices, real-time cryptocurrency coverage for the 24/7 digital asset market, and comprehensive forex and commodities analysis. Additionally, its economic reports and forecasts provide crucial context on broader market trends, helping to connect the dots between different financial sectors. For our culinary travel audience, the FX and commodity sections are especially useful for planning trip budgets and understanding food cost pressures in New York and abroad.

Conclusion

In today’s financial landscape, staying informed is essential. FintechZoom.com business has established itself as a vital tool for navigating the complexities of modern finance and investing.

What we’ve found is that the platform’s AI-powered insights offer a forward-looking perspective, helping users anticipate market movements. From our view in New York City, we appreciate how FintechZoom.com business connects global market trends to local realities. Its commitment to financial education empowers users with the knowledge needed to act confidently.

The future for FintechZoom.com business looks bright as it accepts emerging technologies like blockchain, expands into sustainable finance, and deepens its neobanking analysis. These innovations are the building blocks of tomorrow’s financial world.

For us at The Dining Destination, understanding such platforms highlights the growing intersection of technology, finance, and even our culinary journeys. Having reliable, tech-driven insights is invaluable, whether planning a trip or building a portfolio.

We encourage you to Explore more expert resource guides on our site to continue your journey of findy. Knowledge, in finance or food, is always a worthwhile investment.