Why FintechZoom.com Bitcoin Mining Coverage Matters for Digital Finance

FintechZoom.com bitcoin mining has become a go-to resource for understanding one of the most complex areas of cryptocurrency. Whether you’re curious about mining profitability, hardware requirements, or market trends, this platform breaks down technical concepts into digestible insights.

Quick Overview of FintechZoom Bitcoin Mining Coverage:

- Real-time mining profitability analysis using tools like the Fractal Bitcoin Mining Calculator

- Hardware insights covering ASIC miners, GPU rigs, and energy efficiency metrics

- Market trend analysis including hash rate data and mining difficulty adjustments

- Price predictions for Bitcoin with bull, bear, and neutral scenarios through 2025

- Educational resources explaining mining basics, legal considerations, and environmental impact

- Comparison tools showing how mining operations stack up against traditional investments

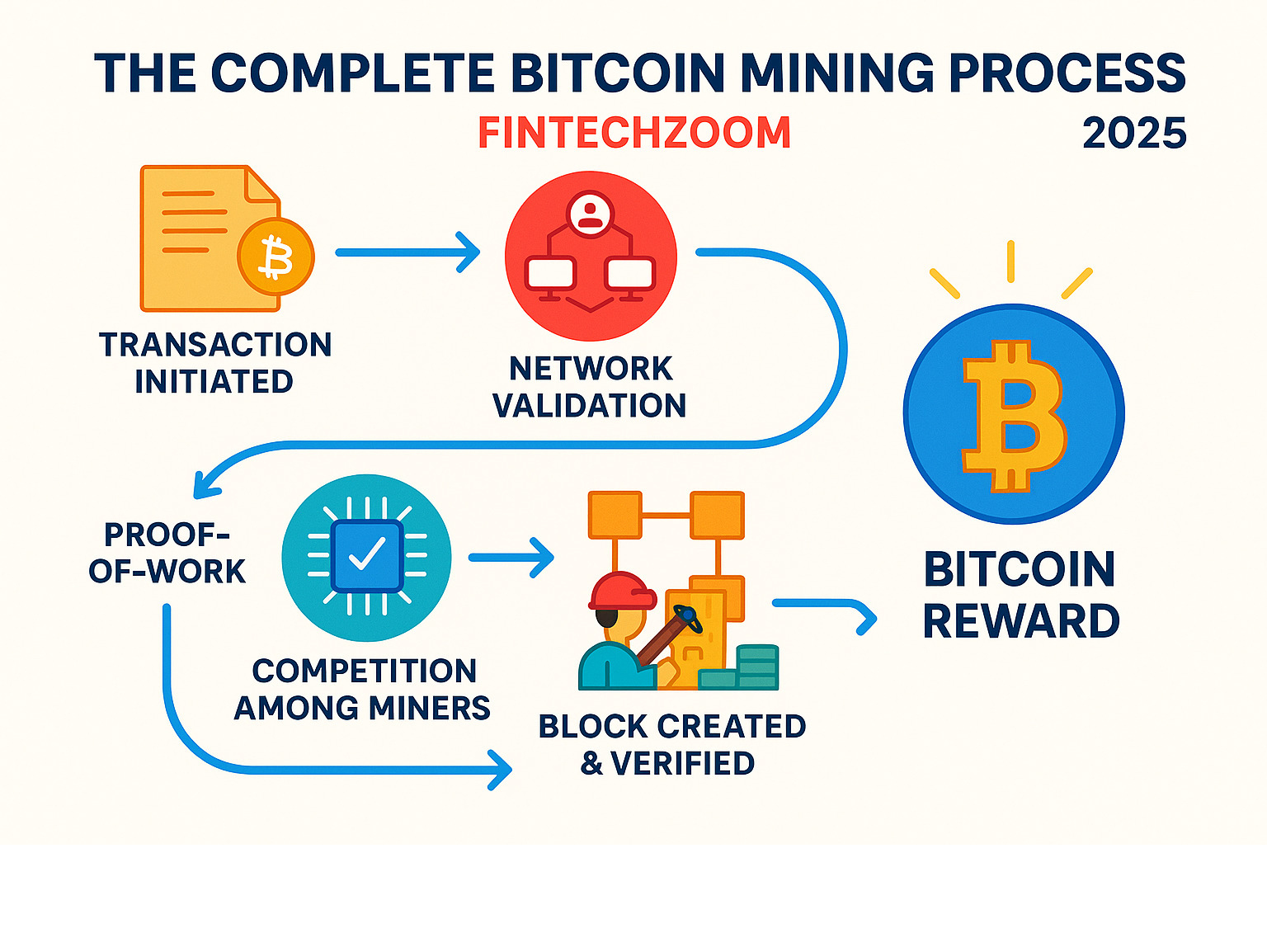

Bitcoin mining validates transactions on the blockchain network through powerful computers solving complex mathematical problems. Miners earn Bitcoin rewards (currently 3.125 BTC per block after the 2024 halving) for successfully adding new blocks to the chain.

FintechZoom stands out by making this technical world accessible. The platform combines real-time data with expert analysis, helping both beginners and experienced miners make informed decisions. Their coverage spans everything from mining pool analysis to regulatory updates affecting the industry.

The U.S. now controls 38% of the global Bitcoin hash rate, with major companies like Marathon Digital Holdings and Riot Platforms leading the charge. Mining profitability depends heavily on electricity costs – ideally below $0.05/kWh – and hardware efficiency.

As institutional investment grows and Bitcoin’s market cap exceeds $1.2 trillion, understanding mining becomes crucial for anyone interested in cryptocurrency’s infrastructure and economics.

Fintechzoom.com bitcoin mining word roundup:

Understanding FintechZoom.com Bitcoin Mining Coverage

Think of fintechzoom.com bitcoin mining coverage like finding a hidden gem restaurant – once you find it, you realize it’s exactly what you’ve been looking for. FintechZoom serves as your personal guide through the complex world of cryptocurrency mining, breaking down intimidating technical jargon into bite-sized, digestible information.

What makes FintechZoom special is its comprehensive approach to Bitcoin mining coverage. The platform offers free access to Bitcoin price tracking, news, and market analysis, but goes deeper than surface-level information. They focus specifically on Bitcoin rather than spreading thin across thousands of cryptocurrencies, allowing for more detailed insights and better specialized tools.

The platform shines when explaining complex financial topics in simple terms. This beginner-friendly approach doesn’t mean they skimp on depth – they cover everything from basic mining concepts to advanced profit maximization strategies. Their guided approach helps you build understanding gradually, much like learning to appreciate fine cuisine by starting with familiar flavors.

FintechZoom’s coverage includes detailed market analysis, Bitcoin forecasts, and the latest industry updates. They pay special attention to major events like the Bitcoin halving, which recently reduced mining rewards to 3.125 BTC per block in April 2024. This event occurs approximately every four years and significantly impacts mining profitability and Bitcoin’s supply dynamics. For deeper insights into this crucial event, check out Fintechzoom.com Bitcoin Halving.

How FintechZoom Provides Insights into Mining Hardware and Trends

Understanding mining hardware through fintechzoom.com bitcoin mining is like learning about professional kitchen equipment – the right tools make all the difference. FintechZoom demystifies the specialized world of mining hardware, explaining how Application-Specific Integrated Circuits (ASICs) have become the backbone of modern Bitcoin mining.

These aren’t your typical computers. The Bitmain Antminer S21 Hyd operates at 255 TH/s, while the MicroBT Whatsminer M60 reaches an impressive 288 TH/s. These machines require serious investment – anywhere from $3,000 to $20,000 for initial hardware – but they’re designed specifically for cryptocurrency mining, far outperforming traditional computers or GPU rigs.

FintechZoom tracks the evolution from casual mining on old gaming PCs to today’s enterprise-grade setups. They provide detailed technical specifications and efficiency metrics, helping you understand what makes these powerful machines tick. For more comprehensive information about these mining tools, explore Specialized mining hardware.

The platform also highlights major mining companies shaping the industry. Marathon Digital Holdings (MARA) leads with 24.7 exahash capacity, followed by Riot Platforms (RIOT), Cipher Mining (CIFR), and Core Scientific (CORZ). These companies are driving U.S. market dominance – America now contributes 38% of global network power.

A significant trend FintechZoom emphasizes is the renewable energy shift. Many U.S. mining companies are embracing solar, wind, and hydroelectric power to reduce costs and address environmental concerns. This sustainability focus becomes crucial when you consider that Bitcoin mining uses about 121 terawatt-hours annually worldwide.

Analyzing Profitability with fintechzoom.com bitcoin mining Tools

Profitability analysis is where fintechzoom.com bitcoin mining tools really shine. Their Fractal Bitcoin Mining Calculator stands out as a comprehensive tool for estimating potential returns using real-time hash rate and market condition data.

Mining profitability depends on several critical factors that FintechZoom helps you steer. Electricity costs often make or break mining operations – the break-even rate remains at $0.05/kWh or lower. Bitcoin’s volatile price directly impacts profitability, while network difficulty increases as more miners join, requiring more computational power to stay competitive. Hardware efficiency also plays a crucial role, as newer ASICs produce more hashes per watt, translating to lower operating costs and higher potential profits.

Key inputs for profitability calculation include:

- Your ASIC miner’s hash rate (measured in TH/s)

- Power consumption (measured in Watts)

- Local electricity costs ($/kWh)

- Pool fees (typically 1-3% of mining rewards)

- Current Bitcoin price

- Network difficulty and block reward

FintechZoom enables multiple scenario analysis to understand potential revenue and break-even timelines. This comprehensive approach helps you make informed investment decisions based on real data rather than guesswork. They also track broader market trends that influence profitability, connecting to resources like Fintechzoom.com Markets.

How FintechZoom’s Data Compares to Other Platforms

In digital finance, accuracy and reliability matter as much as freshness in a quality restaurant. FintechZoom provides real-time Bitcoin data updates, refreshing information continuously with sub-second updates during active trading hours. They use sophisticated algorithms to filter anomalies and aggregate data from multiple exchanges.

While FintechZoom offers comprehensive real-time updates, there can be slight delays in data aggregation that might impact high-frequency trading decisions. The data source transparency isn’t always as clear as some established platforms, though their focus remains on providing reliable, actionable information.

FintechZoom’s unique advantage lies in its Bitcoin specialization and simplified explanations. Rather than covering thousands of cryptocurrencies superficially, they dive deep into Bitcoin’s ecosystem. This focused approach, combined with beginner-friendly explanations and honest risk warnings, makes them particularly valuable for newcomers to crypto mining.

Their strength is making complex topics accessible while maintaining accuracy. For additional cryptocurrency tracking resources beyond FintechZoom, you can explore More on cryptocurrency tracking for broader market perspectives.

Market Analysis and Price Predictions According to FintechZoom

Just like watching the food scene evolve in Manhattan – where yesterday’s trend becomes today’s staple – Bitcoin’s market moves with fascinating patterns that fintechzoom.com bitcoin mining enthusiasts need to understand. The platform provides comprehensive market analysis that helps us make sense of this digital currency’s wild ride.

Bitcoin’s market cap consistently hovers above $1.2 trillion, commanding roughly 59-60% dominance of the entire cryptocurrency market. That’s like being the pizza of the crypto world – it might not be fancy, but everyone wants a slice.

FintechZoom highlights how institutional investment has become Bitcoin’s secret sauce. U.S. spot Bitcoin ETFs are pulling in serious money – we’re talking $773 million in net inflows during peak weeks. Pension funds, insurance companies, and major corporations are finally treating Bitcoin like a legitimate investment rather than internet funny money.

The macroeconomic environment plays a huge role too. When the Federal Reserve adjusts interest rates (currently sitting at 4.25–4.5% with three cuts expected by year-end 2025), it ripples through Bitcoin’s price faster than news of a restaurant closure spreads through food Twitter. Global tensions also matter – geopolitical events like the Israel-Iran situation in June 2025 briefly pushed Bitcoin below $103,000, proving that even digital gold gets nervous during uncertain times.

Bitcoin’s appeal as a hedge against inflation and its “digital gold” status become especially relevant when traditional markets get shaky. For more context on Bitcoin’s fundamentals, check out the comprehensive overview at Bitcoin.

Key Factors Influencing Bitcoin’s Price

Understanding what moves Bitcoin’s price is like learning the ingredients in your grandmother’s secret recipe – each element matters, and they all work together.

Supply and demand dynamics form the foundation. With only 21 million Bitcoin ever to exist, scarcity is built into the system. Every four years, halving events cut mining rewards in half, making new Bitcoin even harder to come by. The recent April 2024 halving dropped rewards to 3.125 BTC per block, creating natural upward pressure on prices.

Regulatory developments can make or break market sentiment overnight. Positive news from regulators tends to boost confidence, while uncertainty or crackdowns can trigger sell-offs faster than a health inspector shutting down a restaurant.

Whale activity – those massive transactions by individuals or entities holding significant Bitcoin amounts – creates short-term volatility that FintechZoom carefully tracks. When whales move, the market notices.

The institutional adoption trend continues gaining momentum. Major financial institutions embracing Bitcoin through ETFs brings both capital and credibility to the market. This institutional backing provides stability that wasn’t there in Bitcoin’s early wild-west days.

Macroeconomic factors like inflation rates, interest rate policies, and global economic stability all influence how investors view Bitcoin as an asset class. For deeper economic analysis, explore Fintechzoom.com Economy.

FintechZoom’s Bitcoin Price Predictions for 2025 and Beyond

Predicting Bitcoin’s price feels a bit like guessing which food truck will become the next big restaurant chain – exciting but inherently uncertain. FintechZoom approaches this challenge by offering bull, bear, and neutral scenarios based on technical analysis and fundamental evaluation.

Their 2025 predictions paint an interesting picture across different market conditions:

| Scenario | Short-Term (Aug–Dec 2025) | Long-Term (2026–2030) | Key Drivers |

|---|---|---|---|

| Bull Market | $130K–$150K (optimistic: $160K) | ARK Invest: $300K (2026), up to $1.5M (2030) | Strong ETF inflows, Fed rate cuts, increased institutional adoption, post-halving momentum. |

| Bear Market | $95K–$100K (severe macro shock: $78.5K–$85K) | $50K–$60K (extreme case: near $30K) | Regulatory crackdowns, significant global economic downturn, sustained negative sentiment, major security breaches. |

| Neutral / Base Case | $108K–$130K (averaging around $120K) | $150K–$200K (2026) | Steady institutional inflows, gradual Fed rate cuts, moderate geopolitical stability, continued but measured adoption. |

The bull case assumes continued institutional adoption, favorable Federal Reserve policies with rate cuts, and sustained ETF inflows. Think of it as Bitcoin’s equivalent of a trendy neighborhood gentrifying – prices rise as more sophisticated players enter the market.

The bear scenario considers potential regulatory crackdowns, global economic downturns, or major security breaches that could shake confidence. Even in these challenging conditions, FintechZoom notes that Bitcoin’s established infrastructure provides some downside protection.

Their neutral prediction assumes steady growth with moderate institutional adoption and gradual policy changes – essentially Bitcoin maturing into a more stable asset class while maintaining growth potential.

FintechZoom emphasizes that these predictions serve informational purposes only, not financial advice. They strongly advocate for risk management strategies like setting stop-loss orders and maintaining diversified portfolios. For their complete analysis with detailed methodology, you can See the full analysis now.

The platform’s approach to fintechzoom.com bitcoin mining predictions combines market sentiment analysis with technical indicators, providing a comprehensive view that helps both beginners and experienced investors steer this volatile but potentially rewarding market.

A Practical Guide to Mining with FintechZoom’s Insights

Getting into Bitcoin mining feels a bit like opening your first restaurant in New York City – exciting potential, but you need the right preparation and realistic expectations. Fintechzoom.com bitcoin mining guides help steer this complex world by breaking down both the opportunities and challenges ahead.

The appeal is clear: Bitcoin mining can generate passive income while supporting the network that validates transactions. When done right, it’s like having a digital money printer humming in your basement. But let’s be honest – it’s not free money. You’ll need serious upfront investment for hardware, ongoing electricity costs that can shock you, and the patience to weather Bitcoin’s notorious price swings.

The hardware can become outdated faster than last year’s smartphone, and electricity bills in places like New York can eat into profits quickly. FintechZoom emphasizes understanding your local electricity rates – ideally under $0.05/kWh – before making any commitments.

Think of it this way: successful mining requires the same careful planning you’d use for any major investment. FintechZoom’s resources help you crunch the real numbers, not just the optimistic projections. They connect mining analysis to broader market trends, similar to how Fintechzoom.com Russell 200 tracks traditional investment opportunities.

Getting Started: A Practical Guide to fintechzoom.com bitcoin mining

Starting your mining journey doesn’t have to feel overwhelming. FintechZoom breaks it down into manageable steps that even beginners can follow.

First, choose your hardware wisely. Those specialized ASIC miners we mentioned earlier – like the Bitmain Antminer S21 or MicroBT Whatsminer M60 – are your workhorses. Budget anywhere from $3,000 to $20,000 for quality equipment. These machines consume serious power, typically 500-1500 watts per rig, so factor that into your planning.

Next, you’ll need mining software to connect your hardware to the Bitcoin network. Popular options like CGMiner or BFGMiner handle the technical communication between your equipment and the blockchain. FintechZoom often recommends reliable software options that work well for beginners.

Joining a mining pool is practically essential for individual miners. Think of it like a cooking cooperative – everyone contributes ingredients (computational power), and everyone shares the meal (Bitcoin rewards). Pool fees typically run 1-3% of your earnings, but you’ll receive smaller, more frequent payouts instead of waiting months or years to solve a block solo.

Securing a proper Bitcoin wallet protects your earnings. FintechZoom strongly advocates for hardware wallets with two-factor authentication. After all, what’s the point of mining Bitcoin if it’s not secure?

Managing electricity consumption becomes your ongoing challenge. A single ASIC miner can draw 3,250 watts continuously – that’s like running multiple high-end ovens 24/7. In New York City, where electricity rates run higher than many mining-friendly locations, timing your operations during off-peak hours can help manage costs.

FintechZoom’s guides include real stories from miners who started small and gradually expanded their operations. One user began with an old gaming PC, learned the ropes, and eventually built a profitable mining setup. It’s a learning process, not a shortcut to wealth.

The Legal and Environmental Landscape of Mining

Understanding the rules and environmental impact of fintechzoom.com bitcoin mining matters just as much as the technical setup. FintechZoom covers these crucial aspects that many new miners overlook.

Bitcoin mining is legal across the United States, but state and local regulations vary significantly. Some areas require permits for high-energy operations, while others welcome mining businesses with open arms. Before setting up shop, research your local laws and potential permit requirements.

Tax implications are unavoidable. Mining earnings count as taxable income, and the IRS expects you to report them properly. FintechZoom recommends consulting with tax professionals who understand cryptocurrency, especially given the complexity of calculating costs, depreciation, and income timing.

Energy consumption remains a hot-button issue. Bitcoin mining uses approximately 121 terawatt-hours annually worldwide – more electricity than some entire countries. This has sparked legitimate environmental concerns and regulatory scrutiny.

The good news? Green mining is rapidly expanding. Many U.S. mining operations now use renewable energy sources like solar, wind, and hydroelectric power. The U.S. leads globally with 60% renewable energy usage for mining operations. This shift isn’t just environmentally responsible – it often reduces long-term operating costs.

FintechZoom predicts that by 2030, artificial intelligence and green technology will transform the mining sector entirely. Companies are already building solar-powered mining farms and using excess renewable energy that would otherwise go to waste. You can explore more about the potential of green energy and its growing role in cryptocurrency mining.

The environmental landscape is evolving quickly, with miners increasingly viewing sustainability as both an ethical responsibility and a competitive advantage. FintechZoom helps miners stay informed about these developments and plan for a more sustainable future.

Frequently Asked Questions about FintechZoom and Bitcoin Mining

When we’re exploring something new – whether it’s a trendy restaurant in Manhattan or Bitcoin mining – questions naturally arise. At The Dining Destination, we know that feeling of curiosity mixed with uncertainty, and fintechzoom.com bitcoin mining coverage addresses the most common concerns people have about entering this digital frontier.

Is Bitcoin mining still profitable in 2024 and beyond?

The short answer is yes, but like finding a great hole-in-the-wall restaurant, it takes research and the right approach. Bitcoin mining can absolutely be profitable, though the 2024 halving event changed the game significantly. When block rewards dropped to 3.125 BTC, it meant miners had to become more efficient – much like how restaurants had to adapt during challenging times.

Profitability hinges on several key factors. Hardware efficiency tops the list – investing in the latest ASIC miners with high hash rates and lower power consumption is crucial. Think of it as upgrading from a basic kitchen to professional-grade equipment; the initial cost is higher, but the results speak for themselves.

Electricity costs remain the make-or-break factor. Ideally, you want rates at $0.05/kWh or lower. Here in New York City, where we’re used to premium prices for everything from rent to a decent bagel, finding such low electricity rates can be challenging. Many successful miners explore renewable energy options or negotiate commercial rates for larger operations.

Bitcoin’s market price directly impacts the value of your mining rewards, while network difficulty continues to increase as more powerful hardware comes online. It’s a dynamic environment that requires constant attention.

FintechZoom’s profitability calculators become invaluable tools here, letting you plug in your specific hardware specs, electricity costs, and pool fees to estimate potential returns. The platform emphasizes that while earnings are definitely possible, success demands careful analysis and the ability to adapt as market conditions shift.

What are the main risks associated with Bitcoin mining?

Just as we always warn our readers about potential travel scams or overpriced tourist traps, it’s important to understand the risks involved in Bitcoin mining. Price volatility stands as the biggest concern – Bitcoin’s dramatic price swings can turn a profitable operation into a money-losing venture overnight.

The high initial investment can be daunting. Quality ASIC miners, cooling systems, and proper infrastructure require substantial upfront capital, often ranging from $10,000 to $50,000 for a serious setup. There’s no guarantee you’ll recoup this investment quickly, especially in a volatile market.

Hardware obsolescence presents another challenge. Mining technology evolves rapidly, and today’s top-tier equipment might become inefficient within a year or two. It’s like investing in restaurant equipment that becomes outdated as cooking techniques advance.

Regulatory changes add uncertainty to the mix. The legal landscape for cryptocurrencies continues evolving, and governments can introduce new regulations or restrictions that suddenly impact your operation’s profitability and legality.

The high energy consumption of mining rigs translates directly to hefty electricity bills. A single ASIC miner can consume as much power as a small restaurant’s kitchen, and those costs add up quickly if not managed effectively.

FintechZoom consistently advises that successful miners stay adaptable, maintain low operational costs, and practice solid risk management – principles that apply whether you’re running a mining operation or a food business.

How does FintechZoom help beginners get started with Bitcoin mining?

FintechZoom excels at making the complex world of crypto mining accessible to newcomers, much like how we break down intimidating culinary techniques for home cooks. Their approach focuses on simplified guides that translate technical jargon into plain English, making concepts like hash rates and mining pools easy to grasp.

Their easy-to-understand analysis covers market trends, hardware insights, and major events like the halving without overwhelming readers with unnecessary technical details. They present information conversationally, acknowledging that everyone starts somewhere.

Profitability tools like the Fractal Bitcoin Mining Calculator empower beginners to estimate potential earnings before making any financial commitments. This transparency helps newcomers understand the financial implications and make informed decisions.

Market news aggregation keeps users informed about regulatory updates, technological advances, and market shifts that could affect mining operations. Rather than leaving readers to hunt through multiple sources, FintechZoom curates relevant information in one accessible location.

Educational resources span everything from choosing appropriate hardware to securing Bitcoin wallets. They offer tutorials, comprehensive FAQs, and knowledge bases presented in an encouraging tone that makes learning less intimidating.

The platform acts as a trusted guide through the mining landscape, helping new miners avoid common mistakes and make informed decisions. It’s the kind of supportive approach we appreciate at The Dining Destination when helping our readers steer unfamiliar culinary territories – providing the knowledge and confidence needed to succeed.

Conclusion: The Future of Bitcoin Mining and Digital Finance

As we wrap up our exploration of fintechzoom.com bitcoin mining, it’s fascinating to see how this platform has become such a valuable compass in the often confusing world of cryptocurrency. Just like finding a hidden gem of a restaurant in New York City, finding reliable guidance in the digital finance space can make all the difference between success and disappointment.

FintechZoom has carved out its niche by making the seemingly impossible task of understanding Bitcoin mining feel approachable. Their role goes beyond just presenting data – they’re translating the technical jargon into conversations we can actually follow. Whether you’re trying to figure out if that expensive ASIC miner is worth the investment or wondering how the latest halving event affects your potential profits, they’ve got you covered with tools and insights that actually make sense.

The future of Bitcoin mining is shaping up to be quite the trip. Artificial Intelligence integration is already changing the game, with predictive maintenance technology potentially reducing equipment breakdowns by 60-75%. It’s like having a smart kitchen that tells you when your equipment needs attention before it breaks down during the dinner rush.

Sustainable practices are becoming more than just a nice-to-have – they’re essential for long-term success. The shift toward renewable energy sources isn’t just about being environmentally responsible (though that’s important too). It’s about smart economics. Lower energy costs mean better profit margins, and the future truly belongs to miners who can adapt and innovate.

We’re also seeing the regulatory landscape evolve rapidly. Increased regulation might feel scary at first, but it could bring the stability and legitimacy that the industry needs to mature. Think of it like food safety regulations – they might seem restrictive, but they ultimately make the entire industry stronger and more trustworthy.

FintechZoom predicts that by 2030, we’ll see significant market concentration, with larger, more efficient operations dominating the space. This mirrors what we’ve seen in many industries – the players who can invest in the best technology and operate most efficiently tend to thrive.

Here at The Dining Destination, we know that staying informed is the secret ingredient for navigating any new frontier. Whether you’re exploring the latest dining trends in Manhattan or trying to understand the backbone of cryptocurrency, having reliable information makes all the difference. Just as we help food enthusiasts find amazing culinary experiences around the world, platforms like FintechZoom help crypto enthusiasts steer the complex but exciting world of Bitcoin mining.

The key takeaway? As technology continues to evolve at breakneck speed, staying curious and well-informed isn’t just helpful – it’s essential. Whether your next trip takes you to a new restaurant or into digital finance, the right guide can turn a potentially overwhelming experience into an exciting journey of findy.

For more insights and guidance across various topics, Explore our resource guides.