What Makes Bitcoin Halving a Critical Event for Crypto Markets

Fintechzoom.com bitcoin halving coverage has become essential reading for crypto investors worldwide, as this pre-programmed event fundamentally reshapes Bitcoin’s supply dynamics every four years. The halving cuts mining rewards in half, creating digital scarcity that historically drives significant price movements.

Quick Facts About Bitcoin Halving:

- Frequency: Occurs every 210,000 blocks (approximately 4 years)

- Purpose: Controls Bitcoin inflation and maintains scarcity

- Current Reward: 3.125 BTC per block (after April 2024 halving)

- Historical Impact: Previous halvings preceded major bull runs

- Next Halving: Expected around 2028

The Bitcoin halving event has captured Wall Street’s attention because it’s the only major asset with a completely predictable monetary policy. Unlike traditional currencies controlled by central banks, Bitcoin’s supply reduction follows mathematical certainty – no committee decisions, no emergency interventions.

This mechanism has proven powerful. After the 2020 halving, Bitcoin’s price increased fivefold within a year. The 2016 halving preceded Bitcoin’s historic run to nearly $20,000. Even the first halving in 2012 saw Bitcoin surge from around $12 to over $1,100.

Why does this matter for everyday investors? The halving creates what economists call “supply shock” – fewer new bitcoins enter circulation while demand often remains steady or grows. This imbalance has historically rewarded patient investors who understand the cycle.

Find more about fintechzoom.com bitcoin halving:

What is the Bitcoin Halving and How Does It Work?

Think of the fintechzoom.com bitcoin halving as Bitcoin’s built-in economic engine – a clever piece of code that automatically taps the brakes on new Bitcoin creation every four years. Unlike traditional currencies where central banks can print money whenever they feel like it, Bitcoin follows a strict mathematical schedule that nobody can change.

Here’s how it works: Bitcoin miners are like digital gold prospectors, using powerful computers to solve complex puzzles. When they crack the code first, they get rewarded with brand-new Bitcoin for adding a new “block” of transactions to the blockchain. But here’s the twist – every 210,000 blocks (roughly four years), that reward gets cut in half automatically.

This proof-of-work system ensures that Bitcoin becomes increasingly rare over time. It’s like having a gold mine that produces half as much gold every few years, making each piece more precious. The beauty lies in its predictability – everyone knows exactly when the next halving will happen.

The entire process is designed to create controlled supply and digital scarcity, making Bitcoin a deflationary asset. While your dollar might buy less coffee next year due to inflation, Bitcoin’s supply keeps shrinking relative to demand. By around 2140, all 21 million Bitcoin will have been mined, but the halving ensures we approach that limit gradually, never quite reaching it.

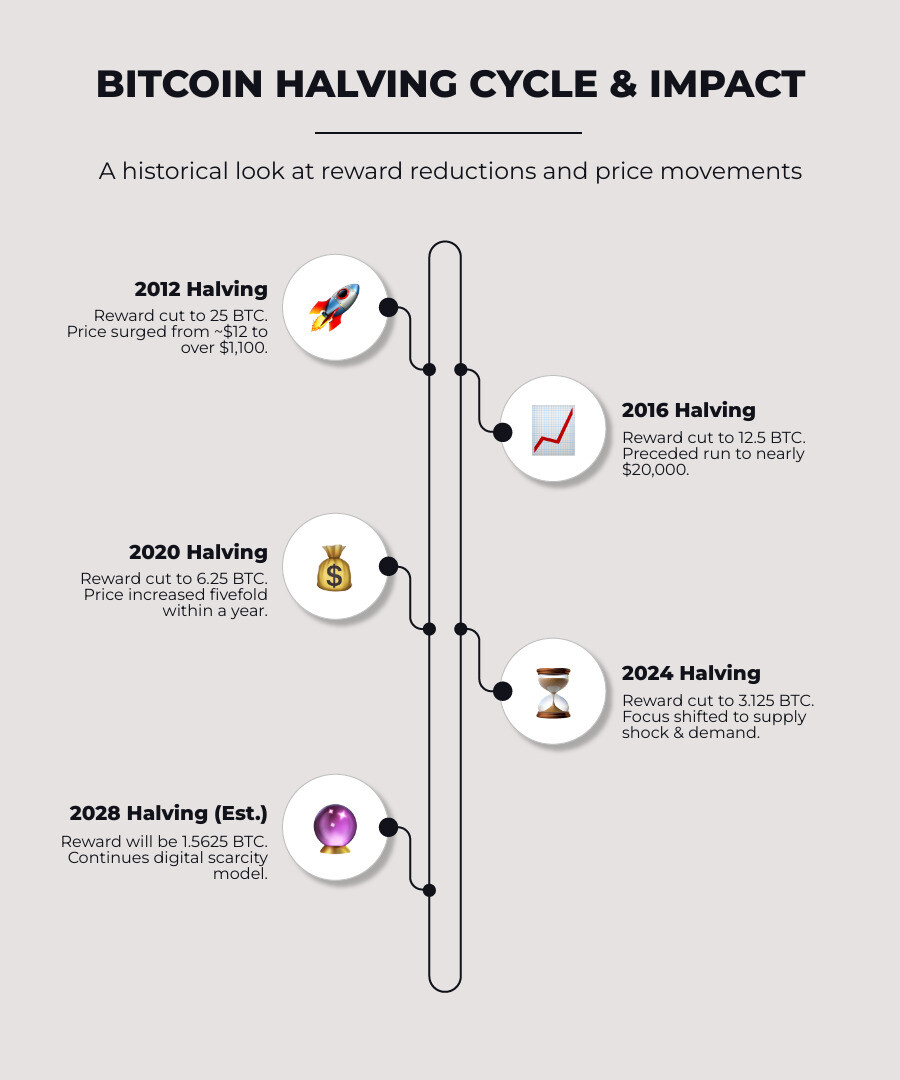

A timeline of Bitcoin halving events provides a comprehensive look at how this process has unfolded over Bitcoin’s history.

The Economics of Scarcity

The magic behind Bitcoin halving lies in one of economics’ most fundamental principles: supply and demand. When you reduce the supply of something while demand stays the same (or grows), prices typically rise. It’s the same reason concert tickets cost more when there are fewer seats available.

Bitcoin’s value proposition becomes clearer when you compare it to gold. Both are scarce, both require effort to obtain, and both have passionate believers. But here’s where Bitcoin gets interesting – while we’re still finding new gold deposits and improving mining techniques, Bitcoin’s supply schedule is set in stone. No surprises, no sudden findies of massive Bitcoin deposits.

This creates a striking contrast with traditional monetary policies. When economic trouble hits, central banks often fire up the money printers, flooding the market with new currency. Remember the massive money printing during recent global events? Bitcoin doesn’t care about economic emergencies or political pressures. Its fiat currency alternative operates on pure mathematics.

Central banks might adjust interest rates or implement quantitative easing to manage their economies, but Bitcoin follows its own drumbeat. This predictable scarcity has made it increasingly attractive to investors seeking an alternative to traditional monetary systems that can change course at any moment.

Historical Halving Events

Bitcoin’s halving history reads like a thrilling investment story, with each chapter bringing dramatic price movements and growing mainstream attention.

The 2012 halving was Bitcoin’s coming-of-age moment. When block rewards dropped from 50 BTC to 25 BTC, Bitcoin was trading around $12. Within 150 days, it had climbed to $127 – that’s over 900% growth! Most people still thought Bitcoin was just internet funny money, but early adopters were starting to take notice.

Fast forward to the 2016 halving, and the stakes got higher. Rewards fell to 12.5 BTC per block, with Bitcoin hovering around $650. The immediate jump was more modest this time, reaching $758 in the following months. But this halving set the stage for Bitcoin’s legendary run to nearly $20,000 in late 2017, when mainstream media couldn’t stop talking about cryptocurrency.

The 2020 halving coincided with a perfect storm of events. As rewards dropped to 6.25 BTC, Bitcoin was trading at about $8,821. The world was dealing with unprecedented monetary stimulus, and institutional investors started viewing Bitcoin as “digital gold.” Companies like Tesla and MicroStrategy began adding Bitcoin to their balance sheets. Within a year, Bitcoin soared to around $64,000.

The most recent 2024 halving brought rewards down to 3.125 BTC per block, marking another milestone in Bitcoin’s journey toward maximum scarcity. This event happened alongside the approval of Bitcoin ETFs in the United States, making it easier than ever for traditional investors to gain Bitcoin exposure.

Each halving has brought Bitcoin closer to its final destination – that magical moment when all 21 million coins will have been mined. The reward reduction from 50 BTC to 3.125 BTC over just four halvings shows how quickly scarcity accelerates in Bitcoin’s design.

More info about market trends can help you understand how these historical patterns might influence future market cycles.

The Role of FintechZoom.com in Understanding the Bitcoin Halving

When you’re trying to wrap your head around something as complex as the Bitcoin halving, having a trusted guide makes all the difference. That’s exactly what FintechZoom.com provides – clear, accessible explanations of financial topics that might otherwise leave your head spinning. Think of it as having a knowledgeable friend who can translate Wall Street jargon into everyday language.

FintechZoom.com has earned its reputation by delivering timely financial news, comprehensive market analysis, and real-time data that actually makes sense. What sets them apart isn’t just the breadth of their coverage – it’s their ability to take intricate concepts like the fintechzoom.com bitcoin halving and break them down into digestible insights that help both newcomers and seasoned investors make informed decisions.

Their cryptocurrency coverage has become particularly valuable as digital assets have moved from niche curiosity to mainstream investment option. Whether you’re checking morning coffee prices or planning your retirement portfolio, FintechZoom.com aims to give you the context you need without drowning you in unnecessary complexity.

The platform’s price charts and market analysis tools provide essential insights, though we always recommend checking multiple sources for the most complete picture.

Check real-time prices on CoinMarketCap

Why Investors Trust FintechZoom for Halving Analysis

There’s something reassuring about having a reliable source when navigating volatile cryptocurrency markets, and FintechZoom has built that trust through consistent, quality analysis. Their approach to halving coverage goes beyond simple price predictions – they focus on helping you understand the why behind market movements.

Aggregated news and expert insights form the backbone of their halving analysis. Rather than leaving you to piece together information from dozens of sources, FintechZoom curates relevant news and provides expert commentary that puts events in context. This saves you time and helps you avoid the noise that often surrounds major crypto events.

Their educational approach particularly shines when covering complex topics. The platform recognizes that not everyone comes to Bitcoin with a finance degree, so they’ve made explaining concepts clearly a priority. Their halving guides walk you through the mechanics without assuming you already know what a “block reward” means.

Bitcoin ETF insights have become increasingly important, especially with recent regulatory approvals. FintechZoom provides analysis on how these institutional products interact with halving cycles, helping you understand whether ETF flows might amplify or dampen traditional halving effects.

The platform also incorporates market sentiment indicators that go beyond raw price data. Understanding whether the market feels optimistic, fearful, or uncertain can be just as valuable as knowing the current Bitcoin price – especially during speculative periods surrounding halving events.

Perhaps most importantly, FintechZoom maintains a user-friendly interface that doesn’t require a PhD in computer science to steer. When you’re trying to make time-sensitive investment decisions, the last thing you need is fighting with a complicated website.

Using FintechZoom for Strategic Insights

Moving beyond basic understanding, FintechZoom offers practical tools for developing your halving strategy. Their price prediction models present different scenarios – bullish, bearish, and neutral – giving you frameworks to think through potential outcomes rather than just hoping for the best.

Technical analysis capabilities on the platform include charting tools and indicator libraries that help you identify patterns and trends. While they might not offer every bell and whistle of specialized trading platforms, they provide sufficient depth for most investors to perform meaningful analysis of post-halving price movements.

Mining coverage adds another crucial perspective to their halving analysis. Since miners play such a vital role in Bitcoin’s network security and supply dynamics, understanding how halving affects their profitability helps you anticipate potential market impacts. When mining becomes less profitable, some miners shut down operations, which can temporarily reduce network security but also decrease selling pressure.

The platform’s wallet and security guidance ensures you’re not just making smart investment decisions but also protecting your assets properly. Their security recommendations cover essential topics like the difference between hot and cold storage, helping you safeguard your Bitcoin regardless of market conditions.

For broader economic context that influences Bitcoin markets, we regularly explore additional factors that shape cryptocurrency trends.

Explore economic factors

Economic Impact: How the Halving Affects Price, Miners, and the Market

The fintechzoom.com bitcoin halving creates ripple effects that reach far beyond simple supply reduction. Think of it like removing half the gold from a mine – suddenly, what’s left becomes more precious, and everyone involved in the gold ecosystem feels the impact.

Bitcoin’s price history tells a compelling story after each halving. The pattern has been remarkably consistent: anticipation builds, prices often rally before the event, then we see a brief cooling-off period followed by explosive growth. After the 2020 halving, Bitcoin climbed from around $8,800 to over $60,000 – a stunning 580% increase within a year.

The 2016 halving painted a similar picture, setting the stage for Bitcoin’s legendary run to nearly $20,000 in late 2017. Even the first halving in 2012 saw Bitcoin surge from about $12 to over $1,100. While past performance doesn’t guarantee future results, these historical price trends suggest something powerful happens when Bitcoin’s supply gets squeezed.

What makes the 2024 halving particularly fascinating is the arrival of Bitcoin ETFs on the scene. These financial products brought Wall Street money flooding in – we’re talking about $773 million in net inflows during just one week. This institutional adoption represents a seismic shift from Bitcoin’s early days when only tech enthusiasts were paying attention.

The numbers tell an incredible story of growing confidence. Long-term holders now control a record 14.71 million Bitcoin, with 248,000 Bitcoin moved into accumulation wallets in the past year alone. These aren’t day traders looking for quick profits – these are believers building positions for the long haul.

Impact on Bitcoin Miners’ Profitability

For Bitcoin miners, the halving feels more like a punch to the gut than a celebration. Imagine if your salary got cut in half overnight – that’s essentially what happens to mining rewards every four years.

The math is brutal but simple. When the reward drops from 6.25 Bitcoin to 3.125 Bitcoin per block, miners suddenly earn half as much for the same amount of work. Their operational costs don’t magically disappear though – electricity bills, equipment maintenance, and facility expenses remain unchanged.

This pressure cooker environment separates the strong from the weak. Less efficient miners often can’t survive the sudden revenue cut, leading to shutdowns and industry consolidation. We’ve seen this play out with companies like Riot Platforms eyeing acquisitions of smaller operations like Bitfarms.

Wall Street analysts aren’t sugar-coating the reality either. Some predict mining costs could spike to $40,000 per Bitcoin post-halving. This forces miners to become incredibly resourceful, investing in cutting-edge mining hardware and hunting for the cheapest electricity sources available.

The smart miners are already adapting. Companies like Bit Digital are doubling their fleet size with more energy efficient equipment. The Bitcoin Mining Council reports that members now use electricity with a 63.1% sustainable power mix. Going green isn’t just good PR – it’s becoming essential for survival.

The Growing Importance of Transaction Fees for the fintechzoom.com bitcoin halving

Here’s where Bitcoin’s design gets really clever. As block rewards shrink with each halving, transaction fees become increasingly important for keeping miners motivated and the network secure.

Think of it like a restaurant transitioning from relying mainly on alcohol sales to building a strong food business. Bitcoin is gradually shifting from a reward-based system to a fee-based economy.

The numbers from April 20, 2024, tell this story perfectly. Transaction fees made up over 75% of miner revenue that day, totaling 1,257.71 Bitcoin. This wasn’t random – new protocols like Runes and Ordinals were creating massive network congestion as users rushed to create tokens and NFTs directly on Bitcoin.

More activity means more transactions, and more congestion drives up fees as users compete to get their transactions processed quickly. It’s basic supply and demand, but applied to blockchain space.

This shift ensures Bitcoin’s long-term sustainability. Even when the last Bitcoin gets mined around 2140, miners will still have strong financial incentives to secure the network through transaction fees. The fintechzoom.com bitcoin halving discussion often misses this crucial point – it’s not just about price, it’s about the fundamental economics keeping Bitcoin alive.

Broader Effects on the Cryptocurrency Market

Bitcoin doesn’t exist in a vacuum. When the king of crypto moves, the entire kingdom feels it.

The altcoin market typically follows Bitcoin’s lead like synchronized swimmers. A strong post-halving Bitcoin rally usually pulls other cryptocurrencies along for the ride, creating what traders call “altcoin season.” Investors often take profits from their Bitcoin gains and rotate them into smaller cryptocurrencies chasing higher percentage returns.

Market sentiment gets a major boost from halving events. The excitement around reduced supply and potential price surges creates infectious optimism. New investors jump in, trading volumes spike, and the whole ecosystem buzzes with energy.

Media attention amplifies everything. Mainstream financial outlets suddenly start covering Bitcoin again, crypto Twitter goes into overdrive, and your uncle starts asking about Bitcoin at family dinners. This spotlight introduces cryptocurrency to fresh audiences who might have been sitting on the sidelines.

The result is often capital rotation on a massive scale. Money flows from traditional assets into crypto, from Bitcoin into altcoins, and from patient holders into active traders’ hands. It’s like watching a financial ecosystem come alive.

The halving acts as a catalyst that shapes not just Bitcoin’s future, but the entire digital asset landscape. Understanding these dynamics helps explain why the fintechzoom.com bitcoin halving coverage has become essential reading for anyone serious about cryptocurrency investing.

Strategic Approaches for Investors During a Halving Cycle

The fintechzoom.com bitcoin halving creates unique opportunities that smart investors can capitalize on, but success requires the right strategy for your goals and risk tolerance. Think of it like planning a culinary trip – you wouldn’t visit Paris without researching the best restaurants, and you shouldn’t approach Bitcoin halving without a solid game plan.

History shows us that halvings often trigger significant market movements, but timing these perfectly is nearly impossible. The key is choosing an approach that matches your investment timeline and sleep-at-night factor. Whether you’re looking to build wealth over decades or capture shorter-term opportunities, there’s a strategy that can work for you.

The beauty of Bitcoin investing is that sophisticated strategies used by Wall Street firms are now accessible to everyday investors. You don’t need a finance degree or millions in capital – just patience, discipline, and a clear understanding of your goals.

Long-Term Strategies: HODLing and DCA

For investors who believe in Bitcoin’s long-term potential, the halving reinforces why holding for the long haul makes sense. The math is simple: fewer new bitcoins + growing demand = potential price appreciation over time.

HODLing (holding on for dear life) means buying Bitcoin and tucking it away, ignoring the daily price swings that can drive you crazy. This strategy works because it aligns with Bitcoin’s fundamental design – each halving makes it scarcer, and scarcity tends to drive value over time. The data backs this up: long-term holders increased their Bitcoin stash by about 73% in the year following the first halving, showing strong conviction in the post-halving potential.

The challenge with HODLing? It requires nerves of steel when prices drop 30% in a week (and they will). But for those who can stomach the volatility, history suggests patience pays off.

Dollar-cost averaging (DCA) offers a smoother ride for your emotions and your wallet. Instead of trying to time the perfect entry point, you invest a fixed amount regularly – maybe $100 every Friday, regardless of whether Bitcoin is at $30,000 or $60,000. When prices are high, your money buys less Bitcoin. When they’re low, you get more for your dollar.

This approach takes the guesswork out of investing and helps you build a position gradually. It’s particularly effective around halving cycles because you’re accumulating through all the ups and downs, potentially benefiting from the long-term upward trend without trying to catch falling knives.

Learn about dollar-cost averaging

Short-Term Trading and Risk Management

The volatility surrounding halving events creates opportunities for traders willing to take on more risk. But let’s be clear – this isn’t investing, it’s speculation, and it requires a completely different mindset and skill set.

Breakout trading involves watching for moments when Bitcoin breaks through key price levels with strong momentum. Think of it like a pressure cooker – when the price finally breaks through resistance, it can move fast and far. Traders look for these moments to capture quick profits, but timing is everything.

Understanding support and resistance levels becomes crucial here. Support is where buyers typically step in to prevent further price drops, while resistance is where sellers often appear to cap price rises. These levels act like psychological barriers that, when broken, can signal significant moves.

The halving period often sees increased volatility, creating more breakout opportunities. However, false breakouts are common, which is why risk management becomes absolutely critical. Every trade should have a predetermined stop-loss level – a price where you’ll cut your losses and move on. Similarly, take-profit levels help you lock in gains before euphoria turns to despair.

Recent market data shows the CME futures premium dipped below 5% earlier this year, indicating cautious sentiment among institutional traders. This kind of information helps short-term traders gauge market mood and adjust their strategies accordingly.

Short-term trading around halving events is like trying to catch lightning in a bottle. The rewards can be significant, but so can the losses. Most successful traders risk only a small percentage of their total portfolio on any single trade.

The Future of Bitcoin’s Sustainability Post-Halving

As we look toward Bitcoin’s future, a fascinating transition is already underway. Diminishing block rewards mean miners must increasingly rely on transaction fees for revenue. This isn’t a bug – it’s a feature designed to ensure Bitcoin’s long-term sustainability.

The 21 million coin limit creates ultimate scarcity, but it also means the network must evolve. By around 2140, when the last Bitcoin is mined, transaction fees will be miners’ only income source. This requires sufficient demand for Bitcoin transactions to generate competitive fees that keep miners profitable and the network secure.

Recent developments like the Runes protocol and Bitcoin Ordinals are already showing how this transition might work. These innovations increase network activity and transaction fees, with fees accounting for over 75% of miner revenue on some days in 2024. This demonstrates that Bitcoin’s network security budget can adapt and thrive even as block rewards shrink.

The growing institutional adoption, increasing use of renewable energy in mining (now at nearly 60% according to the Bitcoin Mining Council), and Bitcoin’s role as digital gold all point toward sustained long-term demand. As more people and institutions recognize Bitcoin’s value as a censorship-resistant, permissionless monetary system, the transaction volume needed to support network security through fees becomes increasingly likely.

What happens after all Bitcoin is mined?

This evolution from a mining-reward system to a fee-based system represents one of the most neat economic transitions in modern finance – a testament to Bitcoin’s ingenious design.

Frequently Asked Questions about the FintechZoom.com Bitcoin Halving

Over the years, we’ve noticed that certain questions about fintechzoom.com bitcoin halving come up again and again in our conversations with readers. Whether you’re just starting to explore Bitcoin or you’ve been following the market for a while, these are the questions that matter most when trying to understand this fascinating event.

What is the primary purpose of the Bitcoin halving?

Think of the Bitcoin halving as a built-in economic control system that’s much smarter than anything we see in traditional finance. The primary purpose is actually quite simple: it controls how fast new Bitcoins enter the market and keeps them scarce over time.

Every four years or so, the halving cuts the reward that miners receive for processing transactions right in half. This isn’t some arbitrary decision made by a committee – it’s programmed directly into Bitcoin’s code. The beauty of this system is that it creates a predictable monetary policy that nobody can change or manipulate.

Unlike traditional currencies where central banks can print more money whenever they want (hello, inflation!), Bitcoin follows mathematical rules. The halving ensures that only 21 million Bitcoins will ever exist, making it similar to precious metals like gold. This scarcity is what gives Bitcoin its “digital gold” nickname.

The result? Bitcoin becomes more valuable over time instead of losing purchasing power like most fiat currencies. It’s a completely different approach to money that puts control back into the hands of the people rather than institutions.

How has the halving historically affected Bitcoin’s price?

Here’s where things get really interesting for investors following fintechzoom.com bitcoin halving coverage. The historical pattern is pretty remarkable, though we always remind folks that past performance doesn’t guarantee future results.

Each of the three previous halvings has been followed by major price increases. After the 2012 halving, Bitcoin jumped over 900% in just 150 days – imagine turning $1,000 into $9,000 in five months! The 2016 halving set the stage for Bitcoin’s famous run to nearly $20,000 in 2017. Then the 2020 halving preceded Bitcoin’s surge to around $64,000 in 2021.

The pattern seems to work like this: anticipation builds before the halving, sometimes causing a rally. Then there might be a brief cooling-off period as the market digests the event. Finally, the reduced supply of new Bitcoins starts to create upward pressure on price, especially if demand stays strong or grows.

What makes the most recent 2024 halving particularly interesting is the approval of Bitcoin ETFs around the same time. These investment products brought institutional money flooding in – we’re talking about $773 million in net inflows in just one week! This combination of reduced supply and increased institutional demand created a perfect storm for price appreciation.

Some experts debate whether the halving’s effects are becoming “priced in” as markets get more sophisticated. But the basic economics remain the same: fewer new Bitcoins plus steady or growing demand usually equals higher prices.

What are the main challenges for Bitcoin miners after a halving?

If you’re following the mining industry through fintechzoom.com bitcoin halving analysis, you’ll know that miners face some serious challenges when the halving hits. It’s like having your paycheck cut in half overnight while your bills stay exactly the same.

The immediate problem is profitability. When the block reward drops from 6.25 BTC to 3.125 BTC (as it did in 2024), miners suddenly earn half as much for the same amount of work. Their electricity bills, equipment costs, and operational expenses don’t change, but their income gets slashed.

This creates a survival-of-the-fittest scenario in the mining industry. Less efficient miners – those with older equipment or expensive electricity – often can’t compete anymore and have to shut down. Meanwhile, larger operations with access to cheap, renewable energy and the latest mining hardware can weather the storm and even grow stronger.

Wall Street analysts predict that mining costs could reach $40,000 per Bitcoin after recent halvings. This forces the entire industry to innovate and become more efficient. Companies like Riot Platforms and Bitfarms are constantly upgrading their equipment and seeking cheaper energy sources.

The long-term challenge is even more interesting: as block rewards continue shrinking with each halving, miners will need to rely more heavily on transaction fees for revenue. This is why new protocols like Runes and Ordinals, which increase network activity and fees, are actually good news for miners. On April 20, 2024, transaction fees made up over 75% of miner revenue – a preview of Bitcoin’s future economic model.

The good news? This pressure is making the mining industry more sustainable and efficient, with many operations now using renewable energy sources. It’s a tough transition, but it’s making the entire Bitcoin network stronger and more resilient.

Conclusion

The fintechzoom.com bitcoin halving represents far more than just a technical adjustment in Bitcoin’s code – it’s a fascinating window into how digital scarcity can reshape our understanding of money itself. Just as we at The Dining Destination help you find rare culinary experiences that become more valuable through their scarcity, Bitcoin’s halving mechanism creates digital rarity that has captured the attention of investors worldwide.

What strikes us most about Bitcoin’s deflationary nature is how it challenges everything we’ve been taught about traditional economics. While central banks can print more money whenever they choose, Bitcoin operates on mathematical certainty. Every four years, like clockwork, the supply gets cut in half. It’s beautifully predictable, yet the market reactions continue to surprise us.

The strategic opportunities surrounding each halving cycle remind us of seasonal dining trends – there are patterns you can observe, but timing is everything. Whether you’re drawn to the patient approach of dollar-cost averaging or prefer the excitement of trading breakouts, the key ingredient remains the same: thorough research and careful planning.

We’ve seen how platforms like FintechZoom.com have become essential for understanding these complex market dynamics. Their ability to break down intimidating financial concepts into digestible insights mirrors our own mission at The Dining Destination – making complex topics accessible and engaging for everyone.

The importance of research cannot be overstated. Just as you wouldn’t book a culinary trip without reading reviews and understanding local customs, approaching Bitcoin investment requires understanding the fundamentals. The halving cycle teaches us patience, the value of scarcity, and the power of long-term thinking.

As we look toward future halvings, Bitcoin’s journey continues to unfold in ways that challenge traditional financial wisdom. The shift from block rewards to transaction fees, the growing institutional adoption, and the emergence of new protocols all point to an evolving ecosystem that rewards those who stay informed and adaptable.

At The Dining Destination, we believe in empowering our readers with knowledge – whether you’re exploring the latest dining trends or navigating the complexities of digital assets. The Bitcoin halving story is still being written, and understanding its implications helps us all make better decisions in an increasingly digital world.