A New Gateway to Crypto Investing

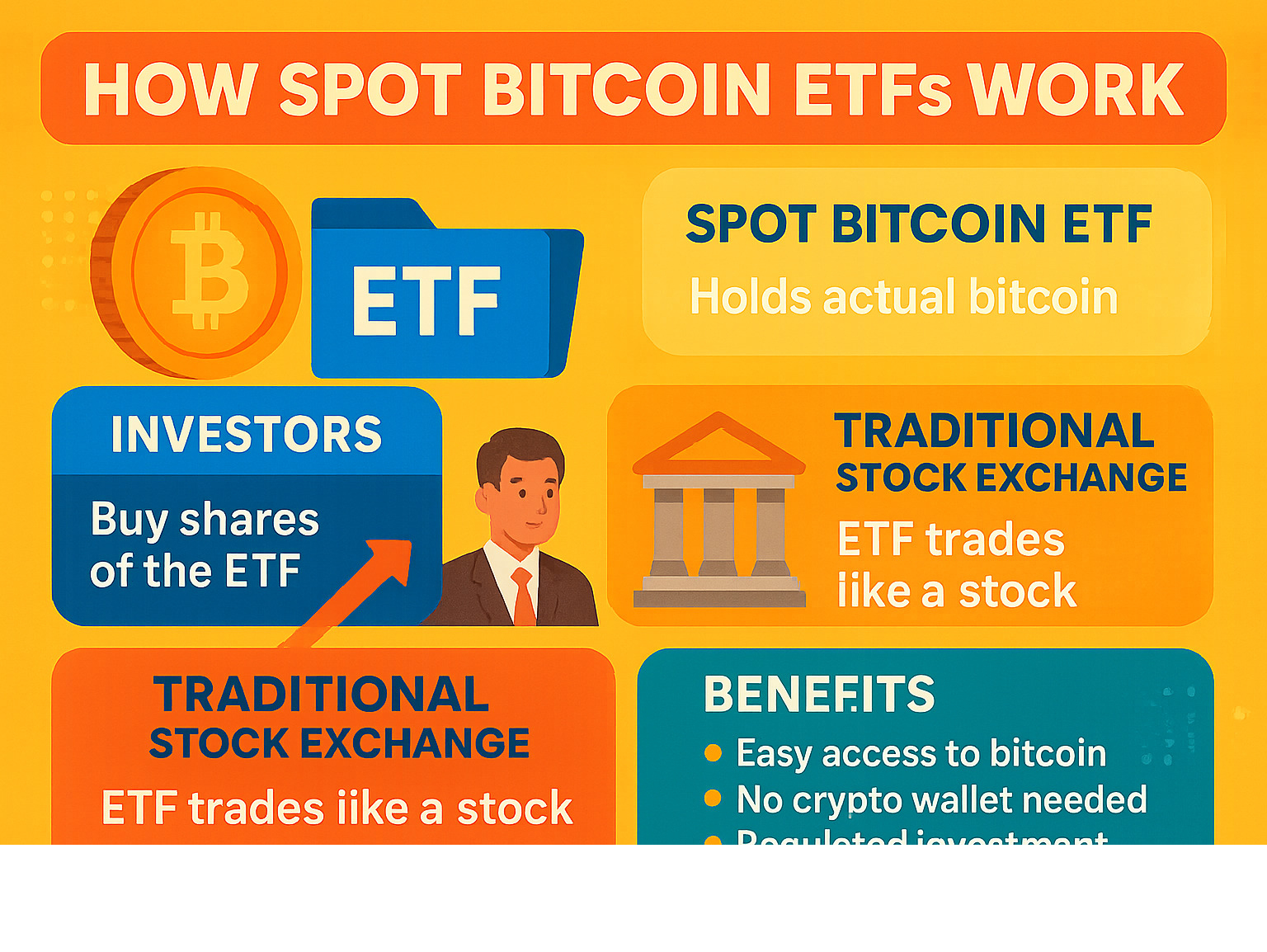

Fintechzoom.com bitcoin etf coverage has become essential for investors seeking accessible cryptocurrency exposure through traditional financial products. Bitcoin Exchange-Traded Funds (ETFs) offer a regulated way to invest in Bitcoin without the complexity of managing digital wallets or private keys. These funds trade on traditional stock exchanges, with some holding actual Bitcoin (Spot ETFs) and others using futures contracts to track its price.

Bitcoin ETFs bridge the gap between traditional finance and the crypto world. Instead of buying Bitcoin directly from crypto exchanges, investors can purchase ETF shares through their regular brokerage accounts, making the process as simple as buying any other stock. This approach eliminates the steep learning curve associated with direct Bitcoin ownership, such as managing digital wallets and securing private keys, while still providing exposure to Bitcoin’s price movements.

Fintechzoom.com serves as a valuable resource for tracking Bitcoin ETF performance, market analysis, and breaking news. The platform aggregates real-time data, helping investors make informed decisions about their cryptocurrency exposure through these regulated investment vehicles.

Fintechzoom.com bitcoin etf terms to remember:

Understanding the Appeal of Bitcoin

Why has Bitcoin moved from a niche curiosity to a recognized asset class? From our New York City vantage point, its journey has been fascinating. Bitcoin is a technological marvel built on a decentralized network without a central bank. Its dominance is clear, with a market capitalization exceeding $1.2 trillion as of June 21, 2025, and growing acceptance from institutional investors.

Many view Bitcoin as “digital gold,” a potential hedge against inflation due to its fixed supply of 21 million coins. Its price is driven by supply and demand, global economic conditions, and key events like the Bitcoin halving, which reduces the reward for mining new coins and has historically preceded price appreciation. The underlying blockchain technology offers transparency and security, features highly valued in the digital age. For many, Bitcoin represents a cultural shift towards financial sovereignty, making it a compelling asset for portfolio diversification. For more insights, explore Fintechzoom.com Investing Tips.

Benefits of Bitcoin ETFs

If Bitcoin is so appealing, why not buy it directly? Bitcoin ETFs offer a familiar and accessible entry point into the digital asset space with several key benefits:

- Simplified Investing: Invest in Bitcoin through your existing brokerage account, just like buying stocks. This removes the need to steer complex and often daunting cryptocurrency exchanges.

- No Technical Burden: Direct ownership requires managing digital wallets and private keys. Losing them means losing your investment. ETFs eliminate this risk, as the fund provider handles custody and security.

- Familiar Trading Environment: ETFs trade on regulated stock exchanges during normal market hours, allowing investors to use familiar platforms and tools. This also improves liquidity.

- Regulatory Oversight: Bitcoin ETFs are regulated by authorities like the SEC, providing a layer of investor protection and standardized reporting not always present on crypto exchanges.

- Simplified Tax Reporting: Depending on your jurisdiction, investing in an ETF may offer simpler tax implications compared to direct crypto ownership. Always consult a tax professional for advice.

Bitcoin ETFs democratize access to the cryptocurrency market, allowing a broader range of investors to participate without needing to become blockchain experts. For guidance on managing your finances, check out Fintechzoom.com Money: Complete Guide.

The Role of Fintechzoom.com for Bitcoin ETF Investors

For those exploring fintechzoom.com bitcoin etf opportunities, the platform serves as a comprehensive hub for financial information on digital assets. It has positioned itself as a go-to resource for both beginners and experienced investors with a user-friendly interface that still offers the depth seasoned traders appreciate.

The platform’s strength lies in its ability to aggregate real-time data from multiple sources, providing live information on Bitcoin and related investment products. This includes current prices, historical trends, and interactive charts. Beyond numbers, Fintechzoom.com provides market analysis and news, including fundamental trend analysis, market sentiment indicators, and price forecasts. It also tracks broader market trends affecting ETF prices, such as regulatory developments and institutional interest.

While Fintechzoom.com aims to be comprehensive, it’s best viewed as a starting point for price checks and market overviews. For deeper exploration of market dynamics, you can visit Fintechzoom.com Markets.

Comprehensive Bitcoin Coverage

Fintechzoom.com takes a holistic approach to Bitcoin, extending beyond ETF analysis to serve as a knowledge hub.

The platform excels at Bitcoin price tracking with real-time updates and interactive charts for spotting trends. For deeper pricing strategies, see the Fintechzoom.com Bitcoin Price: Complete Guide.

It also provides crucial mining and halving updates, explaining how Bitcoin’s design influences its supply and value. Understanding these scheduled supply cuts is vital, as they have historically led to significant price increases. For a comprehensive look, explore Fintechzoom.com Bitcoin Mining: Complete Guide.

For security, the platform offers wallet and security guides covering the essentials of protecting digital assets, such as two-factor authentication and strong password practices. For detailed guidance, see the Fintechzoom.com Bitcoin Wallet: Complete Guide.

Data Reliability and Accuracy

When dealing with fast-moving assets like Bitcoin, data accuracy is everything. Fintechzoom.com aggregates data from multiple exchanges to reduce inaccuracies and provide a more complete market picture. The platform uses analytical tools and refreshes data in real-time, following industry standards.

However, it’s important to be realistic. While generally reliable, minor delays in data aggregation can occur, sometimes a few minutes behind live prices. This is acceptable for casual tracking but may not suffice for high-frequency trading. The depth of analysis can also vary, with some content being more high-level, which is suitable for retail investors but might not satisfy institutional needs.

Our recommendation is to use Fintechzoom.com as an excellent starting point for its user-friendly interface and comprehensive coverage. However, it is always wise to verify important financial data across several platforms before making significant investment decisions. For a deeper dive into the platform’s reliability, you can read Fintechzoom.com Bitcoin: Is It Reliable for Latest Updates?.

Navigating Bitcoin ETF Types and Associated Risks

The Bitcoin ETF landscape presents multiple options for investors with different risk appetites. Understanding these varieties is essential for making smart decisions about fintechzoom.com bitcoin etf investments. The approval of spot Bitcoin ETFs in January 2024 was a watershed moment, opening access for everyday investors.

- Spot Bitcoin ETFs are the most straightforward, as they hold real Bitcoin in secure custody. The value of your shares moves directly with Bitcoin’s price. Popular examples include the iShares Bitcoin Trust (IBIT) and the Fidelity Wise Origin Bitcoin Fund (FBTC).

- Futures-based Bitcoin ETFs invest in Bitcoin futures contracts—agreements to buy or sell Bitcoin at a predetermined future price. The ProShares Bitcoin Strategy ETF (BITO) was the first such product available to U.S. investors.

- Leveraged and Inverse ETFs cater to traders seeking amplified exposure. Leveraged ETFs aim to deliver multiples of Bitcoin’s daily returns, while inverse ETFs profit when its price falls. The Volatility Shares 2X Bitcoin Strategy ETF (BITX) is a key example.

The evolution of these vehicles has democratized Bitcoin access. For more on how these products have shaped the investment landscape, explore 1 Year of Bitcoin ETFs (& Why They Matter in 2025) | ETF Trends.

Key Differences and Examples

The distinction between ETF types fundamentally affects performance and risk. Spot Bitcoin ETFs have seen remarkable success. The iShares Bitcoin Trust (IBIT) quickly amassed over $56 billion in assets, while the Fidelity Wise Origin Bitcoin Fund (FBTC) grew to over $21 billion, demonstrating massive demand for direct Bitcoin exposure through traditional channels. For details, visit iShares Bitcoin Trust (IBIT).

Futures-based Bitcoin ETFs, like the ProShares Bitcoin Strategy ETF (BITO), use futures contracts from regulated exchanges. They face unique challenges like “roll costs” from replacing expiring contracts and “basis risk” from price differences between spot and futures markets.

Innovation continues with hybrid products like the CYBER HORNET S&P 500® and Bitcoin 75/25 Strategy ETF (ZZZ), which balances S&P 500 and Bitcoin futures exposure. For aggressive traders, the leveraged Volatility Shares 2X Bitcoin Strategy ETF (BITX) posted incredible gains but comes with extreme risk.

Understanding Investment Risks

While ETFs simplify crypto investing, they don’t eliminate risk. Understanding these is crucial for any fintechzoom.com bitcoin etf investment.

- Market Volatility: Bitcoin’s price can swing dramatically. ETFs are fully subject to these price swings.

- Tracking Errors: Futures-based ETFs can underperform due to costs from rolling over contracts (“contango”) and other structural inefficiencies.

- Counterparty Risk: Futures ETFs depend on the financial stability of their contract counterparties, a risk not present in spot ETFs.

- Leveraged Product Risks: Products like BITX amplify gains and losses and suffer from “performance decay” over time due to daily rebalancing. They are designed for short-term trades, not long-term holds.

- Regulatory Uncertainty: The crypto space is still evolving. New rules could impact ETF operations, fees, or their existence.

- Lack of Direct Ownership: ETF shareholders trust the fund provider for custody and do not control the private keys to the underlying Bitcoin.

Navigating these risks requires thorough research and an honest assessment of your risk tolerance. For more guidance on making sound business and financial decisions, explore Fintechzoom.com Business Guide.

How to Use Fintechzoom.com for In-Depth Analysis

Making smart fintechzoom.com bitcoin etf investment decisions means digging deeper than surface-level price charts. From our experience watching financial markets, we’ve learned that successful investors take the time to understand their investments. Fintechzoom.com offers several features to help transform your approach from guessing to informed decision-making.

Setting up price alerts ensures you never miss important market movements, while the platform’s educational resources help you understand the fundamentals, from basic ETF mechanics to advanced analysis. For a comprehensive overview of the crypto landscape, explore the Fintechzoom.com Crypto Complete Guide.

Leveraging Fintechzoom.com for Bitcoin ETF Insights

For finding ETF-specific data, Fintechzoom.com organizes complex information into digestible pieces. Focus on these key areas:

- Expense Ratios & Trading Volumes: Lower expense ratios mean more of your money stays invested. High trading volume indicates better liquidity, making it easier to buy and sell shares.

- Fund Flows & AUM: Tracking assets under management (AUM) and fund flows provides insight into market confidence. Large inflows can be a bullish signal.

- Fund Composition: Understand what the ETF holds. Spot ETFs offer direct Bitcoin exposure, while futures-based funds have added complexity.

- Performance Metrics: Comparing performance across different funds helps you match an investment vehicle to your risk tolerance.

Analyzing Market Trends and Predictions

Effective market analysis combines multiple data sources. Fintechzoom.com’s charting tools and technical indicators (like moving averages and RSI) can help identify potential entry and exit points. Market sentiment analysis gauges the emotional side of investing, highlighting potential contrarian opportunities when sentiment is at an extreme.

When evaluating price forecasts, maintain a healthy skepticism. No one can predict the future, but well-researched forecasts can help frame potential scenarios and stress-test your investment thesis. For detailed predictions, check out Fintechzoom.com Bitcoin Price Prediction for 2025 and Forward.

Staying Informed with Fintechzoom.com Bitcoin ETF News

In the fast-moving crypto world, staying informed is essential. The market never sleeps, and neither does the news that drives it.

- Regulatory Updates: News from bodies like the SEC can trigger massive market movements and create new opportunities.

- Institutional Adoption: Announcements of Bitcoin exposure from major financial institutions signal growing mainstream acceptance and can provide long-term price support.

- Breaking News: Geopolitical events or major corporate news can cause sharp price movements. The platform’s analysis helps separate noise from meaningful developments.

Fintechzoom.com’s value lies in filtering this information, curating the most important developments to save you time and help you focus on news that affects your investments.

Frequently Asked Questions about Bitcoin ETFs

As we’ve explored fintechzoom.com bitcoin etf investing, some common questions arise. From our perspective in New York City’s financial district, we hear these all the time from investors curious about this new frontier.

Is Fintechzoom.com a reliable source for Bitcoin data?

Fintechzoom.com improves accuracy by aggregating data from multiple sources, making it a useful starting point for retail investors. Its user-friendly interface and real-time updates help users track market movements. However, there can be minor data delays of a few minutes, which may be significant for high-stakes trading. Our recommendation is to use Fintechzoom.com for general market tracking but to cross-reference data on other reputable platforms before making major investment decisions.

What are the main benefits of a Bitcoin ETF over direct ownership?

The primary benefits are simplicity and security. With a Bitcoin ETF, you avoid the technical challenges of managing digital wallets and private keys. You can invest through your existing brokerage account, just like buying a stock. Furthermore, ETFs are regulated financial products overseen by authorities like the SEC, which provides a layer of investor protection not always found on cryptocurrency exchanges. They also trade on familiar stock exchanges during regular market hours.

Are spot Bitcoin ETFs safer than futures-based ones?

All Bitcoin investments carry significant market risk due to volatility. However, the two ETF types have different structural risks. Spot ETFs directly hold Bitcoin, which generally results in less tracking error and a more straightforward investment. Futures ETFs have additional complexities, such as costs associated with rolling over expiring contracts (“roll costs”) and potential underperformance when futures prices are higher than the spot price (“contango”). They also introduce counterparty risk, as they depend on the financial health of parties in the futures contracts. While both ETF types are exposed to Bitcoin’s price swings, spot ETFs avoid some of the structural risks inherent in futures-based products.

Conclusion: Making Informed Decisions in the Crypto Market

After exploring fintechzoom.com bitcoin etf investments, it’s clear that Bitcoin ETFs have created a vital bridge between traditional finance and digital assets. These regulated vehicles offer a taste of the crypto market without the technical problems of direct ownership, allowing investment through a standard brokerage account.

Platforms like Fintechzoom.com are essential companions, offering data, trend analysis, and news to help investors steer this landscape. However, a reality check is crucial: understanding risk is non-negotiable. While ETFs make Bitcoin more accessible, the underlying asset remains highly volatile, with prices that can swing dramatically.

Whether considering a spot, futures, or leveraged ETF, thorough research is essential. Each type carries a unique risk-reward profile. We believe the best outcomes stem from informed choices, so we encourage you to fully understand any investment before committing capital. Use resources like Fintechzoom.com as part of a broader research strategy, as no single platform should be your only source.

The crypto market is constantly evolving. Staying informed is necessary for making decisions that align with your financial goals and risk tolerance.

Ready to continue your learning journey? Explore more of our comprehensive resource guides to find additional insights that can help you make well-informed financial decisions in this rapidly changing digital landscape.