Why Verifying Crypto Platform Legitimacy Matters More Than Ever

Focus Keyphrase: crypto30x.com gigachad in New York City

The Crypto30x.com gigachad phenomenon has become a major topic in crypto circles, mixing internet meme culture with promises of huge returns. From our base in New York City, we see these pitches targeting local traders across Manhattan, Brooklyn, Queens, the Bronx, and Staten Island—where NYDFS BitLicense standards and strict compliance expectations make thorough due diligence non-negotiable. But behind the confident persona and flashy 30x leverage claims, the platform raises serious red flags for any discerning investor.

Quick Answer: What You Need to Know About Crypto30x.com Gigachad

- Platform Claims: 30x leverage trading with AI-powered tools called “Zeus”

- Gigachad Branding: Uses the confident internet meme to attract bold, risk-taking traders

- Major Red Flags: Anonymous ownership, withdrawal complaints, lack of major regulatory oversight (e.g., NYDFS/SEC/FCA)

- User Reports: Multiple allegations of blocked accounts and unresponsive support

- Expert Verdict: Extreme caution advised – risks likely outweigh potential benefits

The term “crypto30x.com gigachad” is more than a platform; it’s a cultural movement. It merges the Gigachad meme—based on model Ernest Khalimov—with promises of life-changing crypto wealth, marketing itself to “alpha” traders who embody a fearless, diamond-handed mentality.

However, independent reviews and user reports paint a concerning picture. While the platform offers advanced features, significant concerns about transparency, regulation, and user fund safety have emerged. As crypto markets fill with platforms using meme marketing, thorough verification is critical—especially for New Yorkers navigating state-specific rules and protections. This guide will walk you through evaluating any crypto platform’s legitimacy, using crypto30x.com as our case study.

Crypto30x.com gigachad further reading:

Understanding the Hype: What Are Crypto30x.com and the Gigachad Persona?

The crypto world is a blend of tech and internet culture. From our perspective here in New York City, we’ve seen many trends, but the crypto30x.com gigachad phenomenon is unique. It’s where meme culture meets high-stakes finance, creating a brand that’s both aspirational and deeply rooted in online psychology.

Crypto30x.com’s Services: The “30x” Promise and AI Tools

Crypto30x.com positions itself as more than a trading platform. The “30x” represents its core promise: helping users find cryptocurrencies with potential for 30x returns. For those of us who appreciate life’s finer experiences, turning a modest investment into something life-changing has appeal.

The platform’s flagship feature is its AI-driven analytics system, centered on a tool called “Zeus.” This system claims to analyze technical, fundamental, and on-chain data to generate trade signals, attempting to bring institutional-level analysis to everyday traders.

Beyond AI, crypto30x.com offers high-leverage trading opportunities (up to 30x), amplifying both potential profits and losses. They’ve also expanded into staking services for passive income and offer educational resources. The platform markets itself as a complete ecosystem for crypto enthusiasts. For a more detailed breakdown, explore our Crypto30x.com DeFi Ultimate Guide.

The Gigachad Meme: From Internet Culture to a Crypto Archetype

The Gigachad meme began with Ernest Khalimov, a Russian model whose edited photos became an internet symbol of confidence around 2017. In crypto, a “crypto Gigachad” is the idealized trader: fearless in the face of volatility. This archetype has “diamond hands” (holding during market swings) and a HODL mentality (holding on for dear life).

The crypto Gigachad isn’t just about money; it’s a mindset of confidence and strategic thinking that many traders aspire to. You can learn more about this cultural evolution in our GigaChad in Crypto Definition resource.

How Crypto30x.com Uses the Gigachad for Marketing

Crypto30x.com’s adoption of the Gigachad persona is a clever marketing move. It taps into a powerful cultural symbol that resonates with its target audience. This strategy creates an aspirational identity; users want to become the confident trader the Gigachad represents. It transforms trading into a form of self-expression.

The viral marketing potential is huge, as memes spread organically. However, there’s a risk: the Gigachad persona can encourage excessive risk-taking by normalizing extreme leverage. Behind the meme is a real platform with real financial risks, a strategy seen in their Crypto30x.com News 2025 updates.

Step 1: Scrutinize the Platform’s Foundation and Transparency

When diving into cryptocurrency trading, think of it like choosing a restaurant for a special dinner in NYC. You wouldn’t enter a place with no visible health certificate, right? The same caution should apply to any crypto platform, especially one making bold promises like crypto30x.com gigachad.

Investigate Corporate Transparency and Regulatory Standing

This is where crypto30x.com becomes concerning. Imagine trying to book a table at a restaurant, but you can’t find its owner, location, or licenses. Anonymous ownership is the first major red flag. There is no clear information about who runs crypto30x.com—no founder profiles, team bios, or verifiable business address.

The platform claims a Malta Digital Asset Service Provider license, but this isn’t the same level of protection as regulation from bodies like the SEC in the U.S. or the FCA in the U.K. When evaluating a platform, look for clear team information, a legitimate physical address, compliance with reputable authorities, and independent security audits. When these are missing, it’s time to reconsider.

Analyze the Security Infrastructure: Is Your Investment Safe?

Crypto30x.com claims impressive security features: advanced encryption, multi-factor authentication, AI-powered risk detection, and cold storage wallets. These would be excellent if implemented effectively. However, security claims are only as good as their real-world performance.

User complaints tell a different story. When people report difficulty withdrawing funds or find their accounts suddenly blocked, even the best security promises become meaningless. The real test isn’t what a platform promises, but whether users can access their money. For comparison with platforms that prioritize genuine security, check out our Gemini Crypto30x Ultimate Guide.

Deconstruct High-Leverage Offerings and Fees

The “30x returns” promise really means you’re dealing with up to 30x leverage, which amplifies both gains and losses. It’s thrilling if you can handle it, but devastating if you can’t. High-leverage trading dramatically increases your risk of liquidation, where your position is automatically closed and you lose your investment.

Then there are the fees. Crypto30x.com mentions trading fees around 0.05% and leverage interest at 0.01% per hour. These small fees add up quickly, especially with frequent trading, and can erode profits. Unrealistic profit claims are another warning sign. Any platform promising guaranteed high returns without acknowledging the significant risks is selling a fantasy. For more on high-stakes trading, see our Crypto30x.com ASX Guide 2025.

Step 2: Dig into Community Feedback and Reported Red Flags

After checking the official claims, it’s time to see what real users are saying. Think of it like checking restaurant reviews before trying a new spot in Manhattan—you want to know what you’re getting into. The community feedback on crypto30x.com gigachad is troubling.

Uncovering User Complaints: The “Catfish” Scam Allegations

The term “catfish” here refers to a deceptive practice where platforms appear legitimate until users invest money. The pattern of complaints is consistent: withdrawal problems are the top concern. Users deposit funds easily, see impressive gains on their dashboard, but hit a wall when trying to cash out.

Blocked accounts are another major red flag, often suspended right after a withdrawal request. This timing is highly suspicious. Perhaps most frustrating is the unresponsive customer support. Tickets go unanswered and live chats are unavailable. Finally, users report fake profit displays, where incredible returns exist only on screen, designed to encourage more deposits.

How to Spot Authentic vs. Fake Reviews and Testimonials

Navigating online reviews requires a discerning eye. Bot accounts are often easy to spot: generic profiles, minimal history, and overly positive, repetitive reviews. Authentic reviews include specific details, while fake ones are vague and overly enthusiastic. Also, be wary of extreme emotional language without concrete examples.

Cross-referencing multiple sources is your best defense. If you see identical glowing reviews on Reddit, Twitter, and Trustpilot in a short period, it’s a warning sign. Genuine sentiment develops organically. You can explore more about community engagement in our Crypto30x.com Ocean Ultimate Guide.

The Psychology Behind the crypto30x.com gigachad Branding

The crypto30x.com gigachad branding is a masterclass in psychological manipulation. The meme taps into desires for confidence, success, and status. Echo chambers form around this branding, where groupthink takes over and questioning the platform becomes socially unacceptable.

The FOMO effect is amplified, compelling users to act quickly before they “miss out.” The branding weaponizes insecurity. Overconfidence is normalized, encouraging traders to ignore caution. Most dangerously, this branding normalizes extreme risk-taking, blurring the line between confident trading and reckless gambling, making it harder for users to recognize when they’re making potentially devastating financial decisions.

The Final Verdict on the crypto30x.com gigachad Phenomenon

After a deep dive into the claims, features, and user feedback surrounding crypto30x.com gigachad, the evidence demands careful consideration, not impulsive action.

Potential Benefits: The Allure of High Returns and AI Tools

Let’s be honest, elements of crypto30x.com gigachad are appealing. The platform’s AI-driven analytics via its “Zeus” tool is an intriguing approach to automated trading. The promise of signals based on complex data could genuinely help traders. You can explore this system in our Crypto30x.com Zeus Ultimate Guide.

The appeal of high leverage trading is also undeniable. The possibility of turning a modest investment into a fortune is tempting. The community aspect built around the Gigachad persona also creates a sense of shared identity, making trading feel more accessible and fun.

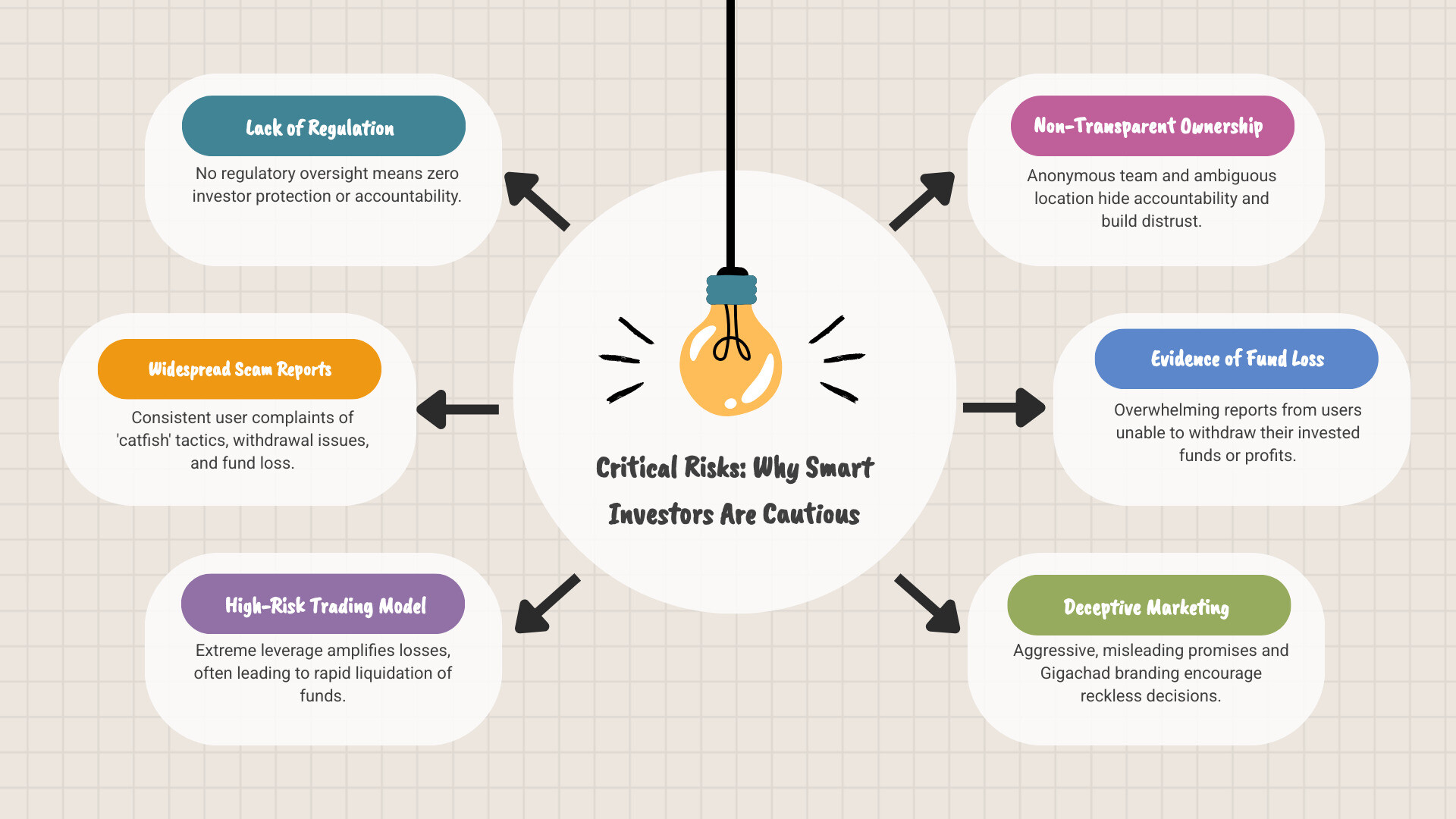

Critical Risks: Why Smart Investors are Cautious

However, our research reveals concerning patterns. As New Yorkers who value straight talk, we must address the major issues. The lack of major regulatory oversight is a fundamental problem. Without SEC or FCA regulation, investors have minimal protection.

More troubling are the widespread user complaints about withdrawal difficulties and blocked accounts. These aren’t isolated incidents but consistent patterns. When users can’t access their funds, it’s a siren, not just a red flag. The platform’s anonymous ownership structure compounds these concerns. Finally, the overwhelming evidence of user fund loss cannot be ignored. When that basic trust is broken, all other features become meaningless.

The Future Outlook for the crypto30x.com gigachad Trend

Looking ahead, meme-driven marketing in crypto isn’t going anywhere. The Gigachad archetype will likely continue to evolve. However, platforms built on hype rather than solid fundamentals face an uncertain future as regulatory scrutiny intensifies globally. Platforms that can’t demonstrate transparency and user protection may find themselves isolated.

The broader trend of meme-based marketing will likely persist but become more accountable. For crypto30x.com, the path forward depends on addressing the fundamental trust issues. The most successful traders balance bold moves with careful risk management—something that transcends any single platform or meme.

Frequently Asked Questions about Verifying Crypto Platforms

As food and travel enthusiasts from New York City, we know you might have questions after this deep dive into the crypto30x.com gigachad phenomenon. Just as we’d research a new restaurant, these questions deserve honest answers.

Is Crypto30x.com a legitimate platform or a scam?

Based on our investigation, crypto30x.com raises too many red flags to be considered trustworthy. While it offers appealing features like 30x leverage and its Zeus tool, these are overshadowed by overwhelming evidence of problems. The consistent pattern of user complaints about withdrawal issues, blocked accounts, and unresponsive support, combined with anonymous ownership and a lack of major regulatory oversight, points to what many experts would classify as a scam. The risk of being unable to access your funds is too high.

What does the “Gigachad” persona represent in crypto?

The Gigachad persona, based on model Ernest Khalimov, has evolved in the crypto world. Positively, it represents the idealized trader: confident, disciplined with “diamond hands,” and a community symbol of success. However, there’s a darker side. The Gigachad branding can encourage reckless behavior by making extreme risk-taking seem heroic. It blurs the line between a humorous meme and a psychological trap that can lead to poor financial decisions.

What are the biggest risks associated with a platform like Crypto30x.com?

The risks are severe. Financial loss is the most immediate danger—not from market volatility, but from the inability to withdraw your funds. Users report seeing profits on their dashboard they can never access. High-leverage trading dangers amplify this; with 30x leverage, a small market move can wipe out your investment, and on a questionable platform, that money may be gone forever. The lack of investor protection from bodies like the SEC or FCA means you have no legal recourse. Finally, the deceptive marketing influence uses FOMO and greed to cloud judgment. The inability to withdraw funds is the ultimate deal-breaker.

Conclusion

Our exploration of the crypto30x.com gigachad phenomenon reveals how flashy marketing can mask serious red flags. Just as we research a new restaurant in Manhattan, we’ve applied a thorough approach to this platform’s legitimacy.

We walked through three essential verification steps: scrutinizing the foundation, digging into community feedback, and weighing the risks. The major red flags surrounding crypto30x.com gigachad are too significant to overlook. Anonymous ownership, widespread user complaints about fund withdrawals, and the absence of major regulatory oversight from bodies like the SEC or FCA create a perfect storm of concern.

While AI tools and meme culture are appealing, they don’t outweigh fundamental trust issues. The “Gigachad” persona can’t hide the underlying problems with transparency and fund safety.

Here at The Dining Destination, whether exploring New York’s food scene or digital assets, our philosophy is consistent: security and transparency must always come before hype. We cannot endorse platforms with such significant, unresolved user complaints.

The crypto space is exciting, but it requires careful consideration. Do your own research thoroughly before investing. Look for platforms with clear ownership, proper regulation, and positive, verified user experiences.

Legitimate wealth building is rarely a shortcut. The most successful investors prioritize protecting their capital over chasing unrealistic returns.

For those seeking to deepen their understanding of financial topics, we invite you to explore our comprehensive resource guides for more in-depth information. Knowledge is the best ingredient for any successful investment.