The Shift to a Digital-First Financial World

Coyyn.com digital money represents a new approach to financial services that bridges the gap between traditional banking and modern digital finance. For travelers and food enthusiasts who value efficiency and control over their money, understanding this platform can transform how you handle payments during your culinary trips.

Quick Overview of Coyyn.com Digital Money:

- Coyyn.com – Educational platform covering digital finance, cryptocurrency, and the gig economy

- Coyni – The actual digital money platform with a mobile app and payment system

- Coyni Token – Digital currency backed 1:1 by the U.S. dollar for stability

- Key Benefits – Instant transactions, low fees, 24/7 access, and blockchain security

- Perfect For – Businesses, freelancers, travelers, and anyone wanting financial control

The financial world is shifting away from slow, expensive traditional systems. While your bank transfer might take 3-5 business days and cost $25-50 for international payments, digital money platforms like Coyni offer instant transfers at a fraction of the cost.

This matters especially for food travelers who need quick, reliable payments when booking unique dining experiences, paying local guides, or settling bills at authentic restaurants around the world. Traditional payment methods often fail us with high fees, poor exchange rates, and frustrating delays.

Coyni’s mission is simple: “Make transferring payments simple and instantaneous with the tokenization of payments.” Each Coyni token maintains a 1:1 backing with the U.S. dollar, providing stability while offering the speed and efficiency of blockchain technology.

The platform operates as a closed-loop ecosystem where consumers and businesses can benefit from peer-to-peer transactions, business-to-consumer payments, and business-to-business transfers – all while maintaining complete control over their money.

Know your coyyn.com digital money terms:

What is Coyyn.com and the Coyni Digital Money Platform?

Picture this: you’re trying to pay for that amazing hole-in-the-wall ramen shop you finded in Tokyo, but your card gets declined due to international restrictions. Or maybe you’re a food blogger waiting three days for a wire transfer to clear before you can book that exclusive cooking class in Tuscany. These everyday frustrations with slow, expensive, and opaque financial systems are exactly what inspired the creation of coyyn.com digital money.

The story behind Coyni emerged from a realization that the financial world desperately needed a change. Traditional banking wasn’t keeping up with our , globally connected lives – especially for those of us who live and breathe food experiences around the world.

Coyyn.com serves as your educational compass in the sometimes confusing world of digital finance. Think of it as your friendly guide that explains everything from cryptocurrency basics to how the gig economy is reshaping payments. It’s where you go to understand the digital money revolution.

But when you’re ready to actually use that knowledge? That’s where Coyni.com steps in as the practical fintech solution. This digital money platform operates as a closed-loop ecosystem, which means your money stays within a secure, controlled environment that gives you complete transparency and control.

What makes this system special is how it bridges the gap between traditional banking and modern digital needs. Whether you’re splitting a dinner bill with friends or running a food truck that needs instant payment processing, Coyni handles it all within one unified platform.

The Coyni Token: A Stable Digital Dollar

Here’s where coyyn.com digital money gets really interesting. The Coyni token isn’t like those wild cryptocurrencies you hear about on the news – the ones that can lose half their value overnight. Instead, it’s what we call a stablecoin.

Every single Coyni token is backed 1:1 with the U.S. dollar. This means when you hold 50 Coyni tokens, you’re holding exactly $50 worth of value. No surprises, no roller coaster rides – just stable, reliable digital money you can actually use for real purchases.

But how do you know this backing is real? That’s where custodial assurance comes in. Coyni doesn’t just promise your money is safe – they prove it. Through their partnership with Trust Explorer, independent audits regularly verify that every Coyni token in circulation is matched by real U.S. dollars in reserve.

You can even check this yourself right now through their real-time attestation system. It’s like having a window into the vault where your money is stored – something traditional banks would never let you see.

The Mission: Empowering Users with Financial Control

At its core, Coyni’s mission is beautifully simple: give people back control of their own money. Too often, we’re at the mercy of bank hours, processing delays, and hidden fees that pop up when we least expect them.

Financial transparency isn’t just a buzzword here – it’s built into the system. Every transaction gets recorded on the blockchain, creating an permanent, unchangeable record. You’ll never have to wonder where your money went or why a fee appeared.

The platform focuses on user empowerment through genuine simplicity. Instead of complex banking jargon and confusing terms, everything is designed to be straightforward. Need to send money to a friend who covered your share of that incredible tasting menu? It happens instantly, not in 3-5 business days.

These instantaneous transfers change everything about how we handle money. For food businesses, it means faster access to revenue. For travelers, it means no more worrying about whether your payment will process before that limited-time dining reservation expires.

Most importantly, Coyni is about taking back control of your money. Your funds aren’t locked away in some distant bank vault with limited access hours. They’re in your digital wallet, ready to use whenever and wherever you need them – whether that’s paying for street food in Bangkok or booking a last-minute reservation at that new fusion restaurant everyone’s talking about.

Core Features Powered by Blockchain Technology

When we talk about coyyn.com digital money, we’re really talking about the power of blockchain technology working behind the scenes to transform how we handle money. Think of blockchain as the invisible engine that makes everything faster, safer, and more transparent than traditional banking.

For those of us who love exploring food scenes around the world, this technology solves real problems. You know that frustrating feeling when you’re trying to pay for an amazing cooking class in Italy, but your bank flags it as suspicious and freezes your card? Or when you split a group dinner bill and have to wait days for everyone’s payments to clear? Blockchain eliminates these headaches.

The magic happens through immutability – once a transaction is recorded, it can’t be changed or erased. This creates an unbreakable record that prevents fraud and gives us complete confidence in every payment. The efficiency means transactions happen in minutes instead of days, while the transparency lets us track exactly where our money goes at every step.

What makes this especially powerful is how blockchain transforms the entire transaction experience. Instead of going through multiple banks and clearinghouses, payments move directly between users on a secure, distributed network. This cuts out unnecessary middlemen and their fees, making every transaction faster and cheaper.

Seamless Digital Wallet and Peer-to-Peer (P2P) Payments

The Coyni digital wallet brings together everything we need for modern money management in one simple app. With multi-currency support, you can hold traditional dollars alongside popular cryptocurrencies like Bitcoin and Ethereum – no more juggling multiple apps or accounts.

The real game-changer is the instant P2P transfers. Picture this: you’re at a fantastic food market with friends, and someone covers everyone’s purchases. Instead of promising to “Venmo you later” and waiting days for bank transfers, you can send your share immediately through Coyni. The money arrives in their wallet within minutes, not business days.

QR code payments make checkout incredibly smooth. Restaurants and food vendors can generate a unique QR code with the exact bill amount. You simply scan it with your phone, confirm the payment, and you’re done. No fumbling with cards, no waiting for receipts to print, no awkward “is the card reader working?” moments.

The platform’s low service fees mean more of your money stays in your pocket instead of going to payment processors. This is especially valuable for frequent travelers who know how quickly transaction fees can add up when you’re making multiple payments across different countries.

The eWallet functionality gives you complete control with real-time insights into all your transactions. You can instantly see where your money went, handle any refunds if needed, and track your spending patterns – perfect for managing travel budgets or business expenses.

How coyyn.com digital money Integrates Fiat and Crypto

One of the most frustrating things about today’s financial world is how disconnected traditional money and cryptocurrency feel. You might have dollars in your bank account and some Bitcoin on an exchange, but getting them to work together usually means multiple apps, confusing transfers, and plenty of fees.

Coyyn.com digital money solves this by creating a unified ecosystem where both worlds live together harmoniously. Your dollars and your crypto sit in the same digital wallet, and you can move between them instantly at current market rates.

This easy conversion feature is incredibly practical. Let’s say you’re planning a culinary tour and want to pay for accommodations with crypto to get better rates, but you prefer keeping your daily spending money in stable dollars. With Coyni, you can convert exactly what you need, when you need it, without leaving the app or paying excessive exchange fees.

The beauty of this single, unified ecosystem is that it gives you flexibility without complexity. Whether you’re paying for a cooking class with traditional dollars or buying a unique food-related NFT with cryptocurrency, everything happens in the same familiar interface. No more mental gymnastics trying to remember which payment method works where.

Smart Contract Integration for Automation

For anyone working in food, travel, or creative industries – which includes many of us in the gig economy – smart contracts are like having a trustworthy assistant who never sleeps and always follows through on agreements.

These automated financial agreements live on the blockchain and execute themselves when specific conditions are met. Think of them as digital contracts that automatically pay out when work is completed to satisfaction.

Here’s how this works in the real world: imagine you’re a food blogger who agrees to write restaurant reviews for a tourism company. Instead of invoicing and waiting 30 days for payment, a smart contract holds the agreed amount in escrow. The moment you submit your approved articles, the payment automatically transfers to your Coyni wallet. No chasing invoices, no payment delays, no wondering if you’ll get paid.

The gig economy benefits enormously from this automation. Food photographers get paid instantly when clients approve their shots. Tour guides receive payment the moment their tours end. Freelance chefs get compensated immediately after completing private dinner services.

Business payment automation streamlines operations for restaurants and food businesses too. Supplier payments can trigger automatically when deliveries are confirmed, and staff can receive tips and wages without manual processing delays.

This secure transaction system protects everyone involved. Buyers know their money is safely held until they receive what they ordered, while sellers know payment is guaranteed once they deliver as promised. It’s like having an impartial referee ensuring fair play in every business deal.

Real-World Benefits of Coyyn.com Digital Money

Picture this: you’re exploring the busy food scene in Queens, hopping between authentic Korean BBQ joints and traditional Greek tavernas. You want to pay quickly, avoid hefty foreign transaction fees, and maybe even split the bill with your foodie friends instantly. This is where coyyn.com digital money transforms from an interesting concept into a practical game-changer for real people living real lives.

The beauty of Coyni isn’t just in its technology – it’s in how seamlessly it fits into the rhythm of our daily experiences, especially for those of us who live and breathe food culture in New York City.

How Businesses Can Streamline Operations

Walking through Chelsea Market on a busy Saturday, you’ll notice something fascinating: the most successful vendors aren’t necessarily the ones with the fanciest setups, but those who can process payments quickly and efficiently. Coyyn.com digital money is revolutionizing how food businesses handle their financial operations, one transaction at a time.

Traditional payment processing can eat into a small business’s profits with fees ranging from 2.9% to 4% per transaction. Coyni’s payment processing offers significantly lower costs, which means more money stays in the pockets of hardworking entrepreneurs. For a busy food truck serving lunch in Midtown, those savings can add up to thousands of dollars annually.

The mPOS solution is particularly brilliant for our city’s dynamic food scene. Any smartphone or tablet becomes a complete payment terminal, perfect for pop-up restaurants, food festivals, or that amazing dumpling vendor who sets up outside the subway station. No expensive hardware, no complicated installations – just download the app and start accepting payments.

What really excites us is the API integration capability. Local restaurants can seamlessly incorporate Coyni payments into their existing online ordering systems, while food tour operators can offer it as a smooth payment option for international visitors. This level of integration means reduced operational costs without sacrificing functionality.

Our insight at The Dining Destination is that digital payments are changing the hospitality landscape in remarkable ways. Restaurants experience faster table turnover when payments process instantly. Tour operators can accept bookings from international guests without worrying about currency conversion headaches. Even small cafés benefit from simplified tip distribution and reduced administrative paperwork. Every business owner we’ve spoken with appreciates having more control over their financial operations.

Personal Finance Management for the Modern User

Let’s be honest – managing money while pursuing your passion for food and travel can be frustrating. Between foreign transaction fees, slow bank transfers, and the constant juggling of different payment apps, it sometimes feels like the financial system is working against us rather than for us.

Coyyn.com digital money changes that entire experience. The platform’s budgeting tools help you track spending across all your culinary trips, whether you’re saving for that special anniversary dinner at a Michelin-starred restaurant or budgeting for your next food tour through Southeast Asia.

The instant cash-out options are where Coyni truly shines for everyday users. Choose from ACH transfers, Push-to-Card services, or direct transfers to your preferred payment method. Received money from a friend who owes you for last night’s group dinner? Access it immediately instead of waiting 3-5 business days for traditional transfers to clear.

For the growing number of freelancers and remote workers in our city – many of whom are also passionate food enthusiasts – Coyni offers something invaluable: fast, low-cost payments that work on their schedule. Picture a freelance food photographer who just completed a shoot for a Brooklyn restaurant. With Coyni, they can receive payment instantly and convert it to their preferred currency without the typical banking delays.

Managing finances while traveling becomes significantly easier when you’re not constantly calculating exchange rates or worrying about foreign transaction fees. Whether you’re exploring street food markets in Bangkok or wine tasting in Tuscany, your Coyni wallet travels with you, offering the same reliability and low costs wherever your culinary journey takes you.

The platform empowers freelancers and gig economy workers with unprecedented financial flexibility. No more waiting for payments to clear before you can pay your own bills or book your next food trip. It’s about having your money work for you, on your terms, exactly when you need it.

Your Guide to Getting Started: Security, Costs, and Future Vision

Taking your first steps with coyyn.com digital money doesn’t have to feel overwhelming. As food and travel enthusiasts here in New York City, we know how important it is to have financial tools that are both secure and simple to use. Let’s walk through everything you need to know about getting started, staying safe, and understanding why Coyni offers such incredible value.

Onboarding and Support Resources

Getting your Coyni account up and running is refreshingly straightforward. The process starts with downloading the app from Coyni.com or your preferred app store. Once you’ve got it installed, you’ll create your account using just your email address – no complicated forms or endless questions.

The next step involves completing KYC verification, which might sound intimidating but is actually quite simple. This Know Your Customer process is standard for all legitimate financial platforms and helps keep everyone safe. You’ll submit some basic identification documents, and the system walks you through each step clearly.

After verification, you’ll fund your wallet using whatever method works best for you – bank transfer, cryptocurrency deposit, or even a credit card. The beauty of Coyni is that it meets you where you are financially, whether you’re completely new to digital money or already comfortable with crypto.

What really sets Coyni apart is their commitment to making sure you never feel lost. Their 24/7 customer service means you can get help whenever you need it, which is especially valuable when you’re dealing with money. The platform offers multilingual support too, perfect for our diverse city where financial inclusion matters.

You’ll also find comprehensive user guides, video tutorials, and detailed FAQ sections that answer common questions before you even think to ask them. There’s even an engaged community forum where users help each other out – it’s like having a knowledgeable friend who’s already figured everything out.

Security and Regulatory Compliance

When it comes to your money, security isn’t just important – it’s everything. Coyni takes this responsibility seriously, implementing bank-grade security protocols that protect both your funds and your personal information. Every communication and transaction gets encrypted end-to-end, so your sensitive data stays private.

The platform uses blockchain technology to create an immutable record of every transaction. This means once something is recorded, it can’t be changed or deleted, which dramatically reduces fraud risk. You’ll also set up two-factor authentication, adding an extra security layer that requires two forms of verification before anyone can access your account.

For added convenience without sacrificing security, Coyni offers biometric login options. You can use your fingerprint or facial recognition to access your account quickly while keeping it secure from unauthorized users.

Beyond technical security measures, Coyni maintains strict regulatory compliance. They follow KYC/AML/GDPR adherence standards, which means they verify user identities to prevent fraud, detect money laundering activities, and protect your data privacy according to international standards.

This commitment to preserving the integrity of digital evidence in all transactions isn’t just about following rules – it builds the trust that makes digital money work for everyone, from individual users to large institutions.

Value Proposition: A Cost-Effective Alternative

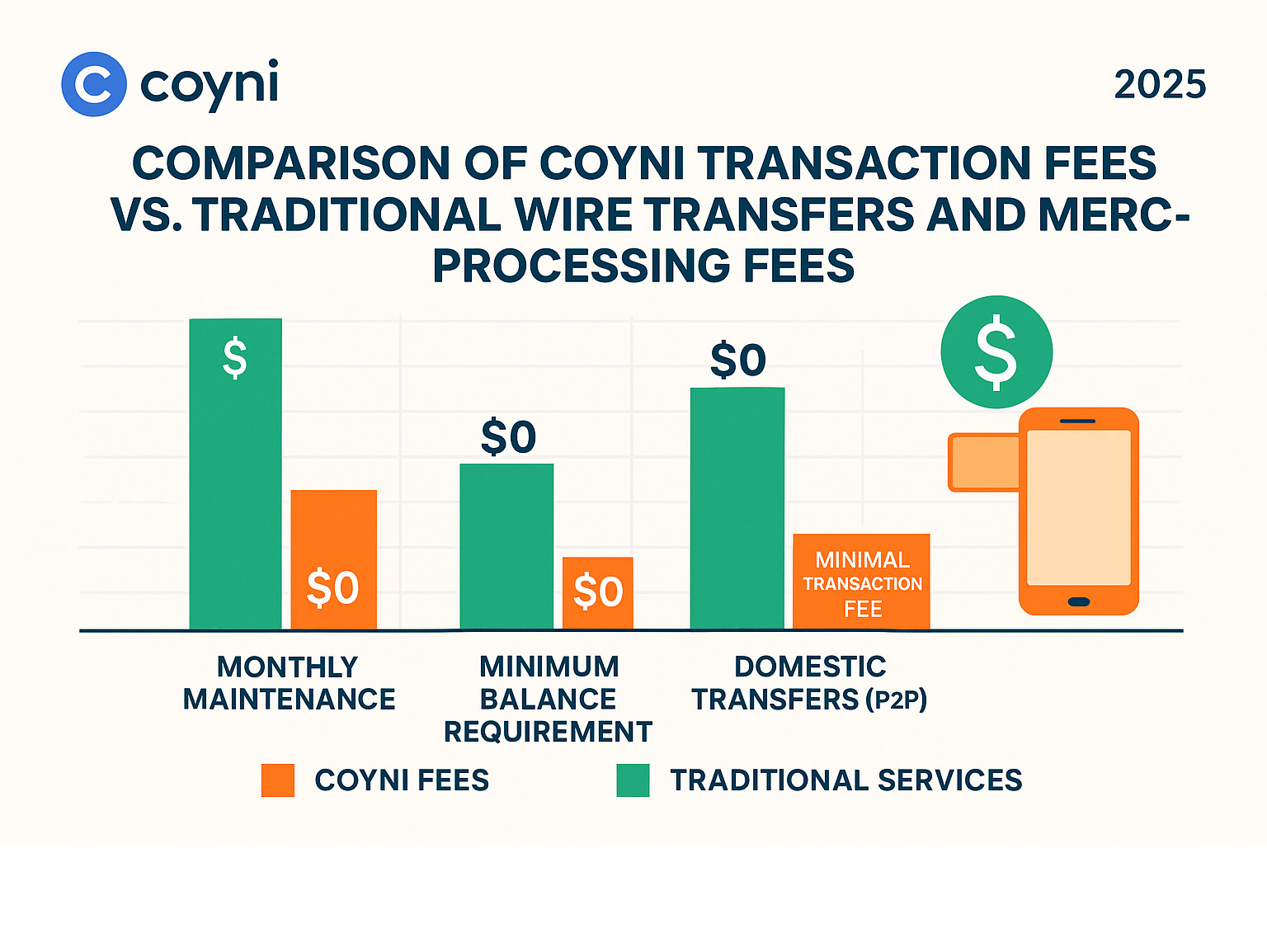

Here’s where coyyn.com digital money really shines – the numbers speak for themselves. Traditional banking hits us with fees at every turn: monthly maintenance charges, minimum balance requirements, hefty international transfer costs, and those sneaky currency conversion markups that eat into our travel budgets.

| Service Type | Coyni Fees | Traditional Services (Typical) |

|---|---|---|

| Monthly Maintenance | $0 | $10 – $30 |

| Minimum Balance Requirement | $0 | $100 – $1,000 |

| Domestic Transfers (P2P) | Minimal Transaction Fee | $0 – $10 |

| International Transfers | Fraction of cost | $25 – $50 |

| Merchant Processing Fees | Competitive Low Fees | 1.5% – 3.5% + fixed fee |

| Currency Conversion | Real-time rates, no hidden markups | Hidden markups, less favorable rates |

Coyni’s transparent fee structure eliminates most of these pain points entirely. There are no monthly maintenance fees or minimum balance requirements, which means your money is truly yours to use as you see fit. International transfers – a frequent headache for anyone who loves global food experiences – cost just a fraction of traditional wire transfer fees while processing much faster.

For small business owners running food trucks, restaurants, or culinary tours, the competitive merchant processing fees can significantly improve profit margins. For individual users, it means more money stays in your pocket for that next amazing dining trip or cooking class abroad.

The Future Roadmap for coyyn.com digital money

The exciting thing about Coyni is that what we see today is just the beginning. Their development roadmap shows a commitment to staying ahead of the curve in digital finance, with plans that could transform how we think about money entirely.

DeFi integration is on the horizon, which will let users participate in decentralized lending and borrowing directly from their Coyni wallet. Imagine earning interest on your travel fund while you plan your next culinary trip, or accessing liquidity for a business opportunity without traditional loan hassles.

NFT support is also coming, opening doors to unique digital collectibles related to food and travel experiences. You might soon be able to collect and trade digital certificates from famous chefs or unique dining experiences, all stored securely in your Coyni wallet.

Perhaps most intriguingly, AI-based financial advisory features will provide personalized investment recommendations based on your goals and risk tolerance. This could help you make smarter financial decisions while building wealth for future culinary trips.

This strong development roadmap ensures that as the financial world evolves, Coyni users will have access to cutting-edge tools and services. For food and travel enthusiasts, this means having financial technology that grows with your passions and supports your lifestyle in ways we’re only beginning to imagine.

Frequently Asked Questions about Coyni

We’ve covered a lot about coyyn.com digital money, but we know that diving into any new financial platform can feel overwhelming. As fellow New Yorkers who value straight talk, let’s address the questions we hear most often when discussing Coyni with our food and travel community.

Is Coyni the same as other cryptocurrencies like Bitcoin?

This is probably the most common question we get, and it’s a great one. While both Coyni and Bitcoin use blockchain technology, they’re actually quite different in purpose and behavior.

Bitcoin is like that friend who’s either flush with cash or completely broke depending on the day. Its value swings wildly based on market speculation, making it exciting for investors but nerve-wracking for everyday purchases. Imagine trying to pay for your dinner at a Brooklyn restaurant, only to find your Bitcoin lost 10% of its value while you were deciding between the pasta and the fish.

Coyyn.com digital money, specifically the Coyni token, takes a completely different approach. It’s what we call a stablecoin, meaning each token is backed 1:1 by the U.S. dollar. Think of it as having the stability of cash with the convenience and speed of digital payments. When you hold 50 Coyni tokens, you know you have exactly $50 worth of purchasing power, whether you’re buying street tacos today or booking a food tour next month.

The key difference is purpose. Bitcoin was designed as a decentralized digital currency and investment vehicle. Coyni was built for practical, everyday use – paying bills, sending money to friends, or handling business transactions without worrying about value fluctuations.

What are the main differences between Coyni and traditional payment apps?

Living in New York, we’re no strangers to digital payments. We use various apps daily, but Coyni brings some unique advantages that really matter for our lifestyle.

The most significant difference is blockchain security. While traditional payment apps rely on centralized servers that can be vulnerable, Coyni records every transaction on an immutable distributed ledger. This means once a payment is made, it can’t be altered or disputed unfairly – a huge advantage for small business owners in our food scene.

24/7 access is another game-changer. Traditional payment apps often follow banking hours for certain functions, but Coyni operates around the clock. Need to cash out at midnight after a late-night catering gig? No problem. The platform offers instant cash-out options through ACH transfers, push-to-card services, and direct bank transfers, regardless of the time.

The fee structure is where Coyni really shines. Traditional payment apps and banks hit you with various charges – monthly maintenance fees, international transfer costs, and processing fees that add up quickly. Coyni’s transparent fee structure eliminates most of these pain points, especially for international payments. For food bloggers working with international clients or restaurants serving global tourists, this can mean significant savings.

Perhaps most importantly, Coyni seamlessly bridges traditional money and cryptocurrency within a single wallet. You can hold dollars for daily expenses and crypto for investments, converting between them instantly at real-time rates. This integration simply isn’t available in most traditional payment apps.

How does Coyni ensure my funds are backed 1:1 by the US dollar?

Trust is everything when it comes to your money, and we completely understand why this question comes up. Coyni takes several concrete steps to ensure that promise of 1:1 backing isn’t just marketing talk.

First, they maintain dedicated reserves of U.S. dollars in regulated financial institutions. For every Coyni token issued, there’s an actual dollar sitting in a secure account. This isn’t a complex investment strategy or risky lending scheme – it’s straightforward dollar-for-token backing.

The platform’s blockchain technology within its closed-loop ecosystem provides the infrastructure for transparent tracking. Unlike traditional banks where you have to trust their word, Coyni’s system allows for verifiable proof of these reserves. Every token issued and every dollar held can be tracked and verified on the blockchain.

But here’s where it gets really impressive: Coyni partners with Trust Explorer for independent audits and real-time attestation. This isn’t an annual review that gets buried in fine print. You can actually See Real Time Attestation showing the current reserves compared to tokens in circulation. It’s like having a financial watchdog that never sleeps, constantly verifying that your digital dollars are backed by real ones.

This level of transparency is unprecedented in traditional banking. When was the last time your bank let you peek into their books in real-time? This commitment to openness and verification gives us the confidence to recommend Coyni to our community of food enthusiasts and small business owners who need reliable, transparent financial services.

Conclusion: Take Control of Your Digital Financial Future

As we wrap up our journey through coyyn.com digital money, it’s clear we’re looking at something truly transformative. This isn’t just another payment app or digital wallet – it’s a complete reimagining of how money should work in our modern world.

Think about the last time you waited three days for a bank transfer to clear, or when you were hit with a surprise $35 fee for an international wire transfer. Those frustrations are exactly what Coyni eliminates. The platform delivers on four core promises that matter most to us: blazing-fast speed with instant transfers, bank-grade security through blockchain technology, complete control over your money without hidden fees or restrictions, and remarkably low costs that put more money back in your pocket.

For those of us passionate about food and travel, these benefits translate into real-world advantages. Picture splitting the bill at that amazing hole-in-the-wall ramen shop in the East Village and instantly sending your share to a friend. Imagine booking a last-minute food tour in Barcelona and having your payment process immediately, securing your spot without the usual banking delays. Or consider running a small catering business and receiving payments from clients instantly, improving your cash flow dramatically.

Coyni and Coyyn.com are actively shaping the future of finance for both individuals and businesses. While Coyyn.com educates us about the evolving digital finance landscape, Coyni provides the practical tools to thrive in this new environment. Together, they’re building a bridge between where we are today and where finance is heading tomorrow.

The beauty lies in the simplicity. You don’t need to be a tech expert or financial wizard to benefit from what Coyni offers. The platform makes advanced blockchain technology accessible to everyone, whether you’re a freelance food photographer needing quick payments or a restaurant owner looking to streamline operations.

As we look ahead, the question isn’t whether digital money will become mainstream – it’s whether you’ll be ready to accept the advantages it offers. The traditional financial system served us well for decades, but it’s time to move beyond its limitations.

Ready to explore how digital finance can improve your culinary trips and business ventures? Explore our complete resource guide for more financial tips for modern travelers and foodies and find how taking control of your digital financial future opens up a world of possibilities for your next great dining experience.