Why Coyyn.com Digital Economy Matters in Today’s Financial World

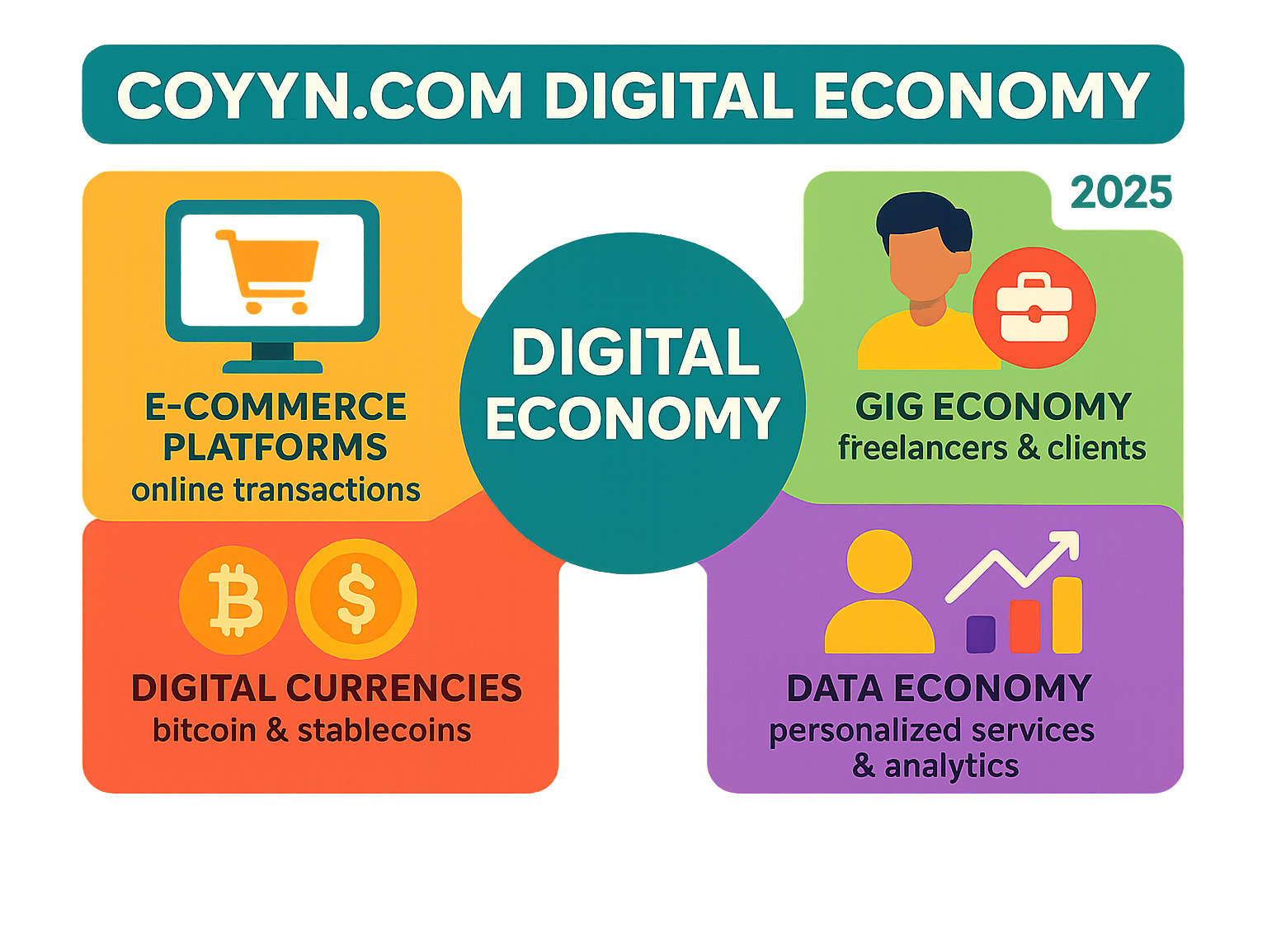

The coyyn.com digital economy represents a shift in how we handle money, investments, and financial services. It’s a comprehensive platform that bridges traditional banking with cutting-edge digital tools like cryptocurrency, blockchain technology, and AI-powered financial services.

Key Components of Coyyn.com Digital Economy:

- Digital Capital Management – Advanced portfolio tools using AI and blockchain

- Multi-Currency Support – Traditional fiat and cryptocurrency integration

- Business Solutions – Automated invoicing, accounting, and global payments

- Educational Resources – Financial literacy guides and tutorials

- Secure Infrastructure – Blockchain-based transaction security

The digital economy is growing at an incredible pace. Research shows it’s expanding at 8.5% annually – three times faster than traditional economic sectors. This massive shift affects everyone, from individual investors to large corporations.

Coyyn.com sits at the center of this change. The platform combines the stability of traditional finance with the innovation of digital currencies and blockchain technology.

For businesses, this means access to global markets, automated processes, and reduced transaction costs. For individuals, it offers easier money management, cryptocurrency support, and educational tools to steer this new financial landscape.

The gig economy alone has grown from just 10.1% of the US workforce in 2005 to 15.8% in 2015, with projections suggesting over 50% participation by 2027. This rapid change creates both opportunities and challenges that platforms like Coyyn.com are designed to address.

What is the Coyyn.com Ecosystem and How Does It Work?

Think of the coyyn.com digital economy as a bridge between two worlds – the traditional banking system you’ve known for years and the exciting new field of digital finance. It’s like having a skilled translator who helps these two very different financial languages work together seamlessly.

The platform’s mission is beautifully simple yet powerful: creating a world where everyone can reach their full economic potential, regardless of where they’re starting from financially. Having worked with diverse communities here in New York City, we understand how crucial this kind of financial inclusion really is.

What makes Coyyn.com special is how it weaves together familiar banking features with cutting-edge tools like cryptocurrencies, blockchain technology, and AI-powered services. The founders understood something important – you can’t revolutionize digital capital management without first understanding how we got here financially.

This isn’t just about moving money around digitally. It’s about strategically leveraging digital assets, knowledge, and data to drive real innovation and boost productivity in our fast-changing world.

The platform thrives on its community-driven approach, fostering trust through collaboration and knowledge-sharing. Users aren’t just customers – they’re part of a supportive ecosystem designed to help everyone grow their digital capital and steer modern finance with confidence.

How Coyyn.com Fosters Financial Literacy

Let’s be honest – the digital financial world can feel overwhelming, especially when you’re just starting out. The coyyn.com digital economy tackles this challenge head-on with an impressive commitment to financial education.

The platform provides extensive learning tools, including free guides and tutorials specifically designed for beginners. Think of it as having a patient financial mentor available 24/7, ready to explain everything from basic budgeting to complex investment strategies.

This comprehensive approach covers all the essentials: smart budgeting techniques, effective saving strategies, informed investing decisions, debt management, and long-term financial planning. They even tackle the darker side of digital finance by teaching users how to spot and avoid common scams – knowledge that’s absolutely vital in today’s digital landscape.

What really sets Coyyn.com apart is its user-friendly Content Management System (CMS) that makes accessing valuable information incredibly easy. Features like “Content Assist” streamline the learning process, making financial education feel less like homework and more like findy.

This dedication to empowering consumers with financial tools isn’t just a nice bonus – it’s essential for building trust and creating genuine community engagement. For those interested in diving deeper into business finance topics, there are additional resources available that complement this educational approach.

Digital Capital Management: The Coyyn.com Approach vs. Traditional Services

The difference between Coyyn.com’s digital capital management and traditional financial services is like comparing a smartphone to a rotary phone – both make calls, but the experience is worlds apart.

While conventional banks still rely heavily on manual processes, periodic reporting, and physical branch networks, Coyyn.com accepts a digital-first philosophy that prioritizes innovation and agility.

| Feature | Traditional Financial Services | Coyyn.com Digital Economy |

|---|---|---|

| Processes | Manual, paper-based, often slow | Automated, digital, real-time |

| Reporting | Periodic statements, monthly or quarterly | Real-time data, instant insights |

| Asset Types | Fiat currency, stocks, bonds, physical assets | Fiat, cryptocurrencies, tokenized assets, digital resources |

| Accessibility | Limited by branch hours, geographic location | Global, 24/7 access from anywhere |

| Technology Use | Legacy systems, slower tech adoption | Blockchain, AI, Machine Learning, Web3 analytics |

| Cost Structure | Higher fees, physical infrastructure overhead | Lower transaction fees, reduced operational costs |

| Customer Experience | Often generic, less personalized | Hyper-personalized recommendations, AI-driven insights |

Coyyn.com revolutionizes how businesses approach banking, markets, and cryptocurrency investments through strategic use of digital tools and knowledge. The platform offers tokenization services, robust compliance frameworks, and Web3 analytics capabilities – all designed to improve security, drive growth, and ensure sustainability.

The platform’s DeepRecs™ technology showcases this innovation beautifully, using image recognition and NLP-based deep learning for product recommendations, even when historical data is limited. This AI-driven approach balances automation with transparency, helping users understand and trust the technology behind their financial decisions.

Whether you’re running a small business in busy Manhattan or managing a large enterprise with global reach, this agility and 24/7 global access provides critical advantages in today’s digital economy. For businesses looking to expand their financial toolkit, exploring options like business loans can complement the digital-first approach that Coyyn.com champions.

Key Benefits and Tools in the coyyn.com Digital Economy

The coyyn.com digital economy is changing how we handle money and business operations, much like how digital platforms have revolutionized the food industry here in New York City. Just as restaurant owners now rely on digital tools for everything from inventory management to customer engagement, financial platforms are becoming essential for modern economic life.

What makes this platform particularly exciting is its real-world impact on efficiency and costs. We’ve witnessed how digital change can cut operational expenses by 27% through cloud infrastructure alone. For businesses operating in the gig economy – whether they’re food delivery services or freelance consultants – platforms with robust payment systems report a remarkable 75% increase in worker satisfaction and retention.

The coyyn.com digital economy delivers these benefits through its comprehensive approach to digital finance. Users gain access to blockchain security that protects their transactions, extensive cryptocurrency support for modern payment needs, and business tools that automate previously time-consuming tasks. The platform’s global payment solutions make international transactions as simple as ordering takeout from your favorite local spot.

Perhaps most importantly, these improvements translate into tangible savings. Automated task management can slash administrative overhead by up to 60%, freeing up resources that businesses can reinvest in growth and innovation.

Primary Benefits of the coyyn.com Digital Economy for Individuals

For everyday users, the coyyn.com digital economy feels like having a financial advisor, crypto exchange, and international bank all rolled into one user-friendly platform. It’s designed with the same attention to simplicity that makes your favorite restaurant app so easy to use.

The platform’s ease of use stands out immediately. Complex financial operations become straightforward through clean, intuitive interfaces. This accessibility is crucial for encouraging people to take control of their digital financial lives without feeling overwhelmed by technical jargon.

Cryptocurrency support is where Coyyn.com really shines. The platform accepts multiple digital currencies with multi-chain features that don’t lock you into just Bitcoin or Ethereum. Users get real-time price tracking that helps them make informed decisions, plus seamless conversion between crypto and traditional currencies. It’s like having a comprehensive crypto wallet guide right at your fingertips.

The global payment systems eliminate the headache of international transfers. Sending money across borders becomes as simple as splitting a dinner check with friends. With lower transaction fees – some services like CoynPay charge around 1% commission, saving users over 40% compared to traditional options – you can send money quickly and even anonymously when needed.

Security concerns? Coyyn.com addresses these through blockchain technology that protects every transaction. This gives users peace of mind in an increasingly digital world where financial security is paramount.

Essential Tools for Businesses Operating in the Digital Economy

Businesses operating in today’s digital landscape need more than just basic payment processing – they need a complete ecosystem of financial tools. The coyyn.com digital economy delivers exactly that, offering solutions that streamline operations while reducing costs and complexity.

Automated accounting transforms how businesses manage their finances. Instead of manual ledger entries and spreadsheet juggling, companies get smart systems that track income, expenses, and financial health automatically. This is particularly valuable for small businesses that can’t afford dedicated accounting staff.

Global payment processing opens doors to international markets without the traditional banking headaches. Businesses can pay suppliers in Tokyo and receive payments from customers in London with the same ease they’d handle local transactions. The low-fee structure makes international expansion financially viable for companies of all sizes.

Token-based reward systems represent the future of customer loyalty programs. Rather than traditional point systems, businesses can create transparent, blockchain-powered rewards that customers actually value and trust. This innovation helps companies stand out in competitive markets.

The platform’s Web3 analytics capabilities provide insights that were previously available only to large corporations. Businesses gain deeper understanding of their digital interactions and asset management, leading to smarter decisions and improved growth strategies.

Perhaps most impressive are the AI-powered matching algorithms that can improve job completion rates by 42% while cutting work search time in half. For businesses managing freelancers or gig workers, this efficiency boost translates directly to improved profitability.

Cloud infrastructure benefits extend beyond cost savings to include improved reliability and scalability. As businesses grow, their financial tools grow with them without requiring expensive infrastructure investments. For companies looking to understand broader market trends, resources like our investing tips guide provide valuable context for making informed financial decisions.

Navigating Risks and Ensuring Security on the Platform

Let’s be honest – while the coyyn.com digital economy opens up amazing opportunities, it’s not without its challenges. Just like when you’re trying a new restaurant in New York City, you want to know what you’re getting into before you dive in. We believe in being straight with our readers about both the exciting possibilities and the potential bumps along the way.

The digital finance world comes with some real considerations you should know about. Market volatility is probably the biggest one, especially when cryptocurrencies are involved. One day Bitcoin might be soaring, the next it could take a nosedive – and that affects your digital wallet. Then there’s the regulatory uncertainty that keeps everyone on their toes. Financial regulations are still catching up to digital innovations, which sometimes creates a gray area that can feel uncomfortable.

Fraud risks are another reality we can’t ignore. While digital platforms offer incredible convenience, they also attract people with less-than-honest intentions. And let’s not forget about the digital divide – not everyone has reliable internet access or the latest devices, which can leave some people out of this digital revolution entirely.

But here’s the good news: Coyyn.com takes these concerns seriously and has built their entire platform around addressing them. They understand that trust isn’t just nice to have – it’s absolutely essential for anyone handling your money.

How Coyyn.com Addresses Security and Builds Trust

Security isn’t just a checkbox for the coyyn.com digital economy – it’s woven into everything they do. Think of it like the kitchen safety standards at a top-rated restaurant. You might not see all the behind-the-scenes work, but it’s there protecting you with every interaction.

The foundation of their security starts with blockchain technology. This isn’t just tech jargon – it’s a game-changer. Every transaction gets recorded on an unchangeable digital ledger that’s spread across multiple computers. It’s like having a receipt that can’t be altered, witnessed by hundreds of people at once. This makes fraud incredibly difficult and gives you a clear trail of every financial move you make.

Transaction transparency goes hand in hand with blockchain. You’re not left wondering where your money went or when a payment will process. Everything is visible and traceable, which builds confidence in the system. Preserving the integrity of digital evidence becomes much easier when every step is documented automatically.

Their data protection protocols use military-grade encryption – the same level of security that protects government communications. Your personal information gets scrambled so thoroughly that even if someone intercepts it, they can’t make sense of it without the proper keys.

Smart contracts are another brilliant security feature. These automated agreements cut payment disputes by 42% and reduce transaction costs by almost a third. Instead of relying on people to follow through on promises, the system automatically executes agreements when conditions are met. It’s like having a reliable friend who never forgets to split the dinner bill correctly.

Two-factor authentication adds that extra layer of protection we all need. Even if someone somehow gets your password, they’d still need access to your phone or email to get into your account. It’s a simple step that makes a huge difference in keeping your money safe.

Leveraging Technology for Improved Service Delivery

What really sets the coyyn.com digital economy apart is how they use cutting-edge technology to make your life easier. It’s not about showing off with fancy tech – it’s about solving real problems and making financial management feel less like a chore.

Blockchain for security forms the bedrock of everything they do. Beyond just keeping transactions safe, it creates an environment where you can trust that what you see is what you get. No hidden fees, no mysterious charges – just transparent, secure financial operations.

AI for personalization is where things get really interesting. The platform learns from your financial habits and preferences to offer suggestions that actually make sense for your situation. Instead of generic advice that applies to everyone, you get recommendations custom to your specific goals and spending patterns. It’s like having a financial advisor who knows you well enough to suggest the perfect investment opportunity or savings strategy.

Data analytics for insights transforms all those numbers and transactions into meaningful information you can actually use. The platform processes vast amounts of data to spot trends, identify opportunities, and help you make smarter financial decisions. You might find that you’re spending more on food delivery than you realized, or that there’s a better time to make certain investments.

IoT for real-time data keeps everything current and responsive. Your financial information updates instantly, so you’re never working with outdated numbers. This real-time approach means you can react quickly to market changes or adjust your spending on the fly.

VR/AR for collaboration might sound futuristic, but these technologies are already improving how financial services work behind the scenes. They make customer support more effective and educational resources more engaging, which ultimately benefits your experience on the platform.

The result is hyper-personalization that goes far beyond what traditional banks offer. Read about AI’s impact on creating truly customized financial experiences. Every interaction feels designed specifically for you, making the complex world of digital finance feel surprisingly approachable and user-friendly.

The Future is Digital: Coyyn.com’s Evolving Role

The financial world is changing at lightning speed, and honestly, it’s pretty exciting to watch. The coyyn.com digital economy isn’t just keeping up with these changes—it’s helping shape what comes next. As experts who’ve spent years observing how digital change affects everything from New York’s busy restaurant scene to global business operations, we can tell you that this shift is real and it’s happening now.

The numbers tell an incredible story. The global digital currency market was worth $5.81 billion in 2023, but here’s where it gets interesting—experts predict it’ll reach $16.95 billion by 2032. That’s a growth rate of 12.64% annually. Think about what that means for businesses, individuals, and entire economies.

The Digital Economy Trends 2025 Report highlights 18 transformative trends that are reshaping industries, societies, and governance. From where we sit, watching these changes unfold across different sectors, it’s clear that platforms like Coyyn.com are positioned at the center of this digital revolution.

Future Outlook for the coyyn.com Digital Economy

Looking ahead, the coyyn.com digital economy is preparing for some pretty remarkable developments. We’re not talking about distant sci-fi dreams here—these are real innovations that could transform how you manage money within the next few years.

AI-based investment tools are becoming incredibly sophisticated. Imagine having a personal financial advisor that never sleeps, constantly analyzes market conditions, and can spot investment opportunities you might miss. Coyyn.com is working toward offering AI-powered investment advisors that provide hyper-personalized portfolio recommendations and automated trading strategies designed to optimize your returns while managing risk more effectively.

Tokenized real-world assets represent another fascinating development. This technology allows you to own a fraction of traditionally expensive investments like real estate, art, or commodities through digital tokens. It’s like democratizing access to investments that were once only available to the wealthy. Coyyn.com is exploring ways to facilitate the creation, management, and trading of these tokenized assets.

The move toward Web 3.0 and decentralized platforms is particularly interesting. This evolution emphasizes user ownership and decentralization, potentially involving decentralized autonomous organizations (DAOs) and token-based incentives that give users more control while reducing costs.

Cross-platform integration is becoming essential. The future demands seamless connectivity where you can manage your digital finances across various devices and applications without any hassle. Coyyn.com is focusing on deeper integration to make this a reality.

Perhaps most impressively, technological advancements are predicted to improve platform efficiency by 72% while reducing operational costs by nearly one-third. For users, this means faster transaction speeds, lower fees, and a smoother overall experience.

The Growing Gig Economy and Coyyn.com’s Contribution

The gig economy isn’t just changing how people work—it’s revolutionizing the entire concept of employment. The coyyn.com digital economy is playing a crucial role in supporting this massive shift, and the statistics are pretty mind-blowing.

Here’s something that might surprise you: the gig economy is growing three times faster than the traditional workforce. Currently, 36% of US workers participate in gig work, and experts predict that over 50% will by 2027. That’s more than half the workforce!

This explosive growth happens because of platform economics, which fundamentally change how value flows through digital marketplaces. Platforms with strong network effects grow faster because they reduce transaction costs, improve trust through ratings, streamline payments, and automate matching between workers and tasks.

Coyyn.com’s contribution to this sector is really impressive. Seamless payments are crucial for gig workers who need to get paid quickly and securely. Research shows that platforms with strong payment systems see a 75% increase in worker satisfaction and retention—something Coyyn.com directly enables.

The integration of AI-powered matching algorithms is game-changing. These systems can improve job completion rates by 42% and cut work search time by more than half. Whether you’re a freelance graphic designer in Manhattan or a delivery driver in Brooklyn, these improvements make a real difference in your daily work life.

Blockchain technology brings unprecedented trust and transparency to gig work relationships. Smart contracts have cut payment disputes by 42% and reduced transaction costs by almost a third. For gig workers who often deal with payment uncertainty, this level of security is invaluable.

Many gig workers (63% to be exact) maintain traditional employment alongside their gig work. Coyyn.com offers the flexible financial tools they need to manage diverse income streams, track expenses, and plan for their financial future—all within one platform.

As we watch this change unfold from our perspective in New York’s diverse economic landscape, it’s clear that Coyyn.com isn’t just observing these changes. It’s actively empowering the people driving this new economy, ensuring they have the financial infrastructure to not just survive, but truly thrive.

Frequently Asked Questions about Coyyn.com

We get a lot of questions about the coyyn.com digital economy from our readers, especially those who are just starting to explore digital finance options. As experts at The Dining Destination, we understand that stepping into any new financial platform can feel a bit like trying a completely new cuisine – exciting but also a little intimidating! Let’s address the most common concerns we hear.

What are the main drawbacks of using the Coyyn.com platform?

Like any financial platform, the coyyn.com digital economy isn’t without its challenges. We believe in being honest about potential risks, just as we’d warn you about a spicy dish if you’re not used to heat!

The biggest concern is cryptocurrency market volatility. Digital currencies can swing up and down faster than New York City restaurant trends, which means your investments might fluctuate significantly. One day you’re up, the next you might be down – it’s part of the crypto world.

Regulatory uncertainty is another factor to consider. Global regulations around digital currencies are still evolving, much like how food safety regulations adapt to new dining trends. Sometimes the rules aren’t crystal clear, which can create confusion for users.

There’s also the universal risk of online fraud that comes with any digital platform. While Coyyn.com employs robust security measures, users need to stay vigilant and practice safe online habits. Think of it like keeping your wallet secure when exploring a new city – common sense goes a long way.

Is Coyyn.com suitable for beginners in the digital economy?

Absolutely! The coyyn.com digital economy is designed with newcomers in mind, much like how the best restaurants make their menus accessible to both food novices and experienced diners.

Coyyn.com provides extensive educational resources that break down complex financial concepts into digestible pieces. Their guides and tutorials are written in plain English, helping beginners understand everything from basic cryptocurrency concepts to advanced investment strategies.

The platform’s user-friendly interface means you won’t feel overwhelmed when you first log in. They’ve put significant effort into making the learning curve as gentle as possible. It’s like having a knowledgeable server walk you through an unfamiliar menu – they’re there to help you succeed.

Their emphasis on financial literacy sets them apart. Rather than throwing you into the deep end, they provide the education and support you need to make informed decisions about your digital financial journey.

How does Coyyn.com support cryptocurrencies?

The coyyn.com digital economy offers comprehensive cryptocurrency support that covers all the bases. They understand that crypto enthusiasts want flexibility and robust tools to manage their digital assets effectively.

The platform supports multiple cryptocurrencies, giving you the freedom to diversify your digital portfolio. Whether you’re interested in Bitcoin, Ethereum, or other popular digital currencies, you’ll find support for various options.

Real-time price tracking keeps you informed about market movements as they happen. No more refreshing multiple websites to check your investments – everything’s right there in your dashboard.

Secure wallet integration ensures your digital assets are protected while remaining easily accessible. They’ve implemented blockchain technology and advanced security protocols to keep your cryptocurrencies safe.

Perhaps most importantly, they offer seamless conversion between crypto and traditional fiat currencies. This multi-chain capability means you can easily move between digital and traditional money as your needs change, making the platform incredibly practical for everyday use.

Conclusion

The coyyn.com digital economy represents something truly special in today’s financial landscape. It’s not just another fintech platform – it’s a bridge between the traditional banking world we’ve known for decades and the exciting digital future that’s unfolding before our eyes.

Throughout our exploration, we’ve seen how Coyyn.com tackles real challenges that affect everyday people and businesses. Whether it’s streamlining payments for a small restaurant in Manhattan or helping freelance food photographers manage their diverse income streams, the platform offers practical solutions that make financial life easier.

What strikes us most is how Coyyn.com makes complex technology feel approachable. Blockchain security, AI-powered personalization, and automated accounting might sound intimidating, but the platform packages these innovations in ways that actually simplify your financial life. It’s like having a sophisticated financial advisor who speaks your language.

The gig economy growth we’ve discussed hits particularly close to home here in New York City. We see it everywhere – from food delivery drivers to culinary consultants building their own brands. Coyyn.com’s support for these modern workers, with tools that handle multiple income streams and flexible payment systems, addresses a real need in our evolving economy.

Yes, there are risks. Market volatility and regulatory uncertainty are genuine concerns that require careful attention. But Coyyn.com’s commitment to user education and transparent security measures helps users steer these challenges with confidence rather than fear.

Looking ahead, the integration of tokenized real-world assets and Web3 technologies promises even more exciting possibilities. We’re talking about democratizing access to investments and creating new ways for businesses to engage with their customers.

As experts at The Dining Destination, we see how understanding these digital shifts is vital for every modern industry, from finance to food tourism in New York City. Just as we help you find amazing culinary experiences, platforms like Coyyn.com help you find new financial opportunities. The future of finance is here, and it’s more accessible than ever before.

Explore more resource guides to stay ahead of the curve in our rapidly changing digital world.