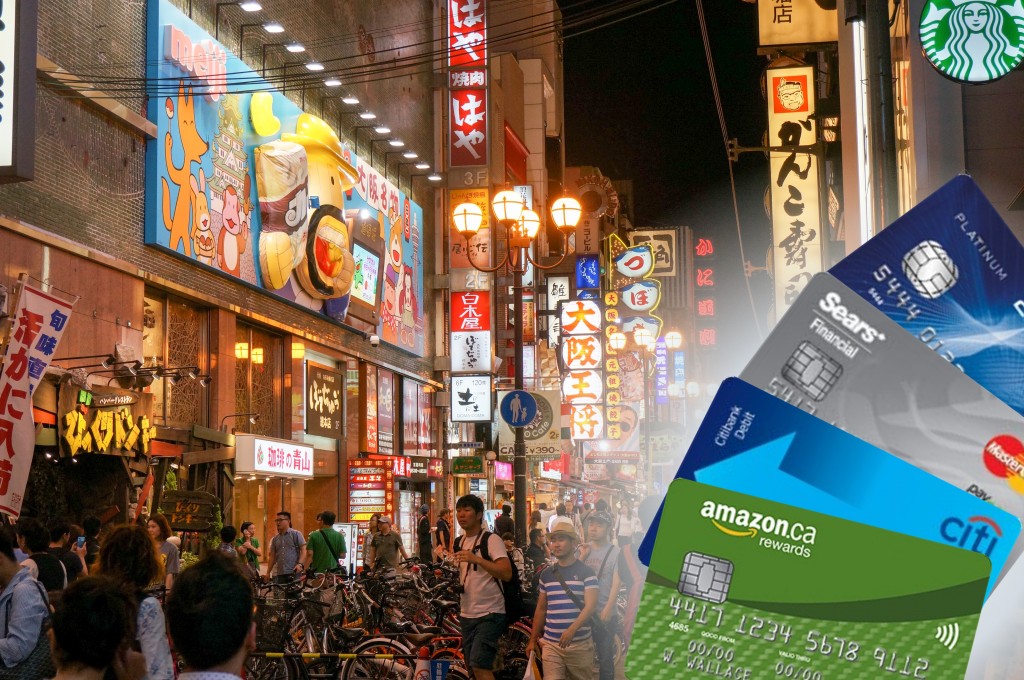

For travelers who love exploring the world, finding the best travel credit cards with no foreign fees can save hundreds of dollars a year. Every time you swipe your card abroad, many banks charge a foreign transaction fee — often up to 3% per purchase. Over time, that adds up.

Fortunately, several travel credit cards waive foreign transaction fees and also offer valuable perks like travel insurance, lounge access, and reward points. In this article, we break down the best options for 2025, so you can travel smarter, spend better, and avoid unnecessary charges.

Why Foreign Transaction Fees Matter

Foreign transaction fees are small charges (typically 1%–3%) that apply when you make a purchase in a currency other than your home country’s. These fees apply to hotel bookings, restaurant bills, transportation, and even online purchases from international vendors.

Avoiding these fees means:

- Lower overall trip costs

- Better value from your rewards

- Smoother international spending experience

- More money to spend on actual travel experiences

Features to Look for in a Travel Credit Card

When selecting the right card for your travel needs, look for the following key features:

- No foreign transaction fees

- Travel rewards and bonus categories

- Airport lounge access

- Trip delay or cancellation insurance

- Lost luggage or rental car coverage

- Easy point redemption for flights and hotels

Best Travel Credit Cards with No Foreign Fees in 2025

Below are some of the top cards that combine zero foreign transaction fees with excellent travel benefits:

1. Global Explorer Platinum Card

- Annual Fee: $95

- Rewards: 3x on travel, 2x on dining

- Benefits: Trip cancellation insurance, rental car protection, mobile phone coverage

- Why It’s Great: Perfect for frequent international travelers who want solid protection and strong rewards.

2. Altitude Travel Rewards Card

- Annual Fee: $0 for the first year, then $75

- Rewards: 2x on travel and dining

- Benefits: TSA PreCheck credit, no blackout dates

- Why It’s Great: Mid-range option that balances affordability and perks.

3. SkyPass World Elite Mastercard

- Annual Fee: $99

- Rewards: 3x on airfare, 1x on everything else

- Benefits: Travel insurance, free checked bag, priority boarding

- Why It’s Great: Ideal for airline-focused travelers.

4. Nomad Ventures Visa Signature

- Annual Fee: $0

- Rewards: 1.5x flat rate on all purchases

- Benefits: No annual fee, zero foreign transaction fees, emergency support

- Why It’s Great: Great starter card with no ongoing costs.

5. Elite Miles Reserve Card

- Annual Fee: $450

- Rewards: 5x on flights, 3x on hotels

- Benefits: Global lounge access, $300 travel credit, travel insurance

- Why It’s Great: Premium travel card for frequent flyers and luxury travelers.

Travel Credit Card Comparison Table

| Card Name | Annual Fee | Rewards Rate | Key Perks | Foreign Fees |

|---|---|---|---|---|

| Global Explorer Platinum | $95 | 3x travel, 2x dining | Trip insurance, rental coverage | None |

| Altitude Travel Rewards | $0–$75 | 2x travel, 2x dining | TSA PreCheck credit | None |

| SkyPass World Elite | $99 | 3x airfare | Free bag, priority boarding | None |

| Nomad Ventures Visa | $0 | 1.5x all purchases | No annual fee, basic protection | None |

| Elite Miles Reserve | $450 | 5x flights, 3x hotels | Lounge access, $300 travel credit | None |

How These Cards Enhance Your Travel Experience

Having the right travel card goes beyond saving on fees. It also adds convenience, safety, and comfort to your trip. Some cards offer access to airport lounges, while others provide automatic insurance for lost bags or delayed flights.

If you’re headed to one of the Top Adventure Travel Destinations for Thrill-Seekers, having a reliable credit card can also help in emergency situations, currency exchanges, and international bookings — especially in remote or challenging locations.

Tips for Using Travel Cards Abroad

- Notify your bank before traveling to avoid fraud alerts or declined transactions.

- Use cards with chip-and-PIN support, especially in Europe.

- Carry a backup card in case your primary one is lost or stolen.

- Pay in local currency to avoid hidden dynamic currency conversion fees.

- Track your spending via mobile apps to stay on budget during your trip.

FAQs

Why should I use a travel credit card instead of cash abroad?

Using a travel card is safer than carrying large amounts of cash. You also earn rewards, get fraud protection, and avoid bad exchange rates.

What is the best no-foreign-fee travel card for beginners?

The Nomad Ventures Visa Signature is a solid choice for first-time travelers due to its $0 annual fee and no international charges.

Are travel credit cards accepted worldwide?

Most major credit cards (Visa, Mastercard, and Amex) are widely accepted globally. However, rural or remote locations may still prefer cash, so it’s smart to carry a small amount.

Do I need a high credit score to get these cards?

Yes. Most top travel cards require good to excellent credit (typically 700+). Some mid-tier cards are available for scores in the mid-600s.

Can I earn rewards and avoid foreign fees at the same time?

Absolutely. All cards in this guide offer both rewards earning and zero foreign transaction fees, making them ideal for international spending.

Are these cards good for domestic travel too?

Yes. Many offer bonus rewards on flights, hotels, and restaurants — whether you’re traveling locally or overseas.

Final Thoughts

If you love to travel, choosing the best travel credit cards with no foreign fees can make a big difference in both savings and convenience. Whether you’re taking weekend trips, flying internationally, or heading to the Top Adventure Travel Destinations for Thrill-Seekers, the right card can unlock rewards, comfort, and peace of mind.

With plenty of options ranging from no-fee starter cards to high-end premium cards, there’s something for every travel style and budget. Make the switch before your next journey and enjoy travel the way it’s meant to be — with less worry and more reward.