Why AMD Stock Price Matters for Tech Investors

From our perch in New York City, we track how the amd stock price quietly shapes the dining and travel experiences our readers care about. AI infrastructure powered by chips from companies like AMD sits behind restaurant findy, translation for international visitors, reservation and waitlist systems, digital menus, and even kitchen operations across NYC. When investors reprice AMD, it often signals shifts in AI spending that trickle into hospitality tech used by city restaurants, food halls, and hotels.

The amd stock price has become a key indicator of the artificial intelligence boom’s momentum, with the semiconductor giant’s shares reflecting both massive opportunity and significant risk in today’s tech landscape.

Current AMD Stock Key Metrics:

- Stock Price: $162-174 range (recent trading)

- Market Cap: $280+ billion

- 52-Week Range: $76.48 – $182.50

- P/E Ratio: 99-127x (high growth premium)

- YTD Performance: +34-44%

- Analyst Consensus: Moderate Buy (73% buy ratings)

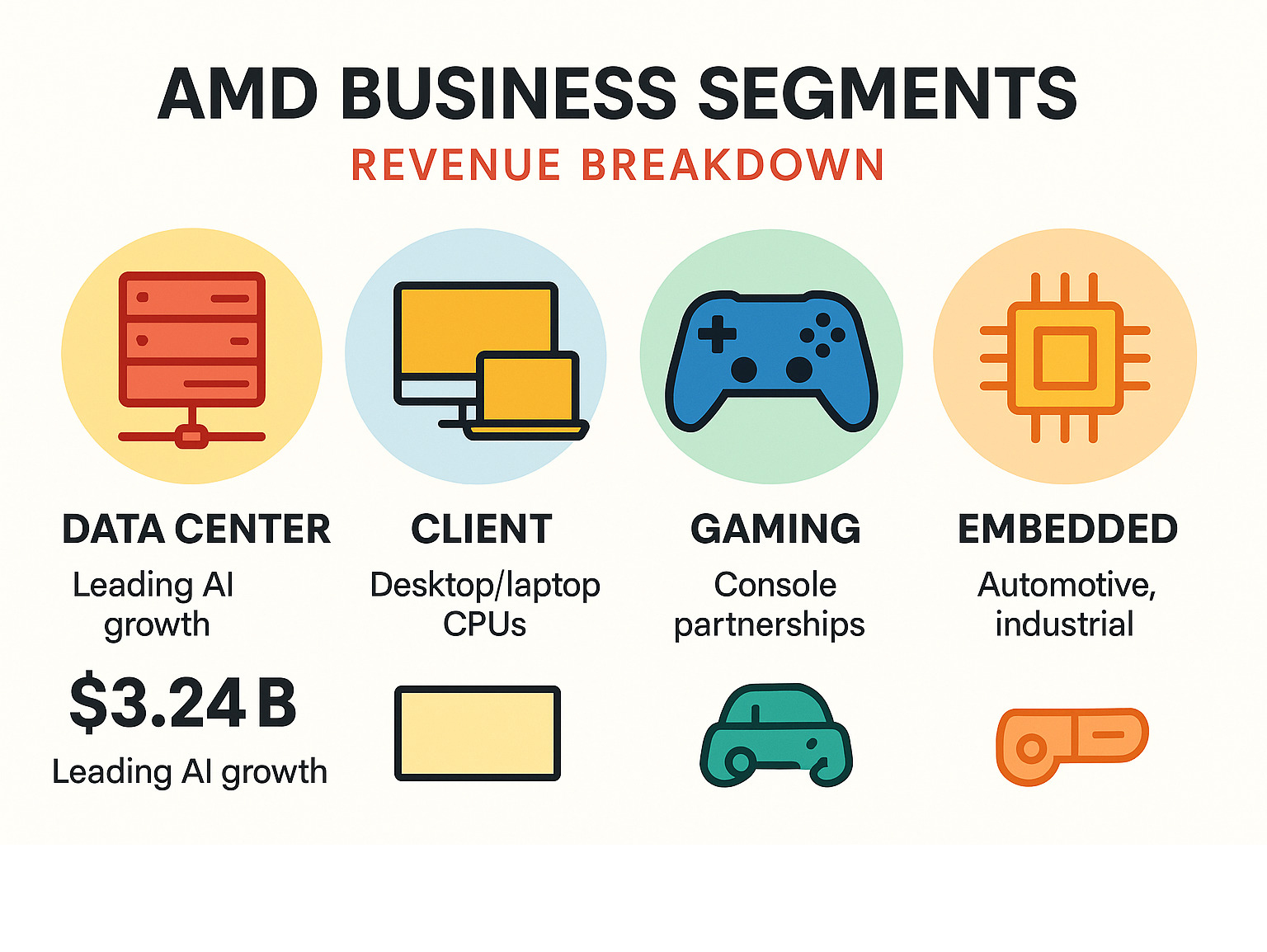

AMD’s stock journey tells the story of a company changing from an Intel challenger into a serious contender in the AI chip market. The company operates through four main segments: Data Center (driving AI growth), Client (desktop/laptop CPUs), Gaming (console chips and GPUs), and Embedded (automotive and industrial applications).

Recent earnings show the company’s AI momentum is real. AMD posted 32% year-over-year revenue growth in Q2 2025, with data center sales surging to $3.24 billion. However, the stock remains volatile, dropping despite beating revenue estimates due to concerns about China export restrictions and intense competition with Nvidia.

Wall Street analysts project an average price target of $181-184, suggesting modest upside potential. But with a P/E ratio nearly 100x, investors are paying a premium for AMD’s AI growth story. The key question isn’t whether AMD will grow – it’s whether that growth justifies today’s valuation.

For NYC diners, restaurateurs, and travelers, why this matters:

- AI recommendations and itinerary planning for where to eat evolve with AI investment cycles tied to the amd stock price.

- Reservation, waitlist, and dynamic pricing tools many NYC spots rely on could get smarter—or costlier—depending on AI compute economics.

- Back-of-house tech (forecasting, inventory, computer vision waste reduction) depends on affordable, available compute; chip cycles influence rollout pace citywide.

Current AMD Stock Price and Financial Health

Understanding where AMD stands financially helps NYC’s hospitality ecosystem anticipate the pace of AI-powered upgrades in findy, translation, and service. As a local guide, we watch these moves because they influence the tools you encounter in New York restaurants—from smarter waitlists to multilingual menus and concierge chat.

Today’s AMD stock price and recent performance

The amd stock price has been serving up quite a performance, trading around $174.31 at recent market close, though it dipped to $163.38 in after-hours trading. Think of it like a popular restaurant—sometimes there’s a wait, sometimes tables open up quickly.

Key AMD Stock Statistics:

| Metric | Value |

|---|---|

| Current Price | $163.38 – $174.31 |

| 52-Week High/Low | $182.50 / $76.48 |

| Market Cap | $282.627 billion |

| P/E Ratio | 127.77 (TTM) |

| EPS (TTM) | $1.36 |

| Average Volume | 63.38 million shares |

| YTD Change | +34.37% |

Over the past year, the stock’s 52-week range from $76.48 to $182.50 shows this company can swing dramatically, much like how food trends can explode overnight. Year-to-date, AMD has delivered a solid 34.37% return, with a five-year increase of over 451%.

With a market cap of $282.627 billion, AMD is a major player. Its high P/E ratio of 127.77 is definitely premium pricing compared to the industry average of 30.1x. Investors are betting heavily on future growth, especially in AI, with the forward P/E of 41.77 suggesting analysts expect earnings to catch up.

For NYC hospitality, richer AI budgets often mean faster upgrades to guest-facing tech—from smarter recommendation engines that tailor a SoHo food crawl to real-time translation for Queens Night Market vendors.

Breaking down AMD’s Q2 2025 earnings report

AMD’s Q2 2025 earnings report was like a mixed review from food critics. Despite beating expectations, the amd stock price dropped 4-5% post-announcement, proving Wall Street can be a finicky diner.

The headline numbers looked delicious: revenue surged 32% year-over-year to $7.69 billion, and net income reached $872 million. However, the Data Center segment’s 14% growth to $3.24 billion was good, but not the mind-blowing special investors had hoped for from its AI business.

In contrast, the Client segment crushed it with a 67% year-over-year surge in desktop CPU sales, while the Gaming segment bounced back with 73% growth to $1.12 billion. Looking ahead, management’s projection of 28% year-over-year revenue growth to $8.7 billion for Q3 2025 is the kind of confidence that keeps long-term investors interested.

For New York’s dining scene, here is the local takeaway:

- Data Center momentum often maps to better AI concierge and findy tools for visitors navigating Manhattan and Brooklyn.

- Client PC strength supports back-office operations in restaurants (analytics, staffing, inventory) and powers digital signage in venues.

- Gaming improvements spill into in-venue entertainment at e-sports bars and experiential dining spots.

For the complete earnings breakdown, you can check out AMD reports on its latest earnings.

The AI Gold Rush: Analyzing AMD’s Primary Growth Engine

Watching the tech landscape unfold from here in New York, it’s impossible to ignore the artificial intelligence revolution. For our readers planning culinary adventures across NYC, this matters because AI increasingly shapes how you find restaurants, get personalized itineraries, and communicate across languages.

The company’s strategic push into AI has become the primary growth engine driving the amd stock price and investor confidence. AMD is tackling this challenge with cutting-edge hardware, an open software ecosystem, and strategic partnerships.

Challenging the competition with Instinct AI accelerators

AMD’s entrance into the AI accelerator market has been bold, with its Instinct MI350 and MI400 GPUs actively challenging the status quo. The MI355 delivers up to 40% more tokens per dollar compared to rivals—a game-changer for businesses running massive AI workloads where cost savings add up quickly.

AMD’s ace in the hole might be its ROCm software platform. As an open-source CUDA alternative, it appeals to companies that want to avoid being locked into a single vendor’s ecosystem. This strategy is working, evidenced by major hyperscaler partnerships with companies like Microsoft, Meta, and OpenAI. Oracle’s commitment to a massive 27,000+ node AI cluster powered by AMD chips shows this technology is production-ready at scale.

For NYC hospitality and travel tech, better cost-performance can mean:

- More affordable multilingual chat assistants for hotel concierges and restaurant groups.

- Faster, more personalized food tour recommendations across neighborhoods.

- Improved computer vision for back-of-house waste reduction and line management in busy food halls.

AMD’s focus on total cost of ownership is smart. By considering the complete picture of hardware, software, and power consumption, its open ecosystem can deliver up to 30% cost savings for enterprises, a compelling proposition in today’s economic climate.

The importance of the Data Center and enterprise segments

The data center business is AMD’s crown jewel, combining powerful Instinct AI accelerators with impressive EPYC Turin CPUs.

The global AI CapEx cycle is expected to hit $364 billion this year, a massive opportunity. AMD’s data center revenue of $3.2 billion in Q2 2025 shows it is thriving in this boom. The leverage here is incredible; capturing just 1% more market share in AI could boost AMD’s overall revenue growth by 10%, driving the amd stock price higher.

In practical NYC terms, this underpins the AI services you touch daily—from smarter translation for international diners in Midtown to personalized curation of Chinatown tasting routes. As providers scale on AMD hardware, expect faster, richer, and more context-aware dining recommendations across the city.

Navigating the Competitive Landscape and Market Risks

While AMD’s growth story gets hearts racing here in New York’s financial district, we must discuss the risks. The semiconductor industry is notoriously volatile, and AMD faces serious headwinds that could impact the amd stock price—and by extension, the pace of AI innovation that reaches NYC hospitality venues.

How government policies and export controls impact AMD

Government actions in the chip industry can shake things up for shareholders. The recent $5.7 billion U.S. CHIPS Act investment in Intel felt like the government was picking winners, giving AMD’s biggest rival a massive lifeline while AMD competes on its own merit. This development, detailed in this government investment in rival chipmakers report, complicates the competitive landscape.

Even more concerning are the China export restrictions, which cut off access to a market worth over $1.5 billion in 2025. AMD’s high-end AI chips like the MI308 can’t be sold to Chinese customers, limiting a major revenue stream. Furthermore, the supply chain concentration with TSMC creates vulnerability; any disruption at its primary foundry partner could send the stock tumbling.

For NYC restaurants and hotels, these macro shifts can translate to:

- Delays or higher costs for AI-powered POS, translation, or reservation systems.

- Slower rollout of computer vision and forecasting tools in busy kitchens.

- Vendor consolidation risk if a single hardware path becomes dominant.

Key risks that keep AMD investors up at night include: intense competition, geopolitical export restrictions, sky-high valuations, heavy dependence on TSMC, and the relentless pace of AI innovation.

A look at the current amd stock price valuation

AMD’s current valuation is, to put it mildly, quite rich. With P/E ratios swinging from 93x to nearly 300x, it trades at a significant premium to the industry average of 30x. Our discounted cash flow models suggest a more reasonable fair value around $138, well below current trading levels.

Yet, Wall Street analysts aren’t running for the exits. The consensus remains a moderate buy, with an average 12-month price target around $181 to $184, suggesting 11-13% upside potential. This creates a classic tension between growth and value. Value investors see a stock priced for perfection, while growth investors believe the AI revolution justifies the premium.

For NYC-based readers—diners, hoteliers, and food entrepreneurs—this means budgeting for AI tools should remain flexible. Volatility in the amd stock price can coincide with changing cloud and hardware costs, affecting timelines for upgrades to guest-facing tech.

Future Outlook: Beyond AI and into Quantum Computing

While AI dominates conversations about the amd stock price, from our perspective watching the markets here in New York, AMD’s future extends far beyond it. The company is making smart moves in gaming, embedded systems, and even the fascinating world of quantum computing.

The steady contribution from Gaming and Embedded segments

Every time someone uses a PlayStation 5 or Xbox Series X, they’re interacting with AMD technology. This is how the company has built reliable revenue streams independent of AI hype. AMD’s Gaming segment generated $1.12 billion in revenue in Q2 2025, largely from its Console SoC Revenue. Exclusive contracts with Sony PlayStation and Microsoft Xbox are expected to bring in $3.5-4 billion annually through 2029.

AMD’s Radeon GPUs also maintain a solid presence in the PC Gaming Market. The Embedded segment, while less flashy, is crucial for the future, creating processors for Automotive Technology and Industrial Systems. These segments provide invaluable stability, making the amd stock price more resilient during uncertain times.

In NYC, these categories surface in unexpected ways:

- Gaming tech powers immersive dining concepts and e-sports bars across Manhattan and Brooklyn.

- Embedded chips drive digital menu boards, self-ordering kiosks, and kitchen automation at high-traffic venues and airports like JFK and LaGuardia.

Forging the future with strategic partnerships

AMD is forming partnerships that could reshape industries. The most exciting is its work with IBM in Quantum Computing, a field that could be worth $130 billion in the coming decades.

The IBM Partnership focuses on Hybrid Quantum-Classical Systems, combining AMD’s high-performance hardware with IBM’s quantum machines to tackle problems in drug findy, financial modeling, and climate research. This fits AMD’s strategy of building Open-Source Ecosystems, positioning the company at the forefront of the next computing revolution.

For New York’s hospitality sector, future quantum advances could one day optimize food supply chains, reduce waste, and model seasonal tourism flows—eventually filtering into the guest experience. It is another reason the amd stock price doubles as a proxy for the pace of innovation diners and travelers will see.

Frequently Asked Questions about the AMD Stock Price

As we keep our finger on the pulse of the financial markets from New York City, we often hear similar questions about AMD. Here are some quick answers to help you understand what moves the amd stock price—and why it matters to the dining and travel experiences we cover.

What are the main factors driving the amd stock price?

The amd stock price is driven by a recipe of key factors:

- AI and Data Center Performance: This is the main ingredient. Strong sales of Instinct AI chips and EPYC data center processors excite investors about future growth.

- Competition: The semiconductor industry is a high-stakes chess match. Market share gains against rivals like Nvidia and Intel often boost the stock.

- Industry Health: Global chip demand, supply chain stability (especially with TSMC), and broad technology trends create the overall market climate.

- Government Policies: Export controls to countries like China can limit revenue, while government investments in competitors can shift the landscape.

- Execution: Consistently hitting financial targets and delivering on its product roadmap builds investor confidence.

NYC relevance: when these drivers are favorable, hospitality tech providers can scale AI services that power reservation systems, multilingual menus, and curated food itineraries across the city.

What is the general Wall Street sentiment on AMD stock?

Wall Street is generally optimistic, with a consensus rating of “Moderate Buy.” About 73% of analysts recommend buying the stock, with an average price target around $181 to $185. However, this bullishness is tempered by the stock’s high valuation. Investors are paying a premium for future growth, which makes the stock sensitive to any disappointments. In short, Wall Street believes in the story but acknowledges that much of the good news may already be priced in.

For NYC restaurateurs and hoteliers, that means budgeting for AI tools should stay nimble: costs tied to cloud compute and hardware can change quickly when sentiment on the amd stock price shifts.

How does AMD’s gaming division contribute to its business?

AMD’s gaming division is a crucial and stable part of its business. The biggest contribution comes from long-term console partnerships with Sony (PlayStation 5) and Microsoft (Xbox Series X/S). This business provides a predictable revenue stream, projected to be $3.5 to $4 billion annually through 2029. This stability acts as a financial foundation for the company. The division also sells Radeon graphics cards for the PC gaming market. In Q2 2025, the gaming segment contributed $1.12 billion in revenue, providing diversification that supports the overall amd stock price.

In New York, this shows up in e-sports lounges and experiential venues that blend dining with gaming—another way chip cycles influence the city’s food culture.

Conclusion

From our perspective here in New York City’s financial district, AMD presents one of the most compelling investment narratives in today’s tech market. The company is at the epicenter of the AI revolution, with its Instinct accelerators and EPYC processors gaining serious traction in the lucrative data center space.

What makes AMD attractive is its diversified approach. While AI drives the amd stock price momentum, steady revenue from gaming, a promising quantum computing partnership with IBM, and the reliable embedded systems business create a robust foundation.

However, investors must weigh this against significant challenges. The stock’s high P/E ratio leaves little room for error. Fierce competition, geopolitical headwinds like China export restrictions, and the government’s investment in Intel are all major risks. Furthermore, a heavy reliance on TSMC for manufacturing creates supply chain vulnerability.

What this means for New York City diners, restaurateurs, and travelers:

- Expect increasingly personalized findy, translation, and concierge tools as AI budgets expand—tempered by chip cycle volatility.

- Keep flexibility in tech budgets; costs for AI-powered reservations, kiosks, and analytics can move with the amd stock price.

- Watch data center trends; they often precede visible upgrades in guest-facing hospitality tech across NYC.

For investors with a long-term perspective and high risk tolerance, AMD is a fascinating bet on the future of computing. The AI revolution is just beginning, but this is not a stock for the faint of heart—expect volatility. The trajectory of the amd stock price will hinge on flawless execution in an increasingly complex global market.

For those looking to dive deeper into evaluating high-growth tech stocks like AMD, The Dining Destination offers a variety of resource guides covering investment strategy, risk assessment, and long-term growth planning.