Why Hims Stock is Capturing Investor Attention

Focus Keyphrase: hims stock

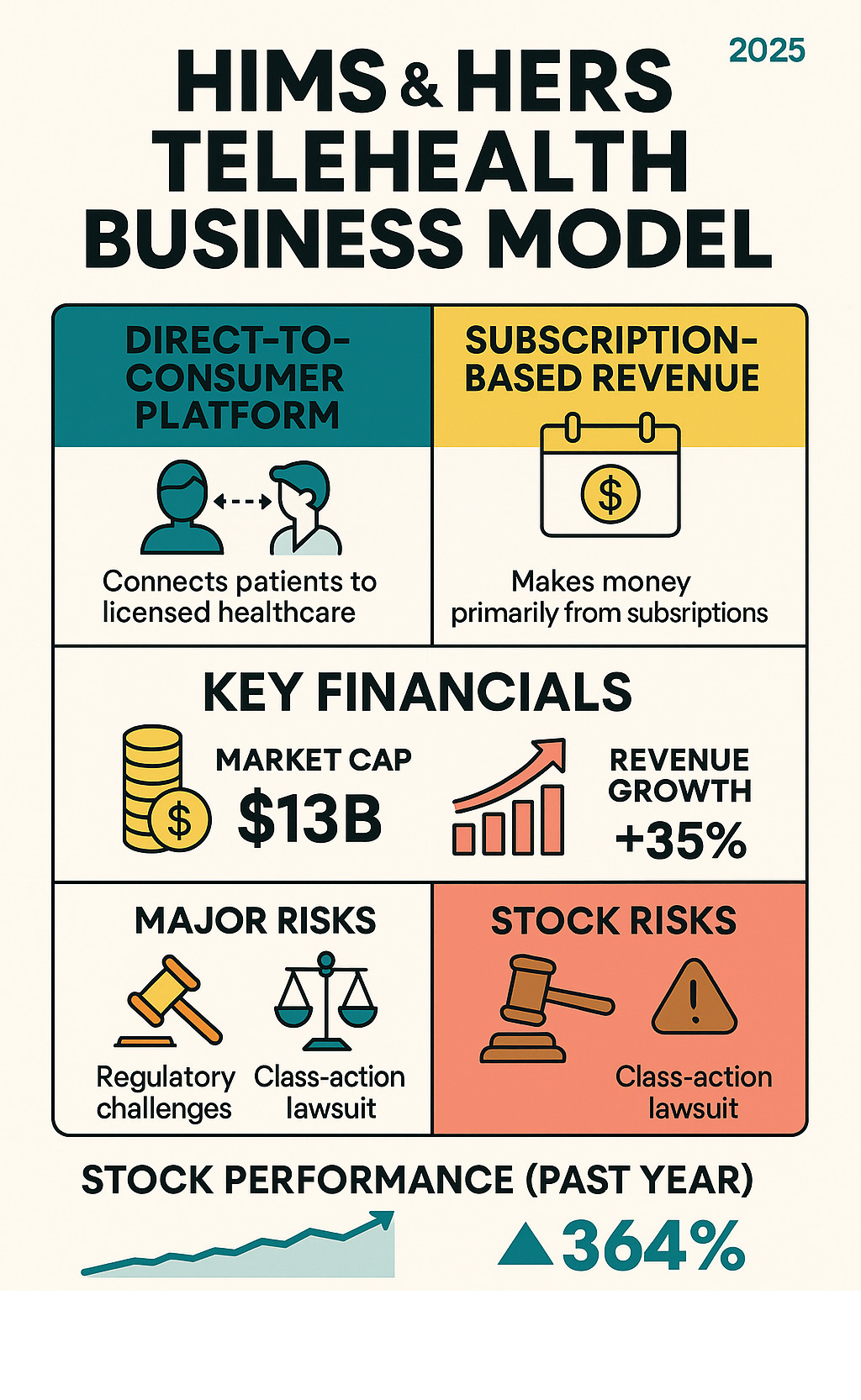

Hims stock has become one of the most talked-about investments in the telehealth sector, with shares skyrocketing 363.86% over the past year. But behind this explosive growth lies a complex story of innovation, controversy, and significant risk.

Quick Facts About HIMS Stock:

- Current Price: $58.02 (as of latest data)

- Market Cap: $12.99 billion

- 52-Week Range: $9.22 – $72.98

- Revenue (TTM): $1.8 billion

- P/E Ratio: Over 70x

- Status: Profitable as of 2024

Hims & Hers Health, Inc. operates a direct-to-consumer telehealth platform that now serves patients in all 50 U.S. states. The company connects over 1 million subscribers to licensed healthcare professionals for treatments like hair loss, sexual health, mental wellness, and weight management, disrupting traditional healthcare by offering convenient, discreet access to prescription medications without insurance.

However, investors should proceed with caution. The stock faces headwinds like a class-action lawsuit for alleged securities fraud, regulatory scrutiny of its compounded drug sales, and the recent termination of its partnership with pharmaceutical giant Novo Nordisk.

The company’s success has attracted controversy. One analyst recently noted, “this isn’t a stock I would rush to buy right now” due to questions about future growth and legal exposure.

With earnings forecast to grow 15.74% annually and trading 28.5% below some fair value estimates, HIMS presents both compelling opportunities and substantial risks.

Quick hims stock definitions:

What is Hims & Hers Health, Inc.?

Think of Hims stock as representing a company that’s revolutionized healthcare like food delivery apps transformed dining—by bringing essential services to your door. Founded in 2017, Hims & Hers Health, Inc. grew from a startup into a telehealth powerhouse, changing how people access medical care.

The company’s recipe for success is simple: connect people with licensed healthcare professionals via their devices, skip insurance headaches, and deliver treatments in discreet packaging. It’s like a doctor’s office that never closes and has no waiting room.

Operating via the Hims website for men and the Hers website for women, the company has attracted over 1 million subscribers. With over 6 million online visits and a 4.7 out of 5-star customer rating, they’re clearly doing something right.

Services and Product Categories

What started as a focused solution for specific health concerns has blossomed into a comprehensive wellness platform. Just like a restaurant that begins with a signature dish and expands its menu, Hims & Hers has grown far beyond its original offerings.

The company now tackles sexual health issues like erectile dysfunction with both prescription medications and creative solutions like “Sex Chews” and “Hard Mints.” Their mental health services connect users with licensed psychiatrists and therapists for anxiety, depression, and burnout, offering everything from generic Lexapro prescriptions to guided in-app experiences.

Dermatology treatments address skin conditions and hair loss through customized prescription creams and proven solutions like finasteride and minoxidil. The primary care expansion means they’re now handling broader general health concerns, while their weight loss programs have become increasingly popular, offering personalized treatment plans that often include prescription medications.

This approach is particularly appealing due to the mix of prescription medications, over-the-counter products, and personal care items—all delivered discreetly.

The Business Model

The magic behind hims stock‘s impressive performance lies in a business model that prioritizes convenience. It’s designed to eliminate the friction points of traditional healthcare.

Everything starts with a simple online consultation. Users complete an intake form detailing their symptoms and medical history, which licensed providers then review. Depending on state requirements, this might lead to a video or audio visit, but often the treatment recommendation arrives directly in the user’s chat inbox.

The subscription service model ensures continuous care while creating predictable revenue. Customers receive treatments on a recurring basis, maintaining consistent access to medications and ongoing provider support.

Discreet packaging addresses a major barrier to seeking help for sensitive health issues. Every product arrives in unmarked packaging, protecting customer privacy.

Perhaps most importantly, no insurance is required. The company offers transparent pricing that bundles medical visits, ongoing shipments, and provider messaging into one straightforward cost. This appeals to everyone, from people with high-deductible plans to those without insurance.

This streamlined approach has transformed healthcare access for millions, making it as simple as ordering a meal online. For investors tracking innovative companies, resources such as 5starsstocks.com provide valuable insights into market performance.

Analyzing Hims Stock Performance and Financial Health

Hims stock tells a story of explosive popularity that has left investors both excited and cautious, much like a restaurant with rave reviews and growing profits.

The numbers are incredible. Over the past year, HIMS stock surged an astounding 363.86%, making it a standout in the telehealth sector. A $1,000 investment a year ago would be worth nearly $4,600 today.

The stock reached an all-time high of $72.98 on February 19, 2025, a remarkable journey from its low of $2.72 in May 2022. Today, the company boasts a market capitalization of $12.99 billion, placing it in large-cap territory. For real-time updates, investors can check HIMS Stock Price on MarketWatch.

Key Financial Metrics for Hims Stock

Let’s dig into the financial ingredients that make Hims stock so appealing to investors.

The revenue story is particularly impressive. Hims & Hers generated $1.8 billion in sales over the trailing 12 months, with Q3 2024 sales jumping 77% year-over-year to $400 million. Management’s forecast for Q4 2024 projects revenue between $465 million and $470 million, representing growth of 89% to 91%. This shows the company isn’t just growing—it’s accelerating.

HIMS earnings for the last quarter came in at $0.20 per share, crushing analyst estimates of $0.12 by 65.41%. This represents the company’s transition to sustainable profitability.

Net income for the most recent quarter reached $49.48 million, up 90.14% from the previous quarter’s $26.02 million. This dramatic improvement shows management’s ability to convert revenue growth into actual profits.

The company’s EBITDA stands at $137.93 million with a margin of 5.76%, while adjusted EBITDA for Q3 2024 exceeded $50 million. These operational metrics demonstrate that the core business is generating real cash.

However, the P/E ratio of over 70 times trailing earnings might give investors pause. This high valuation reflects excitement about future growth but also means the stock has less room for error. For deeper financial analysis, resources like Fintechzoom.com Markets provide comprehensive insights.

Analyst Ratings and Forecasts

Wall Street analysts have mixed but generally optimistic views on Hims stock. Their price targets range widely from a low of $28 to a high of $85, reflecting the uncertainty that comes with such rapid growth.

The earnings forecast is exciting: analysts expect 15.74% annual earnings growth, with a projected 177.8% rise in earnings per share next year. These are not modest expectations; they’re betting on continued explosive growth.

Institutional interest has been growing, with 31 hedge funds holding positions in Q3 2024. When sophisticated investors pay attention, it often signals a company has moved beyond speculative territory.

The analyst consensus hovers around “Neutral” to “Buy” ratings, reflecting cautious optimism. Many recognize the company’s impressive fundamentals while acknowledging the risks of a high valuation and regulatory challenges.

Risks and Controversies Facing Hims & Hers

Hims stock investors have encountered serious surprises, much like finding an unexpected ingredient in a beloved recipe. The company’s rapid growth has been seasoned with controversy, particularly around its use of compounded drugs and subsequent legal challenges.

The regulatory landscape for telehealth is complex, and Hims & Hers has steerd challenging terrain. What began as innovative healthcare solutions has evolved into a story of FDA warnings, partnership disputes, and legal implications that could impact investor returns.

The Compounded Drugs Controversy

Compounded drugs are medications that pharmacists create by mixing ingredients for individual patient needs. While this practice serves legitimate purposes, it becomes problematic when used for mass distribution.

The heart of Hims & Hers’ controversy centers on GLP-1 drugs, particularly semaglutide, the active ingredient in popular weight-loss medications. During a period when these drugs were in short supply, Hims & Hers aggressively promoted and sold compounded versions to capitalize on the booming weight-loss market.

Here’s where things got spicy: the FDA issued warnings about these compounded GLP-1 drugs, emphasizing that they lack FDA approval and carry potential safety risks. Unlike approved medications that undergo rigorous testing, compounded drugs don’t have the same safety guarantees.

The situation reached a boiling point when Novo Nordisk, the pharmaceutical giant behind Wegovy and Ozempic, terminated its partnership with Hims & Hers. The Danish company publicly cited deceptive marketing claims and accused Hims & Hers of failing to follow laws that prohibit mass sales of compounded drugs. This was a public rebuke that questioned the company’s regulatory compliance and ethics.

The Class-Action Lawsuit and its Impact on Hims Stock

When the partnership with Novo Nordisk soured, it escalated into serious legal action that sent Hims stock tumbling.

A class-action lawsuit was filed against Hims & Hers Health, Inc. for alleged securities fraud. The legal action, including cases like Sookdeo v. Hims & Hers Health, Inc. and Yaghsizian v. Hims & Hers Health, Inc. in the U.S. District Court for the Northern District of California, alleges the company misrepresented its partnership with Novo Nordisk and its compliance with FDA regulations.

The market’s reaction was swift and brutal. Following the news, Hims stock experienced a dramatic stock price drop, falling $22.24 per share—a decline of more than 34%—between June 20 and June 23, 2025. In just three trading days, shares plummeted from $64.22 to $41.98, wiping out billions in market value.

Investors who purchased Hims & Hers securities between April 29 and June 23, 2025, found themselves caught in this legal storm. According to lawsuit details from Bleichmar Fonti & Auld LLP, affected investors had until August 25, 2025, to seek appointment as lead plaintiff.

This legal battle represents more than a temporary setback; it introduces ongoing uncertainty about potential violations and financial liability. For investors, it’s a stark reminder that even innovative business models must steer complex regulations, and that investor risk in high-growth telehealth stocks can be substantial.

Future Growth Drivers and Investment Thesis

Like a successful restaurant that constantly evolves its menu, Hims stock represents a company that continues to innovate. Despite recent challenges, Hims & Hers is pursuing multiple growth avenues that could drive value for investors willing to weather the storm.

Hims & Hers’ expansion strategy is like a great restaurant mastering an entire experience, not just one dish. The company is broadening its focus into new territories that could open up substantial revenue streams.

A promising development is the partnership with Eli Lilly, providing a more stable foundation for its weight management offerings than the controversial compounded drug approach. This partnership signals a shift toward working with established pharmaceutical companies, potentially reducing regulatory risks while growing in the lucrative weight loss market.

Expansion and Innovation

The company’s growth strategy unfolds like a planned menu expansion, with each new offering designed to strengthen the overall platform. Expansion into new specialties represents a significant opportunity, as Hims & Hers works to reduce its dependence on any single product category.

Their focus on personalized solutions aligns with modern healthcare trends. Patients increasingly want treatments customized to their specific needs, and the company’s telehealth platform is ideal for delivering these approaches at scale.

Mental health initiatives have emerged as a bright spot. With mental health awareness at new heights, their partnership with celebrities like Kristen Bell as Mental Health Ambassador helps destigmatize these services while building brand recognition. This segment offers strong growth potential and the opportunity to build deeper subscriber relationships.

The company continues to innovate in its core areas. New product lines roll out regularly, from volumizing hair care to improved sexual wellness offerings, keeping the platform fresh.

Intriguingly, Hims & Hers is exploring in-person care partnerships that blend digital convenience with traditional healthcare. Their collaboration with ChristianaCare to expand access suggests a hybrid model that could address trust concerns.

Technological advancements continue to improve user experience, with features like guided in-app experiences and 24/7 access to medical experts. These improvements help justify premium pricing and reduce customer acquisition costs.

For investors tracking similar growth opportunities, platforms like 5starsstocks.com Stocks offer valuable insights into emerging healthcare technology trends.

The Bull vs. Bear Case

Every investment story has two sides. For Hims stock, these contrasting perspectives create a compelling narrative.

The optimistic case centers on explosive growth potential. With sales jumping 77% year-over-year in Q3 2024 and management forecasting continued acceleration, this isn’t a flash in the pan. The company’s recent profitability proves their business model can generate sustainable returns.

Their strong brand and market position shouldn’t be underestimated. With over 1 million subscribers and high customer satisfaction, they’ve built genuine customer loyalty that’s difficult to replicate.

Some analysts suggest the stock might be undervalued despite its recent run-up, trading at what some estimates indicate is 28.5% below fair value. For long-term investors, this could be an attractive entry point.

However, the cautious perspective raises compelling concerns. Regulatory problems remain, with ongoing scrutiny of their compounded drug practices. Future FDA rulings could significantly impact their weight-loss segment.

The stock’s high valuation at over 70 times trailing earnings means future growth expectations are already priced in. Any disappointment could lead to significant price corrections.

Insider selling over recent months has also raised eyebrows. While not always negative, it can signal concerns about near-term prospects.

The ongoing class-action lawsuit adds uncertainty, potentially leading to financial penalties or reputational damage. Combined with the stock’s inherent volatility (beta of 2.83), Hims stock clearly isn’t for the faint of heart.

This creates a classic high-risk, high-reward scenario requiring investors to consider their risk tolerance.

Frequently Asked Questions about Hims Stock

Just as diners have questions before making reservations, investors want to understand Hims stock before investing. We’ve gathered the most common questions about this telehealth company.

What does Hims & Hers Health do?

Hims & Hers Health is like a convenient takeout option for healthcare, delivering medical solutions instead of food. Established in 2017, this American telehealth company operates a direct-to-consumer platform connecting people with licensed healthcare professionals, avoiding the hassles of traditional doctor visits.

The company offers a comprehensive menu of health services. Their sexual health offerings help with conditions like erectile dysfunction and hair loss. Their mental health services connect patients with licensed psychiatrists and therapists for anxiety and depression. The dermatology section tackles skin conditions with customized prescription treatments, while their primary care services address broader health concerns.

What makes them unique is their approach: no insurance required, transparent pricing, and everything delivered discreetly to your home. It’s healthcare reimagined for the digital age.

Is HIMS a profitable company?

Yes, and this is where Hims stock gets particularly interesting. The company has successfully transitioned from a growth-focused startup to a profitable enterprise, a milestone many telehealth companies struggle to achieve.

The numbers are compelling. Hims & Hers reported a net income of $49.48 million for their most recent quarter, a 90% increase from the previous quarter. Over the past four quarters, their earnings totaled $164 million. This shift to sustained profitability shows their business model can convert growth into real, bottom-line results.

This profitability is crucial because it shows the company can generate actual profits from its expanding customer base of over 1 million subscribers. Management’s forecasts suggest this profitable trend will continue, making the investment thesis more compelling.

What are the biggest risks for Hims stock investors?

Every investment has potential pitfalls, and Hims stock comes with its share of risks. The biggest concern revolves around the company’s use of compounded drugs, particularly popular weight-loss medications like semaglutide.

The regulatory landscape poses the most significant threat. Since compounded drugs aren’t FDA-approved, future regulatory changes could severely impact this key growth driver. The controversy intensified when pharmaceutical giant Novo Nordisk terminated its partnership with Hims & Hers, citing “deceptive” marketing.

The legal challenges add another layer of uncertainty. A class-action lawsuit alleging securities fraud caused the stock to drop more than 34% in just a few days. This legal battle could result in financial penalties and reputational damage.

From a valuation perspective, Hims stock trades at more than 70 times its trailing earnings—a premium price that leaves little room for disappointment. The stock is also highly volatile, with price swings that can be 18.80% more dramatic than typical market movements.

Recent insider selling by executives has raised some eyebrows, though this isn’t always a negative indicator. Still, combined with other risks, it creates a complex picture that requires careful consideration of your risk tolerance.

Conclusion: Is HIMS a Buy, Sell, or Hold?

After exploring Hims stock, we see an investment as complex as a layered dish. We’ve examined every aspect of this telehealth company, and the picture is both compelling and concerning.

The positives are impressive. Hims & Hers delivered explosive revenue growth of 363% over the past year, becoming a profitable company with over 1 million subscribers. Its direct-to-consumer model generated $1.8 billion in revenue and a net income of $49.48 million last quarter. The company’s expansion and strong brand position it well for continued growth.

Yet, like a dish with a problematic ingredient, Hims stock carries significant risks. The compounded drugs controversy remains unresolved, with the FDA potentially closing regulatory loopholes that have fueled recent growth. The terminated partnership with Novo Nordisk and the ongoing class-action lawsuit for securities fraud add layers of uncertainty.

The numbers tell their own story about risk. With a P/E ratio exceeding 70 times earnings and volatility nearly three times the broader market, this stock demands a strong stomach. Recent insider selling adds another element for investors to consider.

So where does this leave us? For risk-tolerant investors with a long-term perspective who believe in the telehealth revolution, Hims stock might represent a compelling growth opportunity. These investors might view the current price as a “Buy” despite the headwinds.

For those seeking stability or concerned about the regulatory and legal uncertainties, a “Hold” position makes more sense. Some particularly cautious investors might even consider it a “Sell,” preferring to step away until the dust settles.

At The Dining Destination, we believe in making informed decisions, whether choosing your next culinary trip or your next investment. Hims stock is a high-stakes opportunity that requires careful consideration of your own risk tolerance and investment timeline. It’s not a stock for everyone, but for those who enjoy a thrilling ride with potential for substantial rewards, it offers plenty to consider.

Just as we encourage trying diverse cuisines, we recommend diversifying your investment portfolio. For more insights and analysis on various topics, Explore our Resource Guides to help guide your decision-making journey.