Why CoreWeave Stock Is Capturing Investor Attention

From our vantage point here in New York City, where we cover the intersection of dining, travel, and technology, few tickers have drawn more cross-industry interest than Coreweave stock (NASDAQ: CRWV) since its March 2025 IPO. Why is a food-and-travel publication watching an AI infrastructure company? Because CoreWeaves GPU cloud underpins many tools reshaping hospitality: menu translation for global visitors, recommendation engines for diners, AI concierges for hotels, demand forecasting for reservations, image and video rendering for culinary media, and even routing for delivery logistics. When the cost and availability of AI compute move, it can ripple through the New York City dining scene and wider travel ecosystem.

Key CoreWeave Stock Facts:

- Current Price: ~$100 (highly volatile)

- Market Cap: $48.965 billion

- 52-Week Range: $33.52 – $187.00

- Analyst Rating: Hold (average of 17 analysts)

- Price Target: $106.79 (+7% upside potential)

- Revenue Growth: 736.64% in 2024 ($1.92B)

- Net Losses: -$937.77M in 2024

The stock has shown extreme volatility since its public debut. After peaking near $187, shares faced pressure following earnings reports that revealed widening losses despite explosive revenue growth.

CoreWeave operates as a specialized cloud provider focused on AI infrastructure. Unlike giants like AWS or Azure, its platform was built specifically for GPU-intensive tasks like AI model training and inference. This focus has attracted major clients, including Microsoft, who are racing to deploy AI applications.

However, investing in coreweave stock carries substantial risks. The company has a high cash burn rate, significant debt (290.91% debt-to-equity ratio), and faces intense competition. The current “Hold” consensus from analysts reflects deep uncertainty about whether its growth can justify its valuation.

For New York hospitality operators, food media creators, and travel brands following coreweave stock, these fundamentals matter: they can influence the pace, performance, and cost of AI-powered tools that touch everything from booking flows and dynamic pricing to real-time guest service.

Simple guide to coreweave stock terms:

CoreWeave’s Business Model and Market Position

While traditional cloud providers aim to be generalists, CoreWeave has focused on mastering one critical area: powering artificial intelligence. This specialization is key to understanding the buzz around coreweave stock among tech investors, including many here in New York. The company has built the CoreWeave Cloud Platform, a specialized environment for the demanding computational needs of AI.

The company’s foundation is its GPU infrastructure, but it’s their proprietary software that automates and manages AI workloads at scale. The platform excels at two critical AI tasks: model training, the data-intensive learning process, and inference, where trained models are applied to new data. Both require the immense computing power and high-performance networking that CoreWeave provides.

A key factor for investors in coreweave stock is the company’s strategic partnership with NVIDIA. This relationship provides early access to the latest GPU technology, a significant advantage in a hardware-driven field. This has helped CoreWeave attract major enterprise clients like Microsoft and Google.

The AI market outlook remains exceptionally strong. As AI transforms industries, the demand for specialized computing power is exploding, placing CoreWeave in a prime position within this technological revolution.

For New York Citys dining and travel community, this matters in practical ways: faster, cheaper, and more scalable AI compute can improve table-turn predictions, guest sentiment analysis across languages, personalized itinerary building, and high-quality food media rendering capabilities that directly affect the hospitality experience across our city.

Services and Technology

CoreWeave’s GPU-as-a-Service model allows developers to access powerful graphics processing units on-demand, scaling resources as needed. The platform also includes CPU compute, storage, and networking. For maximum control, CoreWeave offers bare metal servers, providing direct hardware access without virtualization layers.

The platform is built on Kubernetes, simplifying the deployment of complex AI projects. What truly differentiates CoreWeave is its proprietary software suite, including tools like Tensorizer, which optimizes AI model deployment and infrastructure management. These tools are essential for maximizing performance and efficiency. CoreWeave’s infrastructure also serves other demanding fields like VFX and rendering.

For a broader understanding of the AI infrastructure landscape, see this resource: More info about AI infrastructure.

For hospitality operators and food-tourism brands, the upshot is clear: better inference performance can power real-time menu recommendations, multi-language concierge support for travelers in NYC, and quicker turnaround on culinary video content that promotes local neighborhoods.

Competitive Edge in the AI Space

CoreWeave’s bet on specialized focus over the generalized offerings of hyperscalers like AWS, Azure, and Google Cloud is a core part of its strategy. Every aspect of its architecture is optimized for GPU-intensive workloads.

This focus yields several advantages:

- Access to latest NVIDIA GPUs: Their close partnership with NVIDIA often grants early access to cutting-edge hardware.

- Scalability: The platform is designed to handle the rapid scaling of compute resources required for AI development.

- Cost-efficiency vs hyperscalers: By avoiding the overhead of a general-purpose cloud, CoreWeave can offer competitive pricing for specific AI compute tasks.

CoreWeave’s CEO has highlighted that inference now accounts for over 50% of AI workloads, a massive market where their specialized approach offers clear performance and efficiency advantages over one-size-fits-all solutions. For New Yorks restaurants, hotels, and culinary media, that emphasis on inference directly supports live personalization and translation that travelers and local diners increasingly expect.

Analyzing the Coreweave Stock (CRWV) Performance

Since its March 28, 2025 IPO, coreweave stock (CRWV) has exhibited extreme volatility, a topic of constant discussion on Wall Street. The company’s valuation quickly surpassed its IPO price as investors acceptd the AI narrative, but the journey has been turbulent. The stock’s 52-week range of $33.52 to $187.00 illustrates the dramatic price swings investors have endured.

The stock’s performance has been characterized by strong rallies followed by sharp corrections. For instance, after an 11% surge in April, the stock experienced a significant selloff. The most notable drop occurred after its mid-August 2025 earnings report, when shares fell over 10% in one day and another 14% the next.

This volatility is not isolated. While broader market trends, such as when S&P 500 futures slip after the index posts its longest win streak since November, have an impact, CoreWeave’s movements are largely driven by company-specific news and sentiment surrounding the AI sector.

For New York Citys hospitality and travel operators tracking coreweave stock, price swings can signal shifting investor expectations for AI compute capacity and cost. That, in turn, can influence how quickly restaurant-tech and travel-tech partners roll out new AI features in the citys dining rooms, hotels, and tour experiences.

Recent News and Analyst Ratings for Coreweave Stock

The recent turbulence in coreweave stock is largely due to its Q2 2025 earnings report. While revenue surged and guidance beat forecasts, the company reported much wider losses than Wall Street had anticipated. Net losses reached $937.77 million in 2024, a 57.9% increase from 2023, making investors nervous about its path to profitability.

The lock-up expiration in late August 2025 added to the selling pressure, as it allowed insiders to sell their pre-IPO shares. The anticipation of this event often triggers a selloff as investors brace for increased supply.

Wall Street’s view on coreweave stock is mixed, with a consensus “Hold” rating from 17 analysts. The average 12-month price target of $106.79 suggests only modest upside. Analysts are split between those who believe the selloff was justified by the losses and those who see it as an overreaction to necessary growth investments.

Key Trading Metrics

To understand coreweave stock, one must look at its underlying financial metrics. The company’s market capitalization of $48.965 billion reflects massive investor expectations. With 488.57 million shares outstanding, the valuation is substantial.

However, the earnings per share (EPS) is a sobering -$2.02 on a trailing twelve-month basis, indicating the company is burning cash. Consequently, the price-to-earnings (P/E) ratio is -49.60, making traditional valuation difficult. Investors are clearly betting on future earning potential rather than current profitability. These metrics depict a company with enormous expectations but significant financial problems to overcome.

A Deep Dive into CoreWeave’s Financial Health

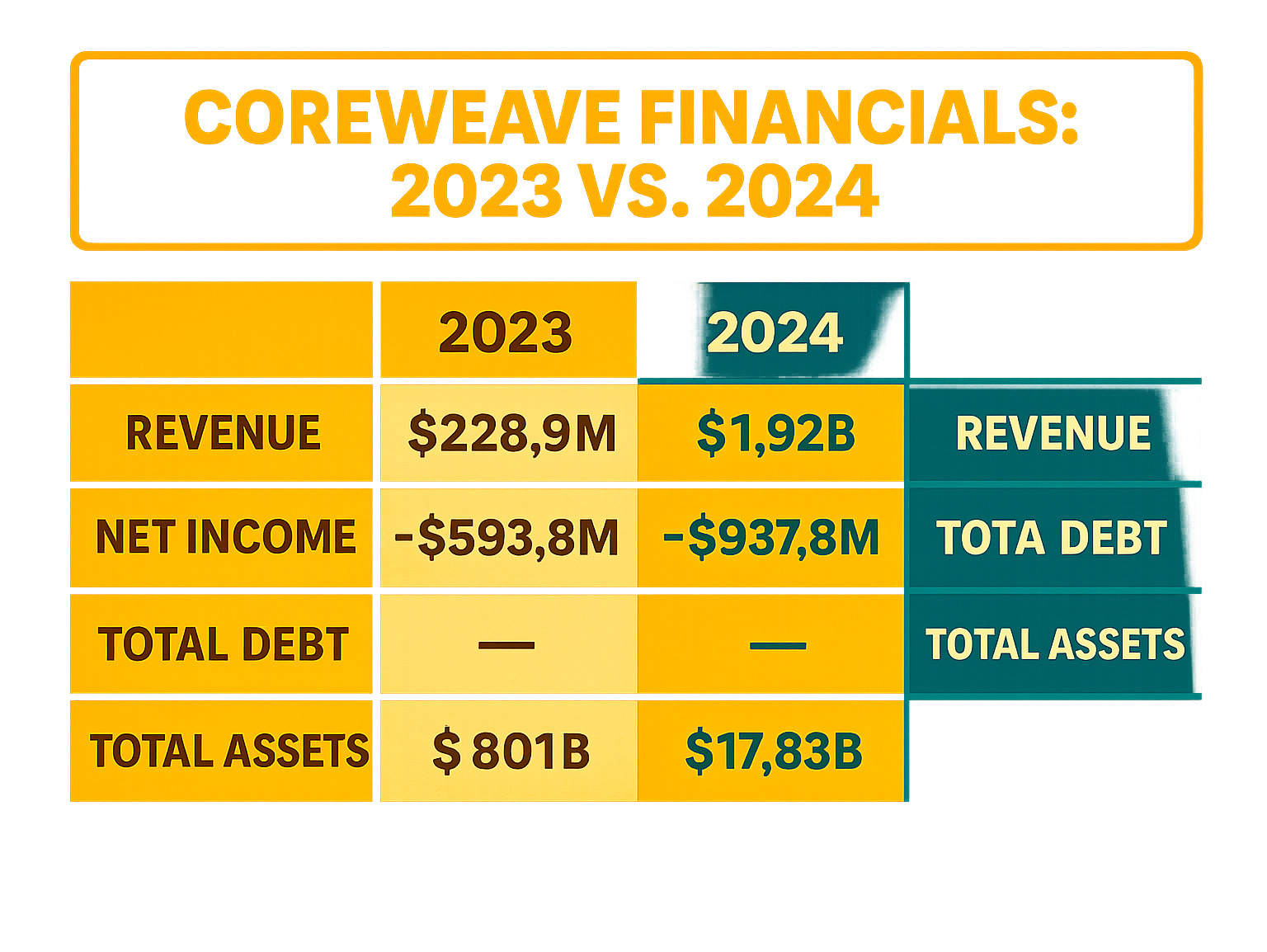

Analyzing CoreWeave’s financial statements reveals a classic high-growth narrative: explosive revenue paired with significant, strategic losses. For investors in coreweave stock, understanding this dynamic is crucial. The company is aggressively expanding in the red-hot AI infrastructure market, and its financials reflect that strategy.

In 2024, CoreWeave generated $1.92 billion in revenue, a stunning 736.64% increase from the prior year’s $228.94 million. This acceleration demonstrates its success in capturing the surging demand for AI compute.

However, this growth came at a cost. Losses deepened to -$937.77 million in 2024, a 57.9% increase from 2023. This is a direct result of heavy investment in expansion. The company’s healthy 74.24% gross margin indicates its core business is efficient, but the net margin of -45.08% highlights the immense operating and investment expenses.

CoreWeave’s debt-to-equity ratio of 290.91% shows a heavy reliance on borrowing to finance its growth. With total debt at $8.01 billion against total assets of $17.83 billion, the company is highly leveraged. On the other hand, it generated $2.75 billion in cash flow from operating activities in 2024, proving the core business generates cash. This was offset by investing activities, which consumed -$8.65 billion for GPUs and data centers.

For New York Citys dining and travel stakeholders, the capital intensity behind coreweave stock helps explain why AI features can be expensive or phased in gradually: the same GPUs and data centers enabling next-gen reservation forecasting, guest-language support, and culinary content creation require massive upfront investment.

Revenue vs. Profitability

CoreWeave’s story is one of prioritizing growth over profit. The 736.64% revenue increase in 2024 is a testament to its market capture ability. However, the increasing net losses of -$937.77 million are a direct result of its aggressive capital expenditure strategy to acquire NVIDIA GPUs and build data centers. Analysts note that this “expansion spending cuts into profitability.”

This is a strategic trade-off: sacrificing short-term profits to establish long-term market dominance. The positive operating cash flow of $2.75 billion suggests the underlying business model is sound; the cash is simply being reinvested immediately to fuel growth.

Balance Sheet and Cash Flow Analysis

The financial evolution from 2023 to 2024 highlights the staggering scale of CoreWeave’s expansion.

| Financial Metric (Millions USD) | 2023 | 2024 | Change (2023 to 2024) |

|---|---|---|---|

| Revenue | $228.94 | $1,920.00 | +$1,691.06 (+738.6%) |

| Net Income | -$593.75 | -$937.77 | -$344.02 (-57.9%) |

| Total Assets | N/A | $17,830.00 | N/A |

| Total Debt | N/A | $8,010.00 | N/A |

The growth in total assets to $17.83 billion represents a massive build-out of physical infrastructure. However, this is financed by significant leverage, with total debt reaching $8.01 billion. The company’s reliance on external financing is a key risk factor for investors.

The cash flow statement tells a dual story: $2.75 billion in operating cash flow proves the business fundamentals are strong, while -$8.65 billion in investing cash flow shows where that moneyand billions more in debtis going. This strategy requires careful monitoring by coreweave stock investors, as it’s a high-risk, high-reward bet on future market leadership. For NYC hospitality, it suggests that access to cutting-edge AI capacity is likely to remain supply-constrained and investment-driven, which can shape timelines for new guest-facing features.

Risks, Opportunities, and the Future of Coreweave Stock

Investing in coreweave stock is a direct bet on the future of artificial intelligence. The company is well-positioned to capitalize on the surging demand for specialized computing power, a trend we’re watching closely from New York. Every AI application, from chatbots to autonomous vehicles, requires the kind of infrastructure CoreWeave provides.

The powerful tailwind of AI market growth is a primary driver for the company. CoreWeave’s attractiveness is improved by its strategic partnerships, particularly its close relationship with NVIDIA, which grants early access to top-tier GPUs. Alliances with tech giants like Microsoft and Google also provide stable revenue streams.

For NYCs dining and travel sectors, the big-picture takeaway is practical: faster inference and scalable training can improve multi-language guest support, real-time recommendations for neighborhood dining, smarter staffing and demand forecasts, dynamic pricing for hotel and experience operators, and higher-fidelity culinary media that draws visitors.

For investors interested in the broader landscape of investing in high-growth tech stocks, CoreWeave exemplifies both the promise and the peril of this sector. However, the competitive landscape is intense, with AWS, Azure, and Google Cloud Platform pouring billions into their own AI services.

Potential Risks for Investors

Before investing in coreweave stock, it’s crucial to consider the significant risks.

- High Debt Load: With a debt-to-equity ratio of 290.91% and over $8 billion in debt, the company is highly leveraged. This financial structure increases risk if growth expectations are not met.

- Continued Unprofitability: Despite soaring revenue, the company loses nearly a billion dollars annually. Investors need to see a clear path to profitability for long-term sustainability.

- Stock Dilution: To fund growth and manage debt, CoreWeave may issue more shares, which would dilute the value for existing shareholders.

- Market Competition: CoreWeave faces formidable competition from hyperscalers with vast resources.

- Dependence on NVIDIA: The partnership is a strength but also a vulnerability. Any disruption in the relationship or NVIDIA’s supply chain could severely impact CoreWeave’s operations.

Growth Opportunities Ahead

Despite the risks, the growth opportunities for coreweave stock are substantial. The inference marketusing trained AI modelsrepresents a massive opportunity, accounting for over half of AI workloads. As companies move from AI experimentation to deployment, this market will grow.

Capturing enterprise AI budgets is another key opportunity. CoreWeave has already secured major clients, and as more corporations adopt AI, demand for its specialized infrastructure will increase. These are often large, multi-million dollar contracts.

International expansion offers another avenue for growth, as the global demand for AI infrastructure is just beginning to accelerate. Finally, CoreWeave is working to build an AI developer platform, moving beyond raw computing power to create a comprehensive ecosystem. This could create stickier customer relationships and a more defensible long-term business model.

For New York businesses across dining, nightlife, hotels, and tours, these opportunities translate into faster, smarter guest experiences from on-the-fly menu translations in Queens to itinerary personalization in Midtown provided the underlying AI capacity scales as planned.

Frequently Asked Questions about Coreweave Stock

Here, we address common questions about coreweave stock from an investor’s perspective.

Is CoreWeave a profitable company?

No, CoreWeave is not yet profitable. The company reported a net loss of -$937.77 million in 2024. This is part of a deliberate high-growth strategy, prioritizing market capture and infrastructure investment over short-term profitability. This is a common playbook for tech companies in a booming sector, but it requires a long-term investment horizon and tolerance for risk.

What do analysts think about CRWV stock?

Wall Street’s view on coreweave stock is cautious. The consensus analyst rating is a ‘Hold’ among 17 analysts, with an average 12-month price target of $106.79. This suggests modest upside from current levels. The analyst community is polarized; some are bullish on the long-term AI demand, while others are wary of the company’s high debt and unprofitability. It’s a classic Wall Street debate between growth potential and current financial health.

Why has CoreWeave stock been so volatile?

The volatility of coreweave stock stems from several factors that create uncertainty and amplify price movements:

- Recent IPO: As a new public company (IPO in March 2025), the market is still determining its fair value, leading to price swings.

- High Growth Expectations: The stock is closely tied to the AI boom. Any news that affects these sky-high expectations can cause a dramatic reaction.

- Financial Risk: Significant losses and high debt create investor uncertainty, leading to sentiment-driven trading.

- Lock-up Expiration: The recent expiration of the post-IPO lock-up period allowed insiders to sell shares, creating selling pressure from the potential for increased supply.

For some New York investors, this volatility presents an opportunity, while for others, it’s a signal to wait for more stability.

Does CoreWeave matter to the dining and travel industry?

Yes, indirectly. As AI infrastructure scales, the tools built on top of it power real-world experiences in NYC hospitality: multilingual guest support, personalized dining recommendations, smarter reservation and staffing forecasts, dynamic pricing for hotels and experiences, and richer culinary media. The trajectory of coreweave stock reflects how quickly and affordably these capabilities may roll out.

Conclusion

Coreweave stock offers a compelling, high-stakes investment narrative. The company is a key infrastructure player in the AI boom, demonstrating explosive revenue growth and strong strategic partnerships with giants like NVIDIA and Microsoft. Its specialized focus on AI infrastructure places it at the center of a major technological shift.

However, this potential is balanced by a high-risk profile, defined by significant debt, continued unprofitability, and the inherent volatility of a newly public company in a fast-moving sector. The core question for investors is whether CoreWeave can convert its impressive market position into sustainable profits.

From our New York City perspective at The Dining Destination, the implications go beyond finance: the pace of CoreWeaves expansion can shape how quickly restaurants, hotels, and food media in our city gain access to faster, cheaper AI capabilities that improve guest experiences and promote culinary tourism.

The current analyst consensus of “Hold” reflects this uncertainty. From our vantage point in New York, we see that Wall Street recognizes the immense potential but is waiting for proof of financial execution before fully committing. The path to profitability is under intense scrutiny.

Investing in coreweave stock is a bet on the company’s ability to steer its financial challenges while capitalizing on the AI market’s growth. This is a high-growth play that requires patience and a high tolerance for risk. As with any such investment, conduct thorough due diligence and consider how it fits within your portfolio’s risk profile.

For those looking to expand their investment knowledge, we encourage you to Explore our complete 2025 stocks guide for a broader perspective on today’s market and how technology trends intersect with New York Citys dining and travel experiences.