Why Monthly Dividend Stocks Are Gaining Popularity Among Income Investors

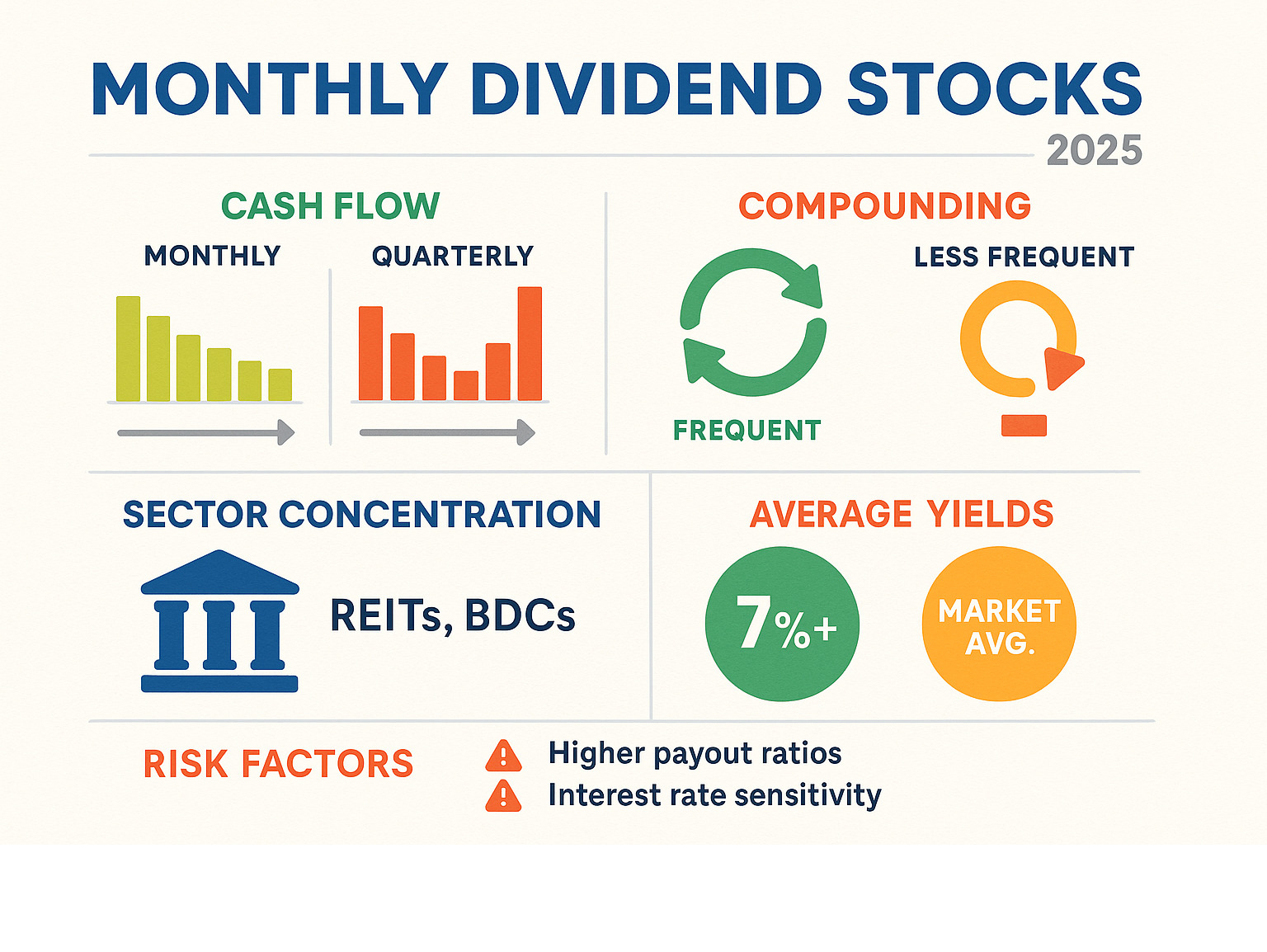

Monthly dividend stocks are securities that pay dividends to shareholders every month instead of the typical quarterly schedule. Here’s what makes them attractive:

Key Benefits:

- Predictable monthly income – perfect for covering regular expenses

- Faster compounding – reinvesting dividends 12 times per year vs. 4 times

- Better budgeting – aligns with monthly bills and expenses

- Higher yields – many offer 7%+ annual yields compared to 1.6% S&P 500 average

Common Sectors:

- Real Estate Investment Trusts (REITs)

- Business Development Companies (BDCs)

- Royalty Trusts

- Mortgage REITs

Top Examples:

- Realty Income (O) – 5.6% yield

- AGNC Investment Corp (AGNC) – 15.4% yield

- Main Street Capital (MAIN) – 5.1% yield

After years of high inflation, many Americans – especially retirees – could use extra cash every month. Monthly dividend stocks provide exactly that. Instead of waiting three months for your next dividend check, you get paid consistently throughout the year.

This regular income stream is particularly valuable for retirees who rely on investment income to cover living expenses. As one financial expert noted, “Monthly dividends are beneficial for retirees who rely on dividend stocks for income, as they match the frequency of personal expenses.”

But finding quality monthly dividend payers requires the right approach. Many high-yielding monthly stocks carry significant risks, with some having “liftd payout ratios” that could lead to dividend cuts during economic downturns.

Monthly dividend stocks terms at a glance:

Why Investors Gravitate Towards Monthly Dividend Stocks

Picture this: you’re sitting at your favorite café in Manhattan, sipping your morning coffee while checking your investment account. Instead of waiting three long months for your next dividend payment, you see fresh income hitting your account every single month. That’s the beauty of monthly dividend stocks – they deliver exactly what busy investors and retirees crave most: predictable, regular income.

For retirees especially, monthly dividend stocks are like having a dependable friend who never forgets to pay you back. Your rent is due monthly, your utilities arrive monthly, and yes, even your favorite restaurant delivery happens monthly (we don’t judge!). Having dividend payments that match your monthly expenses just makes sense. It’s financial planning that actually fits real life.

But here’s where it gets even more interesting – the magic of faster compounding. When you receive dividends twelve times a year instead of four, you can reinvest that money sooner and more often. Through dividend reinvestment plans (DRIPs), your money starts working harder for you. While a $10,000 investment earning 8% annually might only show a $514 difference over 20 years between monthly and quarterly reinvestment, that extra cash can fund quite a few culinary adventures! Our Ultimate Passive Stock Guide dives deeper into how consistent reinvestment builds real wealth over time.

There’s also something deeply satisfying about the psychological comfort of regular payments. Think about it – would you rather get paid once every three months or receive steady income throughout the year? Most people prefer the latter, and for good reason. It provides peace of mind that’s especially valuable compared to investments like bonds that might only pay semi-annually.

The high-yield potential of these stocks is another major draw. While the average S&P 500 stock yields a modest 1.6%, many monthly dividend stocks offer yields of 7% or higher. Some reach truly impressive levels – AGNC Investment Corp. trades at a 15.4% yield, while others in the mortgage REIT space can offer even more.

Of course, smart investors know that higher yields often come with higher risks. But for those seeking regular income to supplement their lifestyle – whether that’s covering basic expenses or funding those amazing food tours we love to explore – monthly dividend stocks offer an appealing combination of steady cash flow and attractive returns.

7 Proven Strategies to Find High-Quality Monthly Dividend Stocks

When I first started hunting for monthly dividend stocks here in New York, I felt like I was searching for a needle in a haystack. The good news? After years of research and experience, I’ve finded that finding quality monthly payers isn’t about luck – it’s about knowing where to look and what tools to use.

Let me share the seven strategies that have consistently helped me uncover those income-generating gems that can provide steady monthly cash flow.

1. Use Specialized Online Stock Screeners

Think of online stock screeners as your personal investment GPS. Just like you wouldn’t drive through Manhattan without navigation, you shouldn’t hunt for monthly dividend stocks without these powerful tools.

The beauty of modern screeners is their ability to filter thousands of stocks using specific criteria. When I’m searching for monthly payers, I always start with dividend frequency filters – many advanced platforms now let you select “monthly” as a payment schedule option.

But frequency is just the beginning. I typically focus on dividend yield first, though I’ve learned the hard way that sky-high yields can be red flags. The payout ratio is equally crucial – this tells you what percentage of a company’s earnings goes to dividends. I generally avoid anything consistently above 100%, as it often signals trouble ahead.

Market capitalization and sector filters help me balance risk and diversification. The Morningstar Stock Screener tool has become one of my go-to resources, along with the comprehensive market data available through Fintechzoom.com – Markets. These custom searches can save you hours of manual research.

2. Explore Monthly Dividend ETFs and Funds

Sometimes the smartest approach is letting professionals do the heavy lifting. If researching individual monthly dividend stocks feels overwhelming – like trying to steer Times Square during rush hour – monthly dividend ETFs and mutual funds might be your perfect solution.

The magic word here is diversification. Instead of betting everything on one company, these funds spread your investment across dozens of monthly dividend payers. If one holding cuts its dividend, the impact on your overall returns is cushioned by the other companies in the fund.

Professional management is another major advantage. Fund managers spend their days analyzing companies, rebalancing portfolios, and making strategic decisions. Of course, this expertise comes with expense ratios, so always check these fees before investing.

Some ETFs get creative with covered call strategies to generate extra income on top of the underlying dividends. While this income isn’t technically from monthly dividends, it still delivers that consistent cash flow you’re seeking. For more insights on building a smart investment strategy, our Investing Tips guide offers valuable perspectives.

3. Target Key Sectors Known for Monthly Payouts

Here’s something I learned early in my investing journey: certain sectors are natural homes for monthly dividend stocks due to their business structures and regulatory requirements.

Real Estate Investment Trusts (REITs) are probably your best hunting ground. These companies must distribute at least 90% of their taxable income to shareholders annually, which often translates to generous, consistent payouts. Realty Income (O) earned its nickname “The Monthly Dividend Company” for good reason, while STAG Industrial (STAG) focuses on industrial properties with reliable tenant income.

Business Development Companies (BDCs) represent another goldmine. These firms lend to smaller businesses and, like REITs, must distribute most of their income to maintain favorable tax treatment. Main Street Capital (MAIN) exemplifies this sector beautifully. You can dive deeper into this fascinating investment category through Business Development Companies (BDCs).

Don’t overlook Royalty Trusts and Term Trusts either. Royalty trusts collect income from natural resource properties and pass it through to investors, while term trusts are designed to return capital over predetermined periods. Gladstone Commercial (GOOD) rounds out this sector as another solid REIT option.

Understanding these business models helps you evaluate whether monthly dividends are sustainable or just too good to be true.

4. Leverage Curated Lists from Financial Data Providers

Why reinvent the wheel when experts have already done the research? Some of the smartest investors I know start with curated lists from reputable financial data providers.

These professionally compiled lists save countless hours of screening and often include pre-calculated metrics like dividend yield, market capitalization, and payout ratios. It’s like having a financial analyst’s research delivered straight to your inbox.

Resources like SureDividend and Dividend Channel regularly update their monthly dividend lists with current financial data. In fact, you can Click here to instantly download your free spreadsheet of all monthly dividend stocks now to get started immediately with comprehensive metrics and company profiles.

These lists become your foundation for deeper research. They won’t make investment decisions for you, but they’ll point you toward the most promising candidates worth investigating further.

5. Analyze Companies with Strong Dividend Histories

Frequency means nothing without sustainability. I’ve learned to prioritize companies with proven track records over flashy high yields that might disappear during tough times.

While true monthly dividend stocks rarely achieve Dividend Aristocrat status (25+ years of consecutive increases), the principle remains crucial: longevity indicates quality. Realty Income (O) stands out here with dividend increases every year since 1994 – that’s the kind of consistency that lets you sleep well at night.

When evaluating potential investments, I look for uninterrupted dividend streaks and evidence of regular dividend growth. These patterns reveal companies with strong business models and management teams committed to shareholders. A company that has paid dividends through multiple economic cycles demonstrates resilience that’s worth paying for.

Our Best Blue Chips guide explores this concept in greater detail, showing how dividend history often predicts future reliability.

6. Review Investor Presentations for Dividend Policy

Want to know what management really thinks about their dividend? Go straight to the source through investor presentations and quarterly calls.

These documents, typically found on company investor relations websites, offer unfiltered insights into dividend policy statements, financial health reports, and future outlook. Management often provides forward-looking guidance about dividend sustainability and growth expectations.

The Investor Presentation for STAG Industrial exemplifies the kind of detailed information you can find. Similarly, the AGNC Investor Presentation reveals their mortgage REIT strategy and income generation methods.

Pay special attention to management commentary during earnings calls. Confident, detailed explanations about dividend coverage and growth plans signal strong leadership, while vague or defensive responses might indicate underlying problems.

7. Build a “Synthetic” Monthly Income Portfolio

Here’s my favorite strategy when I can’t find enough quality monthly dividend stocks: create your own monthly income stream using quarterly dividend payers.

The concept is beautifully simple. Most quarterly dividends follow predictable schedules, generally falling into three groups: January/April/July/October payers, February/May/August/November payers, and March/June/September/December payers.

By strategically selecting high-quality companies from each group, you ensure dividend income arrives every month. For example, you might own a JAJO stock that pays in January, April, July, and October; an FMAN stock covering February, May, August, and November; and an MJSD stock handling March, June, September, and December.

This approach dramatically expands your investment universe beyond the limited pool of true monthly payers. You can prioritize quality and diversification across sectors while still achieving that monthly cash flow rhythm. Our Income Stocks Guide provides detailed strategies for constructing these synthetic monthly portfolios.

The beauty of this method? You’re not settling for potentially lower-quality companies just because they pay monthly. Instead, you’re combining the best quarterly payers to create your ideal income schedule.

Evaluating the Safety of Your Chosen Monthly Dividend Stocks

Here’s where the rubber meets the road in income investing. You’ve found some promising monthly dividend stocks, but now comes the crucial part: making sure they won’t leave you high and dry when you need that income most. Think of it like choosing a restaurant in Manhattan – just because it has an eye-catching menu doesn’t mean the food will actually satisfy you!

Due diligence is absolutely crucial when it comes to monthly dividend payers. Many of these stocks offer tempting yields precisely because they carry higher risks than your typical blue-chip quarterly payer. The last thing you want is to chase a juicy 15% yield only to watch it get slashed in half during the next market downturn.

Payout ratio analysis sits at the heart of dividend safety evaluation. For traditional companies, we generally get nervous when the payout ratio (dividends per share divided by earnings per share) climbs above 70-80%. This suggests the company is stretching itself thin, leaving little room for error if business conditions deteriorate. However, monthly dividend stocks often operate under different structures that require specialized analysis.

For Real Estate Investment Trusts (REITs), traditional earnings can be misleading due to depreciation charges on properties. Instead, we focus on Funds From Operations (FFO), which gives a clearer picture of the cash flow available to cover dividends. A healthy REIT should have stable or growing FFO that comfortably exceeds its dividend obligations.

Business Development Companies (BDCs) require yet another approach. Here, we examine Net Investment Income (NII), which represents the income generated from their loan and equity investments minus operating expenses. Strong, consistent NII is the foundation that supports those attractive monthly payouts from BDCs like Main Street Capital.

Debt levels deserve serious attention, especially in today’s interest rate environment. A company drowning in debt may struggle to refinance when rates rise, potentially forcing dividend cuts to preserve cash. High debt combined with a high payout ratio creates a particularly dangerous cocktail that income investors should avoid.

Don’t ignore dividend cut history – it’s often the best predictor of future behavior. Companies that have slashed dividends in the past, even if they’ve since restored them, tend to be more willing to cut again when times get tough. Many high-yielding monthly dividend stocks have checkered payout histories that warrant careful scrutiny.

High-yield risks cannot be overstated. When you see yields of 15% or higher, your first instinct should be skepticism, not excitement. These astronomical yields often signal underlying business challenges, excessive leverage, or sensitivity to economic factors like interest rate changes. Mortgage REITs, for instance, can see their profitability evaporate quickly when interest rate spreads compress.

The dreaded “yield trap” represents every income investor’s nightmare scenario. This occurs when a stock’s price plummets, artificially inflating its dividend yield and luring unsuspecting investors. They pile in chasing the high yield, only to suffer a dividend cut and further capital losses. Always ask yourself: why is this yield so much higher than similar companies? The market might be signaling trouble ahead.

Building a reliable income stream requires patience and careful analysis. A slightly lower but sustainable yield will serve you far better than a sky-high payout that disappears when you need it most. For more insights on comprehensive financial planning strategies, explore our Money Complete Guide.

A Look at Popular Monthly Dividend Stocks and Their Metrics

When it comes to monthly dividend stocks, seeing real examples with actual numbers helps bring the concept to life. Think of it like browsing a restaurant menu – you want to see the dishes, ingredients, and prices before making your choice. Let’s examine some well-known monthly dividend payers and their key financial metrics to give you a taste of what’s available in this investment space.

| Company Name | Ticker | Sector | Dividend Yield | Market Cap (approx.) |

|---|---|---|---|---|

| AGNC Investment Corp. | AGNC | Mortgage REIT | 15.4% | $5.5 Billion |

| Realty Income | O | Retail REIT | 5.6% | $46 Billion |

| STAG Industrial | STAG | Industrial REIT | 4.3% | $6.5 Billion |

| Main Street Capital | MAIN | Business Development | 5.1% | $4.2 Billion |

| EPR Properties | EPR | Experiential REIT | 6.0% | $3.5 Billion |

AGNC Investment Corp. (AGNC) stands out immediately with its eye-catching 15.4% yield. This mortgage REIT (mREIT) primarily invests in agency mortgage-backed securities and uses leverage to amplify returns. While that yield might make your mouth water like seeing a perfectly prepared dish, mREITs are highly sensitive to interest rate changes. Their AGNC Investor Presentation reveals more about their strategy, but approach with the same caution you’d use with a very spicy dish – it might be too hot to handle for some investors.

Realty Income (O) has earned the nickname “The Monthly Dividend Company” for good reason. This retail REIT owns freestanding, single-tenant properties and boasts an incredible track record of consistent payouts. With a 5.6% yield and a history of increasing dividends since 1994, it’s like that reliable neighborhood restaurant that never disappoints. Their occupancy rate has never dropped below 96%, even during the 2008 financial crisis – that’s impressive staying power.

STAG Industrial (STAG) focuses on single-tenant industrial properties across the United States, benefiting from the massive growth in e-commerce and logistics. Their 4.3% yield might seem modest compared to AGNC, but it comes with significantly more stability. The STAG Industrial investor presentation showcases their diversified tenant base, which helps reduce risk – much like a restaurant with a varied menu appeals to more customers.

Main Street Capital (MAIN) operates as a Business Development Company, investing in debt and equity of smaller companies. Their 5.1% yield comes with the added benefit of being internally managed, which can be more shareholder-friendly than externally managed BDCs. Think of them as the investment equivalent of a chef-owned restaurant – the owner has more skin in the game.

EPR Properties (EPR) brings some entertainment to the portfolio as an experiential REIT. They invest in properties like movie theaters, ski resorts, and entertainment venues. With a 6.0% yield, EPR offers exposure to the leisure sector, though it can be more vulnerable during economic downturns when people cut back on entertainment spending – just like how fine dining restaurants feel the pinch during tough times.

These examples showcase the diversity within the monthly dividend stocks universe, from high-yield but risky mortgage REITs to steady industrial property owners. Each serves a different appetite for risk and return, much like how different restaurants cater to various tastes and budgets. For more comprehensive stock analysis and investment insights, explore our Best Stocks Guide 2025.

Frequently Asked Questions about Monthly Dividend Stocks

We often get questions from investors curious about the ins and outs of monthly dividend stocks. Living here in New York City, where financial conversations happen everywhere from Wall Street to neighborhood coffee shops, we’ve heard just about every question imaginable. Let’s tackle some of the most common ones with the same warmth and honesty we’d bring to discussing your favorite restaurant recommendation.

Are monthly dividend stocks a good investment?

Like asking whether Thai food is better than Italian (both can be amazing, depending on what you’re craving!), the answer really depends on your personal goals and risk tolerance.

The pros are pretty compelling. These stocks provide that regular income we’ve been talking about – a consistent stream that aligns perfectly with your monthly rent, utilities, and yes, even that weekly takeout budget. The faster compounding benefit is real too. When you’re reinvesting dividends twelve times a year instead of four, your money starts working harder for you sooner. There’s also something deeply satisfying about that psychological comfort – knowing income arrives as regularly as your favorite food delivery app.

But let’s be honest about the cons too. Many monthly dividend stocks cluster in specific sectors like REITs and BDCs. While these can be excellent investments, it’s like having a diet consisting only of pizza – delicious, but not exactly balanced. These stocks often carry higher risk to achieve those attractive yields. Our research shows many have liftd payout ratios that are less sustainable during tough economic times.

The limited universe of truly high-quality monthly payers also means you’ll need to dig deeper in your research. Think of it as finding that perfect hole-in-the-wall restaurant – it takes more effort, but the rewards can be worth it.

Bottom line? Monthly dividend stocks can absolutely be a smart investment if you prioritize consistent income and commit to thorough research. Just remember that diversification is key – don’t put all your investment eggs in one monthly dividend basket.

What are the risks of high-yield monthly dividend stocks?

You know that old saying, “If it sounds too good to be true, it often is”? That wisdom definitely applies to some extremely high-yield monthly dividend stocks. While a 15%+ yield might make your eyes light up like spotting your favorite dessert on a menu, it often comes with some serious risks.

Unsustainable payouts are probably the biggest red flag. When a company offers an eye-popping yield, it might be paying out more than it can actually afford long-term. It’s like a restaurant offering $5 lobster dinners – sounds amazing, but probably not sustainable.

Those high payout ratios we mentioned earlier become critical here. When a company is distributing nearly everything it earns (or more!), there’s zero cushion for unexpected challenges. Yield traps are particularly sneaky – the stock price drops, making the dividend yield look incredibly attractive, but often that price drop signals underlying business problems that will lead to dividend cuts and further losses.

Interest rate sensitivity affects many high-yield monthly dividend stocks too, especially REITs and BDCs. When rates rise, their borrowing costs increase, squeezing their ability to maintain those generous payouts. And during economic downturns, companies in vulnerable sectors can face serious pressure. We saw this during the pandemic when some monthly payers like Apple Hospitality REIT and EPR Properties had to suspend dividends entirely.

The key takeaway? A high dividend isn’t automatically a sustainable dividend. Approach those double-digit yields with the same healthy skepticism you’d have toward a restaurant claiming to serve “authentic” cuisine from twelve different countries.

How many monthly dividend stocks should I own?

There’s no magic number here – it’s like asking how many restaurants you should try in a lifetime. The answer depends on your appetite for risk, your investment goals, and how much capital you’re working with.

Diversification is absolutely key though. If you’re building a portfolio of individual monthly dividend stocks, we generally suggest spreading your investments across different companies and sectors. This helps cushion the blow if one company hits a rough patch. You might own a retail REIT like Realty Income, an industrial REIT like STAG, and a BDC like Main Street Capital – giving you exposure to different business models and risk profiles.

For many investors, especially those just getting started, ETFs offer instant diversification across dozens or even hundreds of stocks with a single purchase. It’s like choosing a tasting menu instead of ordering individual dishes – you get variety without having to make dozens of individual decisions.

Focus on quality over quantity. A handful of rock-solid monthly dividend stocks that you’ve thoroughly researched will serve you much better than a large collection of risky, speculative picks. You’re building a reliable income stream, not collecting trading cards.

The most important thing? Make sure whatever number you choose fits comfortably within your overall investment strategy and risk tolerance. Your monthly dividend stocks should complement, not dominate, a well-diversified portfolio.

Conclusion

As we wrap up our journey through monthly dividend stocks, think of it like finding a hidden gem of a restaurant that serves consistently excellent meals every single day. These income-generating investments offer something truly special: predictable cash flow that arrives as regularly as your monthly rent bill, but in a much more welcome way!

We’ve shared 7 proven strategies that can help you uncover these financial treasures. Whether you’re using specialized online screeners to filter through thousands of options, exploring the instant diversification of monthly dividend ETFs, or targeting those key sectors like REITs and BDCs that naturally lean toward monthly payouts, you now have a solid roadmap. Don’t forget about leveraging those curated lists from financial experts, analyzing companies with rock-solid dividend histories, diving deep into investor presentations, or even creating your own “synthetic” monthly income portfolio by strategically combining quarterly payers.

But here’s the thing – and this is crucial – balancing high yield with safety should always be your north star. Just like you wouldn’t trust a restaurant that promises a five-course gourmet meal for five dollars, be wary of dividend yields that seem too good to be true. Due diligence is non-negotiable. Always take the time to examine payout ratios, debt levels, and any history of dividend cuts. The last thing you want is to fall into a yield trap where that attractive dividend disappears faster than a New York minute.

Building a reliable income stream takes careful planning and the kind of patience you’d need to perfect your grandmother’s secret recipe. It’s not about rushing into the highest-yielding stock you can find, but rather about constructing a thoughtful portfolio that can weather different market conditions while providing that steady monthly income you’re after.

At The Dining Destination, we believe that smart financial planning should fund the experiences that matter most to you. Whether that’s exploring the busy food markets of Southeast Asia, savoring wine in the rolling hills of Tuscany, or simply enjoying the incredible diversity of cuisines right here in our own backyard, monthly dividend stocks can help provide the financial foundation for those culinary adventures.

Ready to continue building your financial knowledge and create the income stream that supports your passions? Explore more of our comprehensive resource guides and take the next step toward financial independence. After all, the best investments, like the best meals, are worth taking the time to get right.