Why Crypto30x.com Regulation Matters for Your Financial Safety

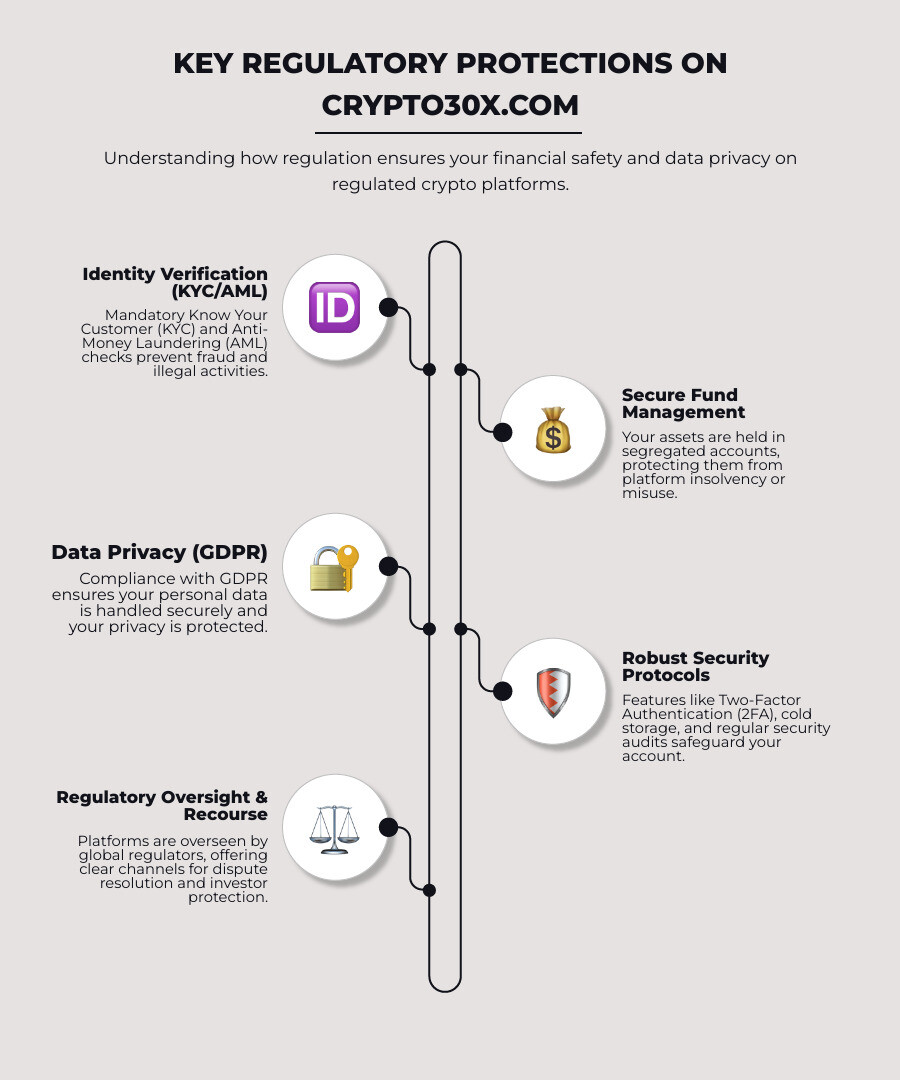

Crypto30x.com regulation provides essential investor protection through compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements, platform licensing, and secure fund management practices.

Quick Answer for Crypto30x.com Regulation:

- Platform Status: Operates with regulatory compliance in most jurisdictions

- Leverage Offered: Up to 30x leverage on deposits through Zeus platform

- Security Features: Advanced encryption, two-factor authentication, cold storage

- Compliance Requirements: Mandatory KYC/AML verification for all users

- User Protection: Segregated funds, transparent operations, audit trails

Cryptocurrency trading can feel like uncharted waters. When platforms promise returns of 30 times your initial investment, it’s easy to overlook the critical foundation of your financial safety: regulation.

Crypto30x.com offers high-leverage trading via its Zeus platform, but its regulatory compliance is what truly protects you. Regulation indicates honesty and value to investors by maintaining prices in line with normal market conditions and offering fair opportunities, as industry experts note.

When dealing with leverage as high as 30x, the stakes are high. A regulated platform means your funds are protected through segregated accounts, your personal data is secured through GDPR compliance, and suspicious activities are monitored.

A regulated platform can mean the difference between secure investing and losing everything to fraud or platform collapse.

Simple crypto30x.com regulation word guide:

The Global Watchdogs: Understanding Key Crypto Regulatory Bodies

Think of crypto30x.com regulation like having experienced guides when exploring a new city’s food scene. Just as you’d want trusted locals to point you toward the best restaurants and away from tourist traps, the crypto world has watchdogs keeping platforms honest and investors safe.

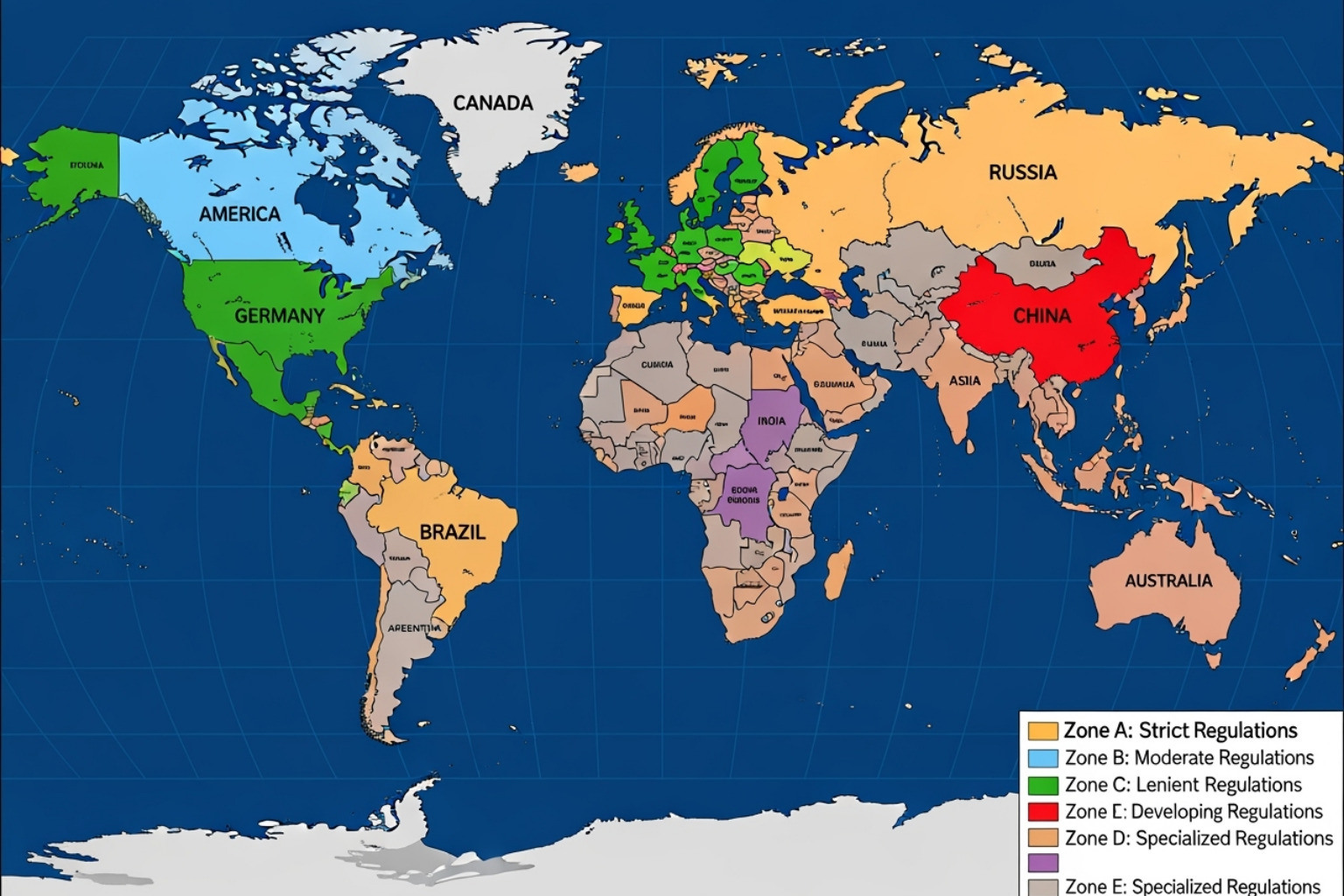

Global crypto oversight is a complex but essential safety net. Regulations differ by country, much like dining cultures, but the core goals are consistent: protecting investors, preventing money laundering, and ensuring market stability.

In the United States, the regulatory landscape resembles a busy kitchen with multiple chefs. The US: Securities and Exchange Commission (SEC) treats many cryptocurrencies as securities, bringing them under strict oversight. They also monitor crypto trading bots for fair practices. Other US agencies handle different aspects, like the Commodity Futures Trading Commission with crypto derivatives and the Financial Crimes Enforcement Network combating financial crimes.

In the UK, the UK: Financial Conduct Authority (FCA) acts like a careful restaurant inspector, focusing on anti-money laundering compliance and consumer protection. They generally don’t regulate cryptocurrencies themselves unless they fall under existing financial laws.

The Canadian framework is particularly thorough. The Canada: Canadian Securities Administrators (CSA) requires crypto platforms to register with provincial regulators, emphasizing that crypto assets are high-risk investments.

International cooperation is growing as regulators share information. The EU is developing frameworks like MiCA (Markets in Crypto-Assets), while Asian countries like Japan and Thailand have established clear legal frameworks. This global effort ensures international platforms meet high standards for market stability and fraud prevention, creating a safer environment for investors on regulated platforms like Crypto30x.com.

Inside Crypto30x.com: A Deep Dive into Compliance and Security

Think of crypto30x.com regulation like the safety protocols at a high-end restaurant. You trust the kitchen follows health codes; you need the same assurance when investing on a platform offering 30x leverage.

Platform compliance at Crypto30x.com means peace of mind. Your assets and data are protected with bank-level care as a legal requirement, creating a safer trading environment for everyone.

How Crypto30x.com Implements KYC and AML

Know Your Customer (KYC) and Anti-Money Laundering (AML) are the financial world’s way of keeping bad actors out while protecting honest investors.

When signing up with Crypto30x.com, you’ll complete a user identity verification process by providing personal info and a government ID. This extra step prevents fraudsters from using fake identities to manipulate the market or steal funds.

The platform doesn’t just verify you once. Transaction monitoring happens 24/7, using smart algorithms and human oversight to watch for unusual patterns. If a system flags suspicious behavior, Crypto30x.com is legally required to report it to authorities. This reporting of suspicious activity is a cornerstone of a trustworthy trading environment.

Protecting Your Privacy: GDPR and Data Security

Crypto30x.com treats your valuable data according to General Data Protection Regulation (GDPR) standards, the global gold standard for handling personal information.

The platform’s user privacy commitment means clear data handling policies. You’ll know what information is collected and how it’s used. Your sensitive information is protected by advanced encryption techniques, creating multiple layers of protection to keep hackers out.

Preventing data breaches requires constant vigilance. Crypto30x.com runs regular security audits and maintains round-the-clock monitoring to spot potential vulnerabilities before they become problems.

Securing Your Funds in a Regulated Environment

When you’re dealing with 30x leverage, fund security is everything. Crypto30x.com uses a multi-layered approach to keep your money safe.

- Two-Factor Authentication (2FA) adds a crucial second layer of security. Even if someone steals your password, they can’t access your account without your phone.

- Most user funds are in cold storage wallets, offline digital safety deposit boxes that are virtually impenetrable to online attacks.

- Hot wallet security protects funds for daily trading with advanced encryption and constant monitoring, balancing security and accessibility.

- Phishing attack prevention includes user education and systems to detect and block malicious attempts to steal login credentials.

- Regular security audits by independent experts ensure defenses stay ahead of cyber threats by identifying and fixing potential weaknesses.

This robust security framework is critical when trading with high leverage, where the need for bulletproof protection is paramount.

The Investor’s Playbook for Crypto30x.com Regulation

Crypto30x.com regulation isn’t an abstract concept; it’s the foundation shaping every interaction you have with the platform, from your first login to your biggest trade.

Think of regulation like Manhattan’s traffic signals. They might slow you down, but they prevent chaos and keep everyone safe on the busy financial streets.

How Regulations Shape Your Trading Experience

With crypto30x.com regulation, you’re not on a Wild West exchange. You’re in a world where every process is designed for your protection.

- Account verification is your first encounter with this framework. Providing ID and address proof might seem like a hassle, but this mandatory KYC process separates legitimate platforms from scams.

- Trading limits, especially for new accounts, aren’t arbitrary. They are safeguards to prevent money laundering while you build your trading history.

- Withdrawal procedures may take longer due to AML-compliant security checks that protect everyone’s funds. The slight delay is a small price for peace of mind.

- For high-leverage trading (up to 30x your deposit), regulations are critical. Crypto30x.com must provide clear risk disclosures and warnings. Its compliance ensures you have access to risk management tools and educational resources.

- Platform transparency is a key benefit of regulation. Crypto30x.com operates openly about costs and policies, unlike unregulated exchanges. This mandated transparency empowers you to make informed decisions.

Your Compliance Checklist: Best Practices for New Investors

Starting your crypto journey on Crypto30x.com is exciting. Use this roadmap for smart, legal, and secure trading.

- Complete your KYC verification immediately with clear copies of your ID and address proof. This establishes your legitimacy on a compliant platform.

- Secure your account by enabling two-factor authentication. Treat your Crypto30x.com account with the same security as your bank account.

- Maintain detailed records of all transactions. This is crucial for tax compliance and can prevent future headaches.

- Understand local laws. Crypto regulations vary by location. Here in New York, specific state guidelines complement federal rules. Research your local requirements and obligations.

- Avoid high-risk activities like services promising unrealistic returns or anonymity. These often operate outside regulations and pose serious legal and financial risks.

- Diversify and manage risk, especially with high leverage. Never invest more than you can afford to lose and use the platform’s risk management tools. 30x leverage amplifies losses as well as gains.

- Stay informed about the evolving regulatory landscape by following reputable news sources and announcements.

Explaining Crypto Taxes on Crypto30x.com

Understanding your tax implications when trading on Crypto30x.com is crucial. In the U.S., crypto is treated as property for tax purposes. Every sale, trade, or purchase is a taxable event. Gains are categorized as short-term (held ≤1 year) or long-term (held >1 year), with different tax rates.

Your reporting requirements are comprehensive. You must report all crypto transactions, including capital gains, losses, and income from activities like staking. Crypto30x.com helps by providing downloadable transaction history reports with all the essential data needed to calculate your tax obligations.

While the platform provides tax assistance via reports, it doesn’t offer tax advice. The data integrates with popular crypto tax software to generate filing reports. Given the complexity, consulting tax professionals who understand crypto is highly recommended. Tax compliance is your responsibility. Staying organized and proactive will save you stress during tax season.

Navigating the Future: Challenges and Outlook for Crypto Rules

The world of crypto30x.com regulation is like the NYC restaurant industry adapting to new health codes: constantly evolving, challenging, but ultimately creating a safer environment for everyone. Just as our favorite dining spots steer changing rules, crypto platforms like Crypto30x.com must balance innovation with compliance.

Challenges and Strategies in the Evolving World of crypto30x.com regulation

Crypto regulation is like coordinating a meal across different kitchens, each with its own rules. Crypto30x.com faces similar challenges operating across various jurisdictions.

- Licensing across jurisdictions is a complex puzzle. Rules vary by country, so Crypto30x.com invests in legal teams to understand each market’s nuances and meet local requirements.

- Adapting to new rules is frequent. Regulators often introduce new guidelines, so successful platforms must stay agile, much like restaurants that pivoted during the pandemic.

- Regulating DeFi and NFTs is a new challenge. These technologies don’t fit traditional categories. Crypto30x.com’s support for DeFi features like yield farming, lending, and borrowing requires balancing innovation with compliance.

- Maintaining decentralization while meeting regulatory oversight creates tension. The goal is to ensure transparency and safety without compromising crypto’s core values.

- Crypto30x.com’s platform strategy focuses on user verification, transparency, and clear guidelines. This approach prioritizes long-term reliability, similar to successful exchanges like Gemini and Kraken.

The Future Outlook for crypto30x.com regulation and User Recourse

The regulatory landscape is moving toward greater clarity and coordination, similar to how food safety standards have become more unified globally.

Increased international coordination is on the horizon. Regulators recognize crypto is borderless and are moving toward harmonized standards. This will help compliant platforms and hinder non-compliant ones. Tighter consumer protection is also becoming the norm, with stronger requirements for asset segregation, insurance, and risk disclosures. This means better protection and transparency for users.

If you have issues, start with Crypto30x.com’s dispute resolution process via customer support. If that fails, escalate issues to regulators like the SEC or CFTC in the U.S., the FCA in the U.K., or the CSA in Canada. In serious cases of fraud or negligence, legal recourse through civil litigation is an option, providing another layer of protection.

Frequently Asked Questions about Crypto30x.com Regulation

Exploring high-leverage crypto trading on platforms like Crypto30x.com naturally brings questions. As food enthusiasts who value transparency, we believe the same clarity should apply to finance. Here are common questions we hear about crypto30x.com regulation.

Is Crypto30x.com a regulated exchange?

Yes, Crypto30x.com operates as a regulated platform in most jurisdictions. This status is a fundamental protection for users. The platform’s regulatory status means it must meet strict financial and security standards, much like a restaurant needs health department approval.

The platform shows its commitment through adherence to KYC/AML rules. Mandatory identity verification for all users creates a transparent environment and is a key defense against fraud. The platform also works to obtain and maintain necessary jurisdictional licenses. These user protection measures are real. Regulation requires segregated client funds, security audits, and robust protocols, protecting your money to the standards of traditional financial institutions.

What are the risks of trading on Crypto30x.com?

Even with strong crypto30x.com regulation in place, crypto trading has inherent risks.

- Market volatility is a top concern. Crypto prices can swing dramatically in minutes. Unlike a consistent restaurant menu, markets are unpredictable and never sleep.

- High-leverage risks are significant. With up to 30x leverage, small market movements can amplify losses and wipe out your investment. Understanding these risks is your responsibility.

- Security threats like phishing are a constant concern. Cybercriminals use convincing tactics to trick users into revealing credentials or sending funds.

- The importance of personal security measures is paramount. Use strong passwords, enable 2FA, and be vigilant about suspicious communications.

Does Crypto30x.com support DeFi features within a regulated framework?

Yes, Crypto30x.com supports decentralized finance (DeFi) support features, creating new opportunities at the intersection of innovation and regulation. The platform offers yield farming, lending, and borrowing. These DeFi services use smart contracts to enable peer-to-peer finance without traditional intermediaries.

Balancing innovation with compliance is the main challenge. While DeFi is often permissionless, regulated platforms like Crypto30x.com must still monitor activity and prevent illicit financial flows. The solution is a regulated gateway to DeFi. Users access innovative services while the platform maintains AML oversight, preserving decentralization while ensuring compliance.

Conclusion

Navigating cryptocurrency regulation can seem as complex as finding a hidden gem restaurant in Manhattan, but understanding crypto30x.com regulation is your essential guide to safe trading.

We’ve seen how the global regulatory framework, from oversight by bodies like the SEC and FCA to Crypto30x.com’s own KYC/AML protocols, creates a financial safety net for your investments. The importance of compliance is paramount. By adhering to GDPR, using 2FA, and maintaining cold storage, Crypto30x.com builds a fortress around your assets, which is crucial when using 30x leverage.

Secure investing means embracing regulatory protections like account verification and transaction monitoring. They ensure your trading experience is both exciting and safe. From our New York perspective, the future of crypto regulation points toward greater coordination and stronger consumer protections, benefiting all investors.

Just as we trust health inspectors, crypto30x.com regulation ensures the platform operates with transparency and security. By choosing regulated platforms and following best practices, you protect your investments and contribute to a more stable crypto ecosystem. The regulatory landscape will evolve, but its foundation is solid: oversight creates confidence and drives market growth. Operating within this framework gives you the peace of mind to focus on making informed trading decisions.

Explore our comprehensive resource guides for more expert insights.