Why the FintechZoom.com Lifestyle is Changing How We Live

The fintechzoom.com lifestyle represents a modern approach to living where financial awareness seamlessly blends with daily decisions, creating more confidence and clarity in everything from planning weekend adventures to daily dining experiences.

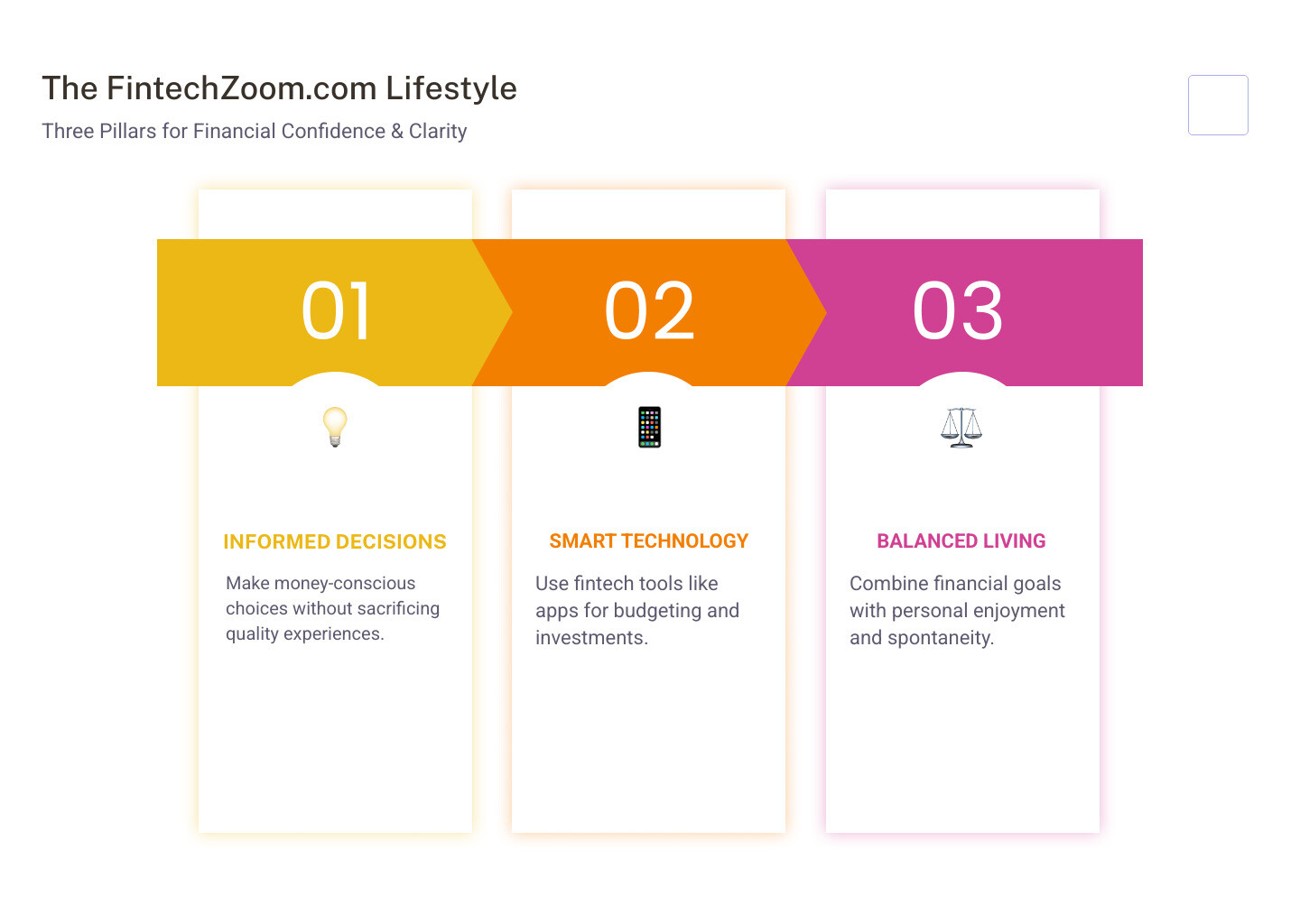

Quick Answer: What is the FintechZoom.com Lifestyle?

- Financial Awareness: Making money-conscious decisions without sacrificing quality experiences

- Smart Technology: Using fintech tools like budgeting apps and investment platforms for better financial management

- Balanced Living: Combining financial goals with personal enjoyment and spontaneity

- Intentional Choices: Evaluating purchases based on long-term value rather than impulse

In today’s digital age, money influences nearly every part of our daily lives. Whether you’re deciding between that favorite café or saving for your next culinary adventure, the FintechZoom.com lifestyle helps you steer these choices with wisdom.

This isn’t about becoming a financial expert overnight. It’s about adopting a balanced mindset that merges finance with lifestyle choices. Think of it as having a financial compass that guides your decisions while still leaving room for the experiences that bring you joy.

The beauty of this approach lies in its simplicity. You don’t need complex financial knowledge to start living more intentionally. Small changes in how you approach planning, dining choices, and everyday purchases can lead to both financial stability and lifestyle satisfaction.

For food enthusiasts, this lifestyle is particularly powerful. It means planning culinary adventures wisely, choosing quality dining experiences over frequent fast food, and using technology to find authentic local spots that offer great value.

Fintechzoom.com lifestyle terms to know:

Way 1: Integrate Financial Awareness into Your Daily Choices

The fintechzoom.com lifestyle starts with a simple but powerful idea: every choice you make has a ripple effect on your financial well-being. Whether you’re deciding between that morning latte or brewing coffee at home, these daily decisions shape your ability to enjoy bigger experiences later.

This isn’t about becoming a penny-pincher who never has fun. It’s about making intentional choices that align your spending with what truly matters to you. When you understand how your daily living, shopping habits, entertainment dreams, health goals, and personal growth all connect financially, you start making decisions that feel both smart and satisfying.

Think about it this way: that $5 coffee every weekday adds up to $1,300 a year. That’s enough for a few incredible tasting menus at some of Manhattan’s best restaurants. The fintechzoom.com lifestyle helps you see these connections without the guilt.

Living in New York City, we’re surrounded by endless temptations and opportunities. The key is learning to distinguish between impulse purchases and investments in experiences that bring lasting joy. Real-life examples make this clearer: exploring the diverse and affordable culinary scenes in Queens or Brooklyn can offer world-class dining experiences at a fraction of the cost you’d pay in Manhattan.

Sustainable living fits perfectly into this mindset too. When you choose to take the subway or bike instead of a cab, or support local businesses, you’re often saving money while making choices that align with broader values. It’s a win-win that exemplifies how financial awareness improves rather than restricts your lifestyle.

For deeper insights on building this financially aware approach, explore our business strategy guide.

Make Savvy Decisions in Dining and Entertainment

As food and culture enthusiasts, we know that culinary experiences often become the heart of our best memories. The fintechzoom.com lifestyle transforms how you approach planning your social life and dining choices, helping you get more flavor for your dollar.

Smart planning goes beyond just picking a restaurant. It means looking for prix-fixe lunch deals at high-end spots, knowing when to book reservations to avoid peak pricing, and evaluating the total cost of an experience. For example, a Broadway show might seem expensive, but using a ticket lottery app can make it surprisingly affordable. It’s about exploring the amazing food and culture scene right here in New York City with a strategic mindset.

The magic happens when you start thinking strategically about your dining budget. Instead of grabbing mediocre meals out of convenience, you might save up for that once-in-a-lifetime dinner at a Michelin-starred restaurant. Or you could invest in high-quality ingredients and learn to create gourmet experiences in your own kitchen.

This approach to budgeting for culinary experiences means evaluating cost versus experience at every turn. That $200 wine pairing dinner might seem expensive until you realize it includes rare vintages you’d never try otherwise, plus the chef’s expertise and an unforgettable atmosphere. The fintechzoom.com lifestyle helps you make these calculations with confidence.

Understanding broader economic trends can also inform your choices. Check out our economy insights to see how global changes might affect your dining and investment plans.

Lift Your Wardrobe and Home Intelligently

The fintechzoom.com lifestyle extends into your closet and living space, encouraging quality over fast fashion and thoughtful purchases over impulse buys. This shift can dramatically improve both your style and your bank balance.

Building a capsule wardrobe exemplifies this philosophy perfectly. Instead of constantly buying trendy pieces that quickly go out of style, you invest in versatile, high-quality items that work together seamlessly. A well-custom blazer, classic white button-down, and quality cashmere sweater can create dozens of different looks when mixed and matched thoughtfully.

When incorporating luxury pieces, the goal isn’t filling your closet with designer labels. It’s about strategically choosing timeless items that lift your entire wardrobe. One beautiful handbag or perfectly fitted coat can transform multiple outfits and last for years, making the cost per wear surprisingly reasonable.

Your home deserves the same thoughtful approach. High-end home decor in the fintechzoom.com lifestyle means creating spaces that reflect lasting value rather than fleeting trends. This might involve investing in quality materials like marble countertops or hardwood floors that appreciate over time, or choosing statement pieces like mirrors and lighting that dramatically improve your space’s ambiance.

The beauty of this approach is how it creates a positive cycle: when you buy fewer, higher-quality items, you enjoy them more and need to replace them less often. Your space becomes more cohesive and sophisticated, while your finances become more stable.

For inspiration on adding luxury touches to your wardrobe strategically, explore these expert tips.

Way 2: Harness Technology for Smarter Financial Management

Living in the digital age has completely transformed how we approach money management. The fintechzoom.com lifestyle accepts this shift, turning our smartphones into powerful financial command centers. Gone are the days when managing money meant endless paperwork and long bank visits.

Today’s mobile banking apps let us check balances while grabbing coffee in Manhattan or transfer money between accounts during our lunch break. Investment apps bring Wall Street to our fingertips, while budgeting tools track every expense without the headache of manual calculations. It’s like having a personal financial advisor in our pocket.

What makes this particularly exciting is how artificial intelligence is making these tools smarter every day. Instead of generic advice, we get personalized recommendations based on our spending patterns and goals. Even cryptocurrency, once intimidating and complex, is now accessible through user-friendly platforms that explain everything in plain English.

The beauty of this technological revolution is how it simplifies complexity. You don’t need a finance degree to understand your investment portfolio or track your spending habits. These digital tools translate complicated financial concepts into clear, actionable insights that help us make better decisions every single day.

For New Yorkers like us, this convenience is invaluable. Between work, social commitments, and exploring the city’s incredible dining scene, who has time for traditional banking? Technology keeps our financial health on track while we focus on living our best lives. To dive deeper into effective money management strategies, check out our comprehensive guide on More info about money management.

The Role of Fintech in the fintechzoom.com lifestyle

Financial technology isn’t just a buzzword—it’s the backbone of modern money management. When we talk about the fintechzoom.com lifestyle, we’re really talking about how digital platforms have democratized access to sophisticated financial tools that were once only available to wealthy investors.

Think about robo-advisors, for example. These AI-driven platforms can create and manage investment portfolios automatically, adjusting them based on market conditions and your personal goals. What used to require expensive financial advisors is now available for a fraction of the cost, making smart investing accessible to everyone.

Blockchain technology is another game-changer that’s reshaping how we think about money. Beyond just powering cryptocurrency, blockchain offers unprecedented transparency and security in financial transactions. It’s enabling everything from more secure transactions to fractional ownership of expensive assets like real estate or artwork.

These innovations aren’t just cool tech—they’re practical solutions that solve real problems. Digital platforms now offer real-time market updates, personalized financial guidance, and seamless integration between different financial services. This means we can make informed decisions quickly, whether we’re considering a new investment or simply tracking our daily expenses.

The result is a more connected, efficient financial ecosystem that puts control back in our hands. We’re no longer dependent on traditional banking hours or limited by geographic constraints. Our financial lives can adapt to our lifestyles, not the other way around.

For those interested in exploring cryptocurrency as part of this digital change, our More info about crypto guide provides everything you need to get started safely.

Practical Tools to Get Started

Jumping into the fintechzoom.com lifestyle doesn’t require a complete financial overhaul. Start with a few key tools that address your most immediate needs, then gradually expand your digital toolkit as you become more comfortable.

Mortgage calculators are essential for anyone considering homeownership, especially in expensive markets like New York. These tools help you understand exactly what you can afford and compare different loan scenarios before you start house hunting.

Investment tracking apps have revolutionized how we monitor our portfolios. Instead of waiting for quarterly statements, you can see real-time updates on your stocks, bonds, and other investments. Many platforms also provide educational content that helps you understand market trends and make informed decisions.

Automated savings tools make building wealth effortless. These clever applications can round up your purchases to the nearest dollar and save the difference, or automatically transfer small amounts to your savings account. It’s amazing how quickly these micro-savings add up without impacting your daily life.

Modern budgeting tools go far beyond simple expense tracking. They categorize your spending automatically, identify patterns, and even suggest areas where you might save money. Some can predict when you might overspend based on your historical patterns.

Real-time news platforms keep you informed about market conditions and financial trends that might affect your decisions. Staying updated helps you spot opportunities and avoid potential pitfalls in your financial planning.

The key is choosing tools that fit naturally into your routine. Start with one or two that address your biggest financial concerns, then add others as you see their value. For insights into global market trends that might impact your financial decisions, explore our guide on More info about forex.

Way 3: The Ultimate fintechzoom.com lifestyle: Balance Aspiration and Wisdom

The true magic of the fintechzoom.com lifestyle happens when we learn to dance gracefully between our dreams and our financial wisdom. It’s not about choosing one over the other—it’s about creating a life where both can flourish together.

Picture this: you’re enjoying a cocktail on a rooftop bar, taking in a breathtaking view of the Manhattan skyline. You’re fully present in the moment, enjoying this beautiful experience without that nagging worry about whether you can afford it. That’s the essence of balancing aspiration with wisdom. You planned for this evening, saved intentionally, and now you can truly savor it.

This balance touches every aspect of our lives. When we align our financial goals with our personal dreams, something wonderful happens—we stop feeling torn between enjoying today and securing tomorrow. Instead of viewing financial stability as a barrier to fun, we see it as the foundation that makes our aspirations possible.

The fintechzoom.com lifestyle teaches us that indulgence and security aren’t opposites—they’re partners. Maybe you splurge on that incredible tasting menu at a new restaurant in Manhattan, but you do it knowing it fits within your thoughtful financial plan. It’s about making choices that feel both smart and satisfying.

Looking ahead, the future outlook for this lifestyle is incredibly exciting. As financial technology continues to evolve, managing money becomes more intuitive and personalized. The innovations influencing the financial industry are making it easier than ever to live with both confidence and clarity. We’re moving toward a world where your financial tools understand your values and help you make decisions that honor both your present happiness and your future security.

Overcoming Common Challenges

Let’s be honest—living the fintechzoom.com lifestyle isn’t always smooth sailing. We face real challenges that can make even the most well-intentioned person feel overwhelmed.

Information overload is probably the biggest hurdle. Between financial news alerts, market updates, and endless investment advice, it can feel like drinking from a fire hose. The key is learning to filter what matters for your specific situation. You don’t need to follow every market trend—focus on the information that directly impacts your goals and lifestyle choices.

Then there’s FOMO—that gnawing fear of missing out on the next big investment opportunity or market trend. We’ve all felt it, especially when friends are talking about their latest stock picks or cryptocurrency gains. The fintechzoom.com lifestyle reminds us that making informed, patient decisions usually beats chasing every shiny opportunity.

Sticking to a plan while staying flexible might sound contradictory, but it’s actually the sweet spot we’re aiming for. Life throws curveballs—your dream weekend experience costs more than expected, or an amazing dining opportunity comes up unexpectedly. The trick is building enough flexibility into your financial plan so you can say yes to what truly matters without derailing your long-term goals.

Balancing financial goals with spontaneity is an art form. Sometimes the best experiences are unplanned—that hole-in-the-wall restaurant you find while exploring a new neighborhood, or the last-minute ticket to a show that becomes a cherished memory. The fintechzoom.com lifestyle creates space for these moments by building a strong financial foundation that can handle a little spontaneity.

For deeper insights into navigating these challenges, especially in complex markets, explore our guide on More info about US markets.

Building Habits for Long-Term Success

The most successful people we know who live the fintechzoom.com lifestyle didn’t transform overnight. They built their confidence and financial wisdom through small, consistent habits that became second nature over time.

Starting small is your secret weapon. Instead of trying to revolutionize your entire financial life in one week, pick one area to focus on. Maybe you begin by being more intentional about your coffee budget—choosing when to grab that artisanal latte versus making coffee at home. This single change builds awareness and confidence that ripples into other areas of your life.

Reviewing financial updates regularly doesn’t mean obsessing over every market fluctuation. Set aside a few minutes each week to check in with your finances and stay informed about trends that affect your goals. This habit keeps you connected to your financial health without letting it consume your daily thoughts.

The real magic happens when you start aligning purchases with priorities. Before making any significant purchase—whether it’s a new gadget or a special dining experience—pause and ask yourself: “Does this support what I truly value?” This simple question transforms impulse spending into intentional investing in your happiness.

Perhaps most importantly, these habits work together to reduce financial stress. When you know where you stand financially and have systems in place to support your goals, money decisions become less anxiety-inducing and more empowering. You stop worrying about whether you can afford something and start confidently choosing what deserves a place in your life.

The beautiful result of all this is creating space for joy and creativity. When your finances are running smoothly in the background, you have more mental and emotional energy for the things that truly matter—whether that’s experimenting with new recipes, planning your next culinary adventure, or simply enjoying a quiet evening with loved ones. The fintechzoom.com lifestyle isn’t about restricting your life—it’s about creating the freedom to live it fully.

Frequently Asked Questions about the FintechZoom.com Lifestyle

Is the FintechZoom lifestyle only for financial experts?

Not at all! One of the most beautiful aspects of the fintechzoom.com lifestyle is that it’s specifically designed for everyone, not just Wall Street wizards or finance professionals. Think of it this way: you don’t need to understand complex derivatives to decide whether that fancy dinner in Manhattan is worth it, or to decide which cooking class to take.

FintechZoom.com has built its reputation on taking intimidating financial jargon and translating it into simple language that anyone can understand. Whether you’re a college student trying to budget for weekend brunches or a busy professional planning your first investment, this lifestyle meets you where you are.

The whole point is accessibility. You’re not expected to read annual reports or analyze market trends like a seasoned trader. Instead, you’re learning to blend basic financial awareness with the choices you’re already making every day. It’s about being beginner-friendly while still being sophisticated enough to genuinely improve your life.

Does this lifestyle mean I have to give up everything I enjoy?

This might be the biggest misconception about the fintechzoom.com lifestyle, and we’re happy to set the record straight: you absolutely don’t have to become a financial monk! In fact, it’s quite the opposite.

This lifestyle is all about balance and intentional spending. Instead of randomly splurging and then feeling guilty about it later, you learn to make conscious choices that align with your values and goals. Picture this: rather than grabbing expensive takeout five nights a week without thinking, you might cook at home more often and then truly savor that special dinner at a restaurant you’ve been wanting to try.

The fintechzoom.com lifestyle is about enhancing your lifestyle, not restricting it. You’re still enjoying entertainment, still dining out, still buying things that bring you joy. The difference is that you’re doing it with purpose and awareness. You’re enjoying life while building a foundation that supports even more enjoyment in the future.

How is this different from just being frugal?

Here’s where things get interesting. While frugality focuses on cutting costs and doing without, the fintechzoom.com lifestyle represents a complete mindset shift toward strategic spending and understanding true value.

Frugality often means choosing the cheapest option available, even if it means sacrificing quality or experience. The fintechzoom.com lifestyle asks a different question: “What gives me the best long-term value and aligns with my goals?” Sometimes that means spending more upfront for something that will last longer or bring greater satisfaction.

For example, a purely frugal approach might mean never eating at expensive restaurants. The fintechzoom.com lifestyle might mean eating out less frequently but choosing quality experiences when you do. You might skip the mediocre chain restaurant and save up for that authentic Italian place that’s been on your list for months.

It’s about aligning with goals rather than just pinching pennies. You’re investing in experiences and items that truly improve your life, creating space for both financial security and genuine enjoyment. This approach leads to greater confidence in your decisions because every choice is intentional and supports the lifestyle you actually want to live.

Conclusion

Living the fintechzoom.com lifestyle isn’t about becoming a financial wizard overnight—it’s about making thoughtful choices that blend money smarts with the experiences that bring us joy. As we’ve finded together, this approach rests on three solid foundations that can transform how we approach our daily lives.

Integrating financial awareness into our everyday decisions means we can still enjoy that perfect dinner at a hidden gem in Little Italy or splurge on quality kitchen equipment, but we do it with intention rather than impulse. It’s about asking ourselves: “Does this choice align with what I truly value?” Whether we’re planning a culinary tour through Queens’ diverse neighborhoods or choosing between fast fashion and a timeless piece, financial awareness helps us make decisions we’ll feel good about long after the moment passes.

Using technology for smarter financial management has never been easier. The budgeting apps, investment platforms, and AI-driven tools we discussed aren’t just fancy gadgets—they’re practical companions that simplify the complex world of finance. They help us track our spending on those weekend culinary explorations, monitor our savings, and even guide us through investment decisions without needing a finance degree.

The real magic happens when we balance our aspirations with wisdom. This is where the fintechzoom.com lifestyle truly shines. We don’t have to choose between financial security and living fully. Instead, we learn to dance between the two, creating space for both our dreams and our practical needs.

The benefits ripple through every aspect of our lives. We make smarter decisions about where to eat, shop, and spend our leisure time. We feel more confident when those unexpected opportunities arise—like a last-minute cooking class or a friend’s invitation to try that new rooftop restaurant. Most importantly, we reduce the financial stress that can cloud our enjoyment of life’s pleasures.

Here in New York, where every corner offers a new culinary temptation and every month brings fresh dining trends, this lifestyle becomes particularly valuable. We can explore the city’s incredible food scene while building a solid financial foundation for bigger adventures ahead.

The future of finance and living continues to evolve, with innovations making financial management more personal and intuitive. As these tools become even more sophisticated, the fintechzoom.com lifestyle will only become more accessible and rewarding.

Your journey toward financial confidence and an improved lifestyle starts with a single intentional choice. Whether that’s downloading a budgeting app, researching your next big dining experience more thoroughly, or simply pausing before your next purchase to consider its true value—every step counts.

Ready to dive deeper into creating a lifestyle that satisfies both your desire for new experiences and your wallet? Explore our resource guides for more insights that blend financial wisdom with your passion for exceptional food and cultural experiences.