Why Understanding Crypto Market Cap Is Essential for Smart Investing

Fintechzoom.com crypto market cap tracking has become a crucial tool for investors navigating the complex world of digital assets. With the global cryptocurrency market surpassing $4 trillion and experiencing dramatic swings, understanding market capitalization – not just individual coin prices – is the key to making informed investment decisions.

Quick Answer for fintechzoom.com crypto market cap:

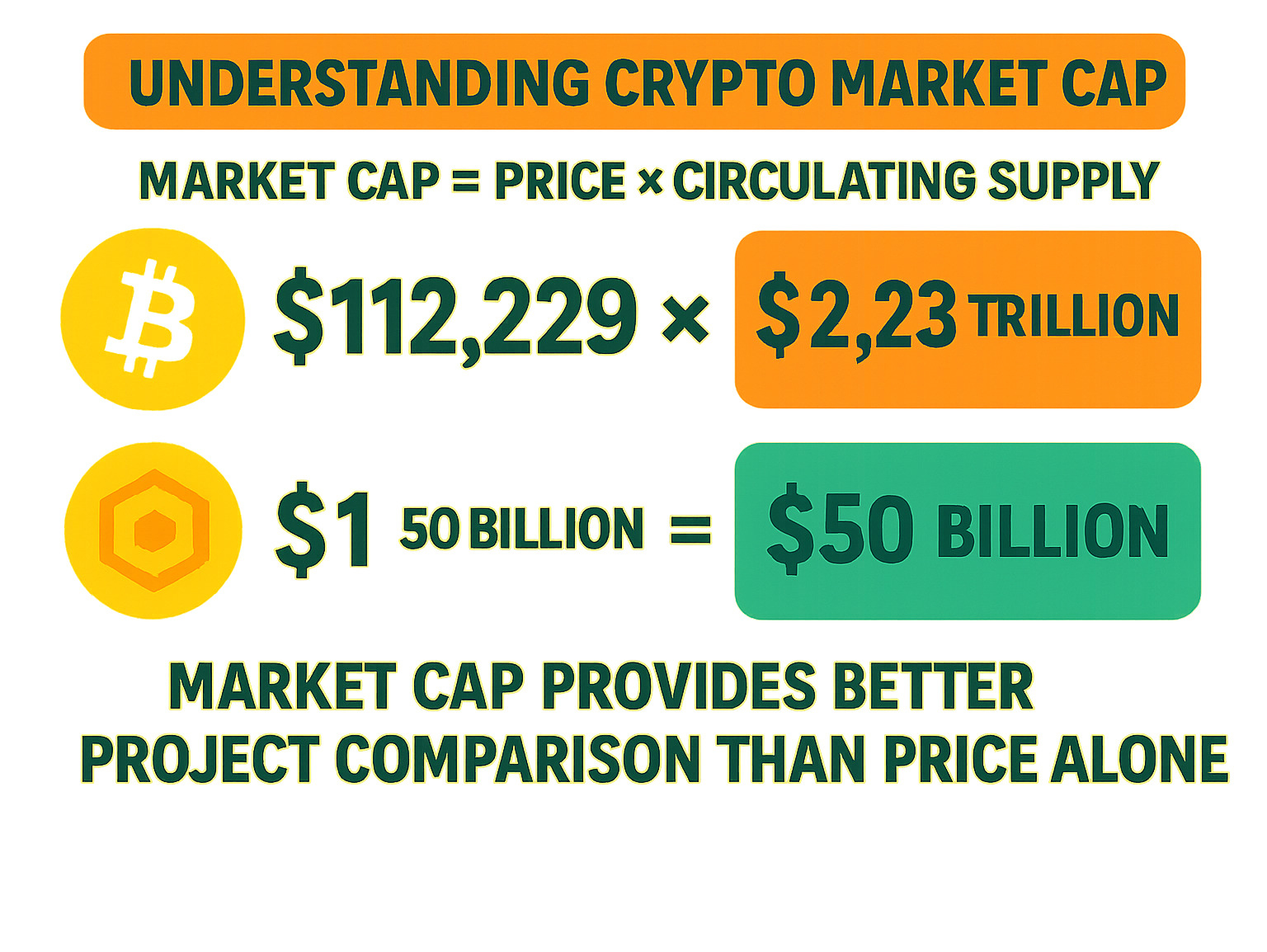

- Market Cap Formula: Current Price × Circulating Supply = Total Market Value

- Why It Matters: Shows true project size and stability, not just price per coin

- FintechZoom’s Role: Provides real-time market cap data alongside traditional finance news

- Key Insight: A $1 coin with 1 billion supply has the same market cap as a $1,000 coin with 1 million supply

- Investment Value: Helps distinguish between large-cap stable projects and small-cap high-risk opportunities

The cryptocurrency landscape has evolved far beyond Bitcoin’s early days when it was worth just pennies. Today’s market features everything from Bitcoin’s $2.23 trillion market cap to emerging altcoins with market caps below $1 billion. Yet many investors still focus solely on coin prices, missing the bigger picture that market cap reveals.

FintechZoom bridges this knowledge gap by offering comprehensive financial insights that connect crypto markets with traditional finance. Unlike specialized crypto-only platforms, FintechZoom shows how digital assets fit into the broader economic landscape, making it invaluable for investors who want to understand both worlds.

The recent milestone of the total crypto market reclaiming the $2 trillion benchmark demonstrates why market cap analysis matters more than ever. This recovery wasn’t just about individual coin prices rising – it reflected renewed investor confidence across the entire digital asset ecosystem.

Fintechzoom.com crypto market cap terms to learn:

What is Cryptocurrency Market Cap and Why Does It Matter?

Understanding fintechzoom.com crypto market cap is like learning to read the true financial health of the crypto world. At its core, market cap is refreshingly simple: take a cryptocurrency’s current price and multiply it by how many coins are actually circulating in the market. Think of it as asking “What’s this entire project really worth?” rather than just “What does one coin cost?”

Here’s where it gets interesting. That circulating supply number isn’t just any random figure – it represents the coins that people can actually buy and sell right now. This is completely different from the total supply, which includes coins locked away in vaults or waiting to be released years from now. For investors, circulating supply gives you the real picture of what’s available in today’s market.

Let me paint this with real numbers that might surprise you. Bitcoin’s market cap sits at roughly $2.23 trillion, making it the undisputed king of crypto. Ethereum’s market cap follows at around $509.54 billion, powering countless applications across the blockchain world. Even stablecoins like Tether ($167.13 billion) and USDC ($67.32 billion) command massive market caps, showing just how much money flows through these digital highways every day.

The magic formula – Market Cap = Current Price × Circulating Supply – becomes your compass in this vast digital ocean. Without it, you’re sailing blind, and trust me, that’s not where you want to be when real money is on the line.

More info about blockchain technology

The Importance of Market Cap Over Price Alone

Picture this scenario: You’re scrolling through crypto listings and spot a coin trading at $0.0001. Your eyes light up – “This is my ticket to riches! When this hits $1, I’ll be set for life!” Sound familiar? We’ve all been there, but here’s the reality check that could save your portfolio.

Price alone is like judging a restaurant by the cost of a single appetizer. You might think you’re getting a bargain, but you have no idea if you’re at a food truck or a five-star establishment. Market cap reveals the restaurant’s true size and reputation.

Let’s break this down with a simple example. Imagine Coin A trades at $100 with 1 million coins in circulation – that’s a $100 million market cap. Now picture Coin B at just $0.10, but with 1 billion coins circulating. Surprise! Both projects are worth exactly the same $100 million.

For Coin B to reach that magical $1 price point, its entire market cap would need to balloon to $1 billion. That’s not impossible, but it’s a completely different challenge than what the low price suggests.

This is why large-cap cryptos (those above $10 billion) like Bitcoin and Ethereum behave more like established companies – they’re harder to shake and tend to move more predictably. Small-cap cryptos (under $1 billion) are the wild cards, offering thrilling potential but with stomach-churning volatility that can test even the bravest investors.

How Market Cap Reflects Overall Market Health

The total crypto market cap acts like the financial world’s mood ring, changing colors based on how investors feel about digital assets. When this number climbs steadily, you’re witnessing a bull market – people are optimistic, money is flowing in, and everyone’s talking about their crypto gains at dinner parties.

When the market cap shrinks, that’s your bear market signal. Investors are nervous, selling pressure builds, and suddenly crypto conversations get a lot quieter. It’s the natural rhythm of any maturing market.

We’ve seen some incredible moments recently. The total crypto market cap soared past $4 trillion, driven by major players like Bitcoin, Ethereum, and XRP catching fire simultaneously. This wasn’t just random price pumping – it reflected genuine confidence returning to the space.

Even more telling was when the market reclaimed the $2 trillion milestone. Industry experts called this “extremely bullish” because it showed the market could bounce back from serious setbacks. Previous crashes from events like regulatory crackdowns or celebrity tweet storms had created stronger support levels, making future rallies more sustainable.

By watching these total crypto market cap trends, you get a bird’s-eye view of where the entire industry is heading. It helps you spot the difference between temporary noise and genuine shifts in investor sentiment – knowledge that’s worth its weight in Bitcoin.

Cryptocurrency Market Cap Reclaims $2 Trillion

Navigating the Digital Finance World with FintechZoom

Picture this: you’re sitting in a busy Manhattan coffee shop, laptop open, trying to make sense of the financial markets. Traditional news sources give you stocks, crypto platforms focus only on digital assets, but what you really need is someone who speaks both languages fluently. That’s exactly where FintechZoom comes into play.

FintechZoom isn’t just another financial news website – it’s your bridge between the old world of Wall Street and the new frontier of digital assets. Think of it as that knowledgeable friend who can explain why Bitcoin crashed when the Fed raised interest rates, or how traditional banking stocks react to cryptocurrency adoption news.

What makes FintechZoom special is its broad market coverage. While you’re tracking the fintechzoom.com crypto market cap data, you can simultaneously keep tabs on how tech stocks are performing, what’s happening in forex markets, and whether banking sector news might impact your crypto investments. It’s like having multiple financial newspapers rolled into one digestible platform.

The beauty of this approach becomes clear when you realize that crypto doesn’t exist in a vacuum. When traditional markets sneeze, crypto often catches a cold – and FintechZoom helps you understand those connections.

More info about FintechZoom’s market coverage

What Services Does FintechZoom Offer?

FintechZoom serves up financial intelligence in bite-sized, easy-to-digest portions. Instead of drowning you in jargon, they focus on making complex market movements understandable for everyday investors.

Their news articles cover everything from major market shifts to emerging trends, always with an eye toward practical implications. When Bitcoin hits a new high or Ethereum introduces a major update, you’ll find clear explanations of what it means for your portfolio.

The platform’s in-depth guides are particularly valuable for newcomers to both crypto and traditional investing. These aren’t dry academic papers – they’re written like conversations with a financially savvy friend who genuinely wants to help you succeed.

Market analysis on FintechZoom goes beyond just reporting numbers. They connect the dots between different market sectors, helping you understand why certain events trigger reactions across multiple asset classes. This is especially helpful when tracking how overall market sentiment affects crypto market caps.

For price tracking, while FintechZoom isn’t a real-time trading platform, it provides regular updates that help you stay informed about major price movements without the constant noise of minute-by-minute fluctuations.

Perhaps most importantly, their educational content transforms intimidating financial concepts into accessible knowledge. Whether you’re trying to understand market capitalization or decode Federal Reserve policy impacts, they break it down into manageable pieces.

More info about FintechZoom’s business guides

The Intersection of Crypto and Traditional Finance on FintechZoom

Here’s where FintechZoom really shines – showing you how the crypto world and traditional finance dance together. It’s like watching two different music genres slowly merge into something entirely new.

When major banks announce crypto custody services, FintechZoom explains what this means for both sectors. When tech giants like Google make blockchain-related announcements, you’ll understand the ripple effects across multiple markets. This cross-market analysis is invaluable for making informed investment decisions.

The platform excels at comparing crypto to stocks, helping you understand when digital assets are moving independently versus when they’re following broader market trends. This insight is crucial for portfolio diversification and risk management.

Banking sector integration coverage on FintechZoom reveals how traditional financial institutions are slowly embracing cryptocurrency. From JPMorgan’s blockchain initiatives to PayPal’s crypto services, you’ll see how the financial landscape is evolving in real-time.

Understanding economic trends impact becomes much clearer when you can see how inflation data affects both bond yields and Bitcoin prices, or how geopolitical events influence both gold and cryptocurrency markets simultaneously.

The global financial updates provide context that pure crypto platforms often miss. When you’re tracking the fintechzoom.com crypto market cap, you’ll also understand how global economic policies, trade relationships, and monetary decisions in different countries create the broader environment in which crypto operates.

Fintechzoom.com Google Stock coverage exemplifies this approach – showing how traditional tech giants are positioning themselves in the digital asset space, and what that means for both stock and crypto investors.

More info about FintechZoom’s economy coverage

Leveraging the fintechzoom.com crypto market cap for Strategic Insights

Here’s where things get really exciting for us crypto enthusiasts – using fintechzoom.com crypto market cap data to make smarter investment decisions. Think of it like having a financial compass that helps steer the sometimes choppy waters of digital assets.

FintechZoom doesn’t just throw numbers at you – it provides context that helps us understand what’s really happening in the crypto world. When Bitcoin’s market cap suddenly jumps or when we see altcoins gaining ground, these movements tell a story about investor confidence, market trends, and where the smart money is flowing.

The beauty of tracking market cap through FintechZoom lies in its ability to show us the bigger picture. We can spot when Bitcoin’s dominance is shifting, which often signals whether we’re entering an “altcoin season” or if investors are playing it safe with the digital gold standard. It’s like watching the tide change – you can see it happening before it fully hits.

More info about Bitcoin prices

Key Features for Tracking the fintechzoom.com crypto market cap

When we dive into fintechzoom.com crypto market cap tracking, we’re looking for specific data points that actually matter for our investment decisions. The platform typically offers live market cap listings that update throughout the day, giving us real-time snapshots of how different cryptocurrencies stack up against each other.

Detailed coin profiles help us understand not just the current market cap, but the underlying factors that drive it – like circulating supply and the project’s actual purpose. This context is crucial because a high market cap without substance is like a soufflé – it might look impressive but could collapse quickly.

Price movement alerts come through FintechZoom’s news coverage, keeping us informed when significant shifts happen. We’re not just seeing that Bitcoin went up 5% – we’re learning why it happened and what it might mean for the broader market.

Trading volume data works hand-in-hand with market cap information. High trading volume backing a large market cap suggests genuine market interest, while low volume might indicate that the numbers don’t tell the whole story.

Bitcoin dominance charts are particularly fascinating to watch. When Bitcoin’s share of the total crypto market cap rises, it often means investors are seeking stability. When it falls, it usually signals that people are feeling adventurous and exploring alternative cryptocurrencies.

Here are the Top 5 Data Points to Watch on FintechZoom for effective market cap analysis: Total crypto market cap gives us the 30,000-foot view of whether the entire space is growing or shrinking. Bitcoin dominance percentage tells us about risk appetite in the market. Individual coin market caps help us compare projects on equal footing. 24-hour trading volume confirms whether market cap movements have real backing. Market cap categories show us whether large-cap stability or small-cap growth is dominating the current cycle.

Using FintechZoom to Understand the fintechzoom.com crypto market cap Trends

The real magic happens when we use FintechZoom’s analysis to decode what fintechzoom.com crypto market cap trends actually mean for our investment strategy. The platform excels at helping us identify bull versus bear cycles by contextualizing market cap movements within broader economic trends.

During bull markets, we typically see the total crypto market cap expanding rapidly, often driven by factors like institutional adoption or positive regulatory news. FintechZoom’s coverage helps us understand whether these gains are sustainable or just hype-driven bubbles waiting to burst.

Spotting emerging narratives becomes much easier when we have context around market cap shifts. When DeFi projects suddenly see their combined market caps surge, or when gaming tokens start gaining traction, FintechZoom’s broader financial perspective helps us understand if these trends have staying power.

The platform’s expert commentary adds another layer of insight to raw market cap data. Instead of just seeing numbers, we get analysis from financial professionals who can explain why certain market cap movements matter and what they might signal for future trends.

Long-term forecasting becomes more reliable when we combine market cap data with FintechZoom’s coverage of fundamental factors. Understanding how events like Bitcoin halving historically impact market caps, or how regulatory changes affect investor sentiment, helps us make better long-term decisions rather than just reacting to daily price movements.

More info about Bitcoin Halving events

Best Practices for Smart Crypto Investing

When we’re diving into cryptocurrency investing, it’s easy to get caught up in the excitement. After all, who doesn’t love hearing about someone who turned $100 into $10,000 overnight? But here’s the reality check we all need: smart crypto investing requires the same discipline and strategy as any other investment approach.

The biggest trap we see investors fall into is chasing hype. You know the story – a friend mentions a coin that’s up 500% this week, or you see endless posts about the next “Bitcoin killer” on social media. While it’s tempting to jump on these rockets, most crash back down to earth just as quickly. Emotional trading is another killer. We’ve all felt that panic when our portfolio drops 20% in a day, or that FOMO when everything seems to be mooning except what we’re holding.

Then there’s the security issue that many new investors completely ignore. Neglecting security by leaving all your crypto on exchanges is like keeping your life savings under a mattress in a hotel room. Exchanges get hacked, accounts get frozen, and suddenly that digital fortune becomes unreachable. The golden rule? If you don’t control the private keys, you don’t really own the crypto.

The solution isn’t to avoid crypto altogether – it’s to approach it with the same importance of diversification and due diligence you’d use for any investment. Think of crypto as one slice of your financial pie, not the whole thing. Mix established players like Bitcoin and Ethereum with carefully researched smaller projects. Take a long-term perspective instead of trying to time every market move. And most importantly, never invest more than you can afford to lose completely.

More info about investing tips

How FintechZoom Helps You Avoid Common Pitfalls

This is where platforms like FintechZoom become invaluable allies in our investing journey. Instead of making decisions based on the latest Twitter thread or YouTube video, FintechZoom helps us focus on data-driven decisions. When we’re tracking fintechzoom.com crypto market cap information, we’re looking at real numbers – market capitalizations, trading volumes, and price trends that tell the actual story of what’s happening in the market.

One of the platform’s strongest features is providing verified information sources. When misinformation spreads faster than wildfire, having access to reliable data becomes crucial. FintechZoom doesn’t just throw random numbers at you – it provides context and analysis that helps separate signal from noise.

What really sets FintechZoom apart is its cross-market analysis approach. Instead of looking at crypto in isolation, it shows how digital assets interact with traditional finance. This broader perspective helps us understand when crypto movements are driven by genuine innovation versus when they’re just following broader market sentiment. For instance, when the Federal Reserve announces interest rate changes, FintechZoom helps us see how this might impact both stock markets and crypto valuations.

The platform’s educational resources are particularly valuable for newer investors. Rather than assuming everyone understands complex financial concepts, FintechZoom breaks down market dynamics in digestible pieces. This education-first approach helps us make informed choices instead of just following the crowd.

By combining FintechZoom’s comprehensive financial coverage with specialized crypto research from other sources when needed, we create a more complete picture of the investment landscape. It’s about building a foundation of knowledge that helps us steer both bull and bear markets with confidence.

Frequently Asked Questions about FintechZoom and Crypto Market Cap

We get a lot of questions from fellow investors about FintechZoom and how to steer the sometimes confusing world of crypto market caps. Let’s explore the most common ones we hear, especially from those just starting their digital asset journey.

What is FintechZoom?

Think of FintechZoom as your friendly neighborhood financial guide – the kind of resource that doesn’t overwhelm you with jargon but still gives you the insights you need. FintechZoom is a financial news and data platform that covers everything from traditional stocks and banking to the exciting world of cryptocurrency.

What makes it special? It’s designed for real people, not just Wall Street pros. Whether you’re curious about mortgage rates, wondering how tech stocks are performing, or trying to understand fintechzoom.com crypto market cap trends, the platform aims to break down complex financial topics into digestible, timely insights.

Unlike platforms that focus on just one area, FintechZoom takes a broader approach. It’s like having a knowledgeable friend who can explain how different parts of the financial world connect – showing you how crypto markets might react to Federal Reserve decisions, or how traditional banking is adapting to digital currencies.

Why is market cap a better metric than a single coin’s price?

Here’s where many new crypto investors get tripped up, and honestly, it’s completely understandable. When you see a coin trading for $0.001, it feels cheap compared to Bitcoin at $112,000. But that feeling can be misleading.

Market cap represents the total value and scale of a cryptocurrency project by multiplying the price by the circulating supply. It’s like comparing the total value of all shares in Apple versus all shares in a smaller company – you wouldn’t just look at the price per share, right?

Let’s say you’re comparing two coins: Coin A costs $100 with 1 million coins in circulation (market cap: $100 million), while Coin B costs $0.10 with 1 billion coins circulating (also $100 million market cap). Even though Coin B seems “cheaper,” both projects have exactly the same total market value. For Coin B to reach $1, it would need a market cap of $1 billion – a 10x increase that’s just as challenging as Coin A reaching $1,000.

Market cap also helps you understand stability and risk. Large-cap cryptos like Bitcoin and Ethereum tend to be more stable, while small-cap coins can offer explosive growth but with much higher volatility.

How does FintechZoom compare to specialized crypto-only platforms?

This is a great question that really depends on what kind of investor you are. FintechZoom provides a broad overview of the financial world, showing how crypto intersects with traditional markets like stocks, banking, and global economics. It’s perfect if you want to understand the bigger picture – how interest rate changes might affect both your stock portfolio and your crypto holdings.

The platform excels at connecting dots between different financial sectors. You might read about how major banks are building crypto custody services, or how institutional investors are treating Bitcoin as a hedge against inflation. This cross-market perspective is invaluable for making well-rounded investment decisions.

Specialized crypto platforms, on the other hand, dive much deeper into technical analysis, blockchain developments, and niche cryptocurrency topics. They might offer detailed breakdowns of DeFi protocols or advanced trading tools that FintechZoom doesn’t focus on.

Think of it this way: FintechZoom is like your comprehensive financial newspaper that includes a solid crypto section, while specialized platforms are like crypto-focused magazines. Both have their place in a smart investor’s toolkit, and many successful crypto investors use both types of resources to get the complete picture.

Conclusion: Making Informed Decisions in the Crypto Space

Understanding fintechzoom.com crypto market cap has been quite a journey, hasn’t it? We’ve moved far beyond simply looking at flashy coin prices to understanding the real story behind the numbers. Market capitalization isn’t just another metric to memorize – it’s your compass in the often-confusing world of digital assets.

Think about it this way: when you’re exploring New York City’s dining scene, you wouldn’t judge a restaurant solely by the price of one appetizer. You’d consider the entire experience, the quality, the atmosphere, and the value it provides. The same logic applies to cryptocurrency. Market cap gives us that complete picture, showing us the true scale and stability of digital projects rather than getting distracted by whether a coin costs $0.01 or $100.

FintechZoom has emerged as a trusted companion in this financial exploration. Just as we help you find hidden culinary gems across the city, FintechZoom helps investors uncover valuable insights by connecting the dots between traditional finance and the crypto revolution. Its strength lies in showing how these digital assets fit into the bigger economic picture – something that’s become increasingly important as crypto moves from niche investment to mainstream financial tool.

The platform empowers us with data-driven decision making rather than letting emotions or social media hype drive our choices. Whether we’re tracking Bitcoin’s market dominance, understanding how global events ripple through altcoin values, or simply trying to avoid those costly beginner mistakes, FintechZoom provides the context we need to invest more intelligently.

Here at The Dining Destination, we believe in providing quality guides that help you steer complex territories with confidence. Whether we’re guiding you to the perfect farm-to-table restaurant in Brooklyn or helping you understand the intricacies of crypto market analysis, our commitment remains the same: giving you the knowledge to make informed choices.

The crypto space will continue evolving, with new projects launching and market dynamics shifting. But armed with a solid understanding of market cap fundamentals and reliable resources like FintechZoom, you’re well-equipped to approach this exciting financial frontier with both enthusiasm and wisdom.