Why Verifying Crypto30x.com Gemini Claims Matters for Your Investment Safety

Crypto30x.com gemini represents a growing trend where high-return analytics platforms analyze established cryptocurrency exchanges. But here’s what you need to know right away:

Key Facts About Crypto30x.com Gemini:

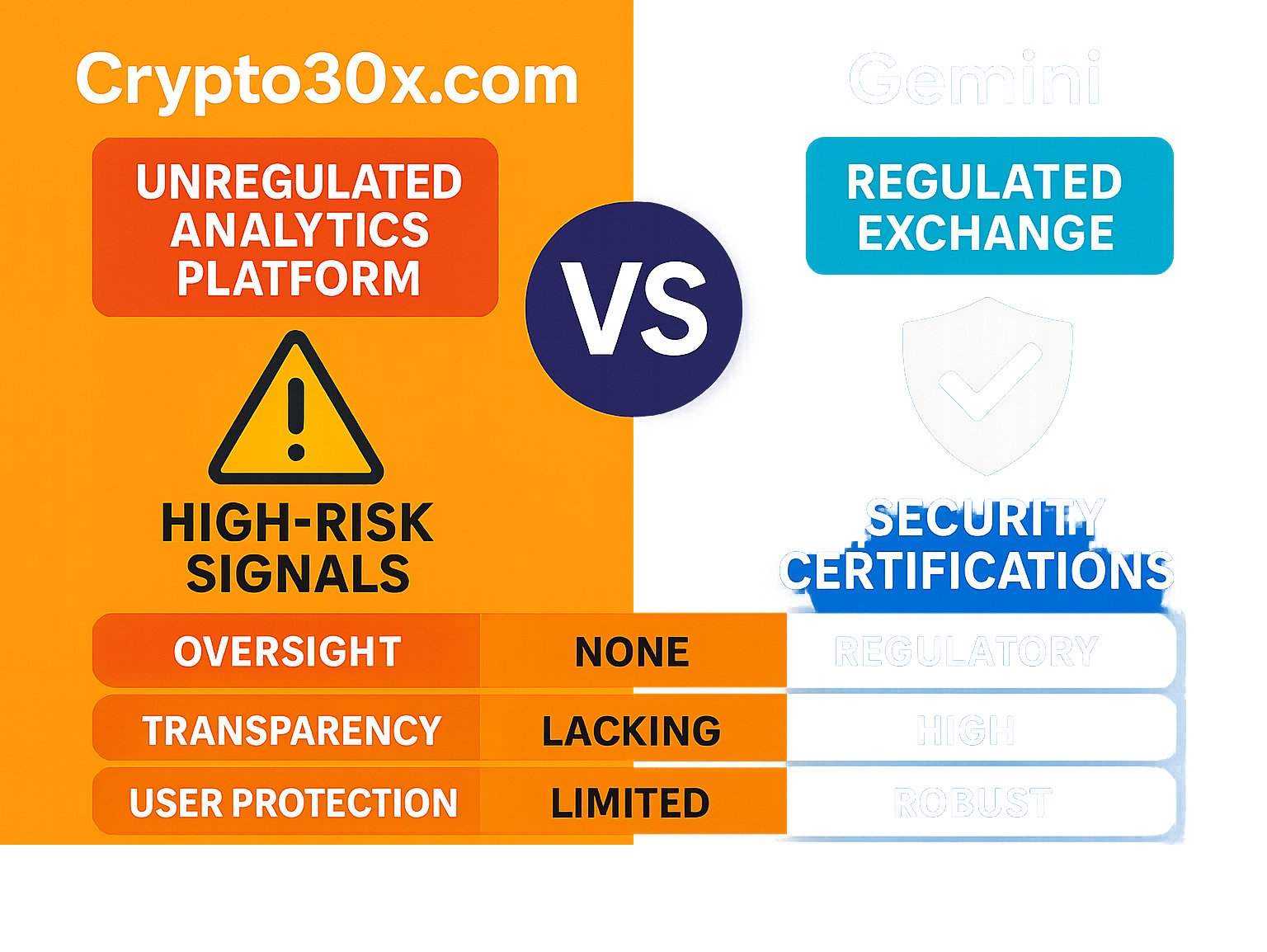

- No Official Partnership: Crypto30x.com and Gemini have no formal business relationship

- Crypto30x.com: Unregulated analytics platform claiming 30x return potential

- Gemini: US-regulated exchange founded by Winklevoss twins with strong security

- Risk Level: High – combining speculative signals with a conservative platform

- Verification Status: Crypto30x.com lacks transparency and regulatory oversight

The crypto world is full of platforms promising extraordinary returns. Crypto isn’t just a technology, it’s a movement. And it’s just getting started, as Gemini’s founders noted when they struggled to find secure crypto platforms themselves.

This combination raises important questions. Crypto30x.com promotes high-leverage trading insights and claims to spot assets with “30x growth potential.” Meanwhile, Gemini operates as one of the most regulated and security-focused exchanges in the US.

The problem? Many investors don’t understand the difference between an analytics platform and a regulated exchange. They see “crypto30x.com gemini” content and assume there’s an official partnership or endorsement.

According to our research, Crypto30x.com faces serious credibility concerns including user complaints about withdrawals, aggressive marketing tactics, and what some call “catfish” schemes designed to mislead investors.

Crypto30x.com gemini definitions:

Deconstructing Crypto30x.com: High-Potential Analytics or High-Risk Hype?

When you first visit Crypto30x.com, it feels like stepping into a digital casino where everyone’s promising you the jackpot. The platform boldly claims it can help you identify cryptocurrencies with 30x growth potential – a promise that would make anyone’s eyes light up with dollar signs.

The website showcases impressive-sounding features like AI-powered trading tools and something called “Zeus signals” that supposedly guide your trading decisions. They also offer high-leverage insights for those brave enough to multiply both their potential gains and losses. The platform focuses heavily on newer crypto trends like Web3 and GameFi, positioning itself as your gateway to the future of digital assets.

But here’s where things get murky. Our research has uncovered some serious concerns about this platform’s credibility. There’s a troubling lack of transparency about who actually runs Crypto30x.com, and we’ve found multiple user complaints about withdrawal issues. Some investigators have even raised “catfish” marketing concerns, suggesting the platform uses deceptive tactics to lure investors.

The connection between crypto30x.com gemini searches often stems from users looking for legitimate ways to trade on regulated exchanges using these analytical tools. However, it’s crucial to understand that these platforms operate independently.

What are Crypto30x.com’s Key Features?

At its heart, Crypto30x.com presents itself as a comprehensive analytics powerhouse. The platform’s AI analytics claim to crunch massive amounts of market data to identify profitable opportunities. These systems generate algorithmic signals that tell you when to buy or sell specific cryptocurrencies.

One feature that catches many users’ attention is the backtesting capability. This tool lets you test trading strategies against historical market data – essentially letting you see how your brilliant plan would have performed during past market crashes or bull runs.

The platform doesn’t stop at basic trading signals. It offers DeFi tools for those interested in yield farming and liquidity mining. There’s also NFT integration that covers the gaming and collectibles markets. For those curious about exploring these features further, you can learn more at Crypto30x.com: Your Gateway to Digital Assets.

The problem? Many of these features sound impressive on paper but lack the transparency and verification you’d expect from legitimate financial tools.

Red Flags and Credibility Concerns

The biggest red flag waving over Crypto30x.com is the anonymity of its owners. When trust is everything, not knowing who’s behind the curtain is deeply concerning. There’s no clear regulatory status – the platform essentially operates in a legal gray area without proper oversight.

What’s particularly troubling is the aggressive marketing approach. Reports suggest Crypto30x.com promotions have appeared in unexpected places, including dating apps and social media, using tactics that legitimate financial platforms typically avoid.

The most damaging evidence comes from negative user reviews scattered across the internet. Users report difficulties withdrawing their funds, delayed customer service responses, and promises that don’t materialize. When a platform makes it easy to deposit money but hard to get it back out, that’s a classic warning sign.

These concerns become especially relevant when people search for crypto30x.com gemini combinations, often hoping to find a safer way to use these analytics. For a deeper dive into these credibility issues, you can read more detailed analysis at Crypto30x.com Review: Is It Worth Your Time?.

The reality is that while the promise of 30x returns sounds incredibly appealing, platforms making such bold claims without proper transparency and regulation often leave investors holding empty bags instead of full wallets.

Gemini Exchange: The Regulated Counterpart

When exploring crypto30x.com gemini connections, understand what makes Gemini such a trusted name in cryptocurrency. Picture this: back in 2014, the Winklevoss twins (yes, the same ones from Facebook fame) were sitting on a growing crypto portfolio but couldn’t find a platform they trusted with their digital assets. So they did what any tech-savvy entrepreneurs would do – they built their own.

That’s how Gemini was born, and it explains everything about their approach. This US-based regulated exchange wasn’t created to chase quick profits or flashy features. Instead, it was built by people who genuinely needed a secure place to store and trade their own cryptocurrency.

Gemini operates as a New York trust company under NYSDFS regulation, which means they follow the same strict rules as traditional banks. They were pioneers in obtaining SOC 1 & SOC 2 certifications – the first crypto exchange to achieve this level of verification. Plus, they offer FDIC insurance for USD deposits, giving users that extra peace of mind we all crave when dealing with our hard-earned money.

It’s no surprise that Forbes Advisor recognized them as one of the Best Crypto Exchanges in 2024. With over $200 billion in trading volume and availability in 70+ countries, they’ve proven their staying power in an industry where platforms come and go overnight.

Gemini’s Strengths: Security and User Experience

Here’s where Gemini truly shines – they treat security like it’s a matter of life and death. Most user funds are kept in cold storage, meaning they’re stored offline where hackers can’t reach them. Think of it like keeping your valuables in a bank vault rather than under your mattress.

They’re also big advocates for hardware security keys, which are like having a physical key to your digital safe. Two-Factor Authentication (2FA) isn’t optional here – it’s mandatory, along with their Approved Addresses feature that only lets you withdraw funds to pre-approved locations. This comprehensive security approach is why many consider Gemini the Fort Knox of crypto exchanges.

From a user experience standpoint, Gemini gets it right. Their user-friendly interface makes sense even if you’re new to crypto – no need to decipher cryptic symbols or steer confusing menus. For those ready to dive deeper, their ActiveTrader platform offers professional-grade tools with advanced charting and multiple order types.

The proof is in the pudding: their mobile app boasts a 4.8-star rating from nearly 94,000 users. When you’re dealing with something as complex as cryptocurrency, having an intuitive platform makes all the difference. You can explore more about their security measures at Gemini’s official exchange page.

Gemini’s Drawbacks: Fees and Token Selection

Let’s be honest – Gemini isn’t perfect, and their higher trading fees are often the first thing users notice. If you’re making smaller trades or just getting started, those fees can feel like a pinch. Credit and debit card purchases come with additional charges that can eat into your investment before you even begin trading.

The limited crypto assets situation is a double-edged sword. While Gemini supports over 70 cryptocurrencies including all the major players like Bitcoin, Ethereum, and Solana, you won’t find the endless buffet of fewer altcoins available on less regulated platforms. Their conservative listing approach means they prioritize quality and regulatory compliance over quantity.

This creates an interesting dynamic when people search for crypto30x.com gemini content – they’re essentially looking at a platform that promises access to high-risk, high-reward tokens alongside an exchange that deliberately avoids such speculative assets.

| Feature | Gemini | Industry Average |

|---|---|---|

| Security | Excellent (SOC 1/2, cold storage, 2FA) | Varies widely |

| Fees | Higher for basic trades | Generally lower |

| # of Coins | Curated selection (70+ top cryptos) | Hundreds to thousands |

The tradeoff is clear: Gemini offers rock-solid security and regulatory compliance, but you’ll pay more in fees and have fewer speculative investment options. For many investors, especially those new to crypto, this conservative approach is exactly what they need.

The Crypto30x.com Gemini Connection: A Balanced Analysis

Here’s where things get interesting – and a bit complicated. The crypto30x.com gemini connection isn’t what many people think it is. There’s no official partnership between these two platforms. Instead, what we’re seeing is Crypto30x.com essentially offering commentary and analysis on tokens that happen to be available on Gemini’s exchange.

Think of it like a food critic reviewing dishes from a specific restaurant, but having no formal relationship with that restaurant. The critic can praise or critique the food, but the restaurant doesn’t endorse the critic’s opinions. That’s essentially what’s happening here.

Crypto30x.com provides analytics for Gemini-listed tokens, focusing on investment-focused analysis that aims to spot potential high-growth opportunities. The idea sounds appealing: use speculative insights to identify high-growth potential within Gemini’s secure, regulated environment. It’s an attempt at balancing risk and regulation – getting the thrill of high-risk analysis while trading on a platform that won’t disappear overnight.

For those curious about this dynamic, our team has put together a comprehensive look at how these platforms interact in our guide: Crypto30x.com Gemini: The Ultimate Guide.

How Crypto30x.com Views the Gemini Platform

What’s fascinating is that Crypto30x.com actually speaks quite positively about Gemini itself. Their analysis gives Gemini a positive assessment, highlighting the exchange’s trust and transparency. They particularly emphasize Gemini’s strong security praise, noting features like FDIC insurance for USD deposits and those impressive SOC certifications we discussed earlier.

Crypto30x.com also recognizes Gemini’s institutional appeal – the fact that serious investors and institutions feel comfortable using the platform. This is actually a smart observation, since institutional adoption often signals long-term stability in the crypto world.

However, Crypto30x.com doesn’t shy away from pointing out what they see as drawbacks. They consistently mention Gemini’s high fee structure as a barrier for active traders. More importantly for their business model, they highlight the limited token availability for “30x” opportunities. This creates an interesting tension – how can you find those explosive growth opportunities when you’re limited to Gemini’s carefully curated selection of established cryptocurrencies?

It’s like trying to find the next big food trend while only shopping at a very conservative, well-established grocery store. Safe? Absolutely. Exciting? Maybe not so much.

Potential Risks of Following crypto30x.com gemini Signals

Now for the reality check. Following crypto30x.com gemini signals comes with serious risks that every investor needs to understand. These aren’t just typical crypto risks – they’re amplified by the combination of speculative analysis and high-leverage strategies.

Crypto30x.com promotes high-risk strategies that can make or break your portfolio in a matter of hours. Their focus on leverage risks means you could potentially lose more money than you initially invested. When they talk about 30x returns, they’re also talking about strategies that could result in 30x losses.

The biggest concern? These signals are completely unverified. There’s no independent audit, no public track record, and no regulatory oversight confirming that their “Zeus signals” actually work. Market volatility can destroy even the most sophisticated predictions, and crypto markets are particularly unpredictable.

There’s no formal partnership between Crypto30x.com and Gemini. This means when you’re following Crypto30x.com’s advice on Gemini, you’re essentially relying on speculative analytics from an unregulated source to make decisions on a regulated platform. Gemini doesn’t endorse, verify, or take any responsibility for Crypto30x.com’s recommendations.

It’s a bit like taking restaurant recommendations from someone who’s never worked in the food industry and has no accountability for their suggestions. The restaurant might be excellent, but the person giving advice? That’s a completely different story.

Frequently Asked Questions about Verifying Crypto Platforms

As experts who’ve watched countless investors steer the exciting but treacherous waters of cryptocurrency, we get these questions all the time. The crypto30x.com gemini connection especially confuses people, so let’s set the record straight with some honest answers.

Is Crypto30x.com directly partnered with Gemini?

Here’s the short answer: No, absolutely not. There’s no formal partnership whatsoever between these two platforms. Think of it like this – just because a food blogger writes reviews about restaurants in Manhattan doesn’t mean they’re officially partnered with those restaurants.

Crypto30x.com operates as completely independent analysis platform. It’s essentially a third-party tool that happens to analyze some of the same cryptocurrencies you can trade on Gemini. This user-driven connection exists only because people choose to use both platforms together.

Any marketing material or content suggesting there’s an official endorsement or collaboration is misleading at best. Gemini has never endorsed Crypto30x.com’s signals or strategies. It’s really important to understand this distinction because it affects how much trust you should place in any recommendations.

Is Gemini a safe exchange to use for trading?

Yes, Gemini stands out as one of the most trustworthy options in crypto. It’s highly regulated by the New York State Department of Financial Services, which puts it through rigorous oversight that most crypto platforms simply don’t face.

The exchange has maintained a strong security record since its founding. They were actually the first crypto platform ever to achieve both SOC 1 Type 2 and SOC 2 Type 2 certifications – that’s a big deal in the security world. These certifications mean independent auditors have verified their internal controls and security practices.

What really sets Gemini apart is that your USD deposits are FDIC insured up to $250,000, just like a traditional bank account. They follow industry best practices including storing most funds in cold storage, supporting hardware security keys, and requiring two-factor authentication.

While no platform is completely risk-free (this is crypto, after all!), Gemini’s commitment to regulation and security makes it a solid choice. You can read more about their history and regulatory status at Gemini (cryptocurrency exchange).

What is the biggest risk with a platform like Crypto30x.com?

The biggest red flag is the complete lack of regulation and transparency. When you can’t verify who’s running a platform or where they’re located, you’re essentially trusting strangers with your money. That creates a high potential for fraud.

The platform makes unverified claims about 30x returns that sound too good to be true – because they usually are. These astronomical promises set unrealistic expectations and often lead people to risk more than they can afford to lose.

User fund safety becomes a serious concern when platforms operate in regulatory gray areas. We’ve seen reports of withdrawal issues, which is always a massive warning sign. If a platform makes it easy to deposit but difficult to withdraw, that’s classic predatory behavior.

Perhaps most concerning are the “catfish” schemes – deceptive marketing tactics designed to lure in unsuspecting investors through fake testimonials, misleading partnerships claims, or promises of guaranteed returns. These tactics prey on people’s desire to get rich quick.

The bottom line? If a platform promises extraordinary returns while hiding behind anonymity and avoiding regulation, proceed with extreme caution – or better yet, don’t proceed at all.

Conclusion: Is the Combination a Reliable Choice for Investors?

After diving deep into this complex relationship, I have to give you the honest truth about crypto30x.com gemini – it’s a tale of two very different platforms that don’t quite belong together.

Gemini’s reliability is unquestionable. As someone who’s watched the crypto space evolve here in New York City, I can tell you that Gemini represents everything we want in a cryptocurrency exchange. The Winklevoss twins built something genuinely trustworthy – a platform with rock-solid security, clear regulatory oversight, and a track record that speaks for itself. If you’re looking for a place to safely buy, sell, and store your crypto, Gemini checks all the boxes.

But here’s where things get tricky. Crypto30x.com’s speculative nature throws a massive wrench into this equation. While the promise of “30x returns” might make your heart race, the reality is far more sobering. We’re talking about an unregulated platform with anonymous owners, user complaints about withdrawals, and what can only be described as questionable marketing tactics.

The combination creates what I can only call a high-risk combination that most investors should approach with extreme caution. Think of it this way – you’re essentially taking investment advice from someone you can’t verify, then executing those trades on one of the most secure platforms available. It’s like getting stock tips from a stranger at a coffee shop, then placing those orders through your most trusted broker.

The importance of due diligence cannot be overstated here. I’ve seen too many people in our community get swept up in promises of extraordinary returns, only to learn painful lessons about the difference between legitimate opportunities and speculative hype.

Here’s The Dining Destination recommendation: if you’re serious about cryptocurrency investing, start with education and verified platforms. Gemini is an excellent choice for your trading needs, but skip the unverified signals from platforms like Crypto30x.com. Your future self will thank you for choosing boring reliability over exciting uncertainty.

Investor responsibility means doing your homework before risking your hard-earned money. Just as we research restaurants before trying new cuisines, you should thoroughly vet any platform promising to help grow your wealth. The crypto world is full of opportunities, but it’s equally full of pitfalls for the unprepared.

For those ready to begin their cryptocurrency journey the right way, we’ve put together comprehensive educational materials to help you steer this complex landscape safely. Start your verified crypto journey with our resource guides – because knowledge truly is your best investment in the volatile world of crypto.