What Is Crypto30x.com and Its Blockchain Promise?

Here at The Dining Destination, we spend our days navigating the vibrant, sometimes overwhelming, world of New York City’s culinary scene. We know a thing or two about spotting the difference between a genuinely groundbreaking new restaurant and a hyped-up spot that’s all sizzle and no steak. Lately, I’ve noticed a similar dynamic in a completely different world: cryptocurrency. That brings us to the crypto30x.com blockchain platform, a trading hub that promises extraordinary returns through advanced AI technology and high-leverage trading. However, just like a restaurant with a flashy menu and terrible reviews, recent investigations reveal significant concerns about its legitimacy and operations.

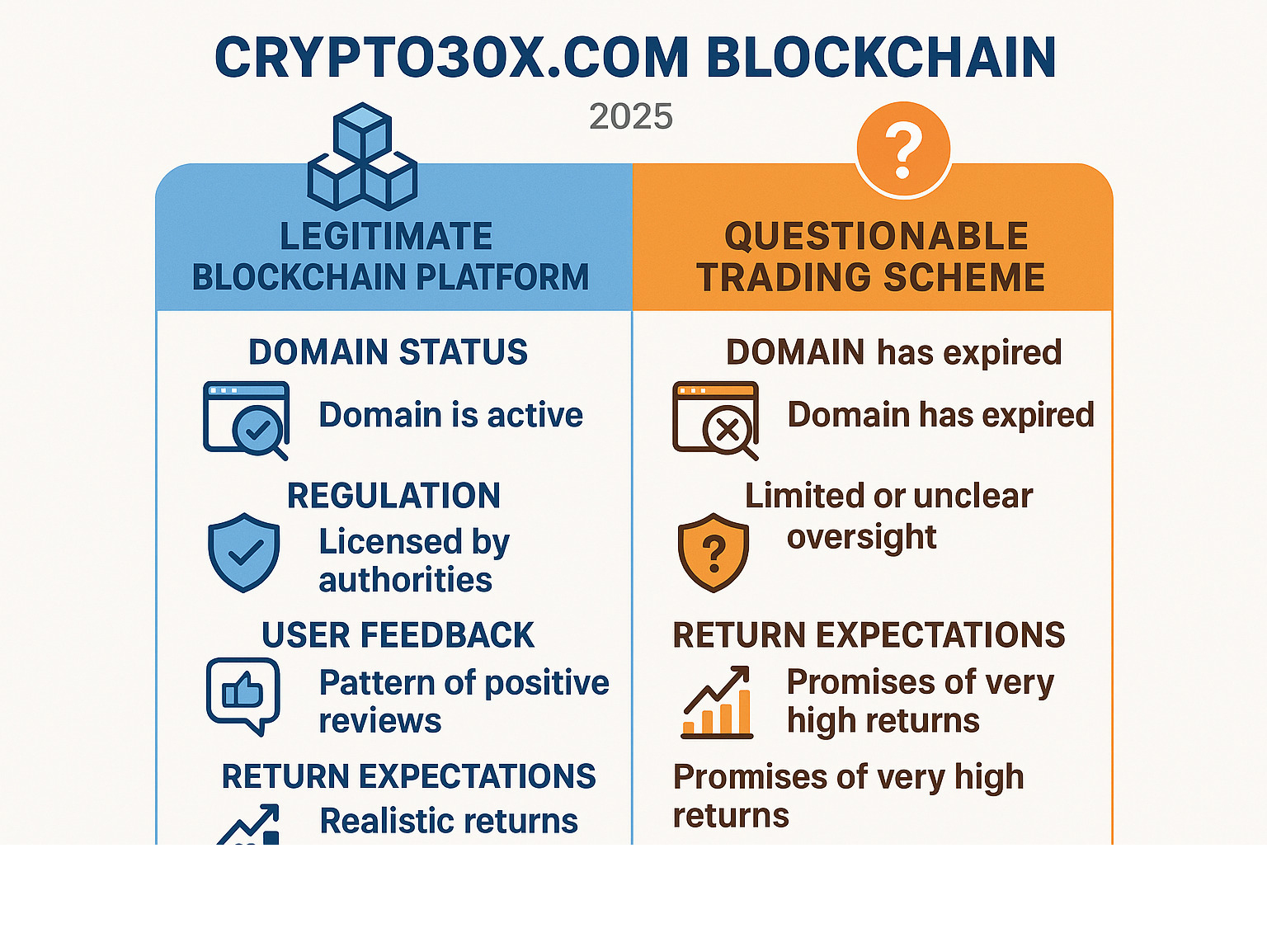

Key Facts About Crypto30x.com:

- Claims: Up to 30x returns on cryptocurrency investments

- Features: AI trading bot called “Zeus” with claimed 64% accuracy

- Leverage: Offers up to 30x leverage on major trading pairs

- Security: Advertises AES-256 encryption and cold storage

- Current Status: Domain has expired, raising immediate red flags

- Regulation: Limited oversight despite Malta license claims

Based on research from multiple sources, crypto30x.com presents a mixed picture. While the platform advertises sophisticated blockchain technology, AI-powered trading tools, and institutional-grade security measures, user reports tell a different story. Many investors have reported withdrawal problems, unresponsive customer support, and concerning marketing tactics that resemble classic cryptocurrency scams.

The platform’s promise of “30x returns” falls into the high-risk, high-reward category that regulatory bodies like the FCA actively warn against. Even more concerning, the crypto30x.com domain has recently expired, which is often a telltale sign of platform abandonment or operational issues.

The reality is stark: platforms promising guaranteed high returns in the volatile crypto market should be approached with extreme caution. The cryptocurrency landscape is filled with legitimate opportunities, but it’s also riddled with schemes designed to separate investors from their money.

For anyone considering crypto30x.com or similar platforms, thorough verification is not just recommended – it’s essential for protecting your financial future.

Quick crypto30x.com blockchain terms:

Step 1: Analyzing the Core Claims and Features

Here in New York City, a new restaurant opens almost every day, each with flashy promises. When you first land on a platform like Crypto30x.com, it feels just like that—walking past a trendy new spot in SoHo with a menu promising the meal of a lifetime. The bold claims and shiny features of the crypto30x.com blockchain platform immediately catch your attention, but just as we’d scour reviews on Resy before booking a table, we need to dig deeper into what it actually offers versus what it promises.

The platform markets itself as your gateway to digital finance’s future, combining advanced technology with user-friendly features and educational resources. They advertise up to 30x leverage on major trading pairs like BTC/USD and ETH/USD, which sounds impressive if you want to maximize your position without putting down massive capital upfront.

Their toolkit includes over 50 technical indicators for advanced charting, competitive trading fees ranging from 0.08% to 0.18%, and educational resources like tutorials and webinars. On paper, it looks comprehensive for both beginners and seasoned traders.

But here’s where things get interesting – and concerning. Let’s compare what they advertise against the reality we’ve uncovered:

| Advertised Feature | Claimed Benefit | Potential Risk/Reality |

|---|---|---|

| Up to 30x Leverage | Maximize returns with less capital | Amplifies losses just as much; high liquidation risk |

| AI Trading Bot “Zeus” (64% accuracy) | Automated profitable trades | Back-tested claims aren’t guarantees; AI fails during market volatility |

| 50+ Technical Indicators | Advanced market analysis | Can overwhelm users; requires deep knowledge to use effectively |

| Educational Resources | Empowers informed decisions | Quality varies; may not cover platform’s own risks |

| Competitive Fees (0.08%-0.18%) | Cost-effective trading | Hidden funding fees accumulate; withdrawal fees often apply |

| Malta License | Regulatory legitimacy | Limited oversight compared to major regulators like SEC or FCA |

The “30x Returns” Promise

The “30x returns” promise is undeniably tempting, especially in a high-cost city like New York where the dream of quick wealth is strong. It whispers of quick wealth that traditional investments simply can’t match. And yes, in crypto’s wild world, massive gains do happen – just look at Bitcoin’s early days or certain altcoins during bull runs.

But here’s the catch: these spectacular returns are the exception, not the rule. The crypto30x.com blockchain platform positions itself as your ticket to these high-growth opportunities, but the devil’s in the details.

How are those returns calculated? Are they sustainable? Most importantly, what’s the real risk involved? When platforms promise 30x returns, they’re targeting high-risk, speculative investments that regulatory bodies actively warn against. It’s like promising a five-star meal without mentioning it might give you food poisoning.

The harsh reality is that aiming for 30x returns means accepting the possibility of 30x losses. Market volatility doesn’t discriminate, and past performance – no matter how impressive – never guarantees future results.

For more guidance on making informed financial decisions, check out our comprehensive resource guides: More info about our resource guides

Understanding the “Zeus” AI Trading Bot

Now let’s talk about “Zeus,” Crypto30x.com’s star attraction. This AI trading bot supposedly delivers trade signals with 64% accuracy in back-tests and real-world trials. It scans multiple exchanges, tracks social sentiment, and analyzes price dynamics to generate actionable signals.

Zeus promises automated strategies with smarter risk control, handling stop-loss decisions and position sizing based on user-defined parameters. It sounds like having a tireless, emotionless trader working around the clock for you.

The platform introduces “Zeus,” an AI-driven trading bot that offers AI-driven analytics, sentiment tracking, and on-chain data analysis: intervention The platform introduces “Zeus,” an AI-driven trading bot

But let’s be realistic here. Even the most sophisticated AI is only as good as the data it processes. 64% accuracy means Zeus is wrong 36% of the time – and in highly leveraged trading, even a few wrong calls can wipe out your account.

AI can’t predict market crashes, regulatory announcements, or the countless variables that move crypto prices. It operates on historical patterns and current trends, which are never guarantees of future performance. It’s like trusting a recipe app to cook your dinner – helpful, sure, but you still need to taste-test and use your judgment.

The bottom line? While Zeus might offer useful insights and automation, it doesn’t eliminate the inherent volatility and risk that comes with cryptocurrency trading. Approach these AI promises with the same healthy skepticism you’d have for any tool that claims to predict the future.

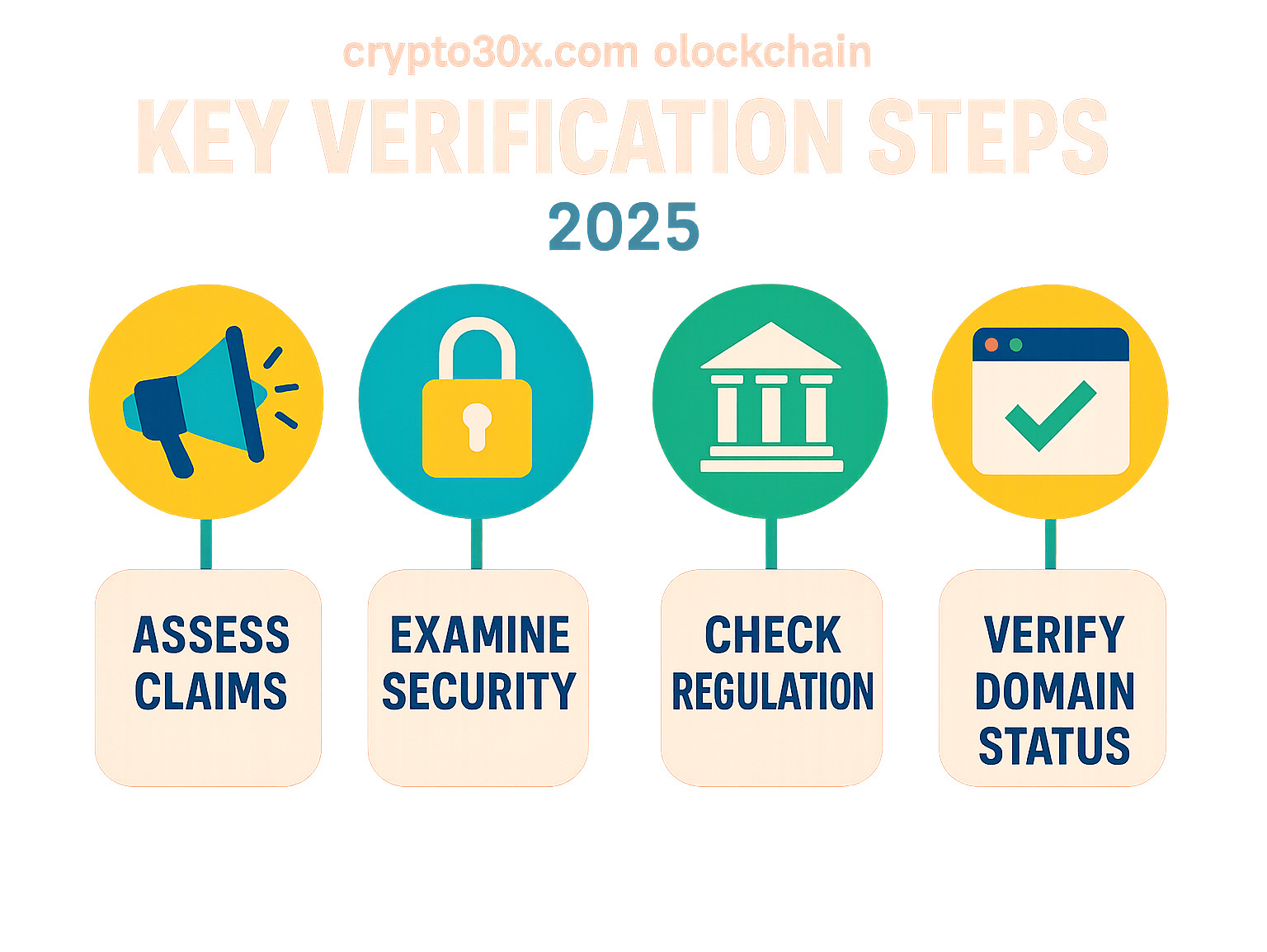

Step 2: Investigating the Security and Regulatory Framework of the crypto30x.com blockchain

When you’re trusting a platform with your hard-earned money, security is everything. It’s like choosing a restaurant for a big celebration here in NYC; you’re not just looking at the menu, you’re looking for that ‘A’ grade from the Department of Health in the window. The same careful scrutiny applies to the crypto30x.com blockchain platform and its security claims.

Crypto30x.com advertises what sounds like top-tier security measures. They claim to use AES-256 encryption to protect your personal data, two-factor authentication (2FA) to secure your login, and cold wallet storage to keep your crypto assets safely offline. These are all excellent security practices that legitimate exchanges should have.

The platform also says it follows KYC and AML protocols – that’s “Know Your Customer” and “Anti-Money Laundering” for those new to crypto jargon. These requirements help prevent illegal activities and are actually good signs when a platform follows them properly.

But here’s where things get murky. Crypto30x.com claims to hold a Malta Digital Asset Service Provider license. While Malta has made efforts to regulate cryptocurrency businesses, this license doesn’t provide the same level of oversight as major regulators like the SEC or FCA. It’s a bit like a food truck having a permit from a suburban town—it’s something, but it’s not the same level of rigorous oversight you’d expect from a Michelin-starred restaurant in Manhattan.

More concerning are the withdrawal problems that users have reported. Even the best security measures mean nothing if you can’t access your own money when you need it.

Verifying the Platform’s Legitimacy and Domain Status

Here’s where our investigation took a dramatic turn. When we tried to verify basic information about Crypto30x.com, we found something alarming: the domain has expired. Yes, you read that correctly – This domain has expired.

An expired domain is like arriving at a restaurant you booked for a special occasion only to find empty tables and a “For Lease” sign in the window. It’s one of the biggest red flags you can encounter when evaluating any online platform, especially one handling your money.

This fundamental operational failure raises serious questions about ownership transparency and professional management. Legitimate businesses don’t just let their domains expire, particularly when they’re supposedly managing millions in user funds. The lack of clear ownership information and this basic oversight suggests either incompetence or something far more sinister.

Community feedback has been mixed at best, with many users reporting difficulties contacting customer support and processing withdrawals. When a platform’s most basic infrastructure – its web address – isn’t maintained, it’s hard to trust them with anything more complex.

How the crypto30x.com blockchain Claims to Ensure Security

The platform promotes its use of blockchain technology as a security feature, emphasizing concepts like decentralization, immutability, and public ledger transparency. They claim this approach eliminates intermediaries and creates a more secure trading environment.

But here’s something important to understand: there’s a big difference between a true public blockchain (like Bitcoin or Ethereum) and a centralized platform that simply uses blockchain elements. When you trade on Crypto30x.com, you’re still trusting a centralized company with your funds – you don’t control your private keys.

The crypto30x.com blockchain implementation may offer some transparency benefits, but it doesn’t change the fundamental trust relationship. You’re still relying on the company behind the platform to act honestly and maintain operations. When that company can’t even keep its domain active, the underlying blockchain technology becomes irrelevant.

Their KYC/AML protocols are presented as security features, and in theory, they should help create a safer trading environment by verifying user identities and preventing illegal activities. However, these same protocols also mean the platform has extensive personal information about its users – information that could be at risk if the platform isn’t properly managed.

The bottom line for any New Yorker considering this? While the crypto30x.com blockchain platform talks a good game about security and its underlying technology, the expired domain and user reports of withdrawal issues suggest their security framework may be more marketing than reality.

Step 3: Scrutinizing User Experiences and Community Feedback

In digital finance, just like in the cutthroat New York City restaurant business, reputation is everything. At The Dining Destination, we live by the word-of-mouth and the detailed reviews that tell the real story of a dining experience. The same principle is crucial when evaluating the crypto30x.com blockchain platform—the real story isn’t in the marketing, it’s in the voices of actual users.

When we dig into community forums, social media channels, and customer support reviews, a troubling pattern emerges. While Crypto30x.com markets itself as having exceptional customer support and educational resources like tutorials and webinars, the user experiences tell a dramatically different story.

Many users report withdrawal difficulties that range from frustrating delays to complete inability to access their funds. These aren’t just isolated complaints – they form a consistent pattern across multiple platforms and review sites. Some users describe being suddenly blocked from their accounts after depositing substantial amounts, while others mention customer support that simply stops responding once withdrawal requests are made.

Even more concerning are reports of fake profit displays on user dashboards. These alleged tactics show inflated account balances to encourage users to deposit more money, creating a false sense of success that mirrors classic investment scam playbooks. It’s like a restaurant showing you photos of someone else’s meal to get you to order more courses.

The “Gigachad” vs. “Catfish” Dilemma

The online conversation around Crypto30x.com has taken on an almost meme-like quality, embodying what we call the “Gigachad” versus “Catfish” dilemma.

On one side, you have the “Gigachad” narrative – the confident, successful trader who uses AI-powered tools like Zeus to dominate the crypto markets. This persona appeals to our desire to be part of an exclusive club of winning traders, making impressive gains while others struggle. The platform’s marketing heavily promotes this image, suggesting that their tools can transform anyone into a disciplined, strategic trader who consistently beats the market.

But scratch beneath the surface, and the “Catfish” reality becomes apparent. Users report marketing tactics that feel disturbingly similar to romance scams – individuals being approached through social media or dating apps, gradually building trust before being encouraged to invest. These tactics exploit emotional connections and trust, leading people into financial traps disguised as investment opportunities.

The emotional manipulation doesn’t stop there. Some users describe being contacted by supposed “account managers” who pressure them to deposit more funds to “open up” higher profit tiers or to cover “processing fees” for withdrawals. These are classic red flags that any experienced investor would recognize immediately.

Assessing the Reality of the crypto30x.com blockchain Ecosystem

The harsh reality for anyone, especially a busy New Yorker, is that a platform’s technology means nothing if you can’t access your funds or get help when you need it. While the crypto30x.com blockchain promises transparency and security through its technological infrastructure, the consistent reports of unresponsive customer support and withdrawal problems paint a very different picture.

Community trust is the foundation of any successful trading platform. When users consistently share negative experiences about being unable to withdraw their money or getting blocked from their accounts, it creates a ripple effect that undermines the entire ecosystem. Forums and social media channels that should be celebrating user success stories instead become warning networks for potential victims.

The platform’s educational resources and community forums, while potentially valuable, become meaningless when the underlying business practices appear designed to prevent users from actually benefiting from their investments. It’s like offering cooking classes while secretly planning to lock the kitchen doors.

For a deeper dive into the reality of the crypto30x.com blockchain ecosystem and its implications, you can read more in our blog: Crypto30x.com Blockchain. Read more in our blog

The evidence from user experiences creates a clear picture: despite the sophisticated marketing and technological promises, the fundamental test of any investment platform – allowing users to access their money – appears to be where Crypto30x.com fails most dramatically. When the most basic function of a financial platform doesn’t work reliably, all the AI trading bots and blockchain technology in the world can’t save it.

Frequently Asked Questions about Verifying Crypto Platforms

As we’ve explored the claims and realities of crypto30x.com blockchain, I find myself fielding the same questions over and over again from friends and readers here in New York City. Whether we’re chatting over coffee about the latest dining trends or discussing investment opportunities, people are curious – and rightfully cautious – about these high-return crypto platforms.

Think of it like finding a new restaurant that promises the most incredible meal of your life at an unbelievable price. Your excitement is tempered by a healthy dose of skepticism, and you want to know what others have experienced before you make a reservation.

Can platforms like Crypto30x.com really guarantee 30x returns?

Absolutely not. This is perhaps the most important thing I can tell you about any platform promising guaranteed returns, especially ones as outrageous as 30x.

The cryptocurrency market is incredibly volatile – imagine a restaurant where the menu changes every few minutes and the prices fluctuate wildly based on how many people are ordering. While huge gains are possible in crypto (we’ve all heard the stories of early Bitcoin investors), these are typically the exception, not the rule.

Any platform claiming to guarantee specific returns is displaying a classic red flag of fraudulent schemes. The reality is that high-risk investments come with the very real possibility of significant losses. When you add high leverage into the mix, those potential losses get amplified dramatically.

No legitimate investment can promise consistent, guaranteed returns without substantial risk. It’s like a chef claiming they can make the perfect dish every single time without ever knowing what ingredients they’ll have available – it’s simply not realistic.

What are the biggest red flags to watch for when evaluating a trading platform?

After researching platforms like Crypto30x.com and hearing countless stories from our community, I’ve identified several warning signs that should make you immediately pause and reconsider.

Unrealistic return promises top the list. If someone guarantees you’ll multiply your money by 30 or promises consistent daily returns, that’s your cue to walk away. Pressure tactics are another major concern – legitimate platforms don’t need to rush you into depositing more funds or making quick decisions.

The most serious red flag is difficulty with withdrawals. This is where many users find they’ve been scammed. If you can’t easily access your own money, or if there are unexpected fees and delays, you’re likely dealing with a fraudulent operation.

Lack of transparent ownership should also concern you. Reputable platforms have identifiable teams and clear corporate structures. If you can’t find out who’s actually running the show, that’s a problem. Similarly, unresponsive customer support – especially when you’re trying to withdraw funds – is a telltale sign of trouble.

Watch out for aggressive marketing tactics, particularly unsolicited messages on social media or dating apps, which are unfortunately common in a dense, target-rich environment like New York City. Legitimate investment platforms don’t typically recruit customers through these channels, so be wary of anyone promoting the crypto30x.com blockchain this way.

Finally, pay attention to regulatory oversight. While crypto regulation is still evolving, platforms without any oversight from reputable financial authorities offer you little protection. And as we saw with Crypto30x.com, something as basic as an expired domain can signal serious operational problems or outright abandonment.

How does a platform using “blockchain” differ from a true public blockchain?

This distinction is crucial, and it’s one that many people find confusing – understandably so, since the marketing can be deliberately misleading.

A true public blockchain like Bitcoin or Ethereum operates without any central authority. It’s like a community cookbook where everyone can see all the recipes, anyone can contribute, and no single person can change what’s already been written. The system runs on consensus among thousands of participants worldwide, and you control your own assets through your private keys.

When a platform like Crypto30x.com claims to use “blockchain,” they’re typically referring to a centralized system that incorporates some blockchain elements. While they might use blockchain technology for internal record-keeping or transaction processing, you’re still trusting the company with your funds.

This means the platform acts as an intermediary – they hold your money, they control access to it, and they can make decisions about your account. The immutability and transparency they tout often exist only within their controlled environment, not on a truly public and uncensored network.

It’s the difference between depositing money in a community-owned credit union where all members have a say, versus putting your money in a private vault where the owner has complete control, even if they use high-tech security systems. If that private company decides to shut down or if their systems fail, your assets are at risk regardless of the underlying technology they claim to use.

Understanding this difference is essential for making informed decisions about where to entrust your digital assets. True decentralization means you don’t have to trust any single entity – you trust the mathematics and the network. Centralized platforms using blockchain still require you to trust the company behind them, which brings us back to all those red flags we discussed earlier.

Conclusion: The Final Verdict on Verification

After diving deep into crypto30x.com blockchain, I feel like we’ve just finished taste-testing a dish that looked absolutely stunning on the menu but left us with serious concerns about what we actually consumed. Sometimes the most beautifully presented opportunities can hide the most bitter disappointments.

Our investigation has taken us through every layer of Crypto30x.com’s promises. We’ve examined their bold claims of 30x returns, scrutinized their AI trading bot Zeus with its supposed 64% accuracy rate, and looked closely at their security measures and regulatory standing. What we finded tells a story that’s unfortunately all too common in the crypto world.

The expired domain status alone should make anyone pause. It’s like arriving at a restaurant to find the doors locked and no explanation posted. When a platform claiming to handle millions in cryptocurrency investments can’t even maintain basic website operations, that’s not just concerning – it’s a dealbreaker.

The pattern of withdrawal difficulties reported by users adds another layer of worry. Imagine ordering an expensive meal, paying upfront, and then being told the kitchen is “temporarily closed” every time you ask where your food is. That’s essentially what many Crypto30x.com users have experienced with their investments.

Due diligence isn’t just recommended – it’s absolutely critical when evaluating any crypto platform. The verification process we’ve outlined here applies to any high-return investment opportunity you might encounter. Check the domain status, research the team behind the platform, look for genuine regulatory oversight, and most importantly, listen to the community’s real experiences.

As someone who’s spent years helping New Yorkers steer everything from the latest food trends to travel destinations, I can tell you that the same principles apply whether you’re choosing a new restaurant or a crypto platform. If something promises results that seem too good to be true, take a step back and ask the hard questions.

The crypto space offers legitimate opportunities for growth and innovation. But platforms like Crypto30x.com, with their combination of unrealistic promises and operational failures, remind us why thorough research matters. Your financial security deserves the same careful attention you’d give to any important decision in your life.

For those of you looking to make smarter financial decisions and understand the red flags in any investment opportunity, we’ve got resources that can help guide your journey: More info about our resource guides

The bottom line for my fellow New Yorkers? Approach platforms promising astronomical returns, like the *crypto30x.com blockchain platform, with the same skepticism you’d have for a restaurant in Times Square claiming to serve five-star meals at fast-food prices.* Sometimes the most valuable lesson is knowing when to walk away.