What is MotoAssure and Its Role in Vehicle Protection?

For any New Yorker who relies on their car for culinary trips—whether it’s a weekend trip to a Hudson Valley farm-to-table spot or a drive to Flushing for the best soup dumplings—a sudden breakdown is more than an inconvenience; it’s a ruined experience. This is where vehicle protection plans come in, and motoassure bbb searches often pop up. These searches reveal a company that acts as a third-party administrator for vehicle service contracts, with a mixed reputation on the Better Business Bureau platform.

Quick Facts About MotoAssure:

- Service Type: Third-party vehicle service contract administrator

- BBB Status: Has received numerous complaints primarily over contract clarity and service quality

- Common Issues: Misleading marketing tactics, high-pressure sales calls, delayed reimbursements, denied claims

- Positive Aspects: Some customers report successful claims processing and helpful service agents

- Response Rate: MotoAssure does respond to most BBB complaints with explanations or documentation

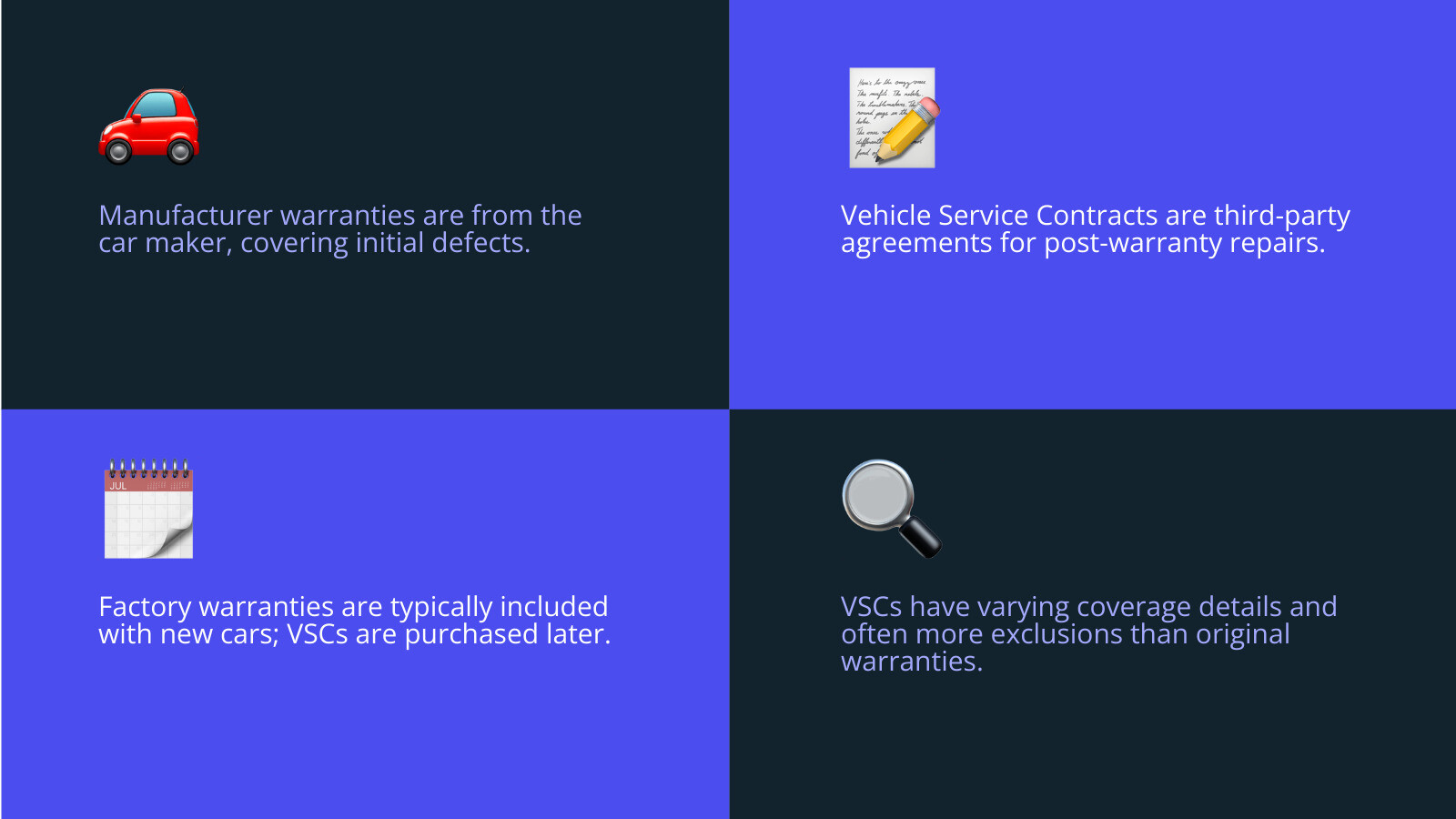

MotoAssure operates as what’s called a third-party administrator in the vehicle protection industry. Think of them as the middleman who handles the paperwork, processes your claims, and manages customer service after your car’s original warranty expires—the one that covered you when you first drove it off the lot.

When your manufacturer warranty ends, companies like MotoAssure offer vehicle service contracts (often called extended warranties) to cover potential repairs. The “Admin” part you see in “MotoAssure Admin BBB” refers to their administrative role in managing these contracts between you and the actual warranty company.

What MotoAssure Actually Does:

- Processes warranty claims

- Handles customer service calls

- Manages contract documentation

- Coordinates with repair shops

- Administers refunds and cancellations

The BBB profile for MotoAssure tells a story of both satisfied customers who avoided costly repairs and frustrated consumers—some right here in the tri-state area—dealing with denied claims. This mixed feedback makes it crucial to understand exactly what you’re buying before signing any agreement, especially when your foodie road trips depend on it.

Simple * motoassure bbb* glossary:

Decoding the MotoAssure BBB Profile: Complaints and Compliments

Think of the Better Business Bureau as the online equivalent of a trusted neighborhood watchdog—a vital resource for a savvy New Yorker. It’s where companies show they care about customer satisfaction and where consumers share their real experiences. The BBB creates marketplace trust by holding businesses accountable, giving you a place to see how they handle problems before you commit.

When you’re looking at the MotoAssure Administration | BBB Business Profile, you’ll find a mixed bag of experiences. Some customers sing their praises, while others share frustrating stories. Let’s break down what you’ll actually see.

Common Customer Complaints Against MotoAssure

The motoassure bbb complaints tend to follow some predictable patterns. Misleading marketing tops the list—customers report feeling like they were promised one thing during a persuasive phone call, only to find their contract said something completely different.

High-pressure sales tactics also feature heavily. You know those calls that make it sound like a deal expires in five minutes? They’re especially jarring when you’re trying to steer the chaos of NYC life, and they don’t sit well when you later realize you didn’t fully understand what you were buying.

Claim denials create the most heated complaints, particularly around the dreaded pre-existing conditions clause. Imagine your transmission fails on the way to a dinner reservation in the West Village. You file a claim, and you’re told it was a pre-existing problem. These disputes can get intense.

Delayed reimbursements round out the major complaint categories. When you’ve already paid for a repair out-of-pocket and are waiting weeks for your approved claim, patience wears thin, especially with the high cost of living in the city.

Positive Customer Reviews

But it’s not all bad news. The MotoAssure Administration | BBB Reviews also showcase successful claims that saved customers thousands of dollars on major repairs—money that could then be spent on exploring new restaurants instead of car troubles.

Many customers praise their helpful service agents who walked them through the claims process. When your car breaks down and you’re worried about a massive repair bill, having someone answer your questions patiently can make all the difference.

The ultimate win? Peace of mind. Several customers mention sleeping better knowing they won’t get blindsided by a $3,000 engine repair, giving them the confidence to plan that next foodie road trip.

MotoAssure’s Response Patterns

Here’s where things get interesting—MotoAssure actually responds to most BBB complaints. Their typical approach involves explaining contract terms in detail, even when customers aren’t thrilled with the explanation.

They’re also willing to consider offering refunds in certain situations, particularly when there’s been a genuine miscommunication. And when they deny claims, they usually provide claim denial documentation that references specific contract language.

While these responses don’t always make unhappy customers happy, they do show the company is engaged in trying to resolve issues rather than just ignoring them.

A Consumer’s Guide to Evaluating a Vehicle Service Contract

Shopping for a vehicle service contract can feel overwhelming. After seeing the mixed reviews in the motoassure bbb profile, it’s clear that doing your homework upfront can save you from a lot of heartache later—especially when a reliable car is your ticket to exploring the food scene beyond your neighborhood.

Think of this as your pre-purchase checklist. Just like you’d scan a menu before ordering, you shouldn’t sign a service contract without understanding every detail.

Key Evaluation Factors

When you’re evaluating any vehicle service contract, whether it’s from MotoAssure or another provider, there are several crucial factors that deserve your attention as a New Yorker.

Coverage details should be your first stop. You need to know exactly which parts and systems are included. Is it just basic powertrain coverage, or does it extend to the complex electrical systems in modern cars? The difference can mean thousands of dollars.

Exclusions are equally important—and often where the motoassure bbb complaints seem to stem from. Every contract excludes things like regular maintenance and wear-and-tear items. The key is knowing these before you need to file a claim.

Your deductible affects your budget. A $100 deductible might seem reasonable, but consider how that fits into your overall NYC budget if you face multiple repairs.

Repair shop choice is a huge deal here. Some contracts require you to use specific repair facilities. As a New Yorker, you need to know: can you use your trusted mechanic in Queens, or do you have to take it to an approved shop in another borough or even out of state?

Don’t overlook transferability. If you can transfer the contract to a new owner, it adds real value when you sell your car in the competitive NYC market, making it more attractive to buyers.

The Power of the Fine Print

We know reading contracts isn’t exciting, but this is where most problems start. Reading the contract thoroughly means actually reading it. When you see terms you don’t understand, ask for clarification in writing. If a sales rep can’t explain their own contract clearly, that’s a major red flag.

Understanding cancellation policies is crucial. Life in the city changes fast. You might sell your car or find you no longer need it. Know if you can cancel, what kind of refund you’ll get (often a pro-rata refund), and if there are any cancellation fees.

Knowing the claims procedure before you need it can save you stress. Find out who you call first—the administrator or the shop. Understand what documentation you’ll need and how payments work. Some companies pay the shop directly, while others reimburse you, which can be a big deal for your cash flow.

Red Flags to Watch For

Based on patterns in motoassure bbb complaints, here are warning signs that should make you pause:

- Unsolicited calls claiming urgency—especially when you’re in the middle of a busy NYC day.

- Vague answers to direct questions about coverage or exclusions.

- High-pressure tactics demanding an immediate decision.

- Refusal to provide written contracts before requiring payment.

- Poor BBB ratings with patterns of unresolved complaints.

A legitimate company wants you to be an informed customer. If someone is rushing you, trust that New Yorker instinct and walk away. The goal is to find a plan that fits your needs, so you can focus on planning your next culinary trip, not worrying about your car.

Frequently Asked Questions about the MotoAssure BBB Standing

When we talk with fellow New Yorkers about vehicle service contracts, especially regarding motoassure bbb experiences, the same questions keep popping up. Think of this as our friendly chat over a cup of coffee about the real stuff you need to know.

Why are claims denied by companies in the motoassure bbb profile?

Claim denials are the biggest headache and fuel most of those motoassure bbb complaints. Here are the common reasons, viewed from a New Yorker’s perspective.

The most frustrating reason? Pre-existing conditions. Imagine your car’s AC dies during a July heatwave, three months after buying your contract. The company could deny the claim, saying the problem was already brewing. It’s a tough pill to swallow when you had no idea.

Missing maintenance records trip up a lot of people. In a city where finding the time and a trustworthy place for an oil change is a challenge, it’s easy to misplace a receipt. But without proof you’ve kept up with maintenance, your engine repair claim might get denied.

Sometimes the part that breaks simply isn’t covered. Remember those exclusions? They come back to bite you here. Your high-tech infotainment screen might go blank, but if it’s not listed in your coverage, you’re out of luck.

Then there are the dollar limits. Your contract might cover transmission repairs, but only up to $3,000. If your repair at a city shop costs $4,500, you’re on the hook for the extra $1,500.

Unauthorized repairs can also sink your claim. Most companies want you to call them for approval before any work starts. Fixing it first and asking questions later is often a recipe for a denied claim.

Can I cancel a vehicle service contract after reviewing the motoassure bbb page?

Absolutely! Reading those motoassure bbb reviews and deciding it’s not for you is a valid choice. You’re not stuck forever.

Most contracts have a “free look” period—usually 30 to 60 days—where you can cancel for a full refund, assuming no claims were filed. It’s a trial run for your peace of mind.

After that, you’ll typically get a pro-rata refund, meaning you get back the unused portion of your contract, minus any cancellation charges. These fees are common, so check your contract for the details.

The cancellation process is usually straightforward: call the company and fill out some paperwork. Always get written confirmation that your contract is cancelled.

Pro tip: If you financed the contract through a dealer, you’ll need to work with them. The refund often goes to the lender first to pay down the loan.

Is a Vehicle Service Contract worth the cost?

This really depends on your lifestyle and your car’s role in it.

Your comfort with risk is a huge factor. Do you sleep better knowing a surprise repair bill won’t derail your finances and cancel your planned foodie trip to the Hamptons? Or would you rather save that money and take your chances?

Your car’s age and track record matter. Driving a ten-year-old luxury SUV known for pricey repairs around the city? A contract might be a lifesaver. Have a reliable, newer car you only use for occasional trips out of Manhattan? Maybe not.

Think about potential repair costs. A quick search can tell you what common repairs cost. If a major repair costs more than the contract itself, the math starts looking attractive.

Your budget situation is crucial. Can you handle a sudden $2,000 repair without stress? Then maybe skip it. Would that same bill be a major financial crisis? A predictable monthly payment might be worth it for the stability.

It’s a personal decision. The goal is to make an informed choice that lets you enjoy your car and all the culinary destinations it can take you to, without unnecessary worry.

Conclusion: Making an Informed Decision for Your Vehicle

Choosing a vehicle service contract is like picking a restaurant for a special occasion in New York City. You wouldn’t just walk into the first place you see. You’d read reviews, check the menu, and see what other diners are saying. The same careful approach applies when you’re considering a motoassure bbb profile or any vehicle protection plan.

At The Dining Destination, we believe the journey is just as important as the meal. Whether you’re driving to a hidden gem in the Bronx, exploring the culinary scene of the Hudson Valley, or heading out to the North Fork for fresh seafood, a reliable car is essential.

Research really is your best friend here. The BBB profile for any company tells a story. With MotoAssure, we’ve seen both sides: customers who were saved from huge repair bills and others who felt frustrated by the process. This is why local knowledge and due diligence are so important.

Understanding your contract is absolutely crucial. That fine print is the roadmap that determines whether your claim gets approved or denied. Every exclusion and deductible matters when you’re facing a costly repair that could disrupt your life and your plans.

The Better Business Bureau is a valuable checkpoint. Look beyond the rating—pay attention to what people are complaining about and how the company responds. A company that actively tries to resolve issues is different from one that ignores its customers.

Here’s something we’ve learned from years of helping people make informed choices: your gut feeling matters. If a sales pitch feels too aggressive or the answers to your questions seem vague, trust that New Yorker instinct. A legitimate company won’t pressure you.

Vehicle service contracts aren’t magic. They are financial tools that work best when you understand what you’re buying. For some, the peace of mind is worth the cost, allowing them to plan their next food trip without worry. Others prefer to self-insure by saving for potential repairs. Neither approach is wrong—it’s about what fits your life.

Just as we guide you toward memorable dining experiences, we hope this exploration of the motoassure bbb reputation helps you steer vehicle protection with confidence. The key is taking your time, asking the right questions, and making a choice that lets you keep exploring.

For more practical advice on making smart consumer decisions across all areas of life, we invite you to explore our collection of helpful guides.