Understanding the Crypto30x.com Ice Phenomenon

Crypto30x.com ice has emerged as one of the most talked-about developments in the SocialFi space, promising to revolutionize how users interact with social media platforms through cryptocurrency rewards.

Quick Overview of Crypto30x.com Ice:

- What it is: A SocialFi token that rewards users for social media engagement

- Core concept: Blend social media activity with decentralized finance (DeFi) benefits

- Market position: Part of the $975 million SocialFi market as of early 2025

- Key promise: Up to 30x returns on investments (high-risk, high-reward)

- Platform features: AI-powered trading tools, automated bots, real-time analysis

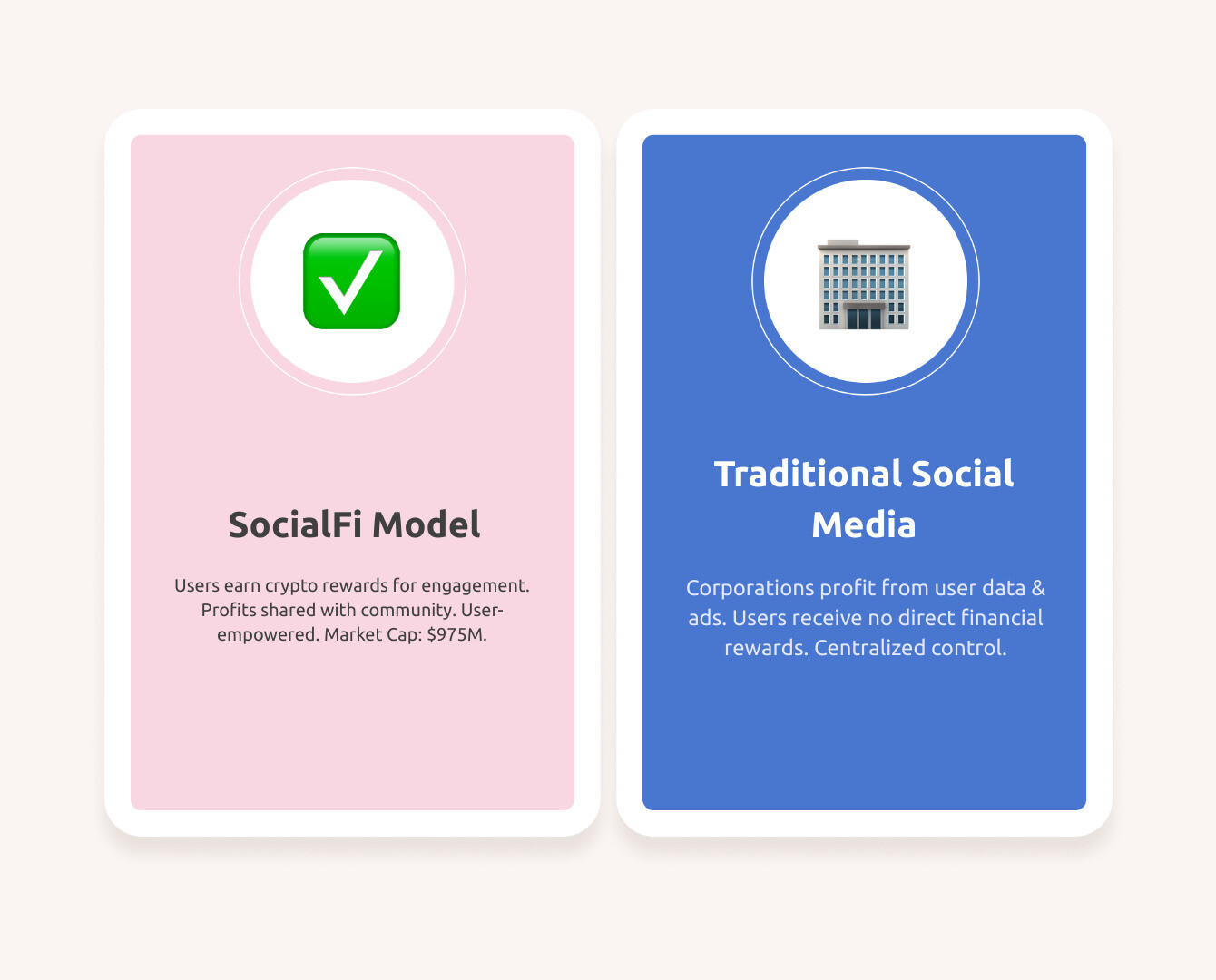

The cryptocurrency world is buzzing with excitement about SocialFi – a trend where social platforms actually pay users for their activity. Instead of corporations profiting from your likes, shares, and posts, you get rewarded with real cryptocurrency.

Crypto30x.com ice sits at the center of this revolution. The platform combines the engagement-driven model of SocialFi with sophisticated trading tools and AI-powered analysis. But here’s the catch: the “30x” promise that gives the platform its name also raises red flags about potential hype and unrealistic expectations.

The numbers tell an interesting story. The platform has seen a 200% increase in user registrations over the past year, while the broader SocialFi market has grown to over $975 million in market cap. Yet experts remain divided – some see genuine innovation, others warn about the risks of chasing high-return promises in the volatile crypto space.

This guide will help you cut through the hype and understand what Crypto30x.com ice really offers, from its AI-powered features to the very real risks involved in high-stakes crypto trading.

* crypto30x.com ice* word guide:

What is Crypto30x.com Ice and the SocialFi Revolution?

Imagine if every time you liked a post, shared content, or created something amazing on social media, you actually got paid for it. That’s the idea behind SocialFi, and it’s exactly where crypto30x.com ice comes into play.

SocialFi stands for Social Finance, and it’s flipping the script on how social media works. Instead of big corporations making all the money from your posts and data, SocialFi platforms reward you with real cryptocurrency for your social activity. Think of it as getting paid to be social online – pretty cool, right?

The numbers show this isn’t just a pipe dream. The SocialFi market has grown to over $975 million as of early 2025, with some impressive daily growth spurts of 4% in April 2025 alone. That’s serious money flowing into this space, and it shows people are hungry for a better way to interact online.

Crypto30x.com ice positions itself right in the heart of this revolution. The platform combines social media engagement with the financial benefits of decentralized finance (DeFi). The ICE token serves as the backbone of this system, rewarding users for everything from creating content to participating in community discussions and voting on platform decisions.

This approach represents true user empowerment – giving people a real stake in the platform’s success rather than just being the product being sold. The broader Crypto30x ecosystem already includes established trading platforms and partnerships with major brands like AC Milan, which provides a solid foundation for rapid growth and credibility.

For those wanting to dive deeper into this concept, What is SocialFi offers excellent additional insights into how this technology is reshaping our digital interactions.

Distinguishing the Platform from ICE (Intercontinental Exchange)

Here’s where things can get confusing – there are actually two different “ICE” entities in the financial world, and mixing them up could lead to some serious misunderstandings.

Crypto30x.com ice is the SocialFi platform we’re discussing – a relatively new player focused on rewarding social media engagement with cryptocurrency tokens. It’s part of the decentralized web movement, putting community and user incentives first.

On the flip side, there’s the Intercontinental Exchange (ICE) – a massive, well-established financial services company that’s been around for decades. This ICE operates traditional exchanges and clearing houses globally. They also provide sophisticated cryptocurrency data services for institutional clients, processing over 250 million updates daily across 600+ currency pairs.

The institutional ICE offers ICE Cryptocurrency Data services that focus on providing tick-by-tick market data and analysis for big financial players. It’s serious, enterprise-level stuff designed for Wall Street types, not everyday social media users.

So while both involve “ICE” and crypto, they’re completely different beasts. Crypto30x.com ice is about rewarding your social activity, while Intercontinental Exchange ICE is about providing data to institutional traders. Keep this distinction clear to avoid any confusion about what you’re actually getting into.

The ’30x’ Promise: High Potential or High Risk?

Let’s talk about the elephant in the room – that bold “30x” in the crypto30x.com ice name. It’s certainly eye-catching, promising potential returns of 30 times your investment. But as anyone who’s spent time watching financial markets knows, claims like this deserve a healthy dose of skepticism.

The platform has seen impressive growth, with a 200% increase in user registrations over the past year. That’s real momentum, and it shows people are interested in what they’re offering. However, the crypto world is notorious for its market volatility – prices can swing wildly in both directions, sometimes within hours.

High-return claims often serve as both a magnet for investors and a warning sign. While the potential for significant gains exists, the investment risk analysis tells a more complex story. Factors like regulatory uncertainty, security risks, and the general unpredictability of cryptocurrency markets all come into play.

Regulatory uncertainty is particularly important to consider. Crypto laws are constantly evolving and vary dramatically from country to country. What’s legal and profitable today might face restrictions tomorrow.

The importance of due diligence cannot be overstated here. Before diving in, research thoroughly, understand the risks completely, and never invest more than you can afford to lose entirely. As financial experts consistently advise, approach platforms promising extraordinary returns with extra caution.

For broader context on economic trends affecting these markets, check out More info about the economy. The “30x” promise highlights ambitious goals, but it also underscores why careful evaluation is essential before making any investment decisions.

Core Features and Underlying Technology

When you first log into crypto30x.com ice, you’ll notice something different from your typical cryptocurrency platform. The dashboard feels intuitive, almost like having a personal trading assistant right at your fingertips.

The platform’s AI-powered tools are where things get really interesting. These aren’t just fancy buzzwords – we’re talking about sophisticated automated trading bots that can execute trades while you’re sleeping (or enjoying a great meal, as we often are here in New York City). The system continuously monitors market movements and can make split-second decisions based on your predetermined parameters.

What really sets crypto30x.com ice apart is its real-time market analysis capabilities. The AI doesn’t just look at current prices – it analyzes patterns, identifies trends, and provides insights that would take human traders hours to compile. It’s like having a team of market analysts working around the clock, but without the hefty fees.

The user-friendly interface deserves special mention. Whether you’re a crypto newbie or a seasoned trader, the platform manages to be both simple enough for beginners and sophisticated enough for professionals. The design prioritizes clarity over complexity, which is refreshing in a space often cluttered with confusing charts and technical jargon.

Perhaps most importantly, crypto30x.com ice offers cross-chain compatibility. This means the platform can work across multiple blockchain networks, including Binance Smart Chain and Arbitrum. This flexibility gives users more options and potentially better opportunities across different blockchain ecosystems.

How AI and Blockchain Power the Platform

The magic behind crypto30x.com ice lies in how it combines two powerful technologies: artificial intelligence and blockchain. Think of blockchain as the secure foundation – it’s the decentralized network that ensures every transaction is recorded permanently and can’t be tampered with. This transaction security is crucial when you’re dealing with real money and high-stakes trading.

But here’s where it gets fascinating: the platform uses AI for trend analysis that goes far beyond what human traders could accomplish alone. The artificial intelligence processes massive amounts of data from multiple sources, identifying patterns and opportunities that might be invisible to the naked eye. It’s constantly learning and adapting, becoming more sophisticated with each market movement.

The portfolio management features leverage this AI power to help users balance their investments intelligently. Rather than putting all your eggs in one basket (a lesson we’ve learned well in the diverse food scene here in New York), the system can suggest diversification strategies based on your risk tolerance and market conditions.

If you’re curious about the underlying technology, you can learn about blockchain technology to get a deeper understanding. And for those interested in how blockchain networks operate more broadly, our guide on More info about Bitcoin mining provides valuable context about the computational power that makes these systems possible.

Security Measures for User Protection

Let’s be honest – security in the crypto world can be scary. We’ve all heard horror stories about hacked exchanges and lost funds. That’s why crypto30x.com ice takes security seriously, implementing multiple layers of protection that work together like a well-coordinated kitchen brigade.

Two-Factor Authentication (2FA) is your first line of defense. It’s like having a bouncer at the door who knows you personally – even if someone gets your password, they still can’t get in without that second verification step. This simple measure stops the vast majority of unauthorized access attempts.

The platform also uses cold wallet storage for the majority of user funds. Think of it as keeping your valuables in a safe deposit box rather than under your mattress. These funds are stored completely offline, making them virtually impossible for hackers to reach through internet-based attacks.

SSL encryption protects all data as it travels between your device and the platform’s servers. It’s the same technology that banks use, ensuring that sensitive information stays private even if someone tries to intercept it.

The platform also features secure chat features for community interaction, allowing users to communicate safely within the ecosystem. Data protection protocols ensure that personal information is handled responsibly and in compliance with privacy regulations.

But here’s the thing – even with all these security measures, user responsibility remains crucial. The platform can build the most secure vault in the world, but if you give someone the combination, that’s on you. Strong passwords, keeping your 2FA device secure, and being cautious about phishing attempts are all part of staying safe in the crypto space.

For additional insights into secure digital interactions and privacy-focused platforms, you can Learn More about best practices in the decentralized web ecosystem.

Getting Started and Navigating the Platform

Ready to dive into crypto30x.com ice? From our perspective here in New York City, where digital innovation moves at lightning speed, we’ve watched countless platforms launch with grand promises. The good news? This platform actually makes getting started surprisingly straightforward, whether you’re a crypto newbie or a seasoned trader.

Your journey begins with creating an account on the crypto30x.com ice website. This first step is refreshingly simple – just provide a strong password and your email address. Think of your password as the front door to your digital wallet; you want it to be Fort Knox-level secure.

Next comes the KYC (Know Your Customer) verification. Now, we know this part can feel like waiting in line at the DMV, and some users have mentioned it can be sluggish during busy periods. But here’s the thing – this identity verification step is what separates legitimate platforms from the sketchy ones. It’s their way of keeping both you and the platform safe from regulatory headaches.

Once you’re verified, it’s time to fund your account. The platform offers plenty of flexibility here, accepting everything from traditional credit cards and bank transfers to popular cryptocurrencies like Bitcoin and Ethereum. It’s like having multiple on-ramps to the crypto highway.

With money in your account, you’ll want to explore the platform’s features before jumping into trading. Take a virtual tour of the dashboard, play around with those AI-powered tools, and get familiar with the automated trading bots. Think of this as your practice run before the real game begins.

Finally, when you’re comfortable with the layout, you can start trading. Set realistic goals, understand what you’re willing to risk (never more than you can afford to lose!), and use those analytical tools to spot opportunities. Even the fanciest AI can’t predict the future – the crypto market has a mind of its own.

The whole process reflects the platform’s goal of serving active cryptocurrency traders without making them jump through unnecessary hoops. For more details about the broader platform ecosystem, check out Crypto30x.com.

Evaluating the Risks and Rewards of crypto30x.com ice

When you’re considering crypto30x.com ice, it’s like standing at the edge of a diving board – the potential rewards look enticing, but you need to understand exactly how deep the water is below. From our perspective watching the financial markets evolve, we’ve learned that the most successful investors are those who approach high-potential platforms with both excitement and healthy skepticism.

The potential benefits of crypto30x.com ice are genuinely compelling. The platform promises high return potential – that “30x” isn’t just marketing fluff, it represents the kind of exponential growth that early crypto adopters have seen before. The user-friendly tools make sophisticated trading accessible to everyday investors, not just Wall Street pros. There’s also something powerful about being part of a community-driven platform where your engagement actually earns you rewards rather than just enriching a corporation.

The numbers tell part of the story too. The platform has experienced a 200% increase in user registrations, suggesting genuine interest and adoption. When we see growth like that, it usually indicates the platform is solving real problems for users.

But here’s where things get complicated – and this is where our years of covering financial trends really matter. Market volatility in cryptocurrency isn’t just a buzzword; it’s a daily reality that can turn promising investments into significant losses overnight. The same market forces that could deliver those 30x returns can just as easily work against you.

Regulatory uncertainty adds another layer of complexity. Crypto laws are constantly changing and vary dramatically between countries. What’s perfectly legal today might face restrictions tomorrow, potentially affecting your ability to access funds or trade freely.

Security risks remain a persistent concern in the crypto space. While crypto30x.com ice implements robust security measures, the broader ecosystem still sees regular hacks and scams. Even with cold wallet storage and two-factor authentication, user error or platform vulnerabilities can lead to losses.

Perhaps most concerning is the limited historical data available for newer platforms like crypto30x.com ice. Unlike established markets where you can analyze decades of performance, newer crypto platforms don’t have extensive track records to help predict future behavior.

The platform does offer risk management tools including stop-loss orders and encourages diversification strategies. These features show that the developers understand the risks involved and are trying to help users manage them responsibly.

For broader context on how these market dynamics affect the crypto space, you might find our guide on More info about Bitcoin price helpful in understanding the volatility patterns that affect all cryptocurrency investments.

User Reviews and Expert Opinions

The community response to crypto30x.com ice paints an interesting picture of a platform that’s getting some things right while still working through growing pains.

Positive feedback consistently highlights the platform’s user interface and speed. Users appreciate that they can execute trades quickly without getting bogged down in overly complex menus or slow response times. This matters more than you might think – in volatile crypto markets, seconds can mean the difference between profit and loss.

The negative feedback tends to focus on verification speed during peak periods. Some users report waiting longer than expected for KYC approval, especially during high-traffic times. While this frustration is understandable, it’s worth noting that thorough verification processes, though slower, often indicate a platform taking regulatory compliance seriously.

Analyst caution is pretty consistent across the board. Most experts acknowledge the platform’s innovative features while emphasizing the speculative nature of high-return crypto investments. One common theme we’ve noticed is experts recommending that users never invest more than they can afford to lose entirely.

Community sentiment appears cautiously optimistic. Users seem genuinely excited about the SocialFi concept and the potential for earning rewards through engagement, but experienced crypto traders are tempering expectations with realistic risk assessment.

The importance of independent research cannot be overstated. While user reviews and expert opinions provide valuable insights, your financial situation and risk tolerance are unique to you.

Addressing Market Volatility and Regulatory Problems

Crypto30x.com ice doesn’t pretend that market volatility doesn’t exist – instead, the platform tries to give users tools to steer it more effectively.

The stop-loss orders feature is particularly valuable for managing downside risk. You can set automatic sell orders that trigger if prices drop to predetermined levels, potentially limiting losses during market downturns. It’s like having a safety net that activates when things go wrong.

Diversification strategies are built into the platform’s educational approach. Rather than encouraging users to put everything into one high-risk bet, the platform promotes spreading investments across different assets and strategies. This is basic investment wisdom that applies whether you’re trading crypto or buying stocks.

On the regulatory front, crypto30x.com ice appears to be making compliance efforts to work within existing legal frameworks. The KYC requirements, while sometimes slow, demonstrate an attempt to meet regulatory standards that could help protect the platform’s long-term viability.

Changing crypto laws remain a wild card that no platform can fully control. Different countries are taking vastly different approaches to cryptocurrency regulation. For the most current regulatory information, resources like adviserinfo.sec.gov can help you understand the evolving legal landscape.

The reality is that regulatory uncertainty isn’t going away anytime soon. Successful crypto investors learn to factor this uncertainty into their decision-making rather than hoping it will resolve quickly.