Why Modern Restaurant Owners Need Fast Access to Capital

Traceloans.com business loans provide a streamlined alternative to bank financing, with approvals in 24-48 hours and loans from $5,000 to $500,000.

Quick Overview:

- Loan Types: Term loans, working capital, equipment financing, invoice financing, business lines of credit

- Interest Rates: Typically 6% to 29% based on loan type and business profile

- Approval Speed: 24-48 hours

- Funding Time: 1-2 business days after approval

- Credit Requirements: Focus on business performance over credit score

- Collateral: Many loans are unsecured

In New York’s hyper-competitive restaurant scene, from Manhattan to Brooklyn, restaurants need fast access to capital. Whether for expansion, equipment upgrades, or cash flow management, traditional banks often fall short, rejecting over 60% of small business loan applications.

This leaves many New York food entrepreneurs seeking alternatives. For instance, a Brooklyn bakery owner, rejected by banks, secured online funding in 24 hours for new ovens and doubled her revenue within six months.

Modern platforms like traceloans.com fill this gap with digital-first solutions. They evaluate your business on performance metrics, not just credit scores, making funding more accessible for the New York hospitality industry, where cash flow is variable but growth potential is high.

Similar topics to * traceloans.com business loans*:

What Are Traceloans.com Business Loans and How Do They Work?

When your Manhattan cafe’s espresso machine breaks or a prime location for a second restaurant opens up, you need capital fast. This is where traceloans.com business loans shine.

Traceloans.com is a modern online lending platform that cuts through traditional banking red tape. Instead of waiting weeks, you get a streamlined digital experience. The platform uses smart technology to evaluate your business on actual performance metrics—like revenue and time in business—rather than just your credit score. This means your thriving food truck or popular bistro is judged on its real-world success.

The process is fast and simple. You can apply online in minutes, get approved within 24-48 hours, and have funds in your account within days. It’s financing that understands opportunities don’t wait.

Understanding the Different Loan Products

Traceloans.com business loans offer a menu of options to fit your specific needs.

- Term loans: Get a lump sum upfront for big moves like opening a new location or a major renovation. Repayment is over a set period, typically 6 months to 5 years.

- Working capital loans: Ideal for day-to-day needs and smoothing out seasonal cash flow bumps, covering everything from payroll to inventory.

- Business lines of credit: A financial safety net. You’re approved for a certain amount but only pay interest on what you use. Perfect for unexpected repairs or inventory deals.

- Equipment financing: For upgrading kitchen gear. The equipment itself often serves as collateral, making approval easier.

- Invoice financing: A lifesaver for caterers waiting on client payments. Get an advance on your outstanding invoices to maintain healthy cash flow.

- Merchant cash advances: Great for businesses with strong daily credit card sales. You get immediate funds in exchange for a percentage of future card sales.

Key Features of traceloans.com business loans

What makes traceloans.com business loans stand out?

- Speed: Approvals in 24-48 hours and funding within 1-2 business days.

- Flexibility: Repayment terms from 6 months to 5 years, often with no prepayment penalties.

- Competitive Interest Rates: Rates typically range from 6% to 29%, often beating traditional banks, especially for newer businesses.

- No Collateral Required: Many loans are unsecured, so you don’t have to risk personal or business assets.

- Customized Loan Amounts: From $5,000 for small projects to $500,000 for major expansions.

- Digital Dashboard: Track your application, manage payments, and access financial insights online.

- Alternative Data Assessment: Your business’s revenue and financial health are weighed heavily, not just your credit score. A minimum of 6 months in operation is usually required.

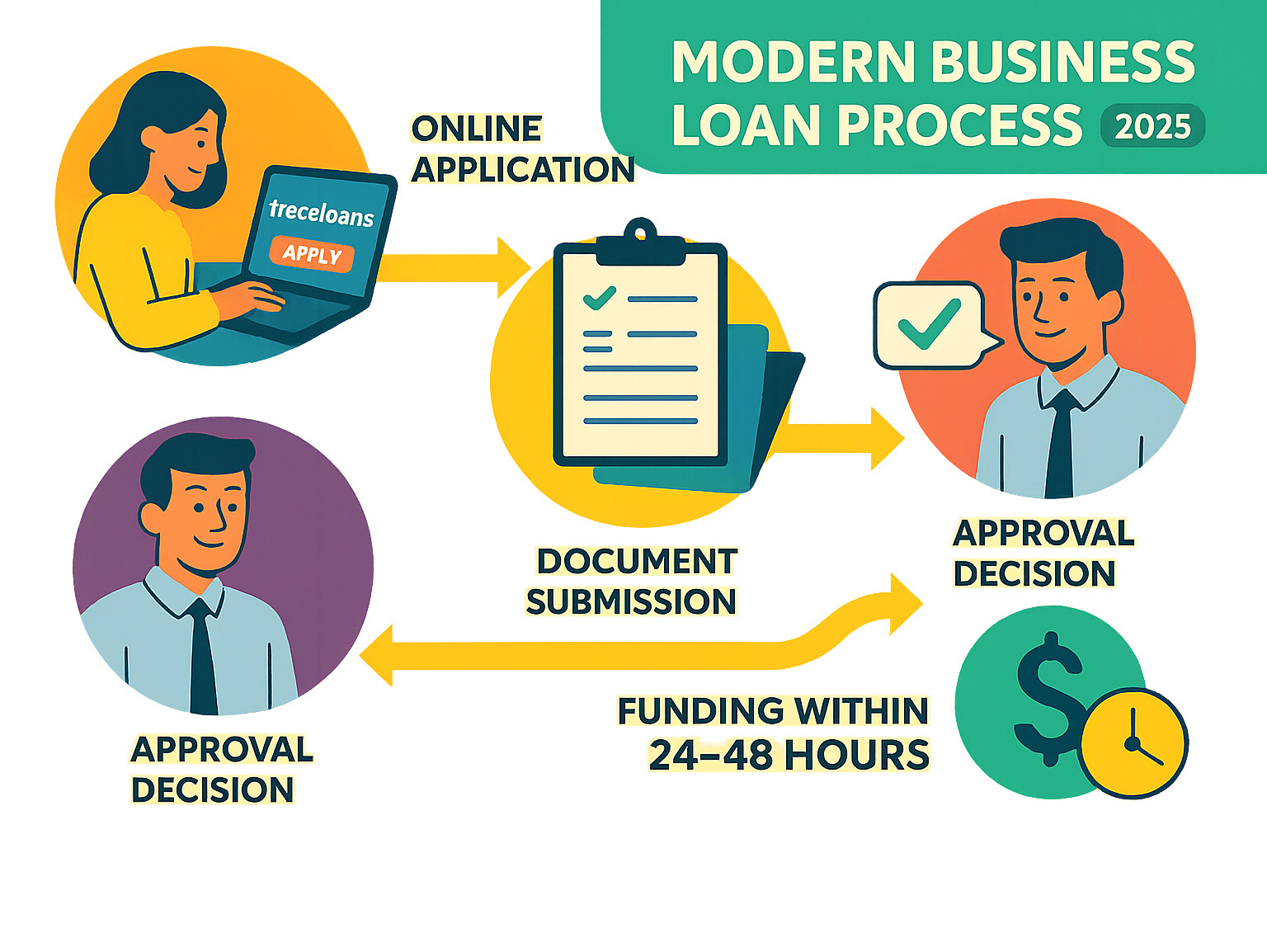

A Step-by-Step Guide to the Application and Approval Process

Getting funding for your food business shouldn’t be a complex ordeal. The traceloans.com business loans process is refreshingly straightforward and designed for busy entrepreneurs in places like Manhattan and Brooklyn.

The journey starts with a brief online application. On the traceloans.com website, you’ll provide essential details like your business name, revenue, and funding needs. This initial step takes just a few minutes.

Next, you’ll submit documentation for verification. This is simpler than traditional bank requirements and typically includes:

- Business registration and licenses

- Proof of identity

- Business bank statements for the last 6-12 months

- Tax returns for the past 1-2 years

For larger loans, a business plan might be requested, but many loans are unsecured, meaning no collateral is needed.

After submission, an assessment system using automated tools and alternative data analysis reviews your eligibility. This is where the platform shines, evaluating your actual business performance, not just your credit score.

Approval decisions typically arrive within 24-48 hours. If approved, you’ll receive a clear, transparent loan offer detailing the amount, interest rate, and terms. Once you digitally sign the agreement, funds are usually deposited into your business account within 1-2 business days.

Maximizing Your Chances of Approval

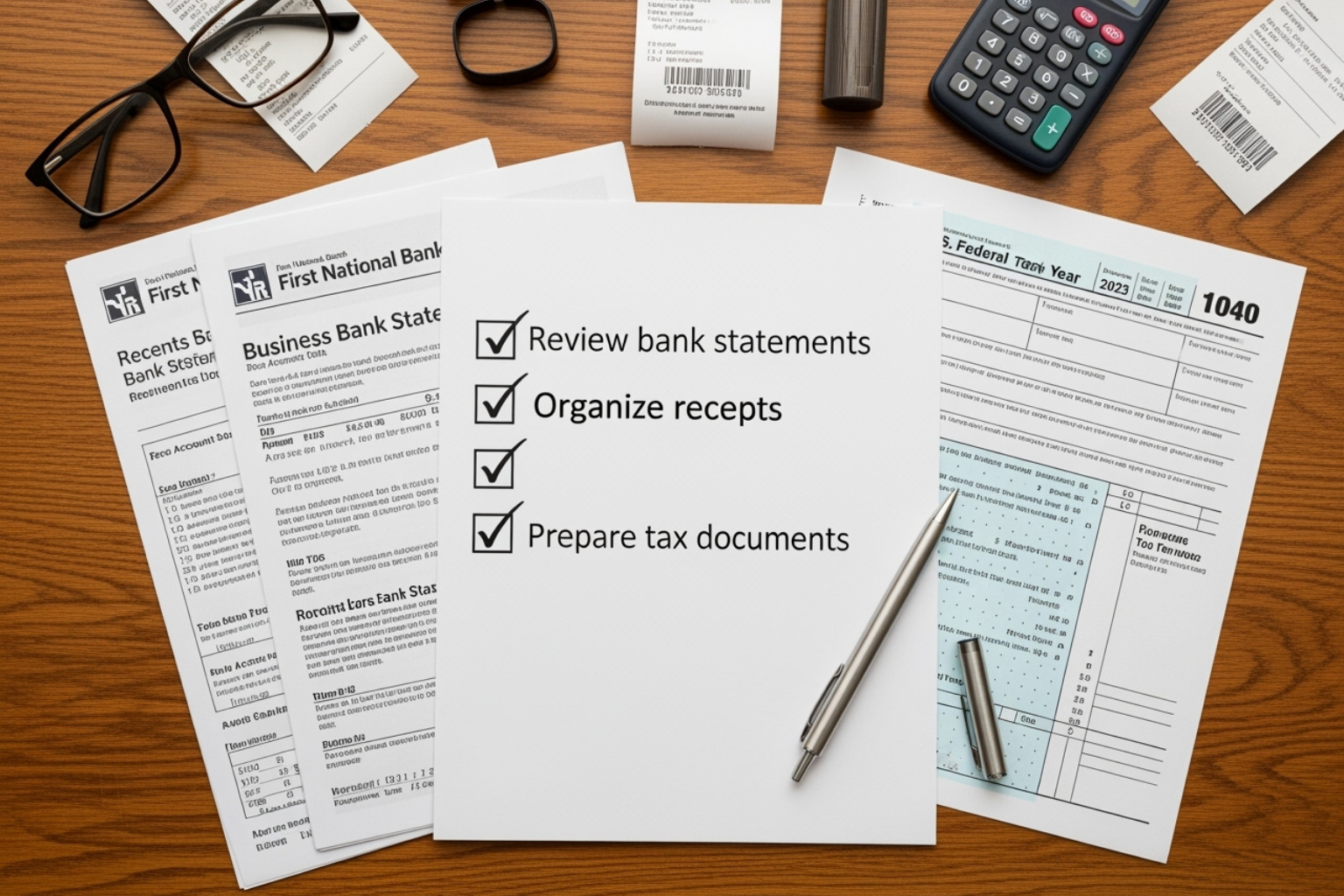

To boost your approval odds for traceloans.com business loans, a little preparation helps.

- Organize Financial Records: Clean bank statements and current tax returns demonstrate professionalism and smooth out the assessment.

- Show Steady Revenue: Lenders look for consistency and growth over time. An annual revenue of around $100,000 is often a good benchmark, but this can vary.

- Have a Clear Business Plan: Articulate how you’ll use the funds to generate returns, whether for new equipment or expanding into catering.

- Request a Realistic Amount: Applying for a loan that aligns with your revenue and repayment ability signals responsible financial planning.

- Be Honest: Discrepancies in your application can cause delays or denial. Be upfront about any past challenges.

For potentially better terms, you can explore government-backed options like SBA loans, which traceloans.com can help connect you with. Learn more at Understanding government-backed loan programs.

Understanding Interest Rates and Repayment Terms for traceloans.com business loans

The real cost of a loan is crucial. Traceloans.com business loans typically have interest rates from 6% to 29%. Your specific rate depends on the loan type, your business’s financial health, the loan amount, and the repayment term.

Repayment terms are flexible, ranging from 6 months to 5 years, allowing you to match payments to your cash flow. You can often choose daily, weekly, or monthly payments. A key benefit is the potential for no prepayment penalties, letting you pay off the loan early to save on interest. All costs, including any fees, are outlined upfront for full transparency. Always read the loan agreement carefully before signing.

Comparing Traceloans.com to Traditional Funding Routes

For a restaurant owner in Greenwich Village, a broken espresso machine requires an immediate fix. Waiting weeks for a traditional bank loan isn’t feasible. This is where modern online lending platforms offering traceloans.com business loans have revolutionized financing for the food service industry.

Traditional banks reject over 60% of small business loan applications, often due to slow processes and rigid requirements. Let’s compare the two approaches:

- Approval Speed: Online platforms like traceloans.com typically approve loans in 24-48 hours. Traditional banks can take 1-4 weeks, or even longer. For a business owner needing to act fast, this difference is critical.

- Collateral Requirements: Many online loans are unsecured, meaning you don’t have to risk personal or business assets. Banks, on the other hand, often require significant collateral.

- Application Process: Online applications are digital, brief, and can be completed in minutes. Banks require extensive paperwork and multiple in-person meetings.

- Flexibility: Online lenders use alternative data (daily sales, seasonal patterns) to assess your business’s health and offer a wider variety of loan products. Banks tend to have rigid criteria and fewer options, often missing the nuances of a modern food business.

While banks might offer slightly lower rates to borrowers with perfect credit, their lengthy and strict processes are often unsuitable for businesses that need agility. The shift to online lending is a direct response to these challenges, as highlighted by small business lending statistics.

For food and travel businesses, the speed and accessibility of modern online lending can be the difference between seizing an opportunity and falling behind.

Potential Risks and How to Borrow Responsibly

Any business loan, including traceloans.com business loans, comes with responsibilities. Understanding the risks is key to making smart financial decisions for your New York restaurant.

The biggest risk is taking on more debt than your business can handle. While competitive, interest rates add to your costs. It’s crucial to factor in the total cost of the loan over its term. Another challenge is repayment affordability. A monthly payment might seem manageable during the summer tourist rush in Manhattan, but you must be able to cover it during the slower winter months as well. Missing payments can lead to fees and damage your business credit.

Finally, resist the temptation to over-borrow. Taking more than you need “just in case” adds unnecessary interest costs and can strain your cash flow—a dangerous game when dealing with high New York City rents.

To borrow responsibly:

- Understand Your Loan Agreement: Dig into the details beyond the monthly payment. Know the APR, any fees, and prepayment terms.

- Create a Realistic Budget: Map out your cash flow for the entire loan term, accounting for seasonal variations and unexpected expenses.

- Use Funds for ROI Activities: The best use of traceloans.com business loans is for growth initiatives like new equipment or marketing that will generate returns. Avoid using loans to cover the high operational shortfalls common in the city.

- Maintain Financial Discipline: Set up automatic payments and keep detailed records. If you anticipate trouble, communicate with your lender early.

A loan should be a strategic investment, not a financial burden. Used responsibly, it can be a powerful catalyst for growth in the competitive New York market.

Frequently Asked Questions about traceloans.com business loans

Here are answers to the most common questions food entrepreneurs in Manhattan and Brooklyn have about traceloans.com business loans.

Do I need a good credit score to apply?

Not necessarily. While a good credit score helps, traceloans.com business loans use an alternative data assessment. This means they evaluate your business’s overall health, focusing on performance metrics like monthly revenue and time in operation (usually a 6-month minimum). This holistic approach provides accessible options for lower credit scores, a lifeline for many New York businesses that have strong sales but may not meet the rigid credit criteria of traditional banks.

How quickly can I receive the funds?

Speed is a major advantage. The approval timeline is typically 24-48 hours. After you accept the loan terms, the disbursement process is also fast, with funds deposited directly into your business bank account within 24-48 hours in most cases. This rapid access to capital is a game-changer when a prime retail space suddenly opens up in Brooklyn or you need to secure a large catering contract in Manhattan.

Are there any hidden fees involved?

Reputable lenders prioritize fee transparency. The application process is usually free. If your loan is approved, there may be an origination fee or service fees, but these costs should be clearly disclosed in your loan offer. Always take the time for reviewing loan terms carefully to understand the interest rate, repayment schedule, and all associated costs before you sign. A basic understanding of what constitutes a business loan can help you steer these details confidently.

Conclusion

After exploring traceloans.com business loans, it’s clear that financing for small businesses has fundamentally changed. The days of waiting weeks for a bank decision that doesn’t account for the unique pace of New York’s food scene are over.

Speed and flexibility are the key benefits. With approvals in 24-48 hours and rapid funding, these loans operate at the speed modern businesses require. This modern solution for SMEs looks beyond credit scores to evaluate your business’s true potential by considering factors like daily sales and growth trends.

With a variety of products, from term loans for major expansions to working capital for seasonal cash flow, there’s likely an option custom to your needs. However, responsible borrowing is crucial. Understanding your terms and using funds strategically turns a loan into a powerful tool for growth.

Empowering business growth is the goal. Reliable access to capital lets you focus on what matters: creating amazing dining experiences and expanding your culinary vision. Traceloans.com business loans represent a major step in making that support accessible and aligned with how today’s businesses operate.

Ready to dive deeper into building your food business? Explore more resource guides for your business for insights on everything from market trends to operational strategies.