What You Need to Know About Traceloans.com

In a city as as New York, finding the right financial tool is crucial. Traceloans.com is an online loan marketplace that connects borrowers with multiple lenders rather than providing loans directly, simplifying the search for New Yorkers on the move. If you’re wondering whether this platform is legitimate and how it works, here’s what you need to know:

Quick Facts About Traceloans.com:

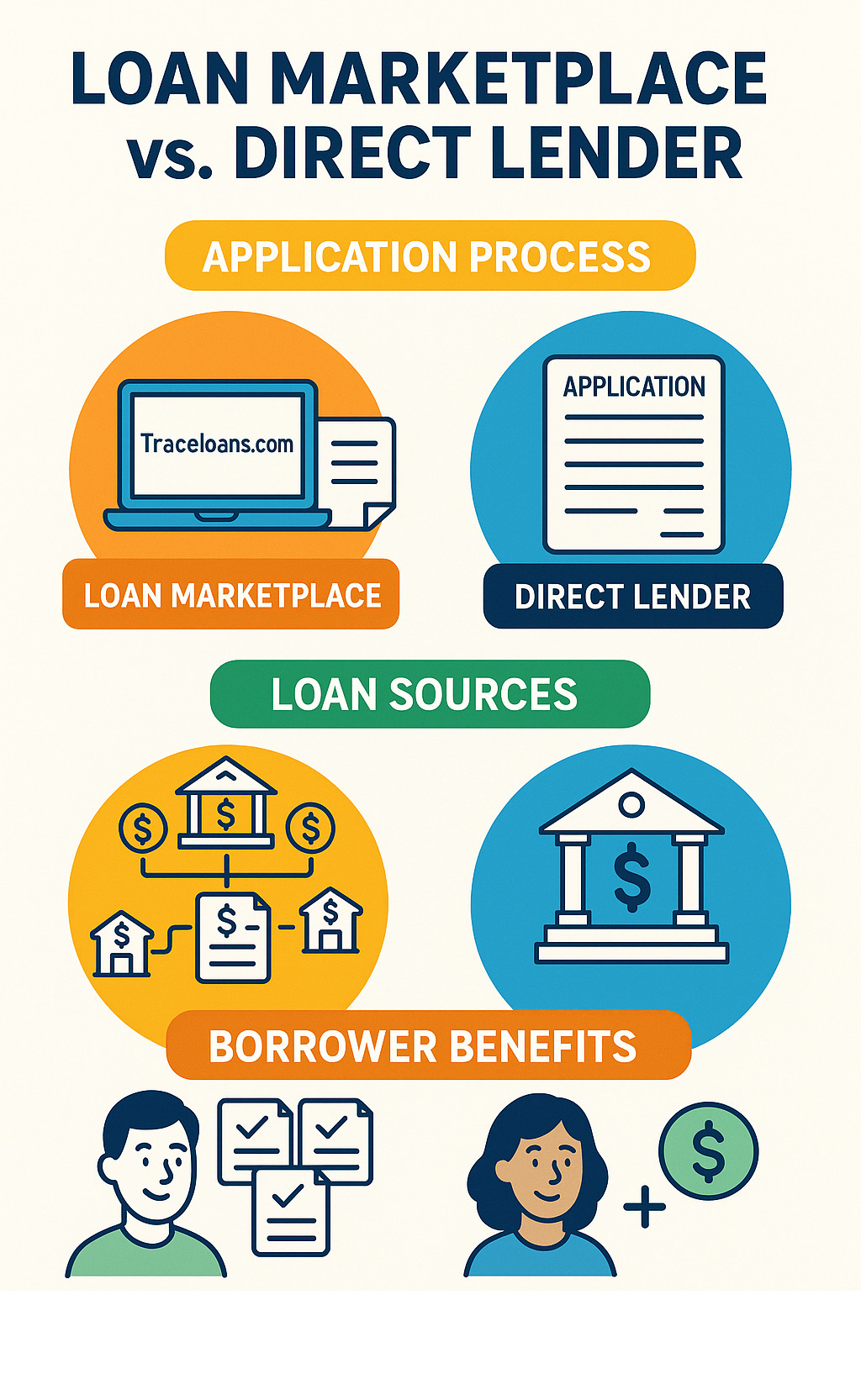

- Platform Type: Loan marketplace (not a direct lender)

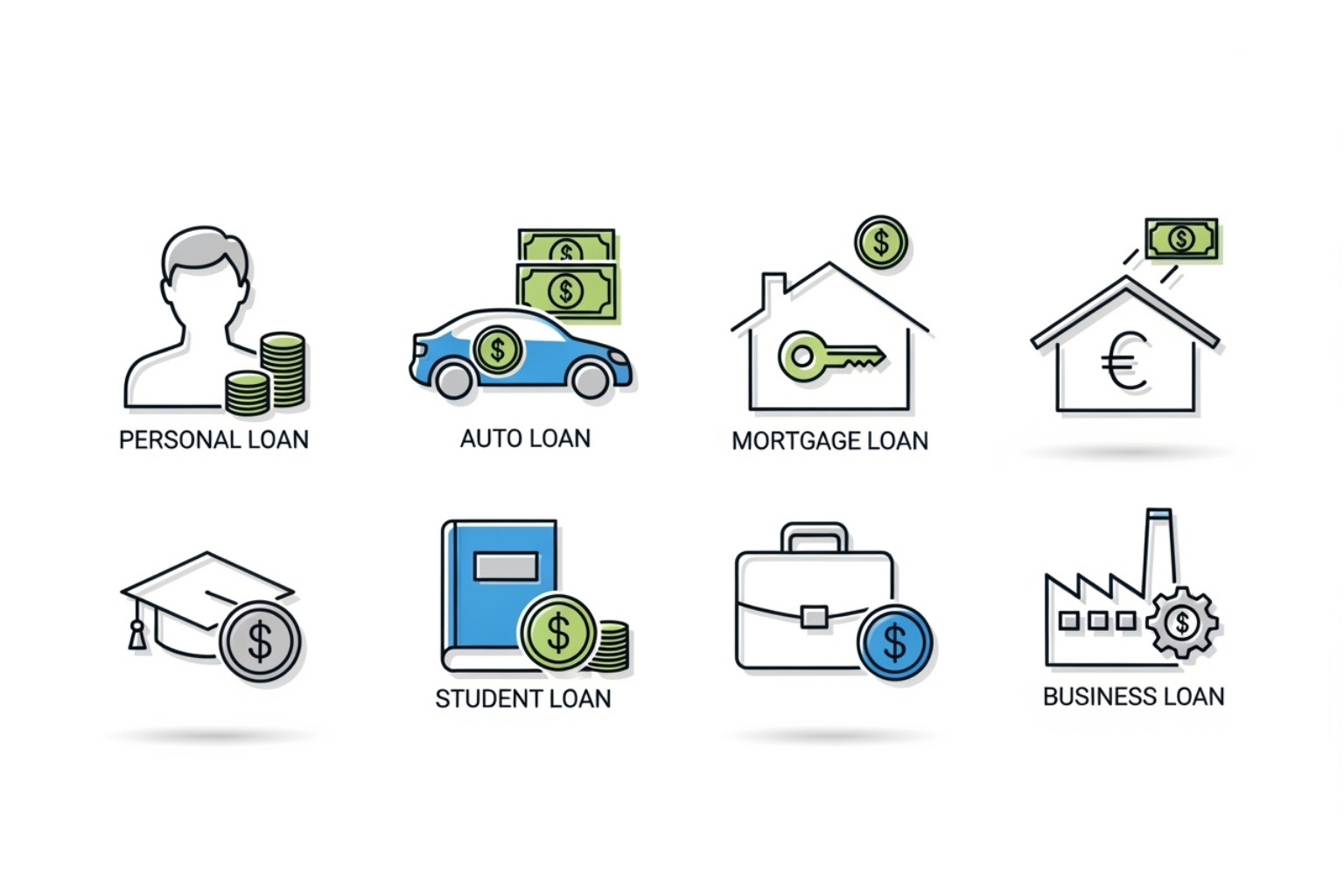

- Loan Types: Personal, mortgage, auto, student, business, and debt consolidation loans

- Credit Requirements: Works with borrowers who have credit scores as low as 580

- Cost to Use: Free for borrowers to search and compare loan offers

- How It Works: You fill out one application and receive multiple loan offers from different lenders

The platform operates by taking your loan requirements and matching you with lenders from their network. You can then compare interest rates, terms, and fees side by side before choosing the best option for your needs.

Key Benefits:

- Compare multiple loan offers without visiting different lender websites

- Pre-qualification process that doesn’t impact your credit score

- Access to lenders who work with various credit profiles

- Educational resources and loan calculators

Important Considerations:

- While using the platform is free, individual lenders may charge fees

- You’ll need to review terms carefully with your chosen lender

- The actual loan comes from the lender, not from Traceloans.com

Traceloans.com terminology:

- fintechzoom.com us markets today

- profitable intraday trading advice 66unblockedgames.com

- sky bri net worth

What is Traceloans.com and How Does It Work?

In a city like New York, finding the right financial help can feel a bit like searching for a hidden gem in the West Village. But what if there was a simpler way? That’s where traceloans.com steps in! Think of it like a smart matchmaker for loans. It’s not a direct lender itself, meaning they don’t give you the money directly. Instead, they act as a fantastic bridge, connecting you with a wide network of lenders. This means you get to see many options in one spot, helping you find the loan that fits your needs best.

The real magic of traceloans.com lies in how it simplifies a process that can often feel overwhelming. Instead of hopping from one bank website to another, filling out endless forms, you just complete one easy application on their platform. This smart system then quickly matches your needs with lenders from their network who are most likely to say “yes!” You’ll then get to compare different loan offers side-by-side. It’s like having a personal assistant find all the best deals for you, which is a real game-changer for making smart money choices in our city.

Of course, when we talk about money online, security is super important. Traceloans.com knows this well. They use strong security measures, like something called 256-bit SSL encryption, to keep your personal and financial details safe. This means your information is protected while it travels across the internet. While they do a great job as a secure middleman, your actual loan agreement will be with a separate lender. So, it’s always a good idea to quickly check their privacy rules too. We, as helpful guides, always recommend taking this extra step for your peace of mind!

The Loan Application Process on traceloans.com

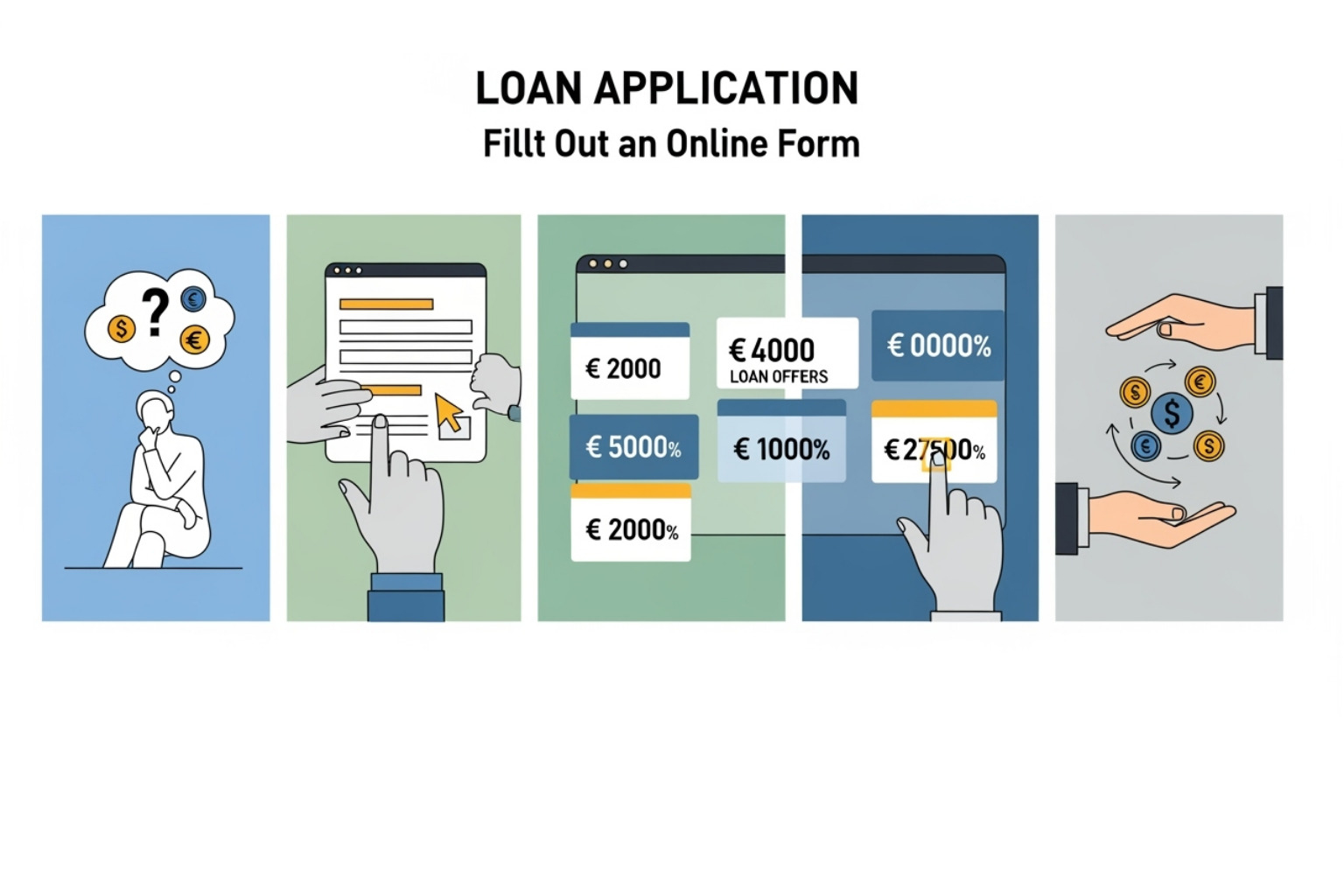

Applying for a loan can sometimes seem as tricky as following a recipe with missing steps, but traceloans.com aims to make it as smooth as possible. From our experience, their process is designed to be very simple and quick, usually happening in these clear steps:

- Step #1: Figure out what you need. Before you even start, traceloans.com suggests you think about why you need the loan and how much money you’ll need. Is it for an unexpected expense, renovating your pre-war apartment, consolidating high-interest debt from navigating city life, or maybe launching that food truck you’ve been dreaming of? Knowing your goal helps you pick the right loan and borrow just what’s necessary. This first step is key for borrowing wisely in a high-cost environment like ours.

- Step #2: Fill out the online form. This is where the process really kicks off! You’ll complete a quick form on the traceloans.com website. It typically asks for your basic details, income, job status, and how much you want to borrow. The best part? It’s just one form for possibly many offers, saving you tons of time and effort.

- Step #3: Check out your loan offers. Once you send in your application, traceloans.com‘s system gets to work, connecting you with lenders. In a very short time – sometimes within hours – you’ll start seeing loan offers made just for you. This is exciting, as you get to see different interest rates, repayment plans, and fees laid out clearly.

- Step #4: Compare your options. With several offers in hand, you can now compare them easily! Traceloans.com provides tools to help you look at these offers side-by-side. Pay close attention to the Annual Percentage Rate (APR), the total amount you’ll pay back, your monthly payments, and any extra fees. This comparison lets you choose the option that best fits your budget and what you want to achieve financially.

- Step #5: Finish up the loan and get your money. After you pick the best loan offer, you’ll complete the agreement directly with that chosen lender. This usually means reviewing and signing the loan papers. Once that’s done, the money often arrives quickly, sometimes within just 1 to 3 business days, right into your bank account. It’s truly amazing how fast things can move these days!

Key Features and Borrower Tools

What truly makes traceloans.com stand out isn’t just that it connects you with lenders. It’s also committed to giving borrowers helpful tools and information. We always appreciate platforms that go the extra mile to teach their users, and traceloans.com definitely does!

One of their best tools is the loan comparison tool. This isn’t just about showing you different offers; it’s about giving you a clear, easy way to compare important loan details. You can easily see how different interest rates, loan terms, and monthly payments stack up against each other. This helps you understand the long-term impact of your decision, so you can choose wisely.

Another very useful feature is the fast pre-qualification process. Nobody likes the idea of their credit score taking a hit just for “looking around.” With traceloans.com, their pre-qualification checks usually don’t affect your credit score. They often use a “soft” credit check, which means you can get an idea of what loans you might qualify for without any worries about your credit. It’s like trying on a new outfit before you buy it – no commitment needed!

To help you borrow responsibly, traceloans.com also offers a loan eligibility calculator and an EMI calculator. These tools are fantastic for figuring out how much you might be able to borrow based on your income, or to calculate your estimated monthly payments for a certain loan amount. Such calculators are super helpful for planning your budget and making sure you can comfortably afford the payments.

Beyond these practical tools, traceloans.com also has many educational resources and financial guides. This includes articles and blog posts on different money topics, from understanding APR and credit scores to tips on managing debt and improving your financial health. As folks who love creating helpful guides ourselves, we applaud their effort to boost financial knowledge. These resources are designed to help everyone, including our local community members here in NYC, make smart choices about borrowing, ensuring they understand all sides of their financial decisions.

A Deep Dive into Loan Products Offered

When it comes to finding the right financial solution, traceloans.com truly shines with its impressive variety of loan options. Think of it like a well-stocked kitchen – no matter what financial recipe you’re cooking up, you’ll likely find the right ingredients here. Whether you’re dealing with unexpected expenses, planning a major purchase, or growing your business, this platform connects you with lenders who specialize in exactly what you need.

The beauty of traceloans.com lies in its comprehensive approach to lending. Instead of being limited to one type of loan from a single lender, you get access to a whole network of financial partners. This means more options, better rates, and terms that actually fit your situation. It’s like having a personal financial concierge who knows exactly where to find the best deals.

To give you a clearer picture of what’s available, here’s how the main loan categories typically stack up:

| Loan Type | Typical APR Range (Subject to Credit) | Loan Amount Range | Typical Term Length |

|---|---|---|---|

| Personal Loans | 6.99% – 20% | $1,000 – $50,000 | 1 – 7 years |

| Auto Loans | 5.99% – 14% | $5,000 – $100,000 | 2 – 7 years |

| Business Loans | 7% – 18% | $10,000 – $500,000 | 1 – 10 years |

Personal and Debt Consolidation Loans

Personal loans through traceloans.com are like the Swiss Army knife of borrowing – incredibly versatile and useful for navigating life in NYC. These unsecured loans don’t require you to put up your co-op or condo as collateral, which makes them accessible for many borrowers who need quick financial solutions.

Medical bills are one of the most common reasons people turn to personal loans. When health emergencies strike, the last thing you want to worry about is how to pay for treatment. A personal loan can bridge that gap, giving you breathing room to focus on recovery instead of financial stress.

Home improvements are another popular use. Whether you’re finally updating that tiny kitchen in your Manhattan apartment or making necessary repairs, personal loans can fund these projects without the lengthy approval process of a home equity loan. You get the money faster and can start your project sooner.

But perhaps the most powerful use of personal loans is debt consolidation. If you’re juggling multiple credit card payments from trying to keep up with the city’s pace, combining those debts into a single personal loan can be a game-changer. Instead of managing several payments at different rates – some as high as 25% or more – you could secure a personal loan at a much lower interest rate.

The math is compelling. Let’s say you have $15,000 spread across three credit cards at an average of 22% APR. By consolidating through a personal loan at 12% APR, you could save thousands in interest and have just one simplified payment each month. It’s not just about saving money – it’s about regaining control of your financial life.

For more detailed information about how traceloans.com handles these loans, check out Traceloans.com – Everything You Need To Know About .

Mortgage and Home Loans

Buying a home in New York City is a unique challenge and probably the biggest financial decision most of us will ever make. Traceloans.com brings its marketplace magic to home financing, connecting you with multiple mortgage lenders so you can compare options side by side. This is incredibly valuable in the competitive NYC market, where even a small difference in interest rates can mean tens of thousands of dollars over the life of your loan.

Conventional loans make up the majority of home purchases. These typically require good credit and a down payment, but they offer competitive rates and flexible terms. Through traceloans.com, you can compare offers from different lenders to find the best conventional loan for your situation.

Government-backed loans open doors for many first-time buyers and those with unique circumstances. FHA loans are popular for their lower down payment requirements, while VA loans provide incredible benefits for military veterans and active service members. USDA loans help rural buyers achieve homeownership with attractive terms.

Refinancing is another area where traceloans.com shines. Maybe you bought your home when rates were higher, or perhaps you want to switch from an adjustable-rate to a fixed-rate mortgage for more predictable payments. The platform can help you explore your options and potentially save money on your monthly payments.

The property purchase process becomes less overwhelming when you have multiple lenders competing for your business. You’ll see different rate offers, closing costs, and terms laid out clearly, making it easier to choose the mortgage that fits your long-term financial goals.

Auto, Student, and Business Loans

Vehicle financing through traceloans.com can take the hassle out of getting a car, which for many New Yorkers is still a necessity for commuting or weekend getaways. Instead of being limited to dealer financing or your local bank, you can compare auto loan offers from multiple lenders. This competition often results in better rates and terms, especially if you have good credit.

Auto loans typically offer some of the lowest interest rates available, starting around 5.99% APR for qualified borrowers. The competitive rates reflect the fact that the vehicle itself serves as collateral, reducing risk for lenders. Flexible terms ranging from 2 to 7 years let you balance monthly payment size with total interest paid.

Student loans address the rising education costs that challenge so many families, especially with world-class universities right here in NYC. While federal student loans should typically be your first choice, private loans through traceloans.com can fill gaps in funding for tuition, books, and the high cost of living as a student in the city. Many lenders offer deferred repayment options, so you can focus on your studies without immediate payment pressure.

Business loans open up opportunities for entrepreneurs and established business owners alike. Whether you need startup funding for a new restaurant in SoHo or capital for business expansion of your Queens-based catering company, traceloans.com connects you with lenders who understand the unique pulse of New York’s business scene.

The flexible terms available through the platform mean you can find financing that matches your business cycle. A seasonal business might need different repayment terms than a steady service company. With loan amounts ranging from $10,000 to $500,000 and terms from 1 to 10 years, there’s likely a solution that fits your business model.

What makes traceloans.com particularly valuable for business owners is the speed of the process. When opportunity knocks, you need funding quickly. The platform’s streamlined application and comparison process means you can move faster than traditional business lending channels.

Navigating Eligibility, Credit Scores, and Rates

Understanding eligibility, credit scores, and rates can feel like trying to steer the MTA during rush hour. But don’t worry, this is where you get down to the brass tacks of loan applications, and traceloans.com is here to help make it much clearer for New Yorkers! While the exact rules might vary a bit from lender to lender, the platform helps you get a good feel for the general landscape and even find options if your credit isn’t quite perfect.

So, what do lenders generally look for? Typically, to be eligible for a loan through traceloans.com‘s network, you’ll need to be at least 18 years old and a legal resident of the U.S. Lenders also want to see that you have a steady income and a stable employment history—which they understand can look different in a city like New York with its thriving gig economy. This helps them feel confident that you’ll be able to make your repayments comfortably. And, of course, having an active bank account is usually a must for getting your funds and setting up those easy repayments.

How traceloans.com Handles Bad Credit

One of the biggest problems for many people seeking a loan is dealing with a less-than-perfect credit score. It can feel like traditional lenders slam the door shut right in your face. But here’s where traceloans.com truly shines as a guide of hope! They specialize in connecting borrowers, even those with bad credit or low credit scores, with lenders who are specifically set up to work with these situations.

Imagine finding a network that includes lenders willing to consider scores as low as 580. That’s a huge difference from many mainstream lenders! Now, it’s important to be honest: loans for those with lower credit scores typically come with higher interest rates (you might see APRs in the 15-35% range) and perhaps some stricter terms. This is simply because lenders see a bit more risk involved.

However, here’s the silver lining: using these loans responsibly can actually be a fantastic way to start rebuilding your credit. By consistently making your payments on time, you’re showing financial discipline, which can really give your credit score a healthy boost over time. Plus, traceloans.com doesn’t just connect you; they also offer helpful resources and guides on how to improve your credit score. They often emphasize simple but powerful tips like always paying on time, keeping your credit utilization low (under 30% is a good rule of thumb!), and regularly checking your credit report for any errors.

Typical Interest Rates and Repayment Terms

When you’re looking at loan offers, the interest rates and repayment terms are super important. They directly affect how much the loan will ultimately cost you. Traceloans.com helps you find competitive rates, but remember, the rate you actually get will depend on your credit profile and the specific loan product you choose.

Let’s talk numbers! For flexible personal loans, if your credit is in great shape, you might find rates starting as low as 6.99% APR. These loans usually come with repayment terms ranging from 1 to 7 years. Ready to hit the road in a new car? Auto loans for those with strong credit can begin around 5.99% APR, with terms typically between 2 and 7 years.

Investing in your future through education? Student loans can offer fixed rates starting at 4.5% APR, providing flexible repayment periods from 5 to 20 years, often with the added bonus of deferred repayment options until after graduation. And for our entrepreneurs out there, business loans can range from $10,000 to $500,000, with repayment schedules typically between 1 and 10 years, offering that much-needed flexibility for growth. For the biggest investment of all, mortgage loans typically have terms spanning 15 to 30 years. Interest rates are dynamic and change with the market, so it’s always best to compare current offers.

It’s really important to keep in mind that the rates mentioned above are often the lowest possible ones, usually for folks with excellent credit. Your actual rate will be custom to your specific credit score, your debt-to-income ratio, the amount you want to borrow, and, of course, the lender you choose. Always compare the APR (Annual Percentage Rate), which includes any fees, to get the clearest picture of the loan’s true cost. As your friendly financial guides, we always recommend digging into these details. For even more specific information regarding loans, it’s a great idea to consult with relevant regulatory bodies like the Consumer Financial Protection Bureau (CFPB).

Frequently Asked Questions about Traceloans.com

Navigating online loans can feel like trying to get a dinner reservation at a hot new spot in Manhattan – exciting, but with a few questions bubbling up! We often hear a few common questions about platforms like traceloans.com, and as your local guides, we’re here to dish out the answers in plain, easy-to-understand terms. Let’s clear up some of the most frequent inquiries we get from fellow New Yorkers.

Is Traceloans.com a direct lender or a loan marketplace?

This is a fantastic question, and it’s super important to understand! Think of traceloans.com not as the chef making the meal, but as the busy food market that brings together all the best ingredients from different farms.

In financial terms, this means traceloans.com operates as a loan marketplace, not a direct lender. They don’t actually lend you money themselves. Instead, their magic lies in connecting you with a wide network of trusted lending partners. This allows you to browse and compare various loan offers all in one convenient spot. So, when you pick a loan, the actual funds and agreement come from the specific lender you choose, not from traceloans.com itself. It’s all about giving you choices!

Are there any hidden fees when using the platform?

Nobody likes hidden charges, whether it’s an unexpected corkage fee or a surprise loan processing cost! We’re happy to report that using the traceloans.com platform to search for and compare loan offers is completely free for the borrower. That’s right, no charges from them for helping you find your perfect loan fit.

However, the lenders within their network are separate entities. Just like different restaurants might have their own service charges, these individual lenders may have their own fees. These could include things like origination fees (a charge for processing the loan) or even prepayment penalties if you pay off your loan early. This is why we always, always stress the importance of carefully reading the Loan Agreement from the specific lender before you sign on the dotted line. Being informed is your best defense against any surprises!

Is my personal information safe and secure?

Keeping your personal information safe is like protecting your grandma’s secret recipe – absolutely paramount! Traceloans.com understands this, and they state that they use strong security measures to protect your personal and financial details. They employ data encryption, similar to the fortress-like security banks use, to keep your information private as it travels through their system.

Since traceloans.com acts as a marketplace, connecting you with third-party lenders, it’s also a good idea to remember that those lenders will have their own privacy and security policies too. Just as you might check a restaurant’s hygiene rating, it’s always smart to quickly review the privacy policies of any lender you consider working with directly. A little extra caution goes a long way in ensuring your peace of mind.

Conclusion

So, after exploring all that traceloans.com has to offer, what’s the verdict from a New Yorker’s perspective? We can tell you it’s a truly legitimate and incredibly helpful online loan marketplace. In a city where finding the right restaurant can be a mission, finding the right loan can feel even more daunting. But traceloans.com simplifies that journey, cutting through the financial noise to connect you with what you need. Here in New York City, where time is our most valuable currency, we appreciate platforms that are clear and get straight to the point – and traceloans.com absolutely shines there.

What truly sets traceloans.com apart is its incredible network. It’s like having access to a huge menu of lenders, all ready to offer different types of loans – whether you need a personal loan for a home project, help consolidating debt, or even financing for a new car or a big business venture. They really open doors, even for those who might have faced problems with lower credit scores (we’re talking scores as low as 580!). And we love that they don’t just connect you; they give you smart tools like calculators and helpful guides to really understand your choices. Making informed decisions? That’s always a recipe for success in our book!

Now, while traceloans.com is a fantastic bridge, remember they’re connecting you to the lenders, not giving you the loan themselves. So, just like you’d read the ingredients list before trying a new dish, it’s super important to carefully read all the fine print from the specific lender you choose. Look closely at the interest rates, the terms, and any fees. Traceloans.com won’t charge you hidden fees, which is great, but individual lenders might have their own small print. A little bit of careful reading now can save you a lot of headaches later!

Traceloans.com acts as your trusted guide, making the often-tricky world of loans much easier to steer through the five boroughs. It truly shows how technology can empower us, making financial choices more straightforward and helping us all step towards a brighter financial future in this incredible city. And who doesn’t want that?