Why Verifying Financial Firm Legitimacy Matters Before You Invest

As New Yorkers, we know a thing or two about due diligence. Whether it’s checking a restaurant’s health grade before booking a table or vetting a financial advisor before investing, the principle is the same: a little research upfront can save you a world of regret. Searches for Financeville craigscottcapital often lead investors down a confusing path, so let’s clear things up immediately.

Quick Facts About Craig Scott Capital:

- Real Company: Craig Scott Capital LLC was a legitimate financial services firm founded in 2010.

- Major Problem: Expelled from FINRA (Financial Industry Regulatory Authority) in early 2023.

- Current Status: No longer a regulated broker-dealer due to compliance violations.

- “Financeville”: Not a real place – just an online term that became associated with the company.

- Red Flags: History of misrepresenting investment products and poor risk management.

The story of Craig Scott Capital is a powerful case study in why every investor needs to verify a financial firm’s legitimacy before trusting them with money. What started as a growing asset management company became a cautionary tale about what happens when regulatory compliance fails.

This firm’s journey from a legitimate business to FINRA expulsion highlights critical lessons that apply to any major decision, from choosing an investment opportunity to picking a five-star restaurant. Understanding how to spot red flags and conduct proper research isn’t just about protecting your money – it’s about making informed choices in a world where trust is everything. In the financial world of New York, taking a moment for thorough verification is paramount.

Financeville craigscottcapital vocabulary:

Deconstructing the Term: What is “Financeville CraigScottCapital”?

If you’ve stumbled across the search term “financeville craigscottcapital” online, you’re probably wondering what you’re looking at. Deciphering it is a bit like reading a complex menu in a foreign language before you order; you need to know what’s real and what’s just marketing fluff. The truth is, this phrase combines two very different things, and understanding the distinction is crucial.

Let’s start with the real part: Craig Scott Capital LLC. This was an actual financial services firm that opened its doors in 2010 with big ambitions in asset management and wealth management. The company wasn’t just another small-time operation either – at its peak, it managed around $500 million in client assets and employed 15 financial advisors serving over 500 clients.

Craig Scott Capital positioned itself as a modern financial firm, claiming to blend traditional investment wisdom with cutting-edge technology like AI-powered analytics and advanced algorithms. They marketed themselves as innovators who could offer personalized investment strategies while exploring everything from blockchain technology to ESG (Environmental, Social, and Governance) investing.

Now here’s where things get interesting. The “Financeville” part of that search term? It’s not a real place. You won’t find Financeville on any map because it exists only as an online term that somehow became associated with Craig Scott Capital in internet searches.

Think of “Financeville” as a conceptual community – a virtual space where people might learn about smart money management. Some sources suggest it was meant to be a complementary platform to Craig Scott Capital’s services, offering financial literacy workshops while the actual firm handled the serious investment advisory work.

The idea seemed to be creating a complete financial ecosystem: “Financeville” would teach you the basics, while Craig Scott Capital would provide the professional investment management. It was an ambitious vision that aimed to bridge the gap between financial education and expert advisory services.

But here’s what matters most: while Craig Scott Capital was a legitimate registered firm for over a decade, “Financeville” remained largely a marketing concept that never fully materialized.

The real focus for any savvy consumer should always be on the actual company – Craig Scott Capital LLC – and its track record and regulatory standing. As we’ll explore, this distinction becomes critical when you learn about the firm’s troubled history. For more guidance on making smart investment choices, check out this more info about investing tips.

Understanding what you’re actually researching is the first step in proper due diligence – a lesson that applies whether you’re vetting financial firms or the latest pop-up restaurant in SoHo.

The Troubled History and Regulatory Downfall of financeville craigscottcapital

Craig Scott Capital’s story reads like a cautionary tale that many investors wish they’d heard before writing their first check. What began as a promising financial firm in 2010 quickly grew into something that looked impressive on paper – but appearances can be deceiving in finance.

The early years painted a rosy picture. The company expanded beyond basic asset management into wealth management, portfolio diversification, and alternative investments. By 2017, they were boasting about a 25% improvement in operational efficiency thanks to fancy new financial software. Their client base doubled by 2020, and for a while, everything seemed to be moving in the right direction.

But here’s where the story takes a sharp turn that would make any investor’s stomach drop. The same company that once proudly talked about client-centric approaches and ethical practices began facing serious headwinds. What our research uncovered was troubling: their trajectory got “significantly impacted by regulatory issues and negative press,” leading to a dramatic decline in the assets they managed.

Think about this for a moment – they went from managing around $500 million at their peak to approximately $300 million by late 2023. That’s not just a market dip; that’s a massive vote of no confidence from investors who were paying attention to the warning signs.

The FINRA Expulsion: A Major Red Flag

When financeville craigscottcapital got kicked out of FINRA in early 2023, it wasn’t like getting a parking ticket or a gentle warning. This was the financial equivalent of being permanently banned from the restaurant industry for health code violations – except instead of making people sick with bad food, they were putting people’s life savings at risk.

Let me explain what FINRA actually does, because understanding this makes the expulsion even more significant. FINRA acts as the watchdog for brokerage firms and exchange markets across the United States. Their job is straightforward: protect investors and keep the marketplace fair and honest. When they decide to expel a firm, it means that company has crossed lines that simply can’t be uncrossed. For anyone wanting to dive deeper into how financial regulation works, there’s a guide to financial regulation that breaks it down clearly.

The reasons behind Craig Scott Capital’s expulsion weren’t minor paperwork issues or technicalities. FINRA found “multiple breaches of financial regulations” that cut to the core of what makes a financial firm trustworthy.

Misrepresentation of investment products was one major issue. Imagine going to a restaurant where the menu says “fresh salmon” but you’re served frozen fish that’s been sitting around for weeks. That’s essentially what happens when a financial firm misrepresents investments – they’re not giving you the straight story about what you’re actually buying, the real risks involved, or what you can reasonably expect in returns.

The second major problem was poor risk management practices. In the financial world, risk management isn’t just important – it’s everything. It’s like the safety systems in an airplane; when they fail, everyone on board is in serious danger. Craig Scott Capital failed to properly assess, monitor, and control the financial risks in their operations and their clients’ investments.

These weren’t isolated incidents that happened once or twice. They were systemic failures that showed a pattern of putting profits ahead of proper procedures. The expulsion “marked a pivotal moment, leading to loss of credibility and difficulty attracting new clients.” Once word got out, it became nearly impossible for them to rebuild trust.

The Crypto Angle and “Cryptopia”

Just when you thought the story couldn’t get more complicated, Craig Scott Capital decided to jump into the cryptocurrency game with something they called “Cryptopia.” This platform was supposed to offer “digital currency investment opportunities,” but given their existing regulatory troubles, it raised more red flags than a Communist parade.

Now, don’t get me wrong – cryptocurrency can be a legitimate part of a diversified investment strategy. Bitcoin, Ethereum, and other digital assets have their place in the financial world. But they’re also notoriously volatile and exist in a regulatory environment that’s still being figured out by lawmakers and regulators.

When a firm that’s already struggling with misrepresentation and poor risk management decides to dive into one of the riskiest investment categories available, it’s like watching someone who just failed their driver’s test decide to enter the Indy 500. The timing couldn’t have been worse.

Our research shows that Craig Scott Capital’s venture into cryptocurrency via “Cryptopia” was “viewed with skepticism by some due to its existing regulatory troubles.” That’s putting it mildly. The lack of regulation in certain parts of the crypto market meant that the usual FINRA oversight was less direct, potentially exposing investors to even greater risks than they’d face with traditional investments.

While some sources suggest the firm offered investment advice on cryptocurrencies and used AI for predictive analytics, their track record of regulatory non-compliance makes any such offerings highly questionable. If you’re interested in learning about digital asset management from more reliable sources, the Fintechzoom Bitcoin Wallet Complete Guide offers solid information to help you make informed decisions about cryptocurrency investments.

How to Vet Any Financial Firm: Lessons from This Case

The story of financeville craigscottcapital offers a masterclass in what can go wrong when proper vetting falls by the wayside. As any New Yorker knows, you wouldn’t pick a restaurant with a ‘C’ grade from the health department on the door. The same principle applies to financial firms, but the stakes are much higher than a bad meal.

Craig Scott Capital’s journey from a seemingly legitimate firm to a FINRA-expelled entity is a powerful reminder: due diligence isn’t optional. It’s the difference between protecting your financial future and watching your hard-earned money disappear. Even firms with impressive marketing and ambitious growth stories can harbor serious issues, which is why savvy consumers always look beyond the glossy brochures.

Key Red Flags to Watch For

Learning to spot warning signs can save you from financial heartache. The financeville craigscottcapital case highlights critical red flags that should make any investor pause.

- Regulatory sanctions: This is the ultimate red flag, like a restaurant being shut down for health code violations. When FINRA expelled Craig Scott Capital, it was a complete shutdown. Always check for any history of violations or fines.

- Unclear fee structures: This is the financial equivalent of mysterious, unexplained charges on your dinner bill. Legitimate firms are transparent about every penny. If you get vague answers about costs, walk away.

- Pressure tactics: Beware of phrases like “limited-time opportunity.” It’s like a waiter aggressively pushing an overpriced “special.” Sound financial planning takes time and careful consideration, not high-pressure sales tactics.

- Promises of guaranteed high returns: No legitimate investment can guarantee high profits. That’s like a food truck promising a Michelin-star meal for $5. All investments carry risk, and any advisor who says otherwise is not being honest.

Best Practices for Investor Protection

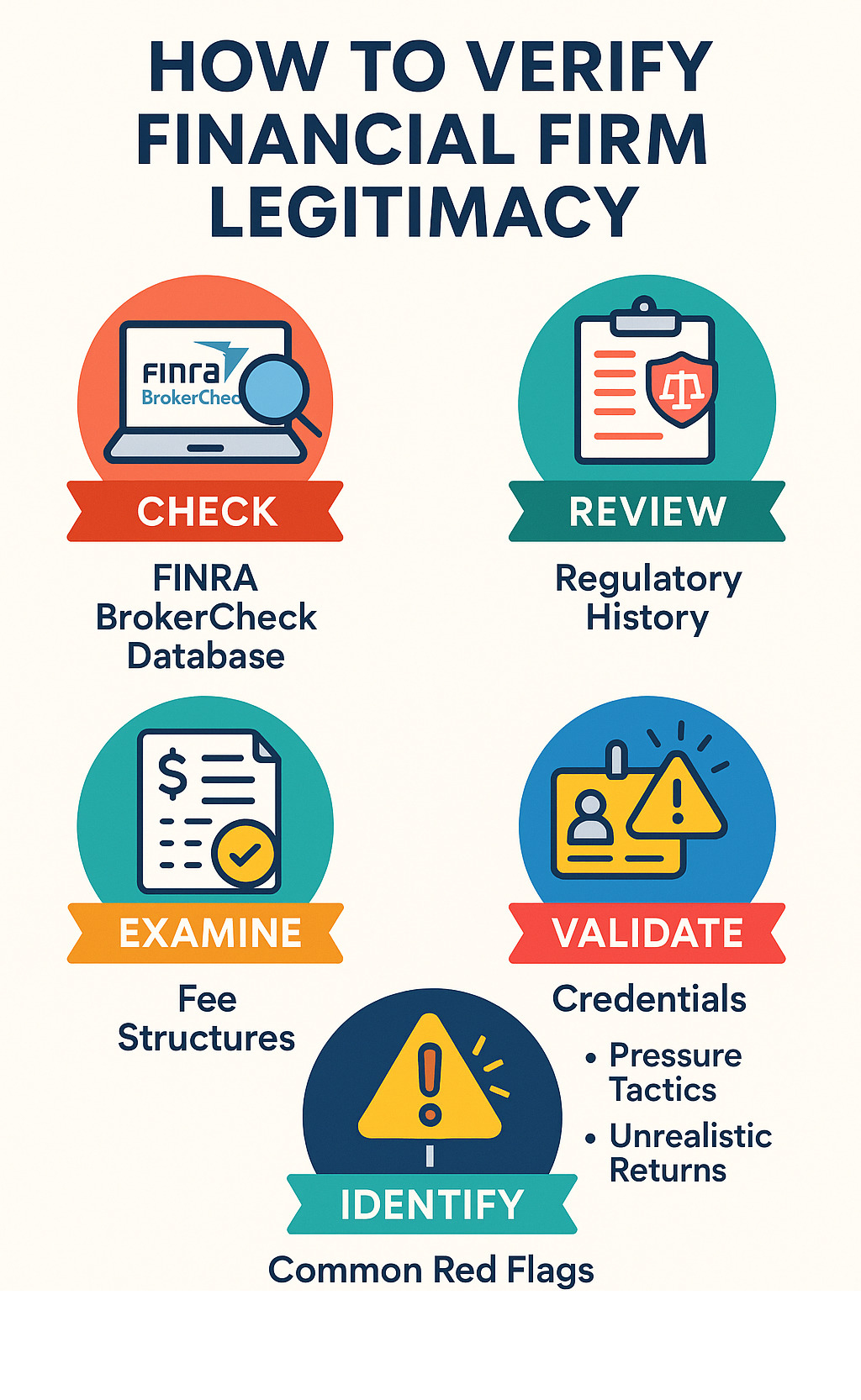

Protecting yourself starts with using the right tools. In a city like New York, we’re used to checking reviews on Yelp or Resy before booking a table. The same instinct should apply to your finances.

FINRA’s BrokerCheck tool should be your first stop. Think of it as the official ‘health inspection’ report for financial firms. It’s a free database that would have immediately revealed Craig Scott Capital’s regulatory troubles.

Independent reviews provide another layer of protection, but approach them with a critical eye, just as you would with online restaurant reviews. Look for patterns and credible third-party evaluations.

Understanding investment strategies is key. Never accept vague promises. Ask specific questions about where your money will be invested and what risks are involved. If an advisor can’t explain their strategy in simple terms, that’s a red flag.

Credential verification protects you from unqualified advisors. Look for legitimate certifications like CFP or CFA and verify them independently. Don’t just take someone’s word for it.

Here are essential questions every investor should ask: What are your specific qualifications and licenses? How long has your firm been in business, and what’s your regulatory history? How exactly are you compensated – through fees, commissions, or both? What’s your investment philosophy, and how do you manage risk? Can you provide references from current clients? How often will we communicate about my portfolio’s performance? What are all the fees I’ll pay, including hidden costs? What happens if I need to access my money quickly?

The financeville craigscottcapital case ultimately teaches us that investor protection begins with healthy skepticism and thorough research. No marketing material substitutes for regulatory compliance and transparent business practices.

Frequently Asked Questions about Verifying Financial Firms

When you’re trying to make sense of confusing financial terms like “financeville craigscottcapital,” it’s natural to have questions. We’ve compiled the most common concerns investors share when they’re trying to figure out whether a financial firm is trustworthy.

Think of this as your friendly neighborhood guide to understanding what really happened with this particular case and what it means for your own investment decisions.

What happened to Craig Scott Capital?

The story of Craig Scott Capital took a dramatic turn. In early 2023, FINRA expelled the firm completely. This wasn’t just a fine; it was the financial regulatory equivalent of a restaurant being permanently shut down by the health department.

FINRA found multiple serious violations, including misrepresenting investment products to clients and poor risk management practices. In simple terms, they weren’t being honest about what people were investing in, and they weren’t properly protecting their clients’ money.

Once FINRA expels a firm, it loses its status as a regulated broker-dealer and can no longer legally operate in the same way. As you’d expect, clients left, and the firm’s managed assets dropped significantly from their peak of around $500 million.

Is financeville craigscottcapital a legitimate service?

This question gets to the heart of why doing your homework matters. Craig Scott Capital LLC was once a legitimate, registered financial firm that started in 2010. On paper, it looked like many other investment companies.

However, legitimacy in finance isn’t just about having the right paperwork initially; it’s about maintaining trust and following the rules. The 2023 FINRA expulsion fundamentally changed Craig Scott Capital’s legitimacy. When a regulator expels a firm, it’s a clear message that the firm cannot be trusted to protect investor interests.

So, while the company was once properly registered, its current regulatory standing raises serious red flags. It’s like asking if a restaurant is still legitimate after the health department shut it down – the building might still be there, but you definitely shouldn’t eat there.

What does the financeville craigscottcapital case teach investors?

The financeville craigscottcapital situation is a masterclass in why you should never skip your homework. For us New Yorkers, it’s a reminder that whether you’re on Wall Street or Restaurant Row, you have to look past the fancy facade and check the fundamentals. This case teaches several key lessons:

- Always check regulatory history first. FINRA’s BrokerCheck tool is free and easy to use. A quick search would have revealed warning signs about Craig Scott Capital long before the final expulsion.

- Past compliance problems predict future troubles. Regulatory issues rarely happen in a vacuum. A pattern of bending the rules is a major red flag.

- Don’t get distracted by shiny objects. The firm’s venture into cryptocurrency with its “Cryptopia” platform might have seemed innovative, but it came when they already had compliance issues. Offering high-risk investments when you can’t manage basic rules is a recipe for disaster.

- Due diligence is your financial lifeline. Trust must be earned through transparent operations, not just claimed in glossy brochures.

This case reminds us that even firms that appear successful can have serious problems underneath. The key is knowing how to look beyond the marketing and check the facts that really matter.

Conclusion

The story of financeville craigscottcapital is a powerful lesson for any savvy consumer, especially here in New York. The same critical eye you’d use to spot a tourist-trap restaurant in Times Square is the one you need when evaluating a financial firm. It’s all about looking past the hype, checking the facts (like a FINRA report or a health department grade), and trusting your gut.

We’ve seen how Craig Scott Capital went from a legitimate firm to being expelled by FINRA for serious violations like misrepresentation of investment products and poor risk management. We’ve also clarified that “Financeville” is just an online term, not a real place. The key takeaway is that due diligence is essential.

Protecting your financial future starts with asking the right questions and doing your homework. A few hours of research upfront can save you from years of regret. The story of Craig Scott Capital proves that even successful-looking firms can have serious problems under the surface.

At The Dining Destination, we apply that same principle of diligent research to help you find the world’s most incredible culinary experiences. We do the homework on the best restaurants, food tours, and hidden gems so you can avoid the ‘bad investments’ and simply enjoy the delicious rewards. Let us guide you on your next, much more delightful, trip.