Why FTAsiaStock Business News Matters for Global Success

FTAsiaStock business news provides essential insights into Asia’s rapidly growing economy, which now accounts for over 60% of global GDP growth. Whether you’re an investor, entrepreneur, or business professional, staying informed about Asian markets has become critical for making smart decisions in today’s interconnected world.

Key Areas Covered by FTAsiaStock Business News:

- AI & Technology: Trading systems with 34% better forecast precision

- Healthcare Innovation: Tech stocks up 31% this year

- Green Technology: 45% rise in clean tech funding

- E-commerce Growth: Companies see 3x faster sales growth

- Market Performance: 73% forecast accuracy rate

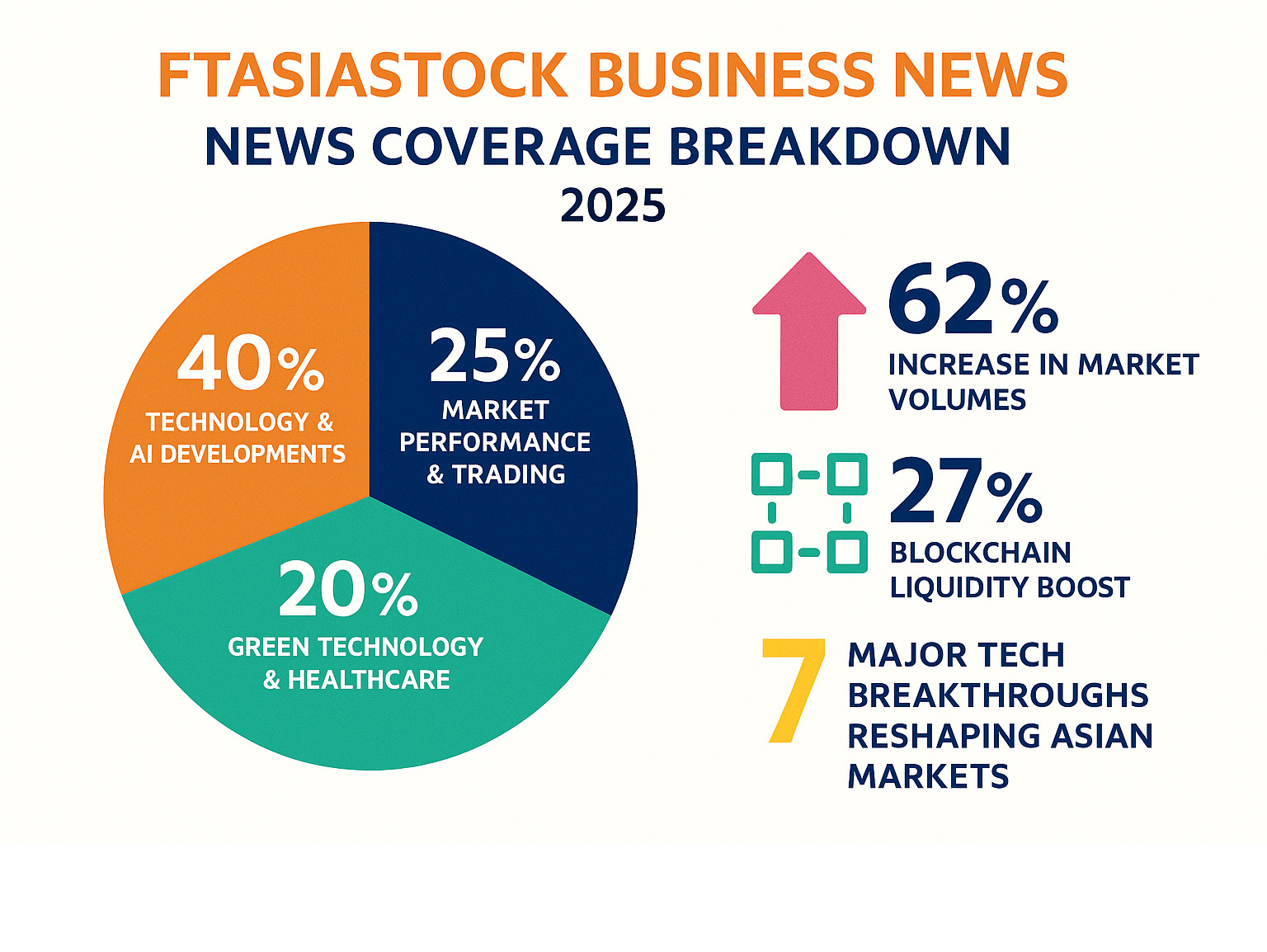

Asia’s financial landscape is changing at breakneck speed. From AI-driven trading platforms processing billions in trades to blockchain integration boosting market liquidity by 27%, the region is reshaping global finance. Companies like Future FinTech Group (FTFT) are launching AI applications for investment analytics, while markets from Hong Kong to Singapore reach new all-time highs.

But here’s the challenge: How do you cut through the noise and monitor the information that actually matters for your goals?

The answer lies in understanding what FTAsiaStock covers, how to extract strategic insights, and when to act on the information. Just like finding the perfect local restaurant requires knowing where to look and what signals matter, successful monitoring of Asian business news demands a systematic approach.

Ftasiastock business news terms you need:

Step 1: Understand the Core Landscape FTAsiaStock Covers

Think of FTAsiaStock business news as your friendly neighborhood guide to Asia’s financial world – except this neighborhood happens to span the fastest-growing economic region on the planet. Just like how we help food travelers find hidden culinary gems, FTAsiaStock helps investors and business professionals uncover the market insights that matter most.

Here’s what makes this platform special: FTAsiaStock business news isn’t just another financial news service throwing random headlines at you. It’s a comprehensive platform operated by FintechAsia that focuses specifically on Asian fintech and stock market developments. Important note – it’s not an official stock market index, but rather a specialized news and analysis service that helps decode the region responsible for over 60% of global GDP growth.

The coverage spans from the gleaming financial towers of Hong Kong and Singapore to the tech hubs of Shanghai and beyond. What sets it apart is how it blends real-time market data with deep cultural and economic understanding of Asian markets. This isn’t just about numbers on a screen – it’s about understanding the why behind market movements and technological breakthroughs.

A perfect example of the dynamic shifts FTAsiaStock business news tracks involves companies like Fintech Asia Limited, which recently underwent a major change through a reverse takeover to become ICFG Ltd. This wasn’t just a name change – ICFG pivoted its entire focus toward microfinance and technology in Central Asia, with ambitious expansion plans. These kinds of strategic pivots happen constantly in Asia’s fast-moving markets, and staying on top of them can make or break investment decisions.

Decoding the Technology: AI, Blockchain, and Digital Change

The real magic happens when you dive into the technological revolution that’s reshaping Asian finance. FTAsiaStock business news doesn’t just report on tech trends – it explains how these innovations are fundamentally changing how money moves, trades happen, and businesses operate.

AI trading systems are leading the charge with remarkable results. We’re seeing platforms that can execute trades 40% faster than traditional methods, with some systems achieving 34% better forecast precision. This isn’t science fiction – it’s happening right now in trading floors across Asia. The Financial Times regularly covers how AI has moved from experimental to essential in modern finance.

Blockchain integration is another game-changer that goes far beyond cryptocurrency. Traditional markets are embracing blockchain technology, resulting in a 27% boost in market liquidity and transaction speeds that can settle in under a second. This technology is making cross-border transactions smoother and more transparent than ever before.

The digital change extends into everyday business too. E-commerce companies using advanced technology are seeing 3x faster sales growth, while cybersecurity improvements have led to fraud reductions of up to 95% in some regions. These aren’t just impressive statistics – they represent fundamental shifts in how Asian businesses operate and compete globally.

Green technology investments have surged by 45%, with companies focusing on sustainable solutions outperforming the market by 18%. Meanwhile, healthcare tech stocks have risen 31% this year, driven by innovations in AI diagnostics and remote patient monitoring. Cross-asset trading platforms are breaking down traditional silos, allowing seamless trading across stocks, bonds, crypto, and even real estate markets.

Identifying Key Players and Market Movers

Understanding who’s driving these changes is just as important as understanding the technology itself. FTAsiaStock business news excels at spotting both established giants and emerging players that are shaping Asia’s economic future.

The platform covers powerhouse companies like TSMC, Alibaba, and Grab – the household names that consistently appear in major Asian indices. But it also keeps a sharp eye on corporate developments that signal broader market trends.

Take Future FinTech Group Inc. (FTFT), a NASDAQ-listed company that recently made waves with its Hong Kong subsidiary launching MaxQuant AI, an artificial intelligence application for investment analytics and trading. This platform features a sophisticated News Intelligence Engine and uses multi-agent AI systems to analyze everything from equities to cryptocurrencies simultaneously.

What makes FTFT particularly interesting is their strategic application for a VASP license in Hong Kong, showing how traditional financial companies are positioning themselves in the regulated digital asset space. This kind of forward-thinking approach to navigating regulatory landscapes is exactly what FTAsiaStock business news helps investors track.

The platform’s sector performance coverage spans from traditional manufacturing to cutting-edge healthcare tech and green technology startups. This comprehensive view helps readers understand not just individual company movements, but broader sector trends that can inform strategic decisions. Whether you’re tracking established blue-chip stocks or promising startups, the insights help paint a complete picture of Asia’s dynamic business landscape.

Step 2: Leverage Ftasiastock Business News for Strategic Insights

Now that we understand what FTAsiaStock business news covers, it’s time to put that knowledge to work. Think of it like finding a new culinary hotspot – knowing it exists is one thing, but the real magic happens when you actually experience what it has to offer and apply those insights to your own trips.

The beauty of FTAsiaStock business news lies in its ability to transform raw information into actionable intelligence. Whether you’re planning your next investment move or looking to expand your business into Asian markets, this platform serves as your strategic compass. Just as we help food enthusiasts steer the world’s culinary landscapes, FTAsiaStock helps professionals steer Asia’s complex financial terrain.

The practical applications stretch far beyond simple news consumption. We’re talking about strategic planning that can reshape your approach to risk management, competitive analysis that reveals hidden opportunities, and business intelligence that keeps you three steps ahead of market shifts. It’s like having an insider’s guide to Asia’s economic kitchen – you get to see what’s cooking before everyone else does.

For the Savvy Investor: Tracking Trends and Performance

For investors, FTAsiaStock business news feels like having a trusted local guide in an unfamiliar city. The platform’s AI-driven predictions achieve an impressive 73% accuracy rate, which isn’t just impressive – it’s game-changing. These AI models don’t just crunch numbers; they analyze historical patterns, digest sentiment data, and factor in macroeconomic events to spot potential market moves before they happen.

The data reliability here is exceptional. Updates flow in throughout trading hours using live feeds from major Asian exchanges. This information gets rigorously verified by AI for errors, then cross-checked with hands-on research and expert feedback. It’s like having multiple chefs taste-test a dish before it reaches your table – you know you’re getting quality.

When examining companies like ICFG Ltd. (formerly Fintech Asia), which focuses on microfinance and technology, the platform guides you through essential financial metrics. You’ll want to monitor key indicators like Revenue, Profit/Loss, P/E Ratio (Price-to-Earnings Ratio), and Cash to Sales Ratio. These metrics, combined with insights into expansion plans, create a complete picture for potential investors.

The platform also excels at tracking market trends across different sectors. Whether you’re interested in healthcare tech (up 31% this year) or green technology (seeing 45% rises in funding), FTAsiaStock provides the context you need to make informed investment decisions. You can learn more about its features from dzinsights blog, which covers in more depth how it’s changing investment workflows.

For the Global Entrepreneur: Applying ftasiastock business news

Entrepreneurs looking at Asian markets will find FTAsiaStock business news absolutely indispensable. It’s like having a local food critic’s insights when you’re planning to open a restaurant in a new city – the intelligence is that valuable.

Consider the e-commerce explosion happening across Asia. Companies adopting advanced e-commerce technologies are seeing 3x faster sales growth. This isn’t just a statistic; it’s a roadmap for digital strategy. If your business has any online component, these insights can directly inform your technology investments and market entry strategies.

The clean tech funding surge of 45% tells an even more compelling story. Companies focusing on green solutions are outperforming the market by 18%. For entrepreneurs, this signals massive opportunities in sustainable innovation, potential partnership prospects, and clear market demand for environmentally conscious solutions.

Healthcare tech innovations present another fascinating case study. With AI diagnostics and remote patient monitoring driving 31% stock increases in this sector, entrepreneurs can spot emerging needs, understand competitor activities, and anticipate changes in consumer demand. It’s strategic intelligence that can reshape your entire business approach.

The platform also provides crucial insights into supply chain dynamics and consumer behavior patterns across Asian markets. Understanding how advanced security technologies have reduced fraud by 95% in some regions helps entrepreneurs build customer trust and implement robust systems from day one. Whether you’re streamlining operations, planning market entry, or developing innovative marketing strategies that resonate with Asian audiences, FTAsiaStock provides the intelligence foundation you need to succeed.

Step 3: Integrate and Act on the Information

The final step, and arguably the most crucial, is to take the insights gathered from FTAsiaStock business news and integrate them into your decision-making processes, then act decisively. Think of it like finding a hidden gem of a restaurant – the real magic happens when you actually book that table and experience it for yourself.

Information without action is just noise, and we’ve all been there – drowning in data but starving for direction. FTAsiaStock business news provides the actionable intelligence needed to cut through that noise and make smart moves. This means actively synthesizing what you’ve learned, setting up alerts for real-time updates, and understanding how to squeeze every ounce of value from the platform’s features.

The goal is simple: move from passive consumption to active engagement. Just like how we transform from casual food lovers to passionate culinary triprs, you want to evolve from someone who reads market news to someone who acts on market opportunities.

Choosing Your Tools and Sources

When it comes to monitoring FTAsiaStock business news, choosing the right tools is like selecting the perfect knife for your kitchen – it makes all the difference. The platform’s data reliability is rock-solid, pulled from trusted exchanges and verified by AI systems that catch errors before they reach your screen.

What sets FTAsiaStock apart from other financial news sources is its thoughtful approach to blending real-time data with deep Asian market knowledge. Instead of throwing random headlines at you, it explains how technological shifts actually affect financial markets. This isn’t just about knowing that AI trading is hot – it’s about understanding how AI-driven systems are processing billions in trades and achieving that impressive 34% increase in forecast precision we mentioned earlier.

The platform covers both established tech giants and promising startups, giving you a complete picture rather than just focusing on the usual suspects. Market volumes are up 62%, and peak-hour activity has tripled in two years, which tells us this is a highly dynamic environment where timing matters.

Here’s the practical part: while there’s often a free tier available for basic insights, the advanced analytics and detailed data feeds typically require a paid subscription. This tiered approach makes sense – casual observers can dip their toes in the water, while serious investors can dive deep into the data they need for major decisions.

The beauty of cross-asset platforms within the FTAsiaStock ecosystem is that they improve access and can actually lower volatility. You can seamlessly track everything from stocks to crypto, and even real estate investments where applicable. No more juggling fifteen different apps just to get a complete market picture.

Early adopters of new technologies, armed with insights from platforms like FTAsiaStock, are seeing an average gain of 27%. That’s not just a nice-to-have advantage – that’s the difference between staying ahead of the curve and playing catch-up.

Navigating the Risks of Asian Markets with ftasiastock business news

While Asian markets offer incredible opportunities, let’s be honest about the challenges. Asia’s markets can feel like navigating a busy street food market in Bangkok – exciting and rewarding, but you need to know what you’re doing to avoid getting burned.

Key risks include geopolitical tensions, regulatory changes, and market volatility that can shift faster than dinner reservations during restaurant week. Different countries mean different rules, currencies, and trading hours. What works in Singapore might not fly in Shanghai, and FTAsiaStock business news helps you understand these nuances.

The good news? Technology is actually helping solve many of these traditional risk factors. Advanced security technologies are making markets safer and more trustworthy. We’re seeing fraud rates drop by 95% in some regions thanks to biometrics and AI fraud detection systems. These aren’t just fancy features – they’re essential tools for building the trust that keeps markets running smoothly.

Companies like Future FinTech Group (FTFT) are showing us how to steer regulatory complexity properly. By proactively seeking licenses like the VASP in Hong Kong, they’re demonstrating that working within clear regulatory frameworks isn’t just about compliance – it’s about creating a more secure environment for everyone involved.

FTAsiaStock business news doesn’t just highlight the exciting opportunities; it also covers potential pitfalls with the same attention to detail. This balanced approach helps you develop robust risk management strategies instead of just chasing the latest trend. Think of it as having a trusted local guide who knows both the best spots to visit and the areas to avoid.

The platform’s multi-layer security systems and rigorous data verification processes mean you’re getting reliable information when you need it most. Because in fast-moving markets, making decisions based on accurate, timely data isn’t just smart – it’s essential for success.

Frequently Asked Questions about FTAsiaStock

Just like when we’re researching the best local restaurants for our travel guides, we get tons of questions about FTAsiaStock business news. These are the ones that come up most often, and we’re excited to share what we’ve learned from our experience tracking Asian markets.

Is FTAsiaStock only for professional investors?

Not at all! Think of it like finding a great restaurant – you don’t need to be a professional food critic to enjoy amazing cuisine. While FTAsiaStock business news does offer some pretty sophisticated analytics that might take a little getting used to, it’s really designed for anyone curious about Asian markets.

We’ve seen complete beginners use the platform to understand market trends and make their first investments in Asian tech companies. The key is starting with the basics – following major market moves, understanding sector performance, and gradually diving deeper into the more advanced features. It’s about democratizing financial information, not keeping it locked away for the pros.

Does FTAsiaStock cover both stocks and cryptocurrencies?

Absolutely, and this is one of our favorite features! FTAsiaStock business news gives you a complete picture by covering both traditional stocks and cryptocurrencies in one place. This unified approach is incredibly valuable because, let’s face it, these markets don’t operate in isolation anymore.

When Bitcoin moves, it often affects tech stocks. When major Asian companies announce blockchain partnerships, it ripples through both equity and crypto markets. Having all this information in one place means you’re not constantly switching between different platforms trying to piece together the full story. It’s like having a restaurant guide that covers both street food and fine dining – you get the complete culinary landscape.

Is FTAsiaStock an official stock market index?

This is a great question that clears up some common confusion. FTAsiaStock business news isn’t an official stock market index like the Dow Jones or NASDAQ. Instead, it’s the brand name that FintechAsia uses for their comprehensive coverage of Asian fintech and stock market developments.

Think of it as a specialized news service and analysis platform rather than an index you can directly invest in. It’s more like a trusted food critic’s column – they’re not the restaurant itself, but they provide invaluable insights about what’s happening in the dining scene. FTAsiaStock gives you the intelligence and analysis you need to understand Asian markets, but the actual investing happens through traditional brokers and exchanges.

This distinction is important because it helps set the right expectations. You’re getting expert analysis, real-time insights, and strategic intelligence – tools that help you make better decisions about where to put your money.

Conclusion

Navigating Asia’s dynamic financial landscape might seem overwhelming at first, but with the right approach, it becomes an exciting journey of findy. Think of it like exploring a new city’s food scene – you need a good map, local insights, and the confidence to try something new.

Throughout this guide, we’ve walked through three essential steps for mastering FTAsiaStock business news. We started by understanding the core landscape, diving deep into the technological breakthroughs reshaping markets and identifying the key players driving change. Then we explored how to leverage these insights strategically, whether you’re an investor tracking the 73% forecast accuracy rates or an entrepreneur capitalizing on the 45% rise in clean tech funding.

Finally, we covered how to integrate this information into your daily decision-making process. Just like how we at The Dining Destination help you steer the best culinary experiences from our New York City base, FTAsiaStock business news serves as your trusted guide through Asia’s complex but rewarding financial terrain.

The numbers tell an incredible story. Asia’s economy is projected to account for 40% of global consumption by 2040, leading innovation across AI, fintech, and green energy. Market volumes are up 62%, and companies adopting new technologies are seeing average gains of 27%. This isn’t just growth – it’s change on a massive scale.

What excites us most is how this mirrors our own philosophy at The Dining Destination. Whether we’re uncovering hidden gems in Manhattan’s food scene or tracking the latest dining trends globally, success comes from staying informed, being strategic, and taking action. The same principles apply to monitoring Asian markets through FTAsiaStock.

Asia’s financial landscape offers incredible opportunities for those willing to stay informed and act decisively. Just as we guide food enthusiasts through their culinary trips, this systematic approach to FTAsiaStock business news will help you steer your financial journey with confidence.

Ready to explore more? Explore our guides on travel for food and continue building the informed, adventurous mindset that leads to success in all areas of life.