The Dawn of the Quantum Age

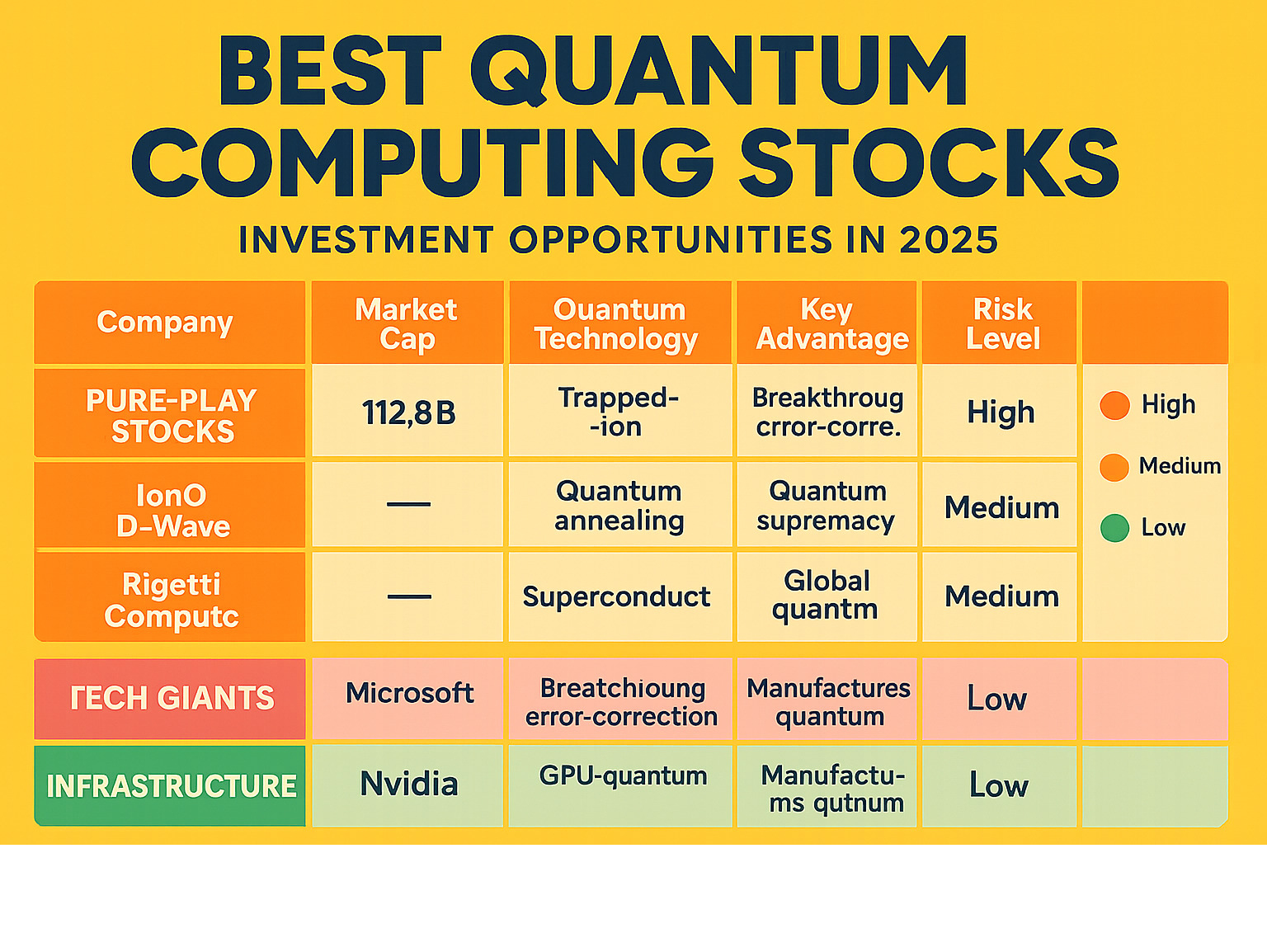

The best quantum computing stocks for 2025 represent a unique opportunity to invest in what could be the next massive technological breakthrough. Here are the top picks across different investment strategies:

Pure-Play Quantum Stocks:

- IonQ (IONQ) – Trapped-ion architecture leader with $12.76B market cap

- D-Wave Quantum (QBTS) – Quantum annealing pioneer, up 118% in 2025

- Rigetti Computing (RGTI) – Superconducting qubit systems developer

Tech Giants with Quantum Exposure:

- Microsoft (MSFT) – Azure Quantum platform, breakthrough error-correction

- Alphabet (GOOGL) – Google’s Willow chip, quantum supremacy achievements

- IBM (IBM) – Quantum System One, global computation centers

- Amazon (AMZN) – AWS quantum services, $36.7M stake in IonQ

Supporting Infrastructure:

- Nvidia (NVDA) – DGX Quantum systems, GPU-quantum integration

- Taiwan Semiconductor (TSM) – Manufactures 90% of advanced quantum chips

While artificial intelligence dominates headlines, quantum computing quietly builds momentum as the technology that could revolutionize everything from drug findy to financial modeling. Unlike classical computers that use bits (0s and 1s), quantum computers harness quantum mechanics through qubits that can exist in multiple states simultaneously.

The numbers tell a compelling story. The quantum computing market is valued at $1.3 billion in 2024 and is expected to surge to $5.3 billion by 2029 – a compound annual growth rate of 32.7%. McKinsey estimates quantum technology could create value worth trillions of dollars within the next decade.

This isn’t just about faster computers. Quantum systems can solve complex problems that would take classical computers millions of years to crack. They’re already showing promise in chemistry simulations, optimization problems, and cryptography – areas that could transform entire industries.

The investment landscape spans from high-risk pure-play companies like IonQ, which targets 2 million qubits by 2030, to established tech giants pouring billions into quantum research. Microsoft’s new error-correction algorithm runs 800 times better than previous quantum computing methods, while IBM has installed quantum processors across four continents.

But here’s the reality check: most quantum computing companies are still losing money. IonQ reported a net loss of $176.84 million last quarter, despite beating revenue estimates. This is early-stage technology with a long runway to profitability.

Smart investors are approaching quantum computing like they did the early internet or AI – with patience, diversification, and an understanding that today’s investments are betting on tomorrow’s breakthroughs.

Best quantum computing stocks vocab explained:

Understanding Your Quantum Investment Strategy

Investing in the best quantum computing stocks is like finding a hidden gem of a restaurant in the West Village before it gets a Michelin star – it requires patience, research, and a willingness to accept the unknown. From our perspective here in New York, we’ve seen countless financial and tech waves begin, and quantum computing presents one of the most fascinating investment opportunities of our generation.

The quantum investment landscape offers several distinct pathways, each with its own flavor profile of risk and reward. Pure-play stocks represent the most direct route into quantum technology. Companies like IonQ, D-Wave, and Rigetti Computing dedicate their entire existence to quantum innovation. These firms live and breathe qubits, developing the fundamental hardware and software that will power tomorrow’s quantum revolution.

However, pure-play investments come with significant volatility. These companies are often pre-profitability, burning through cash while racing to commercialize bleeding-edge technology. It’s a high-stakes game where the winners could become the next tech titans, but the losers might fade into obscurity.

Large-cap tech companies offer a more balanced approach to quantum exposure. When you invest in Microsoft, Alphabet, IBM, or Amazon, you’re getting quantum research backed by massive R&D budgets and diversified revenue streams. These tech giants can weather the inevitable setbacks that come with pioneering technology. Their quantum divisions represent just one slice of their business pie, providing stability while still capturing upside potential.

The “picks and shovels” strategy focuses on companies that supply essential components to the quantum ecosystem. Think of Taiwan Semiconductor manufacturing the specialized chips that quantum computers need, or Nvidia developing the classical computing infrastructure that supports quantum systems. These ancillary plays benefit from quantum growth without betting everything on the technology’s timeline.

Exchange-traded funds provide instant diversification across the quantum landscape. While dedicated quantum ETFs are still emerging, they eliminate the guesswork of picking individual winners and losers.

Your risk tolerance should guide your quantum strategy. This isn’t a technology that will transform industries overnight – we’re talking about a long-term horizon measured in decades, not quarters. The most quantum applications may not materialize until the 2040s.

Diversification remains crucial regardless of your chosen approach. Quantum investments should complement, not dominate, a well-balanced portfolio. Think of quantum stocks as the exotic spice that adds excitement to your investment meal – essential for flavor, but not the main course.

The key is approaching quantum computing with the same curiosity and patience you’d bring to exploring a completely new culinary tradition. The rewards for early adopters could be extraordinary, but success requires understanding both the immense potential and the inherent uncertainties ahead.

The Best Quantum Computing Stocks to Watch in 2025

Finding the best quantum computing stocks is like navigating the thousands of restaurants in New York to find that one hidden gem before it gets its first Michelin star – you need to know where to look and what makes each place special. The quantum computing landscape offers three distinct investment approaches, each with its own flavor profile for different risk appetites.

This fascinating ecosystem spans from scrappy startups betting everything on quantum breakthroughs to tech giants with deep pockets funding the revolution. Let’s explore where the most compelling opportunities lie.

Pure-Play Innovators: High-Risk, High-Reward Ventures

These companies live and breathe quantum computing. They’re the quantum equivalent of a chef who stakes their entire reputation on perfecting one dish – all or nothing, with potentially spectacular results.

IonQ (IONQ) stands as the poster child for pure-play quantum investing. This trapped-ion architecture pioneer has caught serious attention, boasting a Smart Score of eight and ambitious goals that would make any tech enthusiast’s heart race. They’re targeting a cryptographically relevant quantum computer by 2028 and an almost unimaginable 2 million qubits by 2030.

What makes IonQ particularly appetizing for investors is their impressive revenue trajectory. They’re on track for annualized revenues exceeding $100 million by the end of 2025, with projections reaching $1 billion within the next few years. Their cloud partnerships with Microsoft, AWS, and Google Cloud provide crucial market access, while Amazon’s $36.7 million stake serves as a powerful validation.

You can explore IonQ’s stock performance and charts here.

D-Wave Quantum (QBTS) takes a different approach with their quantum annealing technology. Think of them as the specialists who perfected one particular cooking technique rather than trying to master everything. Their focus on optimization and sampling problems has paid off spectacularly – their stock surged an impressive 118% in 2025.

D-Wave’s “Quantum Computing as a Service” model makes their technology accessible through cloud platforms. While they reported a Q1 2025 EPS of -$0.02, they actually beat analyst estimates, showing progress in their development phase.

Rigetti Computing (RGTI) rounds out our pure-play trio with their superconducting qubit approach. They’ve shown steady improvement, with shares advancing about 8% in 2025 and expectations for narrower losses in Q2 2025. Their progress in qubit fidelity will be the key ingredient investors should watch.

Tech Giants: The Best Quantum Computing Stocks for Diversified Exposure

For investors who prefer the stability of an established restaurant chain that’s experimenting with cutting-edge cuisine, these tech titans offer quantum exposure with much lower risk.

Microsoft (MSFT) brings serious firepower through Azure Quantum, their comprehensive platform that provides access to various quantum hardware providers. Their recent breakthrough in error correction is genuinely impressive – running up to 14,000 individual experiments without errors, roughly 800 times better than previous methods. They’re also researching topological qubits, which promise greater stability. Their partnership with DARPA to develop utility-scale quantum computers shows they’re playing for keeps.

Learn more about Microsoft’s quantum ventures here.

Alphabet (GOOGL) made quantum computing headlines with their Sycamore processor achieving “quantum supremacy” back in 2019. They’ve continued pushing boundaries, demonstrating impressive error correction with their Willow chip in December 2024. Google’s global quantum computing competition with XPRIZE demonstrates their commitment to advancing the entire field.

IBM (IBM) deserves respect as a true quantum pioneer. They’ve built an impressive global presence with quantum processors across four continents – from New York to Germany, Japan, and Ohio. Their strategic three-phase approach (emergence, utility, and scale) positions them perfectly for the long game. With over 210 research organizations and companies using IBM’s quantum services, they’re building the ecosystem that others will depend on.

Find more about IBM’s quantum initiatives here.

Amazon (AMZN) approaches quantum computing through AWS Braket, their fully managed quantum service that lets users experiment with different quantum hardware. Their AWS Center for Quantum Networking, launched in 2022, focuses on quantum network solutions. Combined with their substantial IonQ investment, Amazon is clearly betting big on quantum’s future.

Picks and Shovels: Essential Supporting Companies

These companies provide the crucial infrastructure that makes quantum computing possible – like the suppliers who provide the best ingredients to top restaurants.

Nvidia (NVDA) has brilliantly positioned itself at the intersection of AI and quantum computing. Their DGX Quantum system represents the first computing platform to merge GPUs with quantum processing, enabling powerful hybrid workflows. Their cuQuantum software development kit helps researchers simulate quantum computers using AI chips. With plans for Quantum Cloud data centers providing third-party quantum system access, Nvidia is building the bridges between classical and quantum computing. Their stock performance reflects this strategic positioning – up 84.4% year-to-date in 2024.

Track Nvidia’s stock performance here.

Taiwan Semiconductor (TSM) manufactures approximately 90% of all advanced chips for AI and quantum computing applications. As the world’s leading independent semiconductor foundry, they’re absolutely essential to the quantum revolution. Their partnership with Taiwan’s Ministry of Science and Technology highlights their national strategic importance. With consistent double-digit revenue growth, TSM represents a solid foundation play for quantum investing.

Explore Taiwan Semiconductor’s market position here.

Intel (INTC) brings decades of chipmaking expertise to quantum hardware development. Their Tunnel Falls quantum chip, released in 2023, and their new 300-millimeter cryogenic probing process could significantly accelerate quantum development by enabling high-volume data collection on spin qubit devices. While Intel’s stock faced challenges in 2024, their manufacturing prowess positions them well for mass-producing quantum processors when the technology matures.

Read Intel’s research published in Nature here.

Evaluating Quantum Stocks: Key Metrics and Inherent Risks

Investing in the best quantum computing stocks is like finding a promising new restaurant before it opens – exciting, but you need to know what to look for beyond the flashy marketing. From our perspective here in New York’s financial district, we’ve learned that evaluating quantum companies requires a completely different playbook than traditional tech investments.

Qubit quality trumps quantity in today’s quantum landscape. Early on, companies bragged about having the most qubits, like restaurants boasting about having the longest menu. Now we know it’s about excellence, not excess. What matters is achieving high fidelity rates – ideally hitting the “three nines” milestone of 99.9% accuracy in 2-qubit gate operations. Quantinuum’s achievement of 99.914% fidelity represents the kind of precision that separates serious players from the wannabes.

Error correction rates tell us which companies are solving quantum computing’s biggest challenge. Think of quantum computers as incredibly sensitive instruments that need constant fine-tuning. Microsoft’s breakthrough algorithm that runs 800 times better than previous methods isn’t just impressive – it’s the difference between a quantum computer that works occasionally and one that works reliably.

Strategic partnerships reveal which companies have real commercial potential versus those stuck in research labs. When we see IonQ partnering with Microsoft, AWS, and Google Cloud, or IBM installing quantum processors across four continents, these aren’t just business deals – they’re validation from the world’s biggest tech companies that the technology actually works.

The financial metrics get tricky because most pure-play quantum companies are burning cash faster than a busy restaurant kitchen burns through ingredients. Cash burn versus revenue growth becomes critical. IonQ’s target of $100+ million in annual revenue by 2025 sounds impressive until you consider their $176.84 million quarterly loss. The four public quantum computing companies raised over $2.4 billion in 2025, highlighting just how capital-hungry this industry is.

Early-stage technology means we’re essentially betting on the future. While quantum computers show incredible promise, most practical applications won’t arrive until the mid-2040s. It’s like investing in a chef who’s still perfecting their signature dish – the potential is enormous, but patience is essential.

Market volatility in quantum stocks makes cryptocurrency look stable. D-Wave’s 118% surge in 2025 alongside IonQ’s flat performance shows how quickly fortunes can change. News of a breakthrough can send stocks soaring, while a delayed milestone can trigger sell-offs.

Technological uncertainty adds another layer of complexity. Multiple approaches to quantum computing are competing – trapped-ion, superconducting, topological, and quantum annealing architectures. It’s unclear which will ultimately dominate, or if we’ll need a combination of approaches. Investors are essentially placing bets on different cooking techniques before knowing which will become the industry standard.

The long commercialization timeline means most quantum companies will remain unprofitable for years. Until quantum computers consistently demonstrate clear advantages over classical computers for commercially relevant problems, widespread adoption will remain limited.

Government funding plays a crucial role, with nations worldwide recognizing quantum computing’s strategic importance. Changes in government priorities could significantly impact companies dependent on public research dollars. McKinsey estimates quantum technology could create trillions in value, but that massive potential comes with equally massive investment requirements and timeline uncertainty.

The key is approaching quantum investing like finding an innovative restaurant concept – with excitement tempered by realistic expectations and a long-term perspective.

Frequently Asked Questions about Investing in Quantum Computing

As we explore the fascinating world of best quantum computing stocks from our vantage point in New York, we often hear the same thoughtful questions from investors. Let’s explore the most common concerns with the straightforward answers you deserve.

Which company is the current leader in quantum computing?

Here’s the truth that might surprise you: there isn’t one single, undisputed leader in quantum computing right now. It’s like asking which chef makes the best fusion cuisine – the answer depends on what specific flavor you’re craving.

The quantum computing landscape is beautifully diverse, with different companies excelling in different areas. Tech giants like IBM and Google lead in broad research and have the deep pockets needed for this capital-intensive field. IBM has built an impressive global network with quantum computation centers spanning four continents, while Google made headlines with their quantum supremacy achievement and continues pushing boundaries with their Willow chip.

Meanwhile, pure-plays like IonQ lead in specific architectures, particularly in trapped-ion systems. IonQ is racing toward 2 million qubits by 2030 and targeting over $100 million in annual revenue by 2025. D-Wave has carved out its own niche as the leader in quantum annealing technology.

The field is still emerging, which creates both opportunity and uncertainty. It’s similar to the early days of the internet when multiple companies were pioneering different approaches. This diversity is exactly why we recommend a thoughtful, diversified investment strategy rather than betting everything on a single quantum horse.

Is it too early to invest in quantum computing stocks?

This question gets to the heart of investment timing, and the answer depends entirely on your personal situation and risk tolerance.

For conservative investors or those seeking immediate returns, it’s probably too early. This is undeniably a speculative, long-term investment that requires patience measured in decades, not quarters. Most pure-play quantum companies are burning through cash while pouring resources into research and development. They’re not profitable yet, and truly transformative applications might not emerge until the mid-2040s.

However, for investors with high risk tolerance and a long-term horizon, the timing could be perfect. The potential for significant growth mirrors the early days of the internet or AI – technologies that seemed futuristic until they suddenly weren’t. Amazon was just an online bookstore in 1997, and look where patient investors ended up.

Think of quantum computing investments like planting an oak tree. You’re not expecting shade next summer, but in twenty years, you might have something magnificent. The key is ensuring these investments represent only a small portion of your overall portfolio – money you can genuinely afford to lose if the technology takes longer to mature than expected.

How does quantum computing threaten cybersecurity?

This question touches on one of the most immediate and practical implications of quantum computing advancement. The concern is very real, but so are the solutions being developed.

Quantum computers could break current encryption standards that protect everything from your online banking to national security communications. Today’s encryption relies on mathematical problems that would take classical computers millions of years to solve. A sufficiently powerful quantum computer – what experts call a “cryptographically relevant” quantum computer – could crack these codes in hours or days.

But here’s the reassuring part: the cybersecurity community isn’t sitting idle. This has led to the development of quantum-resistant cryptography (QRC) and quantum key distribution (QKD). Scientists are creating new encryption methods designed to withstand attacks from both classical and quantum computers.

Quantum key distribution uses the principles of quantum mechanics itself for security. Any attempt to intercept the communication actually changes the quantum state, immediately alerting both parties that someone is eavesdropping. It’s like having a conversation where the words change color if anyone else tries to listen in.

Companies like Quantinuum are already working on quantum-secure solutions, and governments worldwide are actively transitioning to post-quantum cryptography standards. While the threat is real, the response is proactive and comprehensive. It’s another reason why investing in the best quantum computing stocks isn’t just about computing power – it’s about investing in the entire ecosystem of quantum-enabled security solutions.

Conclusion: The Long-Term Quantum Horizon

As we wrap up our journey through the best quantum computing stocks for 2025, I’m reminded of those early days when personal computers seemed like science fiction. Here in New York City, we’ve witnessed countless technological revolutions transform from wild ideas into everyday reality – and quantum computing feels like the next big leap.

The numbers speak volumes about this opportunity. We’re looking at a market that could explode from $1.3 billion today to over $5 billion by 2029. McKinsey’s research suggests quantum technology could create trillions in value within the next decade. That’s not just impressive – it’s potentially life-changing for early investors.

But let’s be honest about what this means. Quantum computing stocks aren’t your typical blue-chip investments. They’re more like investing in a brilliant chef who’s still perfecting their signature dish. The potential is extraordinary, but you need patience while they work out the recipe.

The investment landscape offers something for every risk appetite. Pure-play companies like IonQ and D-Wave give you direct exposure to quantum breakthroughs, though they come with higher volatility. Tech giants like Microsoft, IBM, and Alphabet provide steadier ground while still capturing quantum upside. And supporting companies like Nvidia and Taiwan Semiconductor offer the “picks and shovels” approach that has historically rewarded patient investors.

What excites me most is that we’re still in the early chapters of this story. The quantum revolution is just beginning, much like the internet was in the 1990s or artificial intelligence was just a few years ago. The companies making breakthroughs today – whether it’s Microsoft’s error-correction advances or Google’s Willow chip – are laying the foundation for tomorrow’s quantum-powered world.

The key to success here is thorough research and realistic expectations. This isn’t a get-rich-quick opportunity. It’s a long-term commitment to one of the most promising technological frontiers we’ve ever seen. For investors ready to accept both the complexity and the incredible potential, the rewards could be truly extraordinary.

Every great investment story starts with someone willing to bet on the future before it becomes obvious to everyone else. The quantum future is coming – the question is whether you’ll be part of it.

Explore our complete library of resource guides for more expert insights.