Why Smart Travelers Need to Understand Financial Markets

Fintechzoom.com us markets today provides real-time updates and analysis on major US stock indices, individual stocks, and economic trends that can impact your financial goals. Here’s what you need to know:

Key Features:

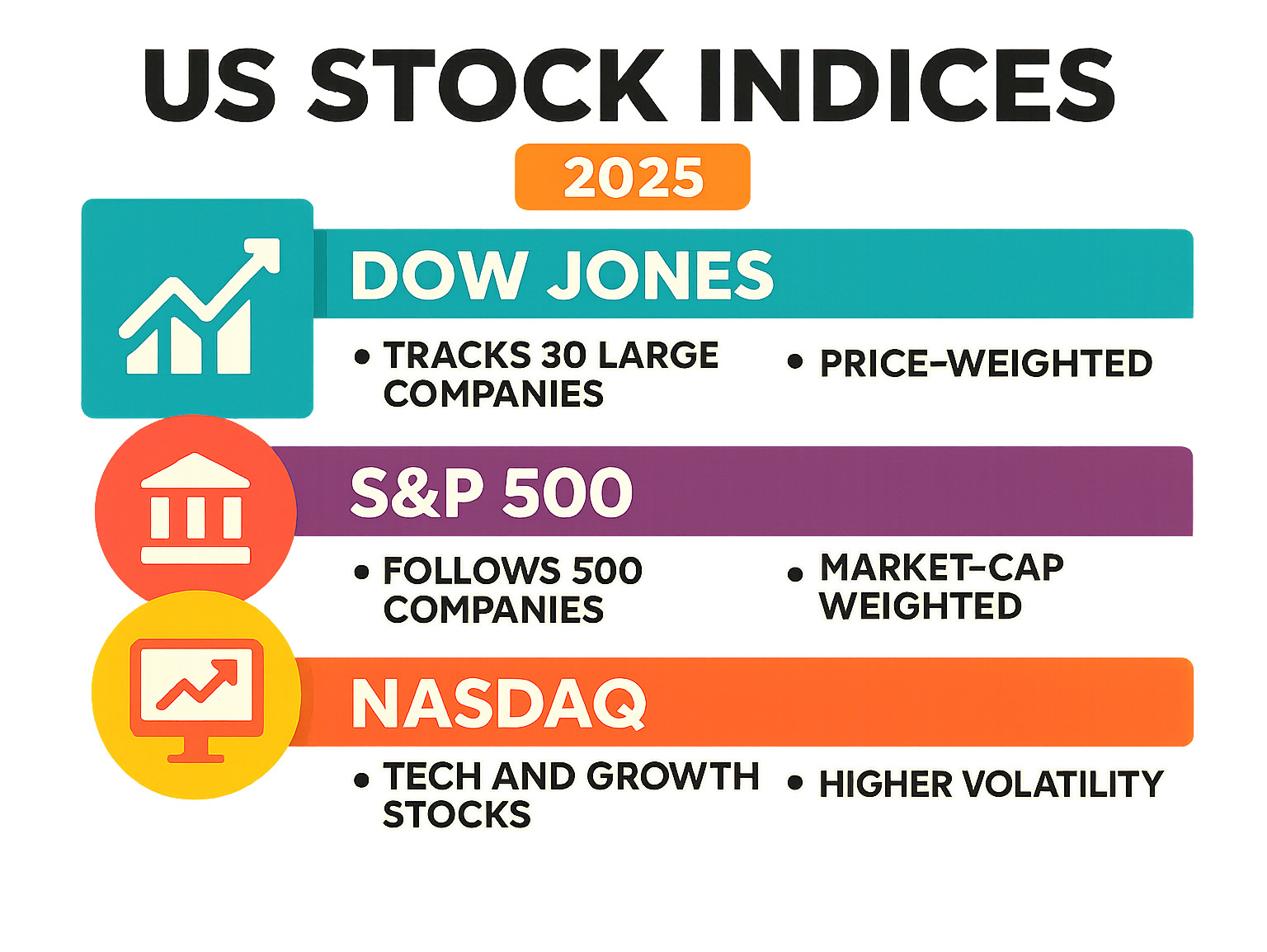

- Real-time tracking of Dow Jones, S&P 500, and Nasdaq performance

- Curated news focusing on quality over quantity for market updates

- Sector analysis covering technology, healthcare, energy, and financial industries

- Individual stock data for companies like Apple, Nvidia, and Walmart

- Integrated crypto coverage including Bitcoin and major digital assets

- Economic indicators like inflation, interest rates, and GDP data

Understanding market trends isn’t just for Wall Street professionals. Whether you’re saving for a culinary tour of Southeast Asia or building wealth for your travel lifestyle, staying informed about US markets helps you make better financial decisions.

Platforms like FintechZoom offer a “quality over quantity” approach to financial news, filtering articles to present only the most impactful information—much like how you’d research the best local restaurants instead of settling for tourist traps.

From our base in New York City, we see how market movements affect everything from restaurant prices to travel costs. Smart travelers know financial literacy is as important as finding the best ramen.

Basic fintechzoom.com us markets today terms:

1. Bookmark the Main Dashboard for Real-Time Index Performance

Checking fintechzoom.com us markets today is like checking the weather before dining outdoors—you want to know what you’re walking into. The dashboard provides that clarity for the financial world, with real-time data on the three major US indices.

The Dow Jones Industrial Average tracks 30 heavyweight companies representing the backbone of American business. A record high is like a five-star review, but there can be ups and downs. We’ve recently noticed some bearish pressure, suggesting a market breather.

The S&P 500 offers a broader view of 500 companies across industries. It’s market-value weighted, so bigger companies have more influence—like a comprehensive food guide. FintechZoom shows strong resistance around the 5,800 level, a tough price ceiling to break.

Then there’s the Nasdaq, which focuses on tech and growth stocks, making it more volatile—like a trendy restaurant that could boom or bust. The Nasdaq Composite shows strong support at 18,000, acting as a safety net.

How Fintechzoom.com US Markets Today Reflects Index Movements

fintechzoom.com us markets today is useful because it presents market movements without jargon. It shows real-time indicators like moving averages to help spot trends (e.g., the Dow’s 50-day or S&P 500’s 200-day averages). Daily fluctuations reflect market sentiment and economic health; a tech surge shows in the Nasdaq, while strong blue-chip earnings boost the Dow. FintechZoom’s clean interface provides prices, percentage changes, and context to understand the market’s performance without decoding complex reports.

2. Set Up Alerts for Key US Stocks and Market Movers

Once you’re comfortable with the dashboard, it’s time to dig into the companies that move the market. Think of it like following your favorite restaurants on social media to get news before anyone else.

Fintechzoom.com us markets today makes it easy to track individual stocks that impact your portfolio, covering market movers like Apple, Microsoft, Nvidia, and Walmart. These heavy hitters often dictate the market’s direction.

Setting up alerts is like having a personal assistant for important news. We’ve seen Apple’s value jump $230 billion in a week on AI news, while Netflix tumbled on subscriber challenges. These movements are fast, and alerts help you catch them as they happen.

FintechZoom doesn’t just show stock prices; they explain why these companies matter. For instance, they analyze if Nvidia can keep climbing despite negative forecasts or if Walmart is a safe pick for 2025. This context helps you separate meaningful alerts from market noise.

For travelers and food enthusiasts, understanding these movements is valuable. A tech surge might signal economic confidence that affects travel costs, while strong retail performance from Walmart reflects consumer spending that ripples through hospitality.

The key is focusing on companies aligned with your goals. Tracking top gainers or monitoring top losers for potential opportunities with personalized alerts keeps you informed without the overwhelm.

All About Hims Stock Analysis

5Starsstocks.com Best Stocks Guide 2025

3. Dive into Sector-Specific Analysis for Deeper Insights

After mastering the basics, explore what makes fintechzoom.com us markets today valuable: sector-specific analysis. It’s like exploring a city’s neighborhoods, each with its own character, opportunities, and risks.

The technology sector analysis on FintechZoom offers insights into AI stocks and innovation drivers like cloud computing and 5G. These Nasdaq-listed stocks present growth opportunities but also higher volatility, like choosing a trendy fusion restaurant over a familiar bistro.

The healthcare sector presents a different story. FintechZoom’s analysis highlights its stability due to consistent consumer demand, making it somewhat recession-proof—the comfort food of investing.

Retail industry coverage helps us understand how consumer spending affects market performance. Companies like Walmart, analyzed as a “Safe Pick for Steady ROI in 2025,” show how traditional retail adapts.

Financials also get thorough attention, especially as the sector shows signs of recovery. FintechZoom’s risk assessment tools help investors steer this complex world.

Identifying Trends in Key Industries

Understanding economic cycles is clearer when you see how industries respond to market changes. FintechZoom shows these patterns, helping spot sector rotation opportunities—when money flows between industries based on market conditions.

Innovation drives the tech sector, and FintechZoom tracks this with detailed analysis of emerging trends like AI and blockchain. The 5Starsstocks.com AI Complete Guide offers deeper insights.

Consumer demand patterns are visible through retail and healthcare analysis, showing how lifestyle changes affect companies. The platform also covers emerging sectors like cannabis with resources like the 5Starsstocks.com Cannabis Complete Guide.

Long-term growth versus short-term volatility becomes clearer with sector dynamics. Energy stocks might swing wildly, while healthcare stocks are more predictable. This knowledge helps you balance stability vs. volatility in your investment approach, much like balancing familiar and adventurous cuisines.

4. Understand the Bigger Picture: Macroeconomic Factors and fintechzoom.com us markets today

The stock market is like a restaurant scene: individual stocks (restaurants) and sectors (districts) matter, but the bigger economic picture—like costs and spending power—shapes everything. This is how macroeconomic factors work with fintechzoom.com us markets today.

FintechZoom helps us understand how major economic forces like inflation rates, interest rates, and Federal Reserve policy ripple through the markets. When planning a culinary trip, you consider exchange rates and local economies; the same thinking applies to investing.

Retail sales data can move markets overnight. FintechZoom explains how strong consumer spending might cool expectations for interest rate cuts, showing how probabilities for cuts can shift based on single reports.

GDP growth and unemployment data indicate the economy’s overall health. FintechZoom breaks down these complex relationships. For instance, strong retail sales suggest consumer confidence, which is good for the economy but might mean the Fed won’t lower interest rates as quickly as hoped.

The platform also covers how global events and policy changes affect markets. Recent tariffs, for example, can lead to inflation and higher import costs. FintechZoom connects these dots, showing how a tariff flows through to consumer prices and stock performance.

How Economic News Shapes the Market

FintechZoom doesn’t just report numbers; they explain the “why” behind market movements. When the Federal Reserve discusses quantitative tightening or interest rate changes, these decisions directly influence investor behavior and stock prices.

Market reaction to economic news can be swift. We’ve seen how discussions between world powers can become focal points for market direction. FintechZoom covers these geopolitical events, understanding that today’s negotiations can impact tomorrow’s market.

The platform excels at explaining the “Goldilocks” environment—a “just right” scenario of moderate growth with low inflation. Understanding these concepts helps explain why markets react differently to good economic news.

Policy shifts from the Federal Reserve often follow a “wait-and-see” approach. FintechZoom’s analysis helps us understand how these moves affect everything from bonds to stocks, ensuring we see the complete picture.

Explore market-moving news

Fintechzoom.com Economy

5. Explore the Crypto Section to See How Digital Assets Intersect

The world of finance is changing fast, and fintechzoom.com us markets today doesn’t just stick to traditional stocks. They’ve smartly integrated cryptocurrency coverage with their US market analysis, giving us a complete picture of how digital assets like Bitcoin and Ethereum are reshaping the financial landscape.

What we love about FintechZoom’s approach is how they show the connections between crypto and traditional markets. They track major cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and BNB, while also covering the blockchain technology that powers these innovations. It’s like watching two different cuisines influence each other – you start to see how flavors from one tradition improve the other.

The platform offers real-time updates and expert analysis on crypto investment opportunities, with guides like “Bitcoin Price Today News: What’s Next?” and “Best Crypto Wallet: A Complete Guide to Choosing the Best Crypto Wallet.” But here’s where it gets really interesting for us as investors: they show how crypto news directly impacts publicly traded companies.

Take Coinbase (COIN), for example. FintechZoom provides detailed stock analysis for this crypto exchange, examining its performance and revenue growth forecasts. We’ve watched Coinbase’s share prices experience bearish pullbacks after surprise earnings, showing us how crypto market dynamics ripple through traditional stock markets. It’s a perfect example of how these two worlds are no longer separate.

Using Fintechzoom.com US Markets Today for Crypto News

FintechZoom’s crypto news integration feels natural and comprehensive. They cover everything from Bitcoin’s volatile movements to the SEC’s ongoing regulatory battles with major exchanges. What sets them apart is their coverage of “U.S. Stocks Tied to Bitcoin,” helping us understand how traditional companies get influenced by crypto market movements.

They’ve reported on fascinating developments like Japanese Bitcoin stocks rising and even how Super Bowl ads impact crypto prices. The platform also keeps us updated on regulatory developments and emerging crypto scams – crucial information for anyone navigating this space safely.

The beauty of their approach is that you don’t need multiple platforms to understand the full picture. Whether it’s Ethereum’s massive withdrawals affecting traditional tech stocks or how blockchain innovations are creating new investment opportunities, fintechzoom.com us markets today brings it all together in one place.

| Feature | Bitcoin | Ethereum |

|---|---|---|

| Transaction Speed | Slower (around 10 minutes per block) | Faster (around 13-15 seconds per block) |

| Consensus Mechanism | Proof-of-Work (PoW) | Primarily Proof-of-Stake (PoS) since “The Merge” |

| Primary Use Case | Digital Gold, Store of Value | Decentralized Applications (dApps), Smart Contracts |

Fintechzoom.com Bitcoin Price Complete Guide

Fintechzoom.com Bitcoin Wallet Complete Guide

6. Learn Their Unique Approach to Financial News Curation

What truly sets FintechZoom apart in fintechzoom.com us markets today is their different approach to financial news. While most platforms bombard you with articles, FintechZoom offers quality information without the overwhelm.

Instead of a 20-page menu with mediocre options, imagine a curated selection of dishes the chef believes will give you the best experience. That’s what FintechZoom does with financial news.

Their news filtering methodology is transparent. Their editorial team sifts through major financial news services, selecting only the most impactful ones—literally one out of every hundred pieces makes the cut. This quality over quantity approach makes their platform valuable for understanding market movements without getting lost in the noise.

The team focuses on stories that affect everyday people. When they cover breaking news or market updates, they explore the “what” and “why” behind each story and its long-term impact. This means you get context that helps you understand what’s happening and why it matters.

Why Filtered News Matters for Investors

From our experience in New York City, we know information overload is real. FintechZoom’s approach to avoiding sensationalism is a breath of fresh air.

Their commitment to noise reduction means you can actually absorb the information. Instead of clickbait, you get actionable insights to make informed decisions. This is valuable when balancing financial planning with other life goals, like saving for a culinary trip or building wealth for travel.

The platform’s focus on relevance ensures the news you read has genuine impact. They provide long-term impact analysis rather than just covering daily ups and downs. This approach helps you develop critical thinking about market movements and avoid temporary market hysteria.

We appreciate how this methodology makes complex financial information accessible. You don’t need an MBA to understand their analysis of fintechzoom.com us markets today; they present information that empowers regular people to make smarter financial decisions.

7. Diversify Your Information for a Well-Rounded View

While fintechzoom.com us markets today provides excellent curated insights, smart investors know that getting a complete picture requires multiple perspectives. Think of it like exploring New York City’s food scene – you wouldn’t rely on just one guidebook, right? You’d check local blogs, ask friends for recommendations, and maybe even peek at a few different restaurant apps to find those hidden gems.

The same principle applies to financial news. Even though FintechZoom’s quality-over-quantity approach gives you a solid foundation, cross-referencing information from other reputable sources helps you verify data and conduct proper due diligence. This isn’t about doubting what you read – it’s about being thorough and forming your own well-informed opinions.

From our perspective here in New York, we see how different news outlets can emphasize different aspects of the same market story. One source might focus on the technical analysis of a stock’s movement, while another digs into the company’s fundamental business changes. By consulting multiple sources, you get that complete picture that helps you engage in critical thinking about your financial decisions.

This approach actually improves the value you get from FintechZoom’s curated content. Their filtered news gives you the essential insights efficiently, then you can use other trusted financial sources to explore specific topics that catch your interest. Maybe you want to dig deeper into a particular sector or get a second opinion on a major economic trend.

The goal isn’t to overwhelm yourself with information – that would defeat the purpose of FintechZoom’s careful curation. Instead, it’s about building confidence in your financial knowledge so you can make independent decisions, whether you’re planning investments for your next culinary trip or simply wanting to understand how market movements might affect your travel budget.

5Starsstocks.com Investing Tips

Frequently Asked Questions about FintechZoom and US Market Updates

After exploring the seven steps to leverage fintechzoom.com us markets today, you might have some lingering questions. We’ve gathered the most common ones we hear from fellow travelers and food enthusiasts starting their financial literacy journey.

What makes Fintechzoom’s approach to US market news unique?

FintechZoom’s uniqueness comes from its “quality over quantity” philosophy. Their editorial team sifts through hundreds of articles, selecting only the most impactful ones—roughly one out of every 100. This curated approach means you get essential information without the noise. They focus on explaining the ‘what’ and ‘why’ behind market events, providing context that helps everyday people understand the impact, which mirrors our own approach to food and travel content.

Does Fintechzoom provide real-time data for US markets today?

Yes, the platform provides real-time updates for major US market indices (Dow Jones, S&P 500, Nasdaq) and individual stock prices. This allows you to track market performance as it happens, which is crucial as conditions can change rapidly. You get a comprehensive view of the financial landscape, from securities exchanges to fintech developments, all in one place.

Can I find information on both stocks and cryptocurrencies on Fintechzoom?

Yes, FintechZoom integrates coverage of traditional stock markets with comprehensive analysis of the cryptocurrency space. You can find information on digital assets like Bitcoin and Ethereum alongside crypto-related stocks like Coinbase. This is helpful as the lines between traditional and digital finance blur. The platform’s holistic approach covers blockchain, fintech innovations, and regulatory updates, so you don’t need multiple sources to understand how these asset classes impact your financial goals.

Conclusion

Starting your journey toward financial literacy really is simpler than you might think. These seven steps we’ve walked through together give you a solid foundation for using fintechzoom.com us markets today as your go-to resource for understanding what’s happening in the financial world.

Think about it this way: just like we research the best local markets and hidden gem restaurants before traveling somewhere new, staying informed about financial markets helps you make smarter money decisions. Whether you’re dreaming of that culinary tour through Italy’s wine regions or planning a food trip across Southeast Asia’s street markets, having a good grasp of market trends can make those dreams more achievable.

What we love most about platforms like FintechZoom is how they make complex financial information accessible to everyday people. You don’t need an MBA or years of Wall Street experience to understand what’s moving markets or why certain stocks are performing well. The curated approach means you get the important stuff without drowning in financial jargon.

Building this knowledge isn’t just about making money – it’s about creating the financial foundation that supports the lifestyle you want. Maybe that means having enough saved for spontaneous weekend getaways to find new restaurants, or perhaps it’s building long-term wealth so you can take those extended culinary journeys we all dream about.

From our perspective here in New York City, we see how economic trends affect everything from restaurant prices to travel costs. The more you understand these connections, the better you can plan and adapt your own financial strategy.

At The Dining Destination, we truly believe that a well-planned life includes amazing experiences, and being financially informed is definitely a key ingredient in that recipe. When you understand how markets work and stay updated on trends, you’re better equipped to make decisions that support both your immediate goals and your long-term dreams.

Ready to dive deeper into smart living strategies? Check out our comprehensive Resource Guides for more practical tips that can help you create the life – and the trips – you’ve been planning.