Why 5starsstocks.com Passive Stock Investing is Perfect for Busy Professionals

5starsstocks.com passive stock investing offers a simple way to build long-term wealth without the stress of daily market monitoring. This approach lets you invest in carefully selected stocks that grow steadily over time while you focus on what matters most – like planning your next culinary trip.

Quick Answer: What You Need to Know About 5starsstocks.com Passive Stocks

- Strategy: Buy and hold quality stocks for years, not days

- Cost: Just 0.05% fees vs 0.65% for active funds

- Time Required: Minimal – set it and forget it

- Starting Amount: As little as $10 through fractional shares

- Best For: Long-term wealth building and financial freedom

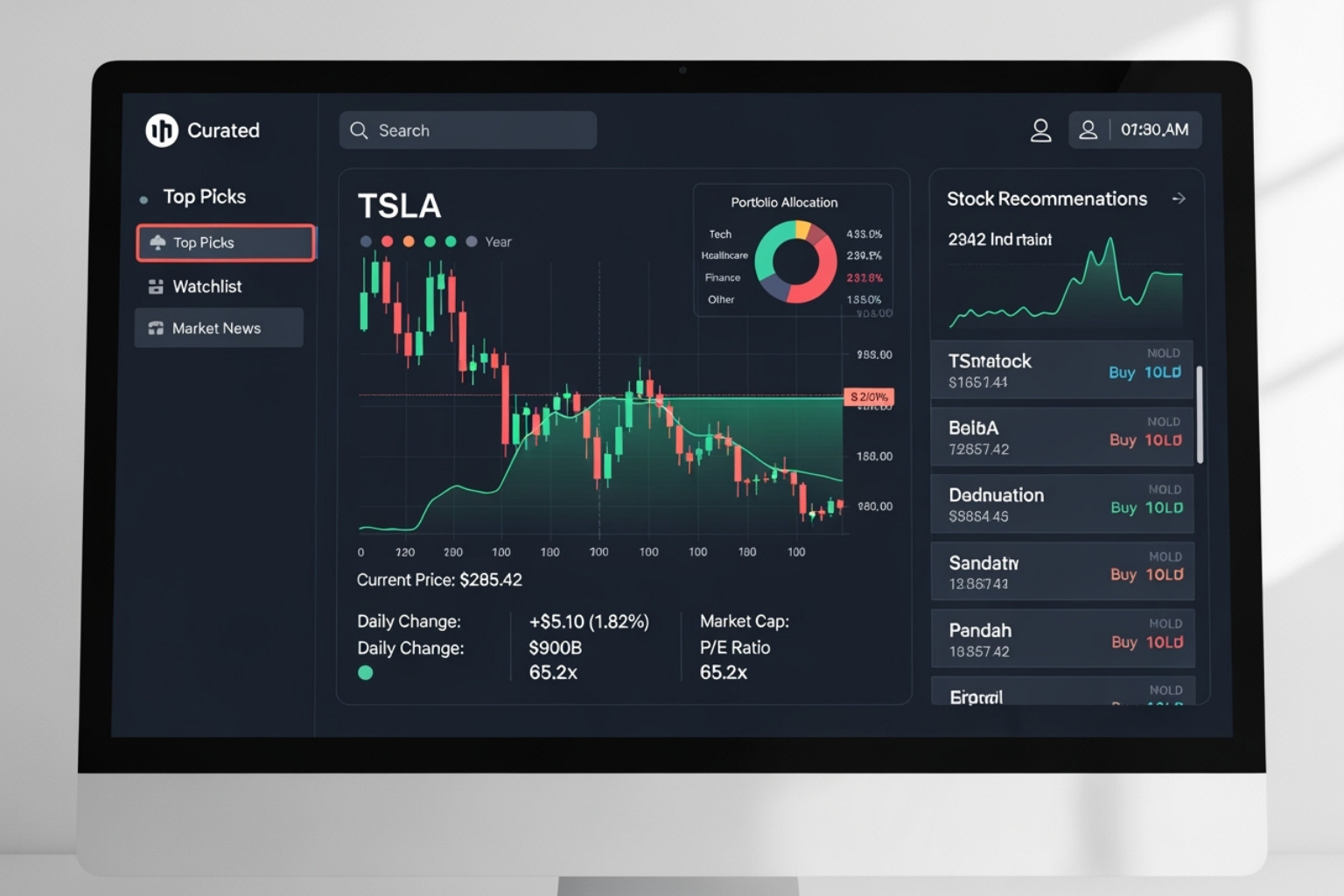

The platform uses AI-driven analysis to identify blue-chip companies, dividend aristocrats, and stable growth stocks across sectors like healthcare, technology, and consumer staples. Instead of trying to time the market, you invest in companies with strong financial health and consistent performance.

Think of it like finding the perfect restaurant during your travels. You don’t want to waste time researching every single option. You want trusted recommendations from experts who’ve already done the hard work. That’s exactly what 5starsstocks.com does for your investment portfolio.

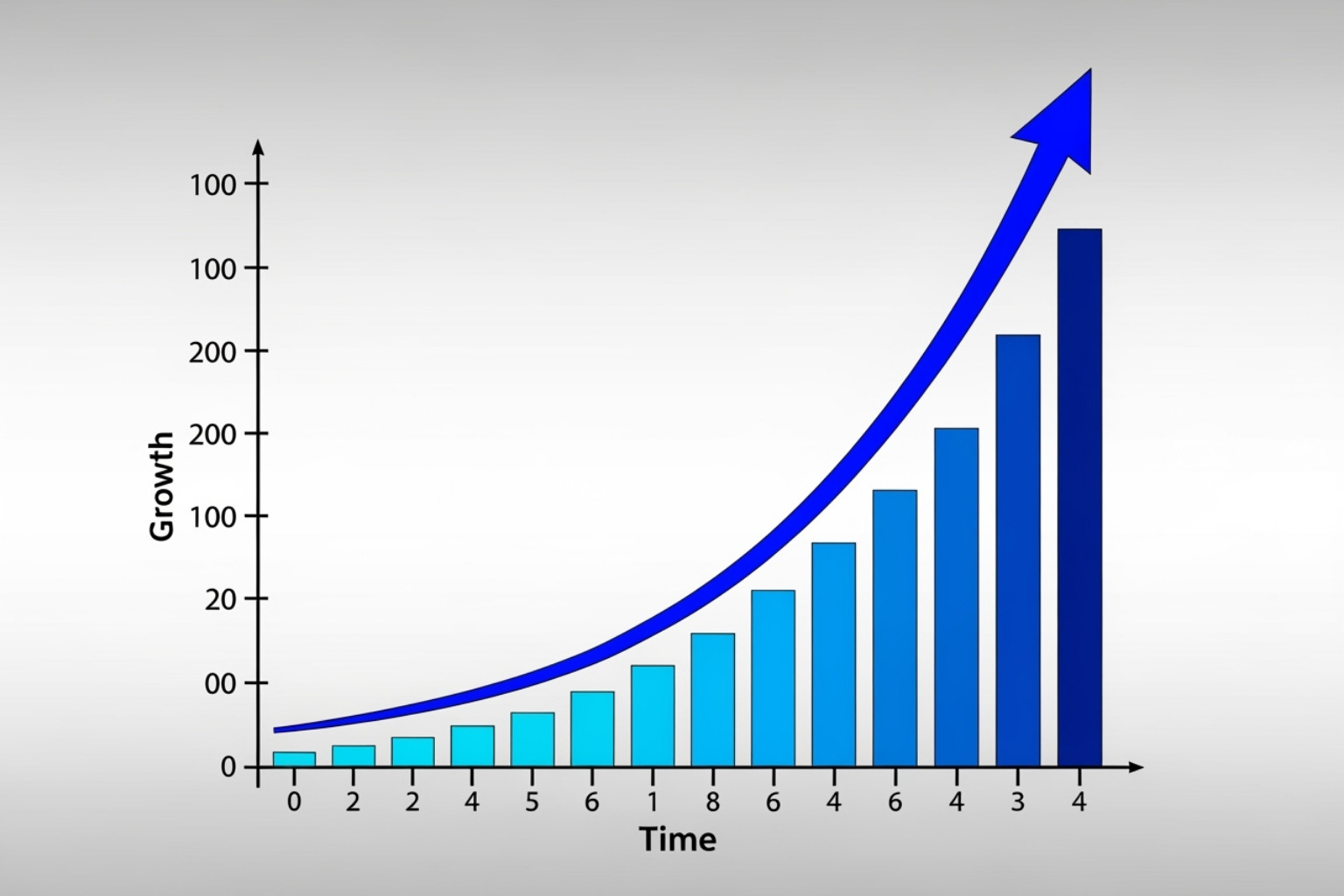

The numbers speak for themselves: A $10,000 investment growing at 4% annually would be worth $21,493 after 20 years in a passive fund with low fees, compared to just $18,959 in a high-fee active fund. That extra $2,500+ could fund several amazing dining experiences around the world.

Common 5starsstocks.com passive stock vocab:

What is Passive Investing and Why is it a Smart Strategy?

Picture the stock market as a busy kitchen during dinner rush – lots of noise, constant movement, and high stress. That’s active trading. Now imagine a slow-simmered stew that gets better with time, requiring minimal attention while delivering incredible results. That’s passive investing, and it’s perfect for anyone who wants to build wealth without the daily drama.

5starsstocks.com passive stock investing follows a beautifully simple principle: buy quality stocks and let time work its magic. Instead of frantically trying to beat the market every day, you match its performance by holding a diversified mix of solid companies for years or even decades. Think of it as the investment world’s equivalent of a perfectly aged wine – patience creates the best results.

This buy-and-hold strategy focuses on market index tracking rather than constant stock picking. You’re essentially saying, “I’ll take steady, reliable growth over the stress of trying to time every market move.” It’s an approach that reduces emotional decision-making and lets compound growth do the heavy lifting while you focus on life’s pleasures – like planning your next culinary trip.

| Metric | Passive Investing | Active Investing |

|---|---|---|

| Strategy | Market Matching | Market Beating |

| Average Cost | Low | High |

| Time Required | Minimal | Significant |

| Tax Efficiency | High | Low |

The numbers tell a compelling story. While active funds often charge around 0.65% in fees, passive investing typically costs just 0.05% annually. That difference might seem small, but it compounds dramatically over time. For deeper insights into how economic trends affect these investments, check out more info about the economy.

The Core Benefits of a Passive Approach

The beauty of passive investing lies in its neat simplicity. Lower costs top the list of advantages – when you’re not paying fund managers to constantly trade, more of your money stays invested and working for you. It’s like finding a hidden gem restaurant that serves five-star quality at three-star prices.

Tax efficiency naturally follows from the buy-and-hold approach. Since you’re not constantly buying and selling, you trigger fewer taxable events. This means more of your returns stay in your pocket instead of going to Uncle Sam. The simplicity factor can’t be overstated either – once your portfolio is set up, it practically runs itself.

Perhaps most importantly, passive investing dramatically reduces emotional decision-making. We’ve all heard stories of investors who panic-sold during market dips or chased hot stocks at their peak. The passive approach removes these temptations by encouraging a disciplined, long-term perspective. The proven long-term performance of broad market indexes speaks for itself – while you might not get bragging rights about beating the market, you’ll likely outperform most active investors after fees and taxes.

Understanding the Cost Advantage

Let’s make those fee differences real with a simple example. Imagine you invest $10,000 and it grows at a steady 4% annually. In a passive fund with low fees, that money becomes approximately $21,493 after 20 years. In a high-fee active fund, the same investment only reaches about $18,959.

That’s nearly $2,500 left on the table – enough to fund several amazing dining experiences around the world! This demonstrates the powerful compounding effect of lower fees. Every dollar saved on management costs gets reinvested and grows over time, maximizing returns over time in a way that truly adds up.

When you choose 5starsstocks.com passive stock investments, you’re prioritizing this cost efficiency. It’s a strategy that recognizes time and patience as your greatest allies in building lasting wealth, leaving you free to enjoy life’s finer experiences while your investments steadily grow in the background.

How 5starsstocks.com Selects Winning Passive Stocks

Picture this: you’re planning a perfect evening out in the city, but instead of spending hours researching every restaurant, you have a trusted food critic who’s already done the legwork. That’s exactly what 5starsstocks.com passive stock selection does for your investment portfolio. For busy professionals like us who value both quality and efficiency, this platform becomes our expert guide through the complex world of stock investing.

The beauty of 5starsstocks.com lies in its sophisticated yet accessible approach. Think of it as having a personal sommelier for your investments – someone who combines cutting-edge AI analysis with seasoned human expertise to curate only the finest selections. Their unique five-star rating system cuts through market noise, providing clear guidance even for beginners who might feel overwhelmed by financial jargon.

Rather than throwing darts at a board, the platform employs rigorous research-driven methods to identify companies with strong fundamentals and genuine long-term growth potential. This saves us countless hours while building confidence in our investment choices. The system provides real-time updates, advanced charts, and smart filters that make informed decision-making feel surprisingly straightforward. If you’re curious to explore their complete stock offerings, check out 5starsstocks.com Stocks.

Screening for Financial Health and Stability

Just as a master chef carefully selects only the freshest ingredients, 5starsstocks.com applies strict quality standards when choosing 5starsstocks.com passive stock recommendations. Their screening process focuses on financial health and stability – the foundation that separates solid long-term investments from risky gambles.

The platform’s financial health analysis starts with liquidity, specifically looking for companies with a Quick Ratio above 1.0. This tells us whether a company can easily cover its short-term bills without scrambling for cash. It’s like ensuring your favorite restaurant has enough ingredients to prepare your meal without running to the grocery store mid-service.

Solvency comes next, where they examine debt-to-equity ratios. Companies drowning in debt spend most of their earnings paying interest instead of growing their business or rewarding shareholders. 5starsstocks.com prioritizes businesses with healthy balance sheets – companies that aren’t living paycheck to paycheck.

Consistent earnings represent the gold standard in passive investing. The platform searches for companies with proven track records of steady profitability. These businesses demonstrate reliable performance year after year, much like that neighborhood restaurant you can always count on for a great meal.

The screening process deliberately avoids high-debt companies and overly volatile stocks. While explosive growth stories might grab headlines, they often come with heart-stopping price swings. For passive investors seeking peace of mind, stability trumps excitement every time. The platform focuses on companies with sustainable dividend payout ratios below 50% of earnings, ensuring those quarterly payments aren’t just generous but genuinely reliable.

While 5starsstocks.com provides excellent guidance, investment decisions should be based on your individual circumstances. The SEC offers valuable insights worth considering before making any investment moves.

Key Passive Stock Categories on 5starsstocks.com

The platform organizes its 5starsstocks.com passive stock recommendations into carefully curated categories, each serving a specific purpose in building a well-rounded portfolio. These aren’t random groupings – they’re strategic building blocks designed for long-term stability and growth.

Dividend Aristocrats represent the crème de la crème of dividend-paying stocks. These companies have increased their dividends for at least 25 consecutive years running. Think McDonald’s, Johnson & Johnson, and 3M – brands as reliable as your favorite coffee shop that never disappoints. They’re the Michelin-starred establishments of the investment world, consistently delivering quality returns.

Blue-Chip Stocks form the backbone of many passive portfolios. These industry giants like Apple, Microsoft, and Procter & Gamble have weathered countless economic storms while maintaining their market leadership. They offer the investment equivalent of dining at a well-established restaurant with decades of satisfied customers.

Real Estate Investment Trusts (REITs) provide a unique flavor to your portfolio mix. Companies like Realty Income and American Tower let you invest in real estate without becoming a landlord. They generate steady income from rent payments, offering regular dividends that can complement your other investments beautifully.

Utility Stocks serve as the comfort food of investing. Duke Energy and NextEra Energy provide essential services people need regardless of economic conditions. Whether times are good or challenging, people still need electricity and water – making these stocks remarkably stable income producers.

The platform also identifies Technology Leaders with solid fundamentals rather than just flashy growth stories. They focus on established tech companies with reasonable valuations and sustainable competitive advantages, leveraging the sector’s long-term growth potential without excessive risk.

Healthcare Innovators benefit from both demographic trends and continuous medical advances. This sector offers defensive characteristics during market downturns while providing growth opportunities through pharmaceutical breakthroughs and medical device innovations.

Consumer Staples companies produce the essentials people buy regardless of economic conditions – food, beverages, household products. These businesses provide steady dividends and defensive stability, much like how people always need to eat, even during tough times.

The platform rounds out its recommendations with carefully selected Defense Stocks, Materials companies, and even emerging opportunities in sectors like cannabis for investors seeking diversified exposure. For a comprehensive overview of market sectors, you can explore Sectors by Yahoo Finance.

By spreading investments across these categories, you create a robust portfolio that balances income generation, stability, and growth potential – much like crafting a perfectly balanced tasting menu that satisfies every palate.

Building Wealth with Your 5starsstocks.com Passive Stock Portfolio

The beauty of 5starsstocks.com passive stock investing lies in its long-term vision. It’s not about getting rich overnight, but rather steadily accumulating wealth, leveraging the power of time and compounding. This strategy is particularly effective for those aiming for significant financial milestones, whether it’s retirement planning or achieving financial independence to pursue passions like extensive travel and culinary exploration.

Think of building wealth through passive investing like aging a fine wine or perfecting a signature recipe. The best results come to those who understand that patience and consistency create something truly remarkable. When you invest in quality companies and let them grow over decades, you’re essentially setting up a financial foundation that can fund all those dream culinary trips you’ve been planning.

We understand that building substantial wealth requires patience and consistency. Passive investing, especially when utilizing dividend reinvestment, is a proven pathway to achieving this. It’s about setting up your investments, letting them grow, and focusing on the bigger picture. For more detailed insights into market trends and their impact on long-term growth, you can check out our guide on more info about the SP500.

The Power of Dividend Reinvestment (DRIP)

Imagine if every time you enjoyed a great meal at a restaurant, they automatically gave you a small ownership stake that grew over time. That’s essentially what happens with dividend reinvestment through 5starsstocks.com passive stock selections. Many high-quality companies pay regular dividends to their shareholders, and instead of pocketing that cash, you can automatically reinvest it to buy more shares.

This creates what we call the compounding snowball effect. Your dividends buy more shares, those new shares earn their own dividends, which buy even more shares. It’s like a recipe that keeps getting better each time you make it.

The numbers tell an incredible story. The S&P 500’s total return with reinvested dividends has historically averaged about two percentage points higher than just price appreciation alone. That might not sound like much, but over time, it’s the difference between a good investment and a life-changing one.

Here’s a real-world example that shows the power: A $5,000 investment growing at 8% with reinvested dividends could reach $24,000 after 20 years. Without reinvestment, growing at 6%, it would only reach $16,000. That extra $8,000 could fund several months of exploring the world’s finest restaurants.

The most stunning example comes from long-term data. A $10,000 investment in the S&P 500 back in 1960 would have grown to approximately $796,432 by 2023 without reinvesting dividends. But with automatic dividend reinvestment? That same $10,000 would have ballooned to over $5.10 million. That’s the kind of wealth that transforms lives and opens doors to endless culinary experiences.

Managing Risks in Your 5starsstocks.com passive stock Portfolio

Even the most carefully crafted dish needs the right balance of ingredients, and your 5starsstocks.com passive stock portfolio is no different. While passive investing is designed to be lower stress than active trading, smart investors understand and prepare for the natural challenges that come with any investment strategy.

Market volatility is perhaps the most obvious risk. Stock markets naturally go through seasons – sometimes they’re booming like a busy weekend brunch service, other times they’re quiet like a Tuesday evening. The key is maintaining a long-term perspective. Instead of panicking when markets dip, successful passive investors stay the course, knowing that historically, markets recover and trend upward over time.

Concentration risk happens when you put too many eggs in one basket. If you invested everything in restaurant stocks right before the pandemic, you learned this lesson the hard way. That’s why diversification across sectors is crucial. 5starsstocks.com helps by recommending a mix of industries – technology leaders, healthcare innovators, consumer staples, and dividend aristocrats. This way, if one sector struggles, your entire portfolio doesn’t suffer.

Another consideration is dividend sustainability. Even stable companies sometimes reduce their dividend payments during tough economic times. The platform addresses this by focusing on companies with strong financial health and reasonable payout ratios, typically below 70% of earnings. This ensures companies can comfortably afford their dividends even during challenging periods.

The secret to managing these risks isn’t complicated – it’s about sticking to the plan. The disciplined, hands-off nature of passive investing naturally discourages the emotional decisions that often turn small setbacks into major losses. When you trust the process and maintain your long-term vision, you’re positioning yourself for the kind of financial freedom that lets you explore every corner of the culinary world without worrying about the cost.

A Beginner’s Step-by-Step Guide to Getting Started

Starting your passive investing journey with 5starsstocks.com passive stock is surprisingly simple, even if you’ve never bought a stock in your life. Think of it like trying a new restaurant – a little intimidating at first, but once you know what to expect, it becomes second nature. The platform removes those scary financial barriers that make investing feel like rocket science.

Here’s the best part: you don’t need thousands of dollars to start. Fractional shares let you invest with as little as $10. That’s less than what you’d spend on a nice lunch in Manhattan! This means you can buy a slice of expensive stocks like Apple or Microsoft without needing their full share price.

The whole process is designed for busy people who want to build wealth without becoming full-time investors. Ready to take that first step toward financial freedom? Visit www.5starsstocks.com to begin your journey.

Step 1: Define Your Goals and Explore the Platform

Before you dive in, take a moment to think about what you’re actually trying to achieve. Are you saving for retirement? Planning that dream food tour through Southeast Asia? Maybe you want to build an emergency fund that actually grows instead of sitting in a savings account earning practically nothing.

Having clear financial goals makes everything else easier. It helps you stay motivated when the market gets bumpy, and it guides how much risk you’re comfortable taking.

Once you know your “why,” spend some time exploring what 5starsstocks.com offers. Browse their curated passive stock lists and get familiar with different categories. Their educational resources explain everything in plain English – no MBA required. You’ll find clear explanations about why they recommend certain stocks and how their screening process works.

Think of this as reading the menu before you order. You want to understand your options so you can make informed choices that align with your goals.

Step 2: Open a Brokerage Account and Start Small

To actually buy stocks, you’ll need a brokerage account. Don’t worry – this isn’t as complicated as it sounds. Many commission-free brokers today make the process straightforward, often taking just minutes to set up online.

Look for brokers that offer fractional shares and have low or no minimum balance requirements. Once you’ve chosen one, you’ll link your bank account to transfer money for investing.

Here’s where the magic of starting small really shines. Begin with a manageable amount – even $50 or $100 if that feels comfortable. The key is getting started, not the size of your initial investment.

Diversify early by spreading your initial investment across different sectors. Instead of putting everything into one tech stock, consider mixing in some healthcare, consumer staples, and maybe a REIT. This way, if one area struggles, your entire portfolio doesn’t suffer.

Step 3: Automate and Be Patient

This is where passive investing truly becomes passive. Set up automatic investments from your bank account on a regular schedule – weekly, bi-weekly, or monthly, whatever works for your budget. This strategy, called dollar-cost averaging, takes the guesswork out of timing the market.

Most importantly, enable Dividend Reinvestment Plans (DRIPs) for any dividend-paying stocks you own. This automatically uses your dividend payments to buy more shares, creating that powerful compounding effect we discussed earlier.

Now comes the hardest part for many people: being patient. Avoid the temptation to check your portfolio every day. The market will have good days and bad days, just like your favorite restaurant might have an off night occasionally. Focus on the long term and trust the process.

Set up these systems once, then let time and compounding work their magic. It’s the ultimate “set-it-and-forget-it” approach to building wealth – kind of like using a slow cooker for the perfect meal. You do the prep work upfront, then let time do the heavy lifting.

Frequently Asked Questions about 5starsstocks.com Passive Stock Investing

We get it – starting your investment journey can feel overwhelming, especially when you’re juggling a busy New York lifestyle. That’s why we’ve gathered the most common questions about 5starsstocks.com passive stock investing to help clear up any confusion. Think of this as your friendly neighborhood guide to getting started with confidence.

How does 5starsstocks.com select its passive stocks?

The platform doesn’t just throw darts at a financial dartboard. Instead, 5starsstocks.com uses a strict screening process that would make even the most discerning restaurant critic proud. They focus on financial health, looking for companies that can weather economic storms just like your favorite neighborhood bistro that’s been serving consistently great food for decades.

Their selection criteria includes companies with strong liquidity – meaning a quick ratio above 1.0 so these businesses can easily pay their bills. They also prioritize low debt-to-equity ratios because nobody wants to invest in a company that’s drowning in debt payments instead of focusing on growth.

What really sets them apart is their focus on sustainable dividend payouts. They target companies in stable, growing sectors like healthcare and technology, but only the established players – not the flashy startups that might disappear faster than a trendy popup restaurant. They specifically avoid overly volatile stocks, keeping your stress levels as low as a leisurely Sunday brunch.

The beauty is that this rigorous process saves you countless hours of research. Instead of spending your evenings analyzing financial statements, you can focus on planning your next culinary trip.

Can I really start investing with a small amount of money?

Here’s some fantastic news – you absolutely can! One of the most exciting developments in modern investing is that 5starsstocks.com passive stock investing is accessible to everyone, regardless of your budget. You can start with as little as $10 through fractional shares.

Think about it this way: instead of needing $3,000 to buy one full share of an expensive stock, fractional shares let you own a piece of that same company for just a few dollars. It’s like being able to enjoy a taste of that exclusive tasting menu without having to book the entire private dining room.

This accessibility means you can build a diversified portfolio gradually without needing a large chunk of initial capital. Start small, stay consistent, and watch your investments grow over time. Many of our fellow New Yorkers have built substantial wealth this way, beginning with modest amounts while they were still paying off student loans or saving for their first apartment.

The key is getting started and developing the habit of regular investing, not the size of your initial deposit.

What are the main benefits of using 5starsstocks.com for passive investing?

Using 5starsstocks.com for your passive investing journey offers three major advantages that align perfectly with our busy, goal-oriented lifestyles.

Lower costs top the list – and we’re talking about significant savings here. The platform guides you toward investments with fees as low as 0.05% compared to actively managed funds that can charge 0.65% or more. Over decades, this difference compounds into thousands of extra dollars in your pocket. That’s money that could fund multiple culinary trips to Paris or Tokyo.

Reduced stress is equally important. The platform’s expert-curated recommendations mean you don’t need to become a financial analyst overnight. Their AI-driven system does the heavy lifting, identifying high-quality companies with strong fundamentals. This time-saving approach lets you focus on what matters most to you, whether that’s advancing your career or exploring the latest dining trends in the city.

Finally, there’s the tax efficiency benefit. 5starsstocks.com’s buy-and-hold strategy minimizes taxable events since you’re not constantly buying and selling. Less frequent trading means fewer capital gains taxes, allowing more of your money to compound over time.

The platform essentially simplifies the entire process, helping you build a solid, long-term portfolio with minimal effort and maximum peace of mind. It’s designed to work for everyone, from complete beginners to seasoned investors who want a more hands-off approach to growing their wealth.

Conclusion

As we wrap up our exploration of 5starsstocks.com passive stock investing, I hope you’re feeling as excited as I am about this neat approach to building wealth. There’s something beautifully simple about a strategy that lets you grow your money while you focus on the things that truly matter – like finding that perfect hole-in-the-wall ramen shop or planning your next culinary trip.

The numbers don’t lie. We’ve seen how passive investing can turn a modest $10,000 into over $21,000 in just 20 years, simply by keeping fees low and letting compound growth work its magic. That extra money could fund multiple foodie trips to Tokyo, wine tastings in Tuscany, or cooking classes with renowned chefs around the world.

5starsstocks.com passive stock investing takes the guesswork out of this process. Their AI-driven analysis and expert curation mean you don’t have to spend your evenings researching financial statements when you could be trying that new fusion restaurant downtown. Instead, you get access to carefully selected dividend aristocrats, blue-chip companies, and stable growth stocks that have been vetted for financial health and long-term potential.

What strikes me most about this approach is how it aligns with the way we think about great dining experiences. You don’t need to reinvent the wheel – you trust established restaurants with proven track records, consistent quality, and sustainable business models. The same principle applies to your investment portfolio.

The beauty of starting with just $10 through fractional shares means there’s no excuse to wait. Whether you’re a recent graduate drowning in student loans or a seasoned professional looking to optimize your retirement planning, 5starsstocks.com passive stock investing meets you where you are. Set up your automatic investments, enable those dividend reinvestment plans, and let time do the heavy lifting.

Think about it this way: every dollar you invest today is like planting a seed for future culinary trips. While you’re savoring life’s flavors today, your investments are quietly growing in the background, funding tomorrow’s wine country tours, chef’s table experiences, and spontaneous weekend getaways to food festivals.

Financial freedom through smart, patient investing opens doors to experiences that money can’t buy – well, actually it can buy them, but you know what I mean. When you’re not worried about money, you can truly appreciate that perfectly prepared osso buco or splurge on the omakase menu without guilt.

The path forward is clear and surprisingly simple. Visit the platform, explore their recommendations, open that brokerage account, and start small. Your future self – the one enjoying champagne and oysters in a Parisian café – will thank you for taking this first step today.

For more insights on building wealth while pursuing your passion for exceptional dining experiences, be sure to explore our resource guides for more financial tips. After all, the best investments are the ones that help you live your best life.