Why AI is Revolutionizing Stock Market Investing

5starsstocks.com ai is changing how people invest in the stock market. This platform uses artificial intelligence to analyze massive amounts of data and help investors make smarter decisions without emotional bias.

What 5starsstocks.com ai offers:

- AI-powered stock analysis that processes millions of data points daily

- Real-time market insights with predictive analytics

- Proprietary star rating system (1-5 stars) for easy stock evaluation

- Risk management tools and portfolio optimization

- Automated trading alerts for timely investment decisions

- Beginner-friendly interface with educational resources

The platform stands out because it removes human emotion from investing. While traditional analysis relies on gut feelings and limited data, 5starsstocks.com ai processes 8,000+ news articles, 500,000 tweets, and 10,000 regulatory filings every second.

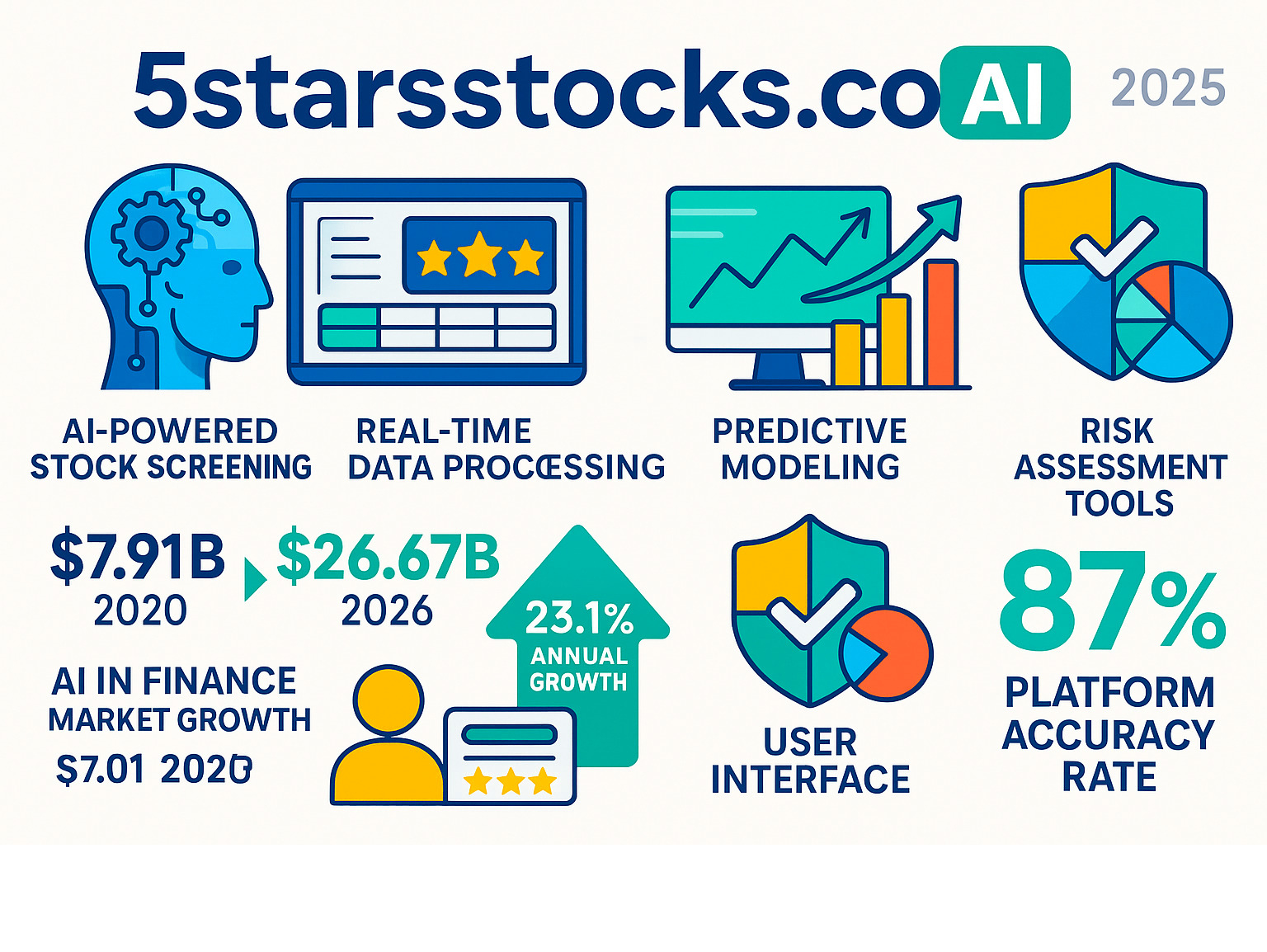

The numbers speak for themselves: The AI in finance market is growing from $7.91 billion in 2020 to a projected $26.67 billion by 2026. That’s a 23.17% annual growth rate, showing how quickly investors are adopting these tools.

As one user shared: “I doubled my portfolio’s value within six months by leveraging the platform’s predictive analytics.” – Sarah from New York

This technology isn’t just for Wall Street professionals anymore. 5starsstocks.com ai makes advanced trading tools accessible to everyday investors, whether you’re a complete beginner or an experienced trader looking for an edge.

Simple 5starsstocks.com ai glossary:

What is 5StarsStocks AI and How Does It Work?

Think of 5starsstocks.com ai as your personal investment chef, carefully selecting the finest market ingredients to create a perfectly balanced portfolio. Just as we at The Dining Destination help you find the best culinary experiences, this cutting-edge platform serves up sophisticated stock analysis that was once only available to Wall Street’s elite.

At its heart, 5starsstocks.com ai is a platform that transforms how everyday investors approach the stock market. Using proprietary machine learning algorithms, it digests massive amounts of market data faster than you can say “buy low, sell high.” The platform builds predictive models and processes real-time market information around the clock, delivering actionable insights that help users make informed investment decisions.

What makes this platform special is how it democratizes sophisticated trading tools. Instead of needing a team of expensive analysts, you get AI-powered insights that level the playing field between individual investors and major financial institutions. It’s like having a Michelin-starred chef in your kitchen, guiding every investment decision with precision and expertise.

The Technology Behind the Predictions

The real magic happens behind the scenes, where 5starsstocks.com ai combines multiple advanced technologies to create something truly powerful. The platform leverages machine learning algorithms that continuously improve their accuracy, deep learning networks that can spot complex patterns, and Natural Language Processing (NLP) that actually understands market sentiment.

Here’s where it gets really interesting – the AI doesn’t just crunch numbers like a calculator. Through NLP technology, it can read and interpret human language from financial reports, news articles, and even social media trends. Imagine an AI that can detect nervousness in a CEO’s voice during an earnings call or spot optimism in thousands of tweets about a company.

The platform draws from an incredibly diverse range of data sources to create a complete market picture. Financial reports provide the fundamental numbers, while social media trends reveal what people really think about companies. Historical market data shows patterns, and real-time information keeps everything current and relevant.

This comprehensive approach means 5starsstocks.com ai can spot opportunities and risks that human analysts might miss. It’s like having thousands of expert taste-testers sampling every ingredient in the market and reporting back with their findings.

From Data to Decisions: The Analysis Process

Once all that data flows in, 5starsstocks.com ai gets to work with some seriously impressive pattern recognition capabilities. The platform excels at identifying trends and connections that would take human analysts weeks to find. It’s constantly performing risk assessment and forecasting future performance based on historical patterns and current market conditions.

One of the most user-friendly features is the proprietary star rating system. Instead of drowning you in complex charts and confusing metrics, the platform distills its analysis into a simple 1-to-5 star rating. Five stars means “strong buy recommendation,” while one star suggests you might want to look elsewhere. It’s as straightforward as checking restaurant reviews before trying a new place.

The platform also uses unsupervised learning algorithms that can identify promising investment opportunities without being explicitly programmed to look for them. These algorithms continuously adapt to changing market conditions, learning from new data and refining their predictions over time.

This means 5starsstocks.com ai gets smarter with experience, just like a seasoned chef who develops better instincts after years in the kitchen. The result is a dynamic tool that evolves with the market, helping users stay ahead of trends and make more confident investment decisions.

Core Features and Benefits of the 5starsstocks.com ai Platform

When I first finded 5starsstocks.com ai, I was amazed by how it transformed my entire approach to investing. Just like how we at The Dining Destination help food enthusiasts steer the complex world of culinary experiences, this platform simplifies the overwhelming landscape of stock market investing.

The most striking benefit is how 5starsstocks.com ai fundamentally improves decision-making by replacing gut feelings with hard data. Instead of wondering whether a stock might perform well, you get insights based on millions of data points analyzed in real-time. This means less time staring at confusing charts and more time focusing on what matters most – whether that’s exploring New York City’s latest dining trends or simply enjoying life.

The platform also saves incredible amounts of time by automating the tedious research that used to take hours. Remember when finding a great restaurant meant calling dozens of places? That’s what stock research used to feel like. Now, 5starsstocks.com ai does the heavy lifting, scanning thousands of stocks while you sleep.

Perhaps most importantly, it increases investor confidence by providing clear, actionable insights. When you see that 5-star rating backed by comprehensive analysis, you can move forward with greater certainty. It’s like having a trusted food critic’s recommendation – you know there’s solid reasoning behind it.

The real game-changer is how this platform democratizes sophisticated trading tools. What Wall Street firms paid millions for is now accessible to everyday investors. It’s the same revolution we’ve seen in food culture – gourmet techniques once exclusive to high-end restaurants are now available to home cooks.

Key Features That Give You an Edge

The AI-powered stock screening feature is like having a personal assistant who never gets tired. It continuously scans the entire market, identifying patterns and opportunities that align with your investment goals. Think of it as the ultimate treasure hunt – the AI finds the hidden gems while you focus on your strategy.

The proprietary star rating system makes complex analysis beautifully simple. A 5-star stock means the AI has very high confidence based on its rigorous analysis of financial performance, growth potential, and market conditions. It’s as straightforward as reading restaurant reviews – you instantly know what’s worth your attention.

Actionable trade alerts ensure you never miss important opportunities. These real-time notifications are custom to your investment style, whether you prefer quick swing trades or long-term positions. The system even provides automated strategies for options trading, giving more advanced investors sophisticated tools for precise execution.

What I love most is the customizable strategies feature. You set your risk tolerance and investment preferences, and the AI tailors everything accordingly. Looking for steady income? Rapid growth? Stable returns? The platform adapts to match your exact needs.

The risk management tools provide real-time assessment and portfolio optimization suggestions. This includes guidance on stop-loss orders and diversification strategies. It’s like having a financial advisor who never sleeps, constantly monitoring your investments and alerting you to potential issues.

Comparing 5StarsStocks AI vs. Traditional Human Analysis

The difference between 5starsstocks.com ai and traditional analysis is like comparing a modern GPS to a paper map when navigating New York City’s complex streets. Both can get you there, but one makes the journey infinitely smoother.

| Feature | 5StarsStocks AI | Traditional Human Analysis |

|---|---|---|

| Speed | High | Moderate |

| Data Volume | Large | Limited |

| Emotional Bias | None | Possible |

| Accessibility | Broad | Varies |

| Cost | Efficient | Can be high |

| Objectivity | High | Varies |

Traditional analysts, despite their expertise, face human limitations. They can only process so much information, need sleep, and sometimes let emotions cloud their judgment. 5starsstocks.com ai processes millions of data points daily, operates 24/7 without coffee breaks, and maintains complete objectivity.

The numbers speak for themselves: while human analysts achieve about 60% accuracy on one-year price targets, 5starsstocks.com ai boasts 76% accuracy in its 2020-2024 backtests. That’s like the difference between a good restaurant recommendation and a great one – those extra percentage points can significantly impact your investment returns over time.

Human analysis will always have its place, but combining it with AI-powered insights creates a more complete picture. It’s not about replacing human judgment entirely – it’s about augmenting it with powerful tools that help us make smarter, more informed decisions.

Navigating AI Stock Investing: Recommendations and Risks

Think of 5starsstocks.com ai as your personal investment sommelier, expertly guiding you through the complex world of stock selections just like we guide food lovers through New York City’s culinary landscape. The platform doesn’t just throw darts at a board – it uses rigorous selection criteria that would make even the most discerning food critic proud.

The AI carefully evaluates each potential investment by examining financial performance (are the numbers healthy?), growth potential (is there room to flourish?), competitive advantage (what makes them special?), management team strength (who’s running the kitchen?), and industry trends (what’s hot right now?). This thorough approach helps identify companies with rock-solid fundamentals and promising long-term prospects.

It’s like finding that perfect hole-in-the-wall restaurant that has everything going for it – great food, smart owners, growing neighborhood, and a unique concept that sets it apart from the competition.

Top AI Stocks Recommended by 5starsstocks.com ai

When 5starsstocks.com ai makes recommendations, it typically focuses on two main categories: companies that are pure AI plays and established tech giants with strong AI focus. Think of it as the difference between a specialized artisanal bakery and a full-service restaurant that happens to make incredible bread.

The platform has highlighted several standout companies in the AI space. Nvidia (NVDA) often takes center stage as a pure AI play, dominating the graphics processing unit market that powers AI development. It’s like being the exclusive supplier of the best ingredients to every top chef in the city.

Palantir Technologies (PLTR) represents another fascinating pure AI play, specializing in data analysis software for government and corporate clients. While sometimes controversial, its unique contracts and proprietary technology make it compelling. SoundHound AI (SOUN) focuses specifically on voice AI technology, representing the smaller, high-growth potential companies in this space.

Then there are the tech giants who’ve acceptd AI like master chefs adopting new cooking techniques. Amazon (AMZN) leverages AI across its entire ecosystem – from e-commerce recommendations to cloud computing through AWS. Alphabet (GOOG) powers ahead with Google’s search algorithms, DeepMind research, and autonomous vehicle projects through Waymo.

ServiceNow Inc. (NOW) specializes in AI-driven workflow automation for enterprises, while IBM has significantly ramped up its AI efforts with the Watson platform. Super Micro Computer Inc. (SMCI) provides the essential server infrastructure that makes AI development possible, and Applovin Corporation (APP) uses AI to optimize mobile advertising.

The platform’s track record speaks for itself. 5starsstocks.com ai caught Nvidia’s earnings beat by analyzing repeated positive phrases in their earnings calls. It can even calculate “Jargon Scores” in company communications, which often correlate with potential downside risk – like detecting when a restaurant’s menu descriptions are trying too hard to hide mediocre food.

Understanding the Risks and Challenges

Now, let’s be honest – even the most sophisticated AI can’t predict everything, just like we can’t guarantee every restaurant recommendation will be your new favorite spot. 5starsstocks.com ai provides powerful insights, but investing always involves risks that no technology can completely eliminate.

Market volatility remains the biggest wild card. Even with the best AI analysis, sudden geopolitical events or economic shifts can shake up stock performance faster than you can say “supply chain disruption.” The AI itself admits it’s “no crystal ball,” and it even “whiffed on the ChatGPT stock frenzy,” proving that no system is perfect.

AI model limitations present another challenge. These sophisticated systems rely on historical data and patterns, but they can struggle with truly unprecedented events – those “black swan” moments that come out of nowhere. It’s like trying to predict food trends based on past data, only to have social media completely change the game overnight.

The rapidly evolving technology landscape means today’s leader might be tomorrow’s footnote. Companies at the forefront can be overtaken quickly, impacting stock performance. Regulatory changes add another layer of uncertainty, as the AI industry is still relatively new and rules can shift.

Perhaps most importantly, there’s the risk of over-reliance on technology. Just as we always encourage our readers to taste for themselves rather than blindly following reviews, investors should never stop conducting their own due diligence. The AI can amplify biases present in training data, despite 5starsstocks.com ai conducting regular bias audits.

Data security and privacy concerns are real, though the platform states its servers are encrypted like Swiss bank vaults and offers read-only access to brokerage accounts. There’s also the possibility of market manipulation by sophisticated actors, which could impact AI-driven predictions.

The stock market involves inherent risks, and past performance doesn’t guarantee future results. Think of AI as your incredibly knowledgeable dining companion – invaluable for insights and recommendations, but you still need to make the final decision based on your own taste and circumstances.

Best Practices for Maximizing Your Investment Strategy

When we think about investing, it’s a lot like exploring New York City’s food scene – you want to make smart choices, but you also need to know how to steer the landscape effectively. 5starsstocks.com ai has truly democratized access to sophisticated trading tools that were once exclusive to Wall Street’s big players. Now, whether you’re a seasoned trader or someone just dipping their toes into the investment waters, you can harness the same powerful analytics that institutional investors use.

This shift means more of us here in New York City and beyond can make data-driven decisions rather than relying on gut feelings or outdated strategies. It’s like having access to a professional chef’s techniques when you’re cooking at home – suddenly, what seemed impossible becomes achievable.

Tips for Using 5starsstocks.com ai Effectively

Getting the most out of 5starsstocks.com ai requires a thoughtful approach, much like mastering any new skill. Starting with small investments is crucial, especially when you’re new to the platform. Think of it as sampling a new dish before ordering the full meal – you want to test the waters and build confidence with the AI’s insights before committing larger amounts.

Conducting your own due diligence remains essential, even with AI assistance. While 5starsstocks.com ai provides incredible insights, the platform isn’t regulated by SEC or FINRA, so its recommendations should be treated as informational guidance rather than direct financial advice. Always try to understand the “why” behind a stock recommendation, not just the “what.”

The platform’s risk management tools are your best friends in this journey. Leverage features for risk assessment, portfolio optimization, and stop-loss orders. Diversification across different sectors and asset classes helps mitigate risk – as one user finded, their “safe” utility stocks would have tanked 60% in 2008, leading them to diversify with AI-prescribed gold miners.

Staying informed on market trends beyond what the AI provides will improve your understanding. While the system processes vast amounts of data, your personal awareness of market news, economic trends, and geopolitical events helps you better interpret the AI’s insights.

The best approach combines trusting the AI while verifying with your own research. The most successful investors blend “gut checks with algo beats.” While 5starsstocks.com ai strips away emotional bias, your human intuition and understanding of broader contexts still add valuable perspective.

Most importantly, make investment decisions based on your individual circumstances. Your investment goals, risk tolerance, and time horizon are uniquely yours. Use the AI’s insights to align with your personal financial situation, not someone else’s strategy.

Real-World Success Stories

The true power of 5starsstocks.com ai shines through in real user experiences. Take John, a part-time trader who doubled his portfolio’s value within six months by leveraging the platform’s predictive analytics. This wasn’t just luck – it was the AI’s ability to identify lucrative trends and provide timely alerts that made the difference.

Sarah, a novice trader from New York, initially found the stock market intimidating. Through 5starsstocks.com ai, she gained the confidence to see consistent growth in her investments. She credits the platform’s clear explanations and simplified insights for helping her learn to identify trending stocks before they skyrocketed.

For seasoned investors like Michael, the platform’s automation significantly reduced research time while improving returns. He found the AI’s ability to process vast amounts of data at lightning speed invaluable for his trading decisions.

Perhaps most inspiring is Emily, a teacher who uses 5starsstocks.com ai for her 403(b) retirement account. She’s seen her portfolio grow by 11% annually without constant monitoring. The AI’s “Set-and-Forget” mode automatically rebalances her portfolio, and she even saved $3,200 in taxes last year thanks to automated tax-loss harvesting features.

These stories highlight how 5starsstocks.com ai empowers diverse investors to achieve their financial goals with greater confidence and efficiency. Just like finding a hidden culinary gem in the city, finding the right investment tool can transform your entire experience.

Frequently Asked Questions about 5StarsStocks AI

Navigating AI-powered investing can feel overwhelming at first, much like trying to find the perfect restaurant in New York City without any guidance. That’s why we’ve compiled answers to the most common questions about 5starsstocks.com ai to help you make informed decisions.

Is 5StarsStocks AI suitable for beginners?

Yes, absolutely! 5starsstocks.com ai was built with accessibility in mind, welcoming everyone from complete investing newcomers to Wall Street veterans. The platform’s user-friendly interface makes complex market analysis as easy to understand as reading a restaurant menu.

The simplified star rating system is particularly helpful for beginners. Instead of drowning in overwhelming financial jargon, you get clear 1-5 star ratings that instantly show you which stocks the AI considers most promising. Think of it like Yelp reviews for stocks!

The platform also includes educational tools and resources that explain investing concepts in plain English. However, we always recommend that beginners take time to learn fundamental investment principles alongside using the AI. It’s like having an expert sommelier recommend wines – their guidance is invaluable, but understanding your own taste preferences makes the experience even better.

Does the platform guarantee profits?

This is perhaps the most important question, and we need to be crystal clear: No platform can guarantee profits. Just as we can’t promise you’ll love every restaurant we recommend, 5starsstocks.com ai can’t guarantee market success.

All investments carry inherent risks, and the stock market can be unpredictable. What the platform does offer is data-driven insights based on sophisticated analysis of millions of data points. It’s designed to improve your decision-making process and increase your probability of success, not eliminate all risk.

5starsstocks.com ai is a powerful tool that helps you make more informed choices, but market conditions, economic events, and countless other factors still influence outcomes. Past performance doesn’t guarantee future results – this is a fundamental truth of investing that no AI can change.

How is this different from my broker’s free research tools?

While many brokers offer free research tools, there’s a significant difference in motivation and capability compared to 5starsstocks.com ai.

Traditional broker tools often have conflicting interests. They’re designed to encourage trading activity that generates fees and commissions. Their recommendations might subtly favor products that earn them higher profits, not necessarily what’s best for your portfolio.

5starsstocks.com ai operates with pure algorithmic objectivity. Its loyalty is to “ones and zeros,” not commission structures. The AI has even recommended shorting major investment banks – something a broker’s tool might hesitate to suggest about their own industry partners.

The data processing capabilities are also vastly different. While broker tools typically analyze basic financial metrics, 5starsstocks.com ai processes millions of data points including social media sentiment, executive vocal analysis during earnings calls, and real-time market patterns. It’s like comparing a basic city map to a sophisticated GPS system that considers traffic, weather, and your personal preferences when navigating New York’s dining scene.

The platform’s proprietary algorithms and machine learning capabilities continuously adapt and improve, something static broker tools simply can’t match. This gives you access to institutional-level analysis that was previously only available to major investment firms.

Conclusion: The Future is Augmented Intelligence

As we wrap up our journey through AI-powered investing, it’s clear that we’re witnessing something truly remarkable. The stock market, much like the culinary world we love to explore, is undergoing a fascinating change. 5starsstocks.com ai isn’t just another tech tool – it’s a glimpse into the future of how we’ll make financial decisions.

Here’s what excites us most: AI isn’t trying to replace human investors any more than a GPS is trying to replace our sense of trip when exploring New York City’s food scene. Instead, we’re seeing the rise of augmented intelligence – a beautiful partnership where machine processing power improves our human insight and judgment.

Think about it this way: when we’re hunting for the perfect hole-in-the-wall restaurant in Manhattan, we might use apps to check reviews and ratings, but we still rely on our instincts, preferences, and experience to make the final choice. 5starsstocks.com ai works similarly for investing. It processes millions of data points, identifies patterns we’d never spot on our own, and presents insights in a way that helps us make smarter decisions. But the final call? That’s still ours.

For our community here in New York City and beyond, this democratization of sophisticated trading tools is genuinely exciting. What once required a team of Wall Street analysts is now accessible to anyone with an internet connection. Whether you’re a teacher building retirement savings, a small business owner diversifying income, or someone just starting their investment journey, 5starsstocks.com ai levels the playing field.

The platform’s ability to cut through market noise, identify valuable opportunities, and manage risk means we can approach investing with the same confidence we have when recommending a great restaurant. It’s about having reliable information that helps us make informed choices.

At The Dining Destination, we’ve always believed that the best experiences come from combining expert guidance with personal exploration. The same principle applies to investing with AI. We’re not handing over control – we’re gaining a powerful ally that helps us steer complex markets with greater confidence and efficiency.

The future isn’t about robots taking over our portfolios any more than food delivery apps have eliminated the joy of finding new restaurants. It’s about smart tools helping us thrive in both our culinary trips and financial journeys.

As we continue providing quality guides and resources for our community, we’re excited to see how technology like 5starsstocks.com ai will help more people achieve their financial goals while still maintaining that essential human touch in decision-making.

Explore our comprehensive resource guides for more insights.