Why LessInvest.com Real Estate is Changing How People Invest

LessInvest.com real estate offers a modern solution to property investment that removes traditional barriers like high upfront costs and property management headaches. This platform allows everyday investors to own fractional shares of real estate properties starting from as little as $100, making what was once exclusive to wealthy investors accessible to anyone.

Quick Overview: What You Need to Know About LessInvest.com Real Estate

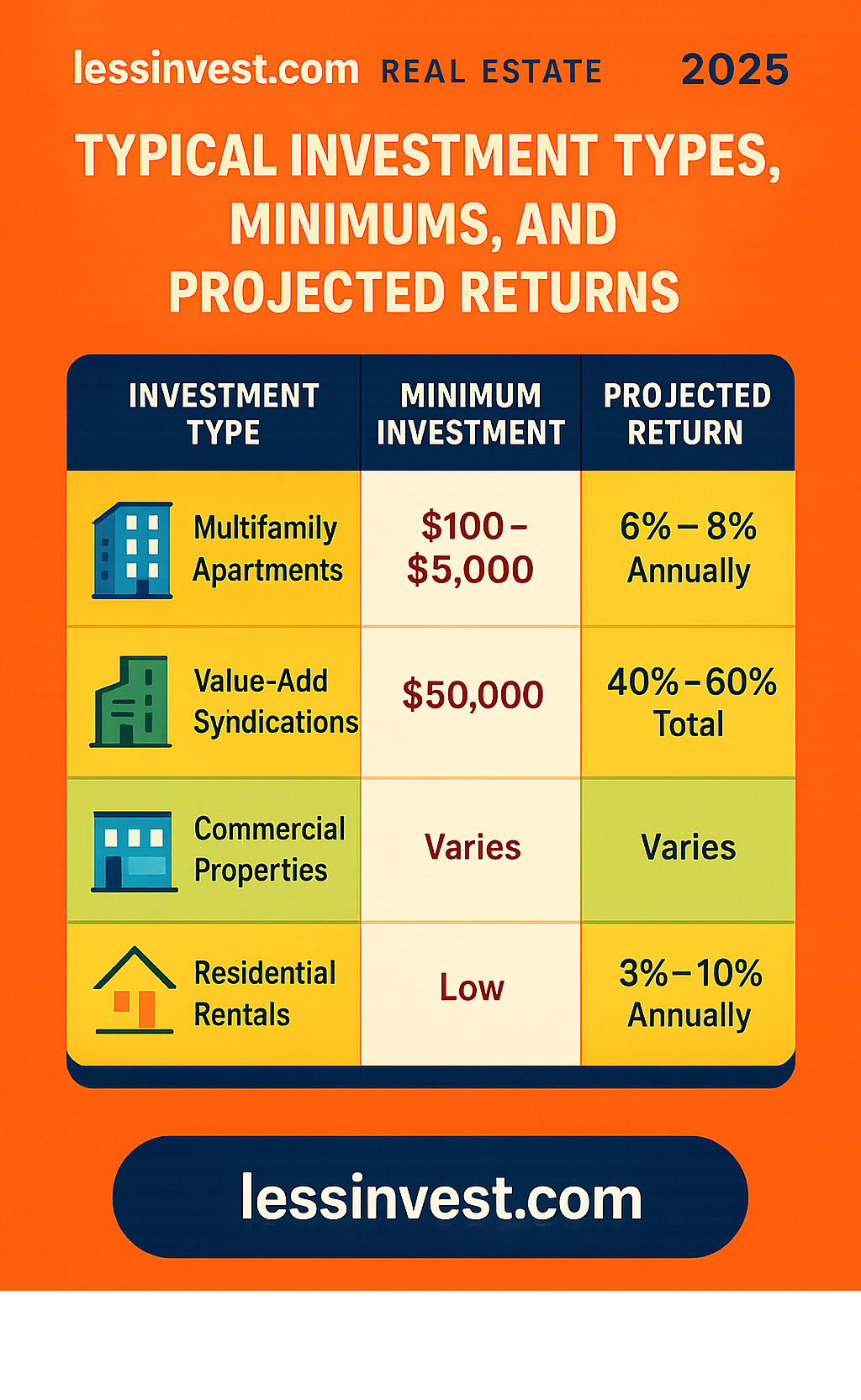

- Minimum Investment: As low as $100 for fractional ownership

- Property Types: Multifamily apartments, commercial properties, vacation rentals

- Expected Returns: 6-8% annual cash flow, 40-60% projected profits on sale

- Getting Started: Account setup takes under 5 minutes with identity verification

- Best For: Beginners seeking passive income and experienced investors wanting diversification

Traditional real estate investing has always demanded significant capital, hands-on management, and deep market knowledge. A typical property purchase might require $50,000 or more as a down payment, plus ongoing responsibilities like tenant screening, maintenance, and legal compliance.

LessInvest.com flips this model completely. Instead of buying entire properties, you purchase shares in professionally managed real estate investments. The platform handles everything – from property selection and due diligence to tenant management and maintenance.

Real-world success stories back up these claims. Research shows that investors in Texas used the platform to acquire a 50-unit apartment complex, achieving a 12% annual return through strategic property upgrades. Another case involved a Florida retiree who invested in a commercial REIT through the platform, securing steady dividend payments.

The identity verification process takes less than 5 minutes, and funding options include bank transfers and wire transfers. This streamlined approach means you can start building your real estate portfolio today, even if you’ve never owned property before.

Basic * lessinvest.com real estate* vocab:

How to Get Started with LessInvest.com in 3 Simple Steps

Getting started with LessInvest.com real estate is refreshingly straightforward – think of it as following a simple recipe that leads to financial success. We’ve designed this process to be as welcoming as your favorite neighborhood restaurant, removing the intimidation factor that often comes with investment platforms.

This section provides a clear, actionable guide for new users, breaking down the onboarding process into manageable stages. Whether you’re a complete beginner or someone looking to diversify your portfolio, these three steps will have you ready to invest in no time.

Step 1: Create Your Account

Creating your account on LessInvest.com real estate is the gateway to accessible property investing, and it’s designed to be completely hassle-free. The platform’s user-friendly interface makes this first step feel natural and intuitive.

The account registration process starts with providing your basic personal details – just your name, email address, and a secure password. It’s no more complicated than signing up for your favorite food delivery app, but the potential rewards are far greater.

While you’re setting up your profile, take a moment to explore what’s available. The platform immediately showcases its commitment to making real estate investing accessible, with clear navigation and helpful prompts guiding you through each step. You’ll notice how everything is designed with the everyday investor in mind, not just Wall Street professionals.

The beauty of this process is its simplicity. Within minutes, you’ll have access to a world of investment opportunities that were previously reserved for those with deep pockets and industry connections.

Step 2: Complete Secure Identity Verification

Identity verification might sound formal, but it’s actually your best friend when it comes to investment security. Think of it as the quality control process that ensures everyone on the platform is legitimate – just like how the best restaurants verify their suppliers.

The process starts with uploading a government-issued ID – your driver’s license, passport, or state ID will work perfectly. Next comes a quick selfie check that matches your face to your identification. It’s surprisingly straightforward and adds an important layer of protection.

Behind the scenes, LessInvest.com runs sophisticated Anti-Money Laundering (AML) checks and Politically Exposed Person (PEP) checks. These automated systems work to maintain the platform’s integrity and ensure compliance with U.S. Securities and Exchange Commission (SEC) regulations.

Here’s the impressive part: this entire 5-minute process happens almost instantly. While traditional investment platforms might take days or weeks to approve new accounts, LessInvest.com’s streamlined approach gets you verified and ready to invest before you’ve finished your morning coffee.

Step 3: Fund Your Investment Wallet

Funding your account is where the excitement really builds – you’re now preparing the capital that will start generating returns through real estate investments. The platform makes this step as smooth as possible with multiple convenient options.

Bank transfers (ACH) are the most popular choice for most investors. These transfers move money directly from your checking or savings account to your investment wallet, usually without fees from LessInvest.com. The process of linking financial accounts is secure and straightforward, with clear instructions guiding you through each step.

For larger investments or when you need faster processing, wire transfers offer another reliable option. While your bank might charge a small fee, wire transfers typically make funds available more quickly, getting you preparing to invest without delay.

Once your funds are deposited, you’re officially ready to start building your real estate portfolio. The platform provides excellent resources to help you make informed decisions, and you can explore more info about market trends to stay current with investment opportunities.

With your wallet funded, you’re now equipped to take advantage of the diverse property investments available on LessInvest.com real estate, from multifamily apartments to commercial properties and vacation rentals.

Opening Up Your Portfolio: Investment Options on LessInvest.com Real Estate

Think of this next step like exploring a world-class buffet after you’ve secured your table. Now that you’re all set up with LessInvest.com real estate, it’s time to find the rich variety of investment opportunities that await you. This section details the specific investment opportunities, expected returns, and the tools provided by the platform to help users make informed decisions.

Just like a master chef curates their menu to satisfy different palates, LessInvest.com offers a carefully selected range of properties that cater to various investment appetites – from conservative investors seeking steady income to those hungry for higher growth potential.

Understanding the Property Types Available

The beauty of LessInvest.com real estate lies in its diverse property portfolio. It’s like having access to ingredients from around the world – each type brings its own flavor of returns and risk to your investment table.

Multifamily apartment communities form the backbone of many successful portfolios. These properties are the comfort food of real estate investing – reliable, consistent, and always in demand. Even during economic uncertainty, people need places to live, making these investments particularly attractive for their steady cash flow.

Value-add real estate syndications offer a more adventurous approach. Think of these as taking a diamond in the rough and polishing it to perfection. You’re pooling your money with other investors to buy properties that need some love – maybe updated kitchens, improved management, or strategic renovations. The magic happens when these improvements boost the property’s value and rental income.

Commercial properties bring a different flavor to your portfolio. These include office buildings, retail centers, and industrial spaces. While they can offer higher returns, they also require a more sophisticated palate – understanding business cycles and tenant needs becomes crucial.

Residential long-term rentals provide the steady, predictable income that many investors crave. These single-family homes or smaller residential units offer the traditional landlord experience without the hands-on management headaches.

Short-term vacation rentals add some spice to your investment mix. Properties in tourist destinations can generate higher rental yields, especially during peak seasons. However, like a complex sauce, they require more attention and can be subject to seasonal fluctuations.

This variety allows you to create a well-balanced investment portfolio that matches your personal taste for risk and return. For those wanting to deepen their understanding of real estate fundamentals, the Guide to real estate investing provides excellent foundational knowledge.

Analyzing Returns and Minimums on LessInvest.com Real Estate

Understanding the financial recipe behind these investments is crucial for your success. LessInvest.com real estate has crafted an approach that makes quality real estate accessible without requiring a fortune to get started.

The minimum investment requirements are refreshingly approachable. While traditional real estate might demand $50,000 or more as a down payment, you can begin building your portfolio with fractional shares starting at just $100. For more substantial opportunities, typical entry points range from $500 to $5,000 – still a fraction of what direct property ownership requires.

The expected returns are where things get truly appetizing. Most real estate syndications on the platform target an annual cash-on-cash return of 6% to 8%. This represents the actual cash flow you’ll receive relative to your investment – think of it as your regular dividend from owning a piece of the property.

Many investments also offer a preferred return of 6% to 8%, which means you get paid before the investment sponsors take their share of profits. It’s like being first in line at your favorite restaurant’s daily special.

The real excitement comes with the projected profits upon sale. After the typical hold period of about five years, investors often see total profits of 40% to 60% when the property is sold. Combined with the annual cash flow, this can result in impressive overall returns.

A perfect example comes from Texas investors who used the platform to acquire a 50-unit apartment complex. Through strategic property improvements and professional management, they achieved a remarkable 12% annual return – proof that the platform’s approach delivers real results.

Key Features and Tools for Smart Investing

LessInvest.com doesn’t just serve up investment opportunities – it provides you with a complete kitchen of tools to make informed decisions. Like a well-equipped culinary workspace, these features help you prepare for investment success.

The investment calculators act as your measuring tools, helping you evaluate potential returns, estimate cash flow, and understand financial projections before you commit your money. These built-in calculators take the guesswork out of complex real estate math.

Market analytics and real-time data keep your finger on the pulse of property trends, rental demand, and economic indicators. Just as a chef needs to understand seasonal ingredient availability, successful real estate investors need current market intelligence.

The platform’s educational resources deserve special mention. From detailed guides and informative webinars to market reports and strategy articles, there’s a wealth of knowledge available. This educational approach is particularly valuable for beginners who need to understand complex real estate concepts.

Curated listings and vetted properties mean you’re not sifting through endless mediocre options. The platform’s team does the initial screening, focusing on properties with strong potential and recession-resistant characteristics. It’s like having a trusted sommelier pre-select wines for your consideration.

Expert insights add another layer of confidence to your decisions. Financial advisors like Regina Hansen note that “LessInvest.com real estate is ideal for investors who prioritize sustainability and ease of use.” This professional endorsement, combined with positive user feedback about the intuitive interface and responsive customer support, creates a foundation of trust.

The platform also offers personalized investment planning that assesses your risk tolerance and aligns opportunities with your financial goals. Think of it as having a personal financial chef who understands your dietary restrictions and preferences.

These comprehensive tools and features work together to create an environment where both newcomers and experienced investors can make confident decisions. For those interested in exploring broader investment strategies beyond real estate, our guide on investment strategies offers additional insights into building a well-rounded financial portfolio.

Strategic Investing: Managing Risk and Maximizing Growth

Smart real estate investing is like crafting a perfect meal – it’s all about balance, timing, and knowing how to manage the heat when things get intense. This section addresses the crucial aspects of risk management and strategies for long-term wealth accumulation through the platform. We’re not just talking about making quick profits; we’re focused on building a financial foundation that can weather any storm.

Think of your investment journey with LessInvest.com real estate as building a diverse menu that appeals to different tastes and dietary needs. Just as a restaurant wouldn’t survive serving only one dish, your portfolio shouldn’t rely on a single type of investment.

Building a Diversified and Resilient Portfolio

Creating a strong portfolio through LessInvest.com real estate means spreading your investments like a chef balances flavors across a tasting menu. You want each element to complement the others while protecting against any single ingredient going bad.

The beauty of diversification lies in cross-sector investing. When you put money into multifamily apartments, commercial office spaces, and vacation rentals, you’re essentially betting on different aspects of the economy. If office workers start working from home more, your commercial investments might slow down, but your residential properties could see increased demand.

Geographic diversification is equally important. While LessInvest.com operates from New York City, the platform offers opportunities across various U.S. markets. This means you’re not tied to one city’s economic ups and downs. A tech boom in Austin might boost your Texas properties while your Florida vacation rentals benefit from tourism trends.

The platform’s focus on recession-resistant assets makes particular sense when you think about basic human needs. People always need somewhere to live, which is why multifamily housing often provides stable cash flow even when the economy gets rocky. It’s like investing in comfort food – there’s always demand.

LessInvest.com’s risk assessment tools help you understand your own comfort level with uncertainty. Some investors sleep better with steady, predictable returns, while others are willing to accept more volatility for the chance of higher profits. The platform’s portfolio balancing features remind you to regularly review your investments, much like a chef tastes their dishes throughout the cooking process.

Understanding the Risks and Challenges of lessinvest.com real estate

Let’s be honest about something – every investment comes with risks, and real estate is no different. We believe in being upfront about potential challenges because an informed investor is a confident investor.

Market fluctuations are probably the most obvious risk. Real estate markets move in cycles, influenced by everything from interest rates to local job markets. Property values can rise and fall, sometimes dramatically. It’s like restaurant trends – what’s hot today might be forgotten tomorrow.

Tenant risks present another challenge for income-generating properties. Even though LessInvest.com handles property management, the underlying issues still affect your returns. Vacant units don’t generate rent, and problem tenants can create expensive headaches. Think of it as the difference between a full restaurant and empty tables – both affect the bottom line.

Financing risks come into play when investments rely on borrowed money. If interest rates climb or refinancing becomes difficult, it can squeeze profits. It’s similar to how rising food costs can hurt a restaurant’s margins.

Perhaps the biggest consideration is liquidity constraints. Real estate investments are illiquid assets, meaning you can’t quickly convert them to cash like you could with stocks. If you suddenly need money, selling your share in a real estate project might take time, and you might not get the price you want. This is why emergency funds and careful financial planning matter so much.

Platform-specific risks deserve mention too. While LessInvest.com carefully vets its opportunities, no system is perfect. Technology issues, operational problems, or unforeseen complications with investment sponsors can arise. This underscores why due diligence remains important, even with professionally curated investments.

Maximizing Your Long-Term Growth

Once you’ve made your initial investments through LessInvest.com real estate, the real magic happens over time. Building wealth through real estate is like aging a fine wine – patience and the right conditions create something truly valuable.

Reinvesting dividends is one of the most powerful strategies available. When your properties generate cash flow, you have a choice: take the money out or put it back to work. Reinvesting these distributions, possibly through Dividend Reinvestment Plans (DRIPs) available with some REITs, harnesses the incredible power of compounding growth. For more detailed information about how DRIPs work in real estate contexts, check out this helpful resource on Dividend Reinvestment Plans (DRIPs).

Compounding growth truly is the eighth wonder of the world. When you earn returns on your original investment plus returns on all your accumulated profits, your wealth can grow exponentially. The longer you let this process work, the more dramatic the results become.

Real estate offers some unique tax advantages that can significantly boost your actual returns. Depreciation deductions allow property owners to reduce their taxable income by writing off a portion of the property’s value each year, even if the property is actually gaining value. It’s like getting a discount on your tax bill while your investment grows.

1031 exchanges represent one of the most powerful tools in real estate investing. This strategy lets you defer capital gains taxes when you sell an investment property, as long as you reinvest the proceeds into similar property within specific timeframes. Think of it as trading up without the immediate tax consequences.

The platform also provides access to Opportunity Zones – economically distressed areas where new investments may qualify for special tax treatment. These investments can offer both social impact and financial benefits.

Tax strategies can be complex and highly personal. Consulting with a tax professional ensures you’re maximizing these benefits for your specific situation. With the right approach and patience, your LessInvest.com real estate portfolio can become a cornerstone of your long-term financial success.

Frequently Asked Questions

We know you’ve got questions, and we’re here to answer them! Just like when you’re trying a new restaurant and want to know about the ingredients, preparation methods, and what makes each dish special, investing in real estate brings up plenty of curiosities. This FAQ section addresses common queries and potential concerns for prospective investors, drawing from identified topic gaps in the research.

Who is LessInvest.com best suited for?

LessInvest.com real estate is like that welcoming neighborhood bistro that somehow manages to satisfy everyone who walks through the door. The platform genuinely caters to a surprisingly broad spectrum of investors, each with their own appetite for risk and return.

Beginner investors will find this platform particularly appetizing. If you’ve never owned real estate before, the low entry barriers make it incredibly accessible – you can start with fractional ownership for as little as $100. That’s less than what you’d spend on a fancy dinner for two! The platform doesn’t just throw you into the deep end either. Their educational tools include comprehensive guides, market reports, and investment calculators that help you understand concepts like cash-on-cash returns and appreciation without needing an MBA in finance.

Seasoned investors aren’t left out of this feast either. Even if you already own properties or have experience with traditional real estate, LessInvest.com offers excellent diversification options that can strengthen your existing portfolio. You can spread investments across multifamily apartments, commercial properties, and vacation rentals without dealing with multiple property managers or maintenance headaches. It’s like being able to sample cuisines from around the world without leaving your table.

Passive income seekers will particularly appreciate how the platform handles all the operational aspects. Whether you’re a busy professional, a retiree looking for steady cash flow, or someone who simply doesn’t want to deal with tenant calls at midnight, LessInvest.com manages the properties while you collect the returns. The focus on recession-resistant sectors like multifamily housing means you’re building a portfolio that can weather economic storms.

The beauty of this platform lies in its flexibility – whether you’re taking your first bite of real estate investing or you’re a seasoned investor looking to add some new flavors to your portfolio, there’s something here that fits your taste.

What are the fees on LessInvest.com?

Understanding fees is crucial to any investment decision, and we believe in complete fee transparency – no hidden charges lurking in the fine print like surprise service fees on a restaurant bill.

The fee structure on LessInvest.com real estate operates on a straightforward principle: costs vary by investment type. A real estate syndication focused on a 50-unit apartment complex will have different fees than a commercial REIT or fractional ownership in vacation rentals. This makes sense when you think about it – different types of investments require different levels of management and expertise.

What sets LessInvest.com apart is their commitment to transparency. All fees are disclosed during the selection process, meaning you’ll see exactly what you’re paying before you commit a single dollar. When you’re reviewing investment opportunities, the platform provides detailed offering documents that break down management fees, acquisition fees, and any performance fees. It’s like having a detailed menu with prices clearly listed – no guessing games.

The platform prides itself on no hidden fees. What you see during the investment selection process is exactly what you’ll pay. This transparency allows you to make informed comparisons between different investment opportunities and factor fees into your expected returns calculations.

How liquid are investments made through the platform?

Liquidity is one of those topics that every real estate investor needs to understand, much like knowing how long it takes to properly age a fine wine. The reality is that real estate illiquidity is simply part of the game, and it’s important to set proper expectations.

Real estate is typically illiquid by nature. Unlike stocks that you can sell with a few clicks and have cash in your account within days, real estate investments require patience. When you invest in a property through LessInvest.com, you’re essentially committing to a longer-term relationship with that investment.

However, the platform does offer some REITs flexibility for those who need more liquidity options. Publicly traded REITs available through the platform can be bought and sold more easily since they trade on stock exchanges, similar to regular stocks. This provides a middle ground between the potentially higher returns of direct property ownership and the flexibility of traditional securities.

Most crowdfunding projects on LessInvest.com are structured with specific hold periods in mind. Typical hold periods range from three to seven years, especially for value-add syndications where the strategy involves improving the property before selling it. This timeline allows the investment sponsors to execute their business plan, whether that’s renovating units, improving management, or waiting for market conditions to optimize the sale.

Before investing, always review the proposed exit strategies for each project. The platform provides detailed information about how and when properties are expected to be sold, and how you’ll receive your returns. While some platforms offer secondary markets for trading shares, these aren’t always guaranteed to be active or available.

The key is approaching LessInvest.com real estate investments with a long-term perspective, understanding that your capital will be working for you over time rather than being readily available for immediate withdrawal. It’s an investment strategy that rewards patience, much like waiting for the perfect soufflé to rise.

Conclusion: Is LessInvest.com the Right Platform for You?

After exploring LessInvest.com real estate together, you might be wondering if this platform is the right fit for your investment journey. Think of it like choosing a restaurant for a special occasion – you want to make sure it matches your taste, budget, and expectations perfectly.

The beauty of LessInvest.com lies in how it transforms real estate investing from an exclusive club into an accessible opportunity for everyone. Traditional real estate investing used to be like dining at a five-star restaurant every night – expensive and intimidating for most people. But this platform changes that equation entirely.

The accessibility factor is perhaps the most compelling benefit. Starting with just $100 for fractional ownership means you don’t need a trust fund to begin building wealth through real estate. The onboarding process takes less than 5 minutes, making it faster than most food delivery orders. This democratization of real estate investing opens doors that were previously locked for everyday investors.

Diversification becomes effortless when you have access to multifamily apartments, commercial properties, and vacation rentals all in one place. It’s like having a buffet of investment options where you can sample different flavors of real estate without committing to just one type. This variety helps protect your portfolio from market ups and downs, much like a well-balanced diet keeps you healthy.

The user-friendly tools and educational resources provided by the platform deserve special mention. Investment calculators, market analytics, and expert insights transform complex real estate concepts into digestible information. For those of us who appreciate learning while we earn, these features make the investment process both educational and profitable.

Passive income potential is where LessInvest.com really shines. The platform handles property management, tenant relations, and maintenance – all the headaches that typically come with real estate ownership. You get to enjoy the benefits of property ownership without becoming a landlord, which is perfect for busy professionals or anyone who values their time.

From our perspective at The Dining Destination, we see LessInvest.com real estate as more than just an investment platform – it’s a pathway to financial freedom. Just as we guide food lovers to find amazing culinary experiences around the world, LessInvest.com guides investors toward building wealth through real estate.

The platform empowers people to take control of their financial futures, whether you’re a complete beginner testing the waters or an experienced investor looking to diversify your portfolio. It’s about creating a financial foundation as solid and satisfying as your favorite comfort food.

Is it right for you? If you value accessibility, appreciate professional management, and want to build wealth without the traditional barriers of real estate investing, then LessInvest.com deserves serious consideration. The combination of low minimums, diverse opportunities, and educational support creates an environment where both novice and experienced investors can thrive.

We encourage you to explore what the platform offers and see how it aligns with your personal investment goals. After all, the best investment is one that helps you sleep better at night while building a brighter financial future.

Explore our complete resource guides for more investment insights.