Why Understanding Your Credit Score Matters for Financial Success

Gomyfinance.com credit score tools help millions of Americans take control of their financial health. Your credit score acts as a financial report card that lenders use to decide if they’ll approve your loan applications and what interest rates you’ll pay.

Quick Answer for Checking Your GoMyFinance.com Credit Score:

- Visit the platform – Create a free account with basic personal information

- Access your dashboard – View your current score, key factors, and credit report summary

- Use improvement tools – Leverage calculators, alerts, and personalized recommendations

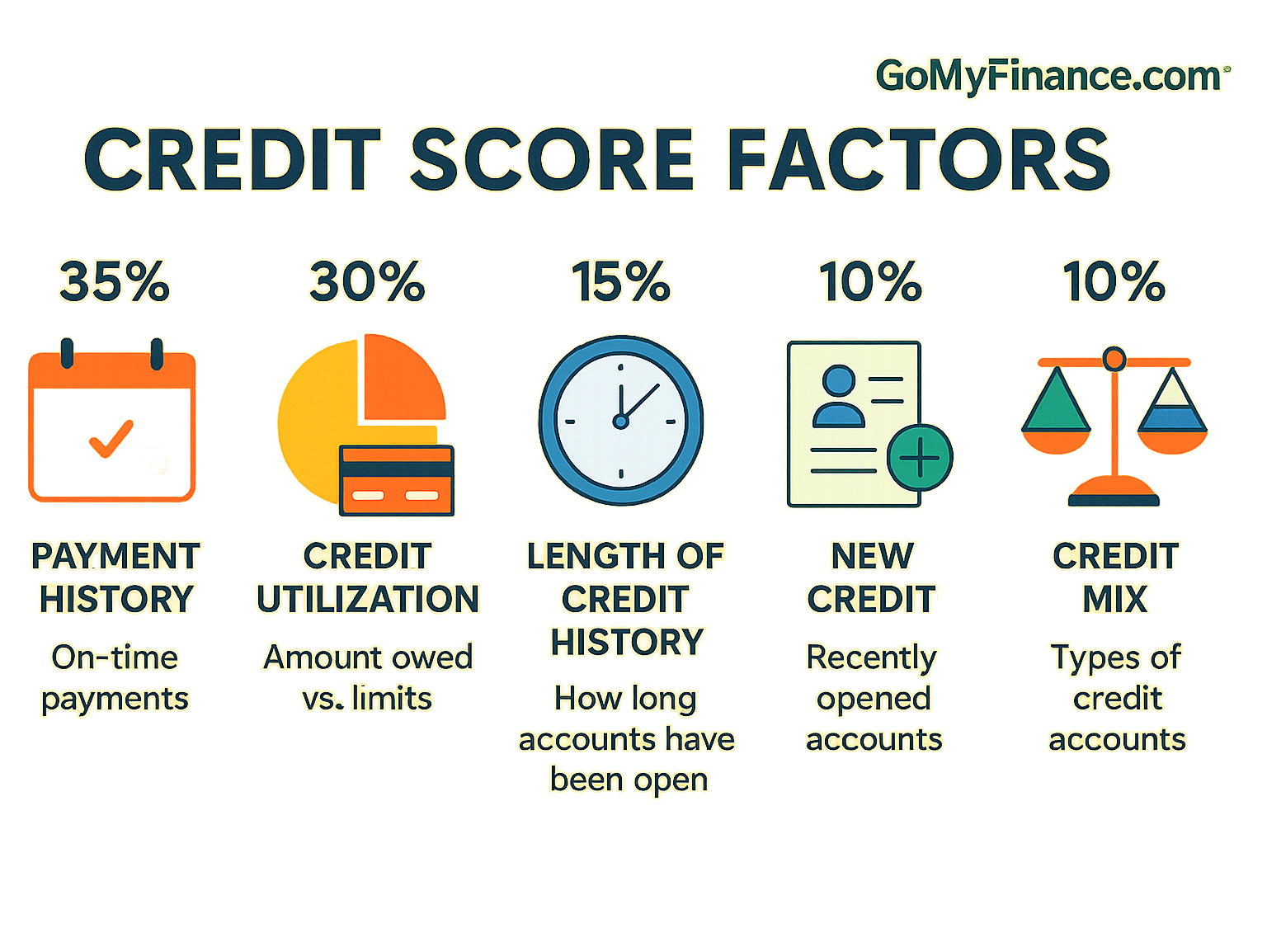

Your credit score typically ranges from 300 to 850, with higher scores open uping better financial opportunities. According to industry data, payment history accounts for 35% of your FICO score, while credit utilization makes up 30% – making these the most important factors to monitor.

Whether you’re planning to buy a home, finance a car, or simply want better credit card terms, understanding your credit score is essential. Poor credit might cost you $50,000 more in mortgage interest over a 30-year loan compared to excellent credit.

The good news? Modern platforms make checking and improving your credit score easier than ever. You can monitor changes, receive alerts, and get actionable advice – all without hurting your score through soft inquiries.

Gomyfinance.com credit score further reading:

What is a GoMyFinance.com Credit Score and Why Does It Matter?

At The Dining Destination, we believe that understanding your finances is as crucial as understanding a new recipe – both empower you to truly savor life’s experiences. This is where your gomyfinance.com credit score comes into play. It’s not just a random number; it’s a vital financial snapshot that lenders, landlords, and even some insurers use to assess your creditworthiness.

Think of your credit score as your financial reputation. Just as a chef’s reputation precedes them in the culinary world, your credit score speaks volumes about your reliability in managing debt. A high score tells potential creditors that you’re a responsible borrower, making you a more attractive candidate for loans, credit cards, and even that dream apartment in New York City.

GoMyFinance.com positions itself as a comprehensive resource dedicated to explaining personal finance, including the intricate world of credit scores. While it’s important to note that GoMyFinance.com operates as an informational and educational platform rather than a direct financial institution, its primary offerings revolve around empowering users with the knowledge and tools to understand, monitor, and actively improve their credit health.

Their platform aims to provide clarity on what a credit score is, how it’s calculated, and why it holds such significant sway over your financial opportunities. They emphasize that financial literacy is the cornerstone of personal and economic growth, and a key part of that is mastering your credit score.

Understanding Your Score Range

Credit scores typically range from 300 (poor) to 850 (exceptional). This three-digit number is derived from a complex analysis of your credit files, giving lenders a quick way to gauge your risk. The two primary credit scoring models you’ll encounter are FICO Score and VantageScore, both operating on this scale.

GoMyFinance.com, like other reputable financial education platforms, helps you understand where you stand on this spectrum. Here’s a general breakdown of what those ranges mean:

- Poor (300-579): This range signals a high risk to lenders. You might face significant challenges getting approved for new credit, and if you do, the interest rates will likely be very high.

- Fair (580-669): While not ideal, a fair score can still get you some credit, though terms won’t be the most favorable. It shows you’re working towards better financial habits.

- Good (670-739): This is generally considered a healthy score. Lenders view you as a reliable borrower, and you’ll likely qualify for a wider range of credit products with competitive interest rates.

- Very Good (740-799): In this range, you’re seen as a very low-risk borrower, opening doors to excellent rates and terms on loans and credit cards.

- Exceptional (800-850): The crème de la crème of credit scores! This indicates outstanding credit management, giving you access to the best possible financial products and rates.

Understanding your score’s range is the first step toward financial empowerment. GoMyFinance.com emphasizes that your FICO scores range from 300 to 850, and knowing where you fall helps you strategize your next moves.

The Real-World Impact of Your Score

Why does all this matter? Because your credit score is a silent partner influencing nearly every major financial decision you make. It’s not just about getting a loan; it’s about the quality of that loan, and much more.

- Mortgage Rates: Imagine securing a mortgage for your dream home. A good credit score can literally save you tens of thousands, or even over $100,000, in interest payments over a 30-year loan term compared to someone with a lower score. That’s more money for culinary trips!

- Car Loans: Similarly, the interest rate on your car loan can vary wildly based on your score, impacting your monthly payments and the total cost of the vehicle.

- Credit Card Approval: The best rewards credit cards, often sought after by food enthusiasts for travel points, are typically reserved for those with excellent credit. Your score dictates not only approval but also your credit limit and interest rate.

- Insurance Premiums: Believe it or not, some insurance providers use credit-based insurance scores to determine your premiums. A better credit score could mean lower rates on auto and home insurance.

- Apartment Rentals: Many landlords check credit scores as part of their tenant screening process. A strong score can give you an edge in competitive rental markets like New York City.

- Negotiating Power: With a high credit score, you gain significant leverage. You’re in a much stronger position to negotiate terms with banks and lenders, knowing they want your business.

Your credit score is a game-changer. It directly impacts your ability to access credit, the cost of that credit, and even certain aspects of your daily life. GoMyFinance.com aims to equip you with the knowledge to leverage your score for maximum financial benefit. For more insights on financial markets, you might explore More info about Fintechzoom.com Markets.

A Step-by-Step Guide to Checking and Understanding Your Score on GoMyFinance.com

Getting your hands on your credit score shouldn’t feel like trying to decode a complex recipe in a foreign language. With gomyfinance.com credit score tools, the process is designed to be as simple as browsing your favorite restaurant’s menu online. The platform transforms what used to be a confusing financial maze into a clear, user-friendly experience that puts you in control of your financial health.

Think of it this way: just as you wouldn’t walk into a five-star restaurant without knowing what you want to order, you shouldn’t steer major financial decisions without understanding your credit standing. GoMyFinance.com’s user dashboard and financial tools are specifically crafted to give you actionable insights, turning complex financial data into information that actually makes sense.

Step 1: Access Your Free Credit Score

Your journey to understanding your gomyfinance.com credit score starts with a straightforward sign-up process that takes just a few minutes.

Account creation begins when you visit the GoMyFinance.com website. You’ll spot a clear “Sign Up” or “Get Your Free Score” button that guides you through creating your account. The platform asks for basic personal information like your name, address, and email – nothing too invasive, just enough to verify your identity.

Once you’ve filled out the initial information, you’ll create secure login credentials. Here’s a pro tip from our experience covering financial topics: use a strong, unique password to protect your financial data. Think of it as locking the door to your financial kitchen – you want to keep unwanted visitors out.

The identity verification step might seem a bit like a pop quiz, but it’s actually your friend. GoMyFinance.com will ask a few multiple-choice questions based on information from your credit report that only you would know. These might include questions about previous addresses or types of loans you’ve had. This security measure ensures that only you can access your sensitive financial information.

After successful verification, you gain instant access to your credit score and a summary of your credit report. The best part? This is typically offered as a free service, meaning you can regularly check your score without spending a dime – more money for those culinary trips we all love planning.

Step 2: Interpret Your Credit Score Dashboard

Once you’re logged in, your personalized credit score dashboard welcomes you like a well-organized kitchen where everything has its place. This is where GoMyFinance.com really shows its value in helping you understand your financial standing.

Your current score display takes center stage, often accompanied by a visual representation showing where you fall within the 300-850 range. Think of it as a thermometer for your financial health – the higher the reading, the better your financial temperature.

The key influencing factors section acts like a recipe breakdown, showing you exactly which ingredients are making your credit score what it is. GoMyFinance.com highlights the main factors affecting your score, both positively and negatively. You’ll see how your payment history, credit utilization, length of credit history, new credit, and credit mix are currently performing. This transparency helps you understand which areas need your immediate attention.

The credit report summary gives you a bird’s-eye view of your financial landscape without overwhelming you with every detail. You’ll see your open accounts, recent inquiries, and any negative marks that might be dragging your score down. It’s like getting the highlights reel instead of watching the entire game – you get the important information without the information overload.

Your alerts section functions like a financial early warning system. Here you’ll find notifications about significant changes to your credit file, such as new accounts opened in your name, large balance changes, or late payments reported. These alerts help you catch potential issues before they become major problems.

The historical tracking feature shows how your score has changed over time, creating a visual story of your financial journey. Watching your score improve can be incredibly motivating – like seeing your cooking skills develop as you practice new techniques.

Step 3: Use the Platform’s Insights and Tools

Beyond simply showing you numbers, GoMyFinance.com provides a toolkit designed to help you actively improve your credit health. These features transform the platform from a simple scorecard into a comprehensive financial improvement resource.

The score simulator works like a financial crystal ball, allowing you to test different scenarios before making actual changes. Want to see how paying off that credit card might affect your score? Or curious about the impact of taking out a new loan? The simulator lets you experiment with these hypothetical situations, giving you the confidence to make informed decisions.

Their debt payoff calculator becomes your strategic planning partner when you’re carrying balances. You can input different payment amounts or timelines to see how quickly you can become debt-free and calculate how much interest you’ll save. This tool is particularly valuable for improving your credit utilization ratio – one of the most important factors in your credit score.

Personalized recommendations feel like having a financial advisor in your pocket. Based on your specific credit profile, GoMyFinance.com offers custom advice custom to your situation. These suggestions might include focusing on paying down your highest-interest credit card, considering debt consolidation, or disputing inaccuracies on your report.

The goal setting features help you create a roadmap for your financial future. You can set targets for your credit score improvement or debt reduction and track your progress over time. This approach makes the credit improvement journey feel more like achieving personal milestones rather than just managing boring financial tasks.

By using these sophisticated yet user-friendly tools, you move beyond simply checking your score to actively managing and enhancing your financial future. Just as we explore various topics that intersect with lifestyle and finance, understanding credit scores opens doors to better financial opportunities that can fund all those amazing dining experiences you’re dreaming about.

How GoMyFinance.com Helps You Actively Improve Your Credit

Think of improving your credit score like perfecting a signature dish – it takes patience, the right ingredients, and consistent technique. At The Dining Destination, we understand that just as culinary mastery opens doors to incredible dining experiences, credit improvement strategies open up financial opportunities that can fund those dream food trips around the world.

Gomyfinance.com credit score tools focus on turning complex financial concepts into digestible action steps. Rather than just showing you numbers, they emphasize debt management and building healthy financial habits through proactive monitoring. It’s about creating a sustainable approach to credit health that fits into your lifestyle.

The platform recognizes that everyone’s financial journey is different. Whether you’re saving for that culinary tour of Italy or planning to open your own restaurant, having excellent credit makes these dreams more affordable and achievable.

Master Your Credit Utilization Ratio

Your credit utilization ratio is like the secret sauce of credit scoring – it might not be the most obvious ingredient, but it packs tremendous flavor. This single factor influences approximately 30% of your FICO score, making it one of the most powerful levers you can pull to improve your credit health.

Here’s how it works: if you have a credit card with a $5,000 limit and you’re carrying a $1,500 balance, you’re using 30% of your available credit. The magic number that credit experts recommend? Keep those revolving balances well below the 30% rule.

GoMyFinance.com helps you master this ratio through clear visualization and practical guidance. Their dashboard shows you exactly where you stand, making it easy to see which cards need attention. Think of it as your financial recipe card – everything laid out clearly so you know exactly what to do next.

Debt reduction strategies become much more manageable when you can see the impact in real-time. The platform might suggest paying down your highest-utilization cards first, or making multiple smaller payments throughout the month to keep your reported balances low. Some users find success by setting up automatic payments just before their statement closing dates.

Credit limit increases offer another path to better utilization. When managed responsibly, requesting higher limits on existing cards can instantly improve your ratio without requiring you to pay down debt. It’s like expanding your kitchen – more space to work with, but you still need to keep things organized.

Focus on Key Credit Score Factors with gomyfinance.com credit score

Understanding your credit score is like learning the fundamentals of cooking – once you know how each ingredient contributes to the final dish, you can adjust and improve with confidence. GoMyFinance.com breaks down the recipe for credit success into five key components.

Payment history carries the most weight at 35% of your FICO score. This is your track record of paying bills on time, every time. Just as consistency makes the difference between a good chef and a great one, consistent on-time payments form the foundation of excellent credit. Missing even one payment can leave a lasting mark, so setting up automatic payments for at least the minimum amount is crucial.

Your length of credit history accounts for 15% of your score and rewards patience. Those old credit cards you rarely use? They’re actually helping your score by demonstrating long-standing financial relationships. Closing them would be like throwing away a well-seasoned cast iron pan – you’re losing something valuable that took time to develop.

New credit inquiries make up 10% of your score, and opening too many accounts quickly can signal financial stress to lenders. It’s better to space out applications and research pre-qualification options that use soft inquiries instead of hard ones.

Your credit mix – the final 10% – shows lenders you can handle different types of debt responsibly. Having both revolving credit like credit cards and installment loans like car payments demonstrates financial versatility. However, don’t open accounts you don’t need just to improve your mix.

Leverage Powerful Credit Monitoring and Alerts

Active credit monitoring is like having a sous chef watching over your kitchen – always alert, ready to catch problems before they become disasters. Gomyfinance.com credit score monitoring services act as your financial early warning system.

Fraud alerts notify you immediately when suspicious activity appears on your credit file. Whether it’s a new account opened in your name or an unexpected address change, quick detection can prevent significant damage. Research shows that credit monitoring services can prevent significant financial damage by enabling rapid response to identity theft attempts.

Identity theft protection extends beyond just credit monitoring. The platform watches for your personal information appearing in places it shouldn’t, like dark web marketplaces. It’s comprehensive protection that covers all aspects of your financial identity.

New account notifications ensure you’re aware of every credit account opened in your name. Hard inquiry alerts tell you when lenders are checking your credit, helping you track legitimate applications and spot unauthorized access.

Disputing inaccuracies becomes much easier when you’re monitoring regularly. The platform guides you through the process of identifying and challenging errors with credit bureaus. Even small mistakes can drag down your score, so staying vigilant pays off.

This comprehensive monitoring approach gives you the confidence to focus on your passions – whether that’s exploring new restaurants or planning your next food trip – knowing your financial foundation is secure. For insights into how successful individuals manage their wealth, explore More info about Sutton Stracke Net Worth.

Best Practices for Using the gomyfinance.com Credit Score Platform

Think of managing your gomyfinance.com credit score like perfecting a favorite recipe – it requires the right ingredients, consistent attention, and patience to achieve the best results. At The Dining Destination, we believe that just as culinary mastery opens doors to incredible dining experiences, mastering your credit score opens doors to financial opportunities that can fund those dream food trips.

The key to success lies in treating credit management as part of your long-term financial health strategy. This means embracing consistent monitoring, practicing financial discipline, and implementing smart credit management techniques that compound over time. Just like how a chef builds their skills through daily practice, your credit score improves through regular, thoughtful attention.

How Often Should You Check Your Score?

Here’s some wonderful news for anyone worried about damaging their credit by checking it too often: monitoring your own gomyfinance.com credit score actually helps rather than hurts your financial health.

When you check your own score through platforms like GoMyFinance.com, it’s classified as a soft inquiry. These gentle checks are like looking in a mirror – they don’t change what you see, they just help you understand where you stand. Soft inquiries have absolutely no negative impact on your credit score, which means you can check as often as you’d like without worry.

Hard inquiries are a different story entirely. These occur when lenders pull your credit report because you’ve applied for new credit, like a mortgage or car loan. While hard inquiries can cause a small, temporary dip in your score, they’re a normal part of the lending process and their impact fades quickly.

Financial experts recommend a smart approach to regular check-ins. Since it’s recommended to check one’s credit report at least annually, many people space out their free annual reports from the three major bureaus throughout the year. This gives you a quarterly snapshot of your credit health from different perspectives.

For your actual score, monthly monitoring through GoMyFinance.com creates a healthy habit that keeps you informed about changes and trends. This frequent monitoring becomes especially valuable during a pre-loan application review – you’ll want to know exactly where you stand before applying for that mortgage or car loan.

What Makes the gomyfinance.com credit score Approach Unique?

In a world filled with financial tools that can feel overwhelming, GoMyFinance.com stands out by making credit management feel approachable and achievable. Their philosophy centers around turning complex financial concepts into clear, actionable guidance.

The platform’s user-friendly interface feels refreshingly straightforward. Instead of drowning you in financial jargon, they present information in digestible pieces that make sense whether you’re a credit novice or someone looking to fine-tune an already good score. This accessibility removes the intimidation factor that keeps many people from actively managing their credit.

What truly sets them apart is their commitment to educational resources. Rather than simply showing you numbers, they help you understand the story those numbers tell. Their actionable insights translate credit score factors into specific steps you can take today, this week, and this month to see improvement.

The platform’s approach to comprehensive account management means you’re not just looking at a single number – you’re getting a complete picture of your credit landscape. This holistic view helps you identify which accounts need attention and which strategies will have the biggest impact on your score.

Perhaps most importantly, their focus on empowerment transforms credit management from a chore into a tool for achieving your goals. They understand that a better credit score isn’t just about numbers – it’s about having the financial flexibility to say yes to opportunities, whether that’s buying a home or booking that culinary tour through Italy.

The Long-Term Benefits for Your Financial Future

The time and attention you invest in managing your gomyfinance.com credit score today pays dividends that extend far beyond your next loan application. Think of it as investing in your future self’s financial freedom.

Lower interest rates represent perhaps the most tangible benefit of excellent credit management. The difference between a good credit score and an exceptional one can save you tens of thousands of dollars over the life of a mortgage. That’s money that stays in your pocket – money you could use for investments, savings, or those unforgettable dining experiences that create lifelong memories.

Increased borrowing power opens doors you might not have even considered. With strong credit, lenders compete for your business, offering you larger credit lines and better terms. This improved borrowing capacity can be crucial when opportunities arise, whether you’re starting a business, renovating your home, or helping a child with college expenses.

Achieving financial goals becomes significantly easier when your credit works for you rather than against you. Whether your dreams include homeownership, early retirement, or the freedom to travel and explore global cuisines, a strong credit foundation supports these aspirations by providing access to favorable financing when you need it.

The reduced financial stress that comes with excellent credit is invaluable. When you know your credit is strong, you approach financial decisions with confidence rather than anxiety. You can focus on building wealth and enjoying life instead of worrying about whether you’ll qualify for the financing you need.

Finally, having an excellent credit score puts you in a powerful negotiating position. You can shop around for the best deals, walk away from unfavorable terms, and generally approach financial transactions from a position of strength rather than desperation.

By embracing the tools and strategies available through GoMyFinance.com, you’re not just improving a number – you’re investing in a future filled with more options, less stress, and the financial flexibility to pursue whatever brings you joy. For those interested in exploring broader financial opportunities, you might find value in More info about 5starsstocks.com.

Frequently Asked Questions about Credit Scores

Let’s address some of the most common questions we hear about credit scores. Just like understanding a complex recipe, getting familiar with these credit basics will help you master your financial kitchen.

What is the fastest way to improve my credit score?

While there’s no overnight magic for boosting your gomyfinance.com credit score, some strategies can deliver noticeable results within a few months. Think of it like seasoning a dish – the right ingredients in the right proportions make all the difference.

Making timely payments is your most powerful tool. If you have any overdue accounts, bring them current immediately. This single action can stop further damage to your credit. Then, commit to making every future payment on time. Setting up automatic payments removes the guesswork and ensures you never miss a due date again.

Reducing your credit card balances can provide surprisingly quick results. Focus on paying down cards that are close to their limits first. When your credit utilization drops below 30% (and ideally into single digits), you’ll likely see your score respond positively within one to two billing cycles.

Disputing errors on your credit report is another fast-acting strategy. Regularly review your credit report for mistakes like accounts that aren’t yours, incorrect payment histories, or outdated information. When you successfully dispute and remove these errors, your score can improve almost immediately.

Consider becoming an authorized user on a trusted family member’s credit card account. If they have excellent credit and a long history of on-time payments, their positive account history might boost your score. Just make sure they’re truly responsible with their credit – their mistakes could hurt you too.

According to financial experts, ensuring bills are paid on time is one of the most impactful methods for both quick improvements and long-term credit health.

How long do negative items stay on my credit report?

Understanding the timeline for negative items helps you plan your financial recovery. Most negative marks don’t stay forever, but they do require patience.

Late payments, collections, and charge-offs typically remain on your credit report for seven years from the date of the original missed payment. This includes accounts that go to collections or are written off by creditors as uncollectible.

Bankruptcies have a longer timeline. Chapter 7 bankruptcies can stay on your report for up to 10 years from the filing date, while Chapter 13 bankruptcies usually remain for seven years. The extended timeline reflects the serious nature of bankruptcy proceedings.

Foreclosures also stick around for seven years from the date of your first missed mortgage payment that led to the foreclosure process.

Here’s the encouraging news: while these items remain visible, their impact on your score typically lessens over time. A three-year-old late payment hurts far less than a recent one. Focus on building positive credit habits now, and these past mistakes will gradually fade into the background.

Does checking my score on a platform like GoMyFinance.com hurt it?

This might be the most common credit myth we encounter, and we’re happy to put your mind at ease. Checking your own credit score never hurts your credit.

When you check your gomyfinance.com credit score, it’s classified as a soft inquiry. These inquiries are like looking in a mirror – you can see yourself, but no one else knows you looked. Soft inquiries appear only on the version of your credit report that you see and have absolutely no impact on your score.

Hard inquiries are different. These happen when a lender pulls your credit report because you’ve applied for new credit like a mortgage, car loan, or credit card. Hard inquiries can cause a small, temporary dip in your score, usually just a few points that recover over time.

The beauty of platforms like GoMyFinance.com is that you can check your score as often as you want without any negative consequences. We actually encourage regular monitoring because it helps you catch errors early, track your progress, and stay motivated on your credit improvement journey.

Individuals have the right to request one free copy of their credit report annually from each of the three major credit bureaus through AnnualCreditReport.com. Combined with regular score monitoring through educational platforms, you can stay completely informed about your credit health without any risk to your score.

Think of credit monitoring like checking your bank balance – it’s a smart financial habit that keeps you informed and in control of your money story.

Conclusion

Your journey toward financial mastery doesn’t have to be intimidating – think of it like learning to appreciate fine wine. At first, the terminology seems overwhelming, but once you understand the basics, a whole world of possibilities opens up. That’s exactly what happens when you take financial control through understanding your gomyfinance.com credit score.

Throughout this guide, we’ve explored how your credit score acts as your financial passport, opening doors to better mortgage rates, premium credit cards, and even that perfect apartment rental. We’ve walked through the practical steps of accessing your score, interpreting your dashboard, and using powerful tools to actively improve your creditworthiness.

The beauty of platforms like GoMyFinance.com lies in their commitment to making complex financial concepts accessible. Their credit management approach transforms what used to be a mysterious process into clear, actionable steps you can take today. Whether it’s mastering your credit utilization ratio, setting up monitoring alerts, or disputing inaccuracies, every small action contributes to your larger financial story.

By understanding and actively managing your credit, you open up the financial freedom to pursue life’s best experiences – from securing that dream home to starting on culinary trips around the globe without financial stress weighing you down. It’s about creating space in your budget for what truly matters: those memorable meals in Paris, that cooking class in Tuscany, or simply the peace of mind that comes with financial stability.

Your financial journey is uniquely yours, but you don’t have to steer it alone. The tools and knowledge we’ve shared here provide a solid foundation for building lasting financial health. Improving your credit score is like perfecting a favorite recipe – it takes time, patience, and consistent effort, but the results are absolutely worth it.

At The Dining Destination, we’re passionate about helping you create the financial foundation that supports all your culinary dreams and travel aspirations. We hope this comprehensive guide has given you the confidence to take those first important steps toward better credit management.

Ready to explore more ways to improve your financial wellness? Explore our resource guides for more financial tips and find how smart money management can fuel your next great trip.