Why the Lithium Investment Boom is Capturing Global Attention

From our vantage point in New York City, we see the future of energy on every street corner, with electric vehicles silently gliding past—and increasingly, powering the way locals and visitors move between restaurants, bars, and hotels. As a NYC-based food and travel guide, we cover trends that directly shape how our community explores the city. EV rideshares, electric delivery fleets, and battery-backed hospitality are becoming part of the dining experience here. Thats why the surge in interest around 5starsstocks.com lithium matters to our readers: it blends sustainability on the street with portfolio decisions at home.

Quick Guide for 5starsstocks.com Lithium Searchers:

- What it is: A content marketing site launched in 2023 focusing on lithium stock ideas.

- Performance: Our research showed only 35% of its recommendations were profitable over a four-month period.

- Best use: For spotting trends and getting ideas, not for making final investment decisions.

- Major concerns: Anonymous founders, unverified performance claims, and aggressive marketing.

- Bottom line: Use for entertainment and trend-spotting, but verify all information with established financial sources.

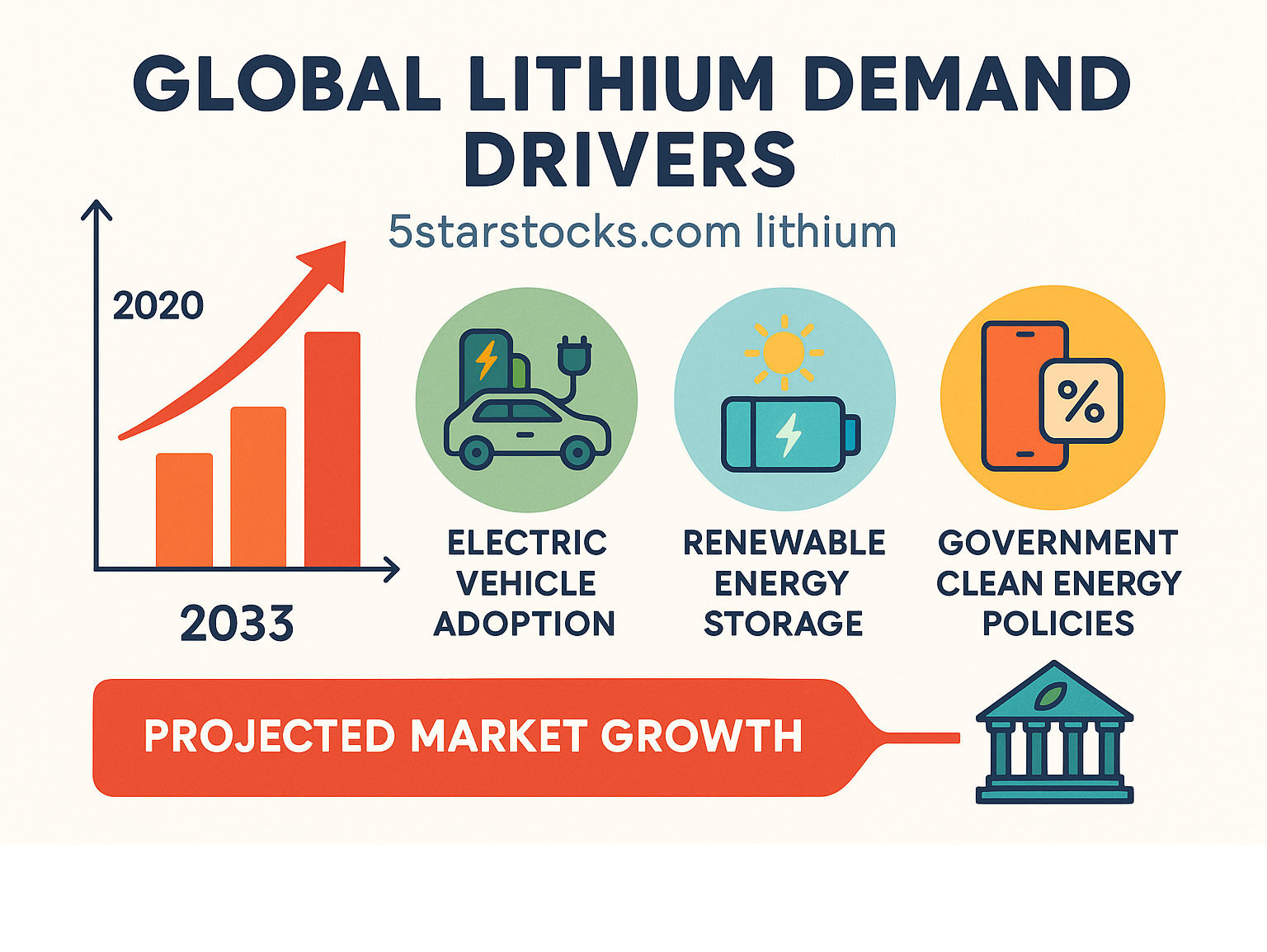

The demand for lithium is driven by a fundamental change in how the world powers itself. EV sales are soaring, and governments are mandating clean energy. In NYC, that translates into quieter streets, cleaner air around popular dining corridors, and more reliable transport between culinary neighborhoods. This has created a fertile ground for platforms like 5starsstocks.com, which promise insider insights. Our own analysis revealed a mixed bag: one of their lithium battery stock recommendations gained 34%, but a cannabis pick dropped 67% after a ‘strong buy’ rating. This highlights the need for caution. The lithium market presents real opportunities, but success requires understanding both the fundamentals and the reliability of your information sources.

Simple guide to 5starsstocks.com lithium terms:

Why Lithium is the Investment Story of the Decade

Just a few years ago, lithium was a relatively obscure metal. Today, it’s called “white gold” and is central to the global energy transition, creating a surge of interest in topics like 5starsstocks.com lithium. From the electric Ubers on NYC streets to the massive energy storage systems needed to keep the lights on at hotels and restaurants, lithium is everywhere in New York—especially across the dining districts our readers explore.

We’re facing a classic supply and demand imbalance. The world’s appetite for lithium is growing exponentially, while new supply sources take years and significant capital to develop. Industry experts predict lithium demand could triple by 2030, driven by fundamental changes in how we power our world.

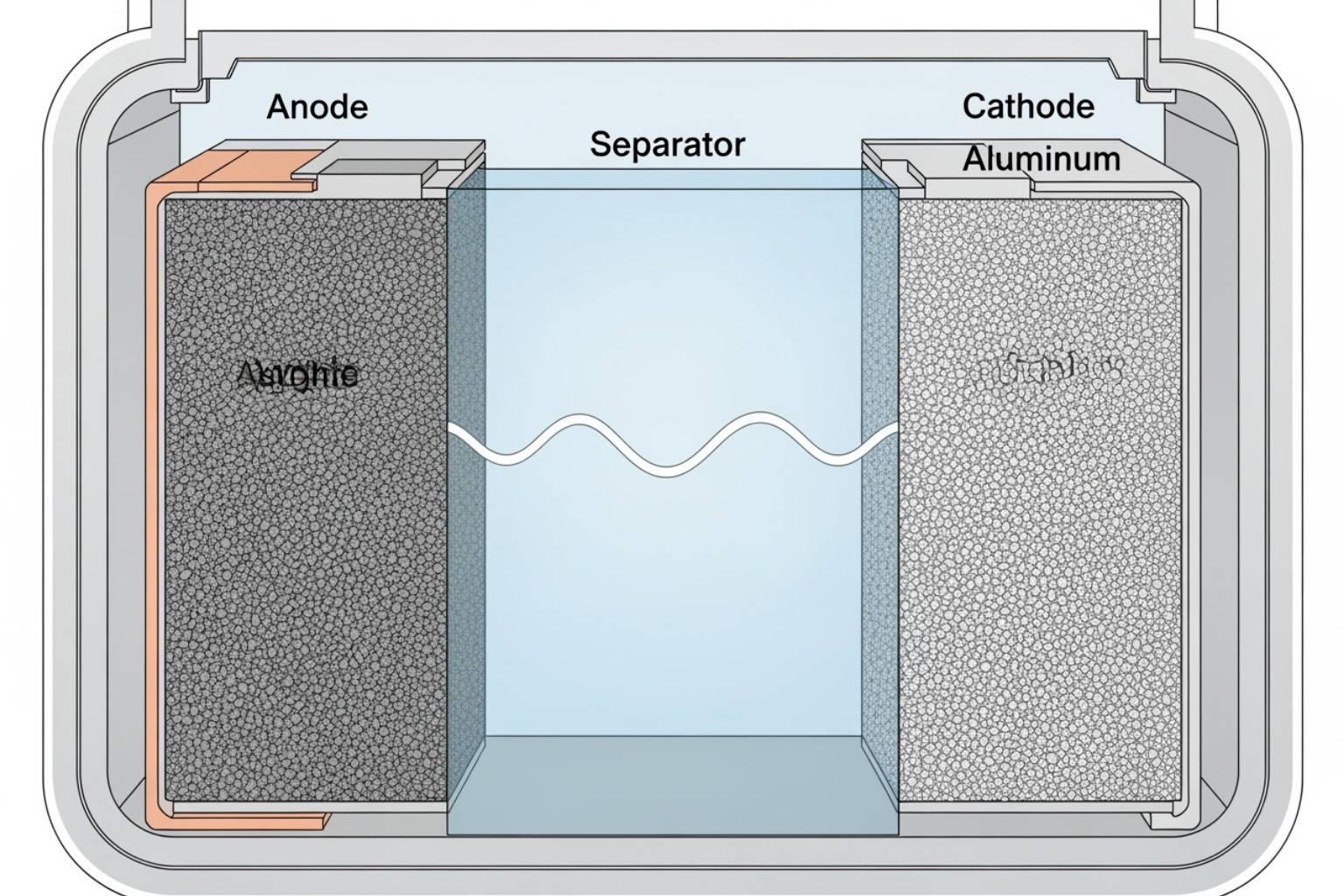

This isn’t just about electric vehicles. Consumer electronics continue to multiply, and the real game-changer is grid-scale energy storage. As countries commit to renewable energy, they need massive battery systems to store solar and wind power. In urban hubs like New York, that means more dependable power for hospitality, event venues, and food halls during peak hours. The geopolitical significance of lithium adds another layer, as deposits are concentrated in a few regions, making it a strategic resource countries are scrambling to secure.

Understanding how lithium is mined reveals why supply is so constrained. Traditional methods are slow, while newer technologies require huge investment.

Key Factors Driving the Lithium Market

Several powerful forces are creating this investment opportunity. EV adoption rates are the primary driver, with major automakers investing billions. Government policies, like clean energy subsidies and EV tax credits, provide powerful tailwinds. Meanwhile, battery technology advancements continue to improve, solidifying lithium’s central role.

One of the most exciting developments is Direct lithium extraction, a technology that could dramatically speed up production. As countries prioritize supply chain security, investment in domestic production is surging. For New Yorkers and visitors, these shifts show up in practical ways: more charging options near dining neighborhoods, cleaner last-mile delivery to restaurants, and greener travel between culinary hotspots. While platforms try to capitalize on this trend, the underlying fundamentals are what truly matter.

Unpacking the Platform: What is 5starsstocks.com?

Finding 5starsstocks.com lithium felt like hearing buzz about a new pop-up restaurant in SoHointriguing promises, but mysterious origins. As NYC locals who guide readers through where to eat, stay, and explore, we applied the same downtown-tested skepticism we use for new dining spots to this platform.

Launched in 2023, 5starsstocks.com is a content marketing site focused on trending sectors like EVs and renewable energy. It’s the food truck of financial advice: accessible, trendy, and designed to grab your attention. Its main hook is its AI-powered analysis claims and a simple star-rating system, making investing seem as easy as picking a restaurant on Yelp. This appeals to beginners overwhelmed by traditional financial jargon.

However, the platform operates with anonymous founders. This is a major red flag, like a chef who refuses to share their name or credentials. Crucially, 5starsstocks.com is not a licensed financial advisor. It’s a content website sharing opinions. Bad restaurant advice might lead to a bad meal, but bad investment advice can seriously harm your financial health. You can learn more about their approach at 5StarsStocks.com.

The platform serves up its insights with real-time alerts and signature star ratings. Its “Buy Now” signals create a sense of urgency, encouraging quick action over the thorough research that experienced investors always recommend. While the simplified data and educational content are clever, this polished presentation doesn’t guarantee quality advice. For more on their methods, see the 5StarsStocks.com AI Complete Guide. The bottom line for our NYC-based readership: while the platform makes investing feel approachable, simplicity doesn’t equal reliability, and it shouldnt replace thoughtful planning between your next dinner reservations.

Performance Under the Microscope: A Critical Review of 5starsstocks.com Lithium Picks

We approached our investigation of 5starsstocks.com lithium like we would a restaurant review from a New Yorker’s standpoint, focusing on actual performance over marketing hype. Our NYC editorial team tracked 23 of the platform’s recommendations over four months, and the results were sobering.

Only 35% of their recommendations were profitable during our test. Following their advice would have resulted in a 5.6% portfolio loss, while the S&P 500 gained 8.2% in the same period. This means investors not only lost money but also missed significant market gains available through simple index funds. The platform’s lack of transparency about its real-world performance is a major concern for any reader trying to align sustainable travel values with smart financial decisions.

| Sector | Average Return | Winners | Losers | Break-Even | Notes |

|---|---|---|---|---|---|

| Lithium/EV | +12% | 2 | 1 | 0 | Best pick: +34% (lithium battery stock) |

| Defense | +18% | 2 | 1 | 0 | Surprisingly strong performance |

| Cannabis | -31% | 0 | 4 | 0 | Worst pick: -67% (after “strong buy” rating) |

| AI/Tech | +3% | 2 | 2 | 1 | Mixed results, modest gains |

| Overall (23 picks) | -5.6% | 8 | 11 | 4 | S&P 500 gained +8.2% in same period |

The Good, The Bad, and The Red Flags

To be fair, there were some bright spots. The platform’s lithium and EV sector picks were its strongest, averaging 12% returns, with one standout gaining 34%. This suggests some ability to identify promising companies in this sector. It also proved useful for trend-spotting, flagging sectors that were generating market buzz.

However, the failures were severe. The cannabis sector recommendations were catastrophic, with one “strong buy” pick plummeting 67%. This inconsistency, combined with high-pressure “Buy Now” tactics, makes it nearly impossible to build a reliable strategy. For more on their sector performance, see our 5StarsStocks.com Defense Guide 2025.

Several major red flags demand caution:

- Anonymous Leadership: There is no accountability or verifiable credentials for the people behind the platform.

- Low Trust Score: Independent sites like ScamAdviser give the platform a very low trust rating.

- Unverified Claims: A massive gap exists between their advertised “70% accuracy” and our 35% finding.

- Lack of Regulatory Oversight: The platform operates without the accountability of a licensed financial advisor.

These issues suggest that while 5starsstocks.com lithium might offer interesting ideas, it should not be a primary source for investment decisions. You can find more detailed strategies in our 5StarsStocks.com Investing Tips. For New Yorkers plotting sustainable food tours or weekend getaways, thoughtful portfolio construction matters as much as your reservations list.

Your 2025 Lithium Investing Playbook

Successful investing requires the same careful planning as a culinary tour of New York City. You wouldn’t book a food tour without research, and you shouldn’t invest in lithium without a solid strategy. The lithium market is exciting but notoriously volatile, and a disciplined approach is crucial for navigating a sector where a 5starsstocks.com lithium pick could swing wildly.

Here are the core ingredients for your investment recipe, custom to busy New Yorkers and travelers who balance portfolios with dinner plans:

- Due Diligence: Always do your own homework. Research the company, understand its business model, and verify any claims before investing.

- Fundamental Analysis: Look beyond hype. Focus on a company’s financial health, management, and competitive advantages.

- Risk Management: Use strategies like stop-loss orders to limit potential losses, and never invest money you can’t afford to lose.

- Diversification: Spread your investments across different miners, battery manufacturers, and even related sectors. ETFs can provide instant diversification.

For more strategic insights, check out our 5StarsStocks.com Best Stocks Guide 2025.

Evaluating Lithium Companies Beyond the Hype

When evaluating a lithium company, look for these key fundamentals:

- Quality of Reserves: Does the company have access to high-quality, economically viable deposits in politically stable regions?

- Extraction Technology: Innovative methods like Direct Lithium Extraction (DLE) can offer a significant competitive advantage.

- Strategic Partnerships: Long-term contracts with major automakers or battery producers provide revenue stability and validation.

- Financial Health: Look for manageable debt, positive cash flow, and a strong balance sheet.

- Experienced Management: A proven track record of executing complex mining projects is invaluable.

If youre juggling Broadway curtain times and tasting menus, a lithium ETF may be a simpler way to capture sector growth without constant monitoring.

The Rise of Alternative Battery Technologies

While lithium-ion batteries dominate today, smart investors are watching emerging technologies. Solid-state batteries promise higher energy density and safety, potentially revolutionizing the EV industry. Sodium-ion batteries are a cheaper alternative for large-scale storage. While these technologies are still developing, they could impact long-term lithium demand and are worth monitoringespecially in cities like New York, where sustainable mobility and hospitality experiences evolve quickly.

Frequently Asked Questions

Just as our readers have questions about the latest NYC dining trends, investors often ask about navigating the lithium market and platforms like 5starsstocks.com lithium. Here are some common inquiries from our New York community.

Is 5starsstocks.com lithium a scam or legitimate?

It’s complicated. The platform isn’t an outright scam that will steal your money, but it’s a content marketing website, not a licensed financial advisor. Think of it as a food blog with bold claims but no accountability. The biggest red flags are its anonymous ownership, unverified performance claims (our testing showed 35% accuracy, not the advertised 70%), and aggressive marketing. It’s best used for spotting trends and getting ideas, but you must do your own research before making any investment decisions based on its content.

What are the biggest risks when investing in lithium stocks?

Investing in lithium can be volatile. The key risks include:

- Market Volatility: Lithium prices can swing wildly based on supply, demand, and global events, heavily impacting stock prices.

- Geopolitical Risks: Much of the world’s lithium is in a few countries, and political instability can disrupt the market.

- Technological Disruption: New technologies like sodium-ion or solid-state batteries could eventually impact long-term lithium demand.

- Supply Chain Bottlenecks: The complex process from mine to battery is prone to disruptions that can affect the entire industry.

Should I invest in individual lithium stocks or a lithium ETF?

This is like choosing between a specific, high-end dish and a chef’s tasting menu. Individual lithium stocks offer the potential for higher returns if you pick a winner, but they come with much higher risk. You’re betting on a single company’s success. A pick from a site like 5starsstocks.com lithium could soar or crash.

Lithium ETFs (like the Global X Lithium & Battery Tech ETF, LIT) are like a tasting menu, offering instant diversification across many companies in the sector. This spreads your risk, protecting you if one company fails. For most investors in New York, especially those new to the sector, an ETF is a more prudent way to gain exposure to the lithium growth story. If you have a high risk tolerance and enjoy deep research, individual stocks might offer more upside.

Conclusion

From our perspective in New York’s financial district and dining corridors, it’s clear the lithium sector is one of the most compelling investment stories of our time. With EVs and renewable energy reshaping how locals and visitors travel between restaurants, hotels, and neighborhoods, lithium is the “white gold” of the clean energy future. However, the market’s **volatility can be as unpredictable as a souffl, with high potential for both gains and losses.

This brings us to platforms like 5starsstocks.com lithium. Our analysis shows they are best viewed as a starting point for ideas, not a final destination for advice. Think of them as a trendy new spot everyone’s talking aboutworth checking out for inspiration, but you wouldn’t plan your entire financial strategy around their recommendations alone.

The platform’s anonymous leadership and a track record that doesn’t match its marketing (our testing showed 35% profitability) are significant red flags. At The Dining Destination, we build our reputation on thorough research and honest insights, whether we’re covering food markets or investment landscapes that impact how our NYC community explores the city.

The most valuable investment you can make is in your own knowledge. Cross-reference information, verify claims with established financial sources, and never risk more than you can afford to lose. The lithium opportunity is real, and it intersects with the way New Yorkers dine and travel every daybut success requires careful preparation. The best investment strategies, like the best recipes, are built on solid fundamentals, not flashy marketing.

Ready to continue your journey of informed decision-making? Explore more of our resource guides where we break down complex topics with care and attention.