Why Building Wealth Through Income Stocks Matters More Than Ever

5starsstocks.com income stocks represent a growing interest among investors seeking steady passive income in uncertain economic times. Based on our research, this platform claims to use AI-powered analysis to identify dividend-paying stocks, though independent testing shows mixed results with only 35% of picks being profitable.

Quick Answer for 5starsstocks.com Income Stocks:

- What it is: A stock research platform focusing on dividend-paying companies

- Key claim: 70% AI accuracy in stock analysis with five-star rating system

- Reality check: Independent tests show 35% success rate, -5.6% portfolio performance vs S&P 500’s +8.2% gain

- Trust score: ScamAdviser rates it 66/100

- Best use: As one research tool among many, not your only source

- Bottom line: Always do your own research and consult a financial advisor

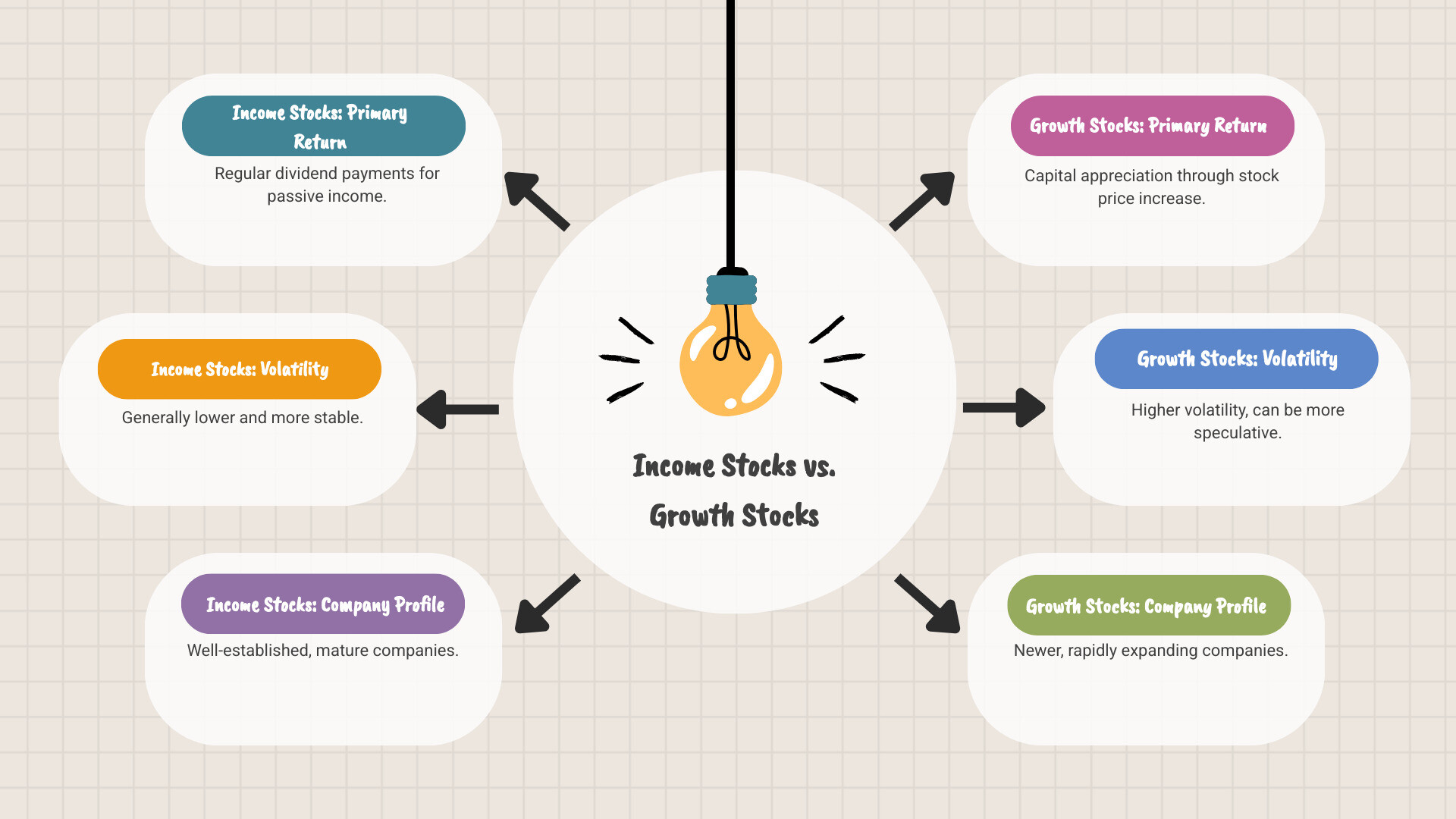

The appeal of income stocks is clear. These are shares in companies that pay regular dividends, offering investors a way to earn passive income while potentially growing their wealth over time. Unlike growth stocks that reinvest all profits back into the business, income stocks distribute a portion of earnings directly to shareholders.

For many investors, especially those nearing or in retirement, income stocks provide stability and predictable cash flow. Companies like Johnson & Johnson, Coca-Cola, and Procter & Gamble have paid dividends for decades, earning them the title of “Dividend Aristocrats.”

However, not all income stock platforms deliver on their promises. While 5StarsStocks.com markets itself as an AI-powered solution for finding quality dividend stocks, our analysis reveals significant gaps between marketing claims and actual performance. This guide will help you understand what works, what doesn’t, and how to make informed decisions about income investing.

5starsstocks.com income stocks helpful reading:

What Are Income Stocks and Why Are They a Popular Strategy?

Think of income stocks as the steady, reliable friends in your investment circle. While growth stocks are out there taking big swings for spectacular returns, 5starsstocks.com income stocks and similar dividend-paying companies are the ones showing up consistently with cash in hand.

Income stocks are shares in companies that regularly pay dividends – essentially, they share a portion of their profits directly with you as a shareholder. Instead of reinvesting every penny back into the business like growth companies do, these firms send you actual money, usually every quarter.

The beauty of this strategy lies in its simplicity and reliability. You own a piece of a company, and that company pays you for the privilege. It’s like having a rental property, but without the midnight calls about broken toilets.

Why are income stocks so popular right now? Several compelling reasons drive investors toward dividend-paying companies. They provide passive income that can supplement your salary or fund your retirement. They’re typically less volatile than high-flying growth stocks, which means you can sleep better at night. Many also offer capital appreciation potential – the stock price can still grow over time, giving you the best of both worlds.

Perhaps most importantly in today’s economic climate, quality income stocks can serve as a hedge against inflation. Companies that consistently raise their dividends help your purchasing power keep pace with rising costs. When everything else gets more expensive, your dividend checks can grow too.

These companies are usually well-established businesses with predictable cash flows. Think utilities that everyone needs, consumer staples like toothpaste and soap, or real estate investment trusts (REITs) that collect rent. They’re not the flashiest investments, but they’re often the most dependable.

Though, that investment decisions should be based on your individual circumstances. What works for your neighbor might not work for you.

Key Characteristics of Quality Income Stocks

Not every company that pays dividends deserves your hard-earned money. Quality income stocks share specific traits that separate the wheat from the chaff.

A consistent dividend history stands as the gold standard. Companies called Dividend Aristocrats have increased their payouts for at least 25 straight years, while Dividend Kings boast an incredible 50+ years of increases. This track record shows management’s commitment to shareholders and financial discipline that spans multiple economic cycles.

Strong financial health forms the foundation of sustainable dividends. Look for companies with low debt levels and strong cash flow – after all, you can’t pay dividends with promises. The cash needs to be there, flowing in consistently enough to cover those quarterly payments with room to spare.

A competitive advantage or “moat” protects the company’s ability to generate profits. This might be brand recognition (everyone knows Coca-Cola), proprietary technology, or simply being too big and efficient for competitors to challenge effectively.

Sustainable payout ratios reveal whether a company can maintain its dividends long-term. When a company pays out more than 80% of its earnings as dividends, that’s often a red flag. The sweet spot usually falls below 75%, giving the company breathing room and flexibility.

Dividend yield – the annual dividend divided by the stock price – matters, but don’t chase the highest yield blindly. Sometimes a sky-high yield signals trouble ahead, like a dividend cut that could devastate your income stream.

How 5StarsStocks.com Claims to Identify Top Income Stocks

5StarsStocks.com markets itself as a modern solution for finding quality dividend stocks, claiming to use AI-powered analysis with 70% accuracy in their stock picks. If accurate, this would be impressive in the notoriously unpredictable world of stock picking.

The platform uses a five-star rating system and focuses on pattern recognition to identify potential winners. They concentrate on sector-specific analysis, particularly in traditional income-generating areas like utilities, consumer staples, and REITs.

Their approach promises to streamline the research process for busy investors who want professional-level analysis without spending hours poring over financial statements. You can explore their full platform at 5StarsStocks .com – Find Dividend, Income, Value and Best Stocks..

The platform offers themed investment approaches designed to help investors find specific types of stocks, including those focused on generating steady income. Whether these claims hold up under scrutiny is something we’ll examine more closely in the next section.

A Critical Review of 5StarsStocks.com’s Tools and Performance

When we dig into any investment platform, we like to look past the shiny marketing promises to see what’s actually under the hood. 5StarsStocks.com income stocks are promoted through a platform that, at first glance, does present itself professionally with what appears to be a clean, straightforward interface.

The platform markets several features that sound quite appealing for income investors. They tout advanced screening tools that supposedly help you filter through thousands of stocks quickly. There are real-time alerts for important events like dividend announcements and earnings reports – the kind of information that can really matter when you’re building an income-focused portfolio.

What caught our attention were their specialized tools with names like “Dividend Health Check” and “Yield Trap Detector.” These sound like exactly what income investors need, since avoiding dividend cuts and yield traps is crucial for long-term success. The platform claims these proprietary tools help identify which dividends are truly sustainable and which ones might be too good to be true.

The user-friendly interface claim seems to hold some water based on user feedback, though as we’ll see, a pretty interface doesn’t necessarily translate to profitable picks.

The Reality of Performance: Claims vs. Independent Tests

Here’s where things get interesting – and not necessarily in a good way. While 5StarsStocks.com talks a big game about their AI-powered analysis, the actual performance tells a different story.

Independent test results conducted over a four-month period revealed some sobering numbers. Only 35% of their stock picks turned out to be profitable – that’s barely better than flipping a coin. Even more concerning, the test portfolio using their recommendations suffered a -5.6% loss during the same period when the S&P 500 gained 8.2%. That’s a performance gap that would make any investor wince.

The mixed user reviews paint a picture of hit-or-miss results. Some users have celebrated wins, like a lithium stock that gained 34% after being featured on the platform. But for every success story, there seems to be a cautionary tale – like the cannabis stock that dropped 67% despite being labeled a “strong buy.”

This kind of volatility isn’t unusual in the stock market, but it does raise questions about the platform’s claimed 70% accuracy rate. When independent testing shows such different results, it makes you wonder about the methodology behind those marketing claims.

Even ScamAdviser, a well-known website that evaluates online platforms, gives 5StarsStocks.com a trust score of 66 out of 100. That’s not failing, but it’s certainly not inspiring confidence either.

Is 5StarsStocks.com Legit? A Look at Transparency

The legitimacy question is where things get a bit murky. The platform exists and appears to be a real business, but there are some transparency issues that give us pause.

There’s a notable lack of team information – you don’t really know who’s behind the analysis or what their credentials are. The unverified success rates are another red flag. When a platform makes bold claims about performance but doesn’t provide verifiable track records, that’s concerning.

Most financial experts we’ve spoken with view platforms like this as more of a marketing tool than a financial advisor. They provide suggestions and analysis, but they’re not giving you personalized financial advice based on your specific situation and goals.

This is why the need for due diligence cannot be overstated. No matter how sophisticated a platform claims to be, it should never be your only source of investment research. Always do your own homework and, most importantly, consult with a qualified financial advisor before making significant investment decisions.

For more detailed discussions about this platform’s pros and cons, you can check out additional analysis at 5starsstocks.com.

The bottom line? While 5StarsStocks.com might offer some useful tools and insights, the performance gap between their claims and reality suggests you should approach with healthy skepticism and never rely on it as your sole source of investment guidance.

Building Your Portfolio with 5starsstocks.com Income Stocks

Creating a solid income portfolio isn’t just about chasing the highest dividend yields – it’s about building something that can weather storms and grow over time. Think of it like preparing a balanced meal; you want different flavors and textures working together to create something satisfying and nourishing.

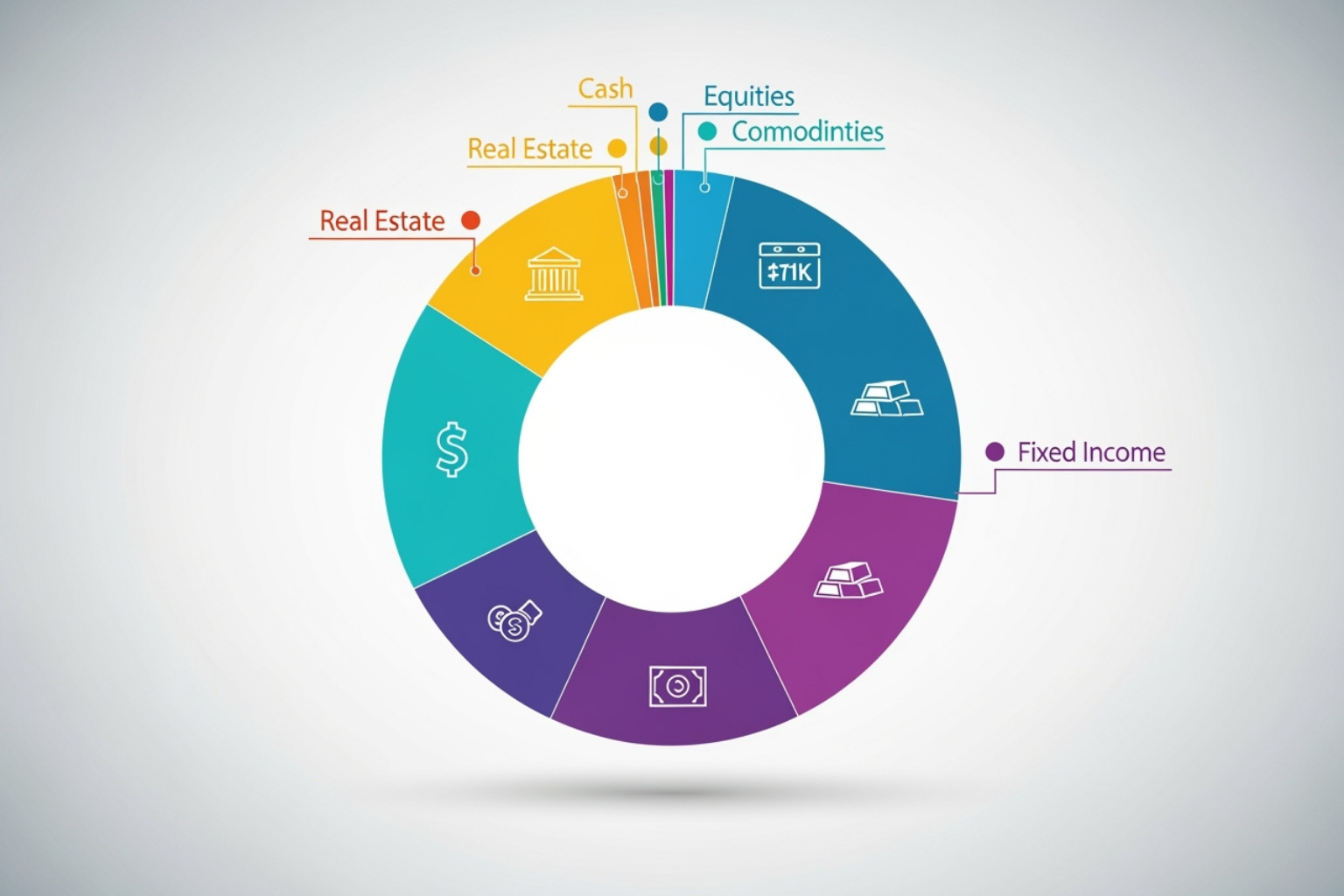

Portfolio diversification is your best friend here. Just as you wouldn’t want to eat only one type of food every day, you don’t want all your 5starsstocks.com income stocks coming from the same sector. Spreading your investments across utilities, consumer staples, healthcare, and real estate helps protect you when one industry hits a rough patch.

The key is balancing yield and growth. Sometimes a stock paying 3% that increases its dividend every year will outperform a 6% yielder that never grows. It’s like choosing between a steady job with regular raises versus a gig that pays more upfront but offers no security.

Smart investors also combine income stocks with other asset classes. This might include bonds, growth stocks, or international investments. It’s about creating a portfolio that can handle whatever the market throws at it.

The Power of Dividend Reinvestment (DRIP)

Here’s where the magic really happens. Dividend reinvestment is like planting seeds that grow into trees that drop more seeds. Instead of spending your dividend payments, you use them to buy more shares of the same stock.

The beauty of compounding wealth through DRIPs is almost hard to believe until you see it in action. One investor reportedly turned $500 monthly investments into $1.2 million over 25 years using this strategy. That’s the power of letting your money work for you while you sleep.

Automatic reinvestment takes the emotion and timing out of the equation. You don’t have to decide when to buy more shares – it happens automatically every time you receive a dividend. 5StarsStocks.com claims to offer a DRIP Builder tool to help with this process, though remember their mixed track record we discussed earlier.

The concept of turning small profits into large gains through reinvestment isn’t just theory – it’s mathematical fact. When your dividends buy more shares, those new shares generate more dividends, which buy even more shares. It’s a beautiful cycle that accelerates over time, making it truly a long-term strategy for patient investors. You can learn more about the power of reinvestment from financial education resources.

Using the Platform to Structure Your Portfolio

5StarsStocks.com suggests what they call a layered portfolio approach, which actually makes a lot of sense regardless of which platform you use. Think of it as building a house with a solid foundation, sturdy walls, and some decorative elements.

The Foundation layer should make up about 60% of your portfolio. These are your steady dividend growers – companies like Johnson & Johnson or Procter & Gamble that might not be exciting but pay their dividends like clockwork. They’re the “meat and potatoes” of your investment meal.

Your Growth layer represents about 30% and includes dividend accelerators. These companies are increasing their payouts faster than inflation, giving you both income today and growth for tomorrow. Think of them as the side dishes that complement your main course.

Finally, the Spice layer adds flavor with about 10% in higher-risk, higher-reward plays. This might include covered call ETFs or regional banks. They’re the hot sauce of your portfolio – a little goes a long way, and too much can burn you.

The platform mentions an Income Roadmap feature designed to help you set income goals and create a plan to reach them. While this sounds helpful, any tool is only as good as the quality of recommendations it provides. Given the mixed performance we’ve seen, treat these features as starting points for your own research rather than final answers.

For more details about their stock categories and recommendations, you can check out 5starsstocks.com Stocks, though always remember to verify any recommendations through your own research and consultation with qualified financial professionals.

Top 5 Income Stock Examples Highlighted by 5StarsStocks.com

Before we dive into specific examples, let’s be crystal clear: these stocks are discussed for informational purposes only and should not be considered direct financial advice. The companies we’re about to explore represent some of the names that frequently appear in discussions about 5starsstocks.com income stocks, but remember—your investment decisions should always be based on your own research and professional guidance.

| Company Name | Ticker | Yield (Approx.) | Payout Ratio (General Advice) | Sector (General) | Key Characteristic |

|---|---|---|---|---|---|

| Johnson & Johnson | JNJ | 3.1% | Sustainable | Healthcare | Reliable payer, strong pharma pipeline, essential products. |

| Procter & Gamble | PG | 2.5% | Sustainable | Consumer Staples | Inflation-resistant brands, consistent dividend increases. |

| Coca-Cola | KO | 3.88% | Sustainable | Consumer Staples | Global brand, consistent dividend history (often cited as Dividend Aristocrat). |

| Realty Income Corp. | O | 5.2% | High, but sustainable for REIT | Real Estate (REIT) | “The Monthly Dividend Company,” recession-resistant properties. |

| Verizon Communications | VZ | 6.5% | Sustainable | Telecommunications | High yield, potential for growth with 5G expansion. |

| AT&T | T | 6.4% | Sustainable | Telecommunications | High yield, turnaround potential. |

| Microsoft | MSFT | 0.8% | Sustainable | Technology | Growing dividend, AI dominance, strong growth prospects. |

| AbbVie | ABBV | 3.8% | Sustainable | Pharmaceuticals | Strong dividend growth (10% in 2023), robust product pipeline. |

| NextEra Energy | NEE | 3.0% | Sustainable | Utilities/Renewables | Leading renewable energy utility, consistent dividend increases. |

Think of income stocks like your favorite reliable restaurant—you know exactly what to expect, and they rarely disappoint. The companies in our table above represent different “flavors” of income investing, from the steady comfort food of dividend aristocrats to the exciting fusion cuisine of tech companies with growing payouts.

Stalwarts and Dividend Aristocrats

When we talk about the Johnson & Johnson (JNJ), Procter & Gamble (PG), and Coca-Cola (KO) trio, we’re looking at the equivalent of culinary classics that have stood the test of time. These aren’t the flashiest companies on the block, but they’re the ones you can count on year after year.

Johnson & Johnson represents the healthcare giant with its diverse portfolio spanning everything from Band-Aids to cutting-edge pharmaceuticals. What makes JNJ particularly appealing is its essential nature—people need healthcare products regardless of economic conditions. The company’s strong fundamentals and robust pipeline of new treatments provide confidence in its ability to maintain dividend payments.

Procter & Gamble brings us those inflation-resistant brands we use every day—think Tide, Crest, and Pampers. When prices rise, P&G can often pass those costs along to consumers because their products are necessities. Their consistent dividend history speaks to decades of smart management and market leadership.

Coca-Cola might seem simple, but its global reach and brand recognition create a moat that’s nearly impossible to cross. As a Dividend Aristocrat, KO has increased its dividend for over 25 consecutive years, making it a favorite among income investors who value predictability.

High-Yield Opportunities

Now let’s explore the higher-yield territory with Realty Income (O), Verizon (VZ), and AT&T (T). These companies offer more immediate income, but as with any investment offering higher returns, they come with their own set of considerations.

Realty Income has earned the nickname “The Monthly Dividend Company” for good reason—they pay dividends monthly instead of quarterly. This REIT focuses on recession-resistant properties like grocery stores and pharmacies, businesses that tend to stay busy even during tough economic times. The 5.2% yield is attractive, especially for those seeking regular cash flow.

Verizon and AT&T represent the telecommunications sector, where 5G growth potential meets high dividend yields. Both companies offer yields above 6%, which can be particularly appealing in low-interest-rate environments. However, these higher yields often reflect the market’s concerns about future growth prospects and the massive capital investments required for network upgrades.

Tech and Growth with a Dividend Twist

The most intriguing category might be companies like Microsoft (MSFT), AbbVie (ABBV), and NextEra Energy (NEE)—stocks that combine dividend income with growth potential. These represent a newer breed of income investing that doesn’t force you to choose between current income and future appreciation.

Microsoft’s change into a dividend-paying powerhouse while maintaining its AI dominance makes it unique. Though the yield is modest at 0.8%, the dividend has been growing consistently, and the company’s strong position in cloud computing and artificial intelligence suggests this growth can continue.

AbbVie stands out in pharmaceuticals with its impressive 10% dividend growth in 2023 and a robust pipeline of new treatments. The company’s focus on innovation while maintaining shareholder returns represents the best of both worlds.

NextEra Energy captures the renewable energy sector growth story while paying a reliable dividend. As utilities shift toward cleaner energy sources, NEE’s leadership position and consistent dividend increases make it an attractive option for environmentally conscious income investors.

While these examples provide insight into different types of income stocks, the key is finding the right mix for your specific situation and risk tolerance.

Navigating Risks and Market Trends in Income Investing

Let’s be honest about something important: no investment comes without risk. Even the most reliable dividend-paying companies can face unexpected challenges, and understanding these risks is just as crucial as celebrating the potential rewards. As we always tell our readers, stock prices fluctuate, and what looks like a sure thing today might surprise you tomorrow.

The key to successful income investing is staying informed and remaining vigilant. Markets change, companies evolve, and what worked brilliantly last year might need adjustment this year. That’s why ongoing research isn’t just recommended—it’s essential for protecting your investment portfolio.

Key Risks for the 5starsstocks.com income stocks

When you’re considering 5starsstocks.com income stocks or any dividend-focused investments, several risks deserve your careful attention. Interest rate sensitivity tops our list of concerns. When interest rates climb, bonds and other fixed-income investments suddenly look more appealing compared to dividend stocks. This shift in investor preference can push down stock prices, even for companies with solid fundamentals.

Dividend cuts represent the nightmare scenario for income investors. When a company slashes or eliminates its dividend, it’s usually signaling serious financial trouble or a major strategic pivot. The stock price typically plummets alongside the dividend announcement, delivering a double blow to investors. While 5StarsStocks.com claims their “Dividend Cut Radar” caught 92% of cuts since 2020, this risk remains ever-present.

Payout ratio monitoring becomes absolutely critical in this context. When companies consistently pay out more than 80% of their earnings as dividends, they’re walking a tightrope. There’s little cushion for economic downturns, unexpected expenses, or necessary reinvestments in the business.

High-yield traps can fool even experienced investors. Sometimes a stock’s dividend yield looks incredibly attractive simply because the stock price has crashed. The market might be anticipating a dividend cut, making that juicy 8% yield more of a warning signal than an opportunity.

Market volatility affects income stocks too, despite their reputation for stability. The 2023 regional banking crisis showed us how quickly even dividend-paying financial stocks can tumble when sector-specific problems emerge. For broader market insights, you can track trends through resources like Fintechzoom.com Markets.

How Economic Factors Influence Performance

Economic forces shape the performance of income stocks in ways that might surprise you. Inflation creates a complex relationship with dividend stocks. While companies in defensive sectors like consumer staples can often raise prices to match inflation, persistent high inflation can erode the real purchasing power of your dividend payments if they don’t keep pace.

Recessionary pressures test even the strongest companies. During economic downturns, earnings typically decline, putting pressure on dividend payments. However, companies in defensive sectors—think healthcare and consumer staples—often weather these storms better than their growth-oriented cousins.

Consumer spending patterns directly impact many dividend-paying companies, especially those in retail, food, and beverage sectors. When consumers tighten their belts, these companies feel it in their revenue, which can ultimately affect their ability to maintain generous dividend policies.

Regulatory changes can reshape entire sectors overnight. New healthcare policies might boost or hurt pharmaceutical companies, while energy regulations can significantly impact utility stocks and oil companies. The push toward renewable energy, for example, has created winners and losers in the utility sector.

Sector-specific trends require constant attention. The rollout of 5G technology affects telecommunications companies like Verizon and AT&T, while the renewable energy transition impacts utilities like NextEra Energy. Staying informed about these evolving trends isn’t just helpful—it’s necessary for making smart investment decisions in the income stock space.

Frequently Asked Questions about 5starsstocks.com Income Stocks

We get a lot of questions about 5starsstocks.com income stocks from readers who are trying to figure out whether this platform is worth their time and money. Let’s explore the most common concerns we hear.

How does 5starsstocks.com differ from free stock screeners?

The main difference, according to 5StarsStocks.com, is that they don’t just dump raw data on you like most free screeners do. While free tools might show you thousands of stocks with basic metrics, 5StarsStocks.com claims to do the heavy lifting by providing pre-screened analysis focused on growth potential, cash flow strength, and sector-specific risks.

They emphasize their proprietary tools like the “Dividend Safety Meter” and “Yield Trap Detector” that supposedly assess the probability of dividend cuts and help filter out companies with shaky payout histories. The platform positions itself as providing the “needle in the haystack” rather than just showing you the haystack.

However, our research suggests taking these claims with a grain of salt. While the interface might be cleaner and the analysis more digestible, the actual performance results we’ve seen don’t necessarily justify choosing this over free alternatives combined with your own research.

Can you actually live off dividends from these stocks?

This is probably the most common dream we hear about – the idea of financial freedom through dividend income. The short answer is yes, it’s theoretically possible, but it requires a substantial capital base and realistic expectations about your living expenses.

The research mentions Linda, whose $200,000 portfolio generated about $1,000 per month in dividend income. That’s a decent supplement, but probably not enough to cover all living expenses for most people. To generate $4,000 monthly (roughly $48,000 annually), you’d likely need a portfolio worth $800,000 to $1.2 million, depending on the average yield.

For younger investors, the smarter strategy is usually to reinvest dividends rather than live off them. The power of compounding works best over decades. A 30-year-old might consider reinvesting 80% of dividends and only taking 20% as income. Living off dividends becomes more realistic as a retirement strategy rather than an immediate solution.

What is the biggest red flag to watch for with income stocks?

Without question, the biggest warning sign is an unsustainable payout ratio – especially when it consistently exceeds 80%. This means the company is paying out nearly all of its earnings as dividends, leaving very little room for error.

When a company has a payout ratio above 80%, it’s essentially walking a tightrope. There’s minimal cushion for business downturns, unexpected expenses, or reinvestment in growth. High debt levels, declining earnings per share, and inconsistent free cash flow are other major red flags that often accompany unsustainable payout ratios.

Dividend cuts are the ultimate warning sign that these underlying issues have reached a breaking point. Once a company cuts its dividend, the stock price typically drops significantly, and it can take years to rebuild investor confidence. This is why monitoring company health through financial metrics is so much more important than just chasing high yields.

The key is remembering that a very high dividend yield isn’t always a good thing – sometimes it’s the market’s way of saying “this dividend probably won’t last.”

Conclusion

When it comes to building wealth through steady income, 5starsstocks.com income stocks represent just one piece of a much larger puzzle. Income investing itself remains a powerful strategy – there’s something deeply satisfying about watching dividend payments roll into your account while you sleep, knowing your money is working for you around the clock.

The appeal is clear: stability when markets get rocky, potential for your investments to grow in value over time, and that wonderful hedge against inflation eating away at your purchasing power. For many of our readers here in New York City and beyond, income stocks have become the foundation of portfolios that weather economic storms while still generating real returns.

Our deep dive into 5StarsStocks.com reveals a platform with bold promises and mixed results. Yes, they offer a clean interface and some genuinely useful tools like their Dividend Health Check and portfolio structuring approach. The idea of AI-powered stock analysis sounds impressive, and their focus on avoiding yield traps shows they understand the real pitfalls of income investing.

But here’s where we need to pump the brakes a bit. Independent testing shows a significant gap between what the platform promises and what it actually delivers. A 35% success rate and portfolio losses while the broader market gained? That’s not the kind of track record that inspires confidence. The 66/100 trust score from ScamAdviser tells us we’re right to be cautious.

Think of 5StarsStocks.com like a recipe you found online – it might give you some good ideas to start with, but you wouldn’t serve dinner to guests without tasting it first. The platform can spark investment ideas and help you understand what to look for in quality dividend stocks. But it should never be your only source of information, just like you wouldn’t plan a food tour of Manhattan based on a single review.

The real recipe for success in income investing combines multiple ingredients: thorough personal research, understanding the companies behind the stocks, monitoring payout ratios and financial health, and most importantly, working with a qualified financial advisor who understands your unique situation.

Whether you’re exploring the latest dining trends in Brooklyn or building your investment portfolio, the same principle applies: do your homework, trust but verify, and never put all your eggs in one basket. The most successful investors we know treat stock recommendations like restaurant suggestions – helpful starting points that require their own investigation before making a commitment.

We at The Dining Destination believe in empowering you with the knowledge to make informed decisions, whether you’re choosing your next culinary trip or your next investment move. Both require research, patience, and a healthy dose of skepticism about anything that sounds too good to be true.

Explore more investment guides and resources to continue your journey toward financial literacy and independence.