Why 5starsstocks.com Value Stocks Are Essential for Long-Term Wealth Building

As New York City-based editors at The Dining Destination, we help readers plan smarter culinary trips in NYC. One practical way locals fund memorable dining and food-travel experiences is by building steady, long-term portfolios. Thats where 5starsstocks.com value stocks come in: a disciplined approach to investing that can complement a lifestyle centered on great restaurants, food markets, and travel.

5starsstocks.com value stocks are a reliable path to building sustainable wealth in today’s volatile market. These selected stocks trade below their intrinsic value, offering a chance to buy quality companies at a discount.

Quick Answer for 5starsstocks.com Value Stocks:

- What they are: Undervalued stocks with strong fundamentals identified through AI-driven analysis

- Key benefits: Lower risk, steady dividends, long-term growth potential

- How to find them: Use the platform’s stock screener and star-rating system

- Best for: Investors seeking stable, defensive portfolio positions

- Risk level: Generally lower than growth stocks, but requires patience

Value investing has been a cornerstone of successful strategies for decades. As Warren Buffett said, “Price is what you pay. Value is what you get.” This principle drives the approach behind 5starsstocks.com’s recommendations.

In an era of market volatility, value stocks offer a defensive advantage. Unlike growth stocks that can swing wildly, value stocks typically represent established companies with solid earnings, manageable debt, and consistent dividends.

The 5starsstocks.com platform combines traditional value principles with modern AI analysis to identify these hidden gems. Their approach uses real-time data, economic trends, and predictive modeling to spot opportunities. Understanding how to invest in value stocks through platforms like 5starsstocks.com can be a game-changer for your financial future.

From a local NYC perspective, the steadier cash flows and dividends common to value strategies can help residents plan seasonal dining splurgesike NYC Restaurant Week, new tasting menus, or borough food tourswithout constantly reacting to market swings.

* 5starsstocks.com value stocks* word guide:

Introduction to Value Investing

Value investing is like finding delicious, but imperfectly shaped, heirloom tomatoes at a farmer’s market; it’s about spotting quality investments that the market has temporarily overlooked. That’s essentially what value investing is all about. In New York City, we see the same principle every week at places like the Union Square Greenmarket: quality isn’t always the flashiest—and knowing where to look is everything. That local lens is how we approach money topics at The Dining Destination, helping NYC food lovers align finances with their culinary and travel plans.

Value investing is a time-tested strategy focused on buying stocks for less than their intrinsic value—what they’re actually worth based on fundamentals. Think of it as getting a $100 bill for $70. The difference is your margin of safety and potential profit.

This approach was pioneered by Benjamin Graham, the “father of value investing.” He taught that successful investing is about understanding a company’s true worth and having the patience to wait for the market to recognize it.

In today’s world of market volatility, this strategy is more relevant than ever. While growth stocks can swing wildly on hype, value stocks offer stability rooted in solid business fundamentals. When the market gets emotional, value investors stay logical.

The 5starsstocks.com platform brings this traditional approach into the modern age, using advanced technology to identify companies trading below their true worth. It’s like having a seasoned value investor as your research partner.

As we look toward the 2025 market outlook, many investors are seeking strategies that can weather uncertainty while building long-term wealth. 5starsstocks.com value stocks offer a methodical approach to finding quality companies at reasonable prices, focusing on businesses with strong balance sheets and consistent earnings.

The beauty of value investing lies in its simplicity. You’re buying good companies when they’re on sale and holding them until the market recognizes their true worth. It’s patient, disciplined, and historically, it works.

For those ready to dive deeper, 5StarsStocks.com value stocks offers a comprehensive guide to applying these principles today.

For NYC readers planning food-centric weekends, culinary trips across the city, or splurge-worthy reservations, adopting a steady value framework can make budgeting more predictable—and ultimately free up more time and dollars for the dining experiences that matter.

What Are Value Stocks and Why Do They Matter?

Here in New York, we know a good deal when we see one. 5starsstocks.com value stocks are like finding quality, organic vegetables at a discount simply because they aren’t the flashiest on display. They represent quality companies trading at bargain prices.

Value stocks are shares of companies trading below their true intrinsic value. These are often well-established companies that have temporarily fallen out of favor, perhaps due to a market overreaction or short-term industry headwinds. This gives savvy investors a chance to buy quality at a discount.

Think of companies in sectors like consumer staples, energy, and financials—the backbone businesses of our economy. They might not have the hype of a tech startup, but they provide essential services.

Why care about value stocks as we head toward 2025? They have a proven track record and defensive nature. Value stocks have historically outperformed growth stocks over long periods, especially during economic uncertainty. When markets are stormy, investors often seek the safety of established companies with strong fundamentals and reliable dividends.

For a foundational understanding, see What is a value stock?. For top picks, 5starsstocks.com has compiled their 5StarsStocks.com – Best Stocks Guide 2025.

Key Characteristics of a Value Stock

When hunting for 5starsstocks.com value stocks, investors look for specific traits that signal both value and quality.

- Low price-to-earnings (P/E) ratio: A P/E ratio below the industry average often means the market is paying less for each dollar of earnings.

- High dividend yields: These regular payments provide steady income while you wait for the stock price to appreciate. They also signal financial stability.

- Consistent earnings and strong cash flow: We look for companies that generate reliable profits and maintain healthy free cash flow, even in tough times.

- Strong balance sheet with manageable debt: Low debt gives a company flexibility to invest in growth, acquire competitors, or return cash to shareholders.

- Stable business model and competitive advantage: Value stocks often belong to companies with established brands and loyal customers that protect their market share.

- Trading below their intrinsic value: The famous “margin of safety” provides protection against mistakes and maximizes potential returns.

Value Stocks vs. Growth Stocks

The investment world often pits value and growth stocks against each other. Understanding their differences helps build a balanced portfolio.

Value stocks are the steady performers: mature companies at reasonable valuations that often pay dividends. They feature lower P/E ratios and patient capital appreciation.

Growth stocks prioritize rapid expansion over current profits, reinvesting earnings instead of paying dividends. Investors accept higher risk for the potential of substantial gains.

| Feature | Value Stocks | Growth Stocks |

|---|---|---|

| Focus | Stability, dividends, lower risk | High growth potential, capital appreciation |

| Risk Level | Generally lower, more defensive | Higher risk, more volatile |

| Dividends | Often provide steady income | Rarely pay dividends |

| Pricing | Trade below intrinsic value | Command premium prices |

| Best Conditions | Uncertain markets, rising rates | Economic expansion, low rates |

During economic expansions, growth stocks often soar. But when uncertainty rises, value stocks typically provide better protection. Many successful investors blend both, using 5starsstocks.com value stocks for portfolio stability while adding growth opportunities.

The Platform’s Approach to Finding 5starsstocks.com Value Stocks

Finding 5starsstocks.com value stocks is like having a sophisticated metal detector that knows what to look for. The platform combines old-school value investing wisdom with modern technology. For our New York City audience navigating a packed dining calendar and travel plans, that efficiency mattersit helps you make informed money moves without sacrificing weekend reservations or neighborhood food crawls.

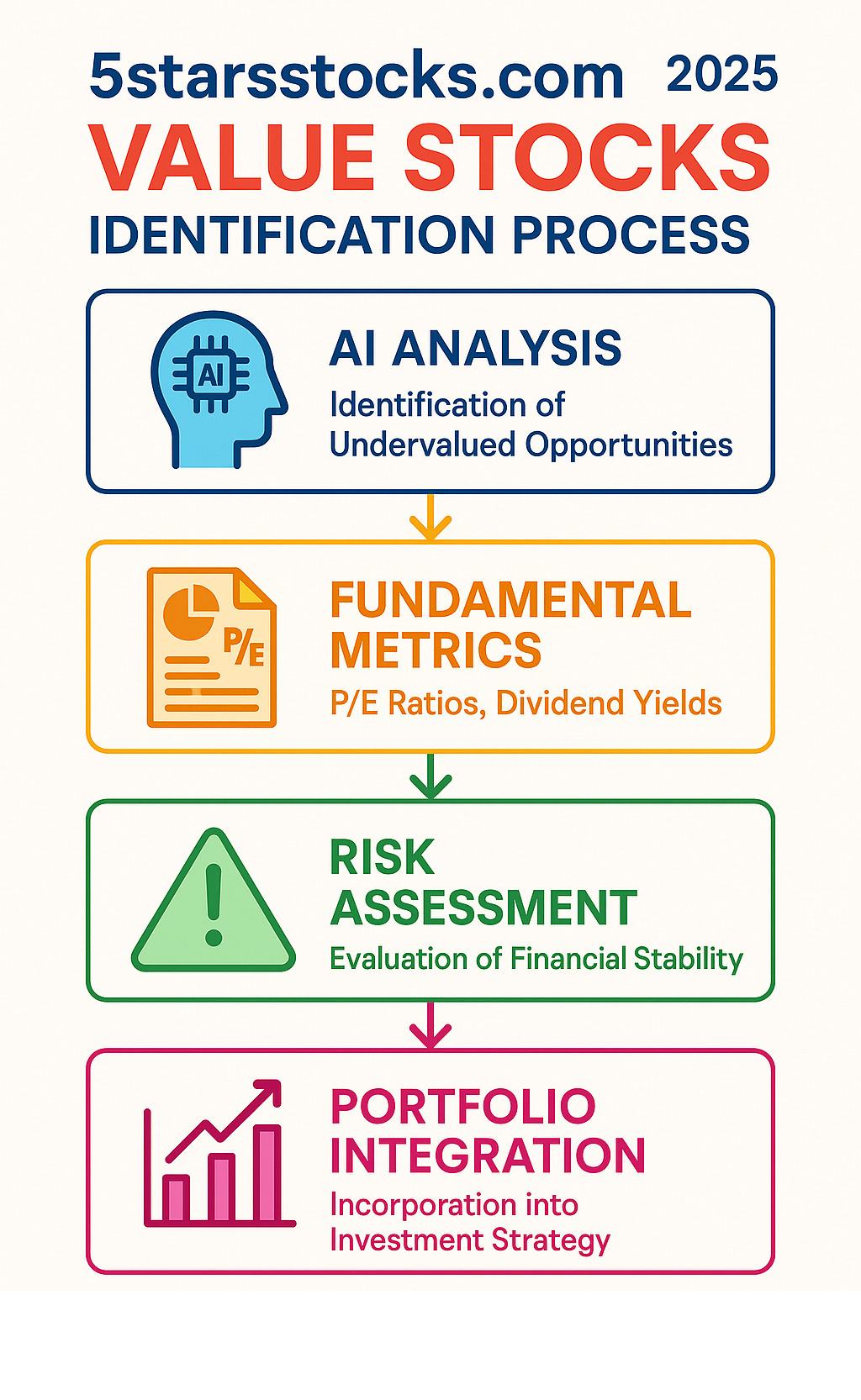

At its core, 5starsstocks.com combines rigorous fundamental research with cutting-edge AI analysis to spot opportunities others miss. Their star-rating system guides investors toward stocks with the best combination of value and potential.

The platform stands out by weaving together multiple layers of analysis, examining how market trends, economic factors, and industry dynamics interactmuch like understanding how ingredients in a recipe work together. The research team digs into company fundamentals, from cash flow to competitive positioning, and layers on expert insights from seasoned analysts who understand market psychology.

For those who want to understand their technology, the 5StarsStocks.com – AI Complete Guide provides a detailed look at how AI powers their stock selection.

How 5starsstocks.com Uses AI and Technology

The magic happens behind the scenes, where proprietary algorithms process mountains of financial data. It’s like a tireless research assistant analyzing thousands of companies at once.

These algorithms excel at data aggregation, pulling information from financial statements, news, and economic indicators. The real breakthrough is predictive modeling, where the AI analyzes patterns to forecast where a company might be heading. This helps identify companies whose true value isn’t yet reflected in their stock price.

Real-time market updates keep the analysis fresh, as the platform continuously monitors market conditions. Most importantly, the AI excels at identifying mispriced opportunities where market sentiment has unfairly driven down the price of a sound company.

Staying Ahead: Monitoring Market and Economic Trends

Smart value investing requires understanding the broader economic landscape. The 5starsstocks.com platform monitors multiple factors that create or destroy value.

- Macroeconomic analysis: They monitor interest rates, inflation, employment data, and GDP growth. These indicators help predict which companies might thrive in different economic conditions.

- Industry-specific research: The team analyzes sector trends, competitive dynamics, and regulatory changes that could impact entire industries.

- Geopolitical factors: Trade tensions and political instability are incorporated into the analysis to provide a more complete picture.

- Impact of interest rates: Understanding how rising or falling rates affect companies is crucial for identifying which are best positioned to weather different environments.

- Inflation monitoring: The platform identifies companies that can maintain profit margins during inflationary periods, a common trait of resilient value stocks.

By weaving these factors together, 5starsstocks.com creates a framework for identifying 5starsstocks.com value stocks that are genuinely undervalued with strong potential for appreciation. For NYC-based readers, this can include monitoring consumer staples, food distribution, and hospitality-adjacent segmentssectors that often connect to the citys vibrant dining economy.

A Practical Guide to Investing with 5starsstocks.com

The theory of value investing is great, but how do you put it into practice? From our perspective here in New York, we know practical application is key. The good news is that 5starsstocks.com designed its platform to be user-friendly for all experience levels. We like this approach for NYC food lovers who want to match their annual restaurant plans and culinary itineraries with a steady, long-term investing routine.

Think of the platform as your personal investment kitchen, equipped with stock screeners, in-depth research reports, and portfolio management tools. The platform does much of the heavy lifting, with expert research that helps match investments to your goals, whether you’re seeking dividend income or long-term growth.

For additional wisdom, their comprehensive 5StarsStocks.com – Investing Tips resource is worth exploring.

Step-by-Step: Finding Your First 5starsstocks.com Value Stock

Let’s walk through the process of finding your first value stock.

- Create your account on the 5starsstocks.com platform to access their full suite of analytical tools.

- Define your investment goals. Are you investing for retirement, income, or wealth building? Your goals will shape your decisions.

- Use the advanced stock screeners. Filter thousands of stocks based on value metrics like low P/E ratios, strong dividend yields, and manageable debt.

- Analyze the research reports. Dive deep into the reports for each potential stock. Look for companies with strong fundamentals that are genuinely undervalued, not just cheap.

- Diversify your portfolio. Never put all your money into one stock. Spread your 5starsstocks.com value stocks across different sectors and industries for a balanced portfolio.

- Monitor your investments. The platform regularly updates its ratings. Check in periodically, but value investing rewards patience.

Common Mistakes to Avoid in Value Investing

From our vantage point in New York’s financial district, we’ve seen common mistakes. Avoiding them can save you money and heartache.

- Focusing on price alone: A cheap stock isn’t always a good value. Avoid “value traps”stocks that are cheap for a good reasonby digging into the company’s fundamentals.

- Ignoring the fundamental story: Understand the business behind the numbers. What does the company do? How does it make money? Is its industry growing?

- Emotional decision-making: Fear and greed can lead to hasty decisions. Value investing requires the discipline to stick with your research, even when the market disagrees.

- Lack of diversification: Putting too much of your portfolio into a single 5starsstocks.com value stock is risky. Spread your investments across multiple companies and sectors.

- Impatience: Value investing is about waiting for the market to recognize a company’s true worth, which can take months or years. As the saying goes, time in the market beats timing the market.

Set a quarterly check-inperhaps right before planning your next NYC tasting menu or neighborhood food tourso your investing cadence supports your culinary calendar.

Managing Risks and Maximizing Long-Term Growth

Investing in 5starsstocks.com value stocks is like finding a hidden gem restaurant in New York Cityit requires research and patience. While value investing is a powerful strategy, it’s not without challenges. The key isn’t avoiding risk, but managing it for sustainable growth.

The SEC reminds us that investment decisions should be based on your individual circumstances, and this principle is paramount. Your financial goals and risk tolerance must shape your decisions.

Value investing focuses on building sustainable wealth through a disciplined, long-term approach. It’s about finding quality companies trading below their true worth and having the patience to wait. Many 5starsstocks.com value stocks also provide reliable dividend income, offering both capital appreciation potential and steady cash flow. For more on income opportunities, see their 5StarsStocks.com – Income Stocks Guide.

Risks of Value Investing and How to Mitigate Them

Even carefully selected value stocks face risks. Understanding them is key to effective management.

- Value traps: These stocks seem cheap but stay that way because the business is deteriorating, like a restaurant whose low prices reflect its poor quality. Mitigation: Conduct thorough research beyond surface metrics. Focus on companies with strong balance sheets and manageable debt.

- Underperformance during growth periods: When growth stocks are soaring, value stocks can seem slow. This can test an investor’s patience. Mitigation: Maintain perspective. Value investing is a long-term strategy that provides stability when high-flying growth stocks falter.

- Market sentiment shifts: Negative news or economic fears can keep good companies undervalued for long periods. Mitigation: Diversify across different sectors and companies to reduce the impact of any single stock’s struggles. Focus on companies with strong competitive advantages.

- Difficulty determining intrinsic value: Valuing a company involves assumptions about the future, which is never certain. Mitigation: Use multiple valuation metrics and cross-reference information from various sources. Never rely on a single opinion.

As research shows, higher returns from value stocks come with risks, including underperformance. A diversified approach is crucial.

Building a Diversified Portfolio with 5starsstocks.com Value Stocks

A diversified portfolio is like a tasting menu; each part complements the others. Diversification protects you from the ups and downs of individual stocks and sectors.

- Asset allocation: Determine the right mix of stocks, bonds, and other investments based on your risk tolerance and timeline.

- Combining value with growth stocks: This is a smart strategy. Growth stocks can provide aggressive appreciation, while your 5starsstocks.com value stocks offer stability and downside protection, leading to more consistent returns.

- Sector diversification: Spread your investments across consumer staples, financials, healthcare, and other sectors to protect against industry-specific challenges.

- Blue-chip value stocks: These established companies with proven track records offer stability and moderate growth. They are the cornerstones of a solid portfolio. Explore more at 5StarsStocks.com – Best Blue Chips.

- Dividend reinvestment: Reinvesting dividends from value stocks can significantly accelerate wealth building through compounding.

- Periodic rebalancing: Rebalancing keeps your portfolio aligned with your goals by systematically selling high and buying low.

In practice, many NYC readers set aside recurring contributions around seasonal dining momentslike summer outdoor dining or winter Restaurant Weekso that investing and culinary plans stay in sync throughout the year.

Frequently Asked Questions about 5starsstocks.com Value Stocks

Here in New York, we get a lot of questions about investing. Whether discussing portfolios over ramen in Chinatown or debating strategies at a rooftop bar, these are the most common questions we hear about 5starsstocks.com value stocks.

What makes 5starsstocks.com different from other stock recommendation sites?

From our Manhattan perspective, 5starsstocks.com stands out by blending cutting-edge technology with accessibility. Their AI-driven analysis crunches vast amounts of data to spot hidden 5starsstocks.com value stocks that others might miss.

Despite its sophistication, the user-friendly interface makes complex financial analysis approachable for all investors. The platform also provides comprehensive research tools and recognizes the importance of diversification across multiple investment styles, including growth, dividend, and blue-chip stocks. Finally, the active investor community provides a space to learn from others navigating the same market challenges.

How often are the stock ratings updated on 5starsstocks.com?

Ratings are updated regularly, triggered by real market events and changing company data, not on a fixed schedule. The system’s real-time market analysis monitors everything from price movements to economic shifts. When a company releases earnings or a major event occurs, it triggers a fresh evaluation. This ensures that recommendations for 5starsstocks.com value stocks are based on current, not outdated, information.

Are value stocks a good choice for passive investing?

Yes, value stocks are an excellent choice for passive investing. For busy professionals who want to build wealth without constant monitoring, this strategy is ideal.

5starsstocks.com value stocks are well-suited for passive strategies because they typically offer steady returns and lower volatility than growth stocks. This means fewer sleepless nights and less temptation to make emotional decisions.

The reliable dividends many value stocks provide can be automatically reinvested, creating a powerful compounding effect. The entire philosophy is built on a long-term, hands-off strategy: buying quality companies at reasonable prices and holding them. It’s patient, disciplined investing that rewards those who can resist tinkering with their portfolios.

Conclusion

Our look at 5starsstocks.com value stocks shows that value investing is no fad. Like a classic New York deli, it’s a strategy that has stood the test of time. The approach is simple and effective: you’re shopping for quality companies that are temporarily on sale. The potential for long-term wealth accumulation is substantial when you combine patience with solid research.

What makes 5starsstocks.com value stocks particularly appealing is how the platform simplifies the process. Its AI-driven analysis does the heavy lifting, identifying hidden gems trading below their true worth. It’s like having a personal sommelier who knows which underrated wines will age beautifully.

The path to financial independence doesn’t have to be complex. By focusing on companies with strong fundamentals and reasonable valuations, you can build a portfolio that weathers market storms while steadily growing. These may not be the flashiest stocks, but they are often the ones that deliver consistent returns.

From our vantage point in New York City, we’ve seen that the principles of value investing remain as relevant as ever. 5starsstocks.com serves as your trusted guide, combining time-tested wisdom with modern technology to help you make informed decisions.

With 5starsstocks.com value stocks in your strategy, you’re positioning yourself for sustainable growth. After all, the best investments are often the ones that let you focus on life’s other pleasures—like finding your next great dining experience.

Ready to dive deeper into smart investing strategies? Explore our comprehensive resource guides for more investing strategies.