The Growing Demand for Accessible Investment Guidance

Focus Keyphrase: 5starsstocks .com

5starsstocks .com has emerged as one of many platforms promising to simplify stock investing. With so many services making bold claims, it’s crucial to separate legitimate opportunities from potential risks.

Quick Answer for “5starsstocks .com”:

- What it is: An investment research platform offering stock ratings and trade alerts

- Core service: 5-star rating system for stocks with AI-powered screening claims

- Target users: Beginner investors, students, and self-directed traders

- Pricing: $99-$299/month across three subscription tiers

- Key concerns: Anonymous team, unverified performance claims, lack of regulatory oversight

- Bottom line: May offer value as a research tool but lacks transparency expected from financial advisors

In today’s financial landscape, retail investors across the United States seek reliable guidance. The rise of DIY investing has fueled demand for platforms like 5starsstocks .com, which aims to simplify complex financial analysis. It claims to use AI to rate stocks on a 1-5 star scale, attracting a young audience—over 40% of its users are under 35. However, beneath its user-friendly surface lie serious questions. The platform’s anonymous team, lack of regulatory oversight, and unverifiable performance claims are significant red flags for any potential investor.

Essential 5starsstocks .com terms:

What is 5starsstocks.com? An Overview of its Purpose and Services

Platforms like 5starsstocks .com aim to be a go-to resource for investment information, acting as a diagnostic tool to help investors see the market more clearly. It’s not a brokerage; instead, it provides research, suggestions, and guidance to empower everyday investors to make more informed decisions.

The 5-Star Rating System and AI Claims

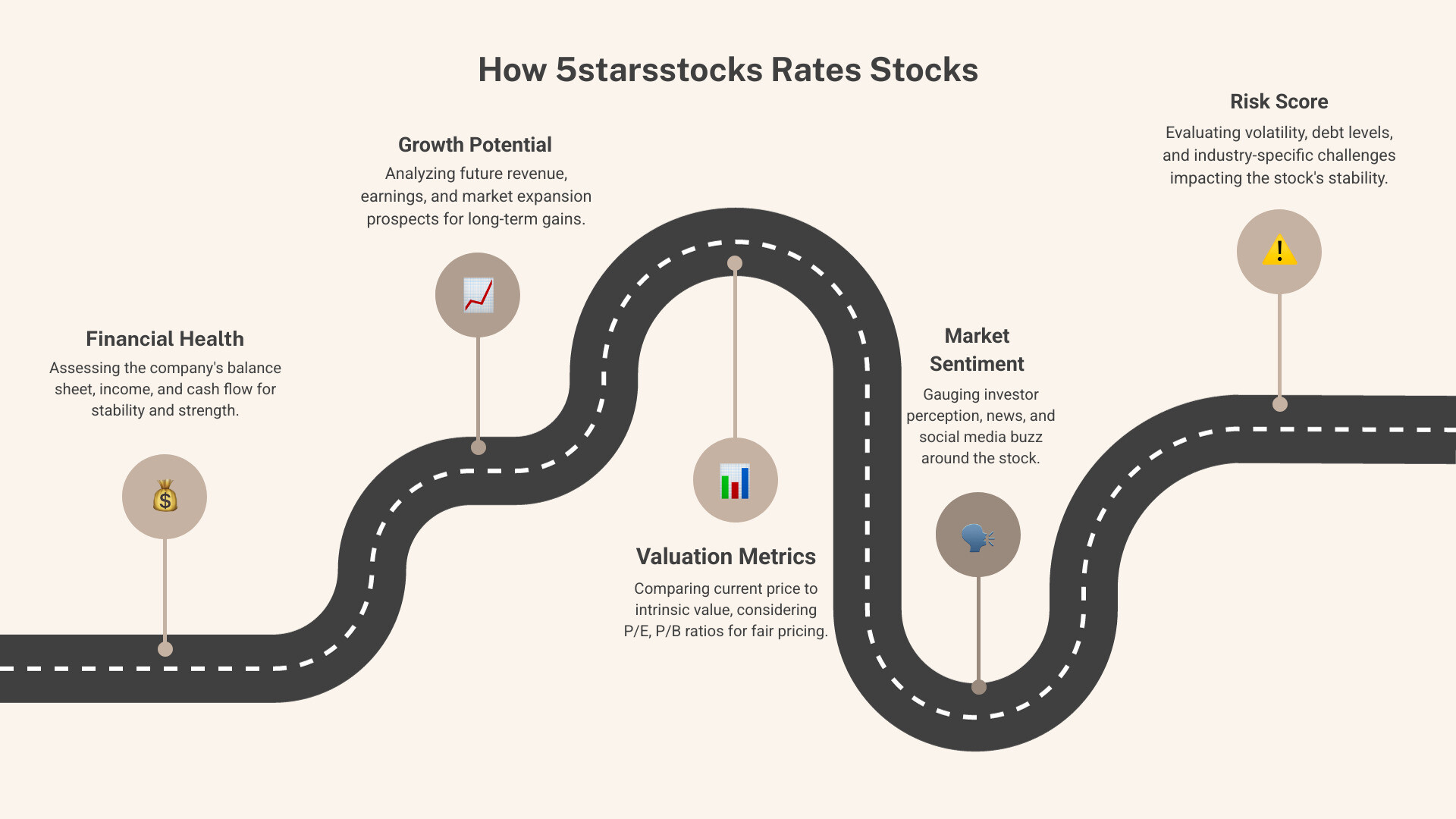

The core of 5starsstocks .com is its star-rating system, which assigns a 1-to-5-star rating to stocks to simplify complex financial data. These ratings are supposedly based on five pillars: Financial Health, Growth Potential, Valuation Metrics, Market Sentiment, and a Risk Score.

The platform heavily markets its use of “artificial intelligence” (AI) and “proprietary algorithms.” However, this “AI” appears to be more of a marketing term for automated screening using pre-set filters based on technical and fundamental analysis. While useful for sifting through stocks, it’s not AI in the advanced, scientific sense. It’s important for users to understand this distinction.

Key Services and Investment Opportunities

Beyond ratings, 5starsstocks .com offers several key services. Trade Alerts for swing, long-term, and options trades are sent via email or phone. An “AI-Powered Screener” filters stocks by various criteria, and the platform provides educational resources like webinars and articles.

The service covers a wide range of investment opportunities, from trendy AI stocks and 3D printing stocks to more stable dividend stocks. It also provides curated lists, personalized alerts, and community features for connecting with other investors.

Subscription Models and Pricing

5starsstocks .com uses a tiered subscription model. The plans are:

- The Basic Plan will set you back $99 per month.

- The Pro Plan costs $199 per month.

- And for the most features, the Elite Plan is $299 per month.

These prices are significant, and potential users should weigh them against the platform’s transparency issues. Revenue comes from subscriptions, not selling user data. However, some users have reported difficulty with the 30-day refund promise, and there is no free trial, meaning you must commit financially to test the service.

| Subscription Tier | Monthly Cost | Key Features (Claimed) | Potential Value |

|---|---|---|---|

| Basic | $99 | Stock Ratings, Basic Alerts | Entry-level research tool |

| Pro | $199 | All Basic, plus Improved Alerts, Advanced Screener | More detailed insights for active traders |

| Elite | $299 | All Pro, plus Premium Educational Content, Priority Support | Comprehensive package for serious investors |

The User Experience: Analyzing Claimed Benefits and Target Audience

Understanding who 5starsstocks .com serves and what it promises reveals a lot about its true value. Let’s analyze the user experience, from its bold performance claims to its intended audience.

Claimed Performance and Success Rates

5starsstocks .com boasts eye-catching numbers: a 78% success rate for swing trades, a 55% average return on options, and a 42% average ROI for long-term picks. Some materials even claim an “85% win rate.”

The problem? These statistics are completely unverified. There is no evidence of third-party audits or independent performance tracking to back up these claims, which is a major red flag in the financial industry. User testimonials are mixed, with some reporting success and others disappointment. This inconsistency underscores the risk of relying on unverifiable claims. For a more balanced view, investors should consult broader resources like market trend analysis.

What is the Target Audience for 5starsstocks .com?

The platform clearly targets a younger demographic. Over 40% of its users are under 35, and nearly a third are first-time investors or students. For these beginner investors, the platform offers a simplified, less intimidating entry point into the stock market.

At the same time, 5starsstocks .com also appeals to experienced traders and self-directed investors looking for new research tools. This focus on younger and novice investors reflects a broader trend in retail investing, where digital-first platforms are gaining traction.

Reported Pros: Why Users Choose the Platform

Despite transparency concerns, users highlight several positive aspects. The platform’s user-friendly interface is frequently praised for its simplicity and intuitive design, making it accessible to both beginners and experienced traders.

Users also value the niche investment options and curated lists that save research time, covering sectors from 3D printing stocks to AI plays. The community features and personalized alerts also receive positive feedback for providing a sense of custom guidance.

A Critical Look at 5starsstocks .com: Risks, Red Flags, and Potential Drawbacks

While the platform’s polished exterior is appealing, a deeper look reveals concerning issues every potential user of 5starsstocks .com should understand before subscribing.

Transparency Issues and Major Red Flags

In finance, transparency is essential, and this is where the platform falters significantly. The biggest red flag is that the team is completely anonymous. There is no information on its founders, analysts, or executives.

Furthermore, the platform operates without regulatory oversight from bodies like the SEC or FINRA, placing it in a regulatory gray area with limited recourse for users. The impressive success rates are self-reported with no documented results or third-party verification. This, combined with overpromising marketing and potential partner bias in recommendations, raises serious concerns. For official guidance, always review Information on investment decisions from the SEC.

Potential Risks and User Complaints

Using 5starsstocks .com comes with risks beyond normal market volatility. A frequent complaint is late alerts, which arrive after a stock’s price has already moved, rendering them useless.

Other common complaints include the high subscription costs relative to the features provided and poor customer service, especially when issues arise. Some users also report inconsistent ratings that change without clear justification, undermining trust in the system. Stock prices fluctuate, and no service can eliminate that risk.

Understanding the Financial Commitment

The financial commitment is substantial. Subscription costs range from $99 to $299 per month ($1,188 to $3,588 annually), a significant sum for many investors before even buying a stock.

Many users question the value for money, feeling the features don’t justify the premium price. The absence of a free trial and reported refund process issues add another layer of financial risk, as you must pay upfront to evaluate the service. When planning your budget, it’s important to weigh these costs against your overall investment strategy, just as one would consider all aspects of a financial profile like Christian Stracke Net Worth.

Evaluating Legitimacy: Security, Support, and Industry Standing

When considering any investment platform, legitimacy, security, and support are non-negotiable. Here’s how 5starsstocks .com measures up in these critical areas.

Is 5starsstocks .com a Legitimate Platform?

The legitimacy of 5starsstocks .com is not a simple yes or no. The platform does provide a service, and some users find value in it, so it’s not an outright scam. However, mixed user reviews and a significant trust gap created by a lack of accountability complicate the picture. The core issue is whether it meets the standards expected of a financial advisory service. Before investing, always perform due diligence and consult official sources like the U.S. Securities and Exchange Commission (SEC).

Security Measures and Customer Support

Data privacy is a major concern. We could not find a published privacy policy on the site, nor is there clear information about data encryption or other security measures. For a platform that collects payment information, this lack of transparency is troubling.

Customer support responsiveness also receives mixed reviews. While some users report getting help, many complain about poor service, particularly regarding refund requests. Timely and effective support should be a given, not a gamble.

How It Compares to Financial Industry Standards

Compared to established financial industry standards, 5starsstocks .com falls short. Reputable advisory services operate under regulatory oversight; this platform has no FINRA registration and is not supervised by the SEC. This unregulated advice leaves users with limited protection.

Furthermore, the industry standard is to provide verifiable track records, often audited by third parties. The platform’s reliance on self-reported claims is a major departure from this norm. The lack of transparency about its team and credentials further distances it from professional standards. Understanding bodies like the Financial Industry Regulatory Authority (FINRA) helps in evaluating any platform’s legitimacy.

Frequently Asked Questions about 5starsstocks.com

Here are answers to the most common questions about 5starsstocks .com to clarify what the platform does and does not offer.

Does 5starsstocks.com offer brokerage services?

No, 5starsstocks .com is strictly a research and analytics tool. You cannot buy or sell stocks through the platform. It provides information and recommendations that you must then take to your own brokerage account (like Fidelity or Charles Schwab) to execute a trade. You are paying for insights, not trade execution.

Is a 5-star rating a guarantee to buy a stock?

Absolutely not. A 5-star rating indicates that a stock scored well against the platform’s internal criteria at a specific point in time. It is not a direct buy recommendation. 5starsstocks .com itself states that its ratings should be a starting point for your own research. You must still consider your personal financial goals, risk tolerance, and conduct further due diligence before investing.

Are the performance statistics on 5starsstocks.com verified?

No. The impressive performance statistics, such as a 78% success rate for swing trades, are published by the platform itself without any third-party audits or independent verification. While the numbers could be accurate, there is no way for an outsider to confirm them. This lack of verification is a significant red flag, as reputable advisors typically have their performance records independently audited. You are essentially taking the platform’s word for it.

Conclusion: The Final Verdict on 5starsstocks.com

After a deep dive into 5starsstocks .com, it’s clear the platform sits at a crossroads of promise and concern. It successfully makes investing feel more accessible with a simple interface and targeted stock alerts, appealing especially to its core demographic of young and first-time investors.

However, these positives are overshadowed by significant red flags. The anonymous team, lack of regulatory oversight, and unverified performance claims create a troubling lack of accountability. The “AI” branding appears to be more marketing than advanced technology, and the high subscription costs are hard to justify given user complaints about poor customer service and refund issues.

Is 5starsstocks .com Worth Your Investment?

Our final recommendation leans heavily toward caution.

For beginners or anyone seeking regulated financial advice, we strongly recommend looking elsewhere. The risks associated with the lack of transparency and oversight are too high.

For experienced, self-directed investors, it might serve as a supplementary source of ideas, provided you treat its alerts as a starting point for your own exhaustive research. Even then, you must question if the high cost provides good value.

5starsstocks .com operates in a gray area that lacks the transparency and security we consider non-negotiable in financial services. While not an outright scam, its business practices fall short of industry standards. Your financial future deserves to be built on reliable information from trustworthy, accountable sources. Prioritize risk management and due diligence by seeking out regulated platforms that are transparent about their team, methods, and performance. For more resources to help you make informed decisions, we encourage you to Explore our resource guides.