Why Cannabis Investing Requires Specialized Analysis

5starsstocks.com cannabis analysis has become a go-to resource for investors navigating one of the market’s fastest-growing sectors. As the cannabis industry experiences exponential growth with legalization spreading across the U.S. and internationally, investors face the challenge of separating high-potential stocks from risky ventures in this volatile market.

Quick Answer for 5starsstocks.com Cannabis:

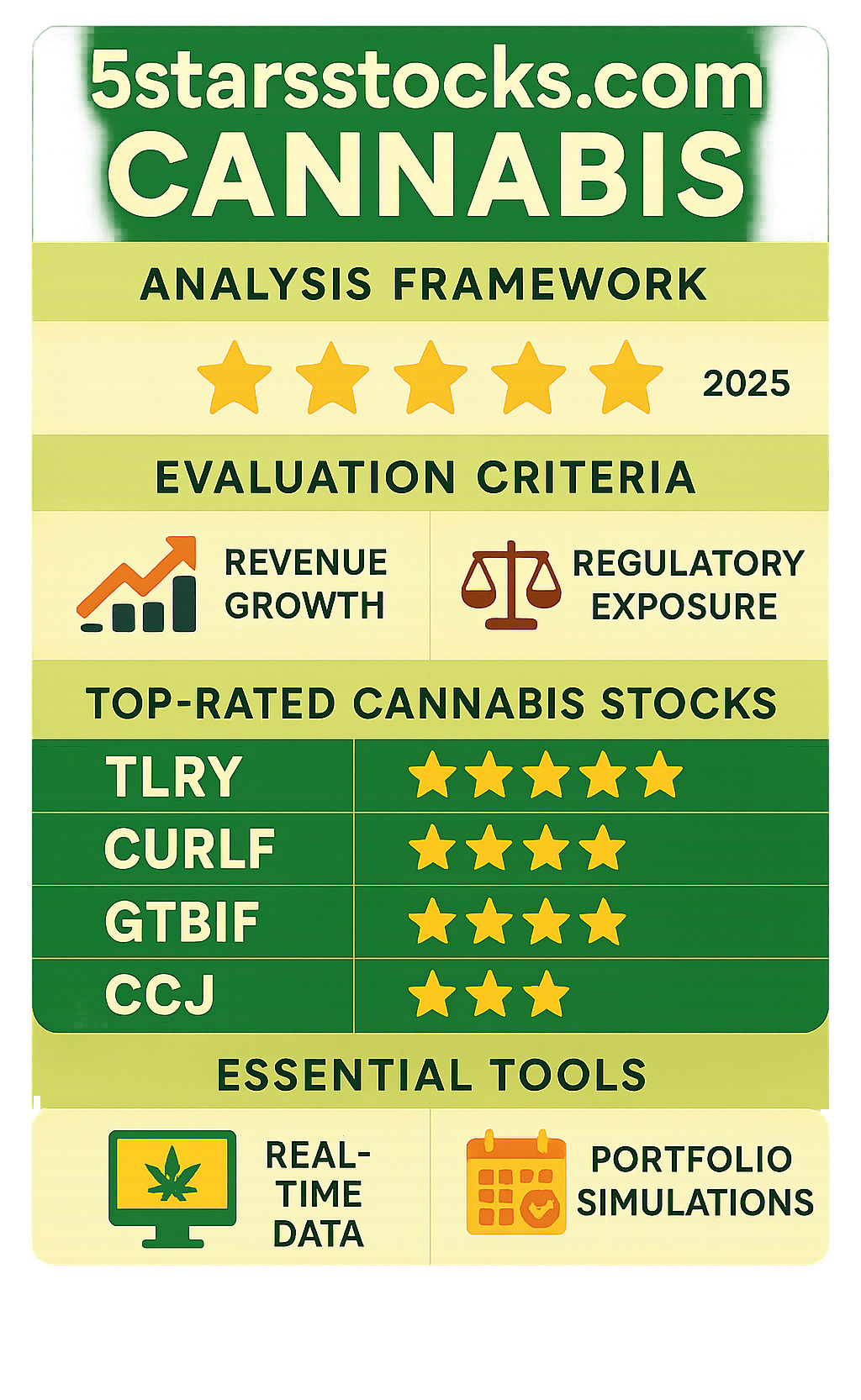

- Platform Focus: Cannabis-specific investment analysis with 5-star rating system

- Top 2025 Pick: Tilray Brands Inc. (TLRY) – 5-star rating for European expansion

- Key Features: Real-time data, regulatory exposure tracking, portfolio simulations

- Best For: Both beginners and experienced investors seeking cannabis sector insights

- Limitation: Use alongside personal research – ratings aren’t guarantees

The cannabis sector presents unique challenges that generic financial platforms often miss. Regulatory changes, licensing developments, and product category performance all impact cannabis stocks differently than traditional investments. This is where specialized tools become essential.

5starsstocks.com addresses this gap by offering a cannabis-centric investment hub designed specifically for this emerging market. The platform uses AI-driven analysis to evaluate companies based on cannabis-specific growth indicators like regulatory exposure and licensing developments.

Unlike broad market analysis tools, 5starsstocks.com provides nuanced insights into growers, dispensaries, biotech firms, and service providers within the cannabis ecosystem. Their proprietary rating algorithm considers factors traditional platforms might overlook.

The platform’s approach helps investors filter through the noise of cannabis market volatility to identify companies with sustainable business models and growth potential. Whether you’re tracking Tilray’s European expansion or Curaleaf’s retail growth, the platform offers specialized metrics for informed decision-making.

Basic 5starsstocks.com cannabis vocab:

Introduction to Cannabis Investing with 5starsstocks.com

Picture this: you’re sitting at your kitchen table, scrolling through endless financial websites, trying to make sense of cannabis stock data that feels more confusing than your grandmother’s secret recipe. Sound familiar? That’s where 5starsstocks.com cannabis comes to the rescue, acting like that knowledgeable friend who actually knows what they’re talking about.

The cannabis industry has been on a wild ride lately. Exponential growth paired with legalization trends across multiple states has created opportunities that make investors’ eyes light up like kids in a candy store. But here’s the thing – with great opportunity comes great complexity. The market volatility in this sector can make even seasoned investors feel like they’re riding a roller coaster blindfolded.

That’s exactly why specialized tools have become so essential. Generic investment platforms often miss the nuances that make cannabis stocks tick. They don’t account for the unique regulatory landscape or the specific challenges that companies face in this emerging industry.

What is 5starsstocks.com?

Think of 5starsstocks.com as your personal investment guide, but one that actually speaks your language. This investment platform focuses on delivering stock recommendations through sophisticated AI-driven insights, all while maintaining a refreshingly user-friendly interface.

What sets it apart is its laser focus on high-growth sectors – particularly areas like cannabis where traditional analysis tools often fall short. The platform cuts through the typical Wall Street jargon to give you actionable information you can actually understand and use.

The beauty of 5starsstocks.com lies in its simplicity. Instead of drowning you in complex financial terminology, it presents data in a clear, digestible format that helps you make informed decisions. Whether you’re a complete beginner or someone who’s been investing for years, the platform adapts to meet you where you are. You can explore their full range of services at 5starsstocks.com.

Why Focus on Cannabis Stocks?

The cannabis sector represents one of those rare high-risk, high-reward opportunities that don’t come around often. We’re talking about an industry experiencing exponential growth as more states and countries accept legalization. But here’s where it gets interesting – and challenging.

Market volatility in cannabis stocks can be intense. Regulatory changes, licensing developments, and shifting public opinion can send stock prices on wild swings that would make a theme park jealous. This creates a pressing need for specialized tools that understand the unique factors driving this market.

5starsstocks.com cannabis addresses this gap perfectly. While general financial platforms might tell you about a company’s basic financials, they often miss the cannabis-specific indicators that really matter – things like regulatory exposure, licensing developments, and product category performance.

The platform’s AI-powered analysis digs deep into these sector-specific factors, helping you steer the complexities that make cannabis investing both exciting and challenging. For those ready to dive deeper into their stock analysis approach, check out more info about 5starsstocks.com stocks.

This specialized focus transforms what could be an overwhelming investment landscape into something much more manageable. Instead of guessing which cannabis companies have real potential, you get data-driven insights that help separate the diamonds from the rough.

How 5starsstocks.com Analyzes the Cannabis Market

Think of 5starsstocks.com cannabis analysis like having a seasoned chef who knows exactly which ingredients make a perfect dish. Just as a chef doesn’t randomly throw spices together, this platform doesn’t haphazardly pick stocks. There’s a carefully crafted recipe behind every recommendation, designed specifically for the unique flavors of the cannabis market.

The 5-Star Rating System Explained

The heart of 5starsstocks.com cannabis analysis beats with its signature 5-star rating system. Picture walking into a restaurant and seeing those familiar stars next to each dish – you immediately know what the chef recommends most highly. That’s exactly how this system works for cannabis stocks.

The platform’s proprietary algorithm acts like a master sommelier, carefully tasting and evaluating each stock across multiple dimensions. Financial health forms the foundation, examining whether a company has solid bones – good balance sheets, healthy cash flow, and the financial stability to weather market storms.

Revenue growth tells the growth story, revealing whether a company is actually expanding or just making noise. The algorithm digs into both historical performance and future projections, painting a picture of trajectory rather than just a single moment in time.

Market behavior captures how the stock dances with volatility. Cannabis stocks can be particularly moody, so understanding their temperament helps investors know what they’re getting into. Risk profile goes deeper, evaluating the unique dangers each company faces, from regulatory problems to competitive pressures.

The system also weighs leadership quality – because even the best business plan falls flat without strong execution. While this might seem subjective, experienced management teams in the cannabis space often make the difference between success and spectacular failure.

What makes this rating system special isn’t just the algorithm itself, but how it’s custom for cannabis-specific challenges. A 5-star rating suggests strong potential across all these factors, while lower ratings signal areas of concern. Remember though, these stars are your starting point, not your final destination. As any good investor knows, you’ll want to dig deeper with your own research. For those just starting their investment journey, brushing up on stock market basics can provide essential foundation knowledge.

Unique Tools for Cannabis Investors

Here’s where 5starsstocks.com cannabis really shows its specialized expertise. While general financial platforms might tell you a stock’s price and basic metrics, they miss the cannabis industry’s unique heartbeat. It’s like trying to understand a complex wine using only its alcohol content – you’re missing all the nuanced flavors that actually matter.

The platform offers sector-specific analytics that dive deep into cannabis industry dynamics. Regulatory exposure tracking becomes crucial when you realize that a single policy change can send stock prices soaring or plummeting overnight. The platform monitors how vulnerable each company is to regulatory shifts, both domestically and internationally.

Licensing developments tracking might sound mundane, but it’s pure gold in the cannabis world. New cultivation, processing, or retail licenses often signal major expansion opportunities. The platform keeps tabs on these developments, helping investors spot growth catalysts before they hit mainstream news.

Product category performance analysis reveals which segments are heating up. Maybe edibles are exploding in certain markets while flower sales plateau. This granular insight helps investors understand which companies are riding the right waves versus those stuck in yesterday’s trends.

The portfolio growth simulations feature acts like a financial crystal ball, letting you test different investment scenarios without risking real money. It’s like being able to taste a dish before ordering the full portion – incredibly valuable for planning your investment strategy.

Real-time data and expert analysis keep everything current and contextual. The cannabis market moves fast, and yesterday’s insights might be today’s missed opportunities. Combined with watchlists and alerts, investors can stay connected to their picks without constantly refreshing screens.

These tools transform cannabis investing from guesswork into informed decision-making, giving investors the specialized insights this unique sector demands.

Top 5starsstocks.com Cannabis Stock Picks for 2025

When it comes to investment recommendations, the proof is in the pudding – or in this case, the data. 5starsstocks.com cannabis doesn’t just throw darts at a board and hope for the best. Their expert picks for 2025 reflect months of careful analysis, market research, and number-crunching that would make even the most dedicated accountant proud.

What makes these recommendations particularly exciting is their data-driven foundation. Each pick represents companies that have demonstrated strong fundamentals, smart strategic positioning, and the kind of growth potential that gets investors’ hearts racing (in a good way).

[TABLE] Comparing Top 5 Cannabis Stock Recommendations

The beauty of having clear, comparative data is that it takes the guesswork out of decision-making. Here’s how the top cannabis stock recommendations stack up according to 5starsstocks.com cannabis analysis:

| Stock | Ticker | 5starsstocks.com Rating | Key Strengths |

|---|---|---|---|

| Tilray Brands Inc. | TLRY | ★★★★★ | Strong North American & European presence, German acquisitions. |

| Curaleaf Holdings Inc. | CURLF | ★★★★☆ | Expanding retail in Texas & Pennsylvania, improved margins. |

| Green Thumb Industries | GTBIF | ★★★★☆ | Strong retail branding, product diversification (edibles). |

| Cronos Group | CRON | ★★★★☆ | Altria backing, advanced cannabinoid R&D. |

| Verano Holdings | VRNOF | ★★★★☆ | High-margin products, premium market positioning. |

What’s fascinating about this lineup is the diversity of approaches. Curaleaf Holdings is playing the expansion game with new retail locations, while Green Thumb Industries is winning hearts (and wallets) through smart branding and product variety. Meanwhile, Cronos Group has the financial muscle of Altria behind them, and Verano Holdings is carving out a premium niche.

This isn’t a one-size-fits-all recommendation list – it’s a carefully curated selection that recognizes different paths to success in the cannabis industry.

In-Depth Look at the 5-Star Pick: Tilray Brands Inc. (TLRY)

When 5starsstocks.com cannabis gives a company their coveted 5-star rating, it’s worth paying serious attention. For 2025, that golden star treatment goes to Tilray Brands Inc. (TLRY), and frankly, it’s not hard to see why.

Tilray isn’t just playing it safe in familiar markets – they’re thinking globally. Their strong presence across both North America and Europe gives them something most cannabis companies can only dream of: geographic diversification. When one market hits regulatory bumps (and let’s be honest, they always do), Tilray has other revenue streams to fall back on.

But here’s where it gets really interesting. Tilray’s recent acquisitions in Germany aren’t just smart – they’re brilliantly timed. Germany represents one of Europe’s most promising cannabis markets, and getting in early could pay dividends for years to come. It’s like getting the best table at a restaurant before everyone else finds how amazing the food is.

The numbers don’t lie either. Q1 revenue jumped 18% year-over-year, which is the kind of growth that makes investors do a happy dance. This isn’t just theoretical potential – it’s real, measurable progress happening right now.

What makes Tilray’s story even more compelling is how they’ve managed to balance expansion with execution. Many companies get so caught up in growth that they forget about fundamentals. Tilray seems to have found that sweet spot between ambitious vision and solid business practices. For those wanting to dig deeper into the financial details, MarketWatch offers comprehensive coverage of their performance.

Navigating Market Trends and Investment Strategies

Understanding the cannabis investment landscape is like reading the pulse of a rapidly evolving industry. It’s not enough to simply pick promising companies – you need to understand the bigger picture that can either propel your investments forward or leave them stuck in regulatory limbo.

The cannabis sector responds to political winds, social shifts, and regulatory changes in ways that traditional industries don’t. This makes staying informed about market trends absolutely essential for anyone serious about 5starsstocks.com cannabis investing.

Key Market Trends Influencing Cannabis Stocks in 2025

Several powerful forces are reshaping the cannabis investment landscape this year. Think of these trends as the underlying currents that could carry your investments to new heights – or create unexpected turbulence.

Federal legalization discussions continue to dominate headlines and investor sentiment. While full U.S. legalization remains uncertain, even incremental progress like the SAFE Banking Act could be game-changing. Imagine cannabis companies suddenly having access to traditional banking services and institutional investors – that’s the kind of shift that transforms entire sectors overnight.

The global expansion story is equally compelling. Europe’s cannabis market is projected to reach €12 billion by 2027, and countries across the continent are rapidly updating their cannabis laws. Companies with international footprints, like Tilray with its German acquisitions, are positioning themselves to capture this growth wave.

Consolidation through mergers and acquisitions is accelerating as the industry matures. Larger players are snapping up smaller companies to expand their reach, diversify product lines, and secure valuable licenses. This M&A activity often creates immediate value for shareholders of acquired companies – and it’s a trend worth watching closely.

Perhaps most fascinating is how technology is revolutionizing cultivation. AI-driven greenhouses that optimize every aspect of plant growth aren’t science fiction anymore – they’re reality. Companies investing heavily in R&D and innovative growing techniques may have significant competitive advantages as the market evolves.

You can stay current on these developments through resources like the U.S. Cannabis Legalization Tracker, which provides regular updates on policy changes and market shifts.

Advice for Beginners Using 5starsstocks.com Cannabis

Stepping into cannabis investing can feel overwhelming at first – there’s so much information to process and the market moves quickly. But with the right approach, 5starsstocks.com cannabis can become your trusted guide through this exciting but complex landscape.

Starting small is absolutely crucial. The cannabis sector’s volatility means even promising investments can experience sudden swings. Begin with amounts you’re comfortable potentially losing while you learn how the market behaves.

The platform’s watchlists and alerts are incredibly valuable tools that many beginners underuse. Set up alerts for companies that catch your interest, then observe how they respond to news, earnings reports, and market changes. This real-world education is worth its weight in gold.

While high-rated stocks from the platform make excellent starting points for research, even 5-star ratings aren’t crystal balls. Use these ratings to narrow your focus, then dig deeper into company fundamentals, management teams, and growth strategies.

Diversification within the cannabis sector helps spread risk across different business models. Consider mixing cultivators, dispensaries, biotech firms, and ancillary service providers. Each responds differently to market changes, providing some protection against sector-specific challenges.

Most importantly, conduct your own research beyond what any single platform provides. Cross-reference information with financial news outlets, company reports, and independent analyses. The goal is building your own informed opinion, not simply following recommendations blindly.

Understanding that cannabis stocks carry inherent risks helps set realistic expectations. Regulatory changes, intense competition, and market volatility are part of this territory. Successful cannabis investors accept these challenges while taking measured, informed risks.

By approaching 5starsstocks.com cannabis as one valuable tool in a broader research toolkit, you’ll be better positioned to steer this dynamic market and potentially capitalize on its significant growth opportunities.

Risks, Limitations, and Making Informed Decisions

Look, I’ll be straight with you – while 5starsstocks.com cannabis offers some genuinely helpful insights, it’s not a magic money-making machine. As someone who’s seen plenty of investment platforms come and go, I believe in giving you the full picture, warts and all.

The platform does have some transparency concerns that are worth discussing. The team behind 5starsstocks.com chooses to remain anonymous, which can feel a bit like having a conversation with someone wearing sunglasses indoors. You’re getting advice, but you’re not entirely sure who’s giving it.

More importantly, their proprietary AI system’s methodology isn’t fully disclosed. They’ll tell you what their ratings mean, but the exact “how” behind those star ratings remains somewhat mysterious. This lack of detailed explanation can make it challenging to independently verify their performance claims.

It’s also crucial to understand that 5starsstocks.com cannabis doesn’t offer personal financial advice. Their ratings are general recommendations based on their models, not custom to your specific financial situation or risk tolerance. Think of it like getting restaurant recommendations from a food blog – helpful, but they don’t know if you’re allergic to shellfish or prefer hole-in-the-wall joints over fancy dining.

The market volatility in cannabis stocks adds another layer of complexity. Even a company with a perfect 5-star rating can face unexpected challenges from regulatory changes, supply chain issues, or shifting consumer preferences. Past performance, as they say in every financial disclaimer ever written, doesn’t guarantee future results.

Potential Risks of Using a Single Platform

Putting all your investment research eggs in one basket – even a good basket – carries some real risks that every smart investor should consider.

Ratings are not guarantees of anything except that someone ran numbers through an algorithm and got a result. Market conditions change faster than New York weather, and unforeseen events can impact even the strongest companies. A 5-star rating today might not reflect tomorrow’s reality.

Algorithmic limitations are real, even with sophisticated systems. Algorithms excel at processing vast amounts of data, but they might miss qualitative factors like management changes, cultural shifts, or breakthrough innovations that human analysis could catch. They’re powerful tools, but they’re not crystal balls.

The need for independent research cannot be overstated. Smart investors always cross-reference recommendations with analyses from multiple reputable sources. Look at company financials directly, read earnings call transcripts, and understand what management is actually planning. The SEC guidance for investors provides excellent framework for this kind of due diligence.

Market unpredictability is especially pronounced in emerging industries like cannabis. Regulatory changes, scientific breakthroughs, or shifts in public opinion can have outsized impacts on stock performance. What looks like a sure bet today might face unexpected headwinds tomorrow.

Differentiating Cannabis Sub-Sectors

The cannabis industry isn’t just one big green blob – it’s actually a complex ecosystem with distinct sub-sectors, each carrying different risk profiles and growth potential. Understanding these differences is crucial for making informed investment decisions.

Medical cannabis represents the more regulated and traditionally stable segment. These companies focus on therapeutic applications, working within healthcare systems and serving patient needs. This sub-sector often benefits first from legalization trends, as medical use typically gains acceptance before recreational use.

Recreational cannabis targets adult consumers and often sees higher growth rates, but it’s also more susceptible to taxation changes, local regulations, and intense competition. When states or countries open up recreational markets, this sector can experience explosive growth – or face regulatory backlash.

CBD and wellness products occupy a unique space, focusing on non-intoxicating cannabinoid products for health and wellness. These products often operate under different regulatory frameworks, sometimes allowing for wider retail distribution than THC products.

Ancillary services provide support to the cannabis industry without directly handling cannabis products. This includes everything from hydroponic equipment and specialized lighting to dispensary software and compliance services. These companies often offer less volatile investment options since they benefit from industry growth regardless of which specific cannabis companies succeed or fail.

5starsstocks.com cannabis helps investors steer these distinctions by tracking companies across all categories and providing cannabis-specific indicators like regulatory exposure and product category performance. This differentiation allows you to build a portfolio that matches your risk tolerance – whether you’re looking for high-growth recreational plays or steadier ancillary service providers.

The platform’s ability to categorize and analyze these different sub-sectors is one of its genuine strengths, helping investors understand that “cannabis stock” covers a lot of different business models and risk profiles.

Frequently Asked Questions about 5starsstocks.com

Let’s be honest – when you’re exploring a new investment platform, especially one focused on something as dynamic as cannabis stocks, questions naturally bubble up. We’ve gathered the most common ones we hear from our community about 5starsstocks.com cannabis and how it actually works in the real world.

Is 5starsstocks.com free to use?

Here’s the scoop: 5starsstocks.com cannabis follows what most investment platforms do these days – a mix of free and premium features. You can definitely dip your toes in without opening your wallet first. The platform offers some basic market insights, general overviews, and introductory information at no cost, which is perfect for getting a feel for their approach.

But here’s where it gets interesting – creating a free account typically open ups more tools and gives you a much better user experience. Think of it like walking into a restaurant and being able to smell the amazing aromas versus actually sitting down for the full meal.

The premium features – those deep-dive research reports, advanced portfolio simulations, unlimited watchlists, and the really detailed cannabis-specific analytics – usually require a subscription. It’s the classic “freemium” model that works well for both curious browsers and serious investors.

How reliable are the stock ratings on 5starsstocks.com?

This is probably the million-dollar question, isn’t it? The ratings on 5starsstocks.com cannabis come from their proprietary algorithm that crunches through financial data, market performance indicators, and cannabis-specific metrics. It’s like having a really smart friend who’s great with numbers and never sleeps.

But – and this is a big but – these ratings are your starting point, not your finish line. Think of them as a knowledgeable tour guide pointing out interesting landmarks, but you’re still the one deciding where to stop and explore further.

The platform is upfront about this: their ratings are based on data analysis and are designed to help you narrow down your research focus. They’re not crystal balls or guarantees of future performance. The stock market has a way of humbling even the most sophisticated algorithms, especially in a sector as young and regulatory-sensitive as cannabis.

Our advice? Use these ratings as a filter to identify promising opportunities, then roll up your sleeves and do your own homework. Combine their insights with your own research and judgment – that’s where the real investment wisdom lies.

What makes 5starsstocks.com different from general financial platforms?

The difference is like comparing a specialized cannabis dispensary to a general pharmacy – both serve their purpose, but one really knows its niche inside and out.

5starsstocks.com cannabis dedicates serious resources to understanding high-growth sectors like cannabis, rather than spreading their attention across every stock under the sun. This focused approach means they can offer cannabis-specific growth indicators that generic platforms simply don’t track.

While a general platform might tell you a cannabis stock’s price-to-earnings ratio, 5starsstocks.com digs deeper. They track things like regulatory exposure (how vulnerable a company is to changing cannabis laws), licensing developments (crucial for growth in this regulated industry), and product category performance (whether a company is winning in edibles, flower, or concentrates).

This specialization also shows up in their curated analysis for emerging industries. They understand that cannabis companies face unique challenges – from banking restrictions to evolving regulations – that don’t apply to traditional businesses. Their tools and insights are built with these industry-specific factors in mind.

It’s the difference between getting investment advice from someone who covers 5,000 stocks versus someone who really understands the 50 cannabis stocks that matter most. Both have their place, but when you’re navigating a complex, rapidly-changing sector like cannabis, specialized expertise can make all the difference.

Conclusion: Your Next Step in Cannabis Investing

After diving deep into 5starsstocks.com cannabis, one thing becomes crystal clear: this isn’t just another investment platform throwing darts at a board. It’s a specialized tool that brings much-needed clarity to one of the market’s most exciting yet unpredictable sectors.

Think of your cannabis investment journey like planning the perfect culinary trip. You wouldn’t just show up in a new city without doing some homework first, right? You’d research the best restaurants, read reviews, maybe even check out some local food blogs. That’s exactly what 5starsstocks.com cannabis does for your investment portfolio – it’s your trusted guide in unfamiliar territory.

The platform’s 5-star rating system acts as your compass, pointing you toward companies like Tilray Brands Inc. with their impressive European expansion strategy. Their cannabis-specific indicators help you understand the nuances that generic financial platforms often miss – like how regulatory changes might impact your investments or which product categories are gaining momentum.

But here’s the thing we’ve learned from years of exploring new destinations and trying unfamiliar cuisines: the best experiences come from balancing expert guidance with your own curiosity and research. The same principle applies to cannabis investing. Use 5starsstocks.com as your starting point, but don’t stop there.

Just as we encourage food enthusiasts to venture beyond the obvious tourist spots and find hidden gems, we urge you to dig deeper into your investment choices. Read company reports, understand market trends, and maybe even chat with a financial advisor who can help tailor advice to your specific situation.

The cannabis industry in 2025 is buzzing with potential – from federal legalization discussions to European market expansion and exciting M&A activity. It’s like being in a city during restaurant week, with new opportunities popping up everywhere. But with great opportunity comes the need for careful navigation.

5starsstocks.com cannabis is a powerful tool for finding and analyzing potential investments, but it’s not a crystal ball. Market volatility is as real in cannabis stocks as a New York minute, and what looks promising today might face unexpected challenges tomorrow.

At The Dining Destination, we’ve always believed in empowering our readers with comprehensive information – whether you’re planning your next food trip or exploring investment opportunities. Just as we help you steer global culinary experiences, this guide aims to give you the confidence to make informed cannabis investment decisions.

Your journey into cannabis investing starts with taking control and making informed choices. The market is waiting, the opportunities are there, and now you have the knowledge to approach them strategically. Ready to explore more insights across different topics? Check out our complete Resource Guide for additional expertise that can help guide your next trip – whether it’s financial or culinary!